|

市場調查報告書

商品編碼

1844712

矽油:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Silicone Fluids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

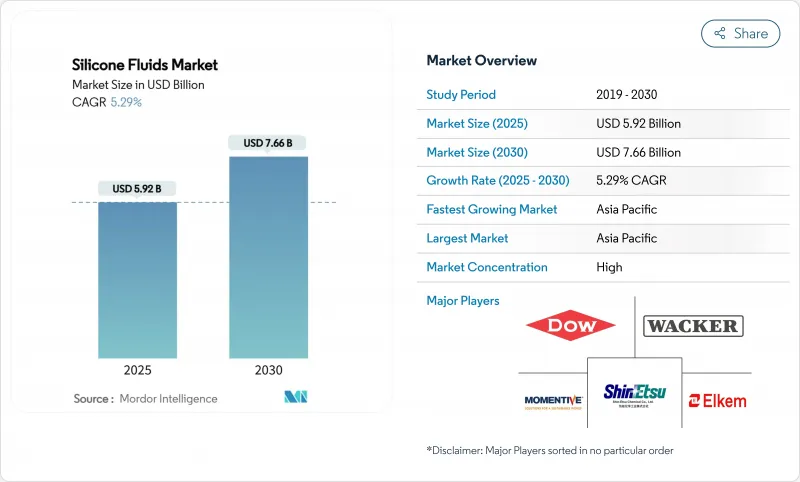

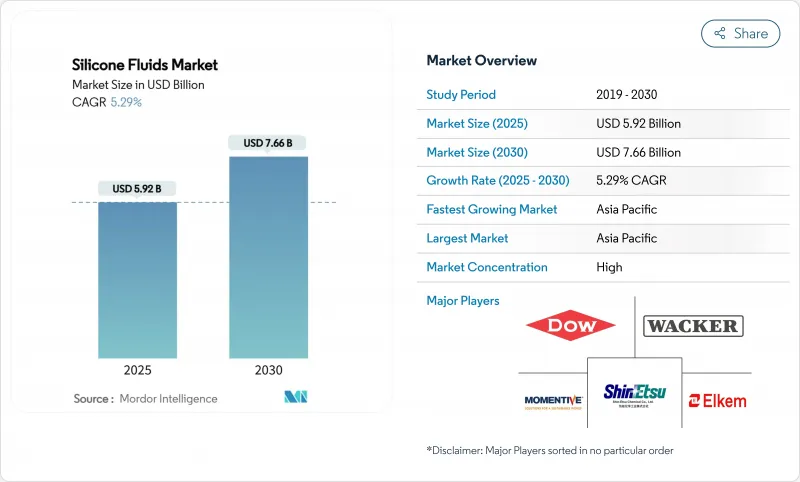

預計 2025 年矽油市場規模為 59.2 億美元,到 2030 年將達到 76.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.29%。

隨著原始設備製造商 (OEM) 和改性商尋求能夠在極端溫度下保持穩定、抗氧化並絕緣電子設備的流體——這些性能是傳統礦物和合成碳氫化合物無法比擬的——對這些高性能聚合物的需求日益成長。電動車的加速發展、超大規模資料中心的興起以及推動製造商轉向更安全、更永續化學的監管趨勢,進一步推動了矽油市場的成長。儘管原料波動和更嚴格的環保標準抑制了成長勢頭,但矽油市場仍將繼續受益於垂直整合努力、回收投資以及利基應用的技術創新。預計未來五年,矽油市場將以中等個位數的速度穩定成長。

全球矽油市場趨勢與洞察

個人護理和化妝品的需求不斷成長

配方師正競相用兼具感官吸引力和永續性的新一代材料取代限制性環狀有機矽。 Siltech 的生物基烷基聚二甲基Dimethicone提高了延展性,同時減少了對原始化石原料的永續性。 CHT 集團的 BeauSil RE-AMO 919 EM 採用超過 94% 的再生單體配製而成,且不犧牲潤膚劑的含量,從而實現了循環經濟目標。亞太地區不斷成長的中等收入人群正在青睞高階多功能護膚和護髮產品,這刺激了對能夠在單一配方中提供調理、阻隔和光澤功效的矽油的需求。隨著各大品牌不斷強化其產品系列,多功能性已成為關鍵的差異化因素,能夠證明減少碳足跡的供應商正獲得青睞。

電動汽車溫度控管液的應用日益廣泛

液冷電池組需要能夠高效傳熱並限制熱失控的介電流體。路博潤的Lifetime Fill矽酮冷卻液反映了這一轉變,能夠在電動車電池組的整個使用壽命中保持穩定的狀態。中國即將推出的GB 29743.2電導率基準值設定了高標準,傳統的乙二醇-水混合物無法滿足這一標準,這促使汽車製造商轉向矽基配方。不僅電池,寬能能隙逆變器、電動馬達和充電系統也受益於矽油的寬動作溫度範圍。上游方面,受電動車成長推動的矽金屬需求預計將在2030年之前以每年4.56%的速度成長,這將使擁有穩定原料供應的垂直整合製造商受益。

金屬矽及單體價格不穩定

中國控制著全球約四分之三的矽金屬產量,這為矽油市場帶來了連鎖風險。能源價格上漲、產量限制以及地緣政治摩擦導致現貨價格波動,並擾亂了下游矽料生產商的預算規劃。儘管美國根據《通膨削減法案》為國內冶煉計劃提供獎勵,但新產能要到2030年才能全面運作。同時,生產商正在透過簽訂長期供應合約進行對沖,並評估後向整合。

細分分析

改質等級的擴張速度快於未改性等級,複合年成長率為 6.84%。這得歸功於配方師指定具有獨特側鏈、反應位點或交聯基團的矽氧烷。這些客製化分子可選擇性地與基材鍵結、增強附著力或形成疏水錶面,使最終用戶無需過度設計即可實現性能目標。電動車灌封膠、三防膠和高柔韌性紡織油墨的需求尤其強勁。然而,純聚二甲基矽氧烷憑藉其成本效益和滿足各種規格的能力,仍佔據銷售領先地位。供應鏈日趨成熟,持續的製程瓶頸消除將進一步降低單位成本。

永續生產的競爭日益激烈。陶氏公司和Circusil的合資企業將創造一個回收循環,可將PDMS的碳足跡減少50%以上。瓦克將於2025年5月在中國運作一條新的流體和乳液生產線,為下一代電子產品增加高純度生產能力。 KCC將於2024年收購邁圖,將業務範圍從上游矽氧烷單體擴展到下游特種流體。隨著循環經濟目標的不斷推進,擁有閉合迴路能力的製造商將優先獲得渴望獲得範圍3減排認證的全球原始設備製造商的供應獎勵。

矽油市場報告按產品類型(直鏈矽油、改性矽油)、應用(潤滑劑和油脂、減震材料、液體電介質、液壓油、消泡劑、個人護理、油漆和塗料添加劑、紡織品、藥品和其他應用)和地區(亞太地區、北美、歐洲、南美和中東和非洲)細分。

區域分析

亞太地區主導矽油市場,其供應鏈從金屬矽冶煉開始,一直延伸到最終產品。中國憑藉著成本優勢和75%的原料控制能力,在該地區佔據領先地位;而日本和韓國則在微型電子和儲存半導體領域處於領先地位,這些領域需要超高純度的介電流體。東南亞正在成為製造業的避險天堂,越南和泰國正在吸引外國對特種化學品綜合體的直接投資。在印度國內汽車製造和個人保健部門擴張的推動下,印度的本土銷售額實現了兩位數成長。

北美的表現有所不同。美國引領關鍵礦產的陸上供應鏈,而資料中心和電動車的建設正在推動特種流體的需求。陶氏公司正在擴大在矽橡膠能,以支持尋求快速交付的區域客戶。埃克森美孚正在德克薩斯增加高黏度合成基料能,這表明優質功能性流體在工業領域的廣泛接受度。加拿大供應以水基為基礎的冶金級有機矽,而墨西哥的加工出口走廊正在吸引用於電子組裝和汽車線束製造的流體。

歐洲仍然是創新中心,儘管它面臨最嚴峻的監管障礙。瓦克預測,到2025年,由於特種級有機矽的銷售量將抵銷通用級有機矽銷量的下滑,其收益將成長10%。德國工程公司指定使用用於工具機的有機矽減震材料,而法國化妝品製造商則率先採用升級再造的有機矽成分,以滿足即將訂定的包裝和碳足跡法規。北歐公用事業公司的綠色能源矩陣增強了循環製造概念的可信度,有助於矽油製造商在推銷其技術性能的同時,也兼顧環境價值。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 個人護理和化妝品的需求不斷成長

- 電動汽車溫度控管液的應用日益廣泛

- 工業自動化高性能潤滑劑的成長

- 超大規模資料中心的浸入式冷卻

- 用於生物刺激素混合物的精密農業消泡劑

- 市場限制

- 金屬矽及單體價格波動

- 嚴重的VOC和REACH合規成本

- 原料矽氧烷供應商集中度高

- 價值鏈分析

- 五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 依產品類型

- 直鏈矽油

- 聚二甲基矽油

- 甲基苯基矽油

- 甲基含氫矽油

- 其他直矽膠

- 改質矽油

- 反應性矽油

- 非反應性矽油

- 直鏈矽油

- 按用途

- 潤滑油和潤滑脂

- 阻尼介質

- 液體電介質

- 油壓

- 消泡劑

- 個人護理

- 油漆和塗料添加劑

- 紡織品整理加工劑

- 製藥

- 其他用途

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- BRB International BV

- CHT Germany GmbH

- Dow

- DuPont

- Elkem ASA

- GELEST Inc.

- Innospec Inc.

- IOTA silicone

- KCC SILICONE CORPORATION

- Momentive

- Shin-Etsu Chemical Co., Ltd.

- Siltech Corporation

- Supreme Silicones India Pvt. Ltd.

- Wacker Chemie AG

- Zhejiang Zhongtian Fluorine Silicon Material Co., Ltd.

第7章 市場機會與未來展望

The Silicone Fluids Market size is estimated at USD 5.92 billion in 2025, and is expected to reach USD 7.66 billion by 2030, at a CAGR of 5.29% during the forecast period (2025-2030).

Demand for these high-performance polymers is climbing as OEMs and formulators look for fluids that stay stable under extreme temperatures, resist oxidation, and insulate electronics-capabilities that conventional mineral or synthetic hydrocarbons cannot match. Growth is further reinforced by the accelerating shift to electric mobility, the rise of hyperscale data centers, and regulatory moves that push manufacturers toward safer, more sustainable chemistries. Although raw-material volatility and tightening environmental standards temper momentum, the silicone fluids market continues to benefit from vertical integration initiatives, recycling investments, and niche-application innovation. Collectively, these forces position the silicone fluids market for steady mid-single-digit expansion over the next five years.

Global Silicone Fluids Market Trends and Insights

Rising Demand from Personal Care and Cosmetics

Formulators are moving quickly to replace restricted cyclic silicones with next-generation materials that marry sensory appeal and sustainability. Bio-based alkyl dimethicones from Siltech improve spreadability while cutting reliance on virgin fossil feedstocks. CHT Group's BeauSil RE-AMO 919 EM incorporates over 94% recycled monomers to meet circular-economy targets without sacrificing emolliency. Expanding middle-class populations in Asia-Pacific are embracing premium multifunctional skin- and hair-care products, spurring demand for silicone fluids that deliver conditioning, barrier, and gloss benefits in a single blend. As brands tighten product portfolios, multifunctionality becomes a critical differentiator, and suppliers able to document lower carbon footprints gain preferred-supplier status.

Increasing Adoption in Electric Vehicle Thermal-Management Fluids

Liquid-cooled battery packs need dielectric fluids that suppress thermal runaway yet transfer heat efficiently. Lubrizol's lifetime-fill silicone coolant exemplifies this shift by remaining stable for the full service life of an EV battery pack. China's forthcoming GB 29743.2 conductivity threshold sets a high bar that conventional glycol-water blends cannot meet, steering automakers toward silicone-based formulations. Beyond batteries, wide-bandgap inverters, e-motors, and charging systems also benefit from the broad operating-temperature band of silicone fluids. Upstream, silicon metal demand tied to EV growth is rising 4.56% annually through 2030, rewarding vertically integrated producers that can secure raw supply.

Volatile Silicon Metal and Monomer Prices

China controls roughly three-quarters of the world's silicon metal output, creating a single-country risk that cascades through the silicone fluids market. Energy-price spikes, production curbs, and geopolitical frictions swing spot quotes, disrupting budgeting for downstream formulators. The United States is incentivizing domestic smelter projects under the Inflation Reduction Act, yet new capacity will not meaningfully come onstream before 2030. In the meantime, producers hedge with long-term supply contracts and evaluate backward integration, actions that demand capital many mid-sized players cannot muster.

Other drivers and restraints analyzed in the detailed report include:

- Growth in High-Performance Lubricants for Industrial Automation

- Liquid-Immersion Cooling of Hyperscale Data Centres

- Stringent VOC and REACH Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Modified grades are expanding faster than unmodified counterparts, charting a 6.84% CAGR as formulators specify siloxanes with tailored side-chains, reactive sites, or crosslinkable groups. These custom molecules bond selectively to substrates, boost adhesion, or create hydrophobic surfaces, letting end-users hit performance targets without over-engineering. Demand is prominent in EV potting, conformal coatings, and high-flex textile inks. Straight polydimethyl-silicone grades nevertheless maintain volume leadership due to cost efficiency and broad spec inclusion. Their supply chains are mature, and continuous-process debottlenecking further reduces unit cost.

Competition is intensifying around sustainable production. Dow's joint venture with Circusil brings a recycling loop able to cut PDMS carbon footprint by more than 50%. Wacker commissioned new Chinese fluid and emulsion lines in May 2025, adding high-purity capacity aimed at next-gen electronics. KCC's 2024 purchase of Momentive broadens vertical reach from upstream siloxane monomers to downstream specialty fluids. As circular-economy targets harden, producers with closed-loop capabilities gain supply-award preference from global OEMs keen to certify Scope 3 reductions.

The Silicone Fluids Market Report is Segmented by Product Type (Straight Silicone Fluid and Modified Silicone Fluid), Application (Lubricants and Greases, Damping Media, Liquid Dielectrics, Hydraulic Fluids, Defoamers, Personal Care, Paints and Coating Additives, Textile, Pharmaceuticals, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific dominates the silicone fluids market, leveraging integrated supply chains that begin with silicon metal smelting and culminate in finished formulations. China's cost advantage and 75% raw-material control anchor the region's leadership, while Japan and South Korea champion miniaturized electronics and memory semiconductors that require ultra-pure dielectric fluids. Southeast Asia is emerging as a manufacturing hedge, with Vietnam and Thailand courting foreign direct investment for specialty-chemical complexes. India, supported by domestic automotive build-out and an expanding personal-care sector, records double-digit local sales increases.

North America presents a different dynamic. The United States orchestrates supply-chain onshoring for critical minerals, while datacenter and EV build-outs propel specialty-fluid demand. Dow's capacity expansion for silicone elastomers in Michigan supports regional customers seeking short lead times. ExxonMobil added high-viscosity synthetic base-stock capacity in Texas, signaling wider industrial acceptance of premium functional fluids. Canada supplies hydro-based metallurgical-grade silicon, and Mexico's maquiladora corridor pulls in fluids for electronics assembly and automotive wiring harness production.

Europe contends with the strictest regulatory hurdles yet remains an innovation epicenter. Wacker forecasts 10% revenue growth in its Silicones division for 2025 as specialty grades offset lower commodity volumes. Germany's engineering companies specify silicone damping media for machine tools, while France's cosmetic houses pioneer upcycled silicone ingredients to meet imminent packaging and carbon-footprint rules. Nordic utilities' green-power matrices lend credibility to circular-manufacturing claims, helping silicone fluid makers sell environmental value alongside technical performance.

- BRB International B.V.

- CHT Germany GmbH

- Dow

- DuPont

- Elkem ASA

- GELEST Inc.

- Innospec Inc.

- IOTA silicone

- KCC SILICONE CORPORATION

- Momentive

- Shin-Etsu Chemical Co., Ltd.

- Siltech Corporation

- Supreme Silicones India Pvt. Ltd.

- Wacker Chemie AG

- Zhejiang Zhongtian Fluorine Silicon Material Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from personal care and cosmetics

- 4.2.2 Increasing adoption in electric vehicle thermal-management fluids

- 4.2.3 Growth in high-performance lubricants for industrial automation

- 4.2.4 Liquid-immersion cooling of hyperscale data centres

- 4.2.5 Precision agriculture anti-foam agents for biostimulant mixtures

- 4.3 Market Restraints

- 4.3.1 Volatile silicon metal and monomer prices

- 4.3.2 Stringent VOC and REACH compliance costs

- 4.3.3 High supplier concentration in raw siloxanes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Straight Silicone Fluids

- 5.1.1.1 Poly-dimethyl Silicone Fluid

- 5.1.1.2 Methylphenyl Silicone Fluid

- 5.1.1.3 Methylhydrogen Silicone Fluid

- 5.1.1.4 Other Straight Silicone Fluids

- 5.1.2 Modified Silicone Fluids

- 5.1.2.1 Reactive Silicone Fluid

- 5.1.2.2 Non-reactive Silicone Fluid

- 5.1.1 Straight Silicone Fluids

- 5.2 By Application

- 5.2.1 Lubricants and Greases

- 5.2.2 Damping Media

- 5.2.3 Liquid Dielectrics

- 5.2.4 Hydraulic Fluids

- 5.2.5 Defoamers

- 5.2.6 Personal Care

- 5.2.7 Paints and Coating Additives

- 5.2.8 Textile Finishes

- 5.2.9 Pharmaceuticals

- 5.2.10 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BRB International B.V.

- 6.4.2 CHT Germany GmbH

- 6.4.3 Dow

- 6.4.4 DuPont

- 6.4.5 Elkem ASA

- 6.4.6 GELEST Inc.

- 6.4.7 Innospec Inc.

- 6.4.8 IOTA silicone

- 6.4.9 KCC SILICONE CORPORATION

- 6.4.10 Momentive

- 6.4.11 Shin-Etsu Chemical Co., Ltd.

- 6.4.12 Siltech Corporation

- 6.4.13 Supreme Silicones India Pvt. Ltd.

- 6.4.14 Wacker Chemie AG

- 6.4.15 Zhejiang Zhongtian Fluorine Silicon Material Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment