|

市場調查報告書

商品編碼

1846140

複合塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Composite Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

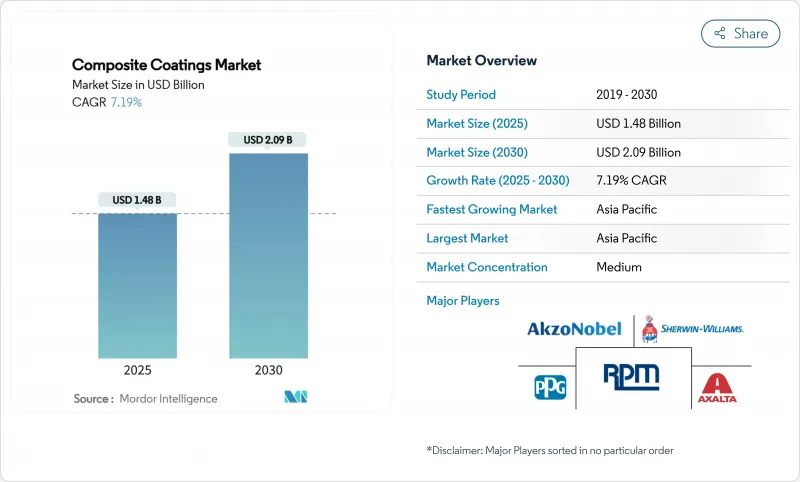

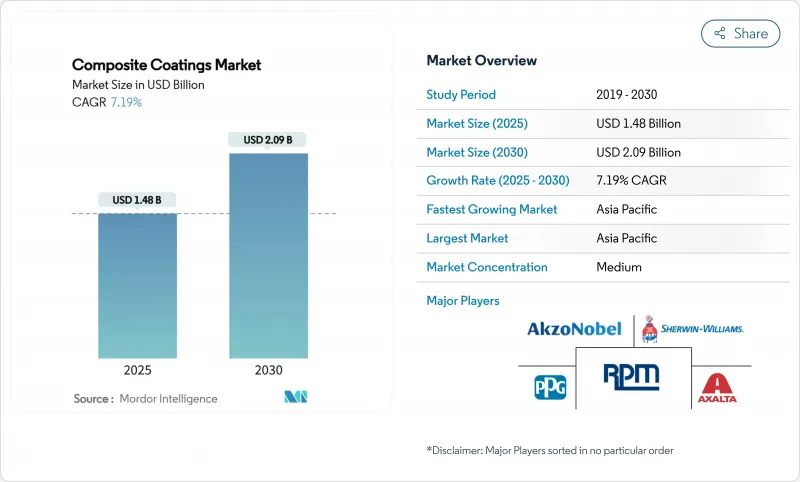

複合塗料市場規模預計在 2025 年為 14.8 億美元,預計到 2030 年將達到 20.9 億美元,預測期內(2025-2030 年)的複合年成長率為 7.19%。

兼具耐腐蝕性、耐磨性和功能性表面特性的多層技術的持續應用預計將推動複合塗層市場的持續擴張。海上石油油氣開發的加速、輕量化運輸部件的日益普及以及主機廠(OEM)使用壽命規範的日益嚴格,正在推動需求的成長。氟聚合物、奈米結構和生物基化學領域的技術創新不斷湧現,正在開啟新的、更具獲利能力的用例。同時,區域製造業的轉移和大規模可再生能源計劃的啟動,正在加劇老牌複合材料製造商和專業化新進入者之間的競爭。

全球複合塗料市場趨勢與洞察

石油和天然氣探勘活動的成長

深水和超深水計劃擴大指定使用高強度玻璃鱗片增強環氧體系,以承受溫度變化、靜水壓力和海水侵蝕。沙烏地阿拉伯、北海和墨西哥灣的主要海上營運商正在透過改用可抑制陰極剝離和底塗層腐蝕的複合材料屏障,將維護週期從10年延長至15年。在立管、井口和頂部設備上塗抹均勻的塗層可以降低整體擁有成本,儘管初始成本較高。因此,鑽機數量的增加和資產壽命延長計畫正在推動複合塗層市場銷售的持續成長。

對輕質、耐腐蝕運輸結構的需求不斷增加

尋求延長電動車續航里程的汽車製造商正在用鋁和複合材料機殼取代鋼製電池機殼,這些外殼需要薄而有彈性的保護。雷射紋理底漆與奈米粒子填充面漆相結合,提高了碳纖維基材的耐磨性和油漆附著力,從而在不犧牲耐用性的情況下減輕了重量。在航太領域,含有微膠囊劑的自修復環氧化學物質可以預警早期腐蝕並自主修復微小缺陷,從而實現預測性維護並縮短飛機週轉時間。

加工成本和資本成本高

先進的噴漆室、惰性氣體固化區和雷射注射設備會增加資本支出,並延遲小型加工商的投資回報。由於供應緊張,1月歐洲環氧樹脂價格上漲,而亞洲庫存過剩導致價格下跌。在供應鏈穩定且設備成本下降之前,一些買家可能會依賴性能較低的傳統塗料。

細分分析

預計到2024年,環氧樹脂將在複合塗料市場維持45.27%的佔有率,凸顯其在鑽探平臺、航太結構和運輸零件領域無與倫比的附著力和耐化學性。採用玻璃鱗片和陶瓷微球填充材的快速固化配方可增強阻隔穿透能力並延長維護週期。隨著海上投資和船舶電氣化需求的成長,環氧複合材料的市場規模預計將穩定成長。

含氟聚合物和新興生物環氧樹脂也同步成長,複合年成長率達8.61%,凸顯了該產業正向永續性目標和極端耐候性轉型。像Sycomin這樣的製造商正在將市場轉向其GreenPoxy系列產品,該產品採用廢棄甘油和植物油製成,且不影響機械性能。

複合塗層報告按樹脂(環氧樹脂、聚酯、聚醯胺等)、技術(無電電鍍、雷射熔體注射、硬焊等)、終端用戶產業(石油天然氣、船舶、汽車運輸等)和地區(亞太地區、北美、歐洲、南美、中東和非洲)細分。市場預測以美元計算。

區域分析

預計到2024年,亞太地區將佔據複合塗料市場的主導地位,達到44.88%,並在2030年維持7.72%的佔有率。中國大規模的港口擴建、印度的高速公路走廊以及東南亞的石化綜合體,共同刺激了重型防護塗料的消費。廣東和泰米爾納德邦沿海的離岸風力發電對防生物污損和防腐蝕系統的需求也日益增加。

受美國職業安全與健康管理局 (OSHA) 和美國環保署( 法規 ) 嚴格立法的推動,北美地區正大力推廣低揮發性有機化合物 (VOC)、高固態化學品。墨西哥灣的深水鑽井平台、加拿大油砂平土機以及美國艦隊的維修管道,都對陶瓷填充環氧樹脂和富鋅底漆的需求保持穩定。

歐洲綠色新政藍圖正在推動對生物基和可回收配方的需求,德國汽車製造商和英國航太工廠是螢光和 RFID 自修復透明塗層的早期採用者,北海的離岸風力發電電場正在使用符合國際海事組織環境公約的奈米結構防污膜。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 石油和天然氣探勘活動的成長

- 交通運輸領域對輕質、耐腐蝕結構的需求不斷增加

- 可再生能源硬體向高效能功能表面的轉變

- OEM 要求延長塗層壽命並縮短維護週期

- 奈米結構複合面漆可防止離岸風力發電生物污損

- 市場限制

- 加工成本和資本成本高

- 與傳統塗料相比,可修復性和可回收性有限

- 多層複合塗層的全球標準不一致

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按樹脂

- 環氧樹脂

- 聚酯纖維

- 聚醯胺

- 其他(氟樹脂、丙烯酸樹脂等)

- 依技術

- 無電電鍍

- 雷射熔體注射

- 硬焊

- 其他技術(溶膠-凝膠、浸塗等)

- 按最終用戶產業

- 石油和天然氣

- 海洋

- 汽車和運輸

- 基礎設施

- 其他最終用戶產業(例如航太和國防)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems, LLC

- BEECK Mineral Paints

- Bodycote

- FUSION Mineral Paint

- Hempel A/S

- Henkel AG and Co. KGaA

- Jotun

- KC Jones Plating Company

- KEIM Mineral Coatings of America, Inc.

- Mader Group

- Nippon Paint Holdings Co., Ltd.

- Plasma Coatings Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Socomore

- The Sherwin-Williams Company

第7章 市場機會與未來展望

The Composite Coatings Market size is estimated at USD 1.48 billion in 2025, and is expected to reach USD 2.09 billion by 2030, at a CAGR of 7.19% during the forecast period (2025-2030).

Continuous adoption of multilayer technologies that marry corrosion resistance, wear tolerance, and functional surface attributes positions the composite coatings market for sustained expansion. Accelerating offshore oil and gas developments, widening uptake of lightweight transportation parts, and stricter OEM lifetime specifications are collectively lifting demand. Innovation momentum in fluoropolymer, nano-structured, and bio-based chemistries is unlocking fresh, higher-margin use cases. Meanwhile, regional manufacturing shifts and large-scale renewable-energy projects are intensifying competition among established formulators and specialized newcomers.

Global Composite Coatings Market Trends and Insights

Growth in Oil and Gas Exploration Activities

Deep-water and ultra-deep-water projects are elevating specifications for high-build, glass-flake-reinforced epoxy systems that tolerate temperature swings, hydrostatic pressure, and saline attack. Major offshore operators in Saudi Arabia, the North Sea, and the Gulf of Mexico are extending maintenance cycles toward 10 to 15 years by switching to composite barriers that inhibit cathodic disbondment and under-film corrosion. Uniform coating integrity on risers, wellheads, and topside equipment lowers the total cost of ownership despite higher upfront spend. Rising rig counts and asset-life extension programs, therefore, inject consistent volume growth into the composite coatings market.

Rising Demand for Lightweight, Corrosion-Resistant Structures in Transportation

Automakers pursuing range gains for electric vehicles are replacing steel battery enclosures with aluminum and composite housings that need thin yet resilient protection. Laser-textured primers combined with nanoparticle-filled topcoats elevate wear resistance and paint adhesion on carbon-fiber substrates, supporting weight reductions without compromising durability. In aerospace, self-healing epoxy chemistries incorporating micro-encapsulated agents flag early corrosion onset and autonomously repair micro-scratches, enabling predictive maintenance and shorter aircraft turnaround times.

High Processing and Capital Costs

Sophisticated spray booths, inert-gas curing zones, and laser-injection units raise capital outlays, delaying payback for smaller converters. In January, the prices of epoxy resins rose in Europe amid tight supply, whereas surplus inventory pushed Asian prices lower, illustrating volatility that squeezes margins. Until supply chains stabilize and equipment costs decline, some purchasers will default to lower-performing legacy coatings.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward High-Performance Functional Surfaces for Renewable-Energy Hardware

- OEM Mandates for Extended Coating Life and Reduced Maintenance Cycles

- Limited Repairability and Recyclability Versus Conventional Paints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy maintained a 45.27% composite coatings market share in 2024, underscoring unmatched adhesion and chemical resistance for drilling platforms, aerospace structures, and transportation components. Fast-curing formulations with glass flake or ceramic microsphere fillers reinforce barrier paths, extending maintenance cycles. The composite coatings market size for epoxy systems is projected to grow steadily alongside offshore investments and fleet electrification requirements.

Parallel momentum is building around fluoropolymers and emerging bio-epoxies, whose 8.61% CAGR highlights an industry pivot toward sustainability mandates and extreme weatherability. Manufacturers like Sicomin are moving the market toward GreenPoxy lines incorporating waste glycerol and plant oils without diluting mechanical performance.

The Composite Coatings Report is Segmented by Resin (Epoxy, Polyester, Polyamide, and Others), Technique (Electroless Plating, Laser-Melt Injection, Brazing, and Other Techniques), End-User Industry (Oil and Gas, Marine, Automotive and Transportation, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained a dominant 44.88% share of the composite coatings market in 2024 and is projected to compound at 7.72% through 2030. Massive Chinese port expansions, Indian highway corridors, and Southeast Asian petrochemical complexes collectively fuel the consumption of high-build protective formulations. Offshore wind farms off Guangdong and Tamil Nadu further call for anti-biofouling and erosion-resistant systems.

North America commands substantial adoption driven by rigorous OSHA and EPA statutes that reward low-VOC, high-solids chemistries. The Gulf of Mexico's deep-water rigs, Canada's oil-sands upgraders, and the United States Navy's fleet refurbishment pipeline together underpin steady requisition of ceramic-filled epoxies and zinc-rich primers.

Europe's Green Deal blueprint is steering demand toward bio-derived and recyclable formulations. German automotive producers and UK aerospace plants are early adopters of self-healing clear coats that broadcast integrity status via fluorescence or embedded RFID. Offshore wind foundations across the North Sea rely on nano-structured foul-release films aligned with IMO environmental conventions.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BEECK Mineral Paints

- Bodycote

- FUSION Mineral Paint

- Hempel A/S

- Henkel AG and Co. KGaA

- Jotun

- KC Jones Plating Company

- KEIM Mineral Coatings of America, Inc.

- Mader Group

- Nippon Paint Holdings Co., Ltd.

- Plasma Coatings Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Socomore

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Oil and Gas Exploration Activities

- 4.2.2 Rising Demand for Lightweight, Corrosion-Resistant Structures in Transportation

- 4.2.3 Shift Toward High-Performance Functional Surfaces for Renewable-Energy Hardware

- 4.2.4 OEM Mandates for Extended Coating Life and Reduced Maintenance Cycles

- 4.2.5 Nano-Structured Composite Topcoats Enabling Anti-Biofouling for Offshore Wind

- 4.3 Market Restraints

- 4.3.1 High Processing and Capital Costs

- 4.3.2 Limited Repairability and Recyclability Versus Conventional Paints

- 4.3.3 Inconsistent Global Standards for Multilayer Composite Coatings

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts(Value)

- 5.1 By Resin

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Polyamide

- 5.1.4 Others (Fluoropolymer, Acrylic, etc.)

- 5.2 By Technique

- 5.2.1 Electroless Plating

- 5.2.2 Laser-Melt Injection

- 5.2.3 Brazing

- 5.2.4 Other Techniques (Sol-Gel and Dip-Coating, etc.)

- 5.3 By End-User Industry

- 5.3.1 Oil and Gas

- 5.3.2 Marine

- 5.3.3 Automotive and Transportation

- 5.3.4 Infrastructure

- 5.3.5 Other End-user Industries (Aerospace and Defense, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 BEECK Mineral Paints

- 6.4.4 Bodycote

- 6.4.5 FUSION Mineral Paint

- 6.4.6 Hempel A/S

- 6.4.7 Henkel AG and Co. KGaA

- 6.4.8 Jotun

- 6.4.9 KC Jones Plating Company

- 6.4.10 KEIM Mineral Coatings of America, Inc.

- 6.4.11 Mader Group

- 6.4.12 Nippon Paint Holdings Co., Ltd.

- 6.4.13 Plasma Coatings Ltd.

- 6.4.14 PPG Industries, Inc.

- 6.4.15 RPM International Inc.

- 6.4.16 Socomore

- 6.4.17 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment