|

市場調查報告書

商品編碼

1844661

生物酒精:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Bio-alcohols - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

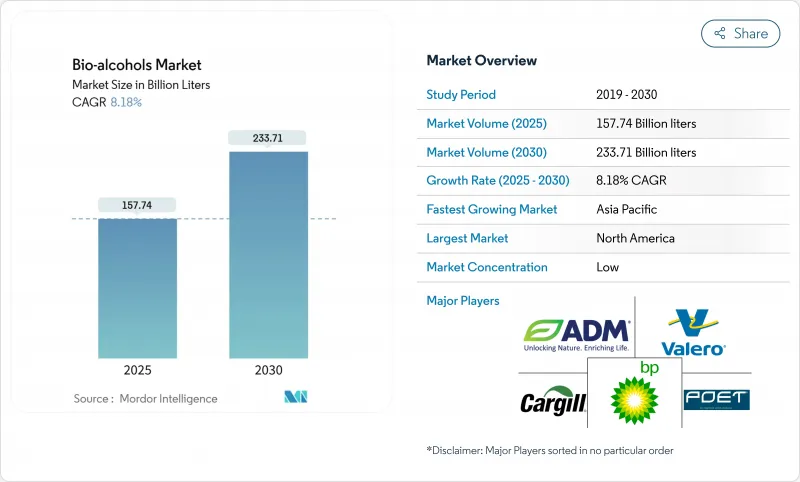

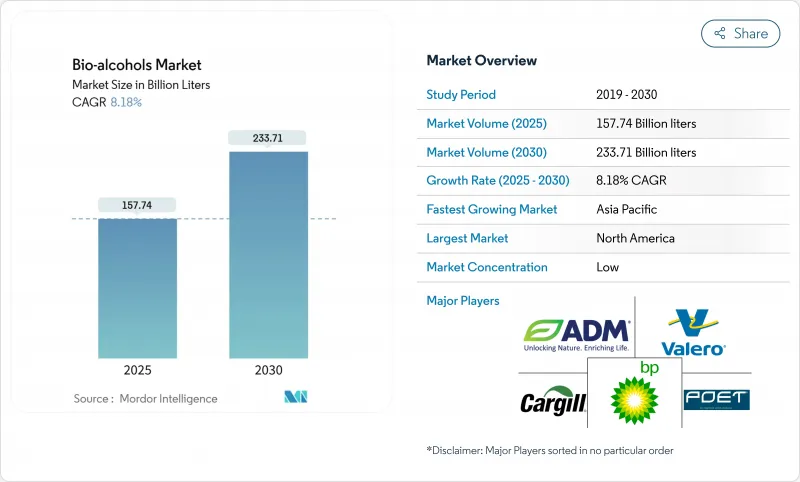

預計 2025 年生物酒精市場規模為 1,577.4 億公升,到 2030 年將達到 2,337.1 億公升,預測期內(2025-2030 年)的複合年成長率為 8.18%。

這一成長反映了可再生燃料法規的加強、酒精轉航空認證的快速進展,以及商業化碳轉酒精系統的出現,這些系統在減少排放的同時,為煉油廠創造了新的收益。永續船用燃料走廊、消費品中高階化學品的應用以及投資者對低碳供應鏈日益成長的興趣也在影響著需求。在北美老牌製造商維持規模經濟的同時,亞太地區在政策利好和成本最佳化技術的推動下,產能正在迅速擴張。與航空公司和船運商簽訂的策略性承購協議也為投資者提供了清晰的現金流。

全球生物酒精市場趨勢與洞察

強制乙醇混合

強制混合燃料可確保需求,降低投資者風險,並加速工廠擴張。印度的目標是到2030年將乙醇混合比例提高到30%,目前已達到20%,彰顯了雄心勃勃的政策帶來的正面影響。歐盟的ReFuel歐盟航空法規將從2025年開始將SAF比例從2%提高到2050年的70%。巴西的E27計畫可作為在物流障礙消除後實現更高混合比例的模板。強制混合燃料可使生產免受大宗商品波動的影響,允許生產商簽訂長期原料合約並降低資金籌措成本。

酒精轉航空航線快速航空公司 SAF 認證

航空業對淨零排放的推動正在迅速加速酒精轉化為航空燃料的測試。 LanzaJet位於喬治亞的Freedom Pines燃料工廠目前年產量已達900萬加侖,這讓投資者對大型工廠的可靠運作充滿信心。 Accens的Jetanol計劃目前計畫年產量超過10億加侖,證實了該技術的可行性。由於SAF的售價通常是傳統噴射機燃料的兩到三倍,生質乙醇生產商在轉向航空公司時可以獲得更高的利潤。長期的航空公司承購協議,例如西南航空與美國生物能源公司(USA BioEnergy)達成的協議,進一步降低了計劃現金流風險。

高混合酒精的管道相容性較差

由於腐蝕和吸濕,大多數石油管線無法輸送高混合度的醇類,因此只能依賴卡車和鐵路運輸。額外的物流成本使得運輸價格缺乏競爭力,尤其是在遠離混合終端的地區。管道升級需要多家業主的合作,這需要高昂的資本支出,而這在某些市場尚不合理。

細分分析

預計到2024年,生質乙醇的市佔率將達到68.05%。生質乙醇的轉化成本優勢和全球供應鏈鞏固了其領先地位。預計生物乙醇市場規模將隨著國家混合燃料限制措施的實施而穩定擴大,即使汽油達到峰值,絕對產量仍將保持成長。然而,生質乙醇卓越的能量密度和直接相容性正在推動對高階化學品的需求,複合年成長率高達9.40%。

酒精轉化為噴射燃料的突破為乙醇開闢了更高價值的出路。 LanzaJet 的早期營運數據證實,低成本的農業乙醇可以升級為 SAF,售價可提高兩到三倍。同時,生物甲醇正在進入船用燃料和塑膠領域,而生物 BDO 則填補了醫藥和工程材料領域的空白。整體而言,特種酒精使生物酒精市場更加多元化,降低了對道路燃料波動的敏感度。

生物酒精市場報告按產品類型(生物甲醇、生質乙醇、生物丁醇、生物BDO等)、原料(澱粉作物、糖作物、木質纖維素生質能等)、應用(運輸、建築、電子等)和地區(亞太地區、北美、歐洲、南美、中東和非洲)細分。市場預測以產量(公升)計算。

區域分析

北美2024年將佔比39.44%,這反映了其密集的玉米製乙醇走廊、充足的鐵路物流以及維持基準產量的可再生燃料標準。加拿大2025年無污染燃料法規將擴大美國以外地區對低碳混合燃料的需求。墨西哥對新麵粉廠的投資將使該大陸融入自我強化的供應鏈。 Summit Next Gen公司在德克薩斯州投資16億美元的乙醇-SAF綜合體有資格獲得JETI撥款,這表明地方補貼與聯邦稅額扣抵如何相結合,以吸引大型企劃。

亞太地區是成長引擎,複合年成長率達9.55%,這得益於印度快速轉向30%的混合燃料以及對米原料創紀錄的需求。中國正透過資助與其2060年零排放計畫相關的二氧化碳-酒精混合燃料試點項目,獲得成長動力;而日本和韓國則正在向煉油廠和機場推出綠色燃料獎勵。包括菲律賓在內的東協市場也正在取消混合燃料限制,維持了該地區的廣泛需求。這些政策趨勢正在吸引將本地原料與進口技術結合的合資企業,加速產能擴張。

在歐洲,嚴格的碳排放價格和永續燃料(SAF)強制規定正在迅速擴大高階市場。 ReFuelEU 規則手冊為投資者明確了未來永續燃料(SAF)的擴張方向,德國和英國正在實施國家補貼以確保國內生產。原料靈活性,包括甜菜和廢棄物物質,有助於緩衝供應衝擊。南美洲繼續利用先進的第二代工廠加工廉價的甘蔗和甘蔗渣,支持向虧損地區穩定出口。作為多元化策略的一部分,中東和非洲正在進行規模較小的試點計劃。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 強制性乙醇混合目標

- 酒精轉航空航線快速航空公司 SAF 認證

- 煉油廠中二氧化碳和酒精CCU工廠的整合

- 生物酒精作為CPG低碳化學原料的用途

- 甲醇動力來源運輸走廊的出現

- 市場限制

- 原物料價格波動

- 缺乏高混合酒精管道相容性。

- 2027年後全球微型車產量將停滯不前

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測(數量)

- 依產品類型

- 生物甲醇

- 生質乙醇

- 生物丁醇

- 生物BDO

- 其他生物酒精

- 按原料

- 作物作物

- 糖料作物

- 木質纖維素生質能

- 藻類生物量

- 工業廢棄物

- 按用途

- 運輸

- 建造

- 電子產品

- 製藥

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Abengoa

- ADM

- BASF SE

- BP plc

- Cargill Incorporated

- CropEnergies AG

- Gevo

- Green Plains Inc.

- INEOS

- Mascoma LLC

- POET LLC

- Raizen

- SEKISUI CHEMICAL CO., LTD.

- Valero Energy Corporation

第7章 市場機會與未來展望

The Bio-alcohols Market size is estimated at 157.74 billion liters in 2025, and is expected to reach 233.71 billion liters by 2030, at a CAGR of 8.18% during the forecast period (2025-2030).

This growth reflects tightening renewable-fuel rules, quick progress in alcohol-to-jet certification, and the arrival of commercial carbon-capture-to-alcohol systems that give refiners fresh revenue while cutting emissions. Demand is also being reshaped by sustainable marine-fuel corridors, premium chemical uses in consumer goods, and stronger investor appetite for low-carbon supply chains. Established North American producers keep scale advantages, yet Asia-Pacific is adding capacity faster thanks to policy tailwinds and cost-optimized technologies. Feedstock innovation, especially with algae and industrial off-gases, is helping moderate margin risks linked to crop price swings, while strategic offtake deals with airlines and shippers give investors cash-flow clarity.

Global Bio-alcohols Market Trends and Insights

Mandated Ethanol-Blend Targets

Blend mandates guarantee demand, reduce investor risk, and speed plant expansions. India's goal of 30% blending by 2030, having already reached 20%, shows the upside that ambitious policy can unlock. The EU's ReFuelEU Aviation rule starts with 2% SAF in 2025 and rises to 70% by 2050, offering a clear runway for alcohol-to-jet projects. Brazil's E27 program remains a template for high blend ratios once logistics barriers ease. Because mandates shield volumes from commodity swings, producers can line up long-term feedstock contracts and lower financing costs.

Rapid Airline SAF Certification of Alcohol-to-Jet Pathways

Aviation's net-zero push has sharply accelerated testing of alcohol-to-jet routes. LanzaJet's Freedom Pines Fuels site in Georgia already makes 9 million gallons a year and gives financiers confidence that large plants will run reliably. Axens' Jetanol projects now top 1 billion gallons per year of planned capacity, underlining the technology's bankability. SAF often sells at two to three times the price of conventional jet fuel, so bio-ethanol producers enjoy wider margins when they pivot toward aviation customers. Long-term airline offtake deals, such as Southwest's agreement with USA BioEnergy, further derisk project cash flows.

Insufficient Pipeline Compatibility for High-Blend Alcohols

Most petroleum pipelines cannot handle high alcohol blends due to corrosion and water uptake, forcing reliance on truck or rail. The extra logistics cost erodes delivered-price competitiveness, especially in regions far from blending terminals. Upgrading lines needs cooperation between many owners and warrants high capital that some markets cannot justify yet.

Other drivers and restraints analyzed in the detailed report include:

- Integration of CO2-to-Alcohol CCU Plants at Refineries

- Bio-Alcohol as Low-Carbon Chemical Feedstock in CPG

- Stagnant Global Light-Vehicle Production Post-2027

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bio-ethanol kept a 68.05% 2024 Bio-alcohol market share, underpinned by mature plants, standardized specs, and supportive mandates. Its conversion cost edge and global supply chain reinforce leadership. The Bio-alcohol market size for bio-ethanol is expected to expand steadily in line with nationwide blend limits that increase absolute volume even as gasoline peaks. Yet bio-butanol's superior energy density and drop-in compatibility are propelling its 9.40% CAGR and a rising slice of premium chemical demand.

Alcohol-to-jet breakthroughs provide a higher-value outlet for ethanol. LanzaJet's early operating data confirm that low-cost agricultural ethanol can be upgraded into SAF that sells at a 2-3X price multiple. Meanwhile, bio-methanol is carving room in marine fuels and plastics, and bio-BDO caters to pharmaceutical and engineered-material niches. Collectively, specialty alcohols diversify the Bio-alcohol market and lessen sensitivity to road-fuel swings.

The Bio-Alcohol Market Report is Segmented by Product Type (Bio-Methanol, Bio-Ethanol, Bio-Butanol, Bio-BDO, and More), Feedstock (Starch-Based Crops, Sugar-Based Crops, Lignocellulosic Biomass, and More), Application (Transportation, Construction, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Liters).

Geography Analysis

North America's 39.44% 2024 share mirrors its dense corn-to-ethanol corridor, ample rail logistics, and the Renewable Fuel Standard that keeps baseline volumes. Canada's 2025 Clean Fuel Regulation widens demand for low-carbon blends beyond the United States. Mexico's new mill investments knit the continent into a self-reinforcing supply chain. Summit Next Gen's USD 1.6 billion Texas ethanol-to-SAF complex, eligible for JETI subsidies, underlines how local grants align with federal tax credits to lure mega-projects.

Asia-Pacific is the growth engine, tracking a 9.55% CAGR on the back of India's fast-tracked 30% blend agenda and record rice-feedstock pull. China adds momentum by funding CO2-to-alcohol pilots that dovetail with its 2060 neutrality plan, while Japan and South Korea channel green-fuel incentives at refineries and airports. ASEAN markets, including the Philippines, are lifting blending rules too, keeping regional demand broad-based. This policy updraft attracts joint ventures that stitch together local feedstock with imported technology, accelerating capacity rollout.

Europe moves with stringent carbon-pricing and SAF mandates that jump-start premium niches. The ReFuelEU rulebook gives investors clarity on future SAF ramp-ups, while Germany and the UK run national subsidies to ensure domestic production. Feedstock flexibility, including sugar beet and waste biomass, helps buffer supply shocks. South America continues leveraging cheap sugarcane and advanced second-generation mills that process bagasse, supporting steady export flows to deficit regions. The Middle East and Africa, though smaller, are piloting projects as part of diversification strategies.

- Abengoa

- ADM

- BASF SE

- BP p.l.c.

- Cargill Incorporated

- CropEnergies AG

- Gevo

- Green Plains Inc.

- INEOS

- Mascoma LLC

- POET LLC

- Raizen

- SEKISUI CHEMICAL CO., LTD.

- Valero Energy Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandated ethanol-blend targets

- 4.2.2 Rapid airline SAF certification of Alcohol-to-Jet pathways

- 4.2.3 Integration of CO2 to alcohol CCU plants at refineries

- 4.2.4 Bio-alcohol use as low-carbon chemical feedstock in CPG

- 4.2.5 Emerging methanol-powered shipping corridors

- 4.3 Market Restraints

- 4.3.1 Feedstock price volatility

- 4.3.2 Insufficient pipeline compatibility for high-blend alcohols

- 4.3.3 Stagnant global light-vehicle production post-2027

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Bio-Methanol

- 5.1.2 Bio-Ethanol

- 5.1.3 Bio-Butanol

- 5.1.4 Bio-BDO

- 5.1.5 Other Bio-Alcohols

- 5.2 By Feedstock

- 5.2.1 Starch-based Crops

- 5.2.2 Sugar-based Crops

- 5.2.3 Lignocellulosic Biomass

- 5.2.4 Algal Biomass

- 5.2.5 Industrial Off-gases and MSW

- 5.3 By Application

- 5.3.1 Transportation

- 5.3.2 Construction

- 5.3.3 Electronics

- 5.3.4 Pharmaceuticals

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Abengoa

- 6.4.2 ADM

- 6.4.3 BASF SE

- 6.4.4 BP p.l.c.

- 6.4.5 Cargill Incorporated

- 6.4.6 CropEnergies AG

- 6.4.7 Gevo

- 6.4.8 Green Plains Inc.

- 6.4.9 INEOS

- 6.4.10 Mascoma LLC

- 6.4.11 POET LLC

- 6.4.12 Raizen

- 6.4.13 SEKISUI CHEMICAL CO., LTD.

- 6.4.14 Valero Energy Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment