|

市場調查報告書

商品編碼

1846160

行動生物識別:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Mobile Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

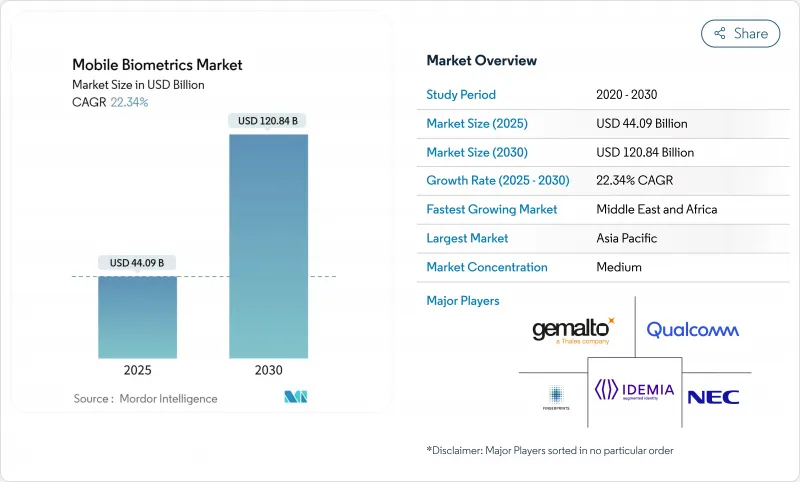

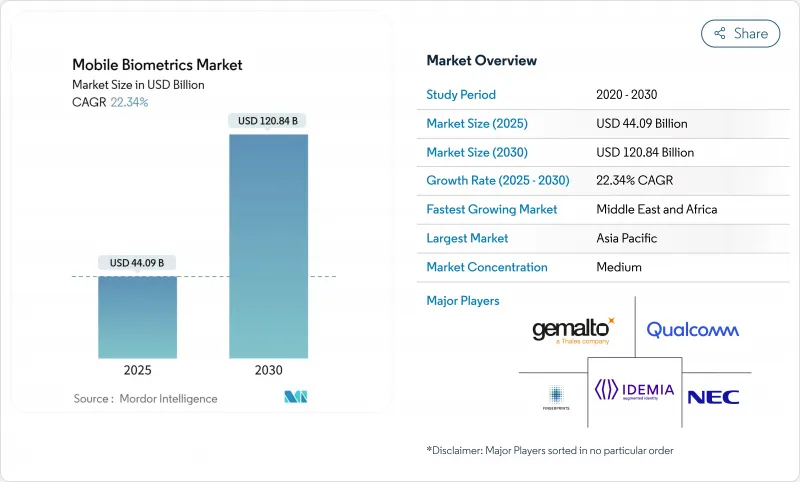

預計到 2025 年,行動生物識別市場規模將達到 440.9 億美元,到 2030 年將擴大到 1,208.4 億美元,複合年成長率高達 22.34%。

5G 連接、設備端人工智慧處理以及新興經濟體日益成長的數位身分要求共同推動了這一趨勢。針對入門級安卓行動電話的攻擊日益增多,使得持續的行為監控比靜態檢查更為重要。隨著企業轉向基於雲端基礎的生物辨識平台,組件發展趨勢正朝著演進型服務方向轉變。指紋感應器代表著日益成熟的核心技術,也是新型技術創新的前沿領域。儘管智慧型手機仍佔據裝置需求的主導地位,但智慧型穿戴裝置正在引領潮流,預示著未來將轉向環境、始終線上身份驗證環境。

全球行動生物識別市場趨勢與洞察

印度UPI生態系中雙模認證激增

印度的統一支付介面(UPI)允許使用指紋或臉部認證代替密碼,從而減少詐欺並加快小額交易。這種模式已經影響東南亞各地的銀行帳戶供應商,並可能推動行動生物辨識技術在無銀行帳戶消費者中的普及。銀行可以從降低扣回爭議帳款成本中獲益,但隱私監管機構仍在密切關注與Aadhaar(印度居民生物識別)關聯的儲存方式。

支援5G的終端AI提升了中國OEM智慧型手機的欺騙偵測能力

鑑於2024年生物辨識詐騙預計將激增40%,中國行動電話製造商已將本土人工智慧模型應用於手機,以偵測身分冒用。這種軟硬體結合的策略提升了手機在全球競爭中的競爭力,鞏固了其高階市場地位,同時也兼顧了電池續航力。

低成本安卓設備上的高演示攻擊率

低價安卓設備通常缺乏有效的身份驗證機制,導致偽造的聲音和麵具在六次試驗內就能有99%的機率繞過感應器。這個缺陷削弱了用戶信任,迫使非洲銀行增加實體身分證件審核,從而降低了它們在價格敏感型市場的規模。

細分市場分析

預計到2024年,硬體生物識別市場規模將達到265.3億美元,佔收益佔有率的60.2%。在產品日益同質化的背景下,感測器製造商已投資研發屏下超音波模組以維持利潤率。人工智慧最佳化晶片可降低延遲,並確保在照度和手指潮濕等環境下的可用性。服務雖然規模較小,但正以23.3%的複合年成長率成長,這主要得益於銀行和醫院購買的識別服務訂閱。服務提供者正在將編配儀錶板、詐欺風險分析和合規性報告等功能捆綁在一起,從而將資本支出轉向營運支出。

託管服務的需求在醫療保健領域最為明顯,醫院紛紛將生物識別患者註冊外包,以避免資料中心運作。主要的基礎設施即服務 (IaaS) 供應商正在聯合銷售生物辨識 API 以擴大其業務範圍,而整合指紋、語音和行為訊號的軟體平台作為多重雲端部署的指定整合商,正逐漸佔據戰略地位。這些因素共同作用,增強了服務飛輪效應,推動了整個行動生物識別市場年度經常性收益的成長。

單因子認證技術預計在2024年將創造314.7億美元的收益,凸顯了用戶對iOS和Android原生內建的一鍵解鎖流程的偏好。然而,監管機構和保險公司目前正敦促銀行減少剩餘的詐騙,並將新的預算項目用於部署多因素認證方案,該方案將生物識別與基於設備的加密金鑰相結合。

透過將FIDO憑證快取在硬體隔離區中,Google可以允許使用人臉或指紋作為使用者不可見的第二重身份驗證。企業無需放棄行動支付流程即可獲得縱深防禦。我們預計董事會層級的風險委員會將優先考慮分層控制措施,例如針對由生成式人工智慧技術武裝的網路釣魚套件包的防禦措施。

區域分析

預計亞太地區2024年的營收將達到197.9億美元,佔全球收益的44.8%。智慧型手機的快速普及、金融科技應用的激增以及政府支持的數位身分識別項目將助力該地區繼續保持領先地位。中國原始設備製造商(OEM)採用超音波屏下感測器已帶動整個供應鏈,降低了零件成本,並推動了該技術的普及應用。印度的Aadhaar(印度居民身分識別系統)連動鐵路計畫正在穩步推進,而使用統一支付介面(UPI)的雙模式交易正在將商家的服務範圍擴展到大都會區以外的地區。

中東將成為成長最快的地區,到2024年市場規模將達到28.5億美元,複合年成長率高達24.2%。阿拉伯聯合大公國以行動認證取代實體身分證,是自上而下政策加速國家間互通性的例證。科威特的「2035願景」將生物辨識註冊與電子政府服務結合,推動了對多模態套件的需求。杜拜的基礎設施建設熱潮,包括計劃交通項目,正促使承包商採用生物辨識門禁系統,進一步推動了該地區的支出成長。

北美保持穩定成長,但成長放緩,這主要得益於企業對其身分和存取管理 (IAM) 系統進行現代化改造,以及消費者銀行業務轉向無密碼登入。摩根大通的生物辨識結帳試點計畫預示著無卡零售支付即將迎來變革。歐洲在結構上仍然具有吸引力,但正努力應對 GDPR 和人工智慧法律的嚴格要求。歐盟數位身分錢包協調了 10 個國家的標準,加快了供應商認證流程。撒哈拉以南非洲地區的攜帶式選民登記套件銷量雖小以金額為準呈成長趨勢,凸顯了對攜帶式登記硬體的潛在需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 印度統一支付介面(UPI)生態系中雙模身份驗證的激增

- 支援5G的終端AI提升了中國OEM智慧型手機的欺騙偵測能力

- 奈及利亞、巴西和印尼強制要求手機銀行進行電子身份驗證 (e-KYC)。

- 在撒哈拉以南非洲部署行動生物識別選民登記套件

- 歐洲的數位身分錢包法規加速了行動電話上生物識別護照的使用。

- 高階市場OEM廠商轉向採用屏下超音波感測器

- 市場限制

- 低成本安卓設備上的高演示攻擊率

- 歐盟嚴格的數據主權法律限制了雲端基礎的語音生物辨識技術

- 持續行為認證帶來的電池消耗問題

- 缺乏通用的行動生物識別性能基準

- 價值/供應鏈分析

- 監理展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體平台

- 透過服務

- 透過身份驗證模式

- 單因素身份驗證

- 多因素身份驗證

- 按技術/模式

- 指紋認證

- 臉部認證

- 語音辨識

- 虹膜辨識

- 靜脈和血管模式識別

- 行為生物特徵(步態、擊鍵)

- 其他方式

- 依設備類型

- 智慧型手機

- 藥片

- 智慧型穿戴裝置

- 物聯網/邊緣設備

- 堅固耐用的手持式掃描儀

- 按行業

- BFSI

- 政府機構

- 衛生保健

- 零售與電子商務

- 資訊科技/通訊

- 國防和安全

- 教育

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐的

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 其他亞太地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Qualcomm Technologies Inc.

- IDEMIA(Safran Identity and Security)

- NEC Corporation

- Thales Group(Gemalto)

- Fingerprint Cards AB

- Goodix Technology Co. Ltd.

- Synaptics Incorporated

- Precise Biometrics AB

- Nuance Communications Inc.

- Aware Inc.

- Daon Inc.

- M2SYS Technology

- Veridium Ltd.

- FaceTec Inc.

- Mobbeel Solutions SLL

- VoiceVault Inc.

- ValidSoft Ltd.

- Tech5 SA

- HYPR Corp.

- Suprema Inc.

- ID RandD Inc.

- ImageWare Systems Inc.

第7章 市場機會與未來展望

The mobile biometric market size is valued at USD 44.09 billion in 2025 and is forecast to expand to USD 120.84 billion by 2030, translating into a robust 22.34% CAGR.

Momentum stems from the convergence of 5G connectivity, on-device AI processing, and tighter digital-identity mandates across emerging economies. Continuous behavioral monitoring is gaining favor over static checks as presentation-attack attempts on entry-level Android phones escalate. Component trends is giving way to services that are advancing as organizations migrate toward cloud-based biometric platforms. Fingerprint sensors illustrating a maturing core and an innovation frontier in new modalities. Device demand is dominated by smartphones, but smart wearables are setting the pace, signaling a pivot toward ambient, always-on authentication environments.

Global Mobile Biometrics Market Trends and Insights

Bi-modal authentication surge in India's UPI ecosystem

India's Unified Payments Interface is enabling fingerprint or facial recognition in lieu of PINs, cutting fraud and speeding micro-transactions. The model is already influencing wallet providers across Southeast Asia and could lift mobile biometric market adoption among unbanked consumers. Banks benefit from reduced chargeback costs, yet privacy regulators continue to scrutinize Aadhaar-linked storage practices.

5G-enabled on-device AI improving spoof detection in Chinese OEM smartphones

Chinese handset makers have embedded AI models that detect deep-fake attempts locally, a timely response after a 40% jump in biometric fraud in 2024. The hardware-software bundle raises the bar for global competitors and underpins premium positioning while preserving battery life.

High presentation-attack rates on low-cost Android devices

Budget phones often lack robust liveness checks, allowing deep-fake audio or masks to bypass sensors 99% of the time in six attempts. The gap erodes user trust and forces banks in Africa to add physical ID reviews, dampening scale in price-sensitive segments.

Other drivers and restraints analyzed in the detailed report include:

- e-KYC mandates for mobile banking in Nigeria and Brazil

- European Digital Identity Wallet regulation accelerating biometric passports on phones

- Restrictive data-sovereignty laws limiting cloud voice biometrics in the EU

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The mobile biometric market size for hardware stood at USD 26.53 billion in 2024, equal to 60.2% revenue share. Sensor makers invested in under-display ultrasonic modules to defend margins as commoditization sets. AI-optimized chips compress latency, ensuring usability in low-light and wet-finger scenarios. Services, though smaller, are compounding at 23.3% CAGR on the back of identity-as-a-service subscriptions purchased by banks and hospitals. Providers bundle orchestration dashboards, fraud-risk analytics, and compliance reporting, shifting capital expense to operating outlays.

Demand for managed services is most pronounced in healthcare, where hospitals outsource biometric patient enrollment to avoid running data centers. Leading IaaS players co-market biometric APIs, broadening reach. Meanwhile, software platforms that unify fingerprint, voice, and behavioral signals hold strategic ground as integrators of record for multicloud deployments. Collectively, these forces reinforce a services flywheel that drives stickier annual recurring revenue across the mobile biometric market.

Single-factor techniques generated USD 31.47 billion in 2024, underscoring user preference for one-touch unlock flows embedded natively in iOS and Android. However, regulators and insurers now pressure banks to shrink residual fraud, steering new budget line items toward multi-factor deployments that mix biometrics with device-based cryptographic keys.

Android 15's passkey integration proves critical; by caching FIDO credentials in the hardware enclave, Google enables face or fingerprint to act as a second factor invisibly to users. Enterprises gain defense-in-depth without abandonment mobile checkout flows. Expect board-level risk committees to prioritize such layered controls as phishing kits that weaponize generative AI.

The Mobile Biometric Market Report is Segmented by Component (Hardware, Software Platforms, Services), Authentication Mode (Single-Factor Authentication, and More), Technology/Modality (Fingerprint Recognition, Facial Recognition, and More), Device Type (Smartphones, Tablets, and More), Industry Vertical (BFSI, Government and Public Sector, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated USD 19.79 billion in 2024, equating to 44.8% of global revenue. Rapid smartphone penetration, proliferating fintech apps, and government-backed digital ID programs sustain region-leading scale. Chinese OEMs' embrace of ultrasonic in-display sensors has rippled across supply chains, lowering BOM costs and seeding mass adoption. India continues to iterate on Aadhaar-linked rails, with bi-modal UPI transactions expanding merchant acceptance beyond metro centers.

The Middle East, at USD 2.85 billion in 2024, is the fastest-growing pocket with a 24.2% CAGR. UAE's replacement of physical Emirates IDs with mobile credentials exemplifies a top-down policy play that accelerates nationwide interoperability. Kuwait's Vision 2035 ties biometric enrollment to e-government service access, lifting demand for multimodal kits. Dubai's infrastructure boom, including transit megaprojects, compels contractors to adopt biometric access control, further lifting regional outlays.

North America maintains steady but slower growth as enterprises modernize IAM stacks and consumer banking shifts toward password-free sign-in. JPMorgan Chase's biometric checkout pilots hint at a coming inflection in card-less retail payments. Europe remains structurally attractive but navigates stringent GDPR and AI Act requirements. The EU Digital Identity Wallet harmonizes standards across 10 nations, catalyzing vendor certification pipelines. Sub-Saharan Africa, while smaller in dollar terms, drives volume in mobile voter-registration kits, underscoring latent demand for portable enrollment hardware.

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Qualcomm Technologies Inc.

- IDEMIA (Safran Identity and Security)

- NEC Corporation

- Thales Group (Gemalto)

- Fingerprint Cards AB

- Goodix Technology Co. Ltd.

- Synaptics Incorporated

- Precise Biometrics AB

- Nuance Communications Inc.

- Aware Inc.

- Daon Inc.

- M2SYS Technology

- Veridium Ltd.

- FaceTec Inc.

- Mobbeel Solutions SLL

- VoiceVault Inc.

- ValidSoft Ltd.

- Tech5 SA

- HYPR Corp.

- Suprema Inc.

- ID RandD Inc.

- ImageWare Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Bi-modal authentication surge in India's Unified Payments Interface (UPI) ecosystem

- 4.2.2 5G-enabled on-device AI improving spoof detection in Chinese OEM smartphones

- 4.2.3 e-KYC mandates for mobile banking in Nigeria, Brazil and Indonesia

- 4.2.4 Deployment of mobile biometric voter enrolment kits across Sub-Saharan Africa

- 4.2.5 European Digital Identity Wallet regulation accelerating biometric passport use on phones

- 4.2.6 OEM shift toward under-display ultrasonic sensors in premium segment

- 4.3 Market Restraints

- 4.3.1 High presentation-attack rates on low-cost Android devices

- 4.3.2 Restrictive data-sovereignty laws limiting cloud-based voice biometrics in EU

- 4.3.3 Battery-drain concerns for continuous behavioral authentication

- 4.3.4 Absence of universal mobile biometric performance benchmarks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software Platforms

- 5.1.3 Services

- 5.2 By Authentication Mode

- 5.2.1 Single-Factor Authentication

- 5.2.2 Multi-Factor Authentication

- 5.3 By Technology / Modality

- 5.3.1 Fingerprint Recognition

- 5.3.2 Facial Recognition

- 5.3.3 Voice Recognition

- 5.3.4 Iris Recognition

- 5.3.5 Vein and Vascular Pattern Recognition

- 5.3.6 Behavioral Biometrics (Gait, Keystroke)

- 5.3.7 Other Modalities

- 5.4 By Device Type

- 5.4.1 Smartphones

- 5.4.2 Tablets

- 5.4.3 Smart Wearables

- 5.4.4 IoT / Edge Devices

- 5.4.5 Rugged Handhelds and Scanners

- 5.5 By Industry Vertical

- 5.5.1 BFSI

- 5.5.2 Government and Public Sector

- 5.5.3 Healthcare

- 5.5.4 Retail and E-commerce

- 5.5.5 IT and Telecom

- 5.5.6 Defense and Security

- 5.5.7 Education

- 5.5.8 Other Verticals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Kenya

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Apple Inc.

- 6.4.2 Samsung Electronics Co. Ltd.

- 6.4.3 Qualcomm Technologies Inc.

- 6.4.4 IDEMIA (Safran Identity and Security)

- 6.4.5 NEC Corporation

- 6.4.6 Thales Group (Gemalto)

- 6.4.7 Fingerprint Cards AB

- 6.4.8 Goodix Technology Co. Ltd.

- 6.4.9 Synaptics Incorporated

- 6.4.10 Precise Biometrics AB

- 6.4.11 Nuance Communications Inc.

- 6.4.12 Aware Inc.

- 6.4.13 Daon Inc.

- 6.4.14 M2SYS Technology

- 6.4.15 Veridium Ltd.

- 6.4.16 FaceTec Inc.

- 6.4.17 Mobbeel Solutions SLL

- 6.4.18 VoiceVault Inc.

- 6.4.19 ValidSoft Ltd.

- 6.4.20 Tech5 SA

- 6.4.21 HYPR Corp.

- 6.4.22 Suprema Inc.

- 6.4.23 ID RandD Inc.

- 6.4.24 ImageWare Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment