|

市場調查報告書

商品編碼

1844676

高性能纖維:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)High-Performance Fibers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

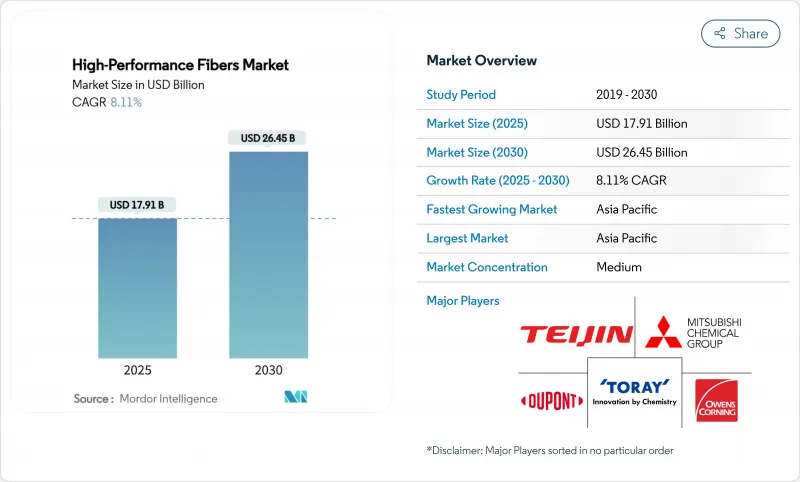

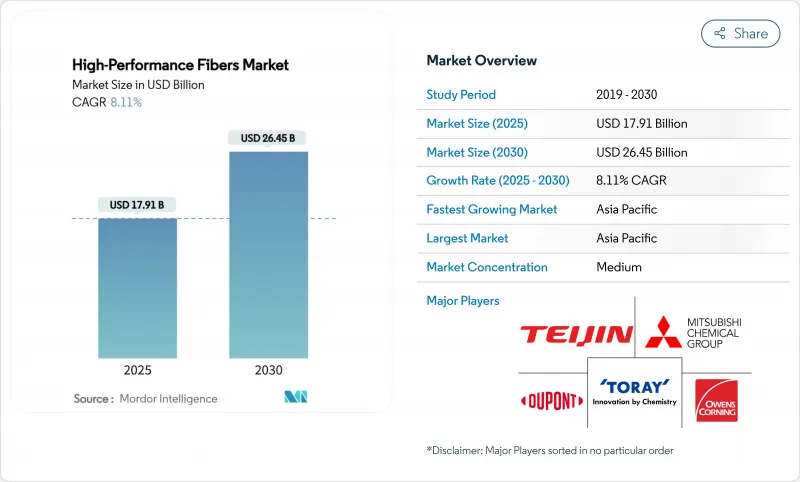

高性能纖維市場規模預計在 2025 年達到 179.1 億美元,預計到 2030 年將達到 264.5 億美元,預測期內(2025-2030 年)的複合年成長率為 8.11%。

碳纖維、醯胺纖維、玻璃纖維和特殊纖維的使用正在加速,它們正從利基航太應用轉向可再生能源硬體、零排放汽車和數據豐富的通訊網路的主流應用。如今,超過100公尺長的商用風力發電機葉片、IV型氫氣壓力容器和5G光纖電纜都需要具有卓越強度重量比和熱穩定性的材料。中國積極的產能擴張正在給平均售價帶來壓力,但不斷成長的銷售量和新興應用繼續推動收益。政策制定者的脫碳指令,加上北美和歐洲的供應鏈在地化舉措,進一步支持了長期成長。

全球高性能纖維市場趨勢與洞察

輕型離岸風電葉片需求激增

如今,長度超過100公尺的渦輪葉片使用的碳纖維數量遠超以往型號,自動化纖維鋪放技術也降低了製造成本,使風電成為一些製造商最大的單一銷售量,甚至超過了航太。碳玻複合材料正被用來平衡剛性、耐腐蝕性和抗雷擊性。隨著北海和東海產能的快速擴張,中國和歐洲的葉片製造商正透過確保纖維生產線獲得成本優勢。

航太和國防工業的需求很高

戰鬥機隊、無人機系統和航太運載火箭的現代化持續推動國防預算對超高模量碳纖維和陶瓷纖維的投資。在商用航空領域,複合材料寬體平台的訂單正在反彈,「更電動化」的飛機架構引入了電磁屏蔽要求,這有利於碳纖維-芳香聚醯胺混合積層法。

揮發性聚丙烯腈 (PAN) - 前驅物供應鏈

到2024年,聚丙烯腈的價格波動可能達到30-40%,這將擠壓缺乏後後向整合的獨立紡紗廠的淨利率。東麗和控制原絲產能的中國本土主要企業已保護自己免受價格上漲的影響,一些歐美製造商已推遲擴張計劃,直至原料供應更加穩定。美國的先導計畫預計將實現原料多元化,但商業化生產仍需數年時間。

細分分析

到 2024 年,碳纖維將佔據高性能纖維市場佔有率的 43.18%,預計到 2030 年的複合年成長率將達到 9.08%。中復神鷹等亞洲製造商正在江蘇省增加新產能,年產能為 3 萬噸,價值 8.66 億美元,以進軍成本敏感的工業領域。帝人在荷蘭的工業規模回收工廠將芳香聚醯胺紗重新加工成新纖維,減少生命週期排放。玻璃纖維仍然是建築和標準汽車面板的低成本支柱,而聚苯硫(PPS) 則因電動車電池組所需的耐熱和耐化學性而經歷兩位數成長。超高分子量聚乙烯和陶瓷纖維分別在低溫儲存和高超音速平台中發揮特殊作用。

工業碳成本的快速下降正在重塑籌資策略。汽車製造商正在簽署多年期合約以確保供應,風電原始設備製造商正在談判代加工協議,以價格上限換取產量承諾。材料製造商正在將碳絲束與低黏度環氧樹脂結合,以滿足高產量葉片的生產目標。同時,高性能纖維市場對木質素衍生碳的風險投資正在增加,以減輕對PAN的依賴並提高環保資格。雖然尚未商業化,但試驗生產線正在生產模量值超過35 Msi的纖維,適用於體育用品層壓板,這預示著十年內現有供應鏈的顛覆潛力。

區域分析

受中國可再生能源應用和積極的汽車電氣化計畫的推動,到2024年,亞太地區將以40.25%的市場佔有率佔據高性能纖維市場佔有率的主導地位。中國政府的五年規劃支持離岸風力發電每年增加100吉瓦以上,使大直徑葉片的纖維用量增加一倍。國內製造商打破了西方國家對T1000級碳纖維的壟斷,使國內原始設備製造商能夠滿足先進戰鬥機的國防和航太規格要求。日本的東麗和帝人繼續在高階市場佔據主導地位,而韓國則為電池外殼和電子電路基板提供聚苯硫醚(PPS)和玻璃纖維。

受通膨控制法和「購買美國貨」政策的推動,北美正在優先發展國內碳纖維生產。預計到2027年,華盛頓州、阿拉巴馬州和魁北克省的新生產線每年將新增1.5萬噸以上產能,從而減少對亞洲前驅體的依賴,並滿足戰鬥機計畫和航太發射器的國家安全目標。墨西哥不斷成長的電動車組裝能正在吸引邊境以南的芳香聚醯胺和玻璃纖維進口,從而鼓勵區域加工商在最終組裝中心附近落戶。

歐洲市場不斷發展,強調永續性和循環經濟原則,法律規範越來越傾向於生物基和可回收纖維解決方案,而非傳統材料。該地區的風電產業是碳纖維需求的主要驅動力,而汽車應用則專注於支援排放目標的輕量化解決方案。德國汽車製造商正在檢驗易於重熔的熱塑性碳纖維結構,北歐能源開發商正在海上原型機中測試生物基環氧樹脂基質。該地區的成長速度落後於亞洲,但嚴格的品質和環境標準意味著更高的平均售價。南美和中東地區新興的需求與基礎設施和可再生能源計劃相關,但受到外匯波動和技術短缺的限制,仍然充滿機會。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 輕型離岸風電葉片需求激增

- 航太和國防工業的需求很高

- 4級氫氣壓力容器的商業化部署

- 5G光纖電纜將採用芳香聚醯胺紗

- 運動和防護產品需求旺盛

- 市場限制

- 揮發性聚丙烯腈 (PAN) 前驅物供應鏈

- 多材料複合材料的回收基礎設施有限

- 中國產能過剩導致價格壓縮

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按類型

- 碳纖維

- 複合材料

- 碳纖維增強聚合物(CFRP)

- 增強碳(RCC)

- 紡織產品

- 微電極

- 催化劑

- 醯胺纖維

- 間芳香聚醯胺

- 對芳香聚醯胺

- 玻璃纖維

- 聚苯硫(PPS)

- 其他類型(超高分子量聚乙烯(UHMWPE)、聚苯並咪唑(PBI)、聚對苯基-2,6-苯並雙噁唑(PBO)、碳化矽(SiC)、玄武岩)

- 碳纖維

- 按最終用戶產業

- 航太/國防

- 車

- 體育用品

- 替代能源

- 電子和通訊

- 建築和基礎設施

- 其他終端使用者產業(醫療保健、醫療設備等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Avient Corporation

- Bally Ribbon Mills

- China Jushi Co., Ltd.

- DuPont

- Hexcel Corporation

- Honeywell International Inc.

- Huvis Corp

- Kolon Industries, Inc.

- Kureha Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Owens Corning

- PBI Performance Products, Inc.

- Sarla Performance Fibers Limited

- Solvay

- Teijin Limited

- Toray Industries Inc.

- Toyobo Co., Ltd.

- TOYOBO MC Corporation

- Weihai Guangwei Group Co., Ltd.

- WL Gore & Associates

- Yantai Tayho Advanced Materials Co., Ltd.

第7章 市場機會與未來展望

The High-Performance Fibers Market size is estimated at USD 17.91 billion in 2025, and is expected to reach USD 26.45 billion by 2030, at a CAGR of 8.11% during the forecast period (2025-2030).

Uptake is accelerating as carbon, aramid, glass, and specialty fibers move from niche aerospace uses to mainstream roles in renewable-energy hardware, zero-emission vehicles, and data-rich telecom networks. Commercial wind-turbine blades that now exceed 100 m lengths, Type-IV hydrogen pressure vessels, and 5G fiber-optic cabling all require materials with exceptional strength-to-weight ratios and thermal stability. Aggressive capacity additions in China have pressured average selling prices, yet rising volumes and new applications continue to lift revenue. Policymakers' decarbonization mandates, combined with supply-chain localization initiatives in North America and Europe, further anchor long-term growth.

Global High-Performance Fibers Market Trends and Insights

Surging Demand for Lightweight Offshore-Wind Blades

Turbine blades topping 100 m now consume far greater volumes of carbon fiber than earlier models, and automated fiber placement is lowering production costs, allowing wind to surpass aerospace as the single largest volume outlet for some manufacturers. Hybrids that combine carbon and glass are being adopted to balance stiffness, corrosion resistance, and lightning-strike protection. Chinese and European blade makers with captive fiber lines gain cost advantages during rapid capacity build-outs in the North Sea and East China Sea.

High Demand from Aerospace and Defense Industry

Modernization of fighter fleets, uncrewed aerial systems, and space-launch vehicles keeps defense budgets invested in ultra-high-modulus carbon and ceramic fibers. Commercial aviation recovery has renewed orders for composite-rich wide-body platforms, while "more-electric" aircraft architectures introduce electromagnetic-shielding requirements that favor hybrid carbon-aramid lay-ups.

Volatile Polyacrylonitrile (PAN)-Precursor Supply Chain

Polyacrylonitrile price swings of 30-40% in 2024 curtailed margins for independent spinners lacking backward integration. Toray and domestic Chinese majors that control precursor capacity insulated themselves from spikes, while several Western producers postponed expansion plans pending more stable feedstock visibility. Bio-based acrylonitrile pilot projects in the United States could diversify inputs, yet commercial output remains years away.

Other drivers and restraints analyzed in the detailed report include:

- Commercial Rollout of Type-IV Hydrogen Pressure Vessels

- 5G Fiber-Optic Cabling Shift to Aramid Yarn

- Limited Recycling Infrastructure for Multi-Material Composites

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Carbon fiber captured 43.18% of the high-performance fibers market share in 2024 and is forecast to climb at a 9.08% CAGR to 2030, underpinned by automotive lightweighting mandates and renewable-energy infrastructure roll-outs. Asia-based producers such as Zhongfu Shenying are injecting fresh capacity-USD 866 million for 30,000 t/y in Jiangsu-to penetrate cost-sensitive industrial segments. Aramid continues to dominate ballistic and telecom applications; Teijin's industrial-scale recycling plant in the Netherlands now reprocesses aramid yarn into new fiber, lowering lifecycle emissions. Glass fiber remains the low-cost mainstay for construction and standard automotive panels, while polyphenylene sulfide (PPS) enjoys double-digit growth as electric-vehicle battery packs require thermal and chemical resilience. UHMWPE and ceramic fibers fill niche roles in cryogenic storage and hypersonic platforms, respectively.

Rapid cost erosion across industrial-grade carbon is reshaping procurement strategies. Automakers are locking multiyear contracts to assure supply, while wind OEMs negotiate tolling arrangements that exchange volume commitments for price ceilings. Material formulators are coupling carbon tow with low-viscosity epoxy resins to meet high-throughput blade production targets. Concurrently, the high-performance fibers market is witnessing growing venture investment in lignin-derived carbon to ease PAN dependence and improve environmental credentials. Although still pre-commercial, pilot lines have produced 35+ Msi modulus fibers suitable for sporting-goods laminates, signaling potential to disrupt incumbent supply chains later in the decade.

The Global High Performance Fibers Market is Segmented by Type (Carbon Fiber, Aramid Fiber, Glass Fiber, Polyphenylene Sulfide (PPS), and More), End-User Industry (Aerospace and Defense, Automotive, Sporting Goods, Alternative Energy, Electronics & Telecommunications, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Value (USD).

Geography Analysis

Asia-Pacific dominates with 40.25% of the high-performance fibers market share in 2024, propelled by China's renewable-energy deployment and aggressive vehicle-electrification timelines. Beijing's Five-Year Plan backs >100 GW/year of offshore-wind additions, doubling fiber usage in large-diameter blades. Domestic producers have broken Western monopoly on T1000-class carbon, enabling local OEMs to meet defense and aerospace specifications for advanced fighter jets. Japan's Toray and Teijin continue to command premium niches, while South Korea channels PPS and glass fiber into battery housings and electronic substrates.

North America, supported by the Inflation Reduction Act and Buy-American policies, is prioritizing domestic carbon-fiber output. New lines in Washington State, Alabama, and Quebec will add >15,000 t/y by 2027, mitigating reliance on Asian precursors and aligning with national-security objectives for fighter programs and space launchers. Mexico's growing EV assembly capacity is pulling aramid and glass imports south of the border, prompting regional converters to co-locate near final assembly hubs.

Europe's market evolution emphasizes sustainability and circular economy principles, with regulatory frameworks that increasingly favor bio-based and recyclable fiber solutions over conventional materials. The region's wind energy sector drives significant carbon fiber demand, while automotive applications focus on lightweight solutions that support emission reduction targets . German automakers validate thermoplastic carbon architectures that allow easier re-melt, while Nordic energy developers test bio-based epoxy matrices in offshore prototypes. Regional growth lags Asia's pace yet commands higher average selling prices due to stringent quality and environmental standards. Emerging demand in South America and the Middle East remains opportunistic, tied to infrastructure and renewable-energy megaprojects but tempered by currency volatility and skills shortages.

- Avient Corporation

- Bally Ribbon Mills

- China Jushi Co., Ltd.

- DuPont

- Hexcel Corporation

- Honeywell International Inc.

- Huvis Corp

- Kolon Industries, Inc.

- Kureha Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Owens Corning

- PBI Performance Products, Inc.

- Sarla Performance Fibers Limited

- Solvay

- Teijin Limited

- Toray Industries Inc.

- Toyobo Co., Ltd.

- TOYOBO MC Corporation

- Weihai Guangwei Group Co., Ltd.

- W. L. Gore & Associates

- Yantai Tayho Advanced Materials Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Lightweight Offshore-Wind Blades

- 4.2.2 High Demand from Aerodpace and Defense Industry

- 4.2.3 Commercial Rollout of Type-IV Hydrogen Pressure Vessels

- 4.2.4 5G fiber-optic Cabling Shift to Aramid Yarn

- 4.2.5 High Demand for Sporting and Protective Products

- 4.3 Market Restraints

- 4.3.1 Volatile Polyacrylonitrile (PAN)-Precursor Supply Chain

- 4.3.2 Limited Recycling Infrastructure for Multi-Material Composites

- 4.3.3 Chinese Over-Capacity Driving Price Compression

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Carbon Fiber

- 5.1.1.1 Composite Materials

- 5.1.1.1.1 Carbon Fiber Reinforced Polymer (CFRP)

- 5.1.1.1.2 Reinforced Carbon Carbon (RCC)

- 5.1.1.2 Textiles

- 5.1.1.3 Microelectrodes

- 5.1.1.4 Catalysis

- 5.1.2 Aramid Fiber

- 5.1.2.1 Meta-Aramid

- 5.1.2.2 Para-Aramid

- 5.1.3 Glass Fiber

- 5.1.4 Polyphenylene Sulfide (PPS)

- 5.1.5 Other Types (Ultra-High Molecular Weight Polyethylene (UHMWPE), Polybenzimidazole (PBI), Poly(p-phenylene-2,6-benzobisoxazole)(PBO), Silicon Carbide (SiC), Basalt)

- 5.1.1 Carbon Fiber

- 5.2 By End-user Industry

- 5.2.1 Aerospace & Defense

- 5.2.2 Automotive

- 5.2.3 Sporting Goods

- 5.2.4 Alternative Energy

- 5.2.5 Electronics & Telecommunications

- 5.2.6 Construction & Infrastructure

- 5.2.7 Other End User Industries (Healthcare & Medical Devices, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Avient Corporation

- 6.4.2 Bally Ribbon Mills

- 6.4.3 China Jushi Co., Ltd.

- 6.4.4 DuPont

- 6.4.5 Hexcel Corporation

- 6.4.6 Honeywell International Inc.

- 6.4.7 Huvis Corp

- 6.4.8 Kolon Industries, Inc.

- 6.4.9 Kureha Corporation

- 6.4.10 Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- 6.4.11 Owens Corning

- 6.4.12 PBI Performance Products, Inc.

- 6.4.13 Sarla Performance Fibers Limited

- 6.4.14 Solvay

- 6.4.15 Teijin Limited

- 6.4.16 Toray Industries Inc.

- 6.4.17 Toyobo Co., Ltd.

- 6.4.18 TOYOBO MC Corporation

- 6.4.19 Weihai Guangwei Group Co., Ltd.

- 6.4.20 W. L. Gore & Associates

- 6.4.21 Yantai Tayho Advanced Materials Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Emerging of Nanofibers and Ceramic Fibers