|

市場調查報告書

商品編碼

1846179

線對基板連接器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Wire-to-Board Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

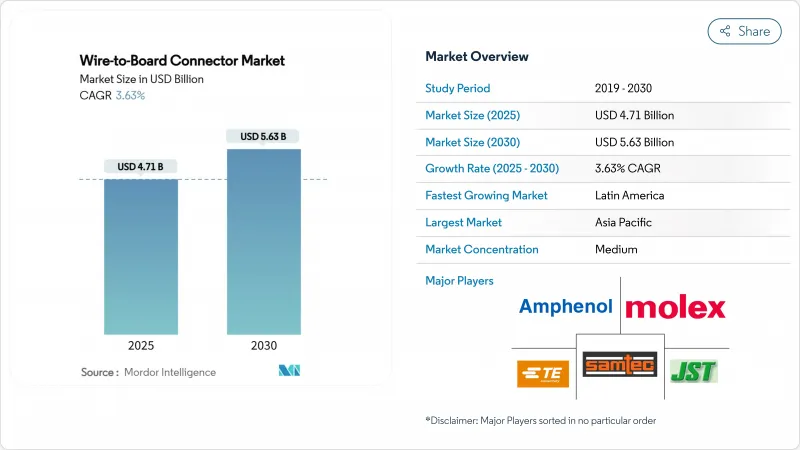

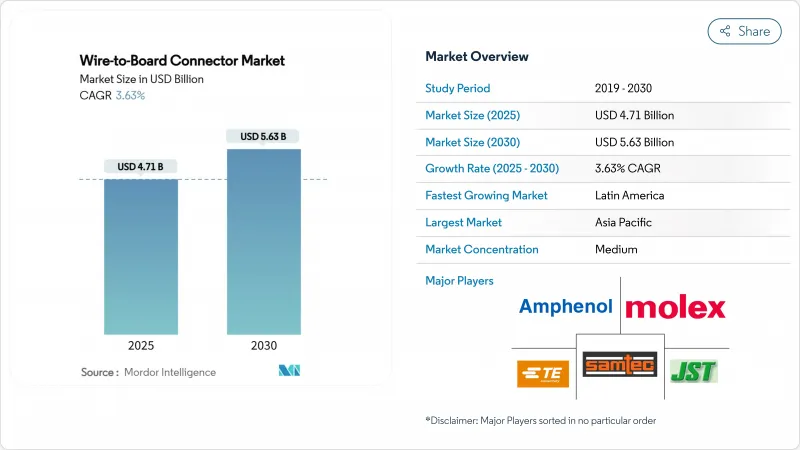

預計到 2025 年,線對基板連接器市場規模將達到 47.1 億美元,到 2030 年將達到 56.3 億美元,預測期內複合年成長率為 3.63%。

電動車、小型消費性電子產品、工廠自動化升級以及低地球軌道衛星的需求不斷成長,推動了產業的穩定擴張。 2024年上半年訂單成長7.0%,營收成長2.7%,證實了儘管面臨供應鏈壓力,該產業依然保持韌性。表面黏著技術自動化、2mm以下間距晶片的應用以及6A以上高電流設計持續影響著產品藍圖。亞太地區繼續保持其製造業主導,而拉丁美洲已成為成長最快的地區。在競爭方面,現有企業依靠小型化和散熱技術而非價格優勢來捍衛自身地位,而諸如TE Connectivity以23億美元收購Richards Manufacturing等選擇性收購則表明行業整合仍在繼續。

全球線對基板連接器市場趨勢及洞察

亞洲超小型穿戴裝置推動了對小於2毫米間距元件的需求。

隨著健身追蹤器和智慧型手錶對尺寸的要求越來越小,尺寸在 2 毫米或以下的連接器目前佔據了出貨量的絕大部分。 Molex 的 0.175 毫米間距系列展示了交錯接點如何克服焊接的限制,同時保持 0.35 毫米的墊片間距。金屬射出成型支援高精度超緊湊型外殼的大批量生產。亞太地區的製造商正在集中生產必要的模具,從而鞏固其在該地區的領先地位。隨著外形規格的不斷縮小,多學科團隊也同時解決訊號完整性和電磁干擾問題。

電動車電池管理系統(BMS)的快速普及推動了高電流連接器的發展

電動車電池組中的電池管理系統擴大採用6A以上的連接器,這是線對基板連接器市場中成長最快的電流等級。 TE Connectivity的HC-Stak連接器可將端子尺寸縮小高達30%,並支援鋁線,有助於降低車輛重量。諸如Penn Engineering的ECCB等專用套管即使在鋁氧化的情況下也能保持低電阻。中國、歐洲和北美電動車數量的不斷成長形成了需求叢集,從而影響了供應商的佈局。

縮小基板尺寸限制了墊片的使用

小於 0.4 毫米的連接器墊片對拾取和放置精度提出了挑戰,推高了返工成本,並抑制了近期成長。高密度佈局會增加串擾和熱熱點,需要使用昂貴的高 Tg 層壓板,抵消了成本優勢。較低的產量比率導致一些原始設備製造商 (OEM) 推遲下一代佈局的推出,直到組裝升級完成。

細分市場分析

2024年,尺寸小於2毫米的連接器將佔總收入的48%,推動線對基板連接器市場小型化浪潮。隨著智慧型手機、穿戴式音訊設備和植入電路板尺寸的持續縮小,到2030年,該細分市場將以3.7%的複合年成長率成長。 2.1-4毫米尺寸的連接器對於汽車模組仍然至關重要,因為在這些應用中,機械強度比尺寸更重要。尺寸大於4毫米的產品主要滿足特定的高電流需求,但其市佔率將穩定下降。

80µm間距、電阻值低於50mΩ的觸點原型測試表明,未來將出現顛覆性變革。在亞太地區的晶圓廠,小於2mm的模具已成為標準配置,進一步鞏固了該地區的市場主導地位。隨著間距的減小,設計人員必須協同最佳化訊號完整性、散熱性能和插入力,這使得線對基板連接器市場的這一細分領域成為跨學科合作的中心。

到2024年,表面黏著技術連接器將佔總收入的57.3%,這反映了消費性電子和工業應用領域自動化程度的提高。自動化貼片技術降低了每個焊點的成本,並減少了PCB鑽孔,從而推動了3.6%的複合年成長率。通孔在電力電子領域仍然非常重要,較大的焊錫槽可以改善散熱和抗衝擊性。

由於相鄰元件會阻礙操作,高密度表面黏著技術基板的重工成本很高。 IPC/WHMA-A-620 標準要求更嚴格的製程窗口,許多傳統生產線難以滿足這些要求。雖然亞太地區擁有最強大的表面黏著技術基礎設施,但一些北美工廠仍傾向於採用通孔技術,以實現線對基板連接器市場的穩健組裝。

區域分析

亞太地區預計到2024年將佔全球收入的46.7%,這主要得益於中國、日本和韓國PCB和最終組裝能的集中。激勵措施正在推動印度建立新的製造地,擴大該地區的市場佔有率。東南亞國家在半導體封裝領域處於領先地位,並將高密度連接器納入區域供應鏈。這些基本面將使線對基板連接器市場在整個預測期內牢牢紮根於該地區。

北美地區主要包括墨西哥的汽車組裝、美國的先進航太、醫療設備出口。儘管製造業回流計畫和舉措的影響正促使部分連接器生產線從亞洲遷回北美,但成本差異仍然存在。加拿大礦業設備產業也為加固型線對基板連接器市場貢獻了一部分需求。

歐洲正將連接器創新與電動車動力系統的推廣和工業4.0升級結合。德國在汽車高電流連接器開發方面處於領先地位,而北歐公用事業公司則將連接器整合到風力發電和網格儲存資產中。嚴格的RoHS和REACH指令正促使全球供應商採用符合規定的化學品。拉丁美洲的複合年成長率(CAGR)高達5.2%,位居全球之首,這主要得益於巴西汽車產業的成長。中東和非洲的小型太陽能微電網計劃正在提升其全球影響力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲超小型穿戴裝置推動了對小於2毫米間距元件的需求。

- 電動車電池管理系統(BMS)的快速普及推動了高電流WTB連接器的發展

- 棕地工廠自動化維修推動感測器連接器更新

- 建造需要抗震連接器的低地球衛星星系

- 開放式運算伺服器設計遷移到更快的夾層 WTB 格式

- 擴大低成本微型WTB、一次性醫用拋棄式(單次使用內視鏡)的數量

- 市場限制

- PCB 安裝面積的減少導致連接器焊盤尺寸被限制在 0.4 毫米以下。

- 引擎室內環境溫度超過 125°C 時,焊點可靠性令人擔憂

- 貿易戰關稅推高了美國進口商的物料清單價格。

- 高密度連接器供應鏈仿冒風險

- 生態系分析

- 監理與技術展望

- RoHS/REACH材料趨勢

- 技術概覽 - 112Gbps PAM4 和 0.175mm 間距藍圖

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場規模及成長預測(金額)

- 按間距大小

- 2毫米或更小

- 2.1~4 mm

- 4毫米或以上

- 按安裝類型

- 表面黏著技術

- 通孔

- 按額定電流

- 小於1A

- 1.1A~3A

- 3.1A~6A

- 6A 或以上

- 按方向

- 垂直的

- 直角

- 按最終用戶產業

- 消費性電子產品

- 資訊科技/通訊

- 車

- 工業自動化

- 航太/國防

- 醫療設備

- 其他(能源、照明)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 其他南美

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 其他亞太地區

- 中東和非洲

- 中東

- 波灣合作理事會成員國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- TE Connectivity Ltd.

- Molex LLC

- Amphenol ICC(Amphenol Corp.)

- JST Mfg. Co. Ltd.

- Samtec Inc.

- Hirose Electric Co. Ltd.

- Harting Technology Group

- Phoenix Contact GmbH and Co. KG

- Wago Kontakttechnik GmbH and Co. KG

- ERNI Deutschland GmbH

- Kyocera-AVX Components

- Wurth Elektronik GmbH and Co. KG

- Yazaki Corp.

- Luxshare Precision

- Foxconn Interconnect Technology

- JAE Electronics Inc.

- LEMO SA

- Harwin Plc

- Global Connector Technology(GCT)

- Omron Electronic Components

- Shenzhen Deren Electronics

第7章 市場機會與未來展望

The wire-to-board connector market size stands at USD 4.71 billion in 2025 and is projected to reach USD 5.63 billion by 2030, reflecting a 3.63% CAGR over the forecast period.

Steady expansion stems from rising demand in electric vehicles (EVs), compact consumer devices, factory automation upgrades, and low-earth-orbit (LEO) satellites. Order growth of 7.0% and sales growth of 2.7% in 1H-2024 confirmed the industry's resilience despite supply-chain pressures. Surface-mount automation, sub-2 mm pitch adoption, and higher-current designs above 6 A continue to shape product roadmaps. Asia-Pacific retains manufacturing leadership while Latin America emerges as the fastest-growing region. On the competitive front, incumbents rely on miniaturization and thermal know-how rather than price to defend positions, and selective acquisitions such as TE Connectivity's USD 2.3 billion purchase of Richards Manufacturing signal ongoing consolidation.

Global Wire-to-Board Connector Market Trends and Insights

Ultra-compact Wearables Driving Sub-2 mm Pitch Demand in Asia

Sub-2 mm connectors now dominate shipments because fitness trackers and smartwatches require ever-smaller footprints. Molex's 0.175 mm pitch range illustrates how staggered contacts overcome soldering limits while keeping 0.35 mm pads. Metal Injection Molding supports mass production of microminiature housings with tight tolerances. Asia-Pacific manufacturers concentrate the necessary tooling, reinforcing the region's lead. As form factors shrink, cross-disciplinary teams address signal integrity and electromagnetic interference concurrently.

Rapid EV-Battery BMS Adoption Boosting High-Current Connectors

Battery management systems in EV packs increasingly specify connectors above 6 A, the fastest-growing current class of the wire-to-board connector market. TE Connectivity's HC-Stak cuts terminal size by up to 30% and supports aluminum cabling, easing vehicle mass targets. Specialized bushings such as PennEngineering's ECCB maintain low resistance despite aluminum oxidation. Rising EV volumes in China, Europe, and North America create demand clusters that influence supplier footprints.

PCB Real-Estate Shrink Limiting Landing Pads

Connector pads under 0.4 mm challenge pick-and-place accuracy and raise rework costs, depressing short-term growth. Denser layouts heighten crosstalk and thermal hotspots, forcing expensive high-Tg laminates that erode savings. Yield drops prompt some OEMs to delay next-gen layouts until assembly lines upgrade.

Other drivers and restraints analyzed in the detailed report include:

- Automation Retrofits in Brownfield Factories Raising Sensor Refresh

- LEO-Satellite Constellations Requiring Vibration-Resistant Connectors

- Solder-Joint Reliability at >125 °C Under-Hood

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sub-2 mm connectors captured 48% of 2024 revenue and anchor the wire-to-board connector market's miniaturization wave. The segment expands at a 3.7% CAGR to 2030 as smartphones, hearables, and implantables shrink boards further. The 2.1-4 mm class remains essential in automotive modules where mechanical robustness trumps size. Above-4 mm products cater to specialized high-current needs but steadily lose share.

Research prototyping 80 µm pitch contacts with <50 mΩ resistance hints at future disruption. Asia-Pacific fabs house most sub-2 mm tooling, reinforcing regional dominance. Designers must co-optimize signal integrity, thermal spread, and insertion force as pitches fall, making this slice of the wire-to-board connector market a nexus for cross-discipline collaboration.

Surface-mount connectors owned 57.3% of 2024 sales, reflecting automation's pull across consumer and industrial lines. Automated pick-and-place lowers cost per joint and limits PCB drilling, supporting a 3.6% CAGR. Through-hole remains critical for power electronics, where larger solder barrels aid heat dissipation and shock resistance.

Rework on dense surface-mount boards is costly because neighboring components block access. IPC/WHMA-A-620 calls for tighter process windows that many legacy lines struggle to meet. Asia-Pacific maintains the strongest surface-mount infrastructure, whereas some North American facilities still favor through-hole for rugged assemblies in the wire-to-board connector market.

The Wire-To-Board Connector Market Report is Segmented by Pitch Size (Up To 2 Mm, 2. 1 To 4 Mm, Above 4 Mm), Mounting Type (Surface-Mount, and Through-Hole), Current Rating (Up To 1 A, 1. 1 A To 3 A, and More), Orientation (Vertical, and Right-Angle), End-User Vertical (Consumer Electronics, IT and Telecommunication, Automotive, Medical Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 46.7% of 2024 turnover owing to clustered PCB and final-assembly capacity in China, Japan, and South Korea. Incentives draw supplementary builds to India, widening the regional base. Southeast Asian nations lead semiconductor packaging, pulling high-density connectors into local supply chains. These fundamentals keep the wire-to-board connector market firmly anchored in the region for the forecast horizon.

North America combines automotive assembly in Mexico, advanced aerospace in the United States, and medical device exports across the zone. Reshoring initiatives and tariff exposure are nudging selected connector lines back from Asia, yet cost gaps persist. Canada's mining equipment sector adds pockets of demand for ruggedized variants of the wire-to-board connector market.

Europe aligns connector innovation with EV drivetrain rollouts and Industrie 4.0 upgrades. Germany spearheads high-current development for vehicles, while Nordic utilities integrate connectors into wind and grid-storage assets. Strict RoHS and REACH mandates drive global suppliers to adopt compliant chemistries. Latin America, led by Brazil's automotive growth, posts the fastest 5.2% CAGR as OEMs deepen local content to buffer currency risk. Small but rising African and Middle-Eastern projects in solar micro-grids round out global exposure.

- TE Connectivity Ltd.

- Molex LLC

- Amphenol ICC (Amphenol Corp.)

- J.S.T. Mfg. Co. Ltd.

- Samtec Inc.

- Hirose Electric Co. Ltd.

- Harting Technology Group

- Phoenix Contact GmbH and Co. KG

- Wago Kontakttechnik GmbH and Co. KG

- ERNI Deutschland GmbH

- Kyocera-AVX Components

- Wurth Elektronik GmbH and Co. KG

- Yazaki Corp.

- Luxshare Precision

- Foxconn Interconnect Technology

- JAE Electronics Inc.

- LEMO SA

- Harwin Plc

- Global Connector Technology (GCT)

- Omron Electronic Components

- Shenzhen Deren Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ultra-compact wearables driving sub-2 mm pitch demand in Asia

- 4.2.2 Rapid EV-battery BMS adoption boosting high-current WTB connectors

- 4.2.3 Automation retrofits in brownfield factories raising sensor-connector refresh

- 4.2.4 LEO-satellite constellation build-outs requiring vibration-resistant connectors

- 4.2.5 Open-compute server designs shifting to higher-speed mezzanine WTB formats

- 4.2.6 Medical disposables (single-use endoscopes) scaling volumes of low-cost micro-WTB

- 4.3 Market Restraints

- 4.3.1 PCB real-estate shrink limiting connector landing padsLess than 0.4 mm

- 4.3.2 Solder-joint reliability concerns at Above 125 °C under-hood environments

- 4.3.3 Trade-war tariffs inflating BOM pricing for U S importers

- 4.3.4 Supply-chain counterfeit risk for high-density connectors

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Materials RoHS/REACH compliance trends

- 4.5.2 Technology Snapshot - 112 Gbps PAM4 and 0.175 mm pitch road-maps

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Pitch Size

- 5.1.1 Upto 2 mm

- 5.1.2 2.1 - 4 mm

- 5.1.3 Above 4 mm

- 5.2 By Mounting Type

- 5.2.1 Surface-Mount

- 5.2.2 Through-Hole

- 5.3 By Current Rating

- 5.3.1 Up to 1 A

- 5.3.2 1.1 A - 3 A

- 5.3.3 3.1 A - 6 A

- 5.3.4 Above 6 A

- 5.4 By Orientation

- 5.4.1 Vertical

- 5.4.2 Right-angle

- 5.5 By End-User Vertical

- 5.5.1 Consumer Electronics

- 5.5.2 IT and Telecommunication

- 5.5.3 Automotive

- 5.5.4 Industrial Automation

- 5.5.5 Aerospace and Defense

- 5.5.6 Medical Devices

- 5.5.7 Others (Energy, Lighting)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TE Connectivity Ltd.

- 6.4.2 Molex LLC

- 6.4.3 Amphenol ICC (Amphenol Corp.)

- 6.4.4 J.S.T. Mfg. Co. Ltd.

- 6.4.5 Samtec Inc.

- 6.4.6 Hirose Electric Co. Ltd.

- 6.4.7 Harting Technology Group

- 6.4.8 Phoenix Contact GmbH and Co. KG

- 6.4.9 Wago Kontakttechnik GmbH and Co. KG

- 6.4.10 ERNI Deutschland GmbH

- 6.4.11 Kyocera-AVX Components

- 6.4.12 Wurth Elektronik GmbH and Co. KG

- 6.4.13 Yazaki Corp.

- 6.4.14 Luxshare Precision

- 6.4.15 Foxconn Interconnect Technology

- 6.4.16 JAE Electronics Inc.

- 6.4.17 LEMO SA

- 6.4.18 Harwin Plc

- 6.4.19 Global Connector Technology (GCT)

- 6.4.20 Omron Electronic Components

- 6.4.21 Shenzhen Deren Electronics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment