|

市場調查報告書

商品編碼

1846195

流量感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Flow Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

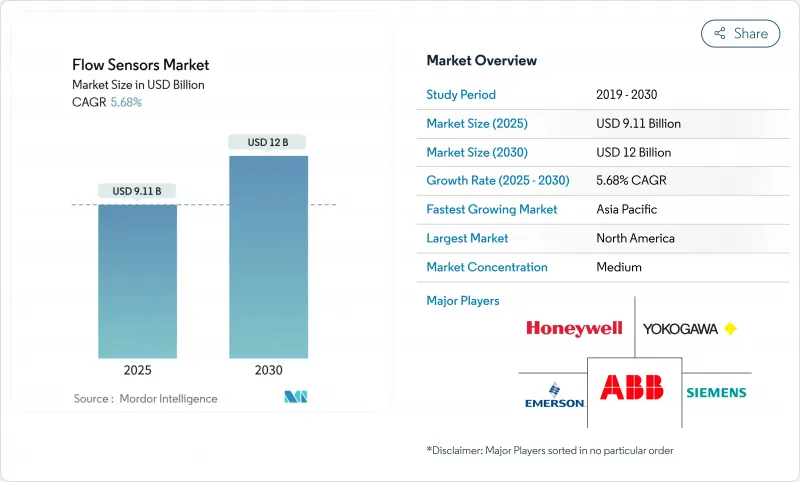

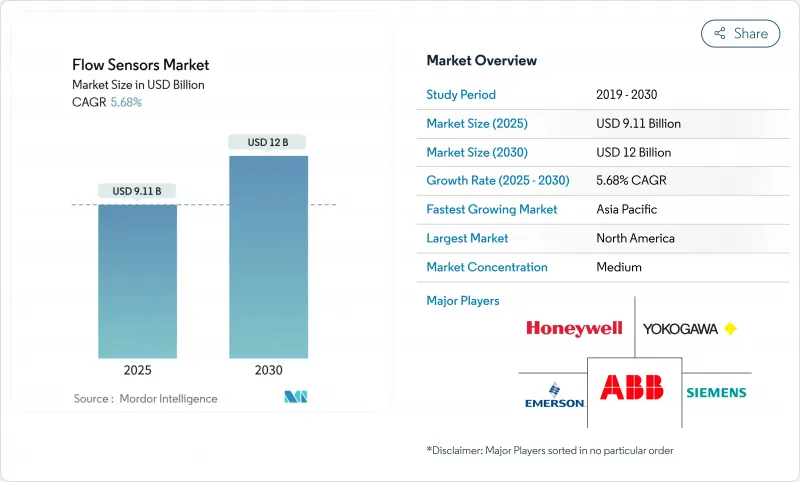

目前流量感測器市場價值為 91.1 億美元,預計到 2030 年將達到 120 億美元,年複合成長率為 5.68%。

流程工業數位化程度的不斷提高、跨境管道強制實施的洩漏檢測規則以及需要精確即時測量的大規模海水淡化投資,共同推動了成長。超音波技術創新、改裝以及工業物聯網 (IIoT) 連接正在縮短安裝時間、提高運作,並幫助營運商遵守不斷變化的貿易交接和環境標準。同時,半導體短缺和大口徑科氏流量計的高昂資本投入限制了其普及速度,促使供應商圍繞更容易取得的晶片組重新設計產品。

北美地區佔據最大的收入佔有率,這主要得益於嚴格的管道安全法規和積極的智慧水務推廣;而亞太地區則憑藉中國和印度數十億美元的製造升級項目實現了最快成長。用水和污水處理企業是成長最快的終端用戶群體,因為他們優先考慮減少無收益水和提高資產可靠性。市場競爭日趨激烈,現有企業紛紛收購專業超音波技術公司、推出工業物聯網服務層並結盟,以鞏固市場佔有率。在資料即服務和微型化MEMS設計正在重新定義價值交付方式的市場中,各方都在積極尋求突破。

全球流量感測器市場趨勢與洞察

智慧和工業物聯網賦能的流量測量解決方案日益普及

來自科隆(KROHNE)等供應商的邊緣運算感測器將閥門驅動與嵌入式流量、壓力和溫度測量功能整合在一起,使操作人員能夠從被動檢查轉向預測性維護。部署了工業物聯網(IIoT)感測器的設施,由於能夠更早偵測到異常情況,計劃外停機時間減少了高達30%。本地數據處理降低了網路負載,並支援即時安全措施。然而,最近在ABB TotalFlow電腦中發現的遠端執行漏洞凸顯了網路安全風險,並強調了加強安全框架的必要性。

維修計劃中對非侵入式夾式超音波測量儀的需求激增

卡箍式裝置無需切割管道,安裝僅需約 30 分鐘,而傳統的管道內維修則可能需要數天時間。發電廠和化工廠正在採用這項技術,在不停機的情況下升級改造老舊管道。艾默生的 FLUXUS 系列產品工作溫度範圍為 -200 度C至 +630 度C,適用於低溫和高溫環境。自動計量檢驗可實現現場健康檢查,進而縮短維護時間,進一步提高資產總利用率。

大直徑貿易計量管道上的科氏流量計需要高額資本投資

大型科氏水質分析儀的單價可能超過10萬美元,對計劃預算造成巨大壓力。業者會考慮其高昂的價格,因為相較之下,超音波和差壓法等替代方案雖然價格更低,但精度也更低。儘管租賃模式和基於績效的合約可以作為一種解決方案,但許多監管規範仍然要求達到科氏水質分析儀的精度水平,這使得市場需求即便麵臨成本挑戰也依然強勁。

細分市場分析

預計到2024年,液體測量將佔流量感測器市場的58.2%,複合年成長率(CAGR)為6.88%。公共產業規模的智慧水務計劃正在推動市場需求,例如莫爾頓尼格爾水務區部署的55,000個水錶每年可節省5億加侖用水量(mnwd.com)。電磁感測器在導電流體領域仍佔據主導地位,但超音波感測器在低導電性和漿液環境中的市場佔有率正在不斷成長。在自然氣領域,管道監測和工業燃燒控制領域的收益保持穩定,但由於成長速度較慢,其市場佔有率低於液體領域。

智慧城市政策迫使公用事業公司減少無收益水的使用,加速了液態水處理技術的應用。北卡羅來納州卡里市耗資 1800 萬美元建設的高級計量基礎設施 (AMI) 平台每年減少了 7.1 萬英里的卡車運輸里程,顯著降低了服務成本和排放。化學企業和啤酒廠也積極推動液態水處理系統的安裝,尤其是在衛生標準要求或處理高腐蝕性介質時,需要採用全焊接不銹鋼流道。

差壓式流量感測器仍是最大的收益細分市場,佔 31.03%,這主要得益於其數十年的裝機量和良好的生命週期經濟性。然而,超音波感測器將以 7.11% 的複合年成長率 (CAGR) 實現最快的成長,因為其夾裝外形規格可減少停機時間,而先進的訊號演算法可將測量誤差降低至 1%。到 2030 年,與超音波流量感測器相關的市場規模將在重工業改裝中實現兩位數成長。

科氏流量計在以密度和質量流量為關鍵的多參數測量領域仍保持其高階地位,而渦街感測器和熱式感測器則適用於蒸氣管道和低流量氣體應用。磁感測器因其零壓降和耐腐蝕襯裡,在水務公司和紙漿廠中仍然廣受歡迎。大多數技術都整合了自檢驗韌體,從而提高了操作人員的信心並降低了重新校準成本。

流量感測器市場報告按類型(液體、氣體)、技術(科氏、差壓、超音波、超音波、熱式、磁式)、安裝類型(線上、夾裝、插入式)、最終用戶產業(石油和天然氣、水和用水和污水、食品和飲料、發電、紙漿和造紙、製藥、其他行業)和地區對產業進行細分。

區域分析

北美地區佔2024年收入的34.3%,這主要得益於PHMSA嚴格的洩漏檢測規則和慷慨的「智慧水務」補貼。奧斯汀水務公司耗資8020萬美元的計量表現代化改造項目,展現了基礎設施建設方案如何促進多年感測器採購。聯邦政府對甲烷減排技術的激勵措施,進一步增加了管道營運商在高精度感測器上的支出,這些感測器為自動警報系統提供數據。

亞太地區以6.32%的複合年成長率領先全球。中國和印度的自動化計劃年投資額超過17億美元,刺激了汽車噴漆車間、化學聯合企業和電子工廠的需求。本土供應商憑藉價格極具競爭力的線上電磁流量計和簡易蝸殼式流量計,正挑戰全球領導企業,迫使跨國公司加強本地支援和增值分析能力。東南亞將受益於大量電子和電池超級工廠的湧入,這些工廠對化學生產線中的超純水和嚴格的流量控制有著極高的要求。

在歐洲,隨著修訂後的污水指令收緊排放標準並要求市政當局實施持續監測,預計監管主導的需求將保持穩定。在中東和非洲,諸如阿曼的巴爾卡5號海水淡化計畫等大型企劃正投入兩位數的資金,這些計畫依賴耐腐蝕的流體解決方案。在南美洲,感測器部署與巴西的衛生特許特許經營和阿根廷的LNG接收站擴建項目密切相關,這兩個項目都需要在嚴苛的製程條件下進行可靠的測量。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 智慧和工業物聯網流量計量解決方案的採用率不斷提高

- 維修計劃中對非侵入式鉗形超音波測量儀的需求激增

- 跨境油氣管線強制性洩漏檢測法規

- 水資源匱乏經濟體中海水淡化和再利用工廠的快速擴張

- 微型MEMS流量感測器為一次性生物製程設備提供動力

- 利用資料即服務(DaaS)經營模式創造經常性收益來源

- 市場限制

- 大直徑貿易交接管道中科氏流量計的高額資本投資

- 新興國家缺乏熟練的校準實驗室

- 無線流量計網路中的網路安全漏洞

- 關鍵半導體晶片供應鏈的不穩定性

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 關鍵相關人員影響評估

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 按類型

- 液體

- 氣體

- 依技術

- 科里奧利

- 壓力差

- 超音波

- 渦流

- 熱敏型

- 磁的

- 按安裝類型

- 排隊

- 夾式

- 插入類型

- 按最終用戶產業

- 石油和天然氣

- 用水和污水

- 化工/石化

- 飲食

- 發電

- 紙漿和造紙

- 製藥

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐的

- 其他歐洲國家

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 澳洲

- 紐西蘭

- 其他亞太地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Endress+Hauser Group Services AG

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Yokogawa Electric Corporation

- Krohne Messtechnik GmbH

- Badger Meter, Inc.

- Christian Burkert GmbH and Co. KG

- Sensirion AG

- TSI Incorporated

- Keyence Corporation

- Brooks Instrument LLC

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- Schneider Electric SE

- OMEGA Engineering Inc.

- SICK AG

- Proxitron GmbH

- Rechner Sensors

- Bronkhorst High-Tech BV

- Katronic Technologies Ltd.

- Alicat Scientific, Inc.

- Tokyo Keiki Inc.

- Fuji Electric Co., Ltd.

第7章 市場機會與未來展望

The flow sensors market is currently valued at USD 9.11 billion and is projected to reach USD 12 billion by 2030, advancing at a 5.68% CAGR.

Growth rests on rising digitalization across process industries, mandatory leak-detection rules in cross-border pipelines, and large-scale desalination investments that demand accurate, real-time measurement. Ultrasonic innovation, clamp-on retrofits, and IIoT connectivity shorten installation times, improve uptime, and help operators comply with evolving custody-transfer and environmental standards. At the same time, semiconductor shortages and high capital requirements for large-diameter Coriolis meters constrain the pace of adoption, nudging suppliers to redesign products around more readily available chipsets.

North America commands the largest revenue share because of strict pipeline safety mandates and aggressive smart-water rollouts, while Asia-Pacific records the fastest growth on the back of multi-billion-dollar manufacturing upgrades in China and India. Water and wastewater utilities represent the fastest-expanding end-user group as utilities prioritize non-revenue water reduction and asset reliability. Competition is intensifying: incumbents acquire niche ultrasonic specialists, launch IIoT service layers, and forge alliances to secure share in a market where data-as-a-service and miniaturized MEMS designs redefine value delivery.

Global Flow Sensors Market Trends and Insights

Increasing adoption of smart and IIoT-enabled flow metering solutions

Edge-ready sensors from suppliers such as KROHNE merge valve actuation with embedded flow, pressure, and temperature measurement, letting operators shift from reactive checks to predictive upkeep. Facilities that fitted IIoT-enabled sensors cut unplanned downtime by up to 30% because anomalies surfaced early. Local data processing lowers network load and empowers real-time safety actions. However, recent discoveries of remote-execution flaws in ABB TotalFlow computers spotlight cyber risks and underscore the need for hardened security frameworks.

Surging demand for non-invasive clamp-on ultrasonic meters in retrofit projects

Clamp-on units avoid pipe cutting and finish installation in roughly 30 minutes, a sharp contrast to multi-day inline retrofits. Power plants and chemical sites now favor the technology to refresh legacy lines without halts. Emerson's FLUXUS series handles -200 °C to +630 °C, proving suitability in cryogenic and high-temperature duties. Automated meter verification permits on-site health checks, trimming maintenance hours and further boosting total asset utilization.

High CapEx for Coriolis meters in large-diameter custody-transfer lines

Each large-bore Coriolis installation can exceed USD 100,000, straining project budgets. Operators weigh the premium against alternative ultrasonic or differential-pressure options that cost less but deliver lower accuracy. Leasing models and outcome-based contracts offer relief, yet many custody-transfer codes enforce Coriolis-level precision, sustaining demand despite cost hurdles.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory leak-detection regulations in cross-border oil and gas pipelines

- Rapid expansion of desalination and reuse plants in water-stressed economies

- Supply-chain volatility for critical semiconductor chips

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid measurement held 58.2% of the flow sensors market in 2024 and is projected to grow at a 6.88% CAGR. Utility-scale smart-water projects boost demand, with Moulton Niguel Water District's 55,000-meter rollout saving 500 million gallons annually mnwd.com. Electromagnetic variants remain dominant for conductive fluids, while ultrasonic sensors gain share in low-conductivity or slurry settings. On the gas side, pipeline monitoring and industrial combustion control sustain steady revenue, but lower growth keeps its contribution below the liquid segment.

Smart city mandates accelerate liquid adoption by compelling utilities to lower non-revenue water. Cary, North Carolina's USD 18 million AMI platform eliminated 71,000 truck miles each year, demonstrating service cost reductions and emissions cuts. Chemical processors and breweries also propel liquid installations, particularly where sanitary standards or aggressive media require fully welded stainless-steel flow paths.

Differential-pressure devices still represent the largest revenue block at 31.03%, anchored by decades of installed base and favorable life-cycle economics. Yet ultrasonic sensors deliver the fastest 7.11% CAGR because clamp-on form factors reduce downtime, and advanced signal algorithms trim measurement error to 1%. The flow sensors market size tied to ultrasonic devices is positioned for double-digit gains in retrofit heavy industries through 2030.

Coriolis meters maintain premium status for multi-parameter measurement where density and mass flow are critical, while vortex and thermal variants address steam lines and low-flow gas applications. Magnetic sensors stay popular in water utilities and pulp plants due to zero pressure drop and corrosion-resistant liners. Integration of self-verification firmware across most technologies boosts operator confidence and lowers recalibration spend.

The Flow Sensor Market Report Segments the Industry Into by Type (Liquid, and Gas), Technology (Coriolis, Differential Pressure, Ultrasonic, Vortex, Thermal, and Magnetic), Installation Type (Inline, Clamp-On, and Insertion), End-User Industry (Oil and Gas, Water and Wastewater, Chemical and Petrochemical, Food and Beverage, Power Generation, Pulp and Paper, Pharmaceuticals, and Other Industries), and Geography.

Geography Analysis

North America controlled 34.3% of 2024 revenue thanks to PHMSA's stringent leak-detection rules and significant smart-water grants. Austin Water's USD 80.2 million meter modernization illustrates how infrastructure packages unlock multi-year sensor procurement. Federal incentives for methane-reduction technologies further raise spending by pipeline operators on high-precision sensors that feed automated alert systems.

Asia-Pacific records a 6.32% CAGR, the highest worldwide. Annual investments topping USD 1.7 billion in Chinese and Indian automation projects spur demand across automotive paint shops, chemical complexes, and electronics fabs. Local vendors challenge global incumbents with price-competitive inline magmeters and simple vortex models, forcing multinationals to sharpen local support and value-added analytics. Southeast Asia benefits from electronics and battery gigafactory inflows that require tight flow control in ultrapure water and chemical lines.

Europe posts stable, regulation-led demand as the revised wastewater directive tightens discharge norms, compelling municipalities to fit continuous monitoring. Middle East and Africa see double-digit spending on desalination megaprojects such as Oman's Barka 5 that depend on corrosion-resistant flow solutions. In South America, sensor uptake is tied to Brazil's sanitation concessions and Argentina's LNG terminal expansions, both of which demand reliable measurement under harsh process conditions.

- ABB Ltd.

- Endress+Hauser Group Services AG

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Yokogawa Electric Corporation

- Krohne Messtechnik GmbH

- Badger Meter, Inc.

- Christian Burkert GmbH and Co. KG

- Sensirion AG

- TSI Incorporated

- Keyence Corporation

- Brooks Instrument LLC

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- Schneider Electric SE

- OMEGA Engineering Inc.

- SICK AG

- Proxitron GmbH

- Rechner Sensors

- Bronkhorst High-Tech B.V.

- Katronic Technologies Ltd.

- Alicat Scientific, Inc.

- Tokyo Keiki Inc.

- Fuji Electric Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing adoption of smart and IIoT-enabled flow metering solutions

- 4.2.2 Surging demand for non-invasive, clamp-on ultrasonic meters in retrofit projects

- 4.2.3 Mandatory leak-detection regulations in cross-border oil and gas pipelines

- 4.2.4 Rapid expansion of desalination and reuse plants in water-stressed economies

- 4.2.5 Miniaturised MEMS flow sensors powering single-use bioprocessing equipment

- 4.2.6 Data-as-a-service (DaaS) business models creating recurring revenue streams

- 4.3 Market Restraints

- 4.3.1 High CapEx for Coriolis meters in large-diameter custody-transfer lines

- 4.3.2 Scarcity of skilled calibration labs in emerging countries

- 4.3.3 Cyber-security vulnerabilities in wireless flow-meter networks

- 4.3.4 Supply-chain volatility for critical semiconductor chips

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Liquid

- 5.1.2 Gas

- 5.2 By Technology

- 5.2.1 Coriolis

- 5.2.2 Differential Pressure

- 5.2.3 Ultrasonic

- 5.2.4 Vortex

- 5.2.5 Thermal

- 5.2.6 Magnetic

- 5.3 By Installation Type

- 5.3.1 Inline

- 5.3.2 Clamp-on

- 5.3.3 Insertion

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Water and Wastewater

- 5.4.3 Chemical and Petrochemical

- 5.4.4 Food and Beverage

- 5.4.5 Power Generation

- 5.4.6 Pulp and Paper

- 5.4.7 Pharmaceuticals

- 5.4.8 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 ASEAN

- 5.5.5.6 Australia

- 5.5.5.7 New Zealand

- 5.5.5.8 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Endress+Hauser Group Services AG

- 6.4.3 Siemens AG

- 6.4.4 Emerson Electric Co.

- 6.4.5 Honeywell International Inc.

- 6.4.6 Yokogawa Electric Corporation

- 6.4.7 Krohne Messtechnik GmbH

- 6.4.8 Badger Meter, Inc.

- 6.4.9 Christian Burkert GmbH and Co. KG

- 6.4.10 Sensirion AG

- 6.4.11 TSI Incorporated

- 6.4.12 Keyence Corporation

- 6.4.13 Brooks Instrument LLC

- 6.4.14 TE Connectivity Ltd.

- 6.4.15 Texas Instruments Incorporated

- 6.4.16 Schneider Electric SE

- 6.4.17 OMEGA Engineering Inc.

- 6.4.18 SICK AG

- 6.4.19 Proxitron GmbH

- 6.4.20 Rechner Sensors

- 6.4.21 Bronkhorst High-Tech B.V.

- 6.4.22 Katronic Technologies Ltd.

- 6.4.23 Alicat Scientific, Inc.

- 6.4.24 Tokyo Keiki Inc.

- 6.4.25 Fuji Electric Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment