|

市場調查報告書

商品編碼

1846156

天門冬胺酸:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Aspartic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

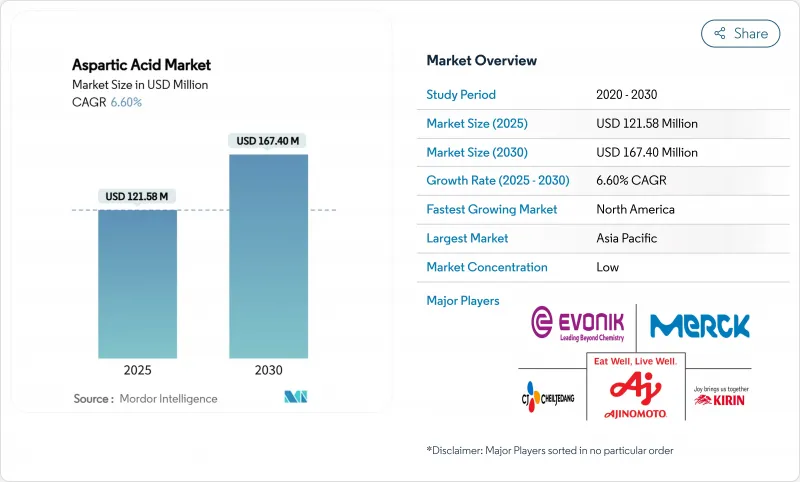

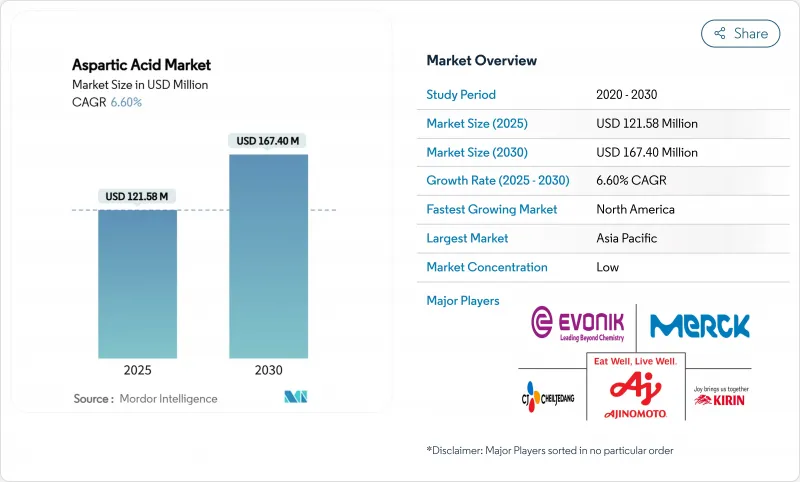

預計 2025 年天門冬胺酸市場價值將達到 1.2158 億美元,到 2030 年將達到 1.674 億美元,複合年成長率為 6.60%。

由於天門冬胺酸在多個產業中的重要應用,市場呈現持續成長。天門冬胺酸是食品和飲料製造中的關鍵成分,特別是在阿斯巴甜等人造甜味劑的生產中,它能夠開發出符合消費者偏好的無糖和低熱量產品。在製藥領域,天門冬胺酸在藥物和補充劑的配方中起著關鍵作用,支持治療和營養需求。市場成長也受到其在永續工業過程中的應用的推動,例如可生物分解的聚合物和無磷清潔劑,符合當前的環境法規。對性能營養和膳食補充劑的不斷成長的需求正在加強天冬胺酸在運動和健康產品中的使用。再加上生物發酵生產技術的改進,天門冬胺酸的應用範圍正在擴大,使天門冬胺酸成為以健康為重點的永續解決方案中必不可少的成分。

全球天冬胺酸市場趨勢與見解

亞洲清潔劑添加劑中天門冬胺酸的需求不斷成長

天門冬胺酸市場正在經歷顯著成長,主要原因是亞洲擴大將天門冬胺酸加入清潔劑添加劑中。這種擴張從根本上是由不斷變化的消費者偏好、嚴格的法律規範和整個全部區域持續的產品創新所決定的。在亞太地區,日益增強的環保意識極大地影響了消費者對環保洗衣精的購買模式。內務部的數據顯示了這一趨勢,該數據報告稱,到 2023 年,日本家庭在洗衣精上的平均支出將達到 4,500 日圓。為了應對這一市場變化,清潔劑製造商正在策略性地重組產品系列,以包括可生物分解和無毒成分。天門冬胺酸衍生的聚合物已成為此類配方中的關鍵成分,具有環境永續性和作為水垢和岩鹽抑制劑的優異性能的雙重優勢。亞洲市場向永續清潔劑添加劑的轉變繼續加強全球對天冬胺酸的需求,為市場建立了強勁的成長軌跡。

男性不孕症和運動營養領域對 D-天冬胺酸的需求不斷成長

在人口趨勢和市場創新的雙重推動下,男性不孕症治療和運動營養領域對 D-天冬胺酸 (DAA) 的需求不斷成長,成為天門冬胺酸市場的主要成長要素。根據美國中央情報局 (CIA) 2024 年的數據,台灣和韓國的人均生育率分別為 1.11 和 1.12,為世界最低,凸顯了東亞地區面臨的巨大生育挑戰。這種人口狀況正在推動消費者和政府對生殖健康解決方案的興趣日益濃厚。 D-天門冬胺酸在增強精子生成和活力方面的作用已得到科學檢驗,因此生育補充劑的使用率不斷提高。各公司正在推出將 D-天門冬胺酸與輔助生育成分結合的新產品,以滿足男性的生殖健康需求。這些補充劑的目標客戶既有注重生育的消費者,也有運動營養用戶,旨在提高精子品質、調節荷爾蒙和增強運動表現。人們對生育治療和運動營養需求的興趣的融合繼續加強了 D-天冬胺酸的市場地位,顯示天門冬胺酸市場具有持續成長的潛力。

長期服用D-天門冬胺酸補充劑的標籤規定更加嚴格

D-天門冬胺酸 (DAA) 補充劑標籤的監管要求影響產品配方、行銷和消費者接受度,從而限制了天門冬胺酸市場。加拿大衛生署和食品藥物管理局( FDA) 已對膳食補充劑實施了全面的標籤要求,包括警告、劑量限制和健康聲明限制。 FDA 於 2025 年 2 月對阿斯巴甜的審查表明,對氨基酸補充劑及其健康聲明的審查將更加嚴格。雖然這些法規保護了消費者,但它們也給高劑量或長期 D-天冬胺酸補充劑的製造商帶來了挑戰,因為合規成本增加並降低了市場潛力。像 D-天冬胺酸這樣的新膳食成分需要對安全性和有效性進行科學檢驗,這進一步使產品核可複雜化和延遲。這些監管要求為產品開發、行銷和消費者對 D-天門冬胺酸補充劑的信任設置了障礙,限制了市場擴張。

細分分析

到2024年,L-天門冬胺酸將以71.16%的市佔率佔據市場主導地位。這一重要的市場地位歸功於其在多個行業中的關鍵作用。在食品領域,L-天門冬胺酸是合成阿斯巴甜(食品和飲料製造中常見的人工甜味劑)的關鍵原料,可滿足人們對低熱量、無糖產品日益成長的需求。該化合物也是藥物配方中必不可少的成分,可作為藥物和補充劑的成分,並可作為螯合劑用於生產工業清潔劑,以提高清潔性能。 L-天冬胺酸完善的生產基礎設施和廣泛的工業應用鞏固了其市場地位。

D-天門冬胺酸是市場中成長最快的細分市場,預計2025年至2030年的複合年成長率為7.93%。這一成長得益於其在運動營養和生殖健康補充劑中的日益廣泛的應用。該化合物因其有助於維持荷爾蒙平衡(尤其是睪固酮水平)而廣受認可,使其成為運動員和健身愛好者運動營養產品的熱門選擇。其在男性生殖健康方面的作用也提升了其在生育補充劑中的佔有率。消費者對健身、運動表現和生殖健康日益成長的興趣,以及支持D-天冬胺酸有效性的研究,正在推動特種健康和營養產品市場的擴張。

生物發酵已成為天門冬胺酸的主要生產方法,到 2024 年將佔據 59.36% 的市場佔有率,並顯示出巨大的成長潛力,到 2030 年的複合年成長率將達到 8.32%。這種市場主導地位歸因於其營運成本效益、生產擴充性和環境永續性,使其特別有利於大規模工業應用。該方法使用特定的微生物將原料轉化為天冬胺酸,滿足了市場對永續生產通訊協定日益成長的需求,同時最大限度地減少了對環境的影響。生物發酵過程在食品和飲料行業中獲得了顯著的關注,它是天冬氨酸大規模生產的重要組成部分,特別是對於阿斯巴甜等甜味劑應用而言,產量和品質穩定性至關重要。

化學合成在天門冬胺酸產業佔有重要的市場影響,尤其是在需要快速生產、精確控制產量和穩定產品規格的應用中。該方法透過氨解和還原胺化等成熟製程將順丁烯二酸酐或富馬酸轉化為產品,為製造商提供了可預測的成本結構和成熟的工業供應鏈網路。這種生產方法在石化基礎設施發達或發酵原料取得受限的地區尤其有利。此外,化學合成有助於生產多種天冬胺酸變體,包括L-和D-天冬胺酸,從而滿足日益成長的藥品和營養保健品製造應用需求。

區域分析

亞太地區佔天門冬胺酸市場的 43.76%,得益於製造業基礎設施、原料供應以及終端使用領域不斷成長的國內需求。中國透過政府和私營部門對氨基酸生產設施的投資,在生產能力方面處於該地區領先地位。根據美國農業部 (USDA) 穀物和飼料更新數據,中國玉米產量將在 2024/25 年度達到 2.949 億噸,比上年度增加 2%。玉米產量的增加將增加發酵原料的供應,包括葡萄糖和澱粉衍生物,這些原料對於 L- 和 D-天冬胺酸的生物發酵生產至關重要。該地區透過由都市化、收入增加和健康偏好變化推動的綜合生產到消費系統來保持其市場主導。

預計北美將見證最高的區域成長率,2025年至2030年的複合年成長率為8.91%。這一成長主要源於製藥和營養保健品行業日益成長的需求,而天冬氨酸在這些領域對於氨基酸療法、膳食補充劑和激素調節化合物至關重要。美國和加拿大在功能性成分的商業化方面表現出色,這得益於其強大的研發基礎設施和支持創新的規範市場環境。該地區對運動營養、臨床營養和潔淨標示配方的關注,正在推動天門冬胺酸及其衍生物的先進應用。契約製造和生物技術公司的成長,正在推動產量的快速擴張,以應對新興的健康趨勢。

歐洲透過監管要求和永續性措施維持其市場地位。歐盟(EU)的磷酸鹽禁令導致天門冬胺酸衍生物在清潔劑和水處理應用中的使用增加,作為磷酸鹽螯合劑的替代品。該地區對可生物分解解決方案的推動,使得天門冬胺酸基聚合物在農業保水和養分輸送系統中的應用增加。由於消費者偏好無糖替代品以及政府對環保材料的支持,英國市場具有成長潛力。歐洲製藥業在藥物配方中使用天門冬胺酸,這有助於該地區應用的多樣化和市場穩定。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場促進因素

- 亞洲清潔劑添加劑對天門冬胺酸的需求不斷增加

- 男性不孕症運動營養對D-天門冬胺酸的需求不斷增加

- 加大綠色氨基酸生產的補貼

- 可生物分解的聚天冬胺酸基高吸附劑在農業的應用日益廣泛

- 歐盟磷酸鹽禁令增加對天門冬胺酸螯合劑的需求

- 新興國家的工業化和可支配所得的增加

- 市場限制

- 長期服用D-天門冬胺酸補充劑的標籤規定更加嚴格

- 高 pH 系統中天門冬胺酸基螯合劑的保存期限不穩定性。

- 在各種應用中與替代氨基酸和甜味劑的競爭

- 主要原物料價格波動影響生產成本與市場穩定

- 供應鏈分析

- 監理展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 依產品類型

- L-天門冬胺酸

- D-天門冬胺酸

- 依製造方法

- 生物發酵

- 化學合成

- 按純度等級

- 食品級

- 醫藥級

- 工業級

- 按用途

- 飲食

- 營養補充品

- 製藥

- 化妝品和個人護理

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市場排名分析

- 公司簡介

- Ajinomoto Co. Inc.

- Evonik Industries AG

- Kirin Holdings Company

- CJ CheilJedang Corp.

- Merck KGaA

- DIC Corporation

- Alpspure Lifesciences Private Limited

- Iris Biotech GmbH

- Fengchen Group Co.,Ltd

- AnaSpec Inc.

- Simson Pharma Limited

- Bio-Techne Corporation

- Alpha Chemika

- Zhangjiagang Huachang Pharmaceutical Co.,Ltd.

- CDH Fine Chemical

- Kishida Chemical Co.,Ltd. Manufacturer

- Tokyo Chemical Industry Co.

- Anmol Chemicals Pvt.Ltd

- Aditya Chemicals Limited

- AvansChem Speciality Chemicals

第7章 市場機會與未來展望

The Aspartic Acid market is valued at USD 121.58 million in 2025 and is expected to reach USD 167.40 million by 2030, registering a CAGR of 6.60%.

The market demonstrates consistent growth due to its essential applications across multiple industries. Aspartic Acid serves as a key component in food and beverage manufacturing, particularly in the production of artificial sweeteners like aspartame, which enables the development of sugar-free and low-calorie products aligned with consumer preferences. In pharmaceuticals, aspartic acid plays a vital role in medication and supplement formulations, supporting both therapeutic and nutritional needs. The market growth is also driven by its applications in sustainable industrial processes, including biodegradable polymers and phosphate-free detergents, which align with current environmental regulations. The increasing demand for performance nutrition and dietary supplements has enhanced aspartic acid usage in sports and wellness products. The expanding application range, coupled with improvements in bio-fermentation production techniques, establishes aspartic acid as an essential component in health-focused and sustainable solutions.

Global Aspartic Acid Market Trends and Insights

Increasing demand for Aspartic acid in Asian Detergent Additives

The aspartic acid market is experiencing substantial growth, primarily driven by its increasing incorporation in Asian detergent additives. This expansion is fundamentally shaped by evolving consumer preferences, stringent regulatory frameworks, and continuous product innovations across the region. In the Asia-Pacific region, heightened environmental awareness has significantly influenced consumer purchasing patterns toward eco-friendly laundry detergents. This trend is evidenced by data from the Ministry of Internal Affairs and Communications, which reported that Japanese households allocated an average of 4.5 thousand yen to laundry detergents in 2023 . In response to this market evolution, detergent manufacturers have strategically reformulated their product portfolios to include biodegradable and non-toxic components. Aspartic acid-derived polymers have emerged as a crucial ingredient in these formulations, offering dual benefits of environmental sustainability and superior performance as scale and halite inhibitors. This shift toward sustainable detergent additives in the Asian market continues to strengthen the global demand for aspartic acid, establishing a robust growth trajectory for the market.

Growing Demand for D-Aspartic Acid in Male-Fertility Sports Nutrition

The escalating demand for D-aspartic acid (DAA) in male fertility and sports nutrition is a key growth driver for the aspartic acid market, strongly supported by both demographic trends and market innovation. According to the Central Intelligence Agency (CIA) data for 2024, Taiwan and South Korea reported fertility rates of 1.11 and 1.12 children per woman, respectively, the lowest worldwide, highlighting a significant fertility challenge in East Asia. This demographic situation has intensified consumer and government attention on reproductive health solutions. The scientific validation of D-aspartic acid's role in enhancing sperm production and motility has increased its adoption in fertility supplements. Companies are introducing new products incorporating D-Aspartic Acid with complementary fertility-enhancing ingredients to address male reproductive health needs. These supplements target both fertility-focused consumers and sports nutrition users, marketed for their benefits in sperm quality improvement, hormonal regulation, and athletic performance enhancement. The convergence of fertility concerns and sports nutrition requirements continues to strengthen the market position of D-Aspartic Acid, indicating sustained growth potential in the aspartic acid market.

Stringent Labeling Rules on Long-Term D-Aspartate Supplementation

Regulatory requirements for D-aspartic acid (DAA) supplementation labeling constrain the aspartic acid market by affecting product formulation, marketing, and consumer acceptance. Health Canada and the Food and Drug Administration (FDA) enforce comprehensive labeling requirements for dietary supplements, including cautionary statements, dosage limits, and health claim restrictions. The Food and Drug Administration (FDA)'s February 2025 aspartame review indicates increased scrutiny of amino acid supplements and their health claims. While these regulations protect consumers, they create challenges for manufacturers of high-dose or long-term D-aspartic acid supplements through compliance costs and reduced market potential. The requirement for scientific validation of safety and efficacy for new dietary ingredients like D-aspartic acid further complicates and delays product approvals. These regulatory requirements limit market expansion by creating obstacles for product development, marketing, and consumer confidence in D-aspartic acid supplements.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Subsidies for Green Amino-Acid Manufacturing

- Increase in the Adoption of Biodegradable Polyaspartic Super-Absorbents in Agriculture

- Shelf-Life Instability of Aspartic-Based Chelators in High-pH Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

L-Aspartic Acid dominates the market with a 71.16% share in 2024. This significant market position stems from its essential role across multiple industries. In the food sector, L-Aspartic Acid is essential for aspartame synthesis, a common artificial sweetener in food and beverage manufacturing, meeting the increasing demand for low-calorie and sugar-free products. The compound is also vital in pharmaceutical formulations as a component for drugs and supplements, and in industrial detergent manufacturing as a chelating agent that improves cleaning performance. The established production infrastructure and broad industrial applications of L-Aspartic Acid strengthen its market position.

D-Aspartic Acid represents the market's fastest-growing segment, with a projected CAGR of 7.93% from 2025 to 2030. This growth results from its increased use in performance nutrition and reproductive health supplements. The compound has gained recognition for supporting hormonal balance, particularly testosterone levels, making it valuable in sports nutrition products for athletes and fitness enthusiasts. Its role in male reproductive health has also increased its presence in fertility supplements. The combination of growing consumer interest in fitness, athletic performance, and reproductive health, along with research supporting D-Aspartic Acid's effectiveness, drives its market expansion in specialized health and nutrition products.

Bio-fermentation has established itself as the predominant production methodology for aspartic acid, commanding 59.36% of the market share in 2024 and exhibiting substantial growth potential with an 8.32% CAGR through 2030. This market dominance is attributed to its operational cost-effectiveness, production scalability, and environmental sustainability characteristics, rendering it particularly advantageous for large-scale industrial applications. The methodology employs specific microorganisms for the conversion of raw materials into aspartic acid, consequently minimizing environmental impact while addressing increasing market requirements for sustainable manufacturing protocols. The bio-fermentation process has gained significant traction in the food and beverage industry, where it serves as an essential component in the large-scale production of aspartic acid, particularly for sweetener applications such as aspartame, where production volume and quality consistency are paramount considerations.

Chemical synthesis methodologies maintain a substantial market presence in the aspartic acid industry, particularly in applications necessitating expedited processing capabilities, precise yield control, and consistent product specifications. The methodology encompasses the transformation of maleic anhydride or fumaric acid through established processes of ammonolysis or reductive amination, providing manufacturers with predictable cost structures and well-established industrial supply chain networks. This production approach remains particularly viable in geographical regions characterized by developed petrochemical infrastructure or areas experiencing limitations in fermentation feedstock availability. Furthermore, chemical synthesis facilitates the production of multiple aspartic acid variants, including L-aspartic acid and D-aspartic acid, thereby addressing increasing demand requirements within pharmaceutical and nutraceutical manufacturing applications.

The Aspartic Acid Market is Segmented by Product Type (L-Aspartic Acid, and D-Aspartic Acid), by Production Method (Bio-Fermentation, and More), by Purity Grade (Food Grade, Pharmaceutical Grade, and More), by Application (Food and Beverages, Nutraceuticals and Dietary Supplements, and More), and by Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 43.76% of the aspartic acid market, supported by its manufacturing infrastructure, feedstock availability, and increasing domestic demand across end-use sectors. China leads the regional production capacity through government and private sector investments in amino acid manufacturing facilities. The country's agricultural strength provides a significant advantage; the United States Department of Agriculture (USDA)'s Grain and Feed Update reports China's corn production reached 294.9 million metric tons in MY 2024/25, a 2% increase from the previous year . This corn production growth increases the availability of fermentation feedstocks, including glucose and starch derivatives, essential for L- and D-aspartic acid production through bio-fermentation. The region maintains its market leadership through an integrated production-to-consumption system, driven by urbanization, increasing incomes, and changing health preferences.

North America demonstrates the highest regional growth rate, with a projected CAGR of 8.91% from 2025 to 2030. This growth stems from increased demand in pharmaceutical and nutraceutical sectors, where aspartic acid is essential for amino acid therapies, dietary supplements, and hormone-regulating compounds. The United States and Canada excel in commercializing functional ingredients, backed by robust research and development infrastructure and a regulated market environment that supports innovation. The region's focus on sports nutrition, clinical nutrition, and clean-label formulations drives advanced applications of aspartic acid and its derivatives. The growth of contract manufacturers and biotechnology companies enables rapid production scaling to meet emerging health trends.

Europe maintains its market position through regulatory requirements and sustainability initiatives. The European Union's phosphate ban has increased the use of aspartic acid derivatives in detergents and water treatment applications as alternatives to phosphate-based chelating agents. The region's commitment to biodegradable solutions has increased the adoption of aspartic acid-based polymers in agricultural applications for water retention and nutrient delivery systems. The United Kingdom market demonstrates growth potential due to consumer preference for sugar-free alternatives and government support for environmentally friendly materials. Europe's pharmaceutical industry utilizes aspartic acid in drug formulations, contributing to the region's diverse application range and market stability.

- Ajinomoto Co. Inc.

- Evonik Industries AG

- Kirin Holdings Company

- CJ CheilJedang Corp.

- Merck KGaA

- DIC Corporation

- Alpspure Lifesciences Private Limited

- Iris Biotech GmbH

- Fengchen Group Co.,Ltd

- AnaSpec Inc.

- Simson Pharma Limited

- Bio-Techne Corporation

- Alpha Chemika

- Zhangjiagang Huachang Pharmaceutical Co.,Ltd.

- CDH Fine Chemical

- Kishida Chemical Co.,Ltd. Manufacturer

- Tokyo Chemical Industry Co.

- Anmol Chemicals Pvt.Ltd

- Aditya Chemicals Limited

- AvansChem Speciality Chemicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Increasing demand for Aspartic acid in Asian Detergent Additives

- 4.1.2 Growing Demand for D-Aspartic Acid in Male-Fertility Sports Nutrition

- 4.1.3 Rise in Subsidies for Green Amino-Acid Manufacturing

- 4.1.4 Increase in the Adoption of Biodegradable Polyaspartic Super-Absorbents in Agriculture

- 4.1.5 Growing Demand for Aspartic-Based Chelating Agents owing to Phosphate Ban in EU

- 4.1.6 Increasing industrialization and disposable income in developing countries

- 4.2 Market Restraints

- 4.2.1 Stringent Labeling Rules on Long-Term D-Aspartate Supplementation

- 4.2.2 Shelf-Life Instability of Aspartic-Based Chelators in High-pH Systems

- 4.2.3 Competition from alternative amino acids and sweeteners in various applications

- 4.2.4 Price volatility of key raw materials impacts manufacturing costs and market stability

- 4.3 Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 L-Aspartic Acid

- 5.1.2 D-Aspartic Acid

- 5.2 By Production Method

- 5.2.1 Bio-fermentation

- 5.2.2 Chemical Synthesis

- 5.3 By Purity Grade

- 5.3.1 Food Grade

- 5.3.2 Pharmaceutical Grade

- 5.3.3 Industrial Grade

- 5.4 By Application

- 5.4.1 Food and Beverages

- 5.4.2 Nutraceuticals and Dietary Supplements

- 5.4.3 Pharmaceuticals

- 5.4.4 Cosmetics and Personal Care

- 5.4.5 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ajinomoto Co. Inc.

- 6.4.2 Evonik Industries AG

- 6.4.3 Kirin Holdings Company

- 6.4.4 CJ CheilJedang Corp.

- 6.4.5 Merck KGaA

- 6.4.6 DIC Corporation

- 6.4.7 Alpspure Lifesciences Private Limited

- 6.4.8 Iris Biotech GmbH

- 6.4.9 Fengchen Group Co.,Ltd

- 6.4.10 AnaSpec Inc.

- 6.4.11 Simson Pharma Limited

- 6.4.12 Bio-Techne Corporation

- 6.4.13 Alpha Chemika

- 6.4.14 Zhangjiagang Huachang Pharmaceutical Co.,Ltd.

- 6.4.15 CDH Fine Chemical

- 6.4.16 Kishida Chemical Co.,Ltd. Manufacturer

- 6.4.17 Tokyo Chemical Industry Co.

- 6.4.18 Anmol Chemicals Pvt.Ltd

- 6.4.19 Aditya Chemicals Limited

- 6.4.20 AvansChem Speciality Chemicals