|

市場調查報告書

商品編碼

1844590

汽車診斷工具:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Diagnostic Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

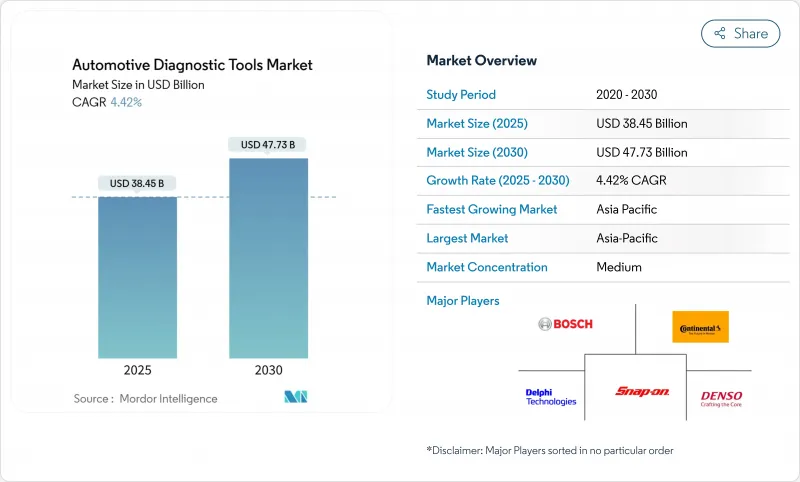

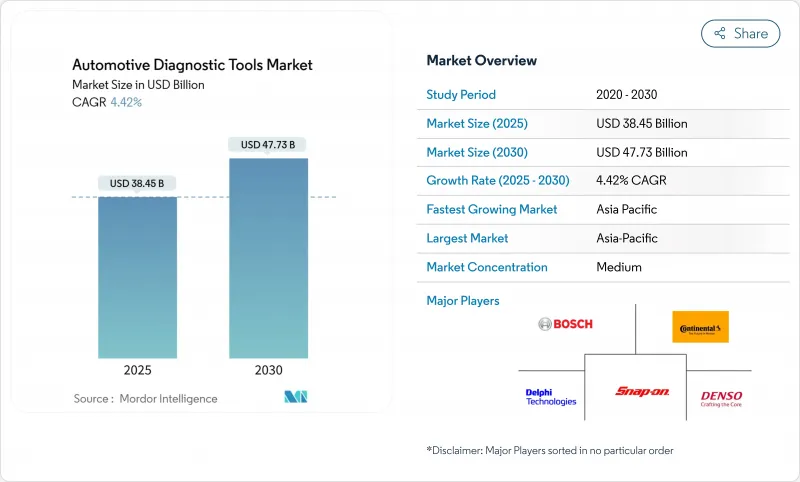

預計到 2025 年汽車診斷工具市場規模將達到 384.5 億美元,到 2030 年將達到 477.3 億美元,複合年成長率為 4.42%。

軟體定義的汽車平臺、日益嚴格的網路安全標準以及電氣化要求,正在推動掃描工具規格向高壓安全、遠端連接和雲端分析方向發展。無線介面、無線更新支援以及符合 ISO/SAE 21434 標準的加密技術,如今已成為大型服務網路的採購標準。將故障碼讀取、ADAS 校準和預測性維護分析整合到單一螢幕的平台整合策略,正日益受到經銷商和車隊營運商的青睞。由於電動車產量成長和政府補貼加速了掃描工具的普及,亞太地區正呈現最強勁的銷售成長動能。

全球汽車診斷工具市場趨勢與見解

動力傳動系統快速電氣化

由於電池式電動車使用高壓電路、熱感包和雙向充電器,因此無法使用標準 OBD-II 讀取器進行診斷。加州計劃到 2026 年強制實施統一的電動車診斷介面,這將迫使工具供應商必須對不同品牌的電池健康狀況、絕緣電阻和充電器故障進行解碼。像 Fluke FEV150 這樣的充電站分析儀現在正逐漸進入維修站,用於檢驗電網互動。供應商也紛紛推出專用的電動車測試儀,例如 THINKTOOL CE EVD,該測試儀涵蓋了 80 多個品牌。由於勞動力認證落後於車輛推廣,用於指導經驗不足的技術人員的數據豐富的工具正在贏得市場佔有率。

更嚴格的OBD-III/遠距離診斷規則

SAE J1979-2 強制要求 2027 年後銷售的內燃機車輛必須支援整合診斷服務。加州空氣資源委員會 (CARB) 和歐盟監管機構也要求即時、雲端基礎的故障報告,將服務從維修店轉移到資料中心。雖然主要工具製造商正在投資安全閘道認證和 ISO/SAE 21434 流程,但規模較小的競爭對手可能難以滿足融資。根據 40 CFR 86.010-18,總重量超過 14,000 磅的大型引擎也面臨並行監控義務。遠端架構允許車隊在故障發生前安排服務,從而減少計劃外停機時間。

進階掃描工具的初始成本高

頂級ADAS校準鑽機和高壓分析儀每個艙室的成本超過5萬美元,這給小型維修廠帶來了沉重的負擔。日本對每家維修廠高達16萬美元的補貼,只能抵銷硬體和訓練總成本的一小部分。訂閱更新會增加擁有成本,但對於總合閘道器存取至關重要。這些經濟因素正在推動獨立公司轉向特許經營網路和像asTech這樣的遠端服務平台,這些平台可以按需租賃OEM工具。

細分分析

OBD掃描器適用於1996年及以後的所有乘用車車型,並在2024年佔據了汽車診斷工具市場的最大佔有率,達到44.58%。儘管這類汽車診斷工具的市場規模仍在不斷擴大,但現代維修站需要ADAS、高壓和雲端同步等複雜功能,而這些功能是傳統手持裝置所缺乏的。 Snap-on的2025年春季程式碼庫為賓士增加了數百萬個測試和安全閘道器,凸顯了將OEM深度嵌入商品硬體的競爭態勢。

電氣系統分析儀的複合年成長率最高,達到 6.18%,依靠藍牙 5.0 和雙頻 Wi-Fi 模組來維持即時遙測上傳期間的吞吐量。壓力洩漏測試儀和電池隔離探頭與核心掃描器相輔相成,確保電動車電池組的熱安全性,Redline Detection 的設備已獲得 Fleet Safety 認證。供應商正在將多個感測器線束整合到一個底盤上,將成本分攤到每個作業中,並為注重預算的研討會提供合理的溢價。

受常規排放和安全檢查的推動,乘用車將在2024年佔據汽車診斷工具市場佔有率的61.35%。然而,車隊貨車和卡車正在推動工具的使用趨勢。到2030年,輕型商用車的複合年成長率將達到6.35%,電子商務將加快交貨週期,從而減少停機時間。像國際卡車公司的OnCommand Connection這樣的平台將即時性能數據輸入雲端儀表板,促使現役訂單,從而減少路邊事故。

總重超過 14,000 磅(約 6,000 公斤)的重型卡車必須遵守更嚴格的 CFR 診斷標準,從而擴展了多品牌設備對通訊協定的支援要求。博世車輛健康報告現在會突出顯示混合負載車輛的冷卻液和機油偏差,使維修經理能夠在引擎損壞之前解決問題。隨著電氣化擴展到送貨車,工具製造商必須在單一工作流程中將燃燒分析與電池分析結合起來,從而簡化技術人員的學習過程並降低庫存。

區域分析

到2024年,亞太地區將佔據汽車診斷工具市場佔有率的36.41%,成長最快,複合年成長率達7.84%。預計2023年中國電動車產量將激增50%,進一步推動10兆元的汽車收益成長,進而支撐對診斷工具的強勁需求。中國政府計劃在2025年前推出自動駕駛汽車,要求在車輛發出前使用支援V2X的診斷設備來檢驗雷達校準和雷射雷達清潔度。日本將於2024年10月開始強制執行OBD檢查,並為維修廠購買掃描工具提供補貼,以確保符合規定。在印度,ASK Auto和愛信的售後市場合資企業將擴展其在南亞地區的零件和服務網路,推動掃描工具在二線城市的普及。

北美緊隨其後,監管勢頭強勁。加州的《先進清潔汽車II》法規將在2026年前強制執行標準化電動車診斷,加州空氣資源委員會(CARB)正在試行遠端車載診斷系統(OBD)概念,以消除實地檢查的需要。車隊採用Uptake的人工智慧健康報告來最佳化維護預算,並增強將數據推送到雲端儀表板的工具升級。原始設備製造商(OEM)經銷商透過Snap-on的2025軟體浪潮,為梅賽德斯-賓士等品牌添加安全閘道器解鎖功能。

在歐洲,聯合國 R155 網路安全法規正在頒布,要求對診斷介面進行型式核准審核。主要供應商正在採用 ISO/SAE 21434 框架來應對這些審核,而特許維修研討會也受惠於法規合規覆蓋。經汽車工業協會認證的培訓計劃正在填補技能缺口,尤其是在高壓維護方面。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 動力傳動系統快速電氣化

- 加強OBD-III/遠距離診斷法規(美國、歐盟)

- 預測性維護分析的需求不斷增加

- 全球輕型車輛數量不斷增加

- OTA 軟體更新診斷整合

- 汽車電子產品日益複雜

- 市場限制

- 進階掃描工具的初始成本高

- 連網工具網路安全認證的障礙

- 獨立售後市場研討會的技能差距

- 原始設備製造商之間的通訊標準分散

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按工具類型

- OBD掃描儀

- 專業掃描工具

- 電氣系統分析儀

- 壓力和洩漏測試儀

- 代碼閱讀器

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中大型商用車

- 透過促銷

- 內燃機

- 純電動車

- 混合動力和插電式混合動力

- 連結性別

- 有線

- 無線/藍牙/Wi-Fi

- 按最終用戶

- OEM經銷商

- 獨立售後市場車庫

- 車隊營運商

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- Snap-on Inc.

- Continental AG

- Delphi/BorgWarner Technologies

- ACTIA Group

- Autel Intelligent Tech

- Launch Tech Co.

- Softing AG

- Vector Informatik GmbH

- KPIT Technologies Ltd.

- Hella KGaA Hueck & Co.

- Texa SpA

- Siemens Digital Industries Software

- Foxwell Tech

- OBD Solutions LLC

- Denso Corporation

- Innova Electronics

- Pico Technology Ltd.

第7章 市場機會與未來展望

The automotive diagnostic tools market size stood at USD 38.45 billion in 2025 and is forecast to reach USD 47.73 billion by 2030, growing at a 4.42% CAGR.

Software-defined vehicle platforms, tighter cybersecurity norms, and electrification mandates are steering tool specifications toward high-voltage safety, remote connectivity, and cloud analytics. Wireless interfaces, over-the-air update support, and ISO/SAE 21434-ready encryption now form baseline purchase criteria for large service networks. Platform integration strategies that bundle fault-code reading, ADAS calibration, and predictive maintenance analytics on a single screen are gaining traction with dealers and fleet operators. Asia-Pacific supplies the strongest volume pull as regional electric-vehicle output and government subsidies accelerate scan-tool adoption.

Global Automotive Diagnostic Tools Market Trends and Insights

Rapid electrification of powertrains

Battery-electric models use high-voltage circuits, thermal packs, and bidirectional chargers that standard OBD-II readers cannot interrogate. California will require a unified EV diagnostic interface by 2026, forcing tool vendors to decode battery health, insulation resistance, and charger faults across brands. Charging-station analyzers such as Fluke FEV150 now join service bays to validate grid interaction. Suppliers answer with purpose-built EV testers like THINKTOOL CE EVD, covering more than 80 brands. Workforce certification lags vehicle rollout, so data-rich tools that guide less-experienced technicians win share.

Tightening OBD-III/remote diagnostics rules

SAE J1979-2 obliges combustion-engine vehicles sold from 2027 to support unified diagnostic services, while the forthcoming J1979-3 standard targets zero-emission models. CARB and EU regulators also press for real-time, cloud-based fault reporting that shifts service from the garage to the data center. Large tool makers invest in secure-gateway credentials and ISO/SAE 21434 processes that small rivals may struggle to fund. Heavy-duty engines above 14,000 lb GVWR face parallel monitoring mandates under 40 CFR 86.010-18. Remote architecture enables fleets to schedule service before breakdowns, reducing unplanned downtime.

High up-front cost of advanced scan tools

Top-tier ADAS calibration rigs and high-voltage analyzers can exceed USD 50,000 per bay, a stretch for small garages. Japan's subsidy of up to JPY 160,000 per shop offsets only a fraction of the total hardware plus training spend. Subscription updates compound ownership cost yet remain essential for secure-gateway access. These economics push independents toward franchise networks or remote-service platforms such as asTech that rent OEM tools on demand.

Other drivers and restraints analyzed in the detailed report include:

- Growing demand for predictive maintenance analytics

- Rising global light-vehicle parc

- Cyber-security certification hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OBD scanners secured the largest slice of the automotive diagnostic tools market at 44.58% in 2024 because they work on every post-1996 passenger model. The automotive diagnostic tools market size attached to this category still grows, yet modern service bays demand combined ADAS, high-voltage, and cloud-sync features that legacy handhelds lack. Snap-on's spring 2025 code library adds millions of tests and secure gateways for Mercedes-Benz, underscoring the race to embed OEM depth inside universal hardware.

Electric-System analyzers, posting the fastest 6.18% CAGR, hinge on Bluetooth 5.0 and dual-band Wi-Fi modules that maintain throughput during live telemetry uploads. Pressure leak testers and battery insulation probes complement the core scanner by ensuring thermal safety in EV packs, with Redline Detection equipment gaining fleet-safety endorsements. Suppliers integrate multiple sensor harnesses into one chassis to spread cost across tasks and justify price premiums amid budget-sensitive workshops.

Passenger cars retained 61.35% of the automotive diagnostic tools market share in 2024, supported by routine emissions and safety inspections. Fleet-oriented vans and trucks, however, drive tool specification trends. Light commercial vehicles grow at 6.35% CAGR to 2030 as e-commerce accelerates delivery cycles that punish downtime. Platforms like International Trucks' OnCommand Connection feed real-time performance data to cloud dashboards, prompting proactive service orders that cut roadside events.

Heavy rigs over 14,000 lb GVWR comply with stricter CFR diagnostics, expanding protocol support requirements inside multi-brand devices. Bosch Vehicle Health reports now highlight coolant and oil deviations on mixed fleets, letting maintenance managers address issues before engine damage. As electrification reaches delivery vans, tool makers must bridge combustion and battery analytics in a single workflow, smoothing technician learning curves and inventory.

The Automotive Diagnostic Scan Tools Market Report is Segmented by Tool Type (OBD Scanners, Professional Scan Tools, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion (Internal Combustion Engine and More), Connectivity (Wired and Wireless and Bluetooth / Wi-Fi), End User (OEM Dealerships and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific holds 36.41% of the automotive diagnostic tools market share in 2024 and expands the fastest at 7.84% CAGR. China's 50% surge in EV production during 2023, plus a 10 trillion-yuan automotive revenue base, keeps tool demand buoyant. Beijing's push toward autonomous-mobility fleets by 2025 requires V2X-aware diagnostics that validate radar alignment and lidar cleanliness before dispatch. Japan begins obligatory OBD inspections in October 2024 and subsidizes scan-tool purchases for workshops to ensure compliance. India's aftermarket joint ventures between ASK Auto and AISIN extend parts and service networks across South Asia, lifting scan-tool penetration in tier-2 cities.

North America follows with strong regulatory momentum. California's Advanced Clean Cars II rule forces standardized EV diagnostics by 2026, and CARB pilots remote-OBD concepts that remove the need for physical inspection visits. Fleets adopt Uptake's AI health reports to optimize maintenance budgets, reinforcing tool upgrades that push data into cloud dashboards. OEM dealerships add secure-gateway unlocks for brands like Mercedes-Benz through Snap-on's 2025 software wave.

Europe aligns with UN R155 cybersecurity rules that demand type-approval audits for diagnostic interfaces. Large suppliers embed ISO/SAE 21434 frameworks to meet these audits, and franchise workshops benefit from corporate compliance coverage. Training schemes certified by the Institute of the Motor Industry close skill gaps, especially for high-voltage servicing.

- Robert Bosch GmbH

- Snap-on Inc.

- Continental AG

- Delphi/BorgWarner Technologies

- ACTIA Group

- Autel Intelligent Tech

- Launch Tech Co.

- Softing AG

- Vector Informatik GmbH

- KPIT Technologies Ltd.

- Hella KGaA Hueck & Co.

- Texa S.p.A.

- Siemens Digital Industries Software

- Foxwell Tech

- OBD Solutions LLC

- Denso Corporation

- Innova Electronics

- Pico Technology Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid electrification of powertrains

- 4.2.2 Tightening OBD-III/remote diagnostics regulations (U.S., EU)

- 4.2.3 Growing demand for predictive maintenance analytics

- 4.2.4 Rising global light-vehicle parc

- 4.2.5 Integration of OTA software update diagnostics

- 4.2.6 Escalating in-vehicle electronics complexity

- 4.3 Market Restraints

- 4.3.1 High up-front cost of advanced scan tools

- 4.3.2 Cyber-security certification hurdles for connected tools

- 4.3.3 Skills gap in independent aftermarket workshops

- 4.3.4 Fragmented communication standards across OEMs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Tool Type

- 5.1.1 OBD Scanners

- 5.1.2 Professional Scan Tools

- 5.1.3 Electric-System Analyzers

- 5.1.4 Pressure & Leak Testers

- 5.1.5 Code Readers

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.3 By Propulsion

- 5.3.1 Internal Combustion Engine

- 5.3.2 Battery-Electric Vehicle

- 5.3.3 Hybrid & Plug-in Hybrid

- 5.4 By Connectivity

- 5.4.1 Wired

- 5.4.2 Wireless / Bluetooth / Wi-Fi

- 5.5 By End User

- 5.5.1 OEM Dealerships

- 5.5.2 Independent Aftermarket Garages

- 5.5.3 Fleet Operators

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Snap-on Inc.

- 6.4.3 Continental AG

- 6.4.4 Delphi/BorgWarner Technologies

- 6.4.5 ACTIA Group

- 6.4.6 Autel Intelligent Tech

- 6.4.7 Launch Tech Co.

- 6.4.8 Softing AG

- 6.4.9 Vector Informatik GmbH

- 6.4.10 KPIT Technologies Ltd.

- 6.4.11 Hella KGaA Hueck & Co.

- 6.4.12 Texa S.p.A.

- 6.4.13 Siemens Digital Industries Software

- 6.4.14 Foxwell Tech

- 6.4.15 OBD Solutions LLC

- 6.4.16 Denso Corporation

- 6.4.17 Innova Electronics

- 6.4.18 Pico Technology Ltd.

7 Market Opportunities & Future Outlook

- 7.1 Remote Diagnostics-as-a-Service

- 7.2 ADAS & Autonomous Calibration Tools

- 7.3 Subscription-based Software Licensing