|

市場調查報告書

商品編碼

1846161

結構電子學:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Structural Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

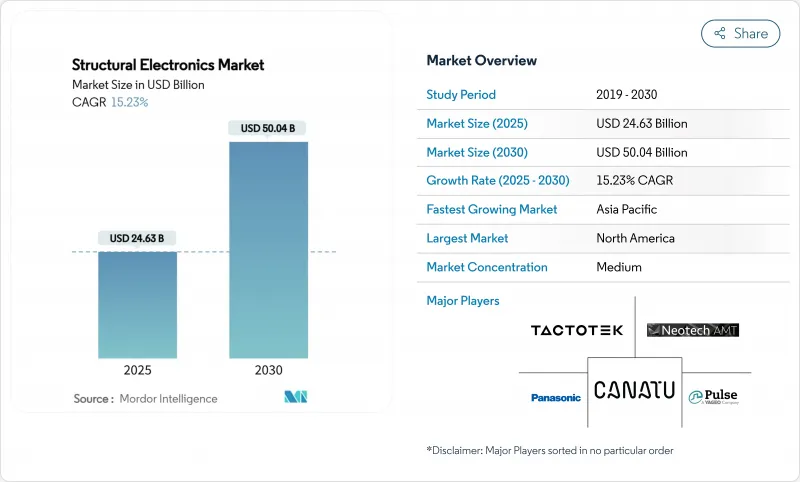

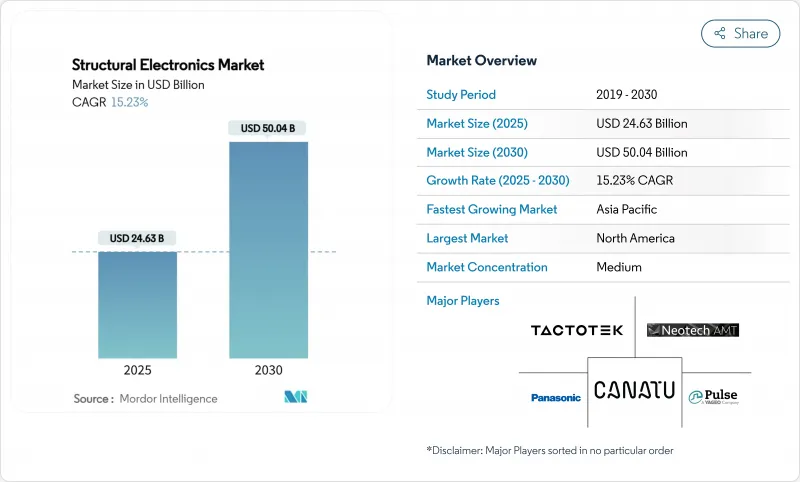

預計到 2025 年,結構電子市場規模將達到 246.3 億美元,到 2030 年將達到 500.4 億美元,複合年成長率為 15.23%。

這種加速成長反映了汽車輕量化法規的快速推進、半導體政策激勵措施的訂定以及3D套模電子技術的突破性進展——該技術可將電路直接嵌入承重部件中。汽車製造商目前將感測器蒙皮和結構電池整合到座艙面板中,以減輕重量並延長電動車的續航里程;亞太地區的消費性電子工廠正在擴大曲面觸控外殼的量產規模。諸如歐洲的《晶片法案》和美國的《晶片與科學法案》等法規正在為先進封裝中心注入資金,從而簡化結構整合。亞太地區製造業的深厚實力將繼續支撐地理成長,而中東地區的國防和智慧基礎設施計劃將推動未來的需求。

全球結構電子市場趨勢與洞察

汽車輕量化和以電動車為中心的車內電子設備正在蓬勃發展

歐洲汽車製造商正面臨日益嚴格的車隊排放法規,這些法規優先考慮採用整合電力電子設備的輕量化車輛。 Synonus AB 的碳纖維結構電池實現了 70% 的續航里程提升和 50% 的重量減輕,展示了單一複合材料零件如何同時實現儲能和承載機械負載。該設計還透過以半固體化學物質取代易燃的液態電解質,有效降低了熱失控的風險。大眾汽車等汽車製造商正將這些電池與安森美半導體的碳化矽逆變器配合使用,以減少組件數量並提高動力傳動系統的效率。圍繞鋼鋁超高速鑄造技術的爭議進一步凸顯了將電路整合到任何結構材料中的價值。因此,結構電子技術正在迅速發展,並在底盤、車門和儀表板等領域中廣泛應用。

亞太地區消費性設備中3D套模電子技術的廣泛應用

中國、韓國和越南的消費性設備契約製造製造商正在將3D套模電子技術標準化,該技術將導電油墨、薄膜和樹脂整合於單一模塑製程。 TactoTek的射出成型結構電子(IMSE)製程檢驗,與傳統組裝相比,可減少60%的溫室氣體排放和70%的塑膠用量。科思創的Makrofol聚碳酸酯薄膜可在超薄外殼內實現觸控照明和觸覺回饋。區域性研究,例如香港大學的有機電化學電晶體,正在推動下一波穿戴式裝置和感測器運算的發展。東南亞的PCB產業產值已超過20億美元,為這些結構外殼提供多層背板。加速的模具週期支援智慧型手機、穿戴式耳機和智慧家庭中心等產品的上市,從而推動了個人電子產品結構電子市場的發展。

亞洲以外地區供不應求

奈米碳管油墨和漿料主要集中在少數幾家中國工廠,佔全球產量的40%以上。颶風摧毀了北卡羅來納州的高純度石英礦藏,暴露了半導體基板關鍵原料基板的脆弱性。近期美國和歐洲生產商宣布的碳奈米管產能擴張計畫仍無法滿足市場需求成長預期。因此,汽車和航太的買家將面臨更長的前置作業時間和更高的價格,這將限制結構電子市場的擴張,直到實現多元化採購。

細分市場分析

到2024年,感測器和天線類別將貢獻34.7%的收入,這主要得益於ADAS(高級駕駛輔助系統)和飛機安全監控的強制性要求。光纖陣列正被整合到飛行複合材料面板中,雷達和電容式觸控技術正被整合到乘用車儀錶板中。到2030年,太陽能光電發電將以17.5%的複合年成長率實現最高成長,這主要得益於可彎曲以適應建築內部結構的軟性鈣鈦礦組件和穿戴式標籤的普及。結構整合技術無需單獨的外殼即可實現發電,從而降低了組裝成本,並為資產追蹤和室內農業等領域開闢了新的應用。

結構電池和微型超級電容器正超越原型階段,MXene墨水裝置已實現611 F cm⁻³的體積電容,便是最好的證明。顯示器也正順應汽車設計潮流,採用OLED和microLED薄膜,朝著連續曲線的方向發展。互連材料面臨銅的揮發性問題,但銀奈米線和MXene能夠在可彎曲的形態中保持導電性。這些轉變將拓展結構電子市場,將感測、能量和顯示功能整合於單一層壓板中。

套模電子技術將薄膜、油墨和樹脂熔合在一起,製成可直接安裝的輕量化零件,預計到2024年,該技術的收入將增加51.3%。汽車門飾板現在採用背光控制,無需單獨的PCB,從而減輕了線束的重量。消費級穿戴裝置也採用相同的製程製造IP68防護等級的外殼。在DARPA的AMME計畫的推動下,積層製造技術將以18.2%的複合年成長率快速發展,直接在3D基板上列印複雜的微電路。 MXene油墨的噴墨列印技術可以製造高能量密度電容器,而多光子微影術則開創了可列印有機生物電子元件的先河。

網版印刷和柔版印刷能夠經濟高效地在電器面板上印刷大面積加熱器和天線。噴墨平台則可在模具轉移到大量生產之前製作精細原型。這項技術的廣泛應用將拓寬結構電子市場的准入管道,並加速其在大量生產和客製化生產中的應用。

區域分析

亞太地區預計到2024年將佔全球銷售額的37.9%,這主要得益於該地區龐大的半導體、PCB和模具製造生態系統。中國正朝著垂直整合的方向發展,而泰國和馬來西亞也在增加其全球供應供給能力。日本供應全球一半以上的積層陶瓷電容,而像村田製作所和QuantumScape這樣的夥伴關係正向固態電池陶瓷領域拓展業務。

歐洲的結構電子市場正受惠於汽車電氣化進程的里程碑以及800億歐元(940.6億美元)的晶片法案基金,該基金的目標是到2030年佔據全球半導體市場20%的佔有率。德國原始設備製造商正在改進其嵌入式電路的千兆鑄件,而法國建設公司正在維修建築幕牆面上試用太陽能感測器皮膚。

中東和非洲地區將以15.7%的複合年成長率實現最快成長,主要受國防現代化和智慧城市發展驅動。阿拉伯聯合大公國的EDGE集團正在探索人工智慧衛星鏈路,這需要共形天線和輕型電源。儘管地方政府正透過抵銷貿易計畫吸引供應商,扶持國內組裝線,但該地區仍依賴進口大部分奈米材料,這一缺口可能在未來十年後半段限制成長。

北美地區在新的《晶片技術創新法案》(CHIPS Act)撥款支持下,航太計劃和先進封裝代工廠持續保持發展勢頭。波音公司收購Spirit公司旨在加強感測器整合到飛機機身部件的應用。聯邦法規鼓勵國內供應,促使結構電子市場參與企業將材料、印刷和成型能力集中佈局。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲的輕量化汽車和以電動車為中心的車內電子設備的激增

- 亞太地區消費性電子產品大規模採用3D模內套模電子技術

- 美國聯邦航空管理局(FAA)推廣複合美國聯邦複合材料整合感測器蒙皮(北美)

- 用於智慧建築中無電池物聯網節點的印刷光伏電池

- 邊緣人工智慧穿戴裝置推動醫療保健領域伸縮性結構的形成

- 以色列和美國對共形天線和智慧表面的國防需求

- 市場限制

- 航太結構電子元件的複雜鑑定週期

- 積層製造生產線的週期時間和吞吐量有限

- 高溫聚合物基板的分層風險 - 汽車

- 亞洲以外地區供不應求

- 產業生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場規模及成長預測(金額)

- 由 Integrants 提供

- 太陽能發電

- 電池/超級電容

- 感測器和天線

- 顯示器(OLED/微型LED)

- 導體和互連線

- 依製造技術

- 套模電子(IME)

- 積層製造/3D列印

- 氣溶膠噴射和噴墨列印

- 絲網/柔版印刷

- 按材質

- 導電油墨(銀、銅、碳、奈米材料)

- 基板(聚合物、玻璃、複合材料、熱固性材料)

- 封裝和黏合劑

- 透過使用

- 汽車-內裝和外觀

- 航太與國防 - 機身、智慧蒙皮

- 消費性電子產品-白色家電、手持設備

- 醫療保健/醫療設備

- 工業和建築自動化

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家(丹麥、瑞典、挪威、芬蘭)

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東

- 波灣合作理事會成員國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- TactoTek Oy

- Molex LLC

- Panasonic Holdings Corp.

- Canatu Oy

- Neotech AMT GmbH

- Pulse Electronics(Yageo)

- Optomec Inc.

- Odyssian Technology LLC

- Aconity3D GmbH

- T-ink Inc.

- Boeing Co.

- Henkel AG and Co. KGaA

- DuPont de Nemours Inc.

- 3D Systems Corp.

- Teijin Ltd.

- PPG Industries Inc.

- Flex Ltd.

- General Electric Co.

- Samsung Electro-Mechanics

- Continental AG

第7章 市場機會與展望

- 閒置頻段與未滿足需求評估

The structural electronics market reached USD 24.63 billion in 2025 and is forecast to rise to USD 50.04 billion by 2030, translating to a 15.23% CAGR.

This acceleration reflects fast-moving vehicle lightweighting mandates, semiconductor policy incentives, and fresh breakthroughs in 3-D in-mold electronics that embed circuitry directly into load-bearing parts. Automotive manufacturers now fold sensor skins and structural batteries into cabin panels to trim weight and extend electric-vehicle range, while Asia-Pacific consumer-electronics plants scale volume production of curved, touch-activated housings. Regulations such as the European Chips Act and the U.S. CHIPS and Science Act pump capital into advanced packaging hubs that simplify structural integration. Geographic growth remains anchored in Asia-Pacific manufacturing depth, but defense and smart-infrastructure projects in the Middle East lift future demand.

Global Structural Electronics Market Trends and Insights

Automotive light weighting and EV-centric cabin electronics surge

European automakers face firm fleet-emission rules that prioritize lighter vehicles equipped with integrated power electronics. Sinonus AB's carbon-fiber structural battery shows a 70% range boost coupled with 50% weight reduction, illustrating how a single composite part can both store energy and carry mechanical loads. The design also mitigates thermal-runaway concerns by replacing flammable liquid electrolytes with semi-solid chemistries. Automakers such as Volkswagen link these batteries with silicon-carbide inverters from onsemi to shrink component count and raise drivetrain efficiency. The debate around steel versus aluminum gigacasting further underscores the value of embedding circuitry into any structural material. The result is a rapid uptick in structural electronics market adoption across chassis, doors, and instrument panels.

Mass adoption of 3-D in-mold electronics in Asia-Pacific consumer devices

Consumer-device contract manufacturers in China, South Korea, and Vietnam are standardizing 3-D in-mold electronics that combine conductive inks, films, and resins in a single molding step. TactoTek's injection-molded structural electronics (IMSE) process has verified a 60% drop in greenhouse-gas emissions and 70% less plastic usage versus traditional assembly. Covestro's Makrofol polycarbonate films enable touch lighting and haptic feedback inside ultrathin shells. Regional research, such as organic electrochemical transistors from the University of Hong Kong, drives the next wave of wearable, on-sensor computing. Southeast Asia's PCB sector, already above USD 2 billion in output, supplies multilayer backplanes that mate with these structural housings. Accelerated tooling cycles support product launches in smartphones, hearables, and smart-home hubs, lifting the structural electronics market across personal electronics.

Shortage of conductive nanomaterial supply outside Asia

Carbon-nanotube inks and pastes are concentrated in a handful of Chinese plants that together command over 40% of global output. Hurricanes that disrupted high-purity quartz in North Carolina exposed parallel weaknesses in raw-material chains essential for semiconductor substrates. Recent CNT scale-up announcements from U.S. and European producers remain short of demand growth projections. Automotive and aerospace buyers consequently face longer lead times and price spikes, constraining structural electronics market expansion until diversified sourcing becomes available.

Other drivers and restraints analyzed in the detailed report include:

- FAA push for integrated sensor skins in composite airframes

- Printed photovoltaics for battery-less IoT nodes in smart buildings

- Complex qualification cycles for structural electronics in aerospace

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The sensor and antenna category contributed 34.7% revenue in 2024, buoyed by mandates for advanced driver-assistance systems and aircraft safety monitoring. Flight composite panels now embed fiber-optic arrays, whereas passenger-vehicle dashboards integrate radar and capacitive touch in one molded insert. Photovoltaics post the strongest 17.5% CAGR through 2030, driven by flexible perovskite modules that curve around building interiors and wearable tags. Structural integration allows power generation without separate housing, shrinking assembly cost, and opening new applications in asset tracking and indoor agriculture.

Structural batteries and micro-super-capacitors move beyond prototypes, illustrated by MXene ink devices delivering 611 F cm-3 volumetric capacitance. Displays follow automotive styling trends toward continuous curved surfaces enabled by OLED and micro-LED films. Interconnect materials confront copper volatility yet gain from silver-nanowire and MXene alternatives that sustain conductivity in bendable formats. Together, these shifts expand the structural electronics market as designers combine sensing, energy, and display functions within a single laminate.

In-mold electronics captured 51.3% revenue in 2024 by fusing films, inks, and resin into lightweight parts that ship ready-to-install. Automotive door trims now host back-lit controls without separate PCBs, cutting wire harness weight. Consumer wearables adopt the same process for IP68-rated casings. Additive manufacturing records the highest 18.2% CAGR, supported by DARPA's AMME program that 3-prints complex micro-circuits directly onto three-dimensional substrates. Aerosol-jet printing of MXene inks scales energy-dense capacitors, while multiphoton lithography pioneers printable organic bioelectronics.

Screen and flexographic presses remain cost-effective for large-area heaters and antennas on appliance panels. Inkjet platforms supply fine-feature prototypes before tooling commits to mass molding. This technology spreads, widening entry options, accelerating structural electronics market adoption in both high-volume and bespoke production runs.

Structural Electronics Market Report is Segmented by Integrant (Photovoltaics, Batteries/Super-capacitors, and More), Manufacturing Technology (In-Mold Electronics, Additive Manufacturing/3-D Printing, and More), Material (Conductive Inks, Substrates, Encapsulation and Adhesives), Application (Automotive, Aerospace and Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific delivered 37.9% of 2024 revenue by virtue of high-volume semiconductor, PCB, and molding ecosystems. China drives vertical integration, while Thailand and Malaysia add capacity that feeds global supply. Japan supplies over half the world's multilayer ceramic capacitors, and partnerships such as Murata with QuantumScape diversify into solid-state battery ceramics.

Europe's structural electronics market gains from automotive electrification milestones and EUR 80 billion (USD 94.06 billion) in Chips Act funds, targeting a 20% global semiconductor share by 2030. German OEMs refine giga casting with embedded circuits, whereas French construction firms pilot PV-powered sensor skins on retrofit facades.

The Middle East and Africa record the fastest 15.7% CAGR, propelled by defense modernization and smart-city rollouts. UAE's EDGE Group explores AI-enabled satellite links that demand conformal antennas and lightweight power sources. Local governments entice suppliers with offset programs that seed domestic assembly lines, yet the region still imports most nanomaterials, a gap that could temper late-decade growth.

North America keeps momentum through aerospace projects and fresh CHIPS Act subsidies for advanced packaging foundries. Boeing's acquisition of Spirit targets tighter integration of sensor-ready fuselage sections. Federal rules now favor home-grown supply, nudging structural electronics market participants to co-locate material, printing, and molding capabilities.

- TactoTek Oy

- Molex LLC

- Panasonic Holdings Corp.

- Canatu Oy

- Neotech AMT GmbH

- Pulse Electronics (Yageo)

- Optomec Inc.

- Odyssian Technology LLC

- Aconity3D GmbH

- T-ink Inc.

- Boeing Co.

- Henkel AG and Co. KGaA

- DuPont de Nemours Inc.

- 3D Systems Corp.

- Teijin Ltd.

- PPG Industries Inc.

- Flex Ltd.

- General Electric Co.

- Samsung Electro-Mechanics

- Continental AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive Lightweighting and EV-Centric Cabin Electronics Surge in Europe

- 4.2.2 Mass Adoption of 3-D In-Mold Electronics in Asia-Pacific Consumer Devices

- 4.2.3 FAA Push for Integrated Sensor Skins in Composite Airframes (North America)

- 4.2.4 Printed Photovoltaics for Battery-Less IoT Nodes in Smart Buildings

- 4.2.5 Edge-AI Wearables Driving Stretchable Structural Circuits in Healthcare

- 4.2.6 Defense Demand for Conformal Antennas and Smart Surfaces (Israel and US)

- 4.3 Market Restraints

- 4.3.1 Complex Qualification Cycles for Structural Electronics in Aerospace

- 4.3.2 Limited Cycle-Time Throughput of Additive Manufacturing Lines

- 4.3.3 Delamination Risks in High-Heat Polymer Substrates - Automotive

- 4.3.4 Shortage of Conductive Nanomaterial Supply Outside Asia

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Integrant

- 5.1.1 Photovoltaics

- 5.1.2 Batteries/Super-capacitors

- 5.1.3 Sensors and Antennas

- 5.1.4 Displays (OLED/Micro-LED)

- 5.1.5 Conductors and Interconnects

- 5.2 By Manufacturing Technology

- 5.2.1 In-Mold Electronics (IME)

- 5.2.2 Additive Manufacturing/3-D Printing

- 5.2.3 Aerosol Jet and Inkjet Printing

- 5.2.4 Screen/Flexographic Printing

- 5.3 By Material

- 5.3.1 Conductive Inks (Silver, Copper, Carbon, Nanomaterial)

- 5.3.2 Substrates (Polymer, Glass, Composite, Thermoset)

- 5.3.3 Encapsulation and Adhesives

- 5.4 By Application

- 5.4.1 Automotive - Interior and Exterior

- 5.4.2 Aerospace and Defense - Airframe, Smart Skins

- 5.4.3 Consumer Electronics - Whitegoods and Handhelds

- 5.4.4 Healthcare/Medical Devices

- 5.4.5 Industrial and Building Automation

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Southeast Asia

- 5.5.3.6 Australia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Gulf Cooperation Council Countries

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-Level Overview, Market-Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 TactoTek Oy

- 6.4.2 Molex LLC

- 6.4.3 Panasonic Holdings Corp.

- 6.4.4 Canatu Oy

- 6.4.5 Neotech AMT GmbH

- 6.4.6 Pulse Electronics (Yageo)

- 6.4.7 Optomec Inc.

- 6.4.8 Odyssian Technology LLC

- 6.4.9 Aconity3D GmbH

- 6.4.10 T-ink Inc.

- 6.4.11 Boeing Co.

- 6.4.12 Henkel AG and Co. KGaA

- 6.4.13 DuPont de Nemours Inc.

- 6.4.14 3D Systems Corp.

- 6.4.15 Teijin Ltd.

- 6.4.16 PPG Industries Inc.

- 6.4.17 Flex Ltd.

- 6.4.18 General Electric Co.

- 6.4.19 Samsung Electro-Mechanics

- 6.4.20 Continental AG

7 MARKET OPPORTUNITIES AND OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment