|

市場調查報告書

商品編碼

1846211

汽車終端:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

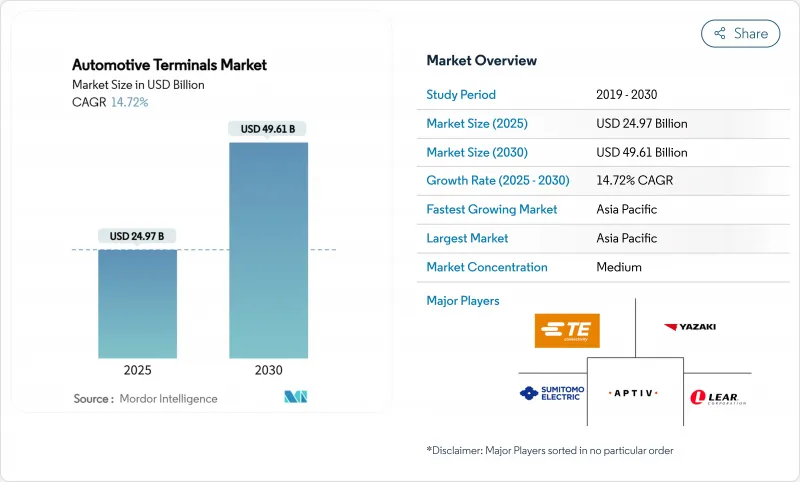

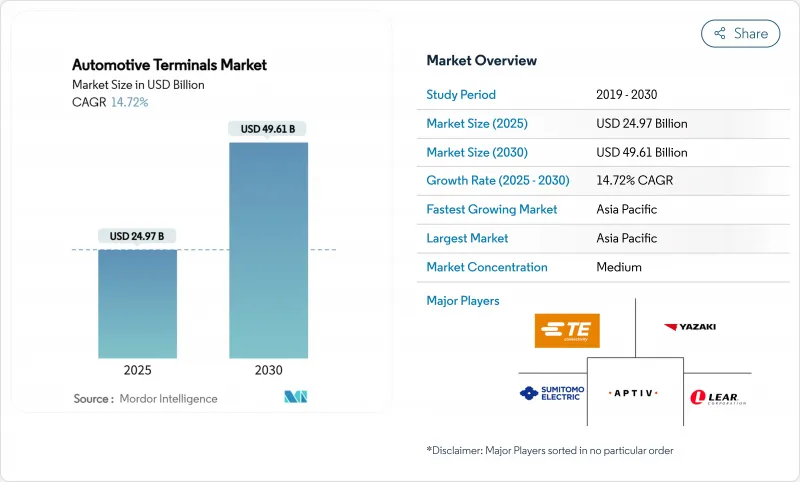

據估計,2025 年汽車終端市場規模為 249.7 億美元,預計到 2030 年將達到 496.1 億美元,預測期(2025-2030 年)複合年成長率為 14.72%。

以特斯拉的低壓連接器標準為例,向48V低壓架構的快速轉型,已將連接器SKU減少至六種,同時仍能滿足90%以上的訊號和電源需求,從而減輕重量、減少材料用量並加速線束自動化。終端供應商也受惠於ADAS的普及,北美和歐洲的改裝計畫推動了售後市場對能夠進行多Gigabit傳輸的資料級屏蔽微型連接器的需求。同時,銅含量極高的電池系統所需的導體體積是內燃機平台的三倍,迫使OEM廠商簽訂多年期供應協議。

全球汽車終端市場趨勢與洞察

由於電氣化,低壓連接點數量呈現爆炸性成長。

汽車電氣化正在增加低壓節點的數量,在現代純電動平台上整合了超過200個連接點,而傳統12V汽車的連接點少於100個。電池管理系統正以強勁的複合年成長率成長,需要超緊湊型端子,以毫秒的間隔監測電池電壓和溫度。 48V配電的高電流密度增加了接觸面的熱負荷,促使人們採用新型錫銀鍍層工藝,以承受100A的持續負載而不會發生微動腐蝕。商用車正在放大這一需求,改裝48V電動渦輪增壓器和能量回收配件,每輛車增加四到六個新的線束分支。

高階汽車向48V電氣架構過渡

BMW、賓士和沃爾沃現已在2024年中期之後推出的所有高階車型中配備48V子系統,為主動式底盤、電子渦輪增壓器和區域控制器供電,且無需增加線徑。每輛車的線束重量最多可減輕19公斤,與輔助電氣設備結合使用時,可節省0.3公升/百公里燃油或延長純電續航里程。特斯拉的低電壓控制系統(LVCS)已證明,48V主幹網可透過DC-DC節點與傳統的12V負載共存,實現漸進式過渡,從而確保售後市場的兼容性。端子現在必須保證60V直流絕緣耐壓,同時保持與現有壓接工具的向下相容性。

銅價波動對終端物料清單利潤率帶來壓力

2024年初,銅價均價為每噸10,800美元。儘管美國加徵關稅和美元疲軟在2025年初推高了銅價,但對全球經濟放緩和中國報復性關稅的擔憂仍然對價格和需求前景構成壓力。由於智利露天礦場關閉導致礦石品位下降,中國冶煉廠面臨精礦供應緊張的局面,迫使加工商就季度提價進行談判。回收有助於抵銷價格波動:美國黃銅棒材廠已確認,2025年平均回收率將超過五分之四,這將使其原生銅需求減少38噸。

細分市場分析

到2024年,電池系統將佔據汽車接點市場33.25%的佔有率,凸顯其作為整個汽車觸點市場中端子密集度最高的子系統的地位。單元成長將主要得益於電芯級感測技術和電池組電壓的提升,這將使下一代滑板式底盤的接點密度超過1400個引腳。由於每個攝影機和雷達模組增加了4到6個屏蔽連接,安全與ADAS(高級駕駛輔助系統)市場到2030年將以14.81%的複合年成長率成長。

新興的固態封裝正在推動間距小於0.35毫米的微型端子的應用,推高了價格。暖通空調和舒適設備產業雖然市場佔有率較小,但隨著48V鼓風機、座椅加熱和熱泵轉向無刷馬達、降低電流消耗並整合銅匯流排,其重要性日益凸顯。

到2024年,乘用車將佔據汽車終端市場64.85%的佔有率,複合年成長率(CAGR)為15.73%。輕型商用車(LCV)也呈現強勁成長勢頭,因為宅配業者正在將其最後一公里配送車輛電氣化,以滿足低排放氣體都市區。二輪車和Scooter正在推動IP67密封直流終端的標準化以及可更換電池平台的應用。

車隊營運商密切關注車輛生命週期經濟效益。對於高運轉率的輕型商用車而言,每次計劃外路邊維修都會產生可觀的交付成本,獎勵選擇高品質、高循環利用率的終端。安波福的 CTCS 重型連接器可承受 30.6G 的振動,並可在 -40°C 至 +140°C 的溫度範圍內穩定運行,其卓越的運作優勢足以抵消總擁有成本模型中 14-18% 的價格溢價。

區域分析

亞太地區預計到2024年將佔據汽車端子市場佔有率的37.76%,並在2030年之前保持15.21%的複合年成長率,成為成長最快的地區。日本一級供應商憑藉數十年的精實生產經驗,向全球OEM廠商提供精密沖壓端子,缺陷率僅為個位數(PPM)。預計印尼和泰國等東南亞國家2024年的電動車註冊量將實現三位數成長,這將促使OEM廠商在當地生產連接器和線束。

即使在通膨和能源成本上升的不利因素導致歐洲汽車收益下滑的情況下,歐洲電動車產量仍將成長。嚴格的車隊二氧化碳排放法規將推動電動車銷售達到2025年的預期水平,從而帶動對高功率充電終端和數據級基板對基板連接器的需求。德國設定的87.3萬輛新電動車註冊目標將加強對終端供應商本地化率的要求。歐洲在ISO 19642和DIN 72036等監管標準的領先地位將為符合標準的供應商提供先發優勢,即使經濟低迷會壓縮短期淨利率。

老化的汽車市場仍然保持著活躍的售後市場,並加速了依賴優質屏蔽連接器的ADAS改裝套件的銷售。通用汽車斥資40億美元進行工廠維修,現代汽車斥資210億美元進行多年擴張,以及Clarios的投資策略,都確保了先進的48V和800V端子的穩定市場需求。到2024年,中東/非洲和南美洲將佔據相當大的市場佔有率,其中南美洲的成長勢頭強勁,這得益於巴西的二氧化碳排放法規和阿根廷的鋰礦開採激勵措施。沙烏地阿拉伯和阿拉伯聯合大公國正在其新興的電動車組裝計畫中推行在地化政策,以振興該地區的電纜和端子製造群。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 由於電氣化,低壓連接點數量呈現爆炸性成長。

- 高階汽車轉向48V電氣架構

- ADAS改裝套件推動售後市場需求激增

- 嚴格的 ISO 19642 線束標準加快了端子重新設計週期

- 需要高精度微型端子的固態電池BMS

- 汽車製造商推廣無壓接雷射焊接端子,以減少組裝工時。

- 市場限制

- 銅價波動對終端物料清單利潤率帶來壓力

- 原始設備製造商 (OEM) 正轉向採用整合式連接器模組以減少端子數量

- 電動車高電流路徑用鋁合金環形端子的可靠性問題

- 亞洲新生產線自動壓接力監測技能缺口

- 價值鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場規模與成長預測

- 透過使用

- 電池系統

- 照明系統

- 資訊娛樂系統

- 動力傳動系統與引擎管理

- 安全與進階駕駛輔助系統

- 暖通空調及舒適系統

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型/大型商用車輛

- 摩托車

- 按終端類型

- 環形端子

- 鏟形端子

- 快速連接端子

- 對接連接器

- 多針連接器

- 按材質

- 銅

- 黃銅

- 鋼

- 其他合金

- 按額定電流

- 小於25安培

- 25至50安培

- 50安培或以上

- 按銷售管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- TE Connectivity

- Lear Corporation

- Aptiv PLC

- Viney Corporation

- Furukawa Electric Co., Ltd.

- Grote Industries

- Keats Manufacturing Co.

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

- Amphenol Corporation

- KS Terminals Inc.

- Hirose Electric Co., Ltd.

- Littelfuse, Inc.

- Samtec Inc.

- Wurth Elektronik

第7章 市場機會與未來展望

The Automotive Terminals Market size is estimated at USD 24.97 billion in 2025, and is expected to reach USD 49.61 billion by 2030, at a CAGR of 14.72% during the forecast period (2025-2030).

A rapid shift toward 48 V low-voltage architectures, exemplified by Tesla's Low-Voltage Connector Standard that reduces connector SKUs to six while still covering more than 90% of signal and power needs, is compressing weight, cutting material usage, and accelerating harness automation. Terminal suppliers also benefit from ADAS proliferation, with retrofit programs in North America and Europe raising aftermarket demand for data-grade, shielded micro-connectors capable of multigigabit transmission. Meanwhile, copper-intensive battery systems require three times the conductor mass of internal-combustion platforms, pushing OEMs to lock multi-year supply contracts even as volatile spot prices pressure gross margins

Global Automotive Terminals Market Trends and Insights

Electrification-Led Explosion in Low-Voltage Connection Points

Vehicle electrification multiplies the number of low-voltage nodes: a contemporary battery electric platform integrates more than 200 distinct connection points against fewer than 100 in conventional 12 V cars. Battery management systems is growing at a robust CAGR, demanding ultra-compact terminals that monitor cell voltage and temperature at millisecond intervals. The higher current density of 48 V distribution increases the thermal load on contact surfaces, prompting the adoption of new tin-silver plating recipes that sustain 100 A continuous loads without fretting corrosion. Commercial fleets extend this demand signal, retrofitting 48 V electric turbochargers and regenerative accessories that add four to six new harness branches per vehicle.

Shift to 48 V Electrical Architectures in Premium Vehicles

BMW, Mercedes-Benz, and Volvo now fit 48 V subsystems across all premium models launched since mid-2024, delivering power for active chassis, e-turbochargers, and zone controllers without oversizing wire gauges. Harness weight falls by up to 19 kg per vehicle, translating to 0.3 L/100 km fuel savings or extended EV range when paired with auxiliary electrics. Tesla's LVCS proves that a 48 V backbone can coexist with legacy 12 V loads through DCDC nodes, allowing phased migration that protects aftermarket compatibility. Terminals must now guarantee 60 V DC dielectric strength while remaining backward-compatible with existing crimp tooling.

Copper Price Volatility is Squeezing Terminal BOM Margins

Copper averaged USD 10,800 per tonne in early 2024. Early 2025 saw rising copper prices due to U.S. tariffs and a weaker dollar, but fears of a global slowdown and China's retaliatory tariffs have weighed heavily on prices and demand outlooks. Chinese smelters face tightening concentrate availability after the closure of Chilean open-pit pits with declining ore grades, forcing fabricators to negotiate quarterly price escalators. Recycling helps offset volatility: US brass-rod mills certified average recycled content more than four fifth of the amount in 2025, reducing primary copper exposure by 38 kt.

Other drivers and restraints analyzed in the detailed report include:

- ADAS Retrofit Kits Creating Aftermarket Demand Spikes

- Stringent ISO 19642 Harness Standards Accelerate Terminal Redesign Cycles

- OEM Migration to Consolidated Connector Blocks Reduces Terminal Counts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery systems contributed 33.25% of the automotive terminals market share in 2024, underscoring their status as the most terminal-intensive sub-system across the automotive terminal market. Unit growth stems from cell-level sensing and rising pack voltages that push contact density beyond 1,400 pins in next-generation skateboard chassis. Safety & ADAS is growing at 14.81% CAGR through 2030 because each camera and radar module adds four to six shielded connections.

Emerging solid-state packs drive micro-terminal adoption, whose pitch falls below 0.35 mm, generating premium pricing. HVAC and comfort segments, despite their modest share, gain relevance as 48 V blowers, seat heaters, and heat pumps switch to brushless motors, lifting current draw and prompting copper busbar integration.

Passenger cars contributed to 64.85% of the automotive terminals market share in 2024, growing at 15.73% CAGR as stricter CO2 targets favor zero-tailpipe solutions. Light commercial vehicles (LCV) also grow steadily as parcel operators electrify last-mile fleets to comply with urban low-emission zones. Motorcycles and scooters leverage swappable battery platforms that spur standardization of IP67 sealed DC terminals.

Fleet operators measure lifecycle economics rigorously: every unscheduled roadside repair on high-utilization LCVs costs fairly in delivery penalties, incentivizing premium high-cycle terminals. Aptiv's CTCS heavy-duty connectors survive 30.6 G vibration and temperatures from -40 °C to +140 °C, offering uptime advantages that justify 14-18% price premiums in total-cost-of-ownership models.

The Automotive Terminals Market Report is Segmented by Application (Battery System, Lighting System, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Terminal Type (Ring Terminals, Spade Terminals, and More), Material (Copper, Brass, and More), Current Rating (Less Than 25 Amp and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with a 37.76% automotive terminals market share in 2024 and is showcasing the fastest 15.21% CAGR through 2030, underpinned by China's control of global new-energy vehicle production. Japan's tier-one suppliers leverage decades of lean manufacturing to ship precision-stamped contacts with single-digit PPM defect rates to global OEMs. Southeast Asian nations such as Indonesia and Thailand recorded triple-digit EV registration growth in 2024, prompting OEMs to localize connector and wire-harness production.

Europe, even after regional automotive revenue fell short amid inflation and energy-cost headwinds. Strict fleet CO2 rules lift EV sales to an expected figure in 2025, feeding demand for high-power charging terminals and data-grade board-to-board connectors, etc. Germany targets 873,000 new EV registrations, cementing local-content requirements for terminal suppliers. The region's regulatory leadership through ISO 19642 and DIN 72036 gives compliant vendors a first-mover edge even as economic stagnation tempers near-term margins.

An aging vehicle parc keeps the aftermarket vibrant and accelerates ADAS retrofit kit sales that rely on premium shielded connectors. General Motors' USD 4 billion plant overhaul, Hyundai's USD 21 billion multiyear expansion, and Clarios' investment strategy guarantee a steady pull for advanced 48V and 800V terminals. Middle East & Africa and South America collectively contributed a affairly decent share in 2024, with South America portraying steady growth on the back of Brazil's CO2 mandates and Argentina's lithium-mining incentives. Saudi Arabia and the United Arab Emirates use local-content policies within nascent EV assembly programs to stimulate regional cable and terminal manufacturing clusters.

- TE Connectivity

- Lear Corporation

- Aptiv PLC

- Viney Corporation

- Furukawa Electric Co., Ltd.

- Grote Industries

- Keats Manufacturing Co.

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

- Amphenol Corporation

- K.S. Terminals Inc.

- Hirose Electric Co., Ltd.

- Littelfuse, Inc.

- Samtec Inc.

- Wurth Elektronik

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification-led explosion in low-voltage connection points

- 4.2.2 Shift to 48-V electrical architectures in premium vehicles

- 4.2.3 ADAS retrofit kits creating aftermarket demand spikes

- 4.2.4 Stringent ISO 19642 harness standards accelerating terminal redesign cycles

- 4.2.5 Solid-state battery BMS requiring high-precision micro-terminals

- 4.2.6 Automaker push for crimp-less laser-weld terminals to cut assembly takt-time

- 4.3 Market Restraints

- 4.3.1 Copper price volatility squeezing terminal BOM margins

- 4.3.2 OEM migration to consolidated connector blocks reducing terminal counts

- 4.3.3 Reliability issues in aluminum-alloy ring terminals for EV high-current paths

- 4.3.4 Skills gap in automated crimp-force monitoring on new Asian lines

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Application

- 5.1.1 Battery System

- 5.1.2 Lighting System

- 5.1.3 Infotainment System

- 5.1.4 Powertrain & Engine Management

- 5.1.5 Safety and ADAS

- 5.1.6 HVAC and Comfort

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Two-Wheelers

- 5.3 By Terminal Type

- 5.3.1 Ring Terminals

- 5.3.2 Spade Terminals

- 5.3.3 Quick-Connect Terminals

- 5.3.4 Butt Connectors

- 5.3.5 Multi-Pin Connectors

- 5.4 By Material

- 5.4.1 Copper

- 5.4.2 Brass

- 5.4.3 Steel

- 5.4.4 Other Alloys

- 5.5 By Current Rating

- 5.5.1 Less than 25 Amp

- 5.5.2 25 - 50 Amp

- 5.5.3 More than 50 Amp

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Russia

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Turkey

- 5.7.5.4 South Africa

- 5.7.5.5 Nigeria

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TE Connectivity

- 6.4.2 Lear Corporation

- 6.4.3 Aptiv PLC

- 6.4.4 Viney Corporation

- 6.4.5 Furukawa Electric Co., Ltd.

- 6.4.6 Grote Industries

- 6.4.7 Keats Manufacturing Co.

- 6.4.8 Sumitomo Electric Industries, Ltd.

- 6.4.9 Yazaki Corporation

- 6.4.10 Amphenol Corporation

- 6.4.11 K.S. Terminals Inc.

- 6.4.12 Hirose Electric Co., Ltd.

- 6.4.13 Littelfuse, Inc.

- 6.4.14 Samtec Inc.

- 6.4.15 Wurth Elektronik

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment