|

市場調查報告書

商品編碼

1846143

綠色塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Green Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

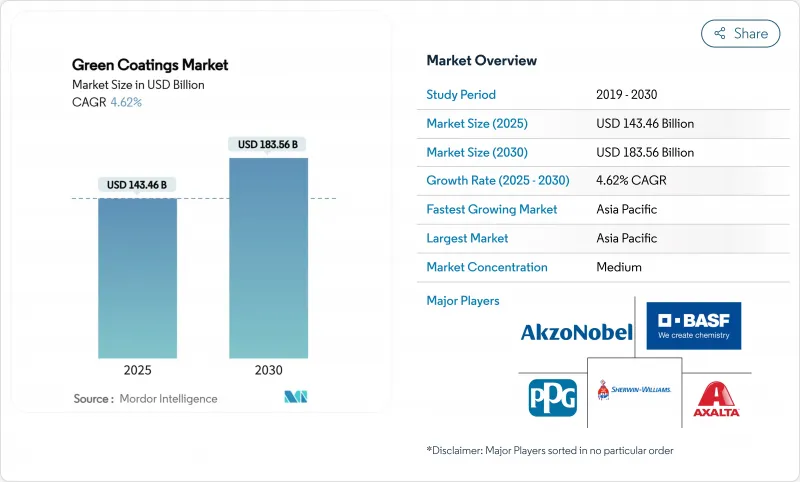

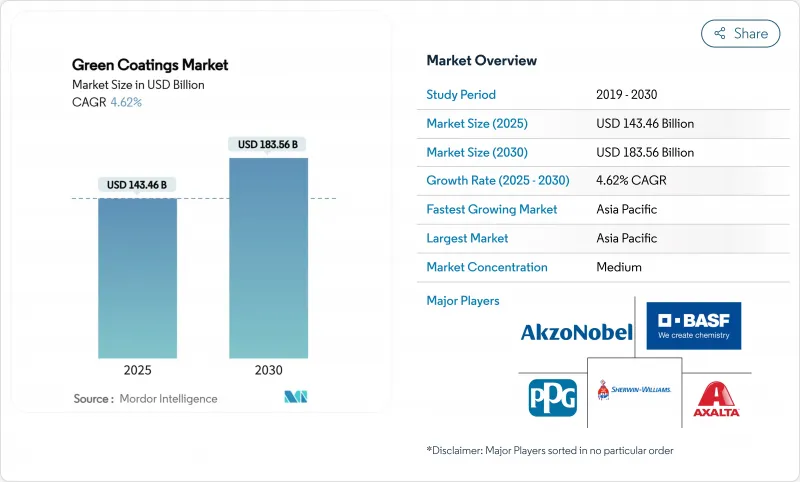

預計2025年綠色塗料市場規模將達到1,464.6億美元,到2030年將達到1,835.6億美元,複合年成長率為4.62%。

監管部門對揮發性有機化合物 (VOC) 限值要求的嚴格化、水性化學品和粉末技術的快速發展及其在汽車和建築應用領域的滲透,仍然是綠色塗料市場的主要成長動力。加州南海岸空氣品質管理區已根據第 1151 號修正案降低了汽車修補漆產品的 VOC 允許含量,並計劃在 2033 年實施更嚴格的標準。同時,歐盟 (EU) 將從 2026 年 8 月起禁止在食品接觸包裝中使用全氟和多氟烷基物質 (PFAS),這將推動包裝配方師轉向生物基阻隔技術。此外,目前用於提高水性樹脂耐久性的技術已可與溶劑型樹脂相媲美。

全球綠色塗料市場趨勢與洞察

有關VOC排放的嚴格環境法規

新的VOC法規正在重新定義綠色塗料市場可接受的配方界線。南海岸空氣品質管理區(AQMD)的第1151號規則將從2025年5月起逐步降低汽車補漆產品的VOC限值,到2033年達到最嚴格的閾值,推動汽車修理廠轉向水性系統。歐盟的《包裝和包裝廢棄物法規》將PFAS的單一物質含量限制為25 ppb,總合限制為250 ppb,這促使包裝供應商從含氟化合物轉向生物基被覆劑。擁有合規產品組合的公司將享有先發優勢,而局限於傳統溶劑型產品的製造商將面臨更高的合規成本和潛在的市場排斥。

低VOC建築塗料需求不斷成長

房屋維修、商業維修和綠色建築標準持續推動建築價值鏈向低VOC替代品靠攏。據宣偉公司稱,住宅重塗訂單正明顯轉向更易於回收、體積碳足跡更低的塗料。如今,水性塗料的保光性和耐刮擦性已與溶劑型塗料不相上下。阿克蘇諾貝爾的RUBBOL WF 3350正是這種轉變的典範,它結合了20%的生物基成分,並保證了室內外木器塗料的耐久性。

與溶劑型系統相比,在惡劣環境下的性能差異

船體、海上平台、化學品儲存槽等仍需要含溶劑、高固態環氧樹脂的長期耐污性和阻隔強度。自修復矽氧烷雜化材料和無鉻緩蝕劑正在興起,但由於認證週期長以及船東對未經測試的化學品的抵觸情緒,商業性應用進展緩慢。

細分分析

水性體系將在綠色塗料市場保持主導,到2024年將佔據55.16%的市場。其主導地位源自於良好的合規性和持續的樹脂升級,可提供與溶劑型塗料相當的機械強度。馬自達將整個工廠改用先進的水性面漆,將揮發性有機化合物(VOC)排放減少了57%,同時保持了展示室的光澤度。然而,粉末塗料的發展速度最快,到2030年的複合年成長率將達到6.51%。現在,催化劑輔助紅外線爐只需2-3分鐘即可在約225°C的溫度下固化厚塗層,從而提高了生產能力並降低了公用事業成本。剪切機的Powdura ECO展示了一種循環設計,將相當於16個半升瓶的再生PET嵌入一磅粉末中。粉末基綠色塗料市場規模預計將隨著150°C低溫固化配方的出現而擴大,這將為熱敏塑膠和中密度纖維板家具等應用開闢新的應用領域。另一方面,紫外光固化流體在電子產業佔據特殊的市場地位,因為該產業需要近乎即時的固化。

綠色塗料產業也受惠於高固含醇酸樹脂和丙烯酸混合塗料。這些系統的溶劑含量可達250克/公升或更低,且不會影響濕邊或對金屬基材的附著力。總而言之,這強化了人們的認知,即永續化學品能夠達到甚至超越傳統基準。

區域分析

亞太地區確立了主導地位,2024年佔銷售額的44.05%,並將在2030年實現5.56%的最快複合年成長率。預計到2024年,印尼的產量將超過100萬噸,其中水性裝飾塗料將佔當地產量的67%。中國《快遞包裝方法》(GB 43352-2023)將進一步刺激該地區的綠色塗料市場,該法將強制電商倉庫改用合規塗料。印度食品安全與標準局(FSSAI)加強食品包裝監管的措施也刺激了需求。持續的都市化、汽車產量的成長以及對OEM塗料廠的外國直接投資將為該地區的綠色塗料市場提供長期發展動力。

受加州VOC標準和強勁的住宅重塗週期的推動,北美正處於復甦之路。通用汽車的「三濕」技術凸顯了其低能耗生產線的競爭力,而多家一級供應商正在轉向簡化顏色轉換的水性底漆。加拿大也取得了類似的進展,家電製造商正在投資粉末噴塗房,而墨西哥的線圈塗布產能正在進行360萬美元的升級,為該地區提供了一個經濟高效的供應基地。

歐洲對全氟烷基化合物(PFAS)實施了全面的限制,並考慮了碳邊界問題,在激勵快速再製造方面仍發揮重要作用。成員國已對高溶劑二氧化鈦的進口徵收反傾銷稅,間接推動負責人轉向低溶劑或水溶性工藝,從而減少顏料用量。德國和法國持續孵化生物基樹脂新興企業,並與現有企業集團加強技術合作。

南美、中東和非洲等新興地區的應用速度雖然放緩,但正在加速。巴西的工業產出和沙烏地阿拉伯的「2030願景」大型企劃正在提升永續塗料在防護鐵製品和裝飾生產線中的重要性。然而,監管執法的碎片化以及可再生原料取得管道的有限性,正在減緩一些區域市場的步伐。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 有關VOC排放的嚴格環境法規

- 低VOC建築塗料需求不斷成長

- 汽車原始設備製造商轉向節能噴漆車間

- 水性樹脂化學的進步增強了耐久性

- 利用農業廢棄物生產生物基樹脂

- 市場限制

- 與溶劑型產品相比,在惡劣環境下的性能差異

- 最終用戶的總塗層成本更高

- 生物基原料供應受限

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按類型

- 水性

- 粉末

- 高固體

- UV固化塗料

- 按用途

- 建築塗料

- 工業漆

- 汽車塗料

- 木材塗料

- 包裝塗料

- 其他用途(電子電氣塗料等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- AkzoNobel NV

- Arkema

- Asian Paints Ltd.

- Axalta Coating Systems, LLC

- BASF

- Beckers Group

- Berger Paints India Ltd.

- DAW SE

- Eastman Chemical Company

- Evonik Industries AG

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

第7章 市場機會與未來展望

The green coatings market size stands at USD 146.46 billion in 2025 and is forecast to reach USD 183.56 billion by 2030, translating into a 4.62% CAGR.

Regulatory pressure that tightens limits on volatile organic compounds (VOC), rapid progress in water-borne chemistries and powder technologies, and higher penetration in automotive and architectural uses remain the central growth engines of the green coating market. California's South Coast Air Quality Management District has already cut allowable VOC content in automotive refinish products under amended Rule 1151 and will enforce even stricter levels by 2033. In parallel, the European Union will prohibit per- and polyfluoroalkyl substances (PFAS) in food-contact packaging from August 2026, redirecting packaging formulators toward bio-based barriers. OEMs seeking lower energy paint shops and builders pursuing green certifications are expanding the addressable pool for sustainable solutions, while technology that lifts the durability of water-based resins now rivals solvent-borne systems.

Global Green Coatings Market Trends and Insights

Stringent Environmental Regulations on VOC Emissions

New VOC limits are redefining acceptable formulation windows for the green coating market. South Coast AQMD's Rule 1151 phases in lower VOC ceilings for automotive refinish products beginning May 2025 and culminates in the strictest thresholds by 2033, pushing body shops toward water-borne systems. On another front, the EU Packaging and Packaging Waste Regulation caps PFAS at 25 ppb per individual substance and 250 ppb total, steering packaging suppliers to bio-based coatings that avoid fluorinated chemistries. Businesses already holding portfolios of compliant products gain a first-mover advantage, whereas producers tied to legacy solvent-borne lines face incremental compliance cost and potential market exclusion.

Growing Demand for Low-VOC Architectural Coatings

Home repairs, commercial retrofits, and green-building standards continue to draw the construction value chain toward low-VOC alternatives. Sherwin-Williams reports a noticeable shift in residential repaint orders toward paints designed for easy recycling and lower embodied carbon. Water-borne formulations now deliver the same gloss retention and scrub resistance as solvent-borne equivalents. AkzoNobel's RUBBOL WF 3350 exemplifies this transition, pairing 20% bio-based content with warranty-backed durability in indoor and outdoor wood finishes.

Performance Gaps Versus Solvent-Borne in Harsh Environments

Marine hulls, offshore platforms, and chemical storage tanks still demand the long-term fouling resistance and barrier strength of high-solids epoxies rich in solvents. Although self-healing siloxane hybrids and chrome-free inhibitors are emerging, their commercial adoption is gradual because certification cycles are lengthy and shipowners resist untested chemistries.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM Shift Toward Energy-Efficient Paint Shops

- Advances in Water-Based Resin Chemistry Enhancing Durability

- Higher Total Applied Cost for End-Users

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water-borne systems preserved leadership in 2024 with a 55.16% share of the green coating market. Their dominance is rooted in favorable compliance footprints and constant resin upgrades that yield mechanical strength on par with solvent-borne counterparts. Mazda's plant-wide switch to advanced water-based topcoats alone lowered VOC output by 57% while retaining showroom-grade gloss. Powder coatings, however, offer the most rapid trajectory, advancing at 6.51% CAGR to 2030. Catalyst-assisted infrared ovens now cure thick films in just 2-3 minutes at roughly 225 °C, elevating production throughput and slashing utility bills. Sherwin-Williams' Powdura ECO illustrates circular design, embedding every pound of powder with recycled PET equal to sixteen half-liter bottles. The green coating market size for powder lines is projected to expand in tandem with low-temperature formulations that harden at 150 °C, opening doors to heat-sensitive plastics and MDF furniture. Meanwhile, UV-curable liquids occupy specialized niches in electronics where near-instant cure is mandatory.

The green coating industry also benefits from higher-solids alkyd and acrylic hybrids. These systems cut the solvent fraction below 250 g/L without sacrificing wet edge or adhesion to metallic substrates. Collectively, such variants reinforce the perception that sustainable chemistries can meet or exceed conventional benchmarks.

The Green Coatings Market Report is Segmented by Type (Water-Borne, Powder, and More), Application (Architectural Coatings, Industrial Coatings, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific confirmed its dominance with 44.05% of 2024 revenue while charting the fastest 5.56% CAGR through 2030. Indonesian output surpassed 1 million tons in 2024, with waterborne decorative paints taking a striking 67% share of local production. The region's green coating market is further stimulated by China's express-packaging law GB 43352-2023 that forces e-commerce warehouses to switch to compliant coatings. India's move to tighten food-container rules under the Food Safety and Standards Authority (FSSAI) also underpins demand. Continued urbanization, automotive build-outs, and foreign direct investment into OEM paint shops present long-run momentum.

North America enjoys a resilient path powered by California's VOC benchmarks and robust residential repaint cycles. General Motors' three-wet technique underscores the competitive edge of low-energy lines, and multiple Tier 1 suppliers pivot to water-borne primers that simplify color changeover. Canada mirrors this progress through appliance manufacturers investing in powder booths, whereas Mexico's coil-coating capacity staking USD 3.6 million in upgrades provides the region a cost-efficient supply hub.

Europe remains a heavyweight courtesy of sweeping PFAS restrictions and carbon-border considerations that motivate rapid reformulation. Member states impose antidumping duties on high-solvent titanium dioxide imports, indirectly steering formulators toward lower-solids or water-borne routes that require less pigment. Germany and France continue to incubate bio-based resin start-ups, fostering technical collaborations with existing conglomerates.

Emerging geographies in South America, the Middle East, and Africa post moderate yet accelerating uptake. Brazil's industrial output and Saudi Arabia's Vision 2030 mega-projects heighten the relevance of sustainable coatings in protective steelwork and decorative lines. However, fragmented regulatory enforcement and limited access to renewable feedstocks temper pace in several local markets.

- AkzoNobel N.V.

- Arkema

- Asian Paints Ltd.

- Axalta Coating Systems, LLC

- BASF

- Beckers Group

- Berger Paints India Ltd.

- DAW SE

- Eastman Chemical Company

- Evonik Industries AG

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent environmental regulations on VOC emissions

- 4.2.2 Growing demand for low-VOC architectural coatings

- 4.2.3 Automotive OEM shift toward energy-efficient paint shops

- 4.2.4 Advances in water-based resin chemistry enhancing durability

- 4.2.5 Adoption of bio-based resins from agricultural waste

- 4.3 Market Restraints

- 4.3.1 Performance gaps versus solvent-borne in harsh environments

- 4.3.2 Higher total applied cost for end-users

- 4.3.3 Supply constraints of bio-based feedstocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Water-borne

- 5.1.2 Powder

- 5.1.3 High-solids

- 5.1.4 UV-cured coatings

- 5.2 By Application

- 5.2.1 Architectural Coatings

- 5.2.2 Industrial Coatings

- 5.2.3 Automotive Coatings

- 5.2.4 Wood Coatings

- 5.2.5 Packaging Coatings

- 5.2.6 Other Applications (Electronics and Electrical Coatings, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AkzoNobel N.V.

- 6.4.2 Arkema

- 6.4.3 Asian Paints Ltd.

- 6.4.4 Axalta Coating Systems, LLC

- 6.4.5 BASF

- 6.4.6 Beckers Group

- 6.4.7 Berger Paints India Ltd.

- 6.4.8 DAW SE

- 6.4.9 Eastman Chemical Company

- 6.4.10 Evonik Industries AG

- 6.4.11 Hempel A/S

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co., Ltd.

- 6.4.14 Nippon Paint Holdings Co., Ltd.

- 6.4.15 PPG Industries Inc.

- 6.4.16 RPM International Inc.

- 6.4.17 Sika AG

- 6.4.18 The Sherwin-Williams Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment