|

市場調查報告書

商品編碼

1844641

耐熱塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Heat-Resistant Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

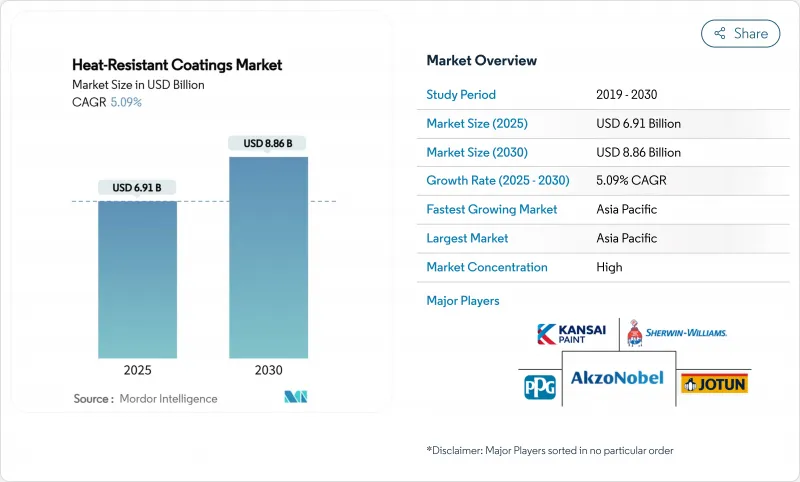

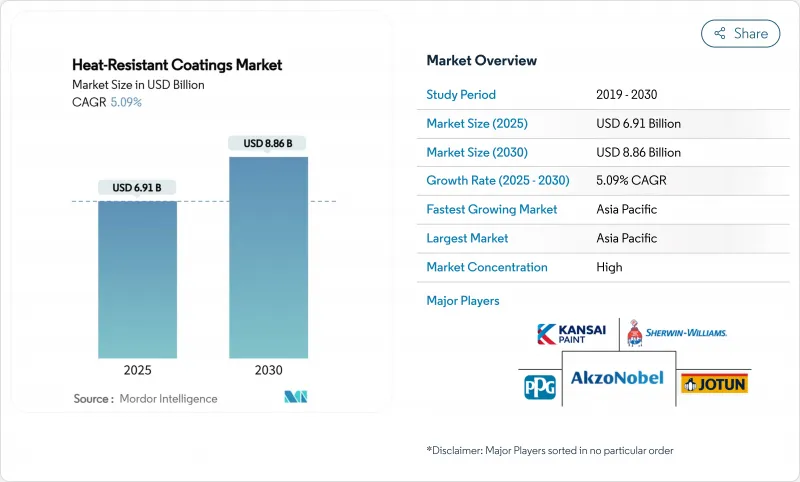

耐熱塗料市場規模預計在 2025 年達到 69.1 億美元,預計到 2030 年將達到 88.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.09%。

全球基礎設施投資增加、消防安全法規更加嚴格以及可重複使用太空船推動的航太產業持續推動需求。亞太地區透過政府主導的建設計劃和擴大製造業保持規模優勢,而北美和歐洲則強調符合更嚴格環境法規的高性能解決方案。技術採用呈現兩種明顯的趨勢:水性系統因其低 VOC排放而保持其產量優勢,而 UV/EB 固化化學品因其快速固化和最小環境影響的結合而成長最快。有機矽樹脂在 600°C 以上具有無與倫比的穩定性,在規模和成長方面佔據主導地位,新興發電工程正在將產量轉移到溫度控管至關重要的能源基礎設施。雖然原料價格波動和認證施用器短缺仍然是不利因素,但永續配方和自動噴塗系統的持續創新使長期前景更加光明。

全球耐熱塗料市場趨勢與洞察

全球基礎設施支出激增

各國政府正以創紀錄的水平投資基礎設施建設,以應對氣候變遷並支持城市發展。美國《基礎建設投資與就業法案》累計2.25億美元,用於更新影響塗層規格的能源標準。亞太地區新興經濟體發展勢頭強勁,印尼、印度和中國加快了機場、橋樑和智慧城市計劃的建設,並指定使用高溫阻隔膜。交通隧道和區域供熱管道領域的官民合作關係將進一步推動長週期隔熱塗層的需求。

加強全球消防安全法規

消防法規改革提高了耐火性、煙霧毒性和最終使用表面溫度的最低性能標準。 2024年國際消防法規引入了更新的火災蔓延標準,這將立即影響塗料配方。加州消防法規第24章要求,處理耐熱產品的噴漆房必須配備自動滅火系統和專用通風設備。歐盟指令持續降低允許的溶劑含量,促使建築商轉向低VOC有機矽-丙烯酸混合物。隨著業主要求其資產符合法規要求,高層建築建築幕牆和交通樞紐的維修正在推動需求激增。認證其產品達到或超過新基準值的製造商將獲得規範優先權,並減少昂貴的返工需求。

矽膠和環氧樹脂價格不穩定

美國國際貿易委員會的裁決發現,某些環氧樹脂的進口價格低於公允價值,導致國內供應緊張,成本上漲。亞洲主要有機矽工廠同時關閉,加劇了價格波動。沒有長期合約的小型配方製造商面臨兩位數的成本成長,利潤率下降,產品被迫重新定價。生產商透過複製前體或擴大內部單體產能進行對沖,但資本支出推遲了立即緩解壓力的措施。雖然原料波動具有周期性,但它會在短期內給現金流帶來壓力,並阻礙研發支出。

細分分析

到2024年,矽膠樹脂將佔據耐熱塗料市場佔有率的38.16%,這得益於其優異的化學特性,使其能夠承受600°C以上的高溫而不會失去附著力。到2030年,矽樹脂的複合年成長率將達到8.90%,是耐熱塗料市場的關鍵成長引擎。其需求涵蓋排氣管、火炬管、烘烤爐、航太零件以及其他不允許故障的零件。環氧樹脂在中溫範圍內仍保持其重要性,但面臨成本方面的阻力以及雙酚A衍生物的監管審查。丙烯酸樹脂非常適合價格敏感型消費品應用,這些應用的峰值表面溫度較低。

耐熱塗料報告按樹脂類型(有機矽、環氧樹脂、丙烯酸、其他樹脂)、技術類型(溶劑型、水基、粉末、UV/EB 固化)、最終用戶行業類型(建築和施工、石油和天然氣、電力部門、運輸、木工和家具、消費品、其他最終用戶行業)和地區類型(亞太地區、北美、歐洲、南美、中東和非洲)行業。

區域分析

到2024年,亞太地區將佔全球總收入的47.81%,複合年成長率為7.50%。中國的「一帶一路」走廊需要用於橋樑和隧道的耐熱底漆,因為這些橋樑和隧道面臨野火和化學品洩漏的風險。印度正在「印度製造」計劃下擴大國內爐灶、鍋爐和工業烤箱的生產,所有這些產品都要求使用耐熱薄膜。

北美仍然是技術創新的中心。美國和加拿大的頂級航太公司指定使用軍用級金屬和陶瓷阻隔塗層。聯邦基礎設施投資,例如更換老化橋樑和改善能源網,要求每個計劃都採用低VOC、耐高溫的塗層。

歐洲正在優先考慮永續性。歐盟揮發性有機化合物(VOC)的限值逐年嚴格,鼓勵建商採用水性矽膠和粉末塗料。德國、法國和義大利的汽車平台正在整合塗有奈米結構陶瓷薄膜的輕質金屬零件,以實現熱管理。雖然南美洲、中東和非洲的市場規模較小,但技術轉移和國際安全標準的採用正在擴大整體可利用的耐熱塗料市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 全球基礎設施支出激增

- 加強世界各地的消防安全法規

- 航太業的需求不斷成長

- 提高防火設備意識

- 可重複使用的太空船和太空旅遊船

- 市場限制

- 矽膠和環氧樹脂價格波動

- 溶劑型系統的VOC法規

- 缺乏多層塗層系統的塗層技術

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按樹脂

- 矽酮

- 環氧樹脂

- 丙烯酸纖維

- 其他樹脂(聚氨酯、醇酸樹脂等)

- 依技術

- 溶劑型

- 水性

- 粉末

- UV/EB固化型

- 按最終用戶產業

- 建築/施工

- 石油和天然氣

- 電力業

- 運輸

- 木工和家具

- 消費品

- 其他終端用戶產業(工業加工設備等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Advanced Industrial Coatings

- AkzoNobel NV

- Aremco

- Arkema

- Axalta Coating Systems LLC

- BASF

- Belzona International Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co. Ltd.

- KCC Corporation

- Momentive

- PPG Industries Inc.

- Teknos Group

- The Sherwin-Williams Company

- Wacker Chemie AG

第7章 市場機會與未來展望

The Heat-Resistant Coatings Market size is estimated at USD 6.91 billion in 2025, and is expected to reach USD 8.86 billion by 2030, at a CAGR of 5.09% during the forecast period (2025-2030).

Rising global infrastructure investments, tighter fire-safety rules and the aerospace sector's push for reusable spacecraft continue to widen demand. Asia-Pacific retains scale advantages through government-led building programs and manufacturing expansion, while North America and Europe emphasize high-performance solutions that meet stricter environmental rules. Technology adoption shows two clear tracks: water-borne systems hold volume leadership owing to lower VOC emissions, and UV/EB-curable chemistries post the fastest gains by combining rapid cure with minimal environmental impact. Silicone-based resins dominate both scale and growth because of unmatched stability above 600 °C, and emerging power-generation projects are shifting volume toward energy infrastructure where thermal management is critical. Raw-material price swings and a shortage of certified applicators remain counterweights, yet sustained innovation in sustainable formulations and automated spray systems keeps the long-term outlook positive.

Global Heat-Resistant Coatings Market Trends and Insights

Surge in Global Infrastructure Spending

Governments are funding record levels of infrastructure aimed at climate resilience and urban growth. The United States Infrastructure Investment and Jobs Act earmarked USD 225 million for updated energy codes that influence coating specifications. Emerging Asia-Pacific economies add momentum as Indonesia, India, and China accelerate airport, bridge, and smart-city projects that specify high-temperature barrier films. Public-private partnerships in transport tunnels and district-heating lines further widen demand for long-cycle thermal coatings.

Stricter Global Fire-Safety Regulations

Fire-code revisions raise minimum performance thresholds for ignition resistance, smoke toxicity, and end-use surface temperature. The International Fire Code 2024 introduces updated flame-spread benchmarks that immediately affect coating formulations. California's Fire Code Chapter 24 mandates automatic extinguishing systems and specialized ventilation for coating booths handling heat-resistant products. EU directives continue to shrink allowed solvent content, pushing builders toward low-VOC silicone-acrylic hybrids. Retrofits of high-rise facades and transportation hubs create demand spikes as owners bring assets into compliance. Manufacturers that certify products above the new baseline win specification priority and reduce the need for costly rework.

Volatile Silicone and Epoxy Prices

A United States International Trade Commission ruling found certain epoxy imports were sold below fair value, tightening domestic supply and raising costs. Simultaneous outages in key Asian silicone plants amplified volatility. Smaller formulators lacking long-term contracts faced double-digit cost spikes that eroded margins and triggered product repricing. Producers hedge by dual-sourcing precursors and expanding in-house monomer capacity, but capital outlays delay immediate relief. Although raw-material swings are cyclical, they compress cash flow and hinder research and development spending in the short term.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand from the Aerospace Industry

- Rising Awareness Toward Fire Protection Equipment

- VOC Limits on Solvent-Borne Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silicone resins accounted for 38.16% of the 2024 heat-resistant coatings market share, reflecting the chemistry's ability to tolerate temperatures above 600 °C without losing adhesion. That leadership is matched by the fastest segment CAGR of 8.90% through 2030, making silicone the pivotal growth engine of the heat-resistant coatings market. Demand spans exhaust stacks, flare stacks, bake ovens, and aerospace parts where failure is unacceptable. Epoxies retain relevance in mid-temperature zones but face cost headwinds and regulatory scrutiny on bisphenol-A derivatives. Acrylics fill price-sensitive applications in consumer goods where surface temperature peaks are lower.

The Heat-Resistant Coatings Report is Segmented by Resin (Silicone, Epoxy, Acrylic, Other Resins), Technology (Solvent-Borne, Water-Borne, Powder, UV/EB-curable), End-User Industry (Building and Construction, Oil and Gas, Power Sector, Transportation, Woodworking and Furniture, Consumer Goods, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific led with 47.81% of 2024 revenue and advances at 7.50% CAGR, powered by megaprojects in transport, housing, and energy. China's Belt and Road corridors require heat-resistant primers for bridges and tunnels exposed to wildfire and chemical spill risks. India, under its Make in India vision, expands domestic manufacturing of cookstoves, boilers, and industrial ovens that all specify heat-stable films.

North America remains an innovation center. Aerospace primes in the United States and Canada specify metallic and ceramic barrier coats qualified to MIL standards. Federal infrastructure outlays replace aging bridges and improve energy grids, each project mandating low-VOC, high-temperature finishes.

Europe emphasizes sustainability. EU VOC ceilings tighten yearly, pushing builders to waterborne silicones and powder options. Automotive platforms in Germany, France, and Italy integrate lightweight metal components coated with nano-structured ceramic films for thermal regulation. Markets in South America, the Middle East and Africa grow from a smaller base yet benefit from technology transfer and the adoption of international safety codes, widening the total addressable heat-resistant coatings market.

- 3M

- Advanced Industrial Coatings

- AkzoNobel N.V.

- Aremco

- Arkema

- Axalta Coating Systems LLC

- BASF

- Belzona International Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co. Ltd.

- KCC Corporation

- Momentive

- PPG Industries Inc.

- Teknos Group

- The Sherwin-Williams Company

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Global Infrastructure Spending

- 4.2.2 Stricter Global Fire-safety Regulations

- 4.2.3 Growing Demand from the Aerospace Industry

- 4.2.4 Rising Awareness Toward Fire Protection Equipment

- 4.2.5 Re-usable Spacecraft and Space-tourism Vehicles

- 4.3 Market Restraints

- 4.3.1 Volatile Silicone and Epoxy Prices

- 4.3.2 VOC Limits on Solvent-borne Systems

- 4.3.3 Applicator Skill Shortage for Multi-layer Systems

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin

- 5.1.1 Silicone

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resins (Polyurethane, Alkyd, etc.)

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Powder

- 5.2.4 UV/EB-curable

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Oil and Gas

- 5.3.3 Power Sector

- 5.3.4 Transportation

- 5.3.5 Woodworking and Furniture

- 5.3.6 Consumer Goods

- 5.3.7 Other End-user Industries (Industrial Processing Equipment, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Advanced Industrial Coatings

- 6.4.3 AkzoNobel N.V.

- 6.4.4 Aremco

- 6.4.5 Arkema

- 6.4.6 Axalta Coating Systems LLC

- 6.4.7 BASF

- 6.4.8 Belzona International Ltd.

- 6.4.9 Hempel A/S

- 6.4.10 Jotun

- 6.4.11 Kansai Paint Co. Ltd.

- 6.4.12 KCC Corporation

- 6.4.13 Momentive

- 6.4.14 PPG Industries Inc.

- 6.4.15 Teknos Group

- 6.4.16 The Sherwin-Williams Company

- 6.4.17 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment