|

市場調查報告書

商品編碼

1844624

奈米金屬氧化物:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Nano-Metal Oxides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

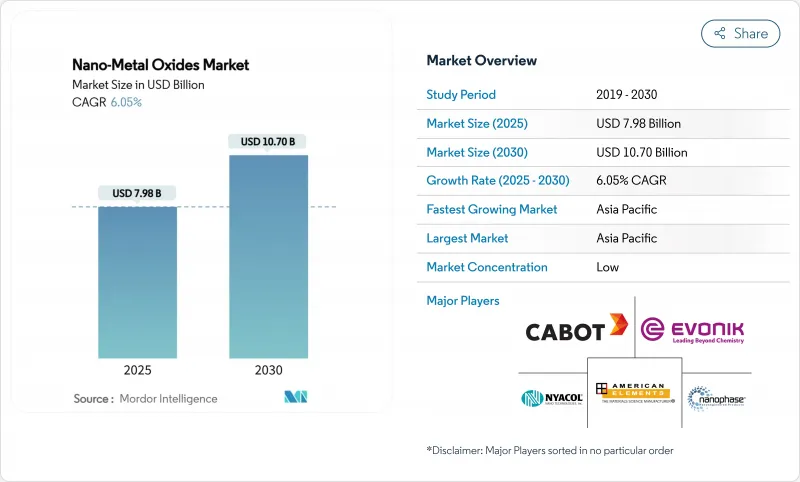

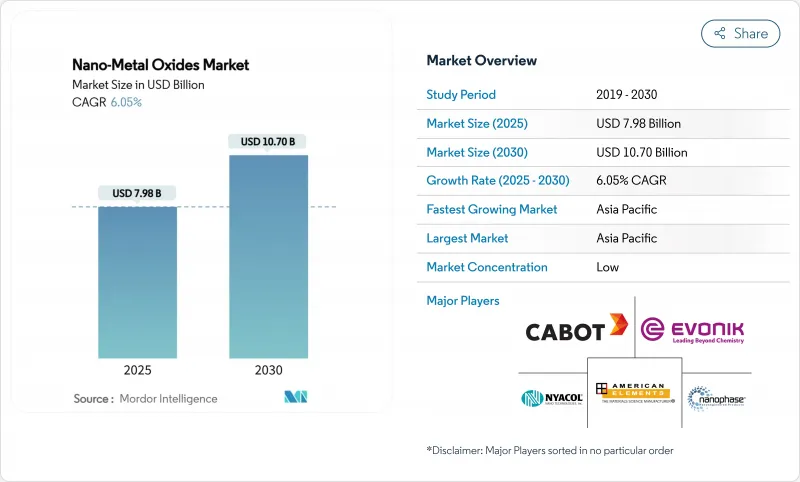

奈米金屬氧化物市場規模預計在 2025 年為 79.8 億美元,預計到 2030 年將達到 107 億美元,預測期內(2025-2030 年)的複合年成長率為 6.05%。

開發行業正在加大這些材料的使用,以增強儲能電極的強度,開發自清潔表面,並突破航太高溫合金的性能極限。隨著配方師以奈米氧化物抗菌劑取代有機除生物劑,以及與傳統製程相比,綠色生物合成可降低30%的能耗和40%的生產成本,這些材料的需求也正在加速成長。隨著全球工巨頭向前體材料供應領域後向整合,以及規模較小的專業公司憑藉特定應用的顆粒設計開拓利基市場,競爭正在分化。亞太地區的製造規模,加上持續的公共研究資金,使其在試點部署和量產方面處於領先地位。

全球奈米金屬氧化物市場趨勢與洞察

奈米材料在航太高溫合金的應用

航太計畫正在採用氧化物彌散強化合金,這種合金在高達 500 度C 的溫度下仍能提供穩定的機械性能,比傳統鋁系統提高了 40%。採用奈米級 L12 沉澱物強化的高熵鎳合金在 -196°C 至 600°C 的溫度下保持一致的抗張強度,消除了高超音速飛機的溫度敏感性瓶頸。由於採用了奈米氧化物填料,波音 787 和空中巴士 A350 平台上的複合機身部分已證明可減輕 20% 的重量,同時保持結構完整性。除了提高承載能力外,嵌入的奈米顆粒還提供電磁屏蔽,保護航空電子設備免受外部干擾。這些綜合優勢加快了資格認證週期,並促成了與一級供應商的採購合約。

個人護理配方中的抗菌需求

消費者對無防腐劑化妝品的偏好推動了人們對氧化鋅奈米顆粒的興趣,這種顆粒可實現90%的細菌生長抑制,且無細胞毒性。多功能二氧化鈦顆粒同時提供紫外線防護和光激活殺滅病原體的功能,從而減少了每個配方的添加劑用量。氧化銅具有卓越的抗真菌活性,支持推出針對抗藥性皮癬菌的高階護膚護膚。向金屬基活性成分的快速轉變縮短了成分列表,並支持潔淨標示聲明,尤其是在法規核准速度很快的亞太地區。隨著品牌商重組其全球SKU組合,擴大化妝品級分散體供應的供應商將獲得先發優勢。

使用金屬粉末對環境的影響

生命週期評估顯示,化學和生物合成的奈米氧化物均可誘導水生物種的氧化壓力和DNA損傷,促使監管機構進行嚴格審查。歐洲食品安全局和美國食品藥物管理局(FDA)目前正在收緊消費品的暴露閾值,這提高了小型生產商的合規成本。回收通訊協定和閉合迴路污水系統正成為授權的先決條件,這增加了綠地計畫的資本支出。因此,市場參與企業必須在創新與嚴格的環境控制之間取得平衡,才能獲得市場准入。

細分分析

二氧化鈦將在2024年佔據奈米金屬氧化物市場佔有率的33.28%,因為其光催化強度和介電穩定性確保了從自清潔建築幕牆到高k電晶體等各種應用。由於利用植物萃取物獲得具有相似能隙但碳足跡較低的生物相容性顆粒的綠色路線,該細分市場將繼續擴張。氧化鈰預計將以7.96%的複合年成長率超越其他同類材料,因為其Ce3+/Ce4+雙態有利於半導體平面化所必需的CMP漿料。二氧化矽和氧化鋅在阻隔膜和皮膚藥膏中仍然可靠,而氧化鐵奈米結構能夠穿透淨化系統,染料分解效率高達89%。

市場勢頭利好那些將顆粒工程與最終用途認證相結合的供應商。二氧化鈦製造商利用食品接觸和化妝品領域廣泛的監管認可,而二氧化鈰製造商則優先考慮晶圓級純度。整合型企業共用前驅體網路,以降低物流成本並增強其在奈米金屬氧化物市場的競爭地位。

預計到2024年,20-80奈米波段將佔據46.25%的市場佔有率,複合年成長率達7.85%,領先其他波段。此波段兼顧了量子表面反應性和製程穩定性,使其易於在油墨和聚合物中分散,同時避免了20奈米以下顆粒常見的聚集現象。 20奈米以下的顆粒具有優異的觸媒活性,但在過濾和防塵方面存在挑戰,導致處理成本高。 80奈米以上的顆粒在光學和耐磨性方面發揮特殊作用,但對於大眾市場應用而言,則處於中階。溶膠-凝膠和水熱反應器的進步如今已允許±5奈米的公差,使配方師能夠確保批次間的一致性。

抓住這一最佳時機的公司正在關注其在光催化中調節能隙和預測塗層流變性的能力。持續的反應器最佳化與線上光譜技術相結合,有望提高產量,鞏固20-80奈米窗口作為奈米金屬氧化物市場主導地位。

區域分析

預計到2024年,亞太地區將佔46.05%的市場佔有率,複合年成長率為8.01%,這得益於中國在全球矽負極材料市場67.8%的佔有率以及日本在先進材料專利領域21.5%的佔有率。垂直整合降低了成本,並加快了從試點到量產的過渡。自2001年以來,政府已投入超過300億美元的資金,用於支持產學研聯盟,以提高技術準備度和勞動力技能。

北美排名第二,受航太供應鏈的推動,該供應鏈需要氧化強化合金和先進的半導體。 American Elements 和 Evonik 等製造商已投資建造用於晶片製造的超高純度膠質氧化矽工廠。

歐洲高度重視生態設計,嚴格的《歐盟化學品註冊、評估、許可和限制》(REACH) 指令推動了綠色生物合成材料的早期應用,建築維修也正在採用近紅外線反射塗層來滿足能源效率要求。南美洲和中東等新興地區正在採用奈米氧化物建築幕牆來打造氣候適應型基礎設施,隨著當地法規的完善,其用量也逐漸增加。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 奈米材料在航太高溫合金的應用

- 個人護理配方中的抗菌需求

- 強化儲能電極

- 油漆和塗料行業對奈米金屬氧化物的需求不斷增加

- 不斷增加的3D列印製程技術

- 市場限制

- 使用金屬粉末對環境的影響

- 前驅金屬價格波動

- 製造成本高

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依產品類型

- 氧化鋁

- 二氧化矽

- 二氧化鈦

- 氧化鋅

- 氧化鐵

- 其他產品類型(例如氧化銅)

- 按粒徑

- 小於20奈米

- 20~80 nm

- 80奈米或更大

- 依合成方法

- 溶膠-凝膠

- 火焰噴霧熱解

- 水熱/熱感

- 化學沉澱

- 綠色/生物合成

- 按最終用戶產業

- 運輸

- 電子產品

- 能源

- 建造

- 個人護理

- 衛生保健

- 其他最終用戶產業(化學品、催化劑等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Advanced Nano Products Co., Ltd.

- American Elements

- Baikowski SA

- Cabot Corporation

- Cerion Nanomaterials

- Chengyin Technology

- Diamon-Fusion International Inc.

- Evonik Industries AG

- MATEXCEL

- Meliorum Technologies, Inc.

- Merck KGaA

- NaBond Technologies Co., Ltd.

- NanoComposix(Fortis Life Sciences)

- Nano-Oxides Inc.

- Nanophase Technologies Corporation

- Nanoshel LLC

- Nissan Chemical Corporation

- NYACOL Nano Technologies, Inc.

- Reinste Nano Ventures

- SkySpring Nanomaterials Inc.

- US Research Nanomaterials, Inc.

第7章 市場機會與未來展望

The Nano-Metal Oxides Market size is estimated at USD 7.98 billion in 2025, and is expected to reach USD 10.70 billion by 2030, at a CAGR of 6.05% during the forecast period (2025-2030), underpinned by the distinct surface area, reactivity and functional tunability that nanostructuring unlocks.

Industries are intensifying the use of these materials to enhance energy storage electrodes, develop self-cleaning surfaces and raise the performance ceiling of aerospace super-alloys. Demand also accelerates as formulators replace organic biocides with nano-oxide antimicrobial agents, while green bio-synthesis trims energy use by 30% and slashes production costs 40% relative to conventional routes. Competition is fragmenting as global chemical majors integrate backward into precursor supply and smaller specialists carve niches through application-specific particle design. Asia-Pacific's manufacturing scale, combined with sustained public research spending, secures the region's lead in pilot adoption and high-volume output.

Global Nano-Metal Oxides Market Trends and Insights

Nanomaterials Adoption in Aerospace Super-Alloys

Aerospace programmes are embedding oxide-dispersion-strengthened alloys that deliver stable mechanical properties up to 500 °C, a 40% improvement on legacy aluminum systems. High-entropy nickel alloys fortified with nanoscale L12 precipitates keep tensile strength constant from -196 °C to 600 °C, removing temperature-sensitivity roadblocks for hypersonic vehicles. Composite fuselage sections on Boeing 787 and Airbus A350 platforms already demonstrate 20% weight savings while preserving structural integrity through nano-oxide fillers. Beyond load-bearing gains, embedded nanoparticles offer electromagnetic shielding that safeguards avionics from external interference. These combined benefits accelerate qualification cycles and ignite procurement contracts across Tier-1 suppliers.

Anti-Microbial Demand in Personal Care Formulations

Consumer preference for preservative-free cosmetics is raising interest in zinc oxide nanoparticles that achieve 90% bacterial growth reduction without cytotoxicity. Multifunctional titanium dioxide particles deliver simultaneous UV protection and photo-activated pathogen kill, reducing additive loading per formulation. Copper oxide offers premium antifungal activity and supports luxury skin-care launches targeting resistant dermatophytes. The swift pivot toward metal-based actives shortens ingredient lists and supports clean-label claims, particularly in Asia-Pacific where regulatory clearance is rapid. Suppliers scaling cosmetic-grade dispersions gain first-mover advantage as brand owners re-formulate global SKU portfolios.

Environmental Implications of Using Metal Powder

Lifecycle assessments reveal that both chemically and bio-synthesised nano-oxides can induce oxidative stress and DNA damage in aquatic species, prompting regulatory scrutiny. The European Food Safety Authority and the FDA now enforce tighter exposure thresholds for consumer products, lifting compliance costs for smaller producers. Recycling protocols and closed-loop wastewater systems are becoming prerequisites for permits, adding capital expenditure to greenfield projects. Market entrants must therefore balance innovation with stringent environmental stewardship to gain market access.

Other drivers and restraints analyzed in the detailed report include:

- Energy Storage Electrode Enhancements

- Growing Demand from Paints and Coatings Industry

- Price Volatility of Precursor Metals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Titanium oxide commanded 33.28% of the nano-metal oxides market share in 2024 as its photocatalytic strength and dielectric stability secured usage from self-cleaning facades to high-k transistors. Segment expansion continues as green routes employ plant extracts to yield biocompatible particles with similar band gaps yet lower carbon footprints. Cerium oxide is projected to outpace peers with a 7.96% CAGR as dual Ce3+/Ce4+ states drive CMP slurries vital for semiconductor planarisation. Silica and zinc oxide remain dependable for barrier films and dermatological creams, while iron oxide nanostructures penetrate remediation systems via 89% dye degradation efficiency.

Market momentum benefits suppliers that align particle engineering with end-use certification. Titanium dioxide makers capitalise on broad regulatory acceptance in food contact and cosmetics, whereas ceria suppliers focus on wafer-scale purity. Integrated firms leverage shared precursor networks to cut logistic costs, reinforcing competitive moats in this slice of the nano-metal oxides market.

The 20-80 nm band represented 46.25% in 2024 and is forecast to lead with a 7.85% CAGR. The interval balances quantum surface reactivity and process stability, offering easy dispersion in inks and polymers while avoiding the agglomeration typical below 20 nm. Sub-20 nm particles deliver superior catalytic rates but raise filtration and dust-safety issues that lift handling costs. Sizes above 80 nm serve niche optical or abrasion-resistant roles yet cede mass-market volumes to the mid-range. Advances in sol-gel and hydrothermal reactors now hold +-5 nm tolerances, giving formulators confidence in batch-to-batch consistency.

Adopters value this sweet spot for tunable band gaps in photocatalysts and predictable rheology in paints. Continued reactor optimisation coupled with inline spectroscopy promises to lift throughput, cementing the 20-80 nm window as the workhorse segment of the nano-metal oxides market.

The Nano-Metal Oxides Market Report is Segmented by Product Type (Alumina, Silica, and More), Particle Size (Less Than 20 Nm, 20-80 Nm, and More), Synthesis Method (Sol-Gel, Flame Spray Pyrolysis, and More), End-User Industry (Transportation, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 46.05% share in 2024 and is projected to record an 8.01% CAGR, anchored by China's 67.8% share of global silicon-anode materials and Japan's 21.5% cut of advanced material patents. Vertical integration compresses costs and quickens pilot-to-mass-production transitions. Government funding exceeding USD 30 billion since 2001 finances university-industry consortia that raise technology readiness and workforce skills.

North America ranks second, supported by aerospace supply chains that require oxide-strengthened alloys and advanced semiconductors. Producers such as American Elements and Evonik invested in ultra-high-purity colloidal silica plants to serve chip fabs.

Europe emphasises eco-design. Strict REACH directives motivate early adoption of green bio-synthesis, and construction retrofits absorb NIR-reflective coatings to meet energy-efficiency mandates. Emerging regions like South America and the Middle East tap nano-oxide facades for climate-resilient infrastructure, gradually lifting their consumption as local regulations mature.

- Advanced Nano Products Co., Ltd.

- American Elements

- Baikowski SA

- Cabot Corporation

- Cerion Nanomaterials

- Chengyin Technology

- Diamon-Fusion International Inc.

- Evonik Industries AG

- MATEXCEL

- Meliorum Technologies, Inc.

- Merck KGaA

- NaBond Technologies Co., Ltd.

- NanoComposix (Fortis Life Sciences)

- Nano-Oxides Inc.

- Nanophase Technologies Corporation

- Nanoshel LLC

- Nissan Chemical Corporation

- NYACOL Nano Technologies, Inc.

- Reinste Nano Ventures

- SkySpring Nanomaterials Inc.

- US Research Nanomaterials, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Nanomaterials adoption in aerospace super-alloys

- 4.2.2 Anti-microbial demand in personal care formulations

- 4.2.3 Energy storage electrode enhancements

- 4.2.4 Growing demand for nano metal oxides from paints and coatings industry

- 4.2.5 Increasing technology of 3D-printing Process

- 4.3 Market Restraints

- 4.3.1 Environmental Implications of Using Metal Powder

- 4.3.2 Price volatility of precursor metals

- 4.3.3 High Production Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Alumina

- 5.1.2 Silica

- 5.1.3 Titanium Oxide

- 5.1.4 Zinc Oxide

- 5.1.5 Iron Oxide

- 5.1.6 Other Product Types (Copper Oxide, etc.)

- 5.2 By Particle Size

- 5.2.1 Less than 20 nm

- 5.2.2 20 - 80 nm

- 5.2.3 Greater than 80 nm

- 5.3 By Synthesis Method

- 5.3.1 Sol-gel

- 5.3.2 Flame Spray Pyrolysis

- 5.3.3 Hydrothermal/ Solvothermal

- 5.3.4 Chemical Vapor Deposition

- 5.3.5 Green/ Bio-synthesis

- 5.4 By End-user Industry

- 5.4.1 Transportation

- 5.4.2 Electronics

- 5.4.3 Energy

- 5.4.4 Construction

- 5.4.5 Personal Care

- 5.4.6 Healthcare

- 5.4.7 Other End-user Industries (Chemicals and Catalysts, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Advanced Nano Products Co., Ltd.

- 6.4.2 American Elements

- 6.4.3 Baikowski SA

- 6.4.4 Cabot Corporation

- 6.4.5 Cerion Nanomaterials

- 6.4.6 Chengyin Technology

- 6.4.7 Diamon-Fusion International Inc.

- 6.4.8 Evonik Industries AG

- 6.4.9 MATEXCEL

- 6.4.10 Meliorum Technologies, Inc.

- 6.4.11 Merck KGaA

- 6.4.12 NaBond Technologies Co., Ltd.

- 6.4.13 NanoComposix (Fortis Life Sciences)

- 6.4.14 Nano-Oxides Inc.

- 6.4.15 Nanophase Technologies Corporation

- 6.4.16 Nanoshel LLC

- 6.4.17 Nissan Chemical Corporation

- 6.4.18 NYACOL Nano Technologies, Inc.

- 6.4.19 Reinste Nano Ventures

- 6.4.20 SkySpring Nanomaterials Inc.

- 6.4.21 US Research Nanomaterials, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment