|

市場調查報告書

商品編碼

1846201

水楊酸:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Salicylic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

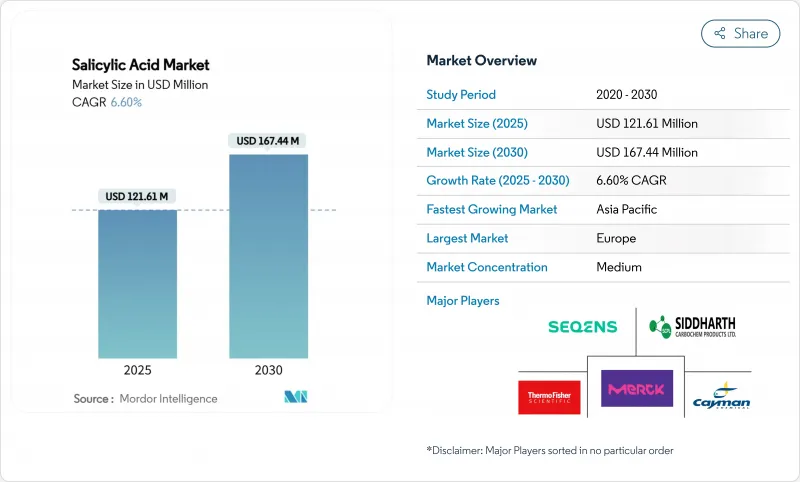

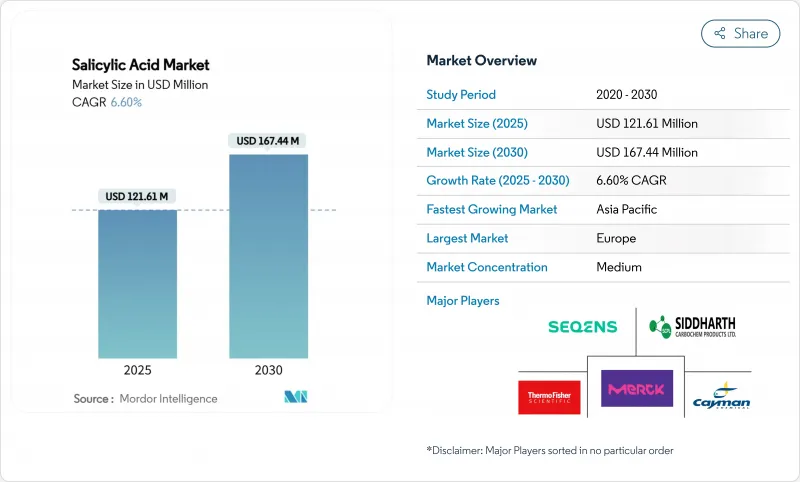

預計到 2025 年,水楊酸市值將達到 1.2161 億美元,到 2030 年將成長至 1.6744 億美元,複合年成長率為 6.60%。

市場成長主要受治療核准、潔淨標示防腐劑需求以及農業應用等因素驅動。製藥業需要水楊酸,因為它具有角質溶解和抗炎特性;個人護理產品製造商則將其用於痤瘡治療和去角質產品。此外,美國和歐洲監管機構提高了兒童產品的安全要求,但放寬了食品和飲料應用的耐受性。一種基於二氧化碳的合成方法,產率高達92.68%,提高了生產效率並減少了排放。此外,其粉末/晶體形式具有高度穩定性,使其在製藥和個人保健產品應用領域佔據市場領先地位。這種晶體形式對於痤瘡霜、去頭皮屑洗髮精和藥用貼片等局部治療產品至關重要。在新興市場完善的法律規範的支持下,製藥業持續成長,這主要得益於水楊酸在非處方藥和處方藥中的應用。

全球水楊酸市場趨勢與洞察

製藥業對水楊酸的需求不斷成長

藥物應用將透過拓展治療適應症和改進製劑技術來推動市場擴張。先進的遞送系統,特別是超分子製劑,與傳統製劑相比,已展現出更顯著的膠原蛋白密度提升和更低的皮膚刺激性,從而克服了以往限制其在更廣泛治療中應用的局限性。藥物應用領域的專利活動仍然活躍,近期申請主要集中於聯合治療和新型遞送機制,這些機制旨在提高生物有效性並最大限度地減少胃腸道副作用。製藥業正受益於完善的監管途徑以及人們對消化器官系統在傳統皮膚科用途之外的抗炎特性的日益認可。此外,該化合物已確立的安全性以及監管部門的核准也鼓勵生產商將其添加到各種製劑中。河北精業集團和山東新華公司等主要供應商在全球藥用級水楊酸的生產中發揮關鍵作用。最後,受消費者自我護理偏好的推動,含有水楊酸的非處方藥數量迅速成長,也顯著促進了市場成長。

對護膚和個人保健產品的需求不斷成長

消費者對經科學檢驗的活性成分的偏好持續推動著水楊酸在化妝品配方中的應用。然而,日益嚴格的安全監管正在影響這種成分的使用方式。例如,美國委員會消費者安全科學委員會核准將兒童化妝品中水楊酸的濃度限制在0.1%以內(用於經皮給藥)。在美國,監管力道也隨之加大,美國食品藥物管理局(FDA)曾向Skin Beauty Solutions公司發出警告信,指出其未經批准的化學換膚產品含有高濃度水楊酸。這促使生產商更加重視開發合規且安全的配方。此外,《化妝品監管現代化法案》實施了新的註冊要求,提高了合規標準和市場准入通訊協定。化妝品和個人護理產品生產商正在使用水楊酸,以滿足市場對經科學檢驗的護膚產品的需求。艾伯維旗下子公司艾爾建美學於 2024 年 4 月推出了兩款 SkinMedica 產品,用於治療痤瘡。痤瘡淨膚護理和毛孔淨化潔面啫咖哩均採用 2% 的包封水楊酸,可實現控釋並減少刺激。

替代產品的可用性

在醫藥和化妝品領域,替代活性成分的出現帶來了競爭壓力,尤其是在對成本敏感的細分市場,因為功效上的差異可能不足以支撐高價。 BETA-羥基酸(如水楊酸甜菜鹼)和α-羥基酸(如乙醇酸)具有類似的去角質功效,同時可能具有低致敏性,因此對那些對水楊酸有副作用的敏感肌膚消費者俱有吸引力。在農業應用領域,合成植物生長調節劑和天然化合物都在爭奪市場佔有率,但水楊酸作為生長促進劑和抗病性增強劑的雙重作用使其具有差異化優勢。含有多種活性成分的混合產品的出現可以減少對水楊酸作為單一成分的依賴,尤其是在化妝品配方中,多功能成分往往佔據高階市場。關鍵配方技術的專利到期可能會加速學名藥的競爭和替代成分的推廣。市場動態有利於那些具有更高功效/刺激性比的產品,這推動了水楊酸配方和競爭性替代成分的創新。

細分市場分析

憑藉成熟的生產流程和經濟高效的生產模式,粉末/晶體製劑將繼續保持市場領先地位,到2024年市場佔有率將達到71.78%。液體製劑將呈現加速成長,年複合成長率將達到7.44%,因為製造商持續致力於改善其生物有效性和給藥便利性。傳統粉末製劑受益於其穩定性優勢和完善的供應鏈基礎設施,尤其是在對劑量精準和保存期限要求較高的製藥應用領域。

由於其優異的溶解性、高效的皮膚吸收性和便捷的使用方式,水楊酸市場對液態製劑的需求日益成長。這些特性滿足了市場對即用型化妝品的需求,尤其是針對痤瘡治療、去角質和清潔化妝水等產品。將水楊酸配製成穩定的液體基質可以增強其功效。此外,新型給藥系統,例如經皮吸收貼片和控制釋放凝膠,結合了固態製劑的穩定性和液體製劑的快速起效性。這些進步正在推動市場對能夠提供最佳功效、最大限度減少皮膚刺激並提供便捷使用方法的水楊酸產品的需求。

全球水楊酸市場分析按應用領域(醫藥、化妝品及個人護理、食品飲料及其他)、形態(粉末/晶體和液體)以及地區(北美、歐洲、亞太、南美以及中東和非洲)進行細分。市場預測以美元計價。

區域分析

憑藉完善的藥品生產基礎設施和嚴格的法規結構(檢驗產品品質和安全標準),歐洲將在2024年繼續保持市場主導,市場佔有率將達到31.17%。歐洲藥品管理局和各國監管機構對歐洲市場進行全面監管,增強了消費者對含水楊酸產品的信心,同時也為生產商提供了明確的合規路徑。歐洲生產商利用先進的生產技術和成熟的分銷網路,服務國內和出口市場,尤其在高價值的藥品和化妝品應用領域具有優勢。

亞太地區預計將成為成長最快的地區,到2030年複合年成長率將達到9.83%,這主要得益於不斷擴大的製藥產能、日益成長的農業應用以及消費者對個人保健產品中活性成分益處的認知不斷提高。中國正透過對製造業的大量投資引領區域成長,包括建造符合環保要求並採用先進製程技術的新生產設施。此外,北美市場已趨於成熟,對藥品、化妝品和新興食品保鮮應用的需求穩定,這得益於完善的法律規範以及消費者對活性成分益處的認可。美國食品藥物管理局(FDA)就水楊酸在各種應用中的使用提供了明確的指導,為產品開發和打入市場策略提供了監管確定性。

南美和中東及非洲(MEA)市場為水楊酸提供了成長機遇,這主要得益於都市化、可支配收入的增加以及對藥品和個人保健產品需求的成長。巴西和墨西哥的國內藥品生產和非處方護膚正在蓬勃發展,推動了水楊酸製劑的廣泛應用。在中東及非洲地區,消費者對個人衛生和皮膚健康的日益重視,也帶動了痤瘡治療和去角質產品中對水楊酸的需求。然而,市場成長也面臨許多限制因素,包括產能有限、地區法規不盡相同以及對進口的依賴。全球製造商正致力於建立策略夥伴關係和在地化佈局,以擴大市場覆蓋範圍,並在這些地區建立更強大的供應鏈。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 製藥業對水楊酸的需求不斷成長

- 對護膚和個人保健產品的需求不斷成長

- 潔淨標示飲料儲存認證數量增加

- 包裝食品產業對水楊酸作為食品防腐劑的需求不斷成長

- 對植物生長調節劑的需求日益成長

- 消費者越來越偏好選擇經過皮膚科測試的天然成分。

- 市場限制

- 替代產品的供應情況

- 原物料價格波動

- 嚴格的監管核准和合規要求

- 潛在健康風險和皮膚敏感性

- 供應鏈分析

- 監理展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過使用

- 製藥

- 化妝品和個人護理

- 飲食

- 其他

- 按形式

- 粉末/晶體

- 液體

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市場排名分析

- 公司簡介

- Seqens Group

- Merck KGaA

- Thermo Fisher Scientific

- Cayman Chemical Company

- Siddharth Carbochem Products

- Lona Industries(Alta Laboratories)

- SimSon Pharma Limited

- Hebei Jingye Group

- Zhenjiang Gaopeng Pharmaceutical

- Spectrum Chemical Mfg

- Avantor Inc.

- Emco Group(Emco Dyestuff Pvt Ltd)

- Alpha Chemika

- Flychem Private Limited

- Central Drug House

- MedChemExpress

- The Andhra Sugars Limited.

- GFS Chemicals

- Plater Group

- Honeywell Research Chemical

第7章 市場機會與未來展望

The salicylic acid market is estimated to be USD 121.61 million in 2025 and is expected to grow to USD 167.44 million by 2030, at a CAGR of 6.60%.

This market growth stems from therapeutic approvals, clean-label preservative demand, and agricultural applications. The pharmaceutical industry requires salicylic acid for its keratolytic and anti-inflammatory properties, while personal care manufacturers use it in acne treatment and exfoliation products. Besides, the United States and European regulators have increased safety requirements for children's products but expanded allowances in food and beverage applications. CO2-based synthesis, achieving 92.68% yield, has improved production efficiency and reduced emissions. Moreover, the powder/crystal form leads the market due to its stability and applications in pharmaceutical and personal care products. This crystalline form is essential in topical treatments, including acne creams, anti-dandruff shampoos, and medicated patches. The pharmaceutical segment maintains growth through salicylic acid's use in over-the-counter and prescription products, supported by established regulatory frameworks in developed markets.

Global Salicylic Acid Market Trends and Insights

Increasing Demand for Salicylic Acid in the Pharmaceutical Industry

Pharmaceutical applications drive market expansion through expanding therapeutic indications and enhanced formulation technologies. Advanced delivery systems, particularly supramolecular formulations, demonstrate superior collagen density improvement and reduced skin irritation compared to conventional preparations, addressing historical limitations that constrained broader therapeutic adoption. Patent activity in pharmaceutical applications remains robust, with recent filings focusing on combination therapies and novel delivery mechanisms that enhance bioavailability while minimizing gastrointestinal side effects. The pharmaceutical segment benefits from established regulatory pathways and growing recognition of salicylic acid's anti-inflammatory properties beyond traditional dermatological applications. Moreover, the compound's established safety profile and regulatory approvals encourage manufacturers to incorporate it into various formulations. Key suppliers such as Hebei Jingye Group, Shandong Xinhua Company, and others play a significant role in producing pharmaceutical-grade salicylic acid for global markets. Finally, the surge in over-the-counter pharmaceutical products containing salicylic acid, driven by consumer preference for self-care solutions, also contributes significantly to the market's growth.

Rising Demand in Skincare and Personal Care Products

Consumer preference for scientifically validated active ingredients continues to drive the adoption of salicylic acid in cosmetic formulations. However, increasing regulatory scrutiny around safety is shaping how the ingredient is used. For instance, the European Commission's Scientific Committee on Consumer Safety recently limited the concentration of salicylic acid in children's cosmetic products to 0.1% for dermal applications, reflecting growing safety concerns while still allowing higher concentrations in adult products . In the United States, regulatory enforcement is also tightening, as evidenced by the United States Food and Drug Administration (FDA)'s warning letter to Skin Beauty Solutions regarding unapproved chemical peel products containing high concentrations of salicylic acid. This has prompted manufacturers to focus on developing compliant, safe formulations. Additionally, the Modernization of Cosmetics Regulation Act implements new registration requirements, increasing compliance standards and market entry protocols. Cosmetic and personal care manufacturers are integrating salicylic acid into formulations to address market demand for scientifically validated skincare products. Allergan Aesthetics, an AbbVie subsidiary, launched two SkinMedica products in April 2024 for acne treatment. The Acne Clarifying Treatment and Pore Purifying Gel Cleanser utilize 2% encapsulated salicylic acid for controlled release and reduced irritation.

Availability of Substitutes

Alternative active ingredients in pharmaceutical and cosmetic applications create competitive pressure, particularly in cost-sensitive market segments where efficacy differences may not justify premium pricing. Beta-hydroxy acids like betaine salicylate and alpha-hydroxy acids such as glycolic acid offer similar exfoliation benefits with potentially reduced irritation profiles, appealing to sensitive-skin consumers who experience adverse reactions to salicylic acid. In agricultural applications, synthetic plant growth regulators and alternative natural compounds compete for market share, though salicylic acid's dual role as both growth promoter and a disease resistance enhancer provides differentiation advantages. The availability of combination products that blend multiple active ingredients can reduce reliance on salicylic acid as a standalone component, particularly in cosmetic formulations where multi-functional ingredients command premium positioning. Patent expiration on key formulation technologies may accelerate generic competition and substitute adoption. Market dynamics favor products that demonstrate superior efficacy-to-irritation ratios, driving innovation in both salicylic acid formulations and competitive alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Clean-Label Beverage Preservation Approvals

- Increasing Demand for Salicylic Acid in the Packaged Food Sector as a Food Preservative

- Price Volatility of Raw Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powder/crystal forms maintain market leadership with a 71.78% share in 2024, supported by established manufacturing processes and cost-effective production economics. Liquid formulations exhibit accelerated growth at 7.44% CAGR as manufacturers develop enhanced bioavailability and application convenience. Traditional powder forms benefit from stability advantages and established supply chain infrastructure, particularly in pharmaceutical applications where precise dosing and extended shelf life remain critical requirements.

The salicylic acid market demonstrates increased adoption of liquid formulations, attributed to their superior solubility, efficient skin absorption, and application convenience. These characteristics address market demand for ready-to-use cosmetic products, specifically in acne treatments, exfoliators, and clarifying toners. The efficacy of salicylic acid increases when formulated in stable liquid bases. Furthermore, emerging delivery systems, including transdermal patches and controlled-release gels, integrate the advantages of solid formulations' stability with liquid forms' rapid effectiveness. These advancements drive market demand for salicylic acid products that deliver optimal performance, minimize skin sensitivity, and provide efficient application methods.

The Global Salicylic Acid Market Analysis is Segmented by Application (Pharmaceuticals, Cosmetics and Personal Care, Food and Beverages, and Others), Form (Powder/Crystal and Liquid), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintains market leadership with a 31.17% share in 2024, supported by established pharmaceutical manufacturing infrastructure and stringent regulatory frameworks that validate product quality and safety standards. The region benefits from comprehensive regulatory oversight through the European Medicines Agency and national authorities, creating consumer confidence in salicylic acid-containing products while establishing clear compliance pathways for manufacturers. European manufacturers leverage advanced production technologies and established distribution networks to serve both domestic and export markets, with particular strength in high-value pharmaceutical and cosmetic applications.

The Asia-Pacific region emerges as the fastest-growing region, with a 9.83% CAGR through 2030, driven by expanding pharmaceutical manufacturing capacity, increasing agricultural applications, and rising consumer awareness of the benefits of active ingredients in personal care products. China leads regional growth through significant investments in manufacturing, including the establishment of new production facilities that incorporate environmental compliance measures and advanced process technologies. Moreover, North America represents a mature market with stable demand patterns across pharmaceutical, cosmetic, and emerging food preservation applications, supported by comprehensive regulatory frameworks and established consumer acceptance of active ingredient benefits. The United States Food and Drug Administration (FDA)'s clear guidance on salicylic acid use in various applications provides regulatory certainty that supports product development and market entry strategies.

South America, and Middle East and Africa (MEA) markets present growth opportunities for salicylic acid, driven by urbanization, higher disposable incomes, and increased demand for pharmaceutical and personal care products. Brazil and Mexico are experiencing growth in their domestic pharmaceutical manufacturing and over-the-counter skincare segments, leading to increased adoption of salicylic acid formulations. The Middle East and Africa (MEA) region shows increased consumer awareness of personal hygiene and skin health, resulting in higher demand for salicylic acid in acne treatments and exfoliating products. However, market growth faces constraints from limited manufacturing capabilities, varying regulations across regions, and dependence on imports. Global manufacturers are focusing on strategic partnerships and local presence to expand their market reach and establish stronger supply chains in these regions.

- Seqens Group

- Merck KGaA

- Thermo Fisher Scientific

- Cayman Chemical Company

- Siddharth Carbochem Products

- Lona Industries (Alta Laboratories)

- SimSon Pharma Limited

- Hebei Jingye Group

- Zhenjiang Gaopeng Pharmaceutical

- Spectrum Chemical Mfg

- Avantor Inc.

- Emco Group (Emco Dyestuff Pvt Ltd)

- Alpha Chemika

- Flychem Private Limited

- Central Drug House

- MedChemExpress

- The Andhra Sugars Limited.

- GFS Chemicals

- Plater Group

- Honeywell Research Chemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Salicylic Acid in the Pharmaceutical Industry

- 4.2.2 Rising Demand in Skincare and Personal Care Products

- 4.2.3 Rise in Clean-Label Beverage Preservation Approvals

- 4.2.4 Increasing Demand for Salicylic Acid in the Packaged Food Sector as a Food Preservative

- 4.2.5 Growing Need for Plant Growth Regulators

- 4.2.6 Increasing Consumer Preference for Dermatologically Tested and Natural Ingredients

- 4.3 Market Restraints

- 4.3.1 Availability of Substitutes

- 4.3.2 Price Volatality of Raw materials

- 4.3.3 Stringent Regulatory Approvals and Compliance Requirements

- 4.3.4 Potential Health Risks and Skin Sensitivities

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD MN)

- 5.1 By Application

- 5.1.1 Pharmaceuticals

- 5.1.2 Cosmetics and Personal Care

- 5.1.3 Food and Beverages

- 5.1.4 Others

- 5.2 By Form

- 5.2.1 Powder/Crystal

- 5.2.2 Liquid

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Seqens Group

- 6.4.2 Merck KGaA

- 6.4.3 Thermo Fisher Scientific

- 6.4.4 Cayman Chemical Company

- 6.4.5 Siddharth Carbochem Products

- 6.4.6 Lona Industries (Alta Laboratories)

- 6.4.7 SimSon Pharma Limited

- 6.4.8 Hebei Jingye Group

- 6.4.9 Zhenjiang Gaopeng Pharmaceutical

- 6.4.10 Spectrum Chemical Mfg

- 6.4.11 Avantor Inc.

- 6.4.12 Emco Group (Emco Dyestuff Pvt Ltd)

- 6.4.13 Alpha Chemika

- 6.4.14 Flychem Private Limited

- 6.4.15 Central Drug House

- 6.4.16 MedChemExpress

- 6.4.17 The Andhra Sugars Limited.

- 6.4.18 GFS Chemicals

- 6.4.19 Plater Group

- 6.4.20 Honeywell Research Chemical