|

市場調查報告書

商品編碼

1844582

汽車溫度感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Temperature Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

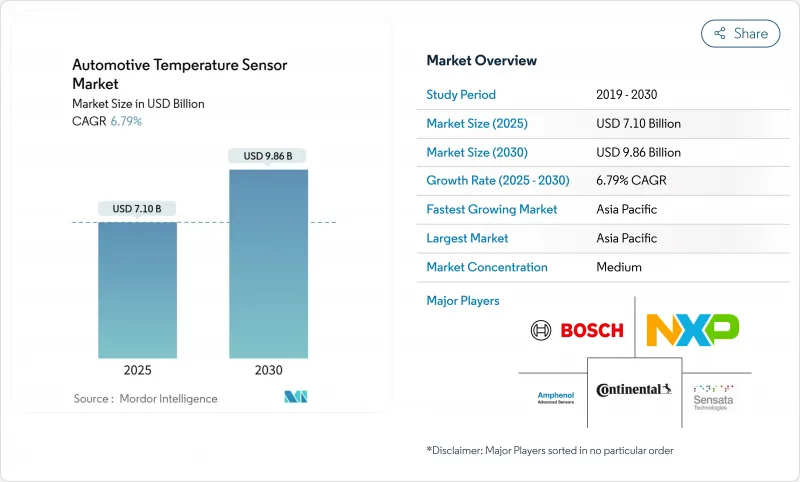

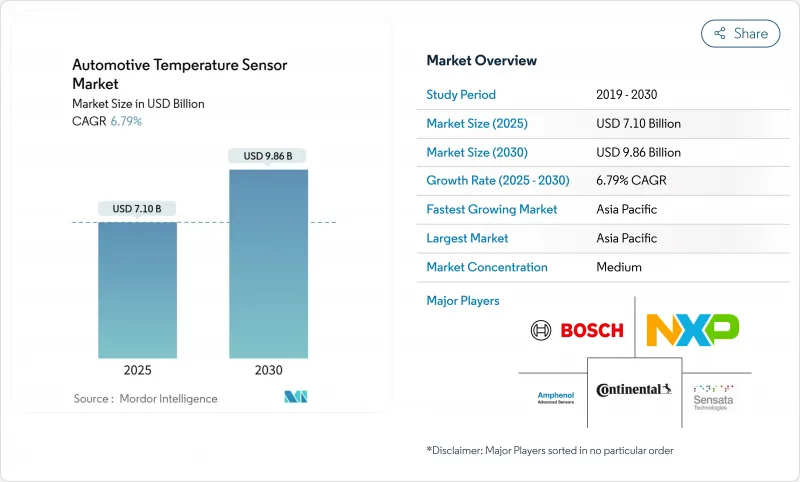

預計2025年汽車溫度感測器市場價值將達到71億美元,到2030年將達到98.6億美元,複合年成長率為6.79%。

快速的電氣化正在推動成長,每輛純電動車 (BEV) 都採用近 150 個感測點。區域電子架構壓縮了佈線,並推動了對能夠透過車載乙太網路報告的多點測量節點的需求。基於碳化矽 (SiC) 逆變器建構的 800V 高壓傳動系統需要能夠在 600°C 以上保持穩定性能的高精度感測器,而隨著內燃機車型的淘汰,歐7 和國六 b 法規擴大了排氣溫度監測窗口。高階內裝座艙健康功能、固態電池試點以及向晶圓級感測器封裝的轉變,正在刺激原始設備製造商和服務管道的銷售進一步成長。

全球汽車溫度感測器市場趨勢與洞察

SiC 基電力電子裝置的採用正在加速,對電動車逆變器的熱精度要求也不斷提高

SiC 開關使驅動模組能夠維持接近 600°C 的結溫,同時與矽相比,轉換效率提高 30%。因此,每個 SiC 半橋增加了兩到三個溫度檢測點,以防止熱失控,並最佳化 800V 快速充電的降額曲線。安森美半導體和其他供應商的代工擴張表明,熱數據對於閘極驅動器校準和逆變器保固延長至關重要。

區域架構ECU的普及推動多點溫度監控

基於區域控制器建構的車輛網路取代了數十個獨立的ECU,減少了30%的佈線量,同時提高了密封鋁製外殼內的熱密度。設計人員現在透過本地I3C鏈路分佈微型數位感測器,使韌體能夠即時平衡負載、風扇轉速和冗餘度。在歐洲高階平台上的初步部署已證明其現場可靠性,足以說服量產車型OEM在2026年後進行遷移。

一級NTC熱敏電阻器標準化降低價格

一級線束製造商正在圍繞1 kΩ至100 kΩ的曲線製定標準化規格,從而實現批量採購,使價格每年下降3%至5%。純熱敏電阻器供應商正採取相應措施,將輸出功率轉換為適用於250 度C溫度範圍的更高阻值環氧塗層磁珠,或將市場轉向內建校準表的數位IC,以保持利潤率。

細分分析

由於熱敏電阻器在冷卻液、暖通空調和入門級電池模組中成本低廉且可靠性得到驗證,到2024年,其在汽車溫度感測器市場中的佔有率將達到43%。每輛純電動車(BEV)已採用超過100個NTC元件,即使單位價格下降,由熱敏電阻器驅動的汽車溫度感測器市場規模也必將穩定成長。這項傳統技術的強大影響力迫使高階汽車將NTC與區域運算中心的線性化演算法結合,以彌補精度差距。

至2030年,基於半導體的IC感測器將以8.8%的複合年成長率發展。其±0.4°C的精度和直接的I3C/I^2C輸出簡化了其在輪轂馬達等受限區域的應用。隨著系統設計人員逐步淘汰笨重的補償表,汽車溫度感測器市場將受益於性能和材料清單效率的同步提升。熱電偶仍將嵌入渦輪增壓器外殼中,溫度高於900 度C。

乘用車仍將是汽車溫度感測器的主導市場,到2024年將佔其銷售額的68.5%。高階車型中先進的座艙舒適度演算法利用多個感測節點來調節微噴射、加熱座椅和分區暖通空調百葉窗。大陸集團的工廠試驗報告顯示,由於在生產線上配備了額外的溫度診斷裝置,整體設施效率提高了15%,證明了上游工程也是感測器的消費載體。

純電動車是成長最快的產品領域,複合年成長率為 10.3%。所有電池模組均在匯流排上安裝熱敏電阻器,在電池極耳下嵌入薄膜電阻式溫度檢測器 (RTD),並採用晶粒進行非接觸式監控。輕型商用電動廂型車現已配備氣體逸出感測器,可將預警資料傳送至車輛儀錶板,從而將熱安全性與資產可用性指標結合。在亞洲人口稠密的城市中,使用小型抗振環氧密封負溫度係數 (NTC) 磁珠的二輪車正在不斷普及。

區域分析

到了2024年,亞太地區將佔據汽車溫度感測器市場的41.6%,這反映其全球最大汽車生產基地的地位。預計到2030年,中國組裝商的先進電子元件本地產量將從15%提高到60%,這將為國內熱敏電阻器和積體電路工廠提供更多的設計中標機會。日本和韓國將繼續大力投資於採用高密度感測陣列的固態電池試點項目,這將在未來十年內增加其對該地區汽車溫度感測器市場規模的貢獻。

歐洲則位居第二,這得益於歐盟七國嚴格的法規,這些法規強制要求進行即時排放分析,以及一系列注重車內溫度調節的高階車型。德國原始設備製造商在分區架構部署方面處於領先地位,每個新的控制器叢集都擁有獨立的環境、電路板邊緣溫度和MOSFET背面晶片晶粒,從而將需求擴展到多個產品系列。萊茵河谷附近的供應商正在推出鎳薄膜RTD生產線的產能,以規避鉑金短缺,從而增強區域自給自足能力。

北美保持強勁地位,這得益於皮卡和SUV廣泛採用基於SiC的驅動模組,這些車型更傾向於使用800V推進系統來牽引拖車。當地電池製造的立法激勵措施正推動感測器採購轉向垂直整合的美國工廠。中東地區目前規模較小,但隨著利雅德和杜拜自動駕駛專區的建立,以及配備冗餘熱感節點以保護計算叢集免受沙漠高溫影響的L4級穿梭巴士成為常態,預計該地區的複合年成長率將達到9.2%。在南美,成長主要由靈活燃料動力傳動系統(此類動力系統仍需要排放感測器)以及巴西特大城市營運的新興電動公車所推動。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義研究範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- SiC 基電力電子裝置的採用正在加速,對電動車逆變器的溫度精度要求也越來越高

- 區域架構ECU的快速成長,促進了多點溫度監控

- EU7 和中國 VI-b排放氣體法規要求廢氣溫度感測器的工作範圍更廣

- 固態電池組溫度控管的必要性

- 高級汽車對座艙健康感知器(暖通空調空氣品質和座椅舒適度)的需求不斷增加

- 半導體封裝轉向汽車級晶圓級感測器

- 市場限制

- 一級製造商NTC熱敏電阻器標準化導致價格下降

- RTD 中使用的高純度鎳和鉑的供應鏈波動

- 商用車改裝率落後

- 低成本 MEMS 感測器的交叉敏感度和漂移問題限制了其在售後市場的採用

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章市場規模及成長預測

- 依感測器類型

- 熱敏電阻器(NTC/PTC)

- 電阻溫度檢測器(RTD)

- 熱電偶

- 半導體IC感測器

- MEMS和紅外線感測器

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 大型商用車

- 摩托車和微型交通工具

- 按用途

- 動力傳動系統(內燃機、混合動力)

- 電池和電力傳動系統

- 底盤和安全系統

- 車身和舒適電子設備

- 遠端資訊處理和連接模組

- 按銷售管道

- OEM安裝

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 德國

- 法國

- 義大利

- 西班牙

- 英國

- 北歐的

- 其他歐洲國家

- 中東

- 波灣合作理事會

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN-5

- 其他亞太地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- NXP Semiconductors NV

- Sensata Technologies, Inc.

- Amphenol Advanced Sensors

- Robert Bosch GmbH

- Continental AG

- Texas Instruments Inc.

- TE Connectivity Ltd.

- Panasonic Holdings Corp.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- STMicroelectronics NV

- Denso Corporation

- BorgWarner Inc.(Delphi Technologies)

- Vishay Intertechnology, Inc.

- Microchip Technology Inc.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Littelfuse, Inc.

第7章 市場機會與未來展望

The automotive temperature sensor market is valued at USD 7.1 billion in 2025 and is forecast to reach USD 9.86 billion by 2030, advancing at a 6.79% CAGR.

Growth is anchored by rapid electrification, with battery-electric vehicles (BEVs) installing close to 150 sensing points per car, nearly triple the requirement in combustion platforms. Zonal electronic architectures are compressing wiring looms and pushing demand for multi-point measurement nodes that can report through automotive Ethernet. High-voltage 800 V drivetrains built around silicon-carbide (SiC) inverters need precision sensors that remain stable above 600 °C, while EU7 and China VI-b regulations widen exhaust temperature monitoring windows as internal-combustion models sunset. Cabin health features in premium trims, solid-state battery pilots, and the migration to wafer-level sensor packaging are catalyzing additional volume in both OEM and service channels.

Global Automotive Temperature Sensor Market Trends and Insights

Accelerating Adoption of SiC-Based Power Electronics Intensifying Thermal Accuracy Requirements in EV Inverters

SiC switches enable drive modules to sustain junction temperatures near 600 °C while boosting conversion efficiency by 30% compared with silicon. Each SiC half-bridge therefore integrates two to three extra temperature sensing points to guard against thermal runaway and to optimise derating curves during 800 V fast charging. Foundry expansions at Onsemi and other suppliers underline how thermal data has become mission-critical for gate-drive calibration and extended inverter warranties.

Rapid Growth of Zonal-Architecture ECUs Driving Multi-Point Temperature Monitoring

Vehicle networks built on zone controllers replace dozens of standalone ECUs, trimming wiring mass by 30% yet raising heat density inside sealed aluminium housings. Designers now distribute small digital sensors on local I3C links so that firmware can balance load, fan speed and redundancy in real time. Early deployments across premium European platforms are demonstrating field reliability that is convincing volume-segment OEMs to transition from 2026 onward.

Price-Erosion from Standardisation of NTC Thermistors among Tier-1s

Tier-1 harness builders have harmonised specifications around 1 kΩ to 100 kΩ curves, allowing large volume buys that drive annual price concessions of 3%-5%. Pure-play thermistor vendors are responding by shifting output to higher-value epoxy--coated beads for 250 °C zones or by moving up-market into digital ICs that embed calibration tables to secure margins.

Other drivers and restraints analyzed in the detailed report include:

- EU7 and China VI-b Emission Norms Mandating Exhaust Gas Sensors with Wider Range

- Thermal Management Imperatives in Solid-State Battery Packs

- Supply-Chain Volatility of High-Purity Nickel & Platinum Used in RTDs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermistors retained a 43% share of the automotive temperature sensor market in 2024 owing to their low cost and proven reliability in coolant, HVAC and entry-level battery modules. Each BEV already deploys more than 100 NTC elements, and the automotive temperature sensor market size attributable to thermistors is on course to rise steadily even as unit prices drift lower. The firm grip of this legacy technology has forced higher-end vehicles to pair NTCs with linearisation algorithms inside zonal compute hubs to reconcile accuracy gaps.

Semiconductor-based IC sensors are advancing at an 8.8% CAGR through 2030. Their +-0.4 °C accuracy and direct I3C/I^2C output simplify harnessing in confined zones such as in-wheel power electronics, where every millimetre counts. As system designers phase out bulky compensation tables, the automotive temperature sensor market benefits from simultaneous gains in performance and bill-of-materials efficiency. RTDs continue serving precision exhaust feedback loops despite metal volatility, while thermocouples stay embedded in turbo housings that exceed 900 °C.

Passenger cars commanded 68.5% of 2024 revenue and remain the anchor for the automotive temperature sensor market. Sophisticated cabin comfort algorithms in premium trims exploit multiple sensing nodes to modulate micro-jets, seat heaters and zoned HVAC louvers. Continental's factory trials reported a 15% uplift in overall equipment effectiveness after equipping production lines with additional thermal diagnostics - evidence that upstream manufacturing is also a consumption vector for sensors.

BEVs represent the fasting-growing cohort at a 10.3% CAGR. Every battery module clips thermistors to bus bars, embeds thin-film RTDs under cell tabs, and situates infrared die for non-contact monitoring-collectively doubling the automotive temperature sensor market size per vehicle relative to hybrids. Light commercial e-vans now integrate gas-generation detection sensors that relay early warning data to fleet dashboards, aligning thermal safety with asset-availability metrics. Two-wheelers in dense Asian cities add scale, leveraging compact, epoxy-sealed NTC beads resistant to vibration.

Automotive Temperature Sensor Manufacturers and the Market is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Application (Powertrain, Body Electronics, Alternative Fuel Vehicles, and More), Sensor Type (Thermistor, Thermocouple, and More), Sales Channel(OEM-Fitted and More) and Geography). The Market Sizes and Forecasts are Provided in Terms of Value in (USD).

Geography Analysis

Asia-Pacific held 41.6% of automotive temperature sensor market share in 2024, reflecting its status as the world's largest vehicle production hub. Chinese assemblers are localising advanced electronic content from 15% to 60% by 2030, funnelling additional design-win opportunities to domestic thermistor and IC fabs. Japan and South Korea continue to invest heavily in solid-state battery pilots, which embed denser sensing arrays and lift the region's contribution to automotive temperature sensor market size through the decade.

Europe ranks second, propelled by stringent EU7 rules that require real-time exhaust gas analytics and by a strong premium vehicle pipeline that emphasises in-cabin climate refinement. German OEMs spearhead zonal architecture rollouts; each new controller cluster carries its own ambient, board-edge, and MOSFET backside die, spreading demand across multiple product families. Suppliers located near the Rhine valley are setting up nickel-film RTD lines to navigate platinum scarcity, reinforcing regional self-sufficiency.

North America maintains a robust position thanks to high uptake of SiC-based drive modules in pickup trucks and SUVs that favour 800 V propulsion for trailer towing. Legislative incentives for local battery manufacturing are steering sensor sourcing toward vertically integrated US facilities. The Middle East, although small today, is forecast to clock a 9.2% CAGR as purpose-built autonomous mobility zones in Riyadh and Dubai standardise L4 shuttles loaded with redundant thermal nodes to safeguard compute clusters against desert heat. South America's incremental growth is linked to flex-fuel powertrains that still need exhaust gas sensors alongside emergent electric buses operating in Brazilian megacities.

- NXP Semiconductors N.V.

- Sensata Technologies, Inc.

- Amphenol Advanced Sensors

- Robert Bosch GmbH

- Continental AG

- Texas Instruments Inc.

- TE Connectivity Ltd.

- Panasonic Holdings Corp.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Denso Corporation

- BorgWarner Inc. (Delphi Technologies)

- Vishay Intertechnology, Inc.

- Microchip Technology Inc.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Littelfuse, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Adoption of SiC-based Power Electronics Intensifying Thermal Accuracy Requirements in EV Inverters

- 4.2.2 Rapid Growth of Zonal-Architecture ECUs Driving Multi-Point Temperature Monitoring

- 4.2.3 EU7 and China VI-b Emission Norms Mandating Exhaust Gas Temperature Sensors with Wider Operating Range

- 4.2.4 Thermal Management Imperatives in Solid-State Battery Packs

- 4.2.5 Rising Demand for Cabin Health Sensors (HVAC Air Quality and Seat Comfort) in Premium Vehicles

- 4.2.6 Semiconductor Packaging Shift to Automotive-Grade Wafer-Level Sensors

- 4.3 Market Restraints

- 4.3.1 Price-Erosion from Standardization of NTC Thermistors among Tier-1s

- 4.3.2 Supply-Chain Volatility of High-Purity Nickel and Platinum Used in RTDs

- 4.3.3 Slow Retrofit Rates in Commercial Vehicle Fleets

- 4.3.4 Cross-Sensitivity and Drift Issues in Low-Cost MEMS Sensors Limiting Aftermarket Adoption

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Thermistor (NTC/PTC)

- 5.1.2 Resistance Temperature Detector (RTD)

- 5.1.3 Thermocouple

- 5.1.4 Semiconductor-Based IC Sensor

- 5.1.5 MEMS and Infra-Red Sensor

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.2.4 Two-Wheelers and Micro-Mobility

- 5.3 By Application

- 5.3.1 Powertrain (ICE, Hybrid)

- 5.3.2 Battery and Electric Drive-Train

- 5.3.3 Chassis and Safety Systems

- 5.3.4 Body and Comfort Electronics

- 5.3.5 Telematics and Connectivity Modules

- 5.4 By Sales Channel

- 5.4.1 OEM-Fitted

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 Italy

- 5.5.3.4 Spain

- 5.5.3.5 United Kingdom

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East

- 5.5.4.1 Gulf Cooperation Council

- 5.5.4.2 Turkey

- 5.5.4.3 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Nigeria

- 5.5.5.3 Rest of Africa

- 5.5.6 Asia-Pacific

- 5.5.6.1 China

- 5.5.6.2 Japan

- 5.5.6.3 India

- 5.5.6.4 South Korea

- 5.5.6.5 ASEAN-5

- 5.5.6.6 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 NXP Semiconductors N.V.

- 6.4.2 Sensata Technologies, Inc.

- 6.4.3 Amphenol Advanced Sensors

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Continental AG

- 6.4.6 Texas Instruments Inc.

- 6.4.7 TE Connectivity Ltd.

- 6.4.8 Panasonic Holdings Corp.

- 6.4.9 Murata Manufacturing Co., Ltd.

- 6.4.10 TDK Corporation

- 6.4.11 Honeywell International Inc.

- 6.4.12 Infineon Technologies AG

- 6.4.13 STMicroelectronics N.V.

- 6.4.14 Denso Corporation

- 6.4.15 BorgWarner Inc. (Delphi Technologies)

- 6.4.16 Vishay Intertechnology, Inc.

- 6.4.17 Microchip Technology Inc.

- 6.4.18 Analog Devices, Inc.

- 6.4.19 Renesas Electronics Corporation

- 6.4.20 Littelfuse, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment