|

市場調查報告書

商品編碼

1844574

預浸料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Prepreg - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

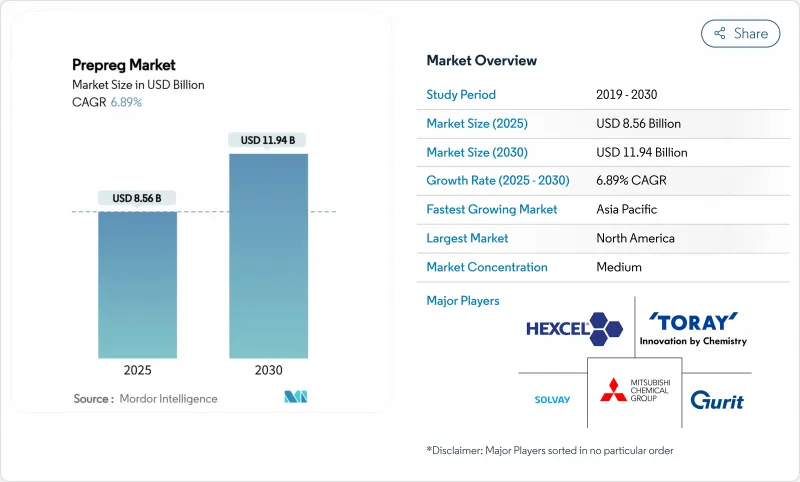

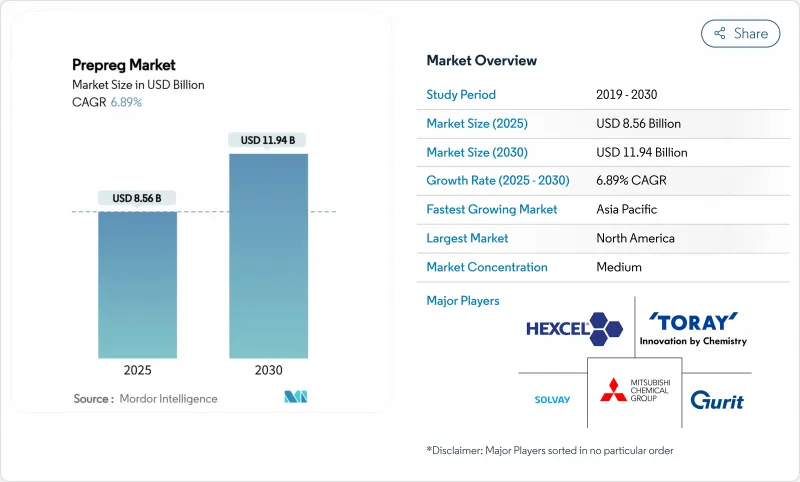

預浸料市場規模預計在 2025 年為 85.6 億美元,預計到 2030 年將達到 119.4 億美元,預測期內(2025-2030 年)的複合年成長率為 6.89%。

依賴複合材料密集機翼和機身的民航機專案、葉片長度超過100公尺的離岸風力發電裝置,以及青睞熱塑性結構的新興eVTOL平台,都在推動這項擴張。航太強勁的燃油經濟性、政策主導的可再生能源建設以及汽車輕量化政策,正在增強對結構複合材料的需求,即便熱壓罐的能源成本和回收缺口抑制了短期成長勢頭。高壓釜差異化依賴垂直整合、自動化積層法技術以及認證的材料資料庫,這些資料庫能夠在控制成本的同時保障品質。供應環境略顯緊張,現有供應商正竭力在中國產能快速擴張的情況下維持物價點,尤其是在標準模量碳纖維等級方面。

全球預浸料市場趨勢與洞察

航太和國防生產率提高

商用飛機產量正在上升,波音 777X 和空中巴士 A350 飛機分別使用了超過 50% 重量的碳纖維增強聚合物,延續了複合材料製造計畫。高升力結構部件、機身和機翼蒙皮依賴經過認證的環氧基預浸料,以滿足嚴格的疲勞和抗損傷要求。北約成員國的民航機現代化反映了這一趨勢,傳統機隊正在維修輕型任務系統,以擴大航程和有效載荷。長期合約使東麗和赫氏等供應商能夠攤銷認證成本,同時確保穩定的交付。隨著每架飛機的複合材料使用量的增加,在專有材料資料庫的支持下,預浸料市場正受益於銷售成長和平均售價上漲。

增加風力發電機葉片的長度

如今,離岸風電轉子的平均直徑已超過200米,葉片長度也超過100米,對翼梁帽的剛度要求也隨之提高。碳纖維預浸料翼梁帽可在保持結構完整性的同時減輕25%的樹脂轉注成形和自動化纖維鋪放技術縮短了生產週期,降低了人事費用,並增強了成本競爭力。北海和南海離岸風力發電專案的加速推進將維持對碳纖維的需求,確保預浸料市場有強勁的長期供應。

高壓高壓釜固化生產線的資本投資和營運成本高

大型航太高壓釜的資本成本超過200萬美元,運作6至8小時的熱壓循環,耗能龐大。規模較小的二級供應商面臨較高的資金籌措壁壘,這限制了它們的全球擴張,並在需求激增時帶來供應瓶頸的風險。非高壓釜製程(真空袋固化、樹脂灌注和基於爐的循環)可將能耗降低高達50%,但目前尚無法複製高壓釜在主要結構件上的孔隙率控制效果。在次級航太零件中推廣使用熱壓罐將降低成本。然而,機身和機翼認證的延遲將使高壓釜繼續佔據主導地位,並繼續抑制預浸料的市場滲透。

細分分析

由於民航機和彈道級國防硬體認證的不斷深入,熱固性樹脂系統在2024年的收入成長率將達到73.45%。環氧樹脂仍然是機翼和機身的關鍵材料,高溫固化製程可在飛機的整個生命週期中提供穩定的機械性能。相較之下,受電動垂直起降飛機(eVTOL)、汽車和儲氫需求不斷成長的推動,熱塑性樹脂的複合年成長率預計將達到8.88%。這一成長將在2025年至2030年期間為預浸料市場貢獻13.5億美元的收入。聚醚醚酮和聚苯硫系列產品的耐熱溫度高達220°C,可實現感應焊接。

封閉式物料流的驅動力增強了熱塑性塑膠的吸引力。使用高噸位壓縮機的汽車原始設備運作商報告稱,從傳統的180°C環氧循環轉換為三分鐘以內的熱塑性宣傳活動後,循環時間縮短了40%。同時,雙馬來亞醯胺和酚醛樹脂在需要符合阻燃、防煙和毒性標準的高溫噴射引擎管道和內裝板領域佔有一席之地。整體而言,不同樹脂化學成分之間截然不同的成長軌跡確保了預浸料市場的競爭多樣性。

到2024年,碳纖維的以金額為準將佔據主導地位,達到81.22%,因為其無與倫比的剛度重量比能夠滿足商用客機、航太發射和一級方程式賽車的需求。飛機空重每減輕一公斤,在其整個生命週期內即可節省高達75噸的燃料。然而,預計到2030年,玻璃纖維的複合年成長率將達到7.99%,主要得益於5G電子設備、LED基板以及對成本敏感且模量要求較低的行動應用。採用專用玻璃纖維預浸料配製的高頻印刷基板層壓板可滿足24 GHz及以上雷達的介電基準要求。

在風力發電機梁帽中,碳纖維蒙皮和玻璃芯織物結合的混合層壓板可以最佳化重量、擴大可用體積,同時降低原料成本。醯胺纖維在防彈和衝擊能量吸收領域的市場影響有限,這凸顯了每種增強材料所發揮的特定作用。隨著中國製造商擴大生產規模,低等級碳纖維的價格下降,導致相對成本Delta擴大,並在性能裕度較小的領域引發了關於替代材料的爭論。

區域分析

2024年,北美將維持預浸料最大的市場佔有率,達到37.88%,這得益於波音公司複合材料飛機787、777X以及獨特的航太發射結構。美國國防部的現代化計畫將把材料需求擴大到旋翼機、無人機系統和高超音速飛機,從而確保穩定的多年期訂單。該地區的認證生態系統有利於赫氏和東麗先進複合材料等國內供應商,它們運作從碳化到預分級的垂直整合生產線。儘管如此,在窄體交付量進行重大調整後,2025年商用航太的銷售額將下降,凸顯出在國防訂單積壓強勁的情況下,短期波動的訂單。

亞太地區已成為成長最快的地區,預計到2030年的複合年成長率將達到8.12%。中國國有碳纖維製造商預計在2030年前控制全球近50%的產能,從而降低價格分佈並促進更廣泛的工業應用。中國商飛的C919和CR929等國內航太項目以及國產電動垂直起降(eVTOL)原型機正在吸引對高等級預浸料的需求。日本的東麗和帝人憑藉高模量纖維和汽車熱塑性層壓板保持著技術領先地位,而韓國的儲存槽計畫則正在刺激絲束預浸料的成長。

在空中巴士機翼組裝、英國先進推進系統研發以及北海積極的離岸風力發電目標的支持下,歐洲將保持中等個位數成長。政策制定者正在加強對消費後複合複合材料廢棄物的審查,並加快對可回收高價值纖維的熱解和溶劑分解中試工廠的投資。固瑞特決定擴大在德國的航太預浸料產能,同時關閉瑞士的一條生產線,這表明在歐洲能源價格緊張的情況下,成本正在合理化。同時,儘管可再生能源和民航機中的輕質材料享有豁免,但汽車複合材料的應用仍面臨有關潛在碳纖維限制的監管不確定性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 航太和國防建設率飆升

- 增加風力發電機葉片的長度

- 碳纖維預浸材在高階汽車和運動應用中的興起

- eVTOL 與城市空中交通對熱塑性預浸料的需求

- 用於拖曳氫壓力容器的預浸料吊桿

- 市場限制

- 高壓高壓釜固化生產線的資本和營運成本高昂

- 碳纖維供應鏈不穩定

- 回收和報廢處理基礎設施薄弱

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依樹脂類型

- 熱固性樹脂

- 熱塑性樹脂

- 依纖維類型

- 碳

- 玻璃

- 芳香聚醯胺

- 按形狀

- UD膠帶

- 絲束預浸料

- 織物/紡織品

- 有機板

- 按最終用戶產業

- 航太/國防

- 風力發電機

- 車

- 電氣和電子

- 運動休閒

- 其他行業

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 東南亞

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- AGC INC.

- Axiom Materials

- DIC Corporation

- Gurit Services AG

- Hexcel Corporation

- Huntsman International LLC

- Isola Group

- Mitsubishi Chemical Group Corporation

- NTPT

- Park Aerospace Corp.

- Renegade Materials Corporation

- SGL Carbon

- Solvay

- Teijin Limited

- THE YOKOHAMA RUBBER CO., LTD.

- Toray Industries Inc.

- Ventec International Group

- Victrex plc

第7章 市場機會與未來展望

The Prepreg Market size is estimated at USD 8.56 billion in 2025, and is expected to reach USD 11.94 billion by 2030, at a CAGR of 6.89% during the forecast period (2025-2030).

Commercial aircraft programs that rely on composite-rich wings and fuselages, offshore wind installations that push blade lengths past 100 m, and emerging eVTOL platforms that favor thermoplastic structures collectively underpin this expansion. Strong fuel-burn economics in aerospace, policy-driven renewable-energy build-outs, and vehicle lightweighting regulations reinforce structural-composite demand even as autoclave energy costs and recycling gaps temper near-term momentum. Competitive differentiation hinges on vertical integration, automated lay-up technologies, and certified material databases that safeguard quality while controlling cost. A moderate but tightening supply landscape leaves incumbent suppliers defending price points against rapid Chinese capacity additions, particularly in standard-modulus carbon fiber grades.

Global Prepreg Market Trends and Insights

Surging Aerospace and Defense Build-Rates

Commercial aircraft production is rising as Boeing's 777X and Airbus's A350 continue composite-heavy build schedules, each incorporating more than 50% carbon-fiber-reinforced polymer by weight. High-lift structural components, fuselage barrels, and wing skins rely on certified epoxy-based prepreg that meets stringent fatigue and damage-tolerance requirements. Defense modernization across NATO members mirrors these trends, retrofitting legacy fleets with lighter mission systems that extend range and payload. Long-term contracts allow suppliers such as Toray Industries and Hexcel Corporation to amortize qualification costs while guaranteeing stable deliveries. As composite usage per aircraft climbs, the prepreg market benefits from both volume growth and higher average selling prices anchored by proprietary material databases.

Wind-Turbine Blade Length Escalation

Average offshore rotor diameters now exceed 200 m, forcing blade lengths above 100 m and increasing spar-cap stiffness demands. Carbon-fiber prepreg spar caps reduce blade weight by 25% while maintaining structural integrity, enabling larger turbines to be installed on existing jacket foundations. European OEMs such as Vestas have shifted from fiberglass to hybrid carbon-glass architectures, and Chinese manufacturers are following to meet capacity-addition targets. Vacuum-assisted resin transfer molding and automated fiber placement shorten cycle times and cut labor expenses, bolstering cost competitiveness. With offshore wind commitments accelerating in the North Sea and South China Sea, sustained carbon-fiber demand secures a robust long-term pipeline for the prepreg market.

High Cap-ex and OPEX of Autoclave Curing Lines

Large-format aerospace autoclaves exceed USD 2 million in capital cost and operate 6-8-hour heat-pressure cycles that consume substantial energy. Smaller Tier-2 suppliers face steep financing barriers, limiting global expansion and introducing supply-bottleneck risk when demand surges. Out-of-autoclave processes-vacuum-bag-only curing, resin-infusion, and oven-based cycles-reduce energy by up to 50% but cannot yet replicate autoclave-derived porosity control for primary structures. Incremental adoption in secondary aerospace parts lowers cost envelopes; however, any delay in fuselage or wing certification sustains the autoclave's dominance and continues to restrain wider prepreg market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Carbon-Prepreg Penetration in Premium Autos and Sports

- eVTOL and Urban-Air-Mobility Demand for Thermoplastic Prepregs

- Carbon-Fiber Supply-Chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoset systems retained 73.45% revenue in 2024, underpinned by certification depth in commercial aviation and ballistic-grade defense hardware. Epoxies remain indispensable for primary wings and fuselage sections where high-temperature cures translate to consistent mechanical properties over the aircraft life cycle. In contrast, thermoplastic grades are projected to advance at an 8.88% CAGR on rising eVTOL, automotive, and hydrogen-storage requirements. That expansion contributes USD 1.35 billion to the prepreg market size between 2025 and 2030. Polyetheretherketone and polyphenylene sulfide families deliver heat resistance up to 220 °C and allow induction welding, thereby reducing assembly fastener counts and maintenance downtime.

The push for closed-loop material flows strengthens thermoplastic appeal, as scrap off-cuts can be re-melted into secondary mouldings without degrading performance. Automotive OEMs running high-tonnage compression presses report cycle-time improvements of 40% when switching from classic 180 °C epoxy cycles to sub-3-minute thermoplastic campaigns. Meanwhile, bismaleimide and phenolic systems hold their niche in high-temperature jet-engine ducts and interior panels that demand flame-smoke-toxicity compliance. Overall, contrasting growth trajectories between resin chemistries ensure competitive diversity within the prepreg market.

Carbon fiber controlled 81.22% by value in 2024 as its unmatched stiffness-to-weight ratio underpins commercial airliner, space-launch, and Formula 1 requirements. Each additional kilogram trimmed from an aircraft's operating empty weight saves up to 75 t of fuel over its service life, a direct economic lever that keeps carbon pricing resilient even during downturns. Glass fiber, however, is projected for 7.99% CAGR growth through 2030, riding 5G electronics, LED substrates, and cost-sensitive mobility applications that tolerate lower modulus values. High-frequency printed-circuit-board laminates formulated with specialized glass-fiber prepreg meet dielectric benchmarks for 24 GHz radar and beyond.

Hybrid laminates combining carbon skins with glass core fabrics in wind-turbine spar caps optimize weight while lowering raw-material cost, widening addressable volume. Aramid fibers retain limited market presence in ballistic protection and impact-energy absorption but underscore the material-specific role each reinforcement plays. As Chinese producers scale output, lower-grade carbon fiber pricing compresses, widening the relative cost delta and spurring substitution debates where performance margins are narrower.

The Prepreg Market Report is Segmented by Resin Type (Thermoset, Thermoplastic), Fiber Type (Carbon, Glass, Aramid), Form (Unidirectional Tapes, Tow Prepreg, Fabric/Woven, Organosheets), End-User Industry (Aerospace and Defense, Wind Turbine, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained the largest 37.88% share of the prepreg market in 2024, buoyed by Boeing's composite-intensive 787, 777X, and proprietary space-launch structures. Pentagon modernization programs extend material demand into rotorcraft, unmanned systems, and hypersonic vehicles, ensuring stable multi-year order books. The region's certification ecosystem favors domestic suppliers such as Hexcel and Toray Advanced Composites, both of which operate vertically integrated lines from carbonization to prepregging. Nevertheless, 2025 commercial-aerospace revenues slipped after a major narrow-body delivery adjustment, highlighting short-cycle variability amid otherwise strong defense backlogs.

Asia-Pacific emerges as the quickest-growing geography with an 8.12% CAGR forecast to 2030. Chinese state-backed carbon fiber producers are on pace to command nearly 50% of global capacity by 2030, lowering price points and catalyzing broader industrial uptake. Indigenous aerospace programs such as COMAC's C919 and CR929, along with domestic eVTOL prototypes, provide captive demand for high-grade prepreg. Japan's Toray and Teijin maintain technology leadership through high-modulus fibers and automotive-qualified thermoplastic laminates, while South Korea's hydrogen-storage tank initiatives fuel tow-prepreg growth.

Europe sustains mid-single-digit growth anchored by Airbus wing-assembly, UK advanced-propulsion R&D, and aggressive offshore-wind targets in the North Sea. Policymakers intensify scrutiny of end-of-life composite waste, accelerating investment into pyrolysis and solvolysis pilot plants that can reclaim high-value fiber. Gurit's decision to expand German aerospace-prepreg capacity while shuttering a Swiss line illustrates cost-rationalization amid tight European energy pricing. Meanwhile, automotive composite adoption faces regulatory uncertainty over potential carbon-fiber usage limits, though lighter materials remain exempt in renewable-energy and commercial-aviation contexts.

- AGC INC.

- Axiom Materials

- DIC Corporation

- Gurit Services AG

- Hexcel Corporation

- Huntsman International LLC

- Isola Group

- Mitsubishi Chemical Group Corporation

- NTPT

- Park Aerospace Corp.

- Renegade Materials Corporation

- SGL Carbon

- Solvay

- Teijin Limited

- THE YOKOHAMA RUBBER CO., LTD.

- Toray Industries Inc.

- Ventec International Group

- Victrex plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging aerospace and defense build-rates

- 4.2.2 Wind-turbine blade length escalation

- 4.2.3 Carbon-prepreg penetration in premium autos and sports

- 4.2.4 eVTOL and urban-air-mobility demand for thermoplastic prepregs

- 4.2.5 Hydrogen pressure-vessel tow-prepreg boom

- 4.3 Market Restraints

- 4.3.1 High cap-ex and OPEX of autoclave curing lines

- 4.3.2 Carbon-fiber supply-chain volatility

- 4.3.3 Weak recycling and EoL infrastructure

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Thermoset

- 5.1.2 Thermoplastic

- 5.2 By Fiber Type

- 5.2.1 Carbon

- 5.2.2 Glass

- 5.2.3 Aramid

- 5.3 By Form

- 5.3.1 Unidirectional (UD) Tapes

- 5.3.2 Tow Prepreg

- 5.3.3 Fabric/Woven

- 5.3.4 Organosheets

- 5.4 By End-User Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Wind Turbine

- 5.4.3 Automotive

- 5.4.4 Electrical and Electronics

- 5.4.5 Sporting and Leisure

- 5.4.6 Other Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Australia

- 5.5.1.6 Southeast Asia

- 5.5.1.7 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AGC INC.

- 6.4.2 Axiom Materials

- 6.4.3 DIC Corporation

- 6.4.4 Gurit Services AG

- 6.4.5 Hexcel Corporation

- 6.4.6 Huntsman International LLC

- 6.4.7 Isola Group

- 6.4.8 Mitsubishi Chemical Group Corporation

- 6.4.9 NTPT

- 6.4.10 Park Aerospace Corp.

- 6.4.11 Renegade Materials Corporation

- 6.4.12 SGL Carbon

- 6.4.13 Solvay

- 6.4.14 Teijin Limited

- 6.4.15 THE YOKOHAMA RUBBER CO., LTD.

- 6.4.16 Toray Industries Inc.

- 6.4.17 Ventec International Group

- 6.4.18 Victrex plc

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment