|

市場調查報告書

商品編碼

1846217

無線對講機:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Wireless Intercoms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

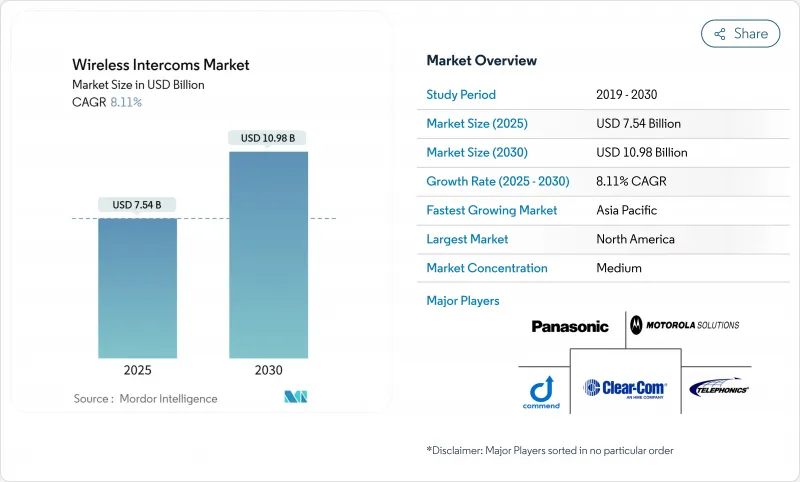

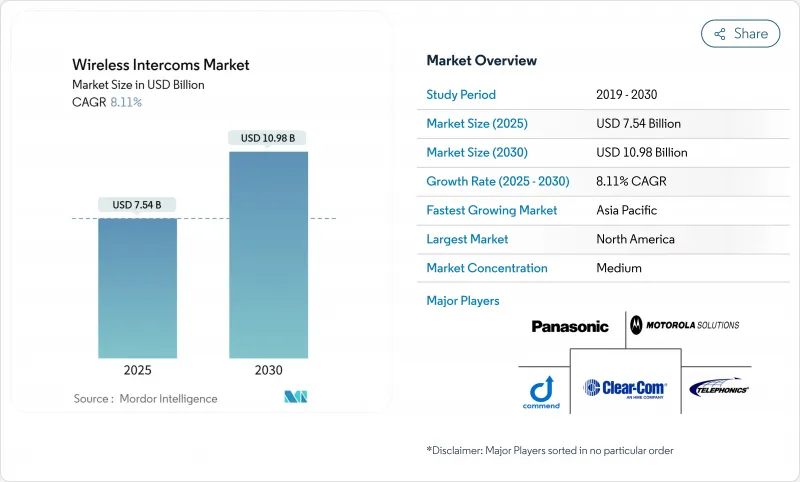

2025 年無線對講機市場規模估計為 75.4 億美元,預計到 2030 年將達到 109.8 億美元,在預測期(2025-2030 年)內複合年成長率為 8.11%。

需求成長主要源自於有線音訊面板向支援IP的多模態系統的穩定過渡,這些系統能夠透過同一網路骨幹網路融合語音、影像和資料。關鍵成長要素包括建築基礎設施的廣泛數位化、Wi-Fi 6E和專用5G無線網路價格的下降,以及職業安全法規對免持通訊的標準化。隨著雲端原生參與企業將設備管理和分析功能與硬體捆綁在一起,提供具有終身價值的提案,市場競爭日益激烈,這尤其吸引那些沒有內部IT資源的設施業主。此外,射頻認證技術人員短缺的環境也傾向於選擇可擴展的架構,以減少工具停機時間和安裝工作。

全球無線對講機市場趨勢與洞察

對安全性和監控解決方案的需求日益成長

整合式對講平台現在可將音訊串流直接傳輸到視訊分析主機,使控制室操作員能夠將語音命令與視覺警報關聯起來。在醫院,Zenitel 的系統透過其內建語音引擎偵測到特定關鍵字,自動將緊急呼叫升級為保全人員呼叫,並鎖定指定門禁,從而展現了這種融合。在大型機場,愛立信的專用 LTE 骨幹網支援停機坪工作人員和塔台控制人員之間關鍵任務的對講功能,從而減少滑行時間偏差並提高事件可追溯性。 2024 年高純度石英短缺凸顯了供應鏈的脆弱性,促使設施所有者傾向於使用模組化設備,因為無需重新認證整個陣列即可更換。語音、視訊和分析的緊密整合縮短了取證調查週期。其結果是,以安全為中心的資本投資與無線對講系統的應用之間存在著密切聯繫。

Wi-Fi/IP智慧家庭對講機的興起

房屋建築商正擴大將音訊面板和門禁攝影機捆綁在同一Wi-Fi 6E網路上,從而簡化低電壓佈線方案並縮短試運行時間。 CableLabs的一項研究證實,6 GHz頻段緩解了以往高密度多用戶住宅中因網路擁塞而導致的語音品質下降問題。 AiphoneCloud允許安裝人員遠端排除裝置故障,從而降低上門服務成本,並使訂閱模式對物業管理人員更具吸引力。 Stryker的Vocera徽章可與物業管理後端整合,使員工能夠透過安全的語音提示接收清潔任務,而無需透過需要螢幕互動的行動應用程式通知。這些措施的累積效應是加快了傳統模擬門禁系統的更新週期,從而增強了無線對講機市場的需求。

射頻干擾與頻率擁塞

CableLabs 的多層模擬揭示了低延遲流量(例如對講語音)的隊頭阻塞現象。共用頻譜策略雖然能部分緩解問題,但會增加協調開銷。日本的技術標準符合性認證要求每個無線電設備都必須通過 315 MHz、400 MHz、920 MHz 和 2.4 GHz頻寬的單獨測試,導致核准週期過長。美國國家頻譜研發計畫強調動態感知是解決之道,但大規模部署仍需數年時間。同時,供應商正在整合抗干擾天線,從而推高了組件成本。

細分市場分析

到2024年,安防監控將佔無線對講市場38%的佔有率,凸顯了該技術在分層防禦架構中的核心作用。機場、醫院和資料中心強制升級門禁系統,使得語音認證成為生物識別掃描的有效補充,從而推動了該領域的發展。供應商透過整合降噪和人工智慧關鍵字辨識功能來提升產品差異化,這些功能無需人工干預即可發出警報。雖然活動管理絕對市場規模較小,但預計將以9.5%的複合年成長率成長,這主要得益於全雙工網狀無線技術的普及,該技術使演出總監能夠即時調整燈光、煙火和廣播鏈路。醫療保健產業也持續採用基於對講的工作流程自動化。 Zenitel的渦輪單元與護理人員呼叫中間件整合,使醫護人員能夠在病患進入隔離病房前進行分診,從而減少個人防護工具的使用。物流公司正在部署卡車稱重對講系統,並將其與稱重軟體配合使用,以減少車輛閒置時間並最大限度地減少司機與裝卸平台的互動。

無線通訊在活動製作中的應用顯而易見,許多多場館合約都明確規定了在禮堂、體育場和臨時場館之間漫遊的功能。飯店連鎖企業傾向於使用隱藏的徽章式設備,這些設備可與物業管理軟體對接,方便住宿無需使用會打擾客人的雙向無線對講機即可向工程部門發出訊號。重工業場所需要本質安全型外殼和連接到同一通話路徑的廣域警報器,INDUSTRONIC 公司提案了「一個網路覆蓋所有警報」的方案。教育機構則選擇整合群發通知功能,以便透過單一的圖形使用者介面同時發布封鎖公告和對講機控制指令。鑑於應用場景的多樣性,多重通訊協定相容性已成為無線對講機市場的必備功能。

無線對講機市場報告按應用(安防監控、活動管理、酒店、交通物流、醫療保健等)、技術(Wi-Fi/IP、DECT 6.0、數位 UHF/VHF [MURS、FRS 等]、LTE/5G 蜂窩網路、Zigbee/藍牙)、最終用戶領域(住宅、商業、企業/公司園區、政府和公共地區進行細分和地區政府和地區進行細分。

區域分析

北美地區佔2024年收入的36.2%,在嚴格的美國職業安全與健康管理局(OSHA)法規和成熟的室內覆蓋基礎設施的支持下,該地區有望率先採用私有5G對講系統。主要系統整合商已簽署長期維護契約,確保系統持續升級。在2025會計年度的採購中,機場優先考慮冗餘呼叫路徑,此前美國聯邦航空管理局(FAA)的一次地面停飛事件凸顯了語音可靠性方面的不足。國家頻譜研發計畫為動態共享實驗提供了政策確定性,並鼓勵供應商加強研發投入。

亞太地區將以10.9%的複合年成長率實現最快成長。中國的「訊號升級」計畫將投入國家和私人資本,在12萬個場所升級室內行動網路覆蓋,並建造無線對講機部署平台。印度通訊業在2024會計年度的市場規模達2.4兆印度盧比(約290億美元),受益於監管品質評估工具,鼓勵家庭用戶安裝高可用性連接,並提升對講機的安裝率。日本的合規性測試確保了低輻射設備,促使國內供應商採用干擾抑制濾波器,這將有利於出口。

節能型智慧建築維修在歐洲將迎來強勁成長。 2030年實現碳中和的主導目標要求採用融合網路,以減少電纜重複建設。歐盟職業安全法規將全雙工音訊列為高噪音區域的關鍵控制方法,從而刺激了對ATEX認證對講機的需求。在南美洲以及中東和非洲地區,對講機正被應用於交通設施升級改造,例如聖保羅和利雅得地鐵在站台邊緣和與旅遊走廊相連的酒店擴建項目中都採用了IP音頻系統。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對安全性和監控解決方案的需求日益成長

- 基於Wi-Fi/IP的智慧家庭對講機的普及

- 智慧建築與基礎設施現代化浪潮

- 現場活動中全雙工網狀對講系統的轉變

- 工作場所安全法規要求使用免持通話

- 適用於臨時工地的LTE/5G站點式系統

- 市場限制

- 射頻干擾與頻譜擁塞

- IP設備中的網路安全漏洞

- 熟練的射頻-IT安裝人員短缺

- 全球頻譜許可證碎片化

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 透過使用

- 安全與監控

- 活動管理

- 飯店業

- 運輸/物流

- 衛生保健

- 工業和製造業

- 教育

- 其他

- 按技術(連接性)

- Wi-Fi/IP

- DECT 6.0

- 數位超高頻/甚高頻(MURS、FRS 等)

- LTE/5G蜂窩網路

- Zigbee/Bluetooth

- 按最終用途面積

- 住房

- 商業設施

- 企業/企業園區

- 政府/公共

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 阿根廷

- 巴西

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Aiphone Co. Ltd

- Panasonic Corp.

- Clear-Com(HME)

- Motorola Solutions

- Zenitel NV

- Commend International GmbH

- RTS Intercom Systems(Bosch)

- Riedel Communications

- Sena Technologies

- Telephonics Corp.

- Axis Communications

- Dahua Technology

- Godrej Security Solutions

- Honeywell International

- Hytera Communications

- JVCKenwood Corp.

- 2N Telekomunikace(Axis)

- ButterflyMX

- DoorBird(Bird Home Automation)

- Alpha Communications

- Siedle and Sohne

- Akuvox

第7章 市場機會與未來展望

The Wireless Intercoms Market size is estimated at USD 7.54 billion in 2025, and is expected to reach USD 10.98 billion by 2030, at a CAGR of 8.11% during the forecast period (2025-2030).

Demand follows the steady shift from hard-wired voice panels to IP-enabled, multi-modal systems that blend audio, video, and data across the same network backbone. Widespread digitization of building infrastructure, improved affordability of Wi-Fi 6E and private 5G radios, and occupational-safety rules that formalize hands-free communication are the primary growth levers. Competitive intensity is rising as cloud-native entrants bundle device management and analytics with hardware, creating lifetime value propositions that appeal to facility owners who lack in-house IT resources. Procurement patterns also favor scalable architectures that limit tooling downtime, trimming installation labor in an environment where RF-certified technicians remain scarce.

Global Wireless Intercoms Market Trends and Insights

Expanding demand for security and surveillance solutions

Integrated intercom platforms now feed audio streams directly into video analytics consoles so control-room operators can correlate spoken commands with visual alerts. Hospitals illustrate this convergence as Zenitel systems automatically escalate a distress call to security staff and lock designated access doors when embedded speech engines detect specific keywords. At major airports, Ericsson's private LTE backbone supports mission-critical push-to-talk between tarmac crews and tower staff, reducing taxi-time deviations and improving incident traceability. High-purity quartz shortages during 2024 highlighted supply-chain fragility, prompting facility owners to favor modular devices that can be swapped without re-certifying the entire array. Tight pairing of voice, video, and analytics shortens forensic investigation cycles, a decisive benefit for operators facing budget scrutiny. The result is a firm linkage between security-centric capital expenditure and wireless intercom adoption.

Proliferation of Wi-Fi/IP-based smart-home intercoms

Residential builders increasingly bundle voice panels with door cameras on the same Wi-Fi 6E network, simplifying low-voltage wiring plans and cutting commissioning time. CableLabs research confirms that the 6 GHz band alleviates earlier congestion that degraded voice quality in dense apartment blocks. AiphoneCloud lets installers troubleshoot devices remotely, lowering truck-roll costs and making subscription models more attractive to property managers. Hotels echo this IP trend; Stryker's Vocera badge integrates with property-management back-ends, allowing staff to receive housekeeping tasks as secure voice prompts rather than mobile app notifications that require screen interaction. The cumulative effect is faster refresh cycles for legacy analog door stations, reinforcing demand nodes for the wireless intercoms market.

RF interference and spectrum congestion

Six-gigahertz Wi-Fi channels are nearing saturation in high-rise dwellings, a problem visualized in CableLabs multi-floor simulations that reveal head-of-line blocking for low-latency traffic such as intercom voice. Shared-spectrum policies offer partial relief but add coordination overhead. Japan's Technical Regulations Conformity Certification requires each wireless appliance to pass separate band tests at 315 MHz, 400 MHz, 920 MHz, and 2.4 GHz, lengthening approval cycles. The US National Spectrum R&D Plan stresses dynamic sensing as a remedy, but large-scale deployment remains years away. In the interim, vendors integrate interference-rejection antennas that raise the bill of materials.

Other drivers and restraints analyzed in the detailed report include:

- Smart-building and infrastructure modernization wave

- Shift to full-duplex mesh intercoms in live events

- Cyber-security vulnerabilities in IP devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Security and surveillance accounted for 38% of the wireless intercoms market in 2024, underscoring the modality's central role in layered defense architectures. The segment benefits from mandatory access-control upgrades in airports, hospitals, and data centers, where voice verification now complements biometric scans. Suppliers differentiate by embedding noise cancellation and AI keyword spotting that escalate alerts without operator input. Event management, while smaller in absolute revenue, is forecast to post a 9.5% CAGR, propelled by full-duplex mesh radios that let show directors coordinate light cues, pyrotechnics, and broadcast links in real time. Healthcare keeps adopting intercom-driven workflow automation; Zenitel's turbine units integrate with nurse-call middleware so staff can triage before entering isolation wards, cutting personal-protective gear use. Logistics firms deploy truck-scale intercoms that pair with weigh-bridge software, slashing idle time and minimizing driver-dock interactions, a feature validated in Zenitel-B-TEK pilots.

Event production's embrace of wireless comms is visible in multi-venue contracts that specify roaming capability across auditoriums, stadiums, and temporary marquees. Hospitality chains gravitate toward discreet badge-style devices that mesh with property-management software, ensuring housekeeping can signal engineering without two-way radios that may disturb guests. Heavy-industry sites demand intrinsically safe housings and wide-area horns linked to the same talk paths, an offering INDUSTRONIC couches as a "one network, all alarms" proposition. Education campuses opt for mass-notification integration, enabling simultaneous lockdown announcements and intercom overrides from a single GUI. Collectively, application diversity cements multiprotocol compatibility as a must-have feature across the wireless intercoms market.

The Wireless Intercoms Market Report is Segmented by Application (Security and Surveillance, Event Management, Hospitality, Transportation and Logistics, Healthcare, and More), Technology (Wi-Fi/IP, DECT 6. 0, Digital UHF/VHF [MURS, FRS, Etc. ], LTE/5G Cellular, and Zigbee/Bluetooth), End-Use Sector (Residential, Commercial, Enterprise/Corporate Campuses, Government and Public Safety, and Others), and Geography.

Geography Analysis

North America generated 36.2% of 2024 revenue, buoyed by stringent OSHA mandates and mature indoor-coverage infrastructure that favors early adoption of private 5G intercoms. Large system integrators lock in long-term maintenance contracts, enabling sustained upgrade cycles. Fiscal 2025 procurement sees airports prioritizing redundant talk paths after FAA ground-stop incidents underscored voice resiliency gaps. The National Spectrum R&D Plan's backing for dynamic sharing experiments adds policy certainty that encourages vendor R&D spend.

Asia Pacific posts the fastest 10.9% CAGR. China's "Signal Upgrade" mission funnels state and private capital into indoor mobile coverage across 120,000 venues, creating a platform for wireless intercom rollouts. India's telecom sector, worth INR 2.4 trillion (USD 29.0 billion) in FY24, benefits from a regulatory quality-rating tool that prods landlords to install high-availability connectivity, lifting intercom attach rates. Japanese compliance testing ensures low emissions gear, spurring domestic suppliers to embed interference-mitigation filters that later become export advantages.

Europe registers steady growth on the back of energy-efficient smart-building retrofits. Directive-led targets for carbon neutrality by 2030 require converged networks that reduce cabling duplication. EU Worker Safety regulations classify full-duplex voice as a critical control measure in high-noise zones, energizing demand for ATEX-rated intercoms. South America and the Middle East & Africa see intercom adoption ride on transportation upgrades, metros in Sao Paulo and Riyadh specify IP voice along platform edges, and hospitality expansions linked to tourism corridors.

- Aiphone Co. Ltd

- Panasonic Corp.

- Clear-Com (HME)

- Motorola Solutions

- Zenitel NV

- Commend International GmbH

- RTS Intercom Systems (Bosch)

- Riedel Communications

- Sena Technologies

- Telephonics Corp.

- Axis Communications

- Dahua Technology

- Godrej Security Solutions

- Honeywell International

- Hytera Communications

- JVCKenwood Corp.

- 2N Telekomunikace (Axis)

- ButterflyMX

- DoorBird (Bird Home Automation)

- Alpha Communications

- Siedle and Sohne

- Akuvox

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding demand for security and surveillance solutions

- 4.2.2 Proliferation of Wi-Fi/IP-based smart-home intercoms

- 4.2.3 Smart-building and infrastructure modernization wave

- 4.2.4 Shift to full-duplex mesh intercoms in live events

- 4.2.5 Occupational-safety rules mandating hands-free comms

- 4.2.6 LTE/5G site-based systems for temporary job sites

- 4.3 Market Restraints

- 4.3.1 RF interference and spectrum congestion

- 4.3.2 Cyber-security vulnerabilities in IP devices

- 4.3.3 Shortage of RF-IT skilled installers

- 4.3.4 Global spectrum-licence fragmentation

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Security and Surveillance

- 5.1.2 Event Management

- 5.1.3 Hospitality

- 5.1.4 Transportation and Logistics

- 5.1.5 Healthcare

- 5.1.6 Industrial and Manufacturing

- 5.1.7 Education

- 5.1.8 Others

- 5.2 By Technology (Connectivity)

- 5.2.1 Wi-Fi/IP

- 5.2.2 DECT 6.0

- 5.2.3 Digital UHF/VHF (MURS, FRS, etc.)

- 5.2.4 LTE/5G Cellular

- 5.2.5 Zigbee/Bluetooth

- 5.3 By End-use Sector

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Enterprise/Corporate Campuses

- 5.3.4 Government and Public Safety

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Argentina

- 5.4.2.2 Brazil

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Aiphone Co. Ltd

- 6.4.2 Panasonic Corp.

- 6.4.3 Clear-Com (HME)

- 6.4.4 Motorola Solutions

- 6.4.5 Zenitel NV

- 6.4.6 Commend International GmbH

- 6.4.7 RTS Intercom Systems (Bosch)

- 6.4.8 Riedel Communications

- 6.4.9 Sena Technologies

- 6.4.10 Telephonics Corp.

- 6.4.11 Axis Communications

- 6.4.12 Dahua Technology

- 6.4.13 Godrej Security Solutions

- 6.4.14 Honeywell International

- 6.4.15 Hytera Communications

- 6.4.16 JVCKenwood Corp.

- 6.4.17 2N Telekomunikace (Axis)

- 6.4.18 ButterflyMX

- 6.4.19 DoorBird (Bird Home Automation)

- 6.4.20 Alpha Communications

- 6.4.21 Siedle and Sohne

- 6.4.22 Akuvox

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment