|

市場調查報告書

商品編碼

1844639

催化劑再生:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Catalyst Regeneration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

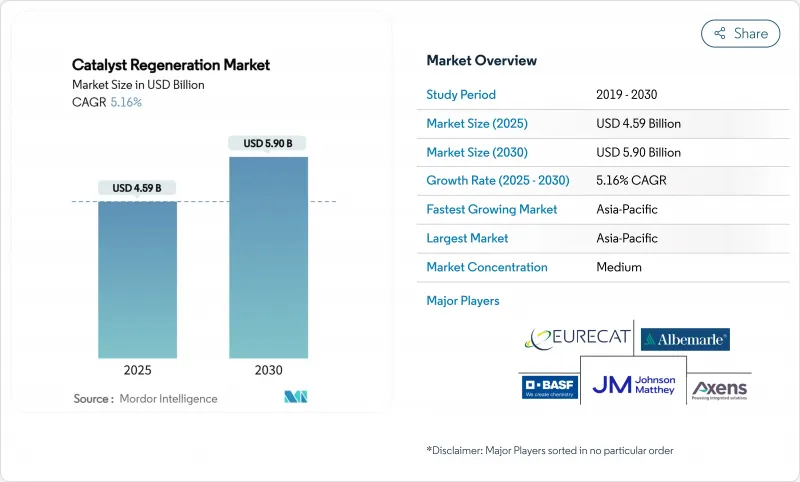

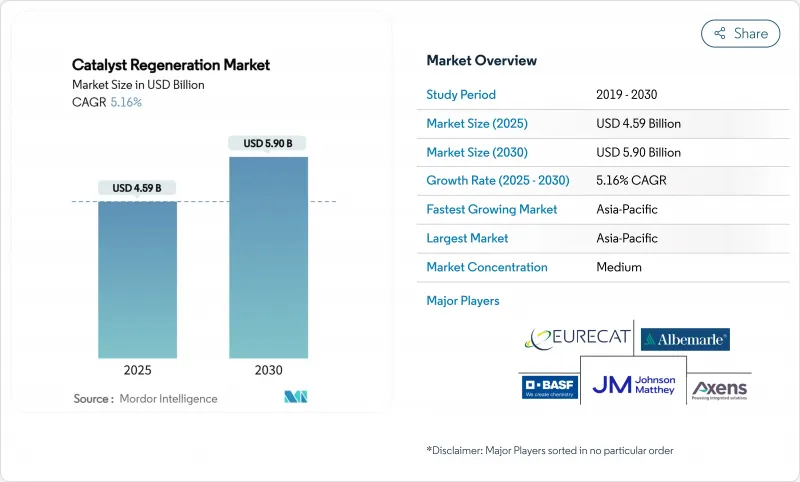

預計 2025 年催化劑再生市場規模為 45.9 億美元,到 2030 年將達到 59 億美元,預測期內(2025-2030 年)的複合年成長率為 5.16%。

這一穩定的成長軌跡得益於日益嚴格的排放法規、不斷上漲的新催化劑成本以及鼓勵低碳生產路線的循環經濟指令的不斷擴展。事實上,煉油廠和石化企業越來越重視廢催化劑的處理,塑膠熱解和揮發性有機化合物 (VOC) 減量等新應用吸引了越來越多的客戶。低溫臭氧氧化和預測分析等技術進步進一步促進了停機時間的減少和成本效率的提高,推動了成熟經濟體和新興經濟體催化劑再生市場的發展。

全球催化劑再生市場趨勢與見解

有關煉油廠和石化排放的嚴格環境法規

國家和地區監管機構正在收緊允許排放法規,從而改變催化劑再利用的經濟性。美國環保署更新的《有害空氣污染物標準》將每年減少2,200噸有害排放,每年帶來超過1億美元的貨幣化健康效益。加州的低碳燃料標準要求在2030年將燃料循環的碳強度降低30%,到2045年降低90%,這推動了對再生催化劑的需求,以符合生命週期核算規則。歐盟的《工業排放指令》已將催化劑再生納入其廢棄物處理的最佳可用技術,進一步加強了以合規為導向的再生主導於掩埋的規定。亞洲各地正在製定類似的法規,迅速擴大催化劑再生的影響。

再生觸媒成本壓力上升

鈀、鉑和銠的價格波動使得再生催化劑的採購成為一項高風險的預算項目。學術評估表明,再生輕度污染的水處理催化劑可以恢復80%以上的基準活性,而成本不到新催化劑的一半。海灣化學冶金公司營運的金屬回收設施通常將99%的廢催化劑轉化為可銷售的鉬和鎳流,從而提高了煉油廠的循環價值。在亞太地區產量較大的樞紐,成本節省倍增,促使設施經理簽訂多年期再生協議。

金屬中毒催化劑回收率降低

重質原油中的釩、鎳和鐵會不可逆地與活性位點結合,進而降低再生產率。實驗室研究表明,釩含量超過5%(重量百分比)會導致孔隙堵塞和相變,使加氫脫硫活性降低一半以上。改良的脫金屬處理方法可以去除高達89.2%的鎳,但通常會以犧牲骨架穩定性為代價,從而限制其再利用週期。因此,使用殘餘原料的業者必須權衡部分回收的成本與購買新催化劑的成本,有時甚至會選擇將其丟棄。

細分分析

現場設施擁有強大的熱處理和化學處理系統,能夠恢復 80-90% 的新鮮活性,到 2024 年將佔據催化劑再生市場佔有率的 73.18%。領先的服務提供者在金屬提取之前在分級窯中去除碳氫化合物、碳和硫,並將再生量通過可無縫插入煉油廠的道路認可桶返回現場。

隨著臭氧氧化技術的成熟,直接在製程設備內應用的原位再生技術正以5.88%的複合年成長率蓬勃發展。連續催化重整器操作員意識到,低溫氧化可以限制反應器的冶金應力,延長容器壽命並減少停機時間。早期採用者報告稱,與將原料送至異地相比,該技術可節省10天的周轉時間,並將每噸催化劑再生的市場成本降低近15%。

催化劑再生報告按方法(原位和非原位)、應用(煉油廠和石化聯合企業、環境、能源和電力、其他應用)和地區(亞太地區、北美、歐洲、南美、中東和非洲)細分。市場預測以美元計算。

區域分析

預計到2024年,亞太地區將佔全球需求的42.54%,這得益於高煉油產能、深度石化一體化以及先進的回收法規。到2030年,催化劑再生市場的複合年成長率將達到5.67%,其中亞太地區將佔據主導地位。日本回收商經營綜合設施,將受污染的催化劑、廢棄電池和電子廢棄物轉化為高純度鈀和釩,確保國內原料的流通。在印度,待開發區的綜合煉油廠計劃投資現場再生列車,以避免跨國廢棄物運輸。

北美正受益於監管確定性和數位化領導力。美國墨西哥灣沿岸的煉油廠正在將運作資料饋送輸入雲端基礎演算法,以推薦最佳燃燒時間;加拿大加氫裂解廠正在接收根據閉合迴路合約交付的回收鈷鉬系統,以確保金屬價格。碳排放稅抵免正在增加第二條收益來源,鼓勵中部大陸的獨立煉油廠在合規調整日期之前安排返工。

在歐洲,嚴格的環境監管與製程技術出口正在取得平衡。法國和德國的授權人正在捆綁供應和再生方案,使中東客戶能夠透過歐洲樞紐獲得「從搖籃到搖籃」的服務。隨著專用反應器轉向客製化催化劑等級,需要精確的再生循環來保持選擇性,歐盟對綠氫能和電子燃料的資助將進一步刺激區域需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 有關煉油廠和石化排放的嚴格環境法規

- 新鮮催化劑的成本壓力不斷增加

- 碳強度要求有利於回收催化劑

- 現場臭氧氧化技術的突破減少了停機時間

- 預測分析實現基於條件的再生

- 市場限制

- 降低金屬污染催化劑的回收率

- 缺乏全球實驗室檢測標準

- 一次性奈米催化劑在特定製程的興起

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依方法

- 礦井外

- 現場施工

- 按用途

- 煉油廠和石化綜合體

- 環境

- 能源和電力

- 其他用途(塑膠熱解、特殊用途)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Advanced Catalyst Systems

- Albemarle Corporation

- AMETEK Inc.

- Axens

- BASF

- CORMETECH

- EBINGER Katalysatorservice GmbH & Co. KG

- Eurecat

- EvoNik Industries AG

- Honeywell International Inc.

- Johnson Matthey

- NIPPON KETJEN Co. Ltd.

- Topsoe A/S

- WR Grace and Co.

- Yokogawa Cororation. of America

第7章 市場機會與未來展望

The Catalyst Regeneration Market size is estimated at USD 4.59 billion in 2025, and is expected to reach USD 5.90 billion by 2030, at a CAGR of 5.16% during the forecast period (2025-2030).

This steady trajectory is underpinned by increasingly stringent emission norms, the escalating cost of fresh catalysts, and expanding circular-economy mandates that reward lower-carbon production routes. In practice, refineries and petrochemical complexes are sharpening focus on end-of-life catalyst handling, while emerging applications in plastics pyrolysis and volatile organic compound (VOC) abatement broaden the customer base. Technology advances such as low-temperature ozone oxidation and predictive analytics further reduce downtime and enhance cost efficiency, reinforcing the momentum of the catalyst regeneration market across both mature and developing economies.

Global Catalyst Regeneration Market Trends and Insights

Strict Environmental Regulations on Refinery and Petrochemical Emissions

National and regional regulators are tightening allowable emission limits, changing the economics of catalyst reuse. The U.S. Environmental Protection Agency's updated hazardous-air-pollutant standards will cut toxic releases by 2,200 short tons a year and deliver monetized health benefits exceeding USD 100 million annually. California's Low Carbon Fuel Standard requires a 30% reduction in fuel-cycle carbon intensity by 2030 and 90% by 2045, elevating demand for regenerated catalysts to comply with lifecycle accounting rules. The EU's Industrial Emissions Directive embeds catalyst regeneration in Best Available Techniques for waste treatment, reinforcing a compliance-driven preference for regeneration over landfill. Across Asia, similar limits are being drafted, ensuring the driver's influence spreads rapidly.

Rising Cost Pressure of Fresh Catalysts

Volatile prices for palladium, platinum, and rhodium have turned fresh catalyst procurement into a high-risk budget item. Academic assessments show that regenerating lightly fouled hydroprocessing catalysts recovers more than 80% of baseline activity at less than half the cost of a new supply. Metal-recovery facilities operated by Gulf Chemical and Metallurgical Corporation routinely convert 99% of spent catalyst into sellable molybdenum and nickel streams, illustrating the circular-value upside for refiners. In volume-heavy APAC hubs, the savings multiply, prompting facility managers to lock in multi-year regeneration contracts.

Lower Recovery on Metal-Poisoned Catalysts

Vanadium, nickel, and iron from heavy crudes bind irreversibly to active sites, curtailing regeneration yields. Laboratory work shows vanadium loads above 5 wt.% slash hydrodesulfurization activity by more than half because of pore blockage and phase changes. Although modified demetallization treatments strip up to 89.2% of nickel, they often damage framework stability, limiting reuse cycles. Operators running resid feeds therefore weigh the cost of partial recovery against fresh catalyst outlay, sometimes opting for disposal.

Other drivers and restraints analyzed in the detailed report include:

- Carbon-Intensity Mandates Favouring Regenerated Catalysts

- On-Site Ozone-Oxidation Breakthroughs Cut Downtime

- Lack of Global Lab Test-Method Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ex-situ facilities captured 73.18% of the catalyst regeneration market share in 2024 on the strength of robust thermal and chemical treatment trains capable of restoring 80-90% of fresh activity. Leading service providers remove hydrocarbons, carbon, and sulfur in staged kilns before metal extraction, delivering regenerated volumes back to the site in road-approved drums that slot seamlessly into refining units.

In-situ regeneration, applied directly inside process equipment, is gaining 5.88% CAGR momentum as ozone-oxidation technology matures. Continuous catalytic reformer operators appreciate that low-temperature oxidation curbs metallurgical stress on reactors, extending vessel life while slashing downtime. Early adopters report 10-day turnaround savings compared with sending material off-site and cutting the catalyst regeneration market cost per tonne by nearly 15%.

The Catalyst Regeneration Report is Segmented by Method (Ex-Situ and In-Situ), Application (Refineries and Petrochemical Complexes, Environmental, Energy and Power, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific carried 42.54% of global demand in 2024 thanks to high refining capacity, deep petrochemical integration, and progressive recycling regulations. Regional growth of 5.67% CAGR through 2030 keeps the catalyst regeneration market firmly centered on APAC. Japanese recyclers run integrated facilities that convert fouled catalyst, spent batteries, and electronic scrap into high-purity palladium and vanadium, ensuring secure domestic raw-material flows. In India, greenfield integrated refineries earmark capex for on-site regeneration trains to avoid cross-border waste shipments.

North America benefits from regulatory certainty and digital leadership. Refineries on the U.S. Gulf Coast stream operating-data feeds to cloud-based algorithms that recommend optimal burn times, while Canadian hydrocrackers receive recycled Co-Mo systems delivered under closed-loop contracts that guarantee metals buy-back pricing. Carbon-tax credits add a second revenue line, nudging mid-continental independent refiners to schedule regeneration just before compliance reconciliation dates.

Europe balances stringent environmental oversight with process-technology exports. French and German licensors bundle supply-and-regeneration packages, allowing clients in the Middle East to receive cradle-to-cradle service routed through European hubs. EU funding for green hydrogen and e-fuels further boosts regional demand as specialty reactors switch to tailored catalyst grades that require precise regeneration cycles to maintain selectivity.

- Advanced Catalyst Systems

- Albemarle Corporation

- AMETEK Inc.

- Axens

- BASF

- CORMETECH

- EBINGER Katalysatorservice GmbH & Co. KG

- Eurecat

- EvoNik Industries AG

- Honeywell International Inc.

- Johnson Matthey

- NIPPON KETJEN Co. Ltd.

- Topsoe A/S

- W.R. Grace and Co.

- Yokogawa Cororation. of America

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strict Environmental Regulations on Refinery And Petrochemical Emissions

- 4.2.2 Rising Cost-Pressure of Fresh Catalysts

- 4.2.3 Carbon-Intensity Mandates Favouring Regenerated Catalysts

- 4.2.4 On-Site Ozone-Oxidation Breakthroughs Cut Downtime

- 4.2.5 Predictive Analytics Enabling Condition-Based Regeneration

- 4.3 Market Restraints

- 4.3.1 Lower Recovery on Metal-Poisoned Catalysts

- 4.3.2 Lack of Global Lab Test-Method Standards

- 4.3.3 Rise of Single-Use Nano-Catalysts in Select Processes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Method

- 5.1.1 Ex-Situ

- 5.1.2 In-Situ

- 5.2 By Application

- 5.2.1 Refineries and Petrochemical Complexes

- 5.2.2 Environmental

- 5.2.3 Energy and Power

- 5.2.4 Other Application (Plastics Pyrolysis, Speciality)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Advanced Catalyst Systems

- 6.4.2 Albemarle Corporation

- 6.4.3 AMETEK Inc.

- 6.4.4 Axens

- 6.4.5 BASF

- 6.4.6 CORMETECH

- 6.4.7 EBINGER Katalysatorservice GmbH & Co. KG

- 6.4.8 Eurecat

- 6.4.9 EvoNik Industries AG

- 6.4.10 Honeywell International Inc.

- 6.4.11 Johnson Matthey

- 6.4.12 NIPPON KETJEN Co. Ltd.

- 6.4.13 Topsoe A/S

- 6.4.14 W.R. Grace and Co.

- 6.4.15 Yokogawa Cororation. of America

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment