|

市場調查報告書

商品編碼

1844678

高吸水性聚合物(SAP):市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Super Absorbent Polymers (SAP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

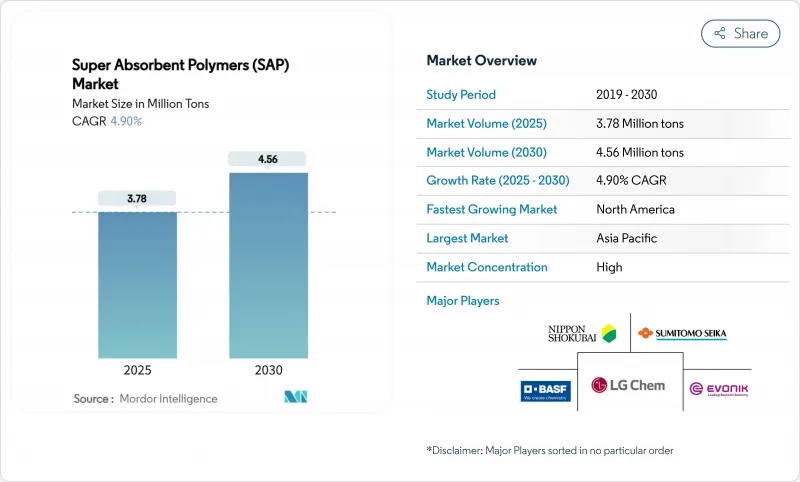

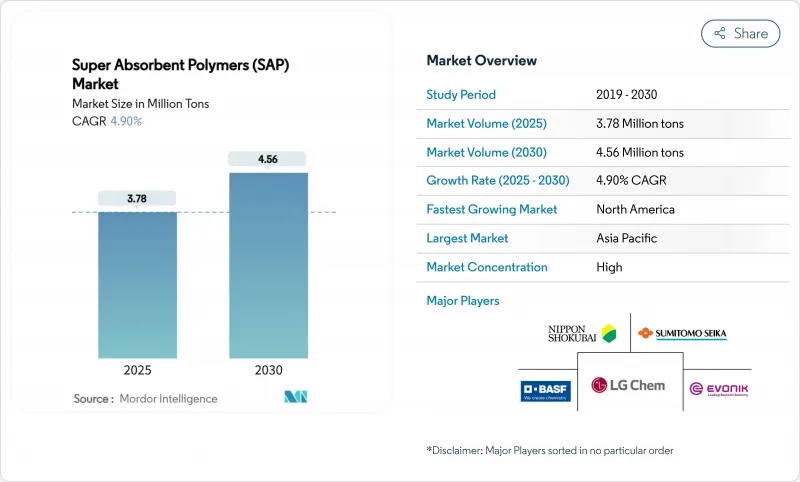

預計高吸水性聚合物 (SAP) 市場規模在 2025 年將達到 378 萬噸,到 2030 年預計將達到 456 萬噸,預測期內 (2025-2030 年) 的複合年成長率為 4.90%。

嬰兒紙尿褲需求的不斷成長、高 SAP 成人失禁墊片的迅速普及以及工業和農業應用的不斷擴大是這一穩步成長的主要驅動力。歐洲法規收緊,有利於生物基化學品,加上中國和印度人均紙尿褲購買量的不斷上升,正在推動產品系列向高階、高性能等級靠攏。製造商繼續升級其工廠,提高能源效率和垂直整合,以緩解丙烯酸價格波動。同時,直接面對消費者的訂購模式和電子商務主導的低溫運輸包裝正在釋放高利潤的利基市場,抵消標準衛生產品銷售的利潤壓力。對纖維素和澱粉基替代品的投資增加表明,永續性正在推動高吸收性聚合物 (SAP) 市場的品牌價值和製程創新。

全球高吸水性聚合物(SAP)市場趨勢與洞察

中國和印度人均一次性尿布支出增加

在支持家庭規模擴大和可支配收入增加的政策推動下,中國都市區家庭自2022年以來平均尿布支出預計將增加15%。在印度,二、三線城市的通路擴張,使首次購買尿布的消費者能夠輕鬆購買到先進的一次性尿布。包括高容量SAP等級和低凝膠堵塞率在內的高階SKU,正在加速高吸水性聚合物(SAP)市場的單位消費量和銷售成長。本地加工商擴大透過長期承購協議鎖定供應,以確保品質並降低運費風險。

高SAP成人失禁墊片迅速普及

日本、韓國、德國和義大利的人口老化加劇了成人失禁的流行。新型墊片提高了高達40%,並且擁有與普通內褲類似的低調設計,鼓勵人們日間使用。訂閱式電商通路不斷擴展,捆綁了謹慎配送、失禁保險和旅遊專用SKU。製造商正積極應對這項挑戰,推出差異化的核殼顆粒形態,以提高負重下的吸收能力,從而在高吸水性聚合物市場中打造出一個利潤豐厚的細分市場。

原物料價格不穩定

丙烯酸佔生產成本的70%,季度波動高達25%,這給採購預算帶來了不確定性。長虹聚合物計畫於2026年投產的16億美元丙烷-丙烯酸工廠,可能會降低可變成本曲線,並打破現有西方供應商之間的價格平價。人們對生物基路線和垂直整合的興趣日益濃厚。

細分分析

由於其在嬰兒紙尿褲領域久經考驗的可靠性,到2024年,丙烯酸樹脂將佔據高吸水性聚合物 (SAP) 市場佔有率的72%。為了提高安全性,高階品牌正在指定使用遊離單體含量低的高純度丙烯酸SAP。同時,聚丙烯醯胺牌號的複合年成長率達到6.6%,這得益於其在農業和工業乾燥密封應用中的卓越保水性。預計2025年至2030年間,聚丙烯醯胺的產量將成長12.5萬噸,從而搶佔丙烯酸牌號的市場佔有率。

產品開發人員正在尋求將丙烯酸和多醣骨架混合的混合網路,以平衡成本和分解性。日本觸媒的生質能SAP生產線就是此類跨化學創新的一個例子,該生產線已獲得清真認證,並在印尼生產。目前的重點是生質能採購物流、雜質管理和可擴展的連續反應器設計,以確保聚合物結構的一致性。

凝膠聚合將在2024年保持60%的收入佔有率,這得益於最佳化的反應器組,以實現高吞吐量和均勻的交聯密度。能源回收迴路和連續單體循環將提高成本競爭力。溶液聚合將以5%的複合年成長率成長,因為它能夠生產小批量、窄分子量分佈的特種等級產品,並降低能源負荷,符合永續性目標。

懸浮聚合和反相懸浮聚合在特定領域仍佔有一席之地,這些領域需要獨特的顆粒形貌,例如用於醫用液體管理的核殼微球。製程工程師專注於精確的交聯劑進料控制和線上光譜分析,以便在加載時客製化吸收率,這進一步細分了高吸水性聚合物市場。

高吸水性聚合物 (SAP) 市場按產品類型(聚丙烯醯胺、丙烯酸基、其他)、聚合工藝(溶液聚合、其他)、應用(嬰兒尿布、成人失禁產品、其他)、最終用戶行業(個人護理和衛生製造商、農業投入品供應商、其他)和地區(亞太地區、北美、歐洲、其他)細分。

區域分析

到2024年,亞太地區將佔據高吸水性聚合物 (SAP) 市場的42%,這得益於中國丙烯酸-SAP一體化叢集,該產業集群最大限度地減少了原料物流。政府的激勵措施,尤其是在江蘇省和山東省,正在幫助消除產能瓶頸並擴大出口導向業務。印度將透過日益普及的一次性尿布來促進銷售量成長,而日本則在特種產品和生質能產品領域保持技術領先地位。

預計到2030年,北美地區的複合年成長率將達到5.50%,位居榜首。成長的促進因素包括:高階一次性尿布的SKU、嬰兒潮世代對高吸水性樹脂(SAP)成人失禁產品的採用,以及集水塊和低溫運輸墊片等特殊工業應用。一個與贈地大學合作的研究聯盟正在開創基於纖維素和蛋白質的網路,以使企業的永續性承諾與監管趨勢保持一致。該地區也率先在園藝領域使用大麻基SAP,這強化了高吸水性聚合物市場的循環經濟敘事。

歐洲嚴格的政策環境正在加速生物基和可回收包裝的採用。德國的產量領先,而北歐國家則正在推動消費者對可堆肥尿布芯的偏好。合規成本促使聚合物供應商和廢棄物管理公司建立合作關係,試行閉合迴路收集方案。歐盟標準對出口配方的影響日益增強,迫使全球生產商協調產品安全和標籤規範。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 中國和印度人均尿布支出增加

- 高SAP成人失禁墊片在亞洲和歐洲越來越受歡迎

- 歐盟一次性塑膠指令轉向生物基SAP

- 電子商務主導吸水包裝墊片(低溫運輸)需求快速成長

- 擴大農業用途

- 市場限制

- 原物料價格不穩定

- 嬰兒紙尿褲中殘留單體的安全隱患

- 生產成本高

- 生產成本概覽

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

第5章市場規模及成長預測

- 依產品類型

- 聚丙烯醯胺

- 丙烯酸類

- 其他

- 按聚合工藝

- 溶液聚合

- 懸浮/反相懸浮聚合

- 凝膠聚合

- 按用途

- 嬰兒尿布

- 成人失禁用品

- 女性用衛生用品

- 農業支持

- 其他用途

- 按最終用戶產業

- 個人護理和衛生產品製造商

- 農資供應商

- 醫療保健提供者

- 其他終端產業(電訊和電力電纜製造商、食品和醫藥低溫運輸物流)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- ADM

- BASF

- Braskem

- Chase Corp.

- Chemtex Speciality Limited

- Evonik Industries AG

- Formosa Plastics Group

- LG Chem

- NIPPON SHOKUBAI CO., LTD.

- SANYO CHEMICAL INDUSTRIES, LTD.

- SAP SE

- Satellite Chemical

- SNF

- SONGWON

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- TOYO BOEKI Co.,Ltd.

- Wanhua

- Yixing Danson Technology

第7章 市場機會與未來展望

The Super Absorbent Polymers Market size is estimated at 3.78 Million tons in 2025, and is expected to reach 4.56 Million tons by 2030, at a CAGR of 4.90% during the forecast period (2025-2030).

Enlarging demand in baby diapers, rapid uptake of high-SAP adult incontinence pads, and a widening set of industrial and agricultural applications are the core forces behind this steady expansion. Tightening European regulations that reward bio-based chemistries, together with higher per-capita diaper spend in China and India, are reshaping product portfolios toward premium, high-performance grades. Manufacturers continue to upgrade plants for energy efficiency and vertical integration to buffer acrylic acid price swings. At the same time, direct-to-consumer subscription models and e-commerce-driven cold-chain packaging unlock high-margin niches that compensate for margin pressure in standard hygiene volumes. Rising investment in cellulosic and starch-derived alternatives signals that sustainability now drives both brand value and process innovation in the super absorbent polymers market.

Global Super Absorbent Polymers (SAP) Market Trends and Insights

Rising Per-Capita Diaper Spend in China and India

Urban households in China lifted their average diaper outlay by 15% since 2022, aided by policy changes that support larger families and rising disposable income. In India, distribution build-out in tier-2 and tier-3 cities raised penetration, bringing advanced diaper formats within reach of first-time buyers. Premium SKUs contain higher-capacity SAP grades and reduced gel blocking, accelerating unit consumption and value growth across the super absorbent polymers market. Local converters increasingly lock supply via long-term offtake deals to secure quality and mitigate freight risks.

Rapid Adoption of High-SAP Adult Incontinence Pads

Demographic aging in Japan, South Korea, Germany, and Italy has elevated adult incontinence prevalence, while social acceptance campaigns reduce stigma. New pads integrate up to 40% more SAP, enabling thinner profiles that resemble regular underwear and encourage daytime use. Subscription e-commerce channels are growing, bundling discrete delivery, leakage guarantees, and mobility-specific SKUs. Producers respond with differentiated core-shell particle morphologies that boost absorption under load, creating a high-margin sub-segment within the super absorbent polymers market.

Volatile Raw Material Prices

Acrylic acid constitutes up to 70% of production cost, and quarterly swings as wide as 25% destabilize procurement budgets. Changhong Polymer's USD 1.6 billion propane-to-acrylic-acid plant, due in 2026, could lower variable cost curves and unsettle pricing parity among established Western suppliers. Interest in bio-routes and vertical integration rises as boards prioritize feedstock security.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Bio-Based SAP in EU Driven by Packaging Rules

- Expanding Agricultural Applications

- Safety Concerns Over Residual Monomers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylic fraction represented 72% of the super absorbent polymers market share in 2024, anchored by its proven reliability in baby diapers. To bolster safety perception, premium brands specify higher-purity acrylic SAPs with lower free monomer levels. In parallel, polyacrylamide grades are expanding at a 6.6% CAGR, propelled by their superior water retention in arid agriculture and industrial sealing. Within the super absorbent polymers market size context, polyacrylamide volumes are forecast to add 125 kilotons between 2025 and 2030, capturing incremental share from acrylic grades.

Product developers pursue hybrid networks that mix acrylic and polysaccharide backbones to marry cost and degradability. Nippon Shokubai's biomass-derived SAP line, certified Halal and produced in Indonesia, exemplifies such cross-chemistry innovation. Investment emphasis now tilts toward biomass sourcing logistics, impurity control, and scalable continuous reactor designs that ensure consistent polymer architecture.

Gel polymerization kept a 60% revenue share in 2024, with its reactor trains optimized for high throughput and uniform cross-link density. Energy recovery loops and continuous monomer recycling drive incremental cost competitiveness. Solution polymerization grows at 5% CAGR because it enables small-lot, specialty grades with tight molecular weight distribution and reduced energy load, aligning with sustainability targets.

Suspension and inverse-suspension routes persist in niche roles that require unique particle morphologies, such as core-shell microspheres for medical fluid management. Process engineers focus on precise cross-linker feed control and in-line spectroscopy to tune absorption under load, further segmenting supply within the super absorbent polymers market.

The Super Absorbent Polymer (SAP) Market Segments the Industry by Product Type (Polyacrylamide, Acrylic Acid Based, and Others), Polymerization Process (Solution Polymerization, and More), Application (Baby Diapers, Adult Incontinence Products, and More), End-User Industry (Personal Care and Hygiene Manufacturers, Agriculture Input Suppliers, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific held 42% of the super absorbent polymers market in 2024, powered by China's integrated acrylic acid-SAP clusters that minimize feedstock logistics. Government incentives, notably in Jiangsu and Shandong, support capacity debottlenecking and export-oriented expansions. India contributes volume growth through broader diaper penetration, while Japan retains a technology leadership niche in specialty and biomass-derived grades.

North America is projected to post the fastest 5.50% CAGR through 2030. Growth arises from premium diaper SKUs, high-SAP adult incontinence adoption among aging baby boomers, and specialized industrial uses such as fracking water blockers and cold-chain pads. Research consortia with land-grant universities pioneer cellulosic and protein-based networks, aligning corporate sustainability pledges with regulatory trends. The region also records early field use of hemp-based SAP in horticulture, reinforcing circular economy narratives within the superabsorbent polymers market.

Europe's stringent policy climate accelerates bio-based uptake and packaging recyclability. Germany leads production volume, whereas Nordic countries drive consumer preference for compostable diaper cores. Compliance costs spur alliances between polymer suppliers and waste-management firms to pilot closed-loop recovery schemes. EU standards increasingly influence export formulations, compelling global producers to harmonize product safety and labeling.

- ADM

- BASF

- Braskem

- Chase Corp.

- Chemtex Speciality Limited

- Evonik Industries AG

- Formosa Plastics Group

- LG Chem

- NIPPON SHOKUBAI CO., LTD.

- SANYO CHEMICAL INDUSTRIES, LTD.

- SAP SE

- Satellite Chemical

- SNF

- SONGWON

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- TOYO BOEKI Co.,Ltd.

- Wanhua

- Yixing Danson Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Per-Capita Diaper Spend in China and India

- 4.2.2 Rapid Adoption of High-SAP Adult Incontinence Pads Asia and Europe

- 4.2.3 Shift to Bio-based SAP in EU Driven by Single-Use Plastics Directive

- 4.2.4 E-Commerce-Led Demand Spike for Absorbent Packaging Pads (Cold Chain)

- 4.2.5 Expanding Agricultural Applications

- 4.3 Market Restraints

- 4.3.1 Volatile Raw Material Prices

- 4.3.2 Safety Concerns Over Residual Monomers in Infant Diapers

- 4.3.3 High Production Cost

- 4.4 Production Cost Overview

- 4.5 Value Supply-Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Polyacrylamide

- 5.1.2 Acrylic Acid Based

- 5.1.3 Others

- 5.2 By Polymerization Process

- 5.2.1 Solution Polymerization

- 5.2.2 Suspension/Inverse-Suspension Polymerization

- 5.2.3 Gel Polymerization

- 5.3 By Application

- 5.3.1 Baby Diapers

- 5.3.2 Adult Incontinence Products

- 5.3.3 Feminine Hygiene

- 5.3.4 Agriculture Support

- 5.3.5 Other Application

- 5.4 By End-User Industry

- 5.4.1 Personal Care and Hygiene Manufacturers

- 5.4.2 Agriculture Input Suppliers

- 5.4.3 Healthcare Providers

- 5.4.4 Other End-use Industries (Telecom and Power Cable Makers and Food and Pharmaceutical Cold-Chain Logistics)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Egypt

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ADM

- 6.4.2 BASF

- 6.4.3 Braskem

- 6.4.4 Chase Corp.

- 6.4.5 Chemtex Speciality Limited

- 6.4.6 Evonik Industries AG

- 6.4.7 Formosa Plastics Group

- 6.4.8 LG Chem

- 6.4.9 NIPPON SHOKUBAI CO., LTD.

- 6.4.10 SANYO CHEMICAL INDUSTRIES, LTD.

- 6.4.11 SAP SE

- 6.4.12 Satellite Chemical

- 6.4.13 SNF

- 6.4.14 SONGWON

- 6.4.15 SUMITOMO SEIKA CHEMICALS CO.,LTD.

- 6.4.16 TOYO BOEKI Co.,Ltd.

- 6.4.17 Wanhua

- 6.4.18 Yixing Danson Technology

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Commercial Scale-up of 100% Bio-Based SAP