|

市場調查報告書

商品編碼

1846224

石腦油:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Naphtha - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

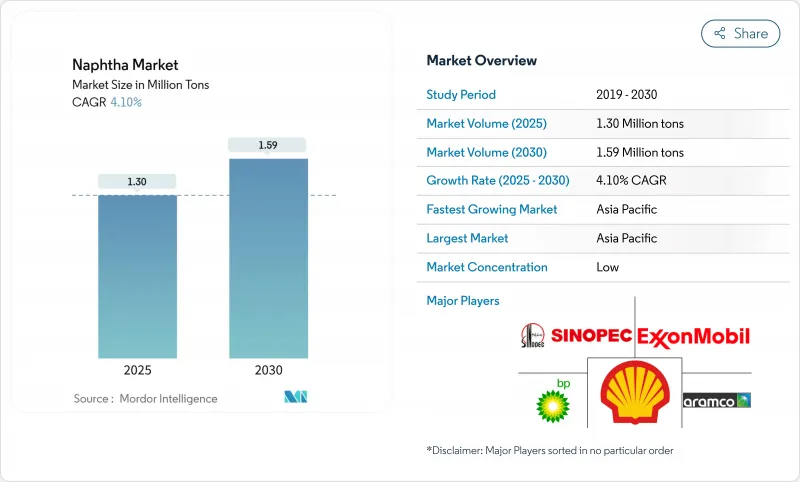

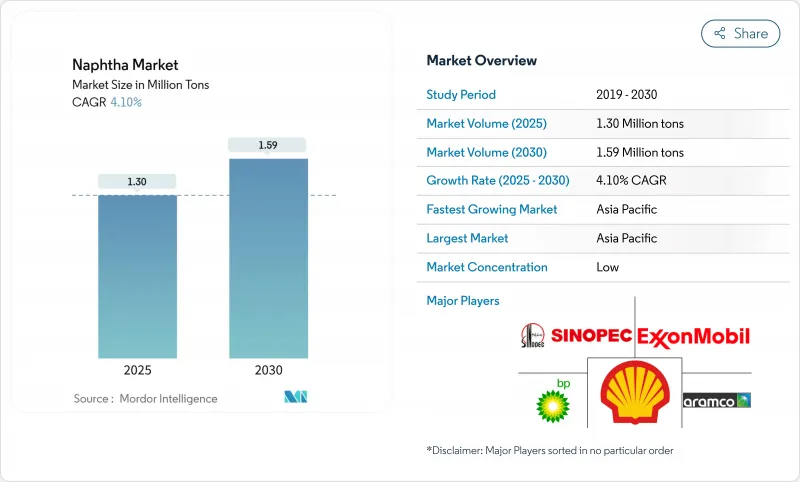

預計到 2025 年,石腦油市場規模將達到 130 萬噸,預計到 2030 年將達到 159 萬噸,在市場估算和預測期(2025-2030 年)內,複合年成長率為 4.10%。

石腦油作為烯烴和芳烴的石化原料,需求佔主導地位,而大型蒸汽裂解裝置為了提高乙烯產率而傾向於使用輕質餾分油,進一步強化了這一需求。美國墨西哥灣沿岸冷凝油裂解裝置和亞洲新建煉油廠的投資正在重塑全球貿易流量,而生物石腦油產能的擴張則提供了補充性的低碳供應管道。大型煉油廠正在將上游原油供應與下游石化轉化相結合,從而在整個產業鏈中實現價值最大化。然而,原油與石腦油價差的波動、天然氣液作為替代原料日益成長的吸引力以及日益嚴格的碳排放法規,都為利潤率穩定性和資本配置決策帶來了不確定性。

全球石腦油市場趨勢與洞察

亞洲蒸汽裂解裝置推動烯烴和芳烴原料需求激增

在中國,為提高輕質石腦油的消耗量,大型裂解裝置正陸續試運行,因為石蠟組分能夠最大程度地提高乙烯產量。這些新裝置到2028年的總合煉油能力將達到80萬至110萬桶/日,其設計均包含整合的冷凝油裂解裝置,以提高石腦油的產率。恆力石化和福建石化的產能擴張將保持需求成長勢頭,從根本上增加冷凝油油的原油進口,並促進石腦油價格與整體市場價格的同步調整。供應安全獎勵正在鼓勵中東生產商與亞洲裂解裝置之間簽訂長期承購協議,進一步鞏固區域價值鏈。根據淨收益計算,每新增一套蒸汽裂解裝置,每年將使區域輕質石腦油需求增加150萬噸,從而顯著促進整體成長。

中東煉油廠升級改造計劃與石腦油重整裝置的整合

巴林石油公司(Bapco)的現代化計畫和沙烏地阿美投資110億美元的AMIRAL煉油廠項目,標誌著一種戰略轉變,即採用催化重整裝置與混合原料裂解裝置相結合的方式,以提高汽油辛烷值和芳烴產量。這種模式將先前用於車用燃料油池的直餾石腦油轉化為利潤率更高的石化產品,從而提升煉油廠的整體毛利率。此外,透過共用公用設施和靈活的原料選擇,此一體化專案還提高了能源效率,並降低了利潤波動。光是AMIRAL煉油廠每年就需要約500萬噸石腦油,這使得該地區成為亞洲石腦油供應的重要樞紐,從而改善了區域供需平衡,並促進了石腦油市場的繁榮發展。

揮發性原油/石腦油價差侵蝕裂解利潤

地緣政治事件和煉油廠產能中斷會導致石腦油裂解價差劇烈波動,使煉廠生產計畫複雜化,並促使煉油廠削減產能。 2024年初,亞丁灣發生成品油輪襲擊事件後,亞洲石腦油裂解價差達到兩年來的最高點,但隨著套利貨物的到來,價差迅速收窄。由於美國煉油產能仍比2019年以來的峰值低62萬桶/日,全球供應緩衝仍然不足,加劇了市場波動。這種波動在不利時期可能導致煉油廠運轉率下降高達8%,增加貿易商的營運資金需求,並限制石腦油市場的擴張。

細分市場分析

由於其優異的乙烯產率和高石蠟含量,輕質石腦油受到現代裂解裝置的青睞,預計到2024年將佔全球石腦油市場的58%。該細分市場預計到2030年將以4.80%的複合年成長率成長,成為所有餾分油中成長最快的。美國和亞洲地區冷凝油裂解裝置的擴建,旨在生產符合裂解裝置餾分油要求的石蠟餾分油,這進一步鞏固了該細分市場在石腦油市場的領導地位。每台日處理量10萬桶的裂解裝置大約生產3萬桶/日的輕質石腦油,這加劇了輕質石腦油與重整裝置的供需平衡,並推高了汽油級原料的溢價。一體化業者透過將裂解裝置產生的餾分油與重整裝置產生的餾分油混合,來對沖利潤週期波動並提高整體資產利用率。

由於重質石腦油芳烴含量高、乙烯轉化率低,其市場成長一直落後,僅為個位數中段。儘管如此,它仍然是催化重整裝置的重要原料,該裝置能夠提高辛烷值並生產苯、甲苯和二甲苯。對鉑錫和鉑錸雙金屬催化劑的投資提高了重整裝置的耐受性,並拓寬了重質石腦油的加工窗口。隨著汽油價差收窄,煉油商利用芳烴銷售合約將重質石腦油收益,從而維持了其在石腦油市場中雖有所下降但仍保持成長的佔有率。

石腦油市場按類型(輕質石腦油、重質石腦油)、來源(煉廠來源、生物石腦油、其他來源)、終端用戶產業(石油化工、農業、油漆塗料、航太、其他產業)和地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲地區)進行細分。市場預測以噸為單位。

區域分析

亞太地區將在2024年佔據石腦油市場44%的佔有率,預計到2030年將以4.90%的複合年成長率成長,這主要得益於石化產品和化肥行業的同步成長。中國2023年原油日加工量將達到創紀錄的1480萬桶,從而實現原料自給自足;而印度的聚合物需求預計到2028年將達到3500萬噸。沙烏地阿美持有恆力石化10%的股份,其在福建省的計劃將進一步擴大區域一體化,使中東的供應與東亞不斷成長的需求相匹配。

由於對冷凝油裂解裝置的投資以及頁岩液化石油氣產量的成長,北美輕質石腦油持續面臨結構性供不應求。預計美國煉油產能將在2023年成長2%,到2024年初達到1,840萬桶/日的運作能。然而,天然氣凝液供應量的激增將轉移石化產品的需求,並減緩區域石腦油市場的擴張速度。對拉丁美洲出口的增加以及偶爾對歐洲的套利交易正在平衡季節性供應過剩。

隨著可再生燃料生產取代化石燃料原料,歐洲對石腦油的需求將略有下降,但剩餘的重整產能將供應芳烴鍊和高辛烷值汽油調和成分。煉油廠將放寬對碳捕集試點設施的投資,透過維修現有設施生產氫化植物油(HVO)和永續航空燃料油(SAF)而非新建設施,來減少傳統石腦油的隱含排放。中東將利用一體化重整-裂解計劃,在套利窗口開啟之際,將自身定位為亞洲和歐洲的邊際供應商。南美和非洲將透過奈及利亞丹格特煉油廠等計劃提升影響力,煉油廠將生產高達8萬桶/日的汽油和石腦油,逐步改變區域貿易格局。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲蒸汽裂解裝置對烯烴和芳烴原料的需求激增

- 中東地區石腦油重整裝置和煉油廠升級改造計劃的整合

- 印度化肥需求不斷成長

- 美國墨西哥灣沿岸地區冷凝油分離器投資增加,目標是提高輕質石腦油產量

- 可再生燃料指令推動生質能生產規模化。

- 市場限制

- 美國液態天然氣需求

- 原油石腦油價差的波動會侵蝕裂解邊緣。

- 對低碳替代燃料和再生材料製定更嚴格的法規

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 原料分析

第5章 市場規模及成長預測(數量與價值)

- 按類型

- 輕石腦油

- 重石腦油

- 按原料

- 精製基礎

- 比奧納夫塔

- 其他

- 按最終用戶產業

- 石化

- 農業

- 油漆和塗料

- 航太

- 其他行業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Alexandria Mineral Oils Company

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- ENEOS Holdings Inc.

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd.

- Kuwait Petroleum Corporation

- LG Chem

- LyondellBasell Industries Holdings BV

- MGT Petroil

- PetroChina Company Limited

- Petroleos Mexicanos

- PTT Global Chemical Public Company Limited

- QatarEnergy

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Saudi Arabian Oil Co.

- Shell plc

- SK Inc.

- TotalEnergies

第7章 市場機會與未來展望

The Naphtha Market size is estimated at 1.30 million tons in 2025, and is expected to reach 1.59 million tons by 2030, at a CAGR of 4.10% during the forecast period (2025-2030).

Demand is anchored by naphtha's role as the dominant petrochemical feedstock for olefins and aromatics, a position reinforced by large-scale steam crackers that prefer light fractions for higher ethylene yields. Investments in condensate splitters along the U.S. Gulf Coast and new integrated refineries in Asia are reshaping global trade flows, while bio-naphtha capacity additions provide a complementary, low-carbon supply stream. Leading refiners integrate upstream crude supply with downstream petrochemical conversion to capture value across the chain. However, volatile crude-naphtha spreads, the growing appeal of natural gas liquids as alternative feedstocks, and increasingly stringent carbon regulations inject uncertainty into margin stability and capital-allocation decisions.

Global Naphtha Market Trends and Insights

Surging Demand for Olefins and Aromatics Feedstocks from Asian Steam Crackers

China is commissioning a wave of mega-crackers that elevate consumption of light naphtha because its paraffinic composition maximizes ethylene output. New capacity totaling 0.8-1.1 million b/d of refining throughput by 2028 is designed with integrated condensate splitters that raise naphtha yield ratios. Capacity additions at Hengli Petrochemical and Fujian Petrochemical will maintain upward demand momentum, translating into structurally higher imports of condensate-rich crudes and driving regional price alignment with the broader naphtha market. Supply security incentives are prompting long-term offtake agreements between Middle-East producers and Asian crackers, further knitting regional value chains. Net-back calculations suggest that each incremental steam cracker complex boosts regional light naphtha requirements by 1.5 million tons annually, underpinning the driver's substantial contribution to overall growth.

Integration of Naphtha Reformers with Refinery Upgrading Projects in the Middle East

Bahrain's Bapco Modernization Programme and Saudi Aramco's USD 11 billion AMIRAL complex illustrate the strategic shift toward co-locating catalytic reformers with mixed-feed crackers to enhance gasoline octane and aromatic output. The model diverts straight-run naphtha that previously entered the motor-fuel pool into higher-margin petrochemical streams, improving overall refinery gross margins. Integration delivers energy-efficiency gains through shared utilities and furnishes flexible feedstock menus that dampen margin volatility. With AMIRAL alone requiring about 5 million tons of naphtha annually, the region becomes a swing supplier to Asia, tightening inter-regional balances and supporting a more robust naphtha market.

Volatile Crude-Naphtha Spreads Undermining Crack Margins

Geopolitical incidents and refining capacity outages drive sharp swings in naphtha crack spreads, challenging refinery scheduling and prompting throughput cuts. An attack on a product tanker in the Gulf of Aden sent Asian naphtha cracks to a two-year high in early 2024, yet spreads retraced swiftly as arbitrage cargoes arrived. With post-2019 U.S. refinery capacity still 620,000 b/d below the peak, global supply buffers remain thin, magnifying volatility. This instability dampens refinery utilization rates by up to 8% in adverse periods and raises working-capital requirements for traders, tempering naphtha market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Fertilizers in India

- Bio-Naphtha Scale-up Backed by Renewable-Fuel Mandates

- Regulatory Push for Low-Carbon Alternatives and Recycled Feedstocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Light naphtha generated 58% of the global naphtha market in 2024 as modern crackers favor its high paraffin content for superior ethylene yield. The segment is projected to grow at 4.80% CAGR to 2030, the briskest pace among cut types. Condensate splitter expansions in the United States and Asia are calibrated to produce paraffinic cuts that align with cracker slate requirements, reinforcing segment leadership in the naphtha market. Each 100,000 b/d splitter yields around 30,000 b/d of light naphtha, tightening balances and supporting premiums to gasoline-grade material. Integrated operators blend splitter streams with reformer output to hedge margin cycles and improve overall asset utilization.

Heavy naphtha lags with mid-single-digit growth owing to its higher aromatic content and lower ethylene productivity. Nonetheless, it remains an essential feedstock for catalytic reformers that upgrade octane and generate benzene, toluene, and xylenes. Investments in platinum-tin and platinum-rhenium bimetallic catalysts improve reformer severity tolerance, widening the processing window for heavier grades. Refiners leverage aromatics marketing agreements to monetize heavy cuts when gasoline spreads compress, preserving a supportive though less dynamic contribution to the naphtha market.

The Naphtha Market Report is Segmented by Type (Light Naphtha and Heavy Naphtha), Source (Refinery-Based, Bio-Naphtha, and Others), End-User Industry (Petrochemicals, Agriculture, Paints and Coatings, Aerospace, and Other Industries), and Geography (Asia Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific led the naphtha market with 44% share in 2024, and its 4.90% forecast CAGR to 2030 stems from synchronized growth in petrochemicals and fertilizers. China processed a record 14.8 million b/d of crude in 2023, underpinning self-sufficiency in feedstocks, while India's polymer demand is on track to hit 35 million tons by 2028. Aramco's 10% stake in Hengli Petrochemical and the Fujian project further expand regional integration, aligning Middle-East supply with East-Asian demand growth.

North America remains structurally long light naphtha due to condensate splitter investments and rising shale liquids output. U.S. refining capacity climbed 2% in 2023, taking operable nameplate to 18.4 million b/d at the start of 2024. Yet surging NGL availability diverts petrochemical demand, moderating the regional naphtha market expansion pace. Export growth into Latin America and occasional arbitrage to Europe balances seasonal surpluses.

Europe's naphtha demand contracts modestly as renewable fuel production displaces fossil feedstocks, but residual reformer capacity supplies aromatics chains and high-octane gasoline blendstocks. Refiners retrofit existing units for HVO and SAF rather than building greenfield assets, freeing investment for carbon-capture pilots that lower the embedded emissions of conventional naphtha. The Middle East capitalizes on integration projects that couple reformers and crackers, positioning itself as the marginal supplier into Asia and Europe when arbitrage windows open. South America and Africa gain influence through projects such as Nigeria's Dangote refinery, which will produce up to 80 kbd of gasoline and naphtha, gradually transforming regional trade balances.

- Alexandria Mineral Oils Company

- BP p.l.c.

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- ENEOS Holdings Inc.

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd.

- Kuwait Petroleum Corporation

- LG Chem

- LyondellBasell Industries Holdings B.V.

- MGT Petroil

- PetroChina Company Limited

- Petroleos Mexicanos

- PTT Global Chemical Public Company Limited

- QatarEnergy

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Saudi Arabian Oil Co.

- Shell plc

- SK Inc.

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Olefins and Aromatics Feedstocks from Asian Steam Crackers

- 4.2.2 Integration of Naphtha Reformers with Refinery Upgrading Projects in the Middle East

- 4.2.3 Rising Demand for Fertilizers in India

- 4.2.4 Rising Investments in USGC Condensate Splitters Targeting Light Naphtha Output

- 4.2.5 Bio-Naphtha Scale-up Backed by Renewable-Fuel Mandates

- 4.3 Market Restraints

- 4.3.1 Natural Gas Liquid Demand in the United States

- 4.3.2 Volatile Crude-Naphtha Spreads Undermining Crack Margins

- 4.3.3 Regulatory Push for Low-Carbon Alternatives and Recycled Feedstocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Feedstock Analysis

5 Market Size and Growth Forecasts (Volume and Value)

- 5.1 By Type

- 5.1.1 Light Naphtha

- 5.1.2 Heavy Naphtha

- 5.2 By Source

- 5.2.1 Refinery-Based

- 5.2.2 Bio-Naphtha

- 5.2.3 Others

- 5.3 By End-user Industry

- 5.3.1 Petrochemicals

- 5.3.2 Agriculture

- 5.3.3 Paints and Coatings

- 5.3.4 Aerospace

- 5.3.5 Other Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Alexandria Mineral Oils Company

- 6.4.2 BP p.l.c.

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation

- 6.4.5 CNPC

- 6.4.6 ENEOS Holdings Inc.

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 Formosa Petrochemical Corporation

- 6.4.9 Idemitsu Kosan Co.,Ltd.

- 6.4.10 Indian Oil Corporation Ltd.

- 6.4.11 Kuwait Petroleum Corporation

- 6.4.12 LG Chem

- 6.4.13 LyondellBasell Industries Holdings B.V.

- 6.4.14 MGT Petroil

- 6.4.15 PetroChina Company Limited

- 6.4.16 Petroleos Mexicanos

- 6.4.17 PTT Global Chemical Public Company Limited

- 6.4.18 QatarEnergy

- 6.4.19 Reliance Industries Limited

- 6.4.20 SABIC

- 6.4.21 Sasol Limited

- 6.4.22 Saudi Arabian Oil Co.

- 6.4.23 Shell plc

- 6.4.24 SK Inc.

- 6.4.25 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment