|

市場調查報告書

商品編碼

1846144

片狀成型和塊狀成型模塑膠:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Sheet Molding And Bulk Molding Compounds - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

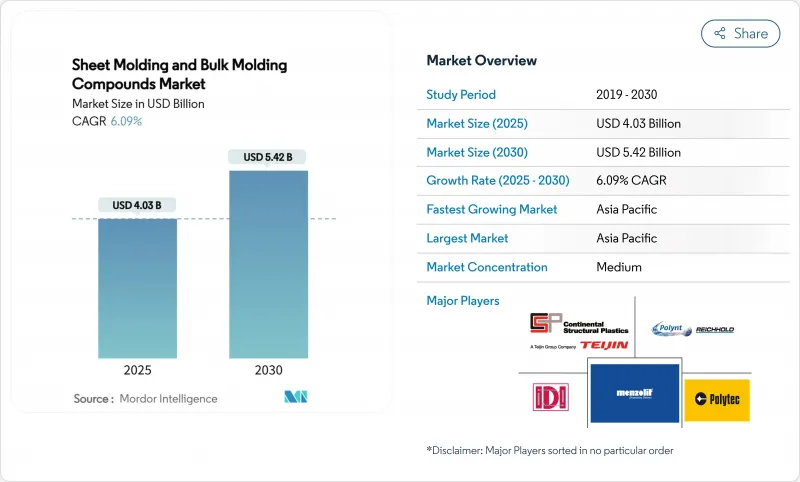

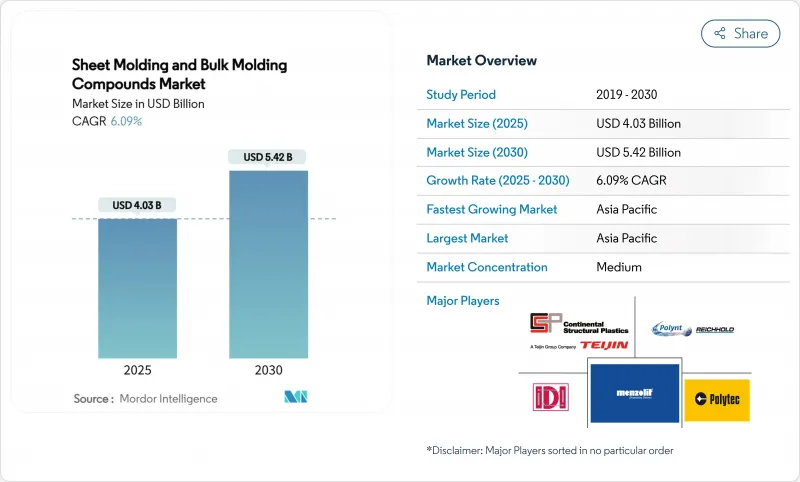

片狀成型和塊狀成型模塑膠市場規模預計在 2025 年為 40.3 億美元,預計到 2030 年將達到 54.2 億美元,預測期內(2025-2030 年)的複合年成長率為 6.09%。

電動車輕量化結構部件的持續需求、模壓成型的低廢品率以及樹脂化學性能的改進,持續推動資本流入新的產能。單一零件成本的降低,尤其是對於先前依賴多級沖壓的複雜形狀零件,正在加速汽車和家電應用中用模壓成型複合複合材料取代金屬衝壓。目標商標產品製造商現在指定使用具有A級表面處理的先進片狀成型材料,這些材料可直接用於外部,並省去了曾經限制其應用的二次噴漆步驟。亞太地區在高流動性、低密度片狀成型化合物方面保持著成本領先地位,但歐洲關於苯乙烯排放的法規正在推動環氧基替代品的快速發展。

全球片狀成型和塊狀成型塑膠市場趨勢和洞察

電動和混合動力汽車原始設備製造商推動輕量化

電動車擁有大型電池組,因此每減輕一公斤重量都意味著續航里程的增加。因此,汽車製造商正在重新設計車門蓋、車身面板和電池外殼,使用先進的片狀模塑膠。與同類鋁製設計相比,這些材料可減輕高達 40% 的零件重量,同時滿足碰撞負載路徑和隔熱要求。特斯拉、通用汽車和知名品牌已公開推出採用單次壓縮成型的多部件整合策略,從而減少焊接操作和生產線節拍時間。隨著這些計畫從試點規模擴大到全面生產,片狀成型和塊狀模塑膠的市場參與企業正從中受益。

電子電氣元件成型中心產能快速擴張

亞太地區中國、越南和馬來西亞的電子產業叢集持續安裝配備自動進料和紅外線固化控制的高噸位壓機。將改質商、注塑商和終端設備組裝商集中位置,縮短了供應鏈,使製造商能夠滿足連接器外殼和馬達絕緣系統所需的嚴格尺寸公差。中國政府旨在實現高性能聚合物自給自足的計劃正在推動這一擴張,使該地區能夠滿足不斷成長的全球需求。

苯乙烯和玻璃纖維價格波動

苯乙烯單體的交易週期緊湊,受苯原料波動和運輸限制的影響。苯乙烯價格每噸100美元的波動會直接影響樹脂價格,擠壓那些沒有長期供應合約的小型片狀成型塑膠生產商的利潤空間。同時,由於許多結構級產品的玻纖含量接近65%(重量百分比),玻璃纖維額外費用也進一步影響了價格的穩定性。

細分分析

2024年,聚酯樹脂佔據了片狀成型和塊狀成型塑膠市場佔有率的55.19%,這得益於低成本、廣泛的供應商基礎以及與傳統壓縮生產線一致的固化速度。該細分市場將繼續受益於對汽車引擎蓋下蓋和結構內部支架的需求。同時,到2030年,環氧樹脂牌號的複合年成長率將達到6.92%,這得益於揮發性有機化合物含量的降低和耐熱性的提高,這對電力傳動系統設計師很有吸引力。贏創主導的玻璃纖維增強環氧樹脂電池外殼專案檢驗,其重量減輕了近10%,同時保持了車輛認證所需的關鍵壓潰力閾值。隨著環氧樹脂體系的成熟,可能會出現將聚酯表皮與環氧樹脂芯材混合的混合積層法,以平衡經濟性和強度。

玻璃纖維憑藉其良好的性價比和優異的電氣元件介電強度,預計到2024年將保持其銷售額的80.22%。主要玻璃纖維製造商持續擴建熔爐,穩定了供應,並支持亞太和北美地區汽車玻璃纖維的大量生產。碳纖維片狀成型塑膠的複合年成長率預計將達到7.06%,在航太二級結構和高階跑車領域發展勢頭強勁。用於繪製纖維取向的製程模擬工具可縮短開發週期,提供可預測的機械性能,並降低廢品率。混合纖維氈採用交替的玻璃層和碳纖維層,有助於在不犧牲剛度的情況下實現中等成本目標。

片狀成型和塊狀成型模塑膠市場報告按樹脂類型(環氧樹脂、聚酯)、纖維類型(玻璃纖維、碳纖維)、製造程序(壓縮成型、轉注成型、其他)、最終用戶行業(汽車和運輸、電氣和電子、其他)和地區(亞太地區、北美、歐洲、南美、中東和非洲)細分。

區域分析

亞太地區將維持其成本優勢,到2024年將佔48.54%的市佔率。受國內電動車產量成長、中階消費性電子產品消費成長以及政府鼓勵國內複合材料零件生產的激勵措施的活性化,壓平機產能已接近滿載運作。預計該地區需求複合年成長率為6.45%,片狀成型和塊狀成型塑膠市場將繼續轉移到亞洲價值鏈。

北美是銷量第二大的地區。早期推出的電動皮卡需要大型結構蓋,而航太計畫則使用高模量碳片狀成型塑膠作為二次結構。聯邦政府為陸上電池工廠提供資金的政策正在鼓勵新的複合材料電池盒生產線,並促進當地複合材料的消費。

歐洲持續推行嚴格的環保法規,推動了低苯乙烯片狀成型系統和環氧樹脂創新技術的採用。汽車製造商藍圖在2030年至2035年之間逐步淘汰內燃機,這將推動對輕質複合材料的需求。同時,強大的化學基礎設施為專用樹脂添加劑提供了支持,這些添加劑可增強機械性能並延長模具壽命。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 電動和混合動力汽車原始設備製造商推動輕量化

- 電子電氣元件成型中心產能快速擴張

- 與金屬衝壓相比,批量壓縮成型更具成本效益

- 高流動性、低密度片狀成型零件 (SMC) 輔助打造 A-Class 車身面板

- 智慧面板的套模電子 (IME) 整合

- 市場限制

- 苯乙烯和玻璃纖維價格波動

- 工程熱塑性塑膠取代電池盒中的片狀成型組件(SMC)

- 回收消費後熱固性樹脂的障礙

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依樹脂類型

- 聚酯纖維

- 環氧樹脂

- 依纖維類型

- 玻璃纖維

- 碳纖維

- 按製造程序

- 壓縮成型

- 注塑/轉注成型

- 樹脂轉注成形(RTM)

- 拉擠成型

- 按最終用戶產業

- 汽車和運輸

- 電氣和電子

- 建築/施工

- 航太

- 電器產品

- 其他終端用戶產業(能源等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- AOC

- Ashland Container Corporation

- Astar SA

- Continental Structural Plastics(Teijin)

- Core Molding Technologies

- CSP

- DIC Corporation

- IDI Composites International

- Kingfa Sci.&Tech. Co.,Ltd.

- LyondellBasell Industries Holdings BV

- Menzolit

- National Manufacturing Group

- OPmobility SE

- POLYNT SPA

- Polynt-Reichhold

- Polytec Group

- Polytec Masterbatch LLC

- TORAY INDUSTRIES, INC.

第7章 市場機會與未來展望

The Sheet Molding & Bulk Molding Compounds Market size is estimated at USD 4.03 billion in 2025, and is expected to reach USD 5.42 billion by 2030, at a CAGR of 6.09% during the forecast period (2025-2030).

Sustained demand for lightweight structural parts in electric vehicles, low scrap rates from compression molding, and improved resin chemistries keep capital flowing into new capacity. Cost reductions per part, especially in complex geometries that previously relied on multi-stage stamping, accelerate the replacement of metal stampings with compression-molded composites across automotive and electrical applications. Original equipment manufacturers now specify advanced sheet molding materials with Class-A finishes, allowing direct exterior use and eliminating secondary paint steps that once limited adoption. Asia-Pacific retains cost-leadership in high-flow, low-density sheet molding compounds, while European regulations on styrene emissions fast-track epoxy-based alternatives.

Global Sheet Molding And Bulk Molding Compounds Market Trends and Insights

Light-weighting Push from Electric Vehicles and Hybrid Vehicle OEMs

Electric models move large battery packs, so every kilogram saved extends range. Automakers therefore redesign closures, body panels, and battery housings with advanced sheet molding compounds that cut part weight by up to 40% versus comparable aluminum designs while satisfying crash-load pathways and thermal shielding demands. Tesla, General Motors, and leading Chinese brands have publicly outlined multi-part consolidation strategies that favor single-shot compression molding, reducing weld operations and line takt time. Sheet molding and bulk molding compounds market participants benefit as these programs scale from pilot to full volume production.

Rapid Capacity Additions in Electrical and Electronics Components Molding Hubs

APAC electronics clusters in China, Vietnam, and Malaysia continue installing high-tonnage compression presses equipped with automated material dosing and infrared curing control. Co-location of compounders, molders, and end-device assemblers shortens supply chains and helps manufacturers meet stringent dimensional tolerances required for connector housings and motor insulation systems. Government programs in China that target self-sufficiency in high-performance polymers reinforce this build-out, positioning the region to support global demand spikes.

Styrene and Fiberglass Price Volatility

Styrene monomer trades in tight cycles, reacting to benzene feedstock swings and shipping constraints. Each USD 100 per ton change in styrene cascades into resin pricing, squeezing margins for small sheet molding compounders that lack long-term supply contracts. Simultaneous fiberglass surcharges further hinder price stability because glass fiber content approaches 65 wt % in many structural grades.

Other drivers and restraints analyzed in the detailed report include:

- Cost-effective High-volume Compression Molding versus Metal Stamping

- High-flow, Low-density Sheet Molding Components Enabling Class-A Body Panels

- Engineering Thermoplastics Replacing SMC in Battery Boxes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyester resin accounted for 55.19% sheet molding and bulk molding compounds market share in 2024 thanks to low cost, broad supplier base, and cure kinetics tailored to legacy compression lines. The segment continues to profit from automotive demand for under-hood covers and structural interior brackets. At the same time epoxy grades post a 6.92% CAGR toward 2030, driven by reduced volatile organic compound content and elevated heat resistance that appeals to electric drivetrain designers. The Evonik-led program for glass-fiber-reinforced epoxy battery housings validated weight reductions approaching 10% while maintaining crush-force thresholds critical to vehicle homologation. As epoxy systems mature, hybrid lay-ups that blend polyester skins with epoxy cores may emerge to balance economics and strength.

Glass fiber kept 80.22% of 2024 revenue due to favorable cost-to-performance and excellent dielectric strength for electrical parts. Continuous furnace expansions at major glass fiber producers stabilize supply, supporting high-volume automotive launches in Asia-Pacific and North America. Carbon fiber sheet molding compounds, posting a 7.06% CAGR, gain momentum in aerospace secondary structures and premium sports cars where curb-weight targets override raw-material premiums. Process simulation tools mapping fiber orientation now shorten development cycles, delivering predictable mechanical performance and cutting scrap rates. Hybridized fiber mats that alternate glass and carbon layers help designers hit mid-tier cost targets without compromising stiffness.

The Sheet Molding & Bulk Molding Compounds Market Report is Segmented by Resin Type (Epoxy and Polyester), Fiber Type (Glass Fiber and Carbon Fiber), Manufacturing Process (Compression Molding, Transfer Molding, and More), End-User Industry (Automotive and Transportation, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific retains the cost advantage that underpins its 48.54% share in 2024. Intensifying domestic EV production, rising middle-class appliance consumption, and government incentives for composite part localization keep presses running near capacity. With estimated demand growth translating to a 6.45% regional CAGR, the sheet molding and bulk molding compounds market continues to shift toward Asian value chains.

North America sits second in regional revenue. Early electric-pickup launches require large structural covers, and aerospace programs consume high-modulus carbon sheet molding compounds for secondary structures. Federal policy that funds onshore battery factories encourages new composite battery-box lines, lifting local compound consumption.

Europe upholds strict environmental rules that spur adoption of low-styrene sheet molding systems and epoxy innovations. Automaker roadmaps that phase out internal combustion between 2030 and 2035 expand demand for lightweight composites. Meanwhile, robust chemical-industry infrastructure supports specialized resin additives that raise mechanical performance and prolong mold life.

- AOC

- Ashland Container Corporation

- Astar S.A.

- Continental Structural Plastics (Teijin)

- Core Molding Technologies

- CSP

- DIC Corporation

- IDI Composites International

- Kingfa Sci.&Tech. Co.,Ltd.

- LyondellBasell Industries Holdings B.V.

- Menzolit

- National Manufacturing Group

- OPmobility SE

- POLYNT SPA

- Polynt-Reichhold

- Polytec Group

- Polytec Masterbatch LLC

- TORAY INDUSTRIES, INC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Light-weighting Push from Electric Vehicles and Hybrid Vehicle OEMs

- 4.2.2 Rapid Capacity Additions in Electrical and Electronics Components Molding Hubs

- 4.2.3 Cost-effective High-volume Compression Molding versus Metal Stamping

- 4.2.4 High-flow, Low-density Sheet Molding Components (SMC) enabling Class-A body Panels

- 4.2.5 Integration of In-mold Electronics (IME) for Smart Panels

- 4.3 Market Restraints

- 4.3.1 Styrene and Fiberglass Price Volatility

- 4.3.2 Engineering Thermoplastics Replacing Sheet Molding Components (SMC) in Battery Boxes

- 4.3.3 End-of-life Recycling Hurdles for Thermosets

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Polyester

- 5.1.2 Epoxy

- 5.2 By Fiber Type

- 5.2.1 Glass Fiber

- 5.2.2 Carbon Fiber

- 5.3 By Manufacturing Process

- 5.3.1 Compression Molding

- 5.3.2 Injection / Transfer Molding

- 5.3.3 Resin Transfer Molding (RTM)

- 5.3.4 Pultrusion

- 5.4 By End-user Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Electrical and Electronics

- 5.4.3 Building and Construction

- 5.4.4 Aerospace

- 5.4.5 Domestic Appliances

- 5.4.6 Other End-user Industries (Energy, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AOC

- 6.4.2 Ashland Container Corporation

- 6.4.3 Astar S.A.

- 6.4.4 Continental Structural Plastics (Teijin)

- 6.4.5 Core Molding Technologies

- 6.4.6 CSP

- 6.4.7 DIC Corporation

- 6.4.8 IDI Composites International

- 6.4.9 Kingfa Sci.&Tech. Co.,Ltd.

- 6.4.10 LyondellBasell Industries Holdings B.V.

- 6.4.11 Menzolit

- 6.4.12 National Manufacturing Group

- 6.4.13 OPmobility SE

- 6.4.14 POLYNT SPA

- 6.4.15 Polynt-Reichhold

- 6.4.16 Polytec Group

- 6.4.17 Polytec Masterbatch LLC

- 6.4.18 TORAY INDUSTRIES, INC.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

![片狀模塑膠(SMC) 市場:趨勢、機會與競爭分析 [2024-2030]](/sample/img/cover/42/default_cover_5.png)