|

市場調查報告書

商品編碼

1846146

流分析:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Streaming Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

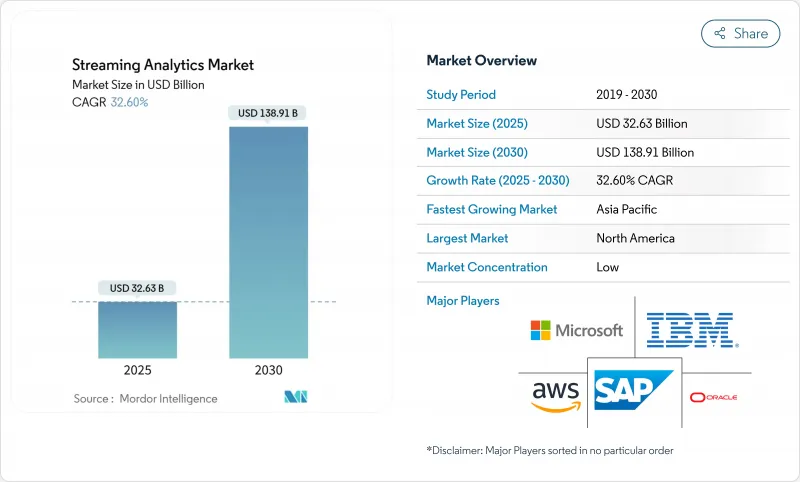

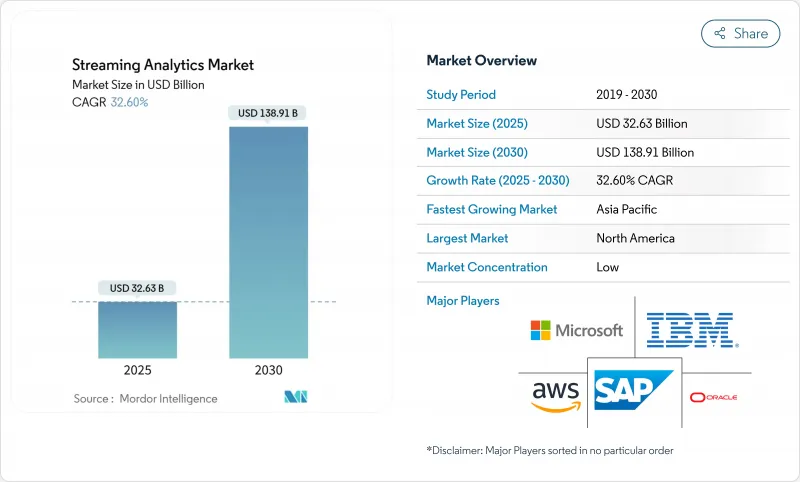

預計到 2025 年流分析市場價值將達到 326.3 億美元,到 2030 年預計將達到 1,389.1 億美元,複合年成長率為 33.6%。

隨著企業從批次轉向響應式、人工智慧驅動的決策循環,從連續資料流中獲取近乎即時的洞察正成為董事會的首要任務。直接嵌入資料管道的生成模型、邊緣推理晶片的廣泛應用以及託管雲端服務的興起,大大縮短了從資料提取到採取行動的時間。供應商正在改進計量收費定價模式,並簡化編配,以便在無需配置負擔的情況下擴展即時工作負載。雖然早期採用者專注於詐欺偵測和建議引擎,但預計到2025年,工業可靠性用例、遠端醫療監控和5G網路最佳化將實現成長。雖然對資料傳輸費用的日益敏感以及人才短缺限制了原本強勁的需求,但向事件驅動架構的根本性轉變正使流分析市場保持快速成長。

全球流分析市場趨勢與洞察

生成式人工智慧驅動的資料管道

與高吞吐量仲介整合的上下文感知模型可在幾毫秒內將原始事件轉換為規範操作。透過將語言模型與串流遙測相結合,金融機構報告詐騙偵測準確率提高了 40%,同時誤報率也降低了。 Confluent Tableflow 和 Databricks Delta Lake 之間的雙向連接器可確保模型始終獲得最新的、沿襲豐富的數據,從而消除手動刷新周期。零售商可以即時自動調整促銷參數,以提高閃購轉換率。隨著向量搜尋和語意豐富函式庫被添加到核心流引擎中,預測性維護和異常分類正在從儀表板轉向封閉式自主。因此,企業越來越渴望在不受傳統 ETL 延遲影響的情況下實現 AI 的營運。

支援設備端處理的邊緣 AI 晶片

NVIDIA Jetson AGX Thor 的運算能力比上一代產品高出 8 倍,記憶體容量高達 128GB,支援從源頭進行大規模轉換推理。透過將此模組放置在振動感測器旁邊,製造商可以在軸承磨損導致代價高昂的停機之前檢測到它。醫院使用邊緣推理在病患生命徵像出現異常時提醒護士,並解決限制持續雲端上傳的隱私法規問題。 Groq 的 LPU 等新型加速器將令牌產生速度提升至每秒 300 個令牌,使對話助理能夠在自助服務終端內運作。透過避免回程傳輸延遲和頻寬費用,公司可以在船舶、礦場以及連接不穩定的農村基地台等環境中解鎖即時用例。這項技術擴展了流分析市場的地理覆蓋範圍,同時加強了對資料主權法規的合規性。

卡夫卡技能短缺和薪資通膨加劇

儘管超過 80% 的財富 100 強公司都在使用 Kafka,但招聘網站提供的職位遠多於合格工程師的數量。美國工程師的薪資超過 10 萬美元,這給中端市場預算帶來了壓力。仲介、複製元素和語義準確性等高難度的學習曲線阻礙了新人的進入,而雲端供應商則會挖走高階員工,導致人才招募變得困難。託管平台有所幫助,但靈活性是以訂閱成本為代價的。諮詢合作夥伴正在擴大培訓訓練營,但推出時間仍落後於計劃截止日期。在教育管道跟上之前,人才短缺可能會抑制部署,尤其是在外包受限的受監管行業。

細分分析

鑑於仲介、處理器和互動式查詢引擎的廣泛採用,解決方案將成為2024年流分析市場的結構性支柱,佔總收入的65.4%。然而,隨著企業尋求藍圖、遷移協助和全天候SRE支持,到2030年,服務將以33.8%的複合年成長率加速成長。架構評估、資料品質改進和模式管治是新的工作說明書的主導。 Confluent與安永於2025年結成策略聯盟,以捆綁實施加速器,凸顯了對外部專業知識的需求。隨著對可觀察性和成本最佳化的需求不斷成長,託管服務將從簡單的託管擴展到根據事件速度自動調整容量。

技能短缺甚至促使那些規避風險的行業也將運行時營運外包,將預算從資本支出轉向經常性服務。供應商藍圖顯示,PCI-DSS 和 HIPAA 合規模組正在預先打包到訂閱層級中,從而降低了採用監管措施的門檻。因此,預計流分析專業服務和託管服務的市場規模將超過核心軟體收益,從而強化良性循環,即供應商之間的差異化取決於專業知識,而非工具數量。

到2024年,雲端運算將佔總營收的59.5%,複合年成長率為34.2%。超大規模企業將自動擴展的串流引擎與Lakehouse和向量資料庫結合,無需採購硬體即可提取、豐富和提供機器學習功能。谷歌雲端透過將Pub/Sub、Dataflow、BigQuery和Vertex AI整合成一個託管的連續體,減輕了缺乏分散式系統人才的公司的負擔。本地工作負載的流分析市場規模在國防、金融科技和公共衛生領域仍然很重要,但更新周期和資本支出障礙使其無法趕上雲端運算的成長。

混合藍圖透過使用 Azure SQL Edge 在工廠中處理敏感遠端檢測,然後再將聚合數據傳輸到雲端的機器學習端點,從而降低出口成本。提供者現在支援基於策略的主題放置,確保各個分區位於國家邊界內,以滿足新興的主權規則。展望未來,隨著買家尋求出口成本保護,涵蓋 IAM、沿襲和管治的多重雲端聯合工具可能會影響供應商的選擇。

區域分析

到2024年,北美將佔據29.7%的收入,這得益於早期超大規模生態系統和一群成熟的Kafka專家。金融服務、叫車和零售領域的先驅企業已經檢驗了投資回報率,創建了參考設計,並推動了各行業的採用。然而,市場飽和限制了增量成長,而技術純熟勞工的瓶頸正在推高薪資溢價,從而影響部署預算。政府對涵蓋天氣、山火、出行等資訊的即時公共部門儀表板的需求正在穩步成長,儘管合規性要求嚴格。

受5G部署、智慧工廠專案和主權舉措整合的推動,亞太地區的複合年成長率最高,達34.1%。預計到2030年,中國的人工智慧收入將達到近3,000億美元,而邊緣流技術對於自主製造單元至關重要。印度的公共數位基礎設施正在將事件流納入稅務、身分識別和支付管道,東南亞的電商平台則依靠即時個人化來贏得行動用戶。本地晶片製造商和通訊業者正在共同創新,以降低硬體成本並加強區域供應商生態系統,保持應用動能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 生成式人工智慧驅動的資料管道

- 支援設備端流處理的邊緣AI晶片

- 面向公民開發者的低程式碼/無程式碼流工作台

- 事件驅動的微服務成為主流

- 中小企業對雲端流分析的需求不斷成長(共識促進因素)

- 物聯網和工業自動化的擴展(共識促進因素)

- 市場限制

- Kafka 技能短缺和薪資通膨上升

- 超大規模資料中心業者雲端中的出口費用不斷上漲

- 限制跨境資料流動的資料主權法規

- 傳統的以批次為中心的架構正在減緩遷移速度(共識)

- 供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估影響市場的宏觀經濟因素

第5章市場規模及成長預測

- 按組件

- 軟體

- 按服務

- 按部署

- 本地部署

- 雲端基礎

- 按最終用戶產業

- 媒體與娛樂

- 零售與電子商務

- 製造業

- BFSI

- 醫療保健和生命科學

- 運輸/物流

- 通訊業

- 其他

- 按組織規模

- 主要企業

- 小型企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 荷蘭

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services

- Google(Alphabet)

- Confluent Inc.

- TIBCO Software Inc.

- Software AG

- SAS Institute Inc.

- Striim Inc.

- Impetus Technologies

- Databricks

- Snowflake Inc.

- Apache Software Foundation(Kafka/Flink)

- Cloudera Inc.

- Ververica

- Aiven Ltd.

- Timeplus

- Hazelcast Inc.

- StreamSets Inc.

- Redpanda Data

- Cisco Systems(ThousandEyes)

第7章 市場機會與未來展望

The streaming analytics market is valued at USD 32.63 billion in 2025 and is forecast to reach USD 138.91 billion by 2030, advancing at a 33.6% CAGR.

Near-instant insights generated from continuously flowing data are becoming a board-room priority as enterprises pivot away from batch practices toward responsive, AI-enhanced decision loops. Generative models embedded directly inside data pipelines, wide availability of edge inference chips, and a growing set of managed cloud services collectively compress the time between data capture and action. Vendors are refining pay-as-you-go pricing and simplifying orchestration so that firms can scale real-time workloads without provisioning burdens. While early adopters focused on fraud detection and recommendation engines, 2025 sees an uptick in industrial reliability use cases, telehealth monitoring, and 5G-enabled network optimization. Heightened sensitivity to data-transfer charges and talent scarcity temper otherwise robust demand, yet the fundamental shift toward event-driven architectures keeps the streaming analytics market on a steep growth path.

Global Streaming Analytics Market Trends and Insights

Generative-AI Infused Data Pipelines

Context-aware models integrated with high-throughput brokers turn raw events into prescriptive actions in milliseconds. Financial institutions combining language models with streaming telemetry report 40% gains in fraud-detection accuracy while slashing false positives. Bidirectional connectors between Confluent Tableflow and Databricks Delta Lake keep models supplied with fresh, lineage-rich data, eliminating manual refresh cycles. Retailers now auto-tune promotion parameters in real time, lifting conversion rates during flash sales. As libraries for vector search and semantic enrichment join core stream engines, predictive maintenance and anomaly triage are shifting from dashboards to closed-loop autonomy. The result is a broader enterprise appetite to operationalize AI without the latency penalties of traditional ETL.

Edge AI Chips Enabling On-Device Processing

NVIDIA's Jetson AGX Thor supplies up to 8 times the prior-generation compute, with 128 GB memory supporting hefty transformer inference at source. Manufacturers deploy the module next to vibration sensors so that models flag bearing wear before costly downtime. Hospitals rely on edge inference to trigger nurse alerts when patient vitals deviate, meeting privacy rules that restrict continuous cloud upload . Emerging accelerators like Groq's LPU push token generation to 300 tokens per second, letting conversational assistants run inside teller kiosks. By sidestepping back-haul latency and bandwidth charges, firms unlock real-time use cases in ships, mines, and rural cell towers where connectivity remains inconsistent. The technology thus widens geographic reach for the streaming analytics market while reinforcing compliance with data-sovereignty codes.

Rising Kafka Skill-Set Shortage and Wage Inflation

Eighty-plus percent of Fortune 100 enterprises rely on Kafka, yet job boards list far more openings than qualified engineers. United States salaries top USD 100,000, squeezing budgets for mid-tier firms. The steep learning curve around brokers, replication factors, and exactly-once semantics deters newcomers, while retaining talent proves challenging as cloud vendors poach senior staff. Managed platforms help but trade flexibility for subscription outlays. Consulting partners expand training bootcamps, though ramp-up times still lag project deadlines. Until educational pipelines catch up, talent scarcity will curb some rollouts, particularly in regulated sectors where outsourcing is constrained.

Other drivers and restraints analyzed in the detailed report include:

- Low-Code/No-Code Streaming Workbenches for Citizen Developers

- Mainstream Adoption of Event-Driven Micro-Services

- Escalating Egress Fees on Hyperscaler Clouds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions provided the structural backbone of the streaming analytics market in 2024 with 65.4% revenue, reflecting wide adoption of brokers, processors, and interactive query engines. Yet services are accelerating at 33.8% CAGR through 2030 as enterprises seek design blueprints, migration aid, and 24/7 SRE support. Architecture assessments, data-quality remediation, and schema governance dominate new statements of work. Confluent and EY formed a strategic alliance in 2025 to bundle implementation accelerators, underscoring demand for outside expertise. As observability and cost-optimization mandates rise, managed services extend from simple hosting to auto-tuning capacity based on event velocity.

Skills shortages push even risk-averse sectors to outsource runtime operations, shifting budgets from capital expenditure to recurring services. Vendor roadmaps show pre-packaged compliance modules for PCI-DSS and HIPAA emerging inside subscription tiers, which lowers the barrier for regulated adopters. Consequently, the streaming analytics market size for professional and managed services is projected to outpace core software revenues, reinforcing a virtuous cycle where know-how, not tool count, differentiates providers.

Cloud claimed 59.5% of 2024 revenue, and its 34.2% CAGR signals continued preference for elastic capacity. Hyperscalers pair auto-scaling stream engines with lakehouses and vector databases, letting teams ingest, enrich, and serve ML features without hardware procurement. Google Cloud stitches Pub/Sub, Dataflow, BigQuery, and Vertex AI into a managed continuum, easing burden for firms lacking distributed-systems talent. The streaming analytics market size for on-premise workloads remains meaningful in defense, fintech, and public health, but growth trails cloud due to refresh cycles and capex hurdles.

Hybrid blueprints mitigate egress costs by processing sensitive telemetry in factories with Azure SQL Edge before forwarding aggregates to cloud ML endpoints. Providers now enable policy-based topic placement so that individual partitions stay inside national borders, satisfying emerging sovereignty rules. Over the forecast, multicloud federation tools that span IAM, lineage, and governance will influence vendor selection as buyers seek exit-cost protection.

Streaming Analytics Market Report is Segmented by Component (Software, Services), Deployment (On-Premise, Cloud-Based), End-User Industry (Media and Entertainment, Retail and ECommerce, Manufacturing, BFSI, and More), Organization Size (Large Enterprises, Small and Medium Enterprises), and by Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America captured 29.7% revenue in 2024 owing to early hyperscaler ecosystems and a mature cadre of Kafka specialists. Financial services, ride-hailing, and retail pioneers validated ROI, creating reference designs that spread across sectors. Yet saturation tempers incremental growth, and skilled-labor bottlenecks spark wage premiums that influence deployment budgets. Government push for real-time public-sector dashboards-covering weather, wildfire, and mobility-adds steady demand, albeit at rigorous compliance levels.

Asia-Pacific posts the swiftest 34.1% CAGR as 5G rollouts, smart-factory programs, and sovereign cloud initiatives converge. China's AI revenue projections near USD 300 billion by 2030, with edge streaming deemed vital to autonomous manufacturing cells. India's public-digital-infrastructure drive embeds event streams into tax, identity, and payments rails, while Southeast Asian e-commerce platforms rely on real-time personalization to compete for mobile users. Local chipmakers and telcos co-innovate, reducing hardware costs and boosting regional vendor ecosystems, which keeps adoption momentum high.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services

- Google (Alphabet)

- Confluent Inc.

- TIBCO Software Inc.

- Software AG

- SAS Institute Inc.

- Striim Inc.

- Impetus Technologies

- Databricks

- Snowflake Inc.

- Apache Software Foundation (Kafka/Flink)

- Cloudera Inc.

- Ververica

- Aiven Ltd.

- Timeplus

- Hazelcast Inc.

- StreamSets Inc.

- Redpanda Data

- Cisco Systems (ThousandEyes)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Generative-AI infused data pipelines

- 4.2.2 Edge AI chips enabling on-device stream processing

- 4.2.3 Low-code/no-code streaming workbenches for citizen developers

- 4.2.4 Mainstream adoption of event-driven micro-services

- 4.2.5 Growing SME demand for cloud stream analytics (consensus driver)

- 4.2.6 Expansion of IoT and industrial automation (consensus driver)

- 4.3 Market Restraints

- 4.3.1 Rising Kafka skill-set shortage and wage inflation

- 4.3.2 Escalating egress fees on hyperscaler clouds

- 4.3.3 Data-sovereignty regulations limiting cross-border stream flows

- 4.3.4 Legacy batch-centric architectures delaying migration (consensus)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud-Based

- 5.3 By End-user Industry

- 5.3.1 Media and Entertainment

- 5.3.2 Retail and eCommerce

- 5.3.3 Manufacturing

- 5.3.4 BFSI

- 5.3.5 Healthcare and Life Sciences

- 5.3.6 Transportation and Logistics

- 5.3.7 Telecommunications

- 5.3.8 Others

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Oracle Corporation

- 6.4.4 SAP SE

- 6.4.5 Amazon Web Services

- 6.4.6 Google (Alphabet)

- 6.4.7 Confluent Inc.

- 6.4.8 TIBCO Software Inc.

- 6.4.9 Software AG

- 6.4.10 SAS Institute Inc.

- 6.4.11 Striim Inc.

- 6.4.12 Impetus Technologies

- 6.4.13 Databricks

- 6.4.14 Snowflake Inc.

- 6.4.15 Apache Software Foundation (Kafka/Flink)

- 6.4.16 Cloudera Inc.

- 6.4.17 Ververica

- 6.4.18 Aiven Ltd.

- 6.4.19 Timeplus

- 6.4.20 Hazelcast Inc.

- 6.4.21 StreamSets Inc.

- 6.4.22 Redpanda Data

- 6.4.23 Cisco Systems (ThousandEyes)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment