|

市場調查報告書

商品編碼

1846229

十二烷基硫酸鈉:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Sodium Lauryl Sulfate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

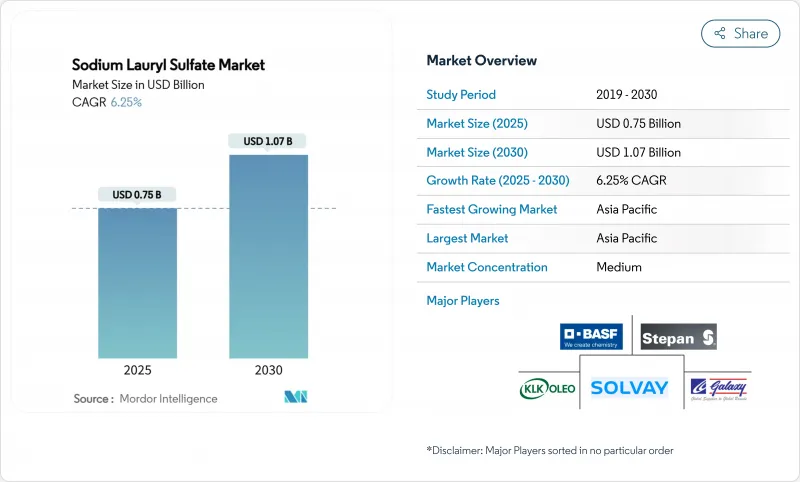

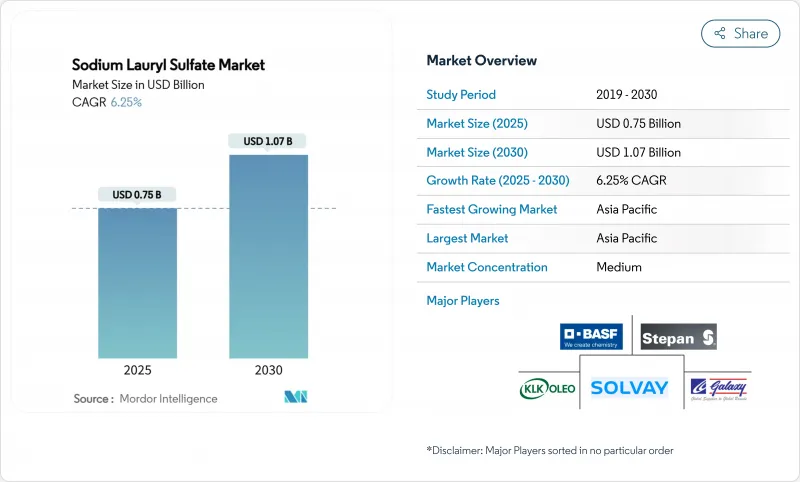

預計 2025 年十二烷基硫酸鈉市場規模為 7.5 億美元,到 2030 年將達到 10.7 億美元,預測期內(2025-2030 年)的複合年成長率為 6.25%。

這一勢頭源於該化合物在清潔劑、個人保健產品、油田化學品和作物保護助劑中的強大作用,儘管「無硫酸鹽」標籤促使配方師尋求更溫和的替代品。原料(尤其是棕櫚衍生的脂醇類)的波動性正在擠壓生產商的淨利率,但同時也凸顯了其相對於全生物基界面活性劑的成本優勢。受中國、馬來西亞和印尼產能擴張的推動,亞太地區在結構上維持了成本領先地位,而跨國巨頭積極的脫碳計畫則保障了該化合物在北美和歐洲的監管認可。

全球十二烷基硫酸鈉市場趨勢與洞察

家用清潔劑和清潔劑需求激增

家電保有量快速成長和洗衣頻率不斷提升是十二烷基硫酸鈉市場最強勁的需求驅動力。配方師非常重視這種陰離子界面活性劑在硬水條件下的穩定性,這使得他們能夠在保持洗滌效果的同時降低助洗劑用量。其泡沫特性還能使濃縮液提供消費者期望的感官體驗——這在新興經濟體中至關重要,因為在這些經濟體中,視覺泡沫等同於功效。改良的高效能洗衣解決方案利用十二烷基硫酸鈉與蛋白酶、脂肪酶和纖維素酶的兼容性,促進低溫洗滌,進而降低能源費用。憑藉2024年美國環保署「更安全選擇」認證,該化合物進一步鞏固了其作為大眾市場清潔劑中主流且經監管機構認可的成分的地位。

擴大亞太地區個人護理製造地

由BASF投資100億美元建設的湛江巴邦德綜合體牽頭的大型資本投資計劃,展現了品牌所有者如何實現原料本地化,以滿足中國、印度和東南亞地區對護髮和沐浴產品日益成長的需求。獲得價格具競爭力的棕櫚油原料和可再生電力,可降低單位成本,同時減少碳排放。叢集效應將契約製造製造商和包裝供應商聚集在一起,縮短了全球快速消費品巨頭的前置作業時間。這些動態增強了亞太地區十二烷基硫酸鈉市場的韌性,即使在高階無硫酸鹽產品日益普及的情況下也是如此。

人類和水生生物毒性問題推動「無硫酸鹽」標籤

儘管美國食品藥物管理局 (FDA) 和化妝品成分審查機構 (COI) 的沖洗毒性評估再次確認了其安全性,但社交媒體的討論卻加劇了有關頭皮刺激的傳聞,促使中高階護髮品牌紛紛推出無硫酸鹽產品。這些產品在北美的價格溢價 20-30%。市場區隔已為「清潔美容」開闢了專屬空間,高階市場的十二烷基硫酸鈉市場也明顯呈現碎片化。歐洲生態標章計畫收緊了排放毒性閾值,促使洗潔精的機構買家嘗試更溫和的配方。

細分分析

預計到2024年,SLS液體製劑將佔總收益的61.35%,超過十二烷基硫酸鈉市場的整體成長,複合年成長率為6.85%。線上計量、全自動配料和即時溶解的特性使SLS液體製劑成為中國和美國百萬噸級清潔劑工廠的預設選擇。液體製劑還能最大限度地減少粉塵暴露,這是職業安全合規的首要任務。乾式SLS在出口主導的紡織助劑和SDS-PAGE試劑領域保持穩固的地位,這些領域的運輸量減少意味著物流成本的降低,但成長率仍低於5%。

針對濃縮膠囊和清潔劑的配方師會添加粉末狀十二烷基硫酸鈉 (SLS) 來控制黏度並減少水分攜帶。噴霧乾燥過程的改進使能耗降低了 15%,並略微提高了粉末的經濟性。儘管如此,馬來西亞和德克薩斯宣布的 2026 年液體產能擴張計畫表明,十二烷基硫酸鈉市場將繼續傾向於自由流動的形式。

十二烷基硫酸鈉報告按產品形式(十二烷基硫酸鈉 (SLS) 液體、十二烷基硫酸鈉 (SLS) 乾)、等級(工業級、化妝品和個人護理級、醫藥級、食品級)、最終用戶行業(清潔劑和清潔劑、個人保健產品、工業清潔劑、其他應用)和地區(亞太地區、北美、歐洲、其他細分市場)。

區域分析

亞太地區將佔全球銷售額的45.16%,到2030年,複合年成長率將達到8.03%。低成本原料、強勁的消費品生產以及馬來西亞、泰國和中國沿海地區新建的油脂化工項目將保持該地區的結構性優勢。湛江巴林提供的陰離子界面活性劑基質足以滿足亞太地區到2030年三分之一的需求。

北美市場成熟且穩定,由歷史悠久的清潔劑品牌和蓬勃發展的油田化學物品部門支撐。 Stepan收購PerformanX將擴大其增值農業界面活性劑的生產能力,並減少對進口的依賴。

儘管歐洲正在努力製定更嚴格的法規,但十二烷基硫酸鈉在工業洗碗機和織物護理片中仍根深蒂固,這給新參與企業帶來了同樣嚴峻的生物分解障礙。根據修訂後的清潔劑法規,數位標籤試驗將詳細的成分數據發送到智慧型手機,引導負責人找到可追溯、永續且經過認證的棕櫚衍生物。中端製造商正在透過採用類似BASF生態平衡牌號的生質能平衡模型來應對利潤率的下降。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 家用清潔劑和清潔劑需求激增

- 擴大亞太地區個人護理製造地

- 新興國家衛生意識不斷增強

- 生物基界面活性劑的成本競爭力

- 高價值除草劑混合物的助劑系統

- 市場限制

- 人類和水生生物毒性問題推動「無硫酸鹽」標籤

- 生物基和溫和表面活性劑替代品的快速商業化

- 棕櫚仁油價格波動導致原物料成本上漲

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按產品形態

- 液態十二烷基硫酸鈉(SLS)

- 十二烷基硫酸鈉(SLS)乾粉

- 按年級

- 工業級(活性93%以上)

- 化妝品和個人護理級

- 醫藥級

- 食品級

- 按最終用戶產業

- 清潔劑和清潔劑

- 個人保健產品

- 工業清潔劑

- 其他用途(油田化學品、提高採收率等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Aarti Surfactants

- Alpha Chemicals Pvt Ltd

- BASF

- Croda International Plc

- Dongming Jujin Chemical Co., Ltd

- Dow

- Galaxy

- Indorama Ventures Public Company Limited.

- Kao Chemicals Europe, SLU

- KLK OLEO

- Sasol Limited

- Solvay

- Spectrum Chemical

- Stepan Company

- Taiwan NJC Corporation

第7章 市場機會與未來展望

The Sodium Lauryl Sulfate Market size is estimated at USD 0.75 billion in 2025, and is expected to reach USD 1.07 billion by 2030, at a CAGR of 6.25% during the forecast period (2025-2030).

This momentum stems from the compound's entrenched role in detergents, personal-care products, oilfield chemicals, and crop-protection adjuvants, even as "sulfate-free" labeling pushes formulators toward milder alternatives. Feedstock volatility, especially in palm-derived fatty alcohols, is compressing producer margins and simultaneously highlighting cost advantages over fully bio-based surfactants. Capacity expansions in China, Malaysia, and Indonesia keep Asia-Pacific in a structural cost-lead position, while aggressive decarbonization programs by multinational majors safeguard the compound's regulatory acceptance in North America and Europe.

Global Sodium Lauryl Sulfate Market Trends and Insights

Demand Surge from Household Detergents and Cleaners

Surging appliance ownership and rising laundry frequency underpin the most resilient outlet for the sodium lauryl sulfate market demand. Formulators value the anionic surfactant's stability under hard-water conditions, enabling lower builder loading while preserving wash performance. Its foaming profile also allows concentrated liquids to deliver the sensory cues consumers expect, a critical success factor in emerging economies where visual foam is equated with efficacy. Reformulated high-efficiency laundry liquids rely on sodium lauryl sulfate's compatibility with protease, lipase, and cellulase enzymes, facilitating lower-temperature washes that trim energy bills. EPA Safer Choice recertification in 2024 further elevates the compound's status as a mainstream, regulatory-endorsed ingredient for mass-market cleaners.

Expansion of Personal-Care Manufacturing Bases in APAC

Massive capital projects, most notably BASF's USD 10 billion Zhanjiang Verbund complex, illustrate how brand owners are localizing ingredient supply to match explosive demand for hair-care and bath-care products in China, India, and Southeast Asia. Access to competitively priced palm lipid feedstocks and renewable electricity keeps unit costs low while trimming embedded carbon. The clustering effect attracts contract manufacturers and packaging suppliers, shortening lead times for global FMCG leaders. These dynamics strengthen the sodium lauryl sulfate market's resilience in APAC even as premium sulfate-free lines proliferate.

Human and Aquatic-Toxicity Concerns Driving "Sulfate-Free" Labeling

Although wash-off toxicology reviews from the FDA and the Cosmetic Ingredient Review reaffirm safety, social-media discussions amplify anecdotal scalp-irritation claims, pushing mid- to high-end hair-care brands toward sulfate-free positioning. These products achieve price premiums of 20-30% in North America. Retail shelf resets allocate dedicated "clean beauty" space, visibly fragmenting the sodium lauryl sulfate market in prestige segments. European eco-label schemes tighten discharge-toxicity thresholds, nudging institutional buyers of dish-wash liquids to pilot milder blends.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Post-COVID Hygiene Focus in Emerging Economies

- Cost-Competitiveness Versus Bio-Based Surfactants

- Rapid Commercialization of Bio-Based and Mild Surfactant Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SLS Liquid captured 61.35% of 2024 revenue and is forecast to outpace the overall sodium lauryl sulfate market at a 6.85% CAGR. Inline dosing, fully automated batching, and instant solubility make liquids the default choice for megatonne detergent plants in China and the United States. Liquid format also minimizes dust exposure, a growing occupational-safety compliance priority. Dry SLS retains a foothold in export-driven textile auxiliaries and SDS-PAGE reagents, where lower freight mass drives logistics savings, but clocks sub-5% growth.

Formulators targeting concentrated pods or bar detergents add powder SLS for viscosity control and reduced water carry. Process improvements in spray-drying cut energy use by 15%, modestly improving powder economics. Even so, liquid capacity expansions announced for 2026 in Malaysia and Texas point to a continued tilt toward flowable formats in the sodium lauryl sulfate market.

The Sodium Lauryl Sulfate Report is Segmented by Product Form (Sodium Lauryl Sulfate (SLS) Liquid and Sodium Lauryl Sulfate (SLS) Dry), Grade (Industrial Grade, Cosmetic and Personal Care Grade, Pharmaceutical Grade, and Food Grade), End-User Industry (Detergents and Cleaners, Personal Care Products, Industrial Cleaners, and Other Applications), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific anchors 45.16% of global sales and will accelerate at 8.03% CAGR to 2030. Low-cost feedstock, robust consumer-goods output, and new oleochemical complexes in Malaysia, Thailand, and coastal China preserve the region's structural advantage. Zhanjiang Verbund alone supplies enough anionic surfactant base to serve one-third of the incremental APAC demand through 2030.

North America holds a mature yet steady position, bolstered by long-lived laundry-detergent brands and a vibrant oilfield-chemicals sector. Stepan's PerformanX acquisition expands value-added agriculture surfactant capacity, mitigating import reliance.

Europe grapples with stiffer regulatory overhead, but sodium lauryl sulfate remains entrenched in industrial dish-washers and fabric-care tablets, where biodegradability hurdles for newcomers are equally onerous. Digital labeling pilots under the revised Detergent Regulation funnel granular ingredient data to smartphones, nudging formulators toward traceable, certified-sustainable palm derivatives. Mid-tier manufacturers counter margin erosion by adopting biomass-balance models similar to BASF's EcoBalanced grades.

List of Companies Covered in this Report:

- Aarti Surfactants

- Alpha Chemicals Pvt Ltd

- BASF

- Croda International Plc

- Dongming Jujin Chemical Co., Ltd

- Dow

- Galaxy

- Indorama Ventures Public Company Limited.

- Kao Chemicals Europe, S.L.U.

- KLK OLEO

- Sasol Limited

- Solvay

- Spectrum Chemical

- Stepan Company

- Taiwan NJC Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand Surge from Household Detergents and Cleaners

- 4.2.2 Expansion of Personal-Care Manufacturing Bases in Asia-Pacific

- 4.2.3 Heightened Hygiene Focus in Emerging Economies

- 4.2.4 Cost-Competitiveness Versus Bio-Based Surfactants

- 4.2.5 Adoption in Adjuvant Systems for High-Value Herbicide Blends

- 4.3 Market Restraints

- 4.3.1 Human and Aquatic-Toxicity Concerns Driving "Sulfate-Free" Labeling

- 4.3.2 Rapid Commercialisation of Bio-Based and Mild Surfactant Substitutes

- 4.3.3 Palm-Kernel Oil Price Volatility Inflating Feedstock Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Form

- 5.1.1 Sodium Lauryl Sulfate (SLS) Liquid

- 5.1.2 Sodium Lauryl Sulfate (SLS) Dry

- 5.2 By Grade

- 5.2.1 Industrial Grade (Greater than or equal to 93% active)

- 5.2.2 Cosmetic and Personal Care Grade

- 5.2.3 Pharmaceutical Grade

- 5.2.4 Food Grade

- 5.3 By End-User Industry

- 5.3.1 Detergents and Cleaners

- 5.3.2 Personal Care Products

- 5.3.3 Industrial Cleaners

- 5.3.4 Other Applications (Oilfield Chemicals and Enhanced Oil Recovery, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Aarti Surfactants

- 6.4.2 Alpha Chemicals Pvt Ltd

- 6.4.3 BASF

- 6.4.4 Croda International Plc

- 6.4.5 Dongming Jujin Chemical Co., Ltd

- 6.4.6 Dow

- 6.4.7 Galaxy

- 6.4.8 Indorama Ventures Public Company Limited.

- 6.4.9 Kao Chemicals Europe, S.L.U.

- 6.4.10 KLK OLEO

- 6.4.11 Sasol Limited

- 6.4.12 Solvay

- 6.4.13 Spectrum Chemical

- 6.4.14 Stepan Company

- 6.4.15 Taiwan NJC Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Growing Application Footprint Across Various Industries