|

市場調查報告書

商品編碼

1846231

丙烯酸乳化:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Acrylic Emulsions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

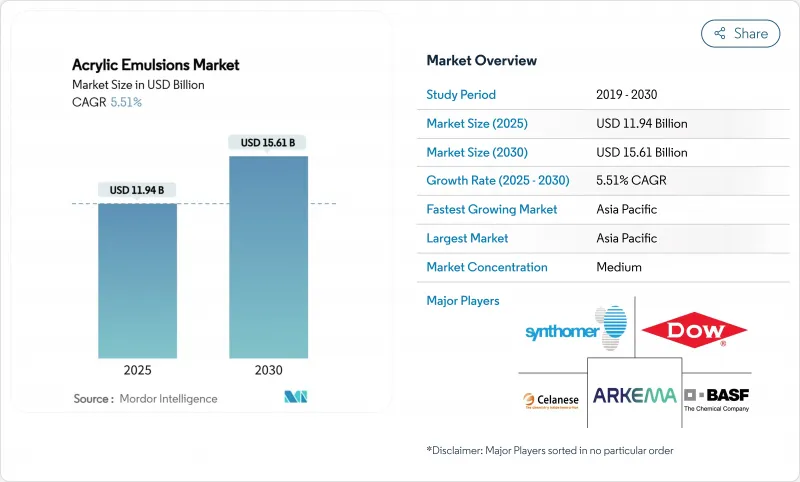

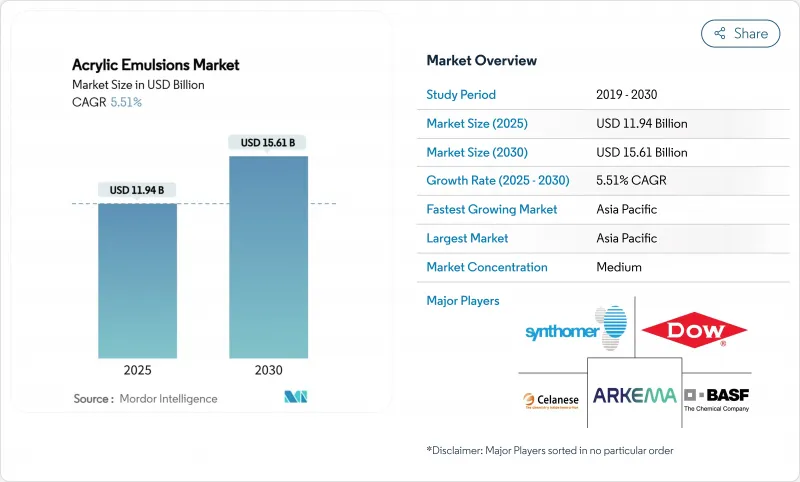

預計到 2025 年,丙烯酸乳化市場規模將達到 119.4 億美元,到 2030 年將達到 156.1 億美元,預測期(2025-2030 年)複合年成長率為 5.51%。

有利於水性配方的監管壓力、亞太地區強勁的基礎設施投資以及數位印刷技術的快速普及,都推動了這一擴張。塗料、黏合劑和造紙製造商正持續從溶劑型系統轉向水性體系,以確保符合美國、加拿大和歐盟的低VOC法規。同時,製造商正投資自交聯和不含PFAS的化學品,以搶佔高階市場,而美國和荷蘭的產能擴張則保障了供應安全。儘管原料價格波動擠壓了利潤空間,但技術升級和永續性承諾為基於價值的定價提供了喘息之機,使生產商即使在單體成本波動的情況下也能保持盈利。

全球丙烯酸乳化市場趨勢與洞察

推廣低VOC水性被覆劑

加州已將建築用平塗塗料的揮發性有機化合物(VOC)含量限制在50克/公升,迫使配方師逐步淘汰溶劑含量高的化學物質。美國環保署已將氣霧劑塗料的合規期限延長至2027年1月,使生產商有時間完善水性配方,使其性能可與溶劑型塗料媲美。加拿大將於2024年1月對130個消費品產品類型實施VOC限制,進一步強化了推動丙烯酸乳化需求的全球監管轉變。因此,生產商正在擴展其自交聯體系,該體系無需使用外部交聯劑即可提高漆膜硬度,從而擴大了目標市場。此類政策措施為丙烯酸乳化市場提供了多年發展前景,並有助於抵消單體成本的波動。

新興國家建築支出激增

中國2025年預算維持5%的GDP成長目標,基礎建設支出將達到1.11兆美元。同時,印度2025-2026會計年度的資本支出成長11.1%,達到11.11兆印度盧比。新建高速公路、地鐵和工業將增加建築塗料、混凝土添加劑和使用丙烯酸分散體的軟包裝黏合劑的消耗量。在東南亞,製造業的轉移正在推動工廠建設並提高產量。丙烯酸乳化憑藉其耐久性、附著力和低氣味等優點,仍然是必須遵守更嚴格環保標準的建築商的首選黏合劑。中產階級收入水準的提高也刺激了住宅重新粉刷的周期,從而維持了穩定的基準需求。

聚氨酯分散體偏好

水性聚氨酯分散體在耐化學性和耐磨性方面通常優於丙烯酸酯,因此在汽車裝飾、地板和耐用金屬塗料領域佔據了一席之地。近期一項針對雙組分紫外光固化聚氨酯化學的調查顯示,其在低排放氣體性能方面取得了突破性進展。丙烯酸酯則透過混合設計和自交聯網路技術予以應對,但在極高應力環境下仍存在不足,這限制了其在一些高階細分市場的佔有率成長。儘管如此,丙烯酸酯在中等性能領域仍保持著成本和製程優勢,確保了市場競爭的平衡,而非完全取代。

細分市場分析

到2024年,苯乙烯-丙烯酸酯類塗料將佔全球銷售量的45.18%。其均衡的硬度、耐水性和價格使其成為飽和型室內建築塗料和紙張生產線的主力。預計到2030年,苯乙烯-丙烯酸酯類塗料的銷量將穩步成長,但隨著用戶轉向以乙烯基為主的塗料體系,該細分市場的佔有率預計將會下降。受軟性建築膠黏劑、密封劑和低溫塗層板材需求的推動,乙烯基-丙烯酸酯乳化預計將以每年6.22%的速度成長。純丙烯酸乳化在對保色性和抗紫外線性能要求極高的亮光外牆和冷屋頂彈性體領域佔據高階地位。

先進的自交聯技術強化了這種層級結構。研究表明,苯乙烯-丙烯酸類道路密封劑中的DAAM-ADH網路比傳統等級的密封劑黏結強度提高了50%以上。生產商正在銷售模組化平台,使客戶能夠以最小的實驗室配方調整來微調玻璃化轉變溫度(Tg)和硬度,從而縮短產品上市時間。同時,乙烯基丙烯酸樹脂供應商強調其不含塑化劑的柔韌性,以使其能夠承受超耐磨地板和防風雨膜的熱循環。純丙烯酸樹脂正在利用生物基單體來吸引具有永續性意識的建築師,並透過降低化學品成本來擴大價值差距。

區域分析

到2024年,亞太地區將佔全球銷售額的46.21%,到2030年將以6.09%的複合年成長率成長。中國不斷擴大的鋼筋加工廠將為蓬勃發展的公共工程塗料需求提供本地黏合劑,而印度不斷成長的資本投資將直接轉化為新的商業和住宅占地面積。越南和印尼等東協成員國擁有出口導向的家具和包裝產業叢集,這些集群依賴水性塗料來滿足經合組織買家的標準。該地區還擁有世界一流的原料工廠,使一體化製造商能夠平衡成本壓力並實現規模經濟。

北美仍然是監管潮流的領導者。美國環保署 (EPA) 的氣霧劑法規和加州空氣資源委員會 (CARB) 的低揮發性有機化合物 (VOC) 排放上限,促使研發投入持續成長,同時也扶持了那些擁有良好合規記錄的成熟企業。根據美國《基礎設施投資與就業法案》,基礎設施升級項目正在投資建造橋樑、交通樞紐和公共建築,這些項目都使用耐用、低氣味的塗料。加拿大將於 2024 年生效的全國性 VOC 法規將統一相關要求,並簡化跨境產品系列。墨西哥的加工出口網路 (maquiladora network) 正在吸引家電和汽車製造商指定使用水性塗料以獲得出口核准。

歐洲正致力於引領永續性。BASF轉向生物基丙烯酸乙酯以及在荷蘭擴大分散體業務,都反映了該地區推動化學價值鏈脫碳的決心。德國透過建築節能補貼支持冷屋頂維修,並擴大反射性丙烯酸膜的市場。法國和英國正在公共採購中推廣循環經濟標準,優先選擇經過生命週期評估的樹脂。儘管南美洲和中東及非洲的消費量合計不到全球的10%,但都市化進程的加速和房屋抵押貸款的改善將推動房屋翻新和基礎設施建設計劃,從而帶來長期的成長潛力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 推廣低VOC水性塗料

- 新興經濟體建築支出激增

- 數位噴墨墨水的普及

- 朝向軟性食品包裝黏合劑的轉變

- 對冷屋頂和反射塗層的需求

- 市場限制

- 聚氨酯分散體偏好

- 丙烯酸單體價格波動

- 富含苯乙烯乳化的紫外線黃變。

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 純丙烯酸乳化

- 苯丙乳化

- 乙烯基丙烯酸乳化

- 透過使用

- 畫

- 建築材料添加劑

- 紙張塗層

- 膠水

- 其他用途(纖維和不織布整理等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- AICA Kogyo Co.Ltd.

- AkzoNobel NV

- Allnex GMBH

- Anhui Sinograce Chemical Co., Ltd.

- Arkema

- Asian Paints Ltd.

- Axalta Coating Systems LLC

- BASF

- Celanese Corporation

- DIC Corporation

- Dow

- Gellner Industrial, LLC.

- HB Fuller Company

- Lubrizol

- Mallard Creek Polymers

- Nippon Paint Holdings Co., Ltd.

- Osaka Organic Chemical

- PPG Industries, Inc.

- Synthomer plc

- The Cary Company

第7章 市場機會與未來展望

The Acrylic Emulsions Market size is estimated at USD 11.94 billion in 2025, and is expected to reach USD 15.61 billion by 2030, at a CAGR of 5.51% during the forecast period (2025-2030).

Regulatory pressure that favors water-borne formulations, steady infrastructure spending in Asia-Pacific, and rapid adoption of digital printing technologies underpin this expansion. Paint makers, adhesive formulators, and paper converters continue to switch from solvent to water-borne systems to secure compliance with low-VOC rules in the United States, Canada, and the European Union. At the same time, manufacturers are investing in self-crosslinking and PFAS-free chemistries to capture premium niches, while capacity additions in the United States and the Netherlands safeguard supply security. Though feedstock price volatility presses margins, technology upgrades and sustainability commitments provide headroom for value-based pricing, enabling producers to preserve profitability even when monomer costs fluctuate.

Global Acrylic Emulsions Market Trends and Insights

Low-VOC Push for Water-Borne Paints and Coatings

California continues to cap VOC content for flat architectural paint at 50 g/L, compelling formulators to phase out solvent-rich chemistries. The United States Environmental Protection Agency extended aerosol coating compliance dates to January 2027, granting producers time to perfect water-based blends that match solvent-borne performance. Canada enforced VOC limits across 130 consumer product categories in January 2024, reinforcing a global regulatory shift that channels demand toward acrylic emulsions. Producers are therefore scaling self-crosslinking systems that raise film hardness without external crosslinkers, widening the addressable market. These policy moves give the acrylic emulsions market multi-year visibility and help offset monomer-cost swings.

Booming Construction Spending in Developing Countries

China's 2025 budget maintains a 5% GDP growth target, supported by USD 1.11 trillion in infrastructure outlays, while India increased 2025-26 capital expenditure by 11.1% to INR 11.11 lakh crore. New highways, metros, and industrial parks lift consumption of architectural coatings, concrete additives, and flexible packaging adhesives that employ acrylic dispersions. Across Southeast Asia, manufacturing relocations drive factory construction, magnifying volumes. Because acrylic emulsions provide durability, adhesion, and low odor, they remain the binder of choice for builders that must meet tightening environmental standards. Rising middle-class income levels also spur residential repaint cycles, keeping baseline demand resilient.

Preference for Polyurethane Dispersions

Water-borne polyurethane dispersions often outclass acrylics in chemical and abrasion resistance, allowing them to gain ground in automotive trim, wood flooring, and heavy-duty metal coatings. Recent research on 2K UV-curable polyurethane chemistries highlights breakthroughs in low-emission performance. While acrylics answer with hybrid designs and self-crosslinking networks, the gap in very high-stress environments remains, capping share growth in select premium niches. Yet acrylics retain cost and process advantages in the mid-performance tier, ensuring balanced competition rather than outright displacement.

Other drivers and restraints analyzed in the detailed report include:

- Digital Ink-Jet Printing Inks Adoption

- Shift to Food-Grade Flexible-Pack Adhesives

- Acrylic Monomer Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Styrene-acrylic grades held 45.18% of global revenue in 2024. Their balanced hardness, water resistance, and price position them as the workhorse for interior architectural paint and paper saturation lines. Through 2030, styrene-acrylic volumes will climb steadily, but the segment's share will edge downward as users diversify into vinyl-rich systems. Vinyl-acrylic emulsions are set to grow 6.22% annually, riding demand for flexible construction adhesives, sealants, and low-temperature coated boards. Pure acrylics command the premium tier, favored in high-gloss exterior walls and cool-roof elastomeric where colour retention and UV durability are paramount.

Advanced self-crosslinking technologies reinforce this hierarchy. Studies show DAAM-ADH networks in styrene-acrylic road sealants boost bond strength by more than 50% over conventional grades. Producers market modular platforms that let customers fine-tune Tg and hardness with minimal lab reformulation, saving time to market. Meanwhile, vinyl-acrylic suppliers stress plasticizer-free flexibility that withstands thermal cycling in laminate flooring and weather-barrier membranes. Pure acrylics leverage bio-based monomer options to target sustainability-conscious architects, widening the value gap versus lower-priced chemistries.

The Acrylic Emulsions Market Report is Segmented by Type (Pure Acrylic Emulsion, Styrene Acrylic Emulsion, and Vinyl Acrylic Emulsion), Application (Paints and Coatings, Construction Material Additives, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 46.21% of global revenue in 2024 and will post a 6.09% CAGR to 2030. China's Verbund site expansions supply local binders for booming public-works paint consumption, while India's elevated capex pipeline translates directly into fresh commercial and residential floor space. ASEAN members such as Vietnam and Indonesia host export-oriented furniture and packaging clusters that rely on water-borne coatings to meet OECD buyer standards. The region also houses world-scale feedstock plants, enabling integrated players to balance cost pressure and drive economies of scale.

North America remains a regulatory trendsetter. The EPA's revised aerosol rules and CARB's low-VOC caps force continuous R&D investment, yet they simultaneously defend incumbents with proven compliance credentials. Infrastructure renewal under the U.S. Infrastructure Investment and Jobs Act pumps spending into bridges, transit hubs, and public buildings, all of which favor durable, low-odor coatings. Canada's country-wide VOC regulations, effective 2024, harmonize requirements and simplify cross-border product portfolios. Mexico's maquiladora network attracts appliance and automotive manufacturers that specify water-borne finishes to secure export approvals.

Europe emphasizes sustainability leadership. BASF's shift to bio-based ethyl acrylate and the Dutch dispersion expansion illustrate the region's drive to decarbonize the chemicals value chain. Germany supports cool-roof retrofits through building-efficiency subsidies, widening the market for reflective acrylic membranes. France and the United Kingdom promote circular-economy criteria in public procurement, favoring resins with life-cycle-assessment backing. Although South America and the Middle-East and Africa together represent less than 10% of global consumption, rising urbanization and increased access to mortgage financing encourage residential repainting and infrastructure projects, providing long-run upside.

- AICA Kogyo Co.Ltd.

- AkzoNobel N.V.

- Allnex GMBH

- Anhui Sinograce Chemical Co., Ltd.

- Arkema

- Asian Paints Ltd.

- Axalta Coating Systems LLC

- BASF

- Celanese Corporation

- DIC Corporation

- Dow

- Gellner Industrial, LLC.

- H.B. Fuller Company

- Lubrizol

- Mallard Creek Polymers

- Nippon Paint Holdings Co., Ltd.

- Osaka Organic Chemical

- PPG Industries, Inc.

- Synthomer plc

- The Cary Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Low-VOC Push for Water-Borne Paints and Coatings

- 4.2.2 Booming Construction Spending in Developing Countries

- 4.2.3 Digital Ink-Jet Printing Inks Adoption

- 4.2.4 Shift to Food-Grade Flexible-Pack Adhesives

- 4.2.5 Cool-Roof and Reflective Coatings Demand

- 4.3 Market Restraints

- 4.3.1 Preference For Polyurethane Dispersions

- 4.3.2 Acrylic Monomer Price Volatility

- 4.3.3 UV-Yellowing of Styrene-Rich Emulsions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Pure Acrylic Emulsion

- 5.1.2 Styrene-Acrylic Emulsion

- 5.1.3 Vinyl-Acrylic Emulsion

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Construction Material Additives

- 5.2.3 Paper Coating

- 5.2.4 Adhesives

- 5.2.5 Other Applications (Textile and Non-woven Finishes, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AICA Kogyo Co.Ltd.

- 6.4.2 AkzoNobel N.V.

- 6.4.3 Allnex GMBH

- 6.4.4 Anhui Sinograce Chemical Co., Ltd.

- 6.4.5 Arkema

- 6.4.6 Asian Paints Ltd.

- 6.4.7 Axalta Coating Systems LLC

- 6.4.8 BASF

- 6.4.9 Celanese Corporation

- 6.4.10 DIC Corporation

- 6.4.11 Dow

- 6.4.12 Gellner Industrial, LLC.

- 6.4.13 H.B. Fuller Company

- 6.4.14 Lubrizol

- 6.4.15 Mallard Creek Polymers

- 6.4.16 Nippon Paint Holdings Co., Ltd.

- 6.4.17 Osaka Organic Chemical

- 6.4.18 PPG Industries, Inc.

- 6.4.19 Synthomer plc

- 6.4.20 The Cary Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Advancements in Self-crosslinking Technology of Acrylic Emulsion