|

市場調查報告書

商品編碼

1844585

輻射固化塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Radiation Curable Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

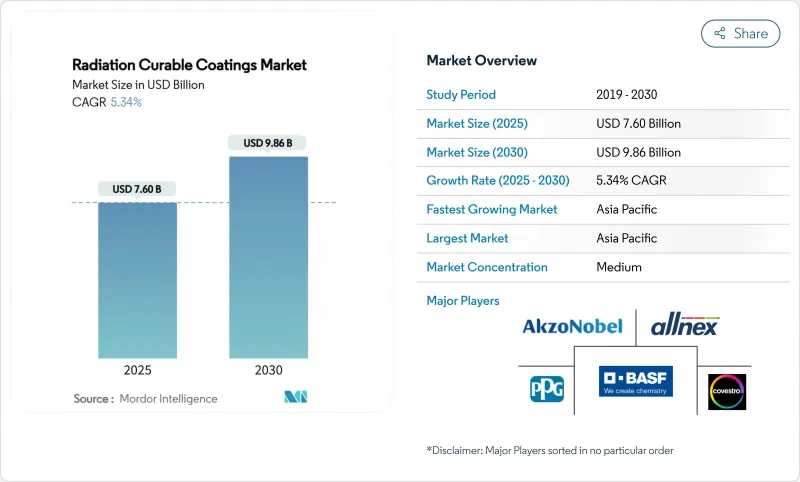

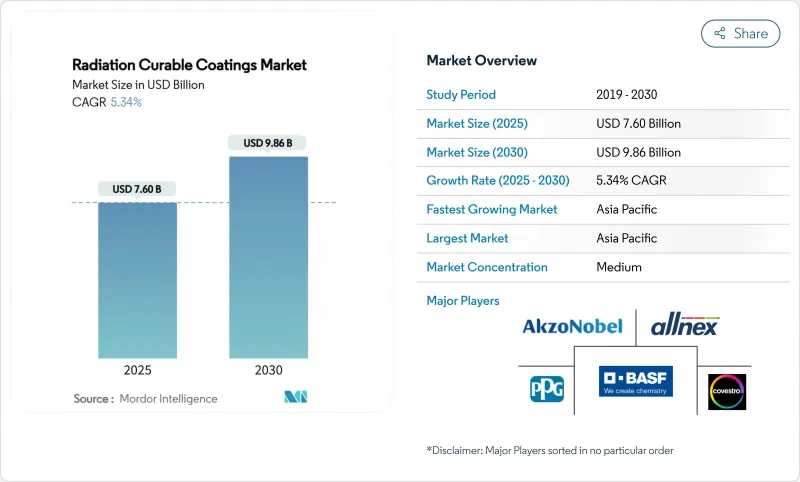

輻射固化塗料市場規模預計在 2025 年達到 76 億美元,預計到 2030 年將達到 98.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.34%。

市場參與企業將此成長歸因於全球範圍內VOC法規的加強、對節能生產方法的探索以及無溶劑化學技術的穩步應用。亞太地區憑藉著監管協調和新型工業化生產,鞏固了其區域優勢。美國環保署(EPA)針對氣霧塗料的揮發性有機化合物排放標準於2025年1月17日生效,合規截止日期延長至2027年1月17日,為製造商提供了24個月的時間來改進其產品,監管勢頭加速了市場採用。

全球輻射固化塗料市場趨勢與洞察

日益嚴格的VOC和碳中和法規加速了無溶劑UV/EB的採用

全球各地的監管機構持續降低揮發性有機化合物 (VOC) 的允許基準值,推動輻射固化被覆劑市場朝向無溶劑、100% 固體含量配方邁進。美國環保署於 2025 年 1 月 17 日更新了氣溶膠塗料的 VOC排放標準,並給予製造商兩年時間實施。加州空氣資源委員會正在實施類似的限制措施,將水和豁免化合物排除在「VOC 限值」的計算之外。這些措施旨在獎勵那些部署了無需溶劑爐即可即時固化的紫外光或電子束 (EB) 生產線的塗料企業,從而減少能源消耗並提高工廠產量。工業維護塗料的聯邦基準值上限為 450 克/公升,但一些州已將此限值降低至 100-250 克/公升,這使得無溶劑技術更具吸引力。

對高吞吐量包裝和數位印刷生產線的需求

生產感壓標籤、軟質包裝和折疊紙盒的加工商依靠UV油墨來省去傳統印刷機漫長的乾燥過程。即時固化印刷品在排放線上完全黏合,可即時進行整理和運輸,這對於即時訂單和個人化設計至關重要。行業出版物預測,快速自動化、永續性以及數位和柔印混合工作流程將在2025年定義包裝產業。像Inks International這樣的設備供應商已經推出了兼容LED的能量固化油墨套裝,這些油墨符合食品接觸通訊協定,並支持用於收縮套標的大容量白色油墨。諸如此類的解決方案正在鞏固輻射固化塗料在包裝印刷應用中的市場地位。

特種寡聚物和光引發劑高成本

與商品樹脂相比,專用寡聚物鏈和高純度光引發劑的成本顯著增加。 2025年美國關稅導致的運費溢價、加拿大和墨西哥某些原物料價格上漲25%以及許多中國產品價格上漲10%,進一步加劇了塗料製造商的採購預算壓力,迫使一些公司調整籌資策略。太陽化學及其同行已採取臨時價格溢價措施,以抵消原料成本上漲的影響,這凸顯了整個輻射固化被覆劑市場的利潤壓力。

細分分析

到2024年,寡聚物將佔據輻射固化塗料市場45.77%的佔有率,引領價值鏈。預計與寡聚物相關的輻射固化被覆劑市場規模將穩定擴大,以滿足聚酯、胺甲酸乙酯、環氧樹脂和丙烯酸等不同終端應用的需求。 Alnex的UCECOAT 7856就是一個典型案例,它為高光澤地板提供無溶劑分散體,消除了傳統的揮發性有機化合物(VOC)。

同時,隨著LED專用光引發劑在低能量波長範圍內的應用成長,以保護生產線操作員免受高溫燈罩的傷害,預計光引發劑的複合年成長率將達到6.88%。單體持續調節黏度和交聯密度,實驗室使用生物基甲基丙烯酸酯稀釋劑來減少對化石燃料的依賴。

受易於改裝的經濟效益和強大的全球分銷網路的推動,到2024年,紫外線燈將佔裝置容量的69.67%。工廠正在用摻鐵燈替換老化的汞燈,從而從現有生產線中提取更高的照度,並推遲了大規模檢修。然而,與電子束設備相關的輻射固化塗料市場可能成長最快,到2030年複合年成長率將超過7.10%,因為加工商越來越重視光引發劑固化、深層薄膜滲透和氧不敏感聚合等優勢。電子束生產線現在能夠處理阻隔包裝中常見的厚顏料體系,這引起了食品罐頭廠和保護性被覆劑的興趣。

LED-UV 光源曾經僅限於窄幅標籤印刷機,如今由於動作溫度很少超過 40°C,它已應用於寬幅圖形和工業拼花線的照明。混合雙固化裝置融合了紫外線和濕氣固化化學成分,以確保在陰影凹槽中的黏合性,而新型雷射誘導光聚合裝置則有望透過將曝光時間縮短至毫秒級,實現秒級的生產效率飛躍。

輻射固化被覆劑報告按原料(寡聚物、單體、光引發劑、添加劑)、固化技術(紫外線燈、電子束、其他)、樹脂化學(環氧丙烯酸酯、胺甲酸乙酯丙烯酸酯、聚酯丙烯酸酯、其他)、最終用戶行業(木材和家具、包裝和印刷油墨、電子和半導體、其他地區(亞太地區)和歐洲地區(亞太地區)。

區域分析

亞太地區佔據市場主導地位,佔41.23%,預計到2024年複合年成長率為6.05%,使該地區呈現雙頭主導格局。中國、日本和印度在電子、包裝和汽車領域佔據主導地位,隨著國內環境法規日益向歐洲標準看齊,這些國家推動了原料需求的持續成長。家具、地板材料和塑膠消費品的添加劑產能正從越南中部向中國東部沿海地區擴張,而紫外光固化木器漆和塑膠面漆的營業額則保持在高位。

在北美,美國)的指令正在推動無溶劑塗料的普及,加州更是為揮發性有機化合物(VOC)法規設定了全國基準。密西根州和安大略省的汽車原始設備製造商正在將LED-UV光固化隧道應用於內飾,以減少能源足跡。然而,美國於2025年推出的關稅制度正在鼓勵固化樹脂製造商加強國內後向整合,並降低市場波動性。

歐洲的願景集中在綠色交易和 REACH 的擴展上,後者已從 2025 年 9 月起禁止在指甲產品中使用 TPO光引發劑。計劃於 2026 年對面板製造商實施甲醛限制,並限制包裝和包裝廢棄物,這將加強有利於輻射固化化學品的市場環境。

隨著跨國公司為規避運輸和外匯風險而建立衛星塗層設施,南美、中東和非洲地區的需求正在興起,但仍然強勁。巴西的軟性塑膠薄膜印刷和沙烏地阿拉伯的板式家具等計劃表明,從北美引進的環境法規正在加速技術轉移。雖然當地配方製造商仍依賴進口寡聚物,但逐步收緊的法規意味著,一旦基礎設施和技能發展,這些地區很可能會成為下一個成長點。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 日益嚴格的VOC和碳中和法規加速了無溶劑UV/EB的普及

- 對高吞吐量包裝和數位印刷生產線的需求

- 超薄電子產品和穿戴式裝置三防膠的成長

- 亞太地區家具及地板製造產能快速擴張

- 原始設備製造商轉向汽車內裝零件的線上 LED-UV 固化

- 市場限制

- 特種寡聚物和光引發劑高成本

- 歐盟 REACH 分類變更後醯基氧化膦供應緊張

- 新興生物構裝基板的熱敏感性

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按原料

- 寡聚物

- 單體

- 光引發劑

- 添加劑

- 透過固化技術

- 紫外線燈

- 電子束

- 混合/雙重固化

- 微波/紅外線

- 依樹脂化學

- 環氧丙烯酸酯

- 胺甲酸乙酯丙烯酸酯

- 聚酯丙烯酸酯

- 丙烯酸酯

- 其他(有機矽、乙烯基醚)

- 按最終用戶產業

- 木材/家具

- 包裝印刷油墨

- 電子和半導體

- 汽車和運輸設備

- 醫療設備

- 3D列印/積層製造

- 其他(光學、建築)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- 3M

- Akzo Nobel NV

- Allnex Netherlands BV

- Arkema

- Ashland

- Axalta Coating Systems LLC

- BASF

- Covestro AG

- Dymax Corporation

- Evonik Industries AG

- Henkel AG & Co. KGaA

- Lord Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- Rahn AG

- The Sherwin-Williams Company

- Watson Coatings, Inc.

第7章 市場機會與未來展望

The Radiation Curable Coatings Market size is estimated at USD 7.60 billion in 2025, and is expected to reach USD 9.86 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

Market participants attribute this upswing to stricter global VOC limits, the search for energy-efficient production methods, and steady uptake of solvent-free chemistries. Asia Pacific secured regional primacy on the back of regulatory harmonisation and new industrial output. Regulatory momentum accelerates market adoption as the EPA's National Volatile Organic Compound Emission Standards for aerosol coatings took effect January 17, 2025, with compliance deadlines extended to January 17, 2027, creating a 24-month window for manufacturers to reformulate products.

Global Radiation Curable Coatings Market Trends and Insights

Tightening VOC and Carbon-Neutrality Regulations Accelerate Solvent-Free UV/EB Adoption

Global regulators continue to narrow permissible VOC thresholds, a move that propels the radiation-curable coatings market toward 100% solids formulas that emit no solvents. The United States Environmental Protection Agency enforced updated National VOC Emission Standards for aerosol coatings on 17 January 2025, giving manufacturers a two-year window to reassess formulations. California's Air Resources Board operates parallel limits that exclude water and exempt compounds from "VOC regulatory" calculations. Together, these measures reward coaters that deploy UV or electron-beam (EB) lines capable of instant curing without solvent ovens, thereby trimming energy footprints and boosting plant throughput. Federal thresholds cap industrial maintenance coatings at 450 g/L, yet some states press down to 100-250 g/L, intensifying the appeal of solvent-free technologies.

Demand for High-Throughput Packaging and Digital Printing Lines

Converters running pressure-sensitive labels, flexible packaging, and folding cartons rely on UV inks to eliminate the long drying stages that slow conventional presses. Instant-cure prints exit the line fully bonded, permitting immediate finishing and shipment, vital for just-in-time orders and personalised designs. Trade journals foresee rapid automation, sustainability compliance, and hybrid digital-flexo workflows defining packaging in 2025. Equipment suppliers such as INX International have responded with LED-compatible energy-curable ink sets that satisfy food-contact protocols and support high-opacity whites for shrink sleeves. These solutions strengthen the position of the radiation-curable coatings market within print-for-pack applications.

High Cost of Specialised Oligomers and Photoinitiators

Tailored oligomer backbones and high-purity photoinitiators add notable expense compared with commodity resins. Freight surcharges arising from 2025 US tariffs, 25% on selected Canadian and Mexican inputs, and 10% on many Chinese goods have further strained coating producers' procurement budgets, prompting several companies to re-engineer sourcing strategies. Sun Chemical and peer formulators adopted temporary price surcharges to offset the spike in raw-material outlays, highlighting margin pressure across the Radiation curable coatings market.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Ultra-Thin Electronic and Wearable Device Conformal Coatings

- Rapid Expansion of Asia Pacific Furniture and Flooring Manufacturing Capacity

- Supply Tightness After EU REACH Reclassification of Acyl-Phosphine Oxides

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oligomers steered the value chain with 45.77% radiation curable coatings market share in 2024, underpinned by their decisive role in film hardness, flexibility, and chemical resistance. The radiation-curable coatings market size tied to oligomers is expected to widen steadily as producers exploit polyester-, urethane-, and epoxy-acrylated backbones to serve contrasting end-use demands. Allnex's UCECOAT 7856 exemplifies progress, delivering a solvent-free dispersion for high-gloss flooring that eliminates traditional VOCs.

In parallel, photoinitiators are projected to chart a 6.88% CAGR because LED-specific grades thrive under lower-energy wavelengths, safeguarding line operators from high-temperature lamp housings. Monomers continue to regulate viscosity and cross-link density, with laboratories channeling bio-based methacrylate diluents to cut fossil dependence.

UV lamps accounted for 69.67% of the 2024 installed capacity thanks to simple retrofit economics and a robust global distributor network. Plants replacing ageing mercury bulbs with iron-doped variants have squeezed higher irradiance out of existing lines, postponing large-scale overhauls. However, the radiation-curable coatings market size associated with electron-beam units could expand the fastest, potentially topping 7.10% CAGR to 2030 as converters weigh the merits of photoinitiator-free curing, deep-film penetration, and oxygen-insensitive polymerisation. EB lines now handle thick pigmented systems common in barrier packaging, spurring interest among food canners and protective-coatings applicators.

LED-UV sources, once confined to narrow-web label presses, now illuminate wide-format graphics and industrial parquet lines because operating temperatures rarely exceed 40 °C. Hybrid dual-cure set-ups merge UV and moisture-curable chemistries to ensure adhesion in shadowed recesses, whereas novel laser-induced photopolymerisation units promise second-level productivity leaps by cutting exposure times to milliseconds.

The Radiation Curable Coatings Report is Segmented by Raw Material (Oligomers, Monomers, Photoinitiators, and Additives), Curing Technology (UV Lamp, Electron Beam, and More), Resin Chemistry (Epoxy Acrylate, Urethane Acrylate, Polyester Acrylate, and More), End-User Industry (Wood and Furniture, Packaging and Printing Inks, Electronics and Semiconductor, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia Pacific holds a commanding role with a 41.23% 2024 share and a 6.05% CAGR outlook that places the region on a dual leadership trajectory. China, Japan, and India dominate electronics, packaging, and automotive sectors, delivering constant feedstock demand as domestic environmental regulations increasingly mirror European norms. Additive capacity for furniture, flooring, and plastic consumer goods is expanding from central Vietnam to eastern coastal China, keeping UV-curable wood lacquers and plastic topcoats in high rotation.

North America remains technology-rich, with EPA edicts steering solvent-free adoption and California acting as a bellwether for national VOC limits. Automotive OEMs in Michigan and Ontario now integrate LED-UV tunnels for interior trims to achieve energy-footprint reductions. The US tariff regime introduced in 2025 has, however, prompted curing-resin producers to strengthen domestic backward integration to buffer volatility.

Europe's vision focuses on the Green Deal and REACH expansions, which have banned TPO photoinitiators in nail products since September 2025. The incoming 2026 formaldehyde rules for panel producers and the Packaging and Packaging Waste Regulation reinforce market conditions favourable to radiation-curable chemistries.

Across South America, the Middle East, and Africa, demand is emergent yet steady as multinationals deploy satellite coating facilities to sidestep freight and currency risk. Projects in Brazil for flexible plastic film printing and in Saudi Arabia for panel furniture underscore how environmental codes imported from Europe and North America accelerate technology transfer. While local formulators still rely on imported oligomers, gradual regulatory tightening suggests these regions will constitute the next growth flank once infrastructure and skills deepen.

- 3M

- Akzo Nobel N.V.

- Allnex Netherlands B.V.

- Arkema

- Ashland

- Axalta Coating Systems LLC

- BASF

- Covestro AG

- Dymax Corporation

- Evonik Industries AG

- Henkel AG & Co. KGaA

- Lord Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- Rahn AG

- The Sherwin-Williams Company

- Watson Coatings, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening VOC and Carbon?Neutrality Regulations Accelerate Solvent-Free UV/EB Adoption

- 4.2.2 Demand for High-Throughput Packaging and Digital Printing Lines

- 4.2.3 Growth in Ultra-Thin Electronic and Wearable Device Conformal Coatings

- 4.2.4 Rapid Expansion of Asia Pacific Furniture and Flooring Manufacturing Capacity

- 4.2.5 OEM Shift to In-Line LED-UV Curing for Automotive Interior Parts

- 4.3 Market Restraints

- 4.3.1 High Cost of Specialized Oligomers and Photoinitiators

- 4.3.2 Supply Tightness after EU REACH Reclassification of Acyl-Phosphine Oxides

- 4.3.3 Thermal Sensitivity of Emerging Bio-Based Packaging Substrates

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts

- 5.1 By Raw Material

- 5.1.1 Oligomers

- 5.1.2 Monomers

- 5.1.3 Photoinitiators

- 5.1.4 Additives

- 5.2 By Curing Technology

- 5.2.1 UV Lamp

- 5.2.2 Electron Beam

- 5.2.3 Hybrid / Dual-Cure

- 5.2.4 Microwave / Infra-red

- 5.3 By Resin Chemistry

- 5.3.1 Epoxy Acrylate

- 5.3.2 Urethane Acrylate

- 5.3.3 Polyester Acrylate

- 5.3.4 Acrylic Ester

- 5.3.5 Others (Silicone, Vinyl Ether)

- 5.4 By End-User Industry

- 5.4.1 Wood and Furniture

- 5.4.2 Packaging and Printing Inks

- 5.4.3 Electronics and Semiconductor

- 5.4.4 Automotive and Transportation

- 5.4.5 Medical Devices

- 5.4.6 3D Printing/Additive Manufacturing

- 5.4.7 Others (Optical, Construction)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Allnex Netherlands B.V.

- 6.4.4 Arkema

- 6.4.5 Ashland

- 6.4.6 Axalta Coating Systems LLC

- 6.4.7 BASF

- 6.4.8 Covestro AG

- 6.4.9 Dymax Corporation

- 6.4.10 Evonik Industries AG

- 6.4.11 Henkel AG & Co. KGaA

- 6.4.12 Lord Corporation

- 6.4.13 Nippon Paint Holdings Co., Ltd.

- 6.4.14 PPG Industries, Inc.

- 6.4.15 Rahn AG

- 6.4.16 The Sherwin-Williams Company

- 6.4.17 Watson Coatings, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment