|

市場調查報告書

商品編碼

1844708

汽車觸媒轉換器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Catalytic Converter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

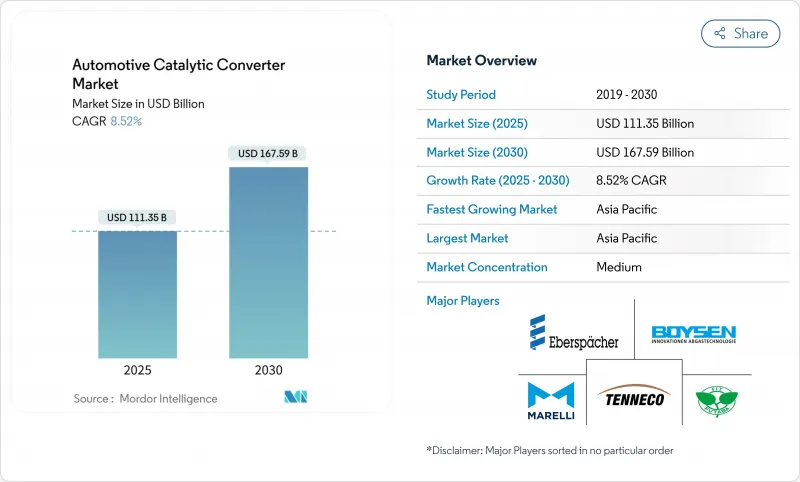

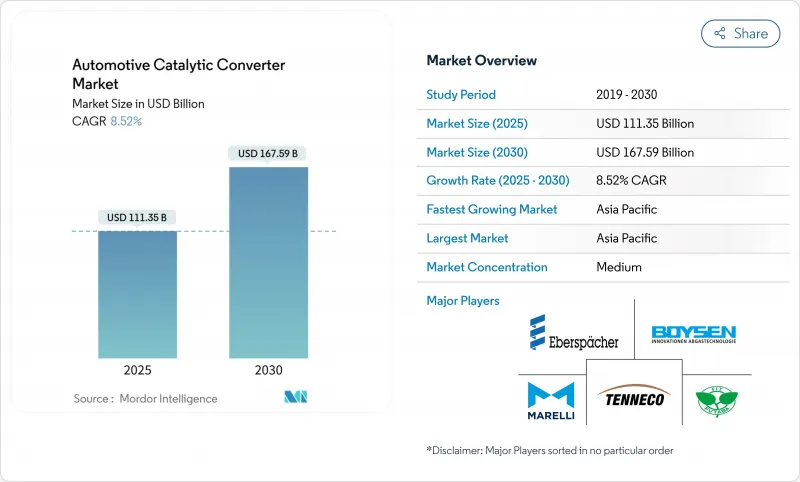

預計觸媒轉換器市場在 2025 年將達到 1,113.5 億美元,到 2030 年將達到 1,675.9 億美元,複合年成長率為 8.52%。

這反映了自2025年起持續收緊的監管措施,包括歐7、國7和更新的美國標,這些標準都要求更高的貴金屬負載量和先進的塗層化學成分。全球內燃機和混合動力汽車產量的復甦、旨在降低成本和風險的貴金屬替代策略,以及非道路機械車隊的改造活動,將帶來進一步的動力。供應鏈的韌性、新的氫內燃機計劃以及前景看好的單一材料催化劑,正在為觸媒轉換器市場帶來機會。

全球汽車觸媒轉換器市場趨勢與洞察

2025年起更嚴格的排放法規將推動技術升級

歐盟7標準將於2025年7月起分階段實施,將合規壽命延長至8年/16萬公里,迫使汽車製造商指定更厚的貴金屬層和更先進的汽油顆粒過濾器。國7標準與歐7標準一致,甚至在某些方面超越了歐7標準,強制要求各平台的粒狀物計數限值和實際排放測試。在美國,針對越野車和輕型車輛的更嚴格法規消除了歷史性的監管空白。全球統一的閾值消除了原始設備製造商先前使用的滯後緩衝,從而加快了先進三向和四向系統的設計週期。

疫情後全球內燃機汽車和混合動力汽車產量的復甦

全球輕型汽車產量在汽油、柴油和混合動力車型上均有所復甦。商用卡車產量因物流需求而成長,而亞太地區的基礎設施獎勵策略則使重型汽車組裝保持活躍。混合動力汽車約佔總產量的10%,需要更大的催化劑用量來抑制頻繁啟停循環中的冷啟動排放。中國工業協會正在實施一項分三階段實施的發展策略,旨在透過提高熱效率和先進的排放控制系統,到2035年將二氧化碳排放減少20%。隨著工廠運轉率的恢復,觸媒轉換器市場儘管面臨長期的電氣化壓力,但短期內出貨量仍將成長。

鉑族金屬價格的極端波動

預計鈀金價格將從2022年的每盎司3000美元以上跌至2025年初的1000美元以下,而鉑金價格將在900美元至1100美元/盎司之間波動,這將使採購預算更加複雜,並鼓勵替代產品。雖然供應商正在進行對沖,但規模較小的參與者難以抵消價格波動,一旦出現成本衝擊,他們將面臨短期利潤不確定和訂單延遲的風險。南非計劃削減礦業資本支出,這可能導致十年後供應緊張。

細分分析

到2024年,三元催化器將佔據觸媒轉換器市場66.78%的佔有率,反映出其對化學計量汽油引擎的普遍適用性。隨著顆粒物和耐久性法規的日益嚴格,這種催化器在合規性方面發揮核心作用,同時金屬負載和塗層配方也在不斷發展。預計到2030年,三元觸媒轉換器市場規模將與汽車總產量同步成長,而混合動力化將增加冷啟動事件的發生。

新一波四效轉換器、稀油氮氧化物捕集器和混合選擇性催化還原系統將集中在「其他類型」類別中,預計複合年成長率為11.83%。華盛頓州立大學的實驗室發現,高排氣熱能促進奈米級二氧化鈰叢集,使活性增加10倍,同時減少貴金屬使用量。同時進行的自再生鈣鈦礦催化劑研究旨在將鉑族金屬(PGM)含量降低高達90%,一旦達到生產規模和耐久性基準,即可實現更廣泛的應用。

受絕對產量驅動,乘用車將在2024年佔據觸媒轉換器市場的63.60%。儘管隨著電氣化的發展,這一比例將略有下降,但由於車輛壽命延長、混合動力汽車推出較晚,以及柴油車小型化和汽油車戰略的興起,乘用車催化劑仍將是主導產品。

中型和重型商用車的複合年成長率最高,為 9.08%。物流擴張、基礎設施投資以及重型車輛氮氧化物排放法規的日益嚴格,促使車隊管理者尋求更大容量的催化劑和更長的保固期。開發商已開始檢驗氫內燃機系統是否適用於遠距卡車,為三元催化劑的研發鋪平了道路。三元催化劑必須能夠承受高排氣溫度下的 100% 氫氣流,同時抑制氮氧化物。非公路機械雖然市場規模較小,但得益於採用客製化加工管殼的 Stage V 改裝套件,其市場正經歷長期成長。

區域分析

預計到2024年,亞太地區將佔觸媒轉換器市場收益的49.82%,到2030年,複合年成長率將達到7.85%。中國正在推動國七標準,該標準納入了高於歐洲基準值的顆粒物計數和實際駕駛通訊協定,以支撐該地區的成長。隨著印度汽車產量擴大以滿足國內出行需求和出口訂單,印度的產量將會成長。該地區的重型汽車產量將受益於基礎設施建設,這將刺激卡車和非公路設備的銷售。在新廣州交易所上市的鉑金和鈀金期貨將提高金屬採購的專業化程度,並降低當地製造商的價格波動風險。

北美預計將以5.10%的複合年成長率成長。聯邦法規正在更新,要求到2032年將非機動車廢氣(NMOG)和氮氧化物(NOx)排放量減少50%,並強制採用汽油顆粒過濾器。德克薩斯州、密西根州和安大略省仍然是輕型汽車廢氣轉換器的主要生產地,而加州的Tier 5非公路排放法規正在推動施工機械採用先進的選擇性催化還原(SCR)系統。對氫燃料內燃機測試實驗室的投資顯示了該地區對替代推進技術的決心,同時依靠後處理來減少氮氧化物。

歐洲的複合年成長率為4.80%,反映出其成熟的汽車群體正面臨2035年起強制零排放銷售的壓力。歐7將引入八年的耐久性限制,並擴大工作溫度範圍,這將在短期內增加催化劑的需求。領先的供應商正專注於開發更緻密的塗層、電加熱磚以及氮氧化物/顆粒物綜合再生演算法,以滿足嚴格的歐7法規。一旦新車需求趨於平穩,非道路車輛的改裝活動將支撐售後市場的銷售量。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 2025年起更嚴格的排放法規將推動技術升級

- 疫情後全球內燃機汽車和混合動力汽車產量的復甦

- 增加 GDI 和輕度混合動力引擎中的貴金屬負載

- ESG壓力推動非道路/汽車機械OEM的改造需求

- 轉換器竊盜回收熱潮導致供應鏈出現缺口

- 加大對需要三元轉換器的氫動力內燃機汽車的獎勵

- 市場限制

- 鉑族金屬(PGM)價格劇烈波動

- 由於純電動車的加速普及,車輛需求長期下降

- 打擊非法鉑金屬採購導致合規成本上升

- 單一材料催化劑(釩、鈣鈦礦)的早期商業化

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測(單位:美元)

- 按轉換器類型

- 雙向觸媒轉換器

- 三元觸媒轉換器

- 其他類型

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中大型商用車

- 越野和非道路設備

- 摩托車和強力運動

- 按燃料類型

- 汽油

- 柴油引擎

- 混合動力(MHEV、HEV、PHEV)

- 按基板

- 鉑

- 鈀

- 銠

- 其他(鈰、釩、鈣鈦礦)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略性舉措(合資企業、生產能力、回收計劃)

- 市佔率分析

- 公司簡介

- Marelli Holdings Co., Ltd.

- Tenneco Inc.(Walker Emissions Control)

- HELLA GmbH and Co. KGaA

- Eberspacher Group

- Yutaka Giken Company Limited

- Futaba Industrial Co. Ltd.

- Boysen Group

- BOSAL International

- Katcon SA de CV

- Sejong Industrial Co., Ltd.

- Hanwoo Industrial Co. Ltd.

- Sango Co. Ltd.

- Benteler International AG

第7章 市場機會與未來展望

The catalytic converters market generated USD 111.35 billion in 2025 and is forecast to reach USD 167.59 billion by 2030, advancing at an 8.52% CAGR.

The expansion reflects consistent regulatory tightening after 2025, including Euro 7, China 7, and updated United States standards, all of which mandate higher precious-metal loadings and advanced wash-coat chemistries. Further momentum comes from the rebound in global internal-combustion and hybrid vehicle production, precious-metal substitution strategies that cut cost risk, and retrofit activity in non-road machinery fleets. Supply chain resilience, new hydrogen internal-combustion projects, and promising single-material catalysts round out the opportunity set for the catalytic converters market.

Global Automotive Catalytic Converter Market Trends and Insights

Stringent Post-2025 Emission Legislation Drives Technology Upgrades

Euro 7 begins phasing in from July 2025 and extends compliance durability to eight years/160,000 km, forcing automakers to specify thicker precious-metal layers and sophisticated gasoline particulate filters. China 7 mirrors and, in several respects, exceeds Euro 7, requiring particulate-number limits and real-driving emissions testing across platforms. In the United States, tougher off-road and light-vehicle rules close historical regulatory gaps. Unified global thresholds remove the lag-time cushion OEMs once used, accelerating design cycles for advanced three- and four-way systems.

Rebound in Global ICE and Hybrid Production Volume Post-COVID

Worldwide light-vehicle output witnessed volume restoration across gasoline, diesel, and hybrid lines. Commercial trucks added volume on the back of logistics demand, while infrastructure stimulus in Asia-Pacific kept heavy-duty assembly lines active. Hybrids represented approximately 10% of production and need larger catalyst volumes to control cold-start emissions during frequent stop-start cycling. the China Association of Automobile Manufacturers is implementing a three-step development strategy targeting 20% carbon emissions reduction by 2035 through enhanced thermal efficiency and advanced emission control systems. Normalized factory utilization raises near-term unit shipments for the catalytic converters market despite longer-term electrification pressure.

Extreme Platinum-Group-Metal Price Volatility

Palladium's fall from more than USD 3,000/oz in 2022 to under USD 1,000/oz in early 2025, and platinum's swings between USD 900-1,100/oz, complicate sourcing budgets and encourage substitution. Suppliers hedge, but small participants struggle to offset price moves, reducing short-term margin visibility and delaying orders when cost shocks hit. Planned reductions in South African mine capex threaten to tighten supply later in the decade..

Other drivers and restraints analyzed in the detailed report include:

- Higher Precious-Metal Loadings in GDI and Mild Hybrid Engines

- OEM Retrofit Demand from Non-Road/Mobile Machinery ESG Pressure

- Accelerated BEV Penetration Reducing Long-Term Unit Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Three-way converters retained a 66.78% share of the catalytic converters market in 2024, reflecting their universal fit for stoichiometric gasoline engines. Tightening particulate-number and durability rules keep this format central to compliance, though metal loading and wash-coat formulations continue to evolve. The catalytic converters market size for three-way units is forecast to rise in line with overall vehicle production through 2030, underpinned by hybridization that magnifies cold-start events.

A new wave of four-way converters, lean-NOx traps, and combined selective catalytic-reduction systems clusters in the "other types" category, which is projected to grow at 11.83% CAGR. Laboratory work at Washington State University shows that nano-scale ceria clustering induced by high exhaust heat boosts activity tenfold while using less precious metal, a discovery that may reshape cost curves. Parallel research into self-regenerating perovskite catalysts aims to cut PGM content by up to 90%, setting the stage for broader adoption once production scale and durability benchmarks are met.

Passenger cars dominated the 2024 volume with 63.60% catalytic converters market share, driven by their absolute production scale. Despite the portion declining modestly as electrification grows, passenger-car catalysts remain a staple due to long fleet lives, late-cycle hybrid launches, and emerging diesel-downsize gasoline strategies.

Medium and heavy commercial vehicles provide the fastest 9.08% CAGR. Logistics expansion, infrastructure spending, and stricter heavy-duty NOx ceilings push fleet managers toward higher-capacity catalyst bricks and longer warranties. Developers are already validating hydrogen-ICE systems for long-haul trucking, opening a fresh avenue for three-way catalysts that must tolerate 100% hydrogen streams at high exhaust temperatures while still curbing NOx. Off-road machinery, though niche, prolongs growth by tapping Stage V retrofit packages with bespoke pipe-fabricated housings.

The Catalytic Converter Market Report is Segmented by Converter Type (Two-Way Catalytic Converters, Three-Way Catalytic Converters, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Fuel Type (Gasoline, Diesel, and Hybrid), Substrate Material (Platinum, Palladium, and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 49.82% of the catalytic converters market revenue in 2024 and is expected to expand at a 7.85% CAGR through 2030. China anchors regional growth on the back of China 7 standards that embed particulate-number and real-driving protocols exceeding European thresholds. India adds volume as automotive production ramps up to meet both domestic mobility demand and export orders. Regional heavy-duty output benefits from infrastructure pipelines that stimulate truck and off-road equipment sales. Futures contracts for platinum and palladium listed on a new Guangzhou exchange further professionalize metal procurement, lessening price-shock exposure for local manufacturers.

North America is forecast to grow at 5.10% CAGR. Updated federal rules demand 50% NMOG + NOx cuts by 2032 and force gasoline particulate-filter adoption. Texas, Michigan, and Ontario remain key production clusters for light-vehicle converters, while Tier 5 off-road proposals in California pull through advanced SCR systems for construction machinery. Investments in hydrogen-ICE testing labs illustrate the region's commitment to alternative propulsion while still relying on after-treatment for NOx abatement.

Europe's 4.80% CAGR reflects a mature vehicle base under pressure from mandated zero-emission sales after 2035. Near-term catalyst demand rises as Euro 7 introduces eight-year durability and extended temperature compliance windows. Leading suppliers focus on higher density wash-coats, electrically heated bricks, and combined NOx/particulate regeneration algorithms to meet the stringent Euro 7 limits. Retrofit activity in non-road fleets sustains aftermarket volumes once new-car demand flattens.

- Marelli Holdings Co., Ltd.

- Tenneco Inc. (Walker Emissions Control)

- HELLA GmbH and Co. KGaA

- Eberspacher Group

- Yutaka Giken Company Limited

- Futaba Industrial Co. Ltd.

- Boysen Group

- BOSAL International

- Katcon S.A. de C.V.

- Sejong Industrial Co., Ltd.

- Hanwoo Industrial Co. Ltd.

- Sango Co. Ltd.

- Benteler International AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Post-2025 Emission Legislation Drives Technology Upgrades

- 4.2.2 Rebound in global ICE and hybrid production volumes post-COVID

- 4.2.3 Higher precious-metal loadings in GDI and mild-hybrid engines

- 4.2.4 OEM retrofit demand from non-road/mobile machinery ESG pressure

- 4.2.5 Supply-chain gaps caused by converter-theft recycling boom

- 4.2.6 Growing incentives for hydrogen-ICE vehicles needing three-way converters

- 4.3 Market Restraints

- 4.3.1 Extreme platinum-group metal (PGM) price volatility

- 4.3.2 Accelerated BEV penetration reducing long-term unit demand

- 4.3.3 Crack-down on illicit PGM sourcing raising compliance cost

- 4.3.4 Early-stage commercialisation of single-material catalysts (vanadium, perovskite)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in USD)

- 5.1 By Converter Type

- 5.1.1 Two-Way Catalytic Converters

- 5.1.2 Three-Way Catalytic Converters

- 5.1.3 Other Types

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Off-Road and Non-Road Equipment

- 5.2.5 Motorcycles and Powersports

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Hybrid (MHEV, HEV, and PHEV)

- 5.4 By Substrate Material

- 5.4.1 Platinum

- 5.4.2 Palladium

- 5.4.3 Rhodium

- 5.4.4 Others (Cerium, Vanadium, and Perovskites)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, JV, capacity, and recycling initiatives)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Marelli Holdings Co., Ltd.

- 6.4.2 Tenneco Inc. (Walker Emissions Control)

- 6.4.3 HELLA GmbH and Co. KGaA

- 6.4.4 Eberspacher Group

- 6.4.5 Yutaka Giken Company Limited

- 6.4.6 Futaba Industrial Co. Ltd.

- 6.4.7 Boysen Group

- 6.4.8 BOSAL International

- 6.4.9 Katcon S.A. de C.V.

- 6.4.10 Sejong Industrial Co., Ltd.

- 6.4.11 Hanwoo Industrial Co. Ltd.

- 6.4.12 Sango Co. Ltd.

- 6.4.13 Benteler International AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment