|

市場調查報告書

商品編碼

1844702

硫化學品:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Thiochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

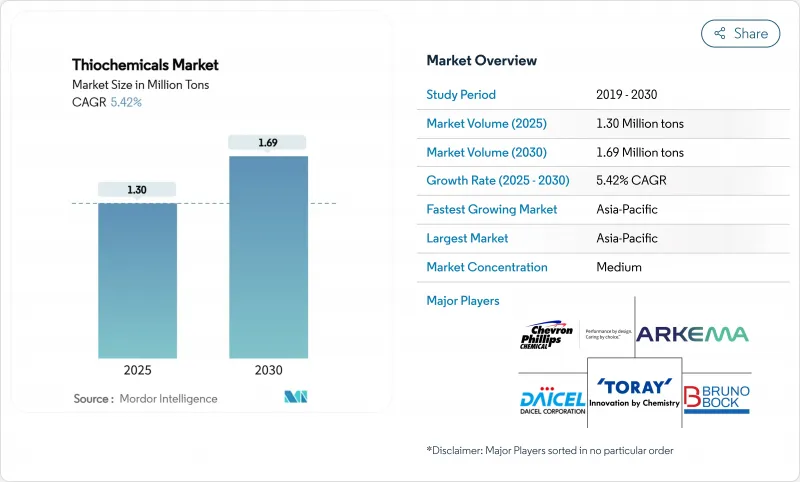

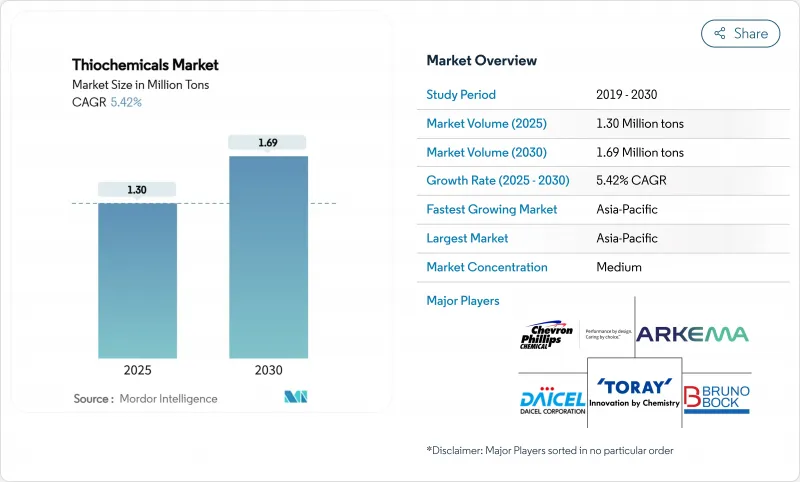

預計 2025 年硫化工市場規模為 130 萬噸,到 2030 年將達到 169 萬噸,預測期間(2025-2030 年)的複合年成長率為 5.42%。

強勁的蛋白質消費、穩定的煉油催化劑需求以及新興的電池級溶劑應用是支撐硫化學品市場的關鍵成長動力。亞太地區畜牧業現代化進程的加強、煉油廠為滿足超低硫柴油車需求而進行的升級改造,以及高純度二甲基亞碸在電子產品製造業的日益普及,這些因素共同支撐了市場的積極發展軌跡。綜合製造商正在引入專有技術並擴展區域產能,以確保硫原料的安全、最佳化成本,並深化客戶在動物營養、煉油和電子產品領域的參與度。監管部門對更安全硫化劑的需求日益成長,加上生物基途徑的創新,在帶來新機會的同時,也提高了合規成本。因此,供應鏈的韌性,尤其是元素硫採購的韌性,是硫化學品市場長期成功的關鍵差異化因素。

全球硫化學品市場趨勢與洞察

工業規模動物飼料生產商對甲硫胺酸的需求快速成長

全球家禽和水產養殖生產商正在擴大依賴硫代化學品衍生甲硫胺酸的優質飼料配方,從而刺激整個硫代化學品市場的額外資本投資。贏創工業集團在安特衛普、莫比爾和新加坡設有綜合樞紐,年總產能超過70萬公噸。亞太地區的消費量成長最為顯著,商業性農場整合正在推動收入和蛋白質攝取量的增加。科學評估表明,DL-甲硫胺酸可改善肝臟代謝和氧化壓力,而L-甲硫胺酸可促進肉雞增重,這為支撐高價的差異化添加劑創造了利基市場。硫代化學品-甲硫胺酸複合物的整合降低了物流成本,降低了硫輸入的波動性,並保護了利潤率,促使生產商加強後向整合策略。因此,即使飼料產業規模擴大,持續的甲硫胺酸拉動也將使硫代化學品市場保持強勁的需求基準。

擴大二甲基二硫作為煉油催化劑硫化劑的用途。

由於二硫化二甲基(DMDS) 比硫化氫安全隱患更少且硫供應量更高,煉油廠擴大使用其來活化加氫裂解催化劑。技術評估表明,基於 DMDS 的 Exact-S 級催化劑能夠快速提高觸媒活性,同時最大限度地減少危險操作,使煉油廠能夠遵守更嚴格的燃料硫含量法規。全球向超低硫柴油的轉變正在加速這一替代趨勢,尤其是在北美、中東以及正在擴大產能的亞洲新興煉油中心。發表在 ScienceDirect 上的一項研究表明,在深度脫硫條件下,DMDS 硫化催化劑的性能與 H2S 預硫化催化劑相當甚至更好。可再生柴油共處理進一步推動了 DMDS 的採用,因為混合原料需要一種能夠穩定暴露於含氧化合物的催化劑的多功能硫化劑。這些操作優勢共同支持了 DMDS 在整個硫化化學品市場的持續成長。

毒性和氣味控制成本高

硫化化學品的強烈氣味和毒性迫使生產商投資於圍堵設施、洗滌器和專門的處理基礎設施,從而增加了營運成本。美國環保署2024年風險管理計畫修正案將使有機合成化工廠的年度遵循成本按3%的折扣率增加2.569億美元,而多家硫化化學品工廠已經承擔了這一成本。取得專利的氣味吸附筒和膜生物反應器旨在100%去除DMSO,是可行的解決方案,但這些技術需要大量的資本支出和技術監督。台灣和韓國的半導體工廠正在應用針對含DMSO污水流客製化的需氧膜反應器,這表明終端市場也在供應鏈下游通過更嚴格的排放標準。環境審查的加強可能會加速向低氣味配方的轉變,但這可能會限制現有工廠的短期產能擴張,並限制硫化化學品市場的短期成長。

細分分析

硫醇在二甲基二硫合成和甲硫胺酸生產中起著核心作用,在 2024 年佔據了硫化學市場 71.19% 的佔有率。隨著亞洲新的煉油廠和飼料廠尋求可靠的甲硫醇和乙硫醇供應,這一細分市場不斷擴大。由於 DMDS 單位質量含硫量高,並且能夠縮短觸媒活性過程中的周轉時間,它仍然是基準硫化劑。中東的大型煉油廠客戶會提前幾年下大訂單,確保綜合硫醇-DMDS 製造商的產量可預測。連續硫醇氧化反應器的進步也提高了產量並降低了變動成本,支持硫醇預計到 2030 年的複合年成長率達到 5.71%。生物硫醇計畫可以帶來進一步的上行空間,有望降低碳強度,同時也使供應商在碳邊境調整機制正在興起的司法管轄區獲得行銷優勢。

二甲基亞碸在硫化化學品市場中佔有相當大的佔有率(以產量計算)。家用電子電器組裝現在要求高純度產品,將金屬離子限制在100 ppt以下,這促使生產商採用雙蒸餾塔和不鏽鋼系統來減少污染。在歐洲,用於冷凍保存和腫瘤製劑的藥用級二甲基亞碸(DMSO)的安全採購也在增加,擴大了其應用的多樣性。巰基乙酸及其酯在護髮化妝品、PVC熱穩定劑和微電子光阻劑剝離劑中保持著小眾但穩定的地位。其他次要化學品,例如多硫化物和噻唑,支持油田中的橡膠硫化和硫化氫去除,為願意進行客製化合成的創新者提供了輔助的高利潤收益來源。

硫化學品市場報告按類型(硫醇、二甲基亞碸、巰基乙酸及酯、其他類型)、終端用途產業(動物營養、石油和天然氣、聚合物和化學品、其他終端用途產業)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。市場預測以產量(噸)為單位。

區域分析

2024年,亞太地區佔據了全球硫化學品市場佔有率的38.42%,預計到2030年,該地區的複合年成長率將達到6.41%,這得益於生產規模和下游需求的多元化。中國煉油廠的建設和雞肉產量的快速成長將確保硫醇產量的穩定成長,而當地電子組裝則需要優質的二甲基亞碸 (DMSO) 用於液晶顯示器和內存製造。受惠於全球「中國+1」採購模式,印度特種化學物品部門正在加速對甲硫胺酸和二甲基亞碸 (DMDS) 整合能力的投資。馬來西亞和泰國正在透過吸引重視自由貿易准入和支持性政策框架的先進材料跨國公司,擴大硫化學品的區域需求節點。

北美嚴格的環保標準強制使用超低硫燃料和先進的氣味控制技術,鞏固了該地區的市場地位。美國工業理事會預測,到2033年,國內化學品需求將成長15%,但產能成長落後導致進口依賴度高,這為硫化工的進一步擴張創造了機會。墨西哥灣沿岸擁有一個垂直整合的硫化工園區,與該地區的甲硫胺酸和二甲基二硫(DMDS)生產相連,受益於豐富的頁岩氫能和強大的物流。加拿大的硫磺產量使當地煉油廠成為硫醇製造商的戰略供應來源,但鐵路擁擠和港口限制有時會阻礙供應,促使人們採取庫存囤積策略。

歐洲技術成熟,環境先進,在推動生物基硫化學研究的同時,對排放實施處罰。總部位於法國的阿科瑪公司正在針對特種橡膠市場創新其Vultac硫供體,瞄準高階輪胎品牌。德國化工產業叢集正在資助專注於廢棄物製硫和碳中和製程熱的循環經濟計劃。雖然南美、中東和非洲目前佔全球貿易的不到10%,但隨著區域供應鏈的成熟和環境政策的加強,巴西煉油廠的升級和沙烏地阿拉伯石化產品的多元化發展,預示著硫化學市場未來將迎來機會。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 工業規模動物飼料製造商對甲硫胺酸的需求快速成長

- 擴大二硫化二甲基作為煉油催化劑硫化劑的用途。

- 先進電池中的硫化學品

- 擴大硫化學品在甲硫胺酸生產的應用

- 超低硫柴油脫硫宣傳活動不斷發展

- 市場限制

- 毒性和氣味控制成本高

- 元素硫價格波動

- 導致供應衝擊的生產者集中風險

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測(數量)

- 按類型

- 硫醇

- 二甲基亞碸(DMSO)

- 巰基乙酸及其酯

- 其他類型(例如硫化氫清除劑)

- 按最終用途行業

- 動物營養

- 石油和天然氣

- 聚合物和化學品

- 其他終端用戶產業(電子和半導體清潔、殺蟲劑等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Arkema

- BRUNO BOCK

- Chevron Phillips Chemical Company LLC.

- Daicel Corporation

- Dr. Spiess Chemische Fabrik

- Hebei Yanuo Bioscience

- KIP Chemicals

- Merck KGaA

- Taizhou Sunny Chemical Co., Ltd.

- TCI Chemicals

- Toray Fine Chemicals

- WEIFANG YI HUA CHEMICAL CO., LTD.

第7章 市場機會與未來展望

The Thiochemicals Market size is estimated at 1.30 million tons in 2025, and is expected to reach 1.69 million tons by 2030, at a CAGR of 5.42% during the forecast period (2025-2030).

Strong protein consumption, steady refinery catalyst demand, and emerging battery-grade solvent applications are the principal growth vectors sustaining the thiochemicals market. Intensifying livestock modernization in Asia-Pacific, refinery upgrades aimed at ultra-low-sulfur diesel compliance, and rising adoption of high-purity dimethyl sulfoxide in electronic fabrication jointly anchor the market's positive trajectory. Integrated producers deploy proprietary technologies and expand regional capacities to secure sulfur feedstock, optimize costs, and deepen customer engagement across animal nutrition, refining, and electronics domains. Regulatory pressures for safer sulfiding agents, coupled with innovation in bio-based pathways, are opening new opportunities while simultaneously elevating compliance expenditures. Supply chain resilience, especially in elemental sulfur procurement, has therefore become a decisive differentiator for long-term success within the thiochemicals market.

Global Thiochemicals Market Trends and Insights

Surging Methionine Demand From Industrial-Scale Animal Feed Producers

Global poultry and aquaculture producers are scaling premium feed formulations that rely on methionine derived from thiochemicals, thereby stimulating additional capacity investments across the thiochemicals market. Evonik Industries operates integrated hubs in Antwerp, Mobile, and Singapore with aggregate output surpassing 700,000 t per year, underscoring the capital intensity tied to this demand surge. Consumption growth remains most pronounced in Asia-Pacific where incomes and protein uptake are climbing in tandem with commercial farm consolidation. Scientific assessments reveal DL-methionine improves liver metabolism and oxidative stress, while L-methionine accelerates weight gain in broilers, creating differentiated additive niches that support premium pricing. Integrated thiochemical-to-methionine complexes reduce logistics costs, lower sulfur input volatility, and protect margins, prompting leading producers to reinforce backward integration strategies. Consequently, sustained methionine pull-through ensures the thiochemicals market maintains a robust baseline of demand as feed industries upscale.

Expanding Use of Dimethyl Disulfide as a Refinery Catalyst Sulfiding Agent

Refineries increasingly prefer dimethyl disulfide (DMDS) to activate hydrotreating catalysts because it volumetrically delivers more sulfur with fewer safety concerns than hydrogen sulfide, aligning with worker protection norms and continuous operation imperatives. Technical evaluations show that DMDS-based Exact-S grades raise catalytic activity quickly while minimizing hazardous handling, enabling refineries to comply with stricter fuel sulfur limits. The global shift toward ultra-low-sulfur diesel accelerates this substitution trend, especially in North America, the Middle East, and emerging Asian refining hubs undergoing capacity expansions. Research published on ScienceDirect validates that DMDS-sulfided catalysts meet or exceed performance achieved with H2S presulfiding under deep desulfurization conditions. Renewable diesel co-processing is further bolstering DMDS uptake because mixed feedstocks require versatile sulfiding agents capable of stabilizing catalysts exposed to oxygenated compounds. Collectively, these operational advantages ensure persistent DMDS volume growth within the broader thiochemicals market.

High Toxicity and Odor Management Costs

Thiochemicals possess strong odors and toxicity profiles that oblige producers to invest in containment, scrubbers, and specialized handling infrastructure, thereby elevating operating costs. The 2024 U.S. EPA Risk Management Program amendments boost annual compliance spending for synthetic organic chemical plants by USD 256.9 million at a 3% discount rate, a burden borne by several thiochemical facilities. Patented odor-adsorbent cartridges and membrane bioreactors targeting 100% DMSO removal demonstrate available solutions, yet these technologies require meaningful capital outlays and technical oversight. Semiconductor fabs in Taiwan and South Korea apply aerobic membrane reactors tailored to DMSO-laden wastewater streams, showing that end-markets also pass stricter discharge criteria down the supply chain. Elevated environmental scrutiny may accelerate the shift toward low-odor formulations but will likely restrain short-term output expansion in legacy facilities, tempering near-term growth for the thiochemicals market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Thiochemicals in Advanced Batteries

- Growing Usage of Thiochemicals in Methionine Production

- Volatility in Elemental Sulfur Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mercaptans captured 71.19% of thiochemicals market share in 2024 owing to their centrality in dimethyl disulfide synthesis and methionine manufacturing. The segment expanded alongside new Asian refineries and feed mills that demand reliable supplies of methyl mercaptan and ethanethiol. DMDS remains the benchmark sulfiding agent because it safely delivers high sulfur content per unit mass, reducing turnaround times during catalyst activation. Customers in Middle Eastern mega-refineries place bulk orders years in advance, ensuring predictable throughput for integrated mercaptan-DMDS producers. Advancements in continuous mercaptan oxidation reactors have also improved yields, lowering variable costs and supporting a 5.71% CAGR outlook for mercaptans through 2030. Further upside could arise from bio-mercaptan initiatives that promise to shrink carbon intensity while giving suppliers a marketing edge in jurisdictions with emerging carbon-border adjustment mechanisms.

Dimethyl sulfoxide holds a significant share in the thiochemicals market by volume. Consumer electronics assemblers now demand higher purity ranges that limit metal ions to below 100 ppt, spurring producers to install double-distillation columns and stainless-steel systems that inhibit contamination. Secure sourcing of pharmaceutical-grade DMSO for cryopreservation and oncology formulations is also rising in Europe, widening application diversity. Thioglycolic acid and esters maintain stable though niche roles in hair-care cosmetics, PVC heat stabilizers, and microelectronic photoresist stripping. Other minor chemistries such as polysulfides and thiazoles address rubber vulcanization and oilfield H2S scavenging, providing supplemental, high-margin revenue streams for innovators willing to engage in custom synthesis.

The Thiochemicals Market Report is Segmented by Type (Mercaptans, Dimethyl Sulfoxide, Thioglycolic Acid and Esters, Other Types), End-Use Industry (Animal Nutrition, Oil and Gas, Polymers and Chemicals, Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific held 38.42% of thiochemicals market share in 2024 and is projected to expand at a 6.41% CAGR through 2030, powered by manufacturing scale and downstream demand diversity. China's refinery build-out combined with surging poultry output secures steady mercaptan liftings, while local electronics assemblers consume premium DMSO grades for LCD and memory fabrication. India's speciality chemical segment benefits from global "China + 1" sourcing models, accelerating investment in integrated methionine and DMDS capabilities. Malaysia and Thailand attract advanced-material multinationals who value free-trade access and supportive policy frameworks, thereby expanding regional demand nodes for thiochemicals.

Strict environmental standards in North America, which mandate ultra-low-sulfur fuels and advanced odor controls, strengthen the region's market position. The American Chemistry Council anticipates 15% domestic chemical demand growth by 2033, but capacity additions lag, implying heavier import reliance and opportunity for incremental thiochemical expansions. The Gulf Coast hosts vertically integrated thiochemical parks that feed into regional methionine and DMDS production, benefiting from abundant shale-derived hydrogen and robust logistics. Canada's sulfur output renders local refineries strategic suppliers to mercaptan producers, yet rail congestion and port limitations occasionally disrupt flows, prompting inventory stockpiling strategies.

Europe remains technologically mature and environmentally progressive, promoting bio-based thiochemical research while penalizing emissions. Arkema, based in France, innovates Vultac sulfur donors catering to specialty rubber markets that service premium tire brands. German chemical clusters channel funding into circular-economy projects focusing on waste-to-sulfur and carbon-neutral process heat, initiatives that could reshape regional supply structures. South America and the Middle East & Africa collectively account for less than 10% of global trade today, yet refinery upgrades in Brazil and petrochemical diversification in Saudi Arabia hint at future thiochemicals market opportunities as localized supply chains mature and environmental policies tighten.

List of Companies Covered in this Report:

- Arkema

- BRUNO BOCK

- Chevron Phillips Chemical Company LLC.

- Daicel Corporation

- Dr. Spiess Chemische Fabrik

- Hebei Yanuo Bioscience

- KIP Chemicals

- Merck KGaA

- Taizhou Sunny Chemical Co., Ltd.

- TCI Chemicals

- Toray Fine Chemicals

- WEIFANG YI HUA CHEMICAL CO., LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging methionine demand from industrial-scale animal feed producers

- 4.2.2 Expanding use of Dimethyl Disulfide as a refinery catalyst sulfiding agent

- 4.2.3 Adoption of thiochemicals in advanced batteries

- 4.2.4 Growing usage of thiochemcials in methionine production

- 4.2.5 Growth in ultra-low-sulfur diesel desulfurisation campaigns

- 4.3 Market Restraints

- 4.3.1 High toxicity and odour management costs

- 4.3.2 Volatility in elemental sulfur prices

- 4.3.3 Producer concentration risk causing supply shocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Mercaptans

- 5.1.2 Dimethyl Sulfoxide (DMSO)

- 5.1.3 Thioglycolic Acid and Esters

- 5.1.4 Other Types (Hydrogen-Sulfide Scavengers, etc.)

- 5.2 By End-Use Industry

- 5.2.1 Animal Nutrition

- 5.2.2 Oil and Gas

- 5.2.3 Polymers and Chemicals

- 5.2.4 Other End-user Industries (Electronics and Semiconductor Cleaning, Agrochemicals, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arkema

- 6.4.2 BRUNO BOCK

- 6.4.3 Chevron Phillips Chemical Company LLC.

- 6.4.4 Daicel Corporation

- 6.4.5 Dr. Spiess Chemische Fabrik

- 6.4.6 Hebei Yanuo Bioscience

- 6.4.7 KIP Chemicals

- 6.4.8 Merck KGaA

- 6.4.9 Taizhou Sunny Chemical Co., Ltd.

- 6.4.10 TCI Chemicals

- 6.4.11 Toray Fine Chemicals

- 6.4.12 WEIFANG YI HUA CHEMICAL CO., LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment