|

市場調查報告書

商品編碼

1844540

汽車轉向:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Steering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

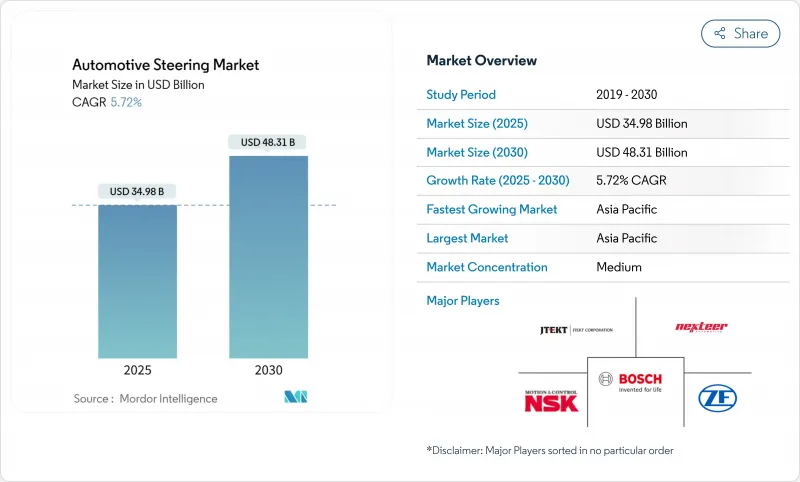

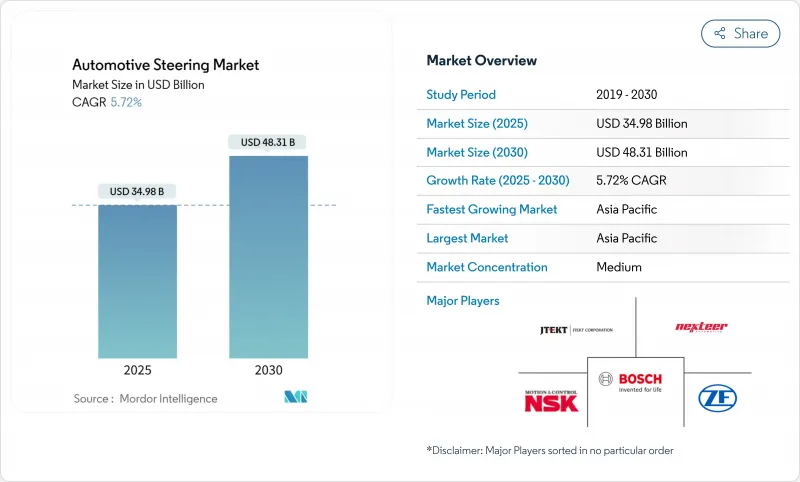

預計 2025 年汽車轉向系統市場價值將達到 349.8 億美元,到 2030 年將達到 483.1 億美元,複合年成長率為 5.72%。

成長動力源自於液壓輔助轉向電子動力方向盤的快速轉型,以及線控轉向的首次商業化部署。此外,聯合國歐洲經濟委員會 R155 網路安全法規正在加速對軟體定義電控系統的需求。由於中國的規模優勢和日本在高精度零件領域的專業化,亞太地區維持了 48.67% 的收入佔有率。稀土元素供應商正在整合核心技術,以確保智慧財產權,並承擔冗餘「故障操作」架構所需的高額前期投資。對於能夠消除稀土元素、減輕重量並在不增加材料成本的情況下提高功能安全性的馬達和感測器專家來說,機會正在湧現。

全球汽車轉向市場趨勢與洞察

EPS 在 ICE 和 xEV 平台上的快速採用

電子動力方向盤在中國乘用車產業迅速普及,在歐洲和日本也日益普及。原始設備製造商可以解鎖電力傳動系統中再生煞車的兼容性,同時獲得節油效益。採埃孚的商用車電動輔助轉向系統無需液壓油即可提供高達 8,000 牛頓米的扭矩,這使得該技術廣泛應用於從緊湊型轎車到 8 級卡車的各種車型。雖然管柱輔助轉向系統在 B-Class 中佔據主導地位,但齒條輔助轉向系統在對精度和路感要求更高的高階車型中也逐漸佔據了市場佔有率。快速換檔正在推動汽車轉向系統市場的穩定成長。

線傳系統將於 2025 年在高階電動車中推出

繼採埃孚 (ZF) 於 2025 年為蔚來 (NIO) ET9 推出該系統之後,梅賽德斯-奔馳 (Mercedes-Benz) 將於 2026 年推出歐洲首款量產線傳系統。該系統取消了機械軸,實現了可變轉向比,使停車更加便捷,並提高了高速公路行駛穩定性。豐田的「One Motion Grip」方向盤,其 200 度輸入行程取代了傳統的 540 度轉彎,改善了人體工學和座艙佈局。冗餘馬達、電源和觸覺回饋可保持駕駛信心,但消費者接受度研究表明,學習曲線可能會延長推出時間,使其超越豪華品牌。

稀土磁鐵價格波動推高EPS的BOM

中國控制全球約70%的稀土加工,釹的出口受到限制。磁鐵成本已佔到EPS馬達材料清單的25%。福特汽車公司暫停Explorer的生產,為原始設備製造商的進度帶來了風險。供應商正透過追求無稀土創新來應對這項挑戰,例如ZF的I2SM馬達和麥格納對Niron Magnetics的鐵氮清潔土磁鐵的投資。

細分分析

2024年,轉向柱和齒條將主導汽車轉向系統市場,佔39.26%的收益佔有率。整合防傾倒裝置、多功能開關和駕駛員安全氣囊模組使該細分市場成為所有平台的必備組件。同時,隨著無刷直流馬達設計取代液壓泵和皮帶傳動裝置,電動馬達將以最快的速度成長,到2030年複合年成長率達到8.91%。網路安全電控系統構成第三大市場,隨著UNECE R155標準要求製造商確保每項新的無線功能,每輛車的網路安全電子控制單元的配置量都在增加。

扭矩、角度和位置感測器正與依賴毫秒級精確回饋的線傳和ADAS功能同步發展。 TDK的四模HAL 39xy晶片展示了單封裝解決方案如何在減輕線路重量的同時,有效抵禦高壓動力傳動系統的磁噪聲。能夠將馬達、感測器和ECU功能整合到緊湊的屏蔽外殼中的供應商,能夠透過提高系統可靠性和縮短保固期,鞏固其在汽車轉向系統市場的地位。

乘用車將主導全球汽車轉向系統市場,到2024年將佔總收入的63.28%。同時,輕型商用車已成為成長最快的細分市場,複合年成長率高達7.56%。電商車隊重視電動輔助轉向系統 (EPS) 帶來的精準低速操控和低維護成本,而自動駕駛配送概念則傾向於軟體控制轉向,以實現精準的路邊停車。隨著現代齒條驅動EPS 裝置實現工業級扭力輸出,重型商用車逐漸放棄液壓轉向。車主對燃油經濟性的日益關注將使各類汽車轉向系統市場受益。

在乘用車領域,純電動車正在取代傳統液壓系統所使用的引擎真空源,使電動輔助轉向系統 (EPS) 成為必需品。由於消費者偏好更高的駕駛位置,運動型多用途車 (SUV) 的市場佔有率正在不斷成長,而其更大的佔地面積意味著轉向系統組件的數量也隨之增加。多用途車和小型貨車正在利用 EPS 封裝來提供平地板座艙。由於這些複雜的變化,汽車轉向系統產業的單位產量和銷售量均保持著穩定的成長軌跡。

汽車轉向系統市場按零件(液壓幫浦、電動馬達等)、車型(乘用車、商用車)、機構(電動動力方向盤(EPS)、液壓動力方向盤(HPS)、電助力液壓動力方向盤等)、銷售管道(整車廠、售後市場)及地區細分。市場預測以金額(美元)和數量(單位)表示。

區域分析

預計到2024年,亞太地區將佔據汽車轉向系統市場的48.67%,到2030年將維持6.81%的強勁複合年成長率。中國龐大的電動車生產基地將推動電動輔助轉向系統(EPS)的普及,而像HIVE Steering這樣的本土企業則利用國內矽晶圓和磁鐵供應,以低於現有進口產品的價格競爭。日本則擁有豐富的專業知識,包括捷太JTEKT)的線傳測試和日本精工(NSK)的低摩擦軸承技術。地方政府正在製定清晰的自動駕駛認證藍圖,進一步推動汽車轉向系統市場對線傳系統的需求。

在歐洲,歐7和聯合國歐洲經濟委員會(UNECE)網路安全法規鼓勵採用先進的電子控制單元(ECU)、輕量化轉向柱和冗餘作動器,從而提高單車價值。採埃孚(ZF)和博世(Bosch)已開始大量出貨線控轉向系統,並利用當地技術中心為高階品牌調校轉向手感。然而,如果釹金屬短缺導致生產停產,原始設備製造商(OEM)面臨的原料風險將更加凸顯。這項風險加速了對無稀土馬達技術的研究,使供應商無需等待新車型週期即可提高單車釹金屬含量。

在北美,皮卡和運動型多用途汽車(銷量最大的汽車細分市場)對電動輔助轉向系統的採用率正在穩步上升。車隊營運商密切關注總擁有成本,而電動輔助轉向系統節省3-5%的燃油成本,正在推動其採用。美國也是免校準安裝和安全無線軟體(可在車輛使用期間更新轉向邏輯)的研發中心。同時,南美、中東和非洲地區正採用電子轉向系統作為工廠升級平台。這些市場通常會在新車型上直接過渡到電動輔助轉向系統,從而為汽車轉向系統市場帶來長期的上漲空間。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- EPS 在 ICE 和 Xev 平台上的快速採用

- 線傳系統將於 2025 年起在高階電動車中推出

- 輕型轉向柱,符合歐盟 7/CAFE 法規

- OEM對支援ADAS的「故障運行」架構的需求

- UNECE R155 要求市場上必須使用網路安全 ECU

- OTA可升級扭力疊加軟體銷售

- 市場限制

- 稀土元素磁鐵價格波動推高EPS的BOM

- 到2026年汽車MCU短缺

- 對轉向系統的擔憂導致線控轉向系統普及速度緩慢

- 一級供應商整合限制了原始設備製造商的議價能力

- 價值/供應鏈分析

- 技術展望

- 監管狀況

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按組件

- 液壓泵浦

- 電動機

- 轉向柱/轉向架

- 感測器(扭矩、角度、位置)

- 電控系統(ECU)

- 其他組件

- 按車輛類型

- 搭乘用車

- 掀背車

- 轎車

- 運動型多用途車

- 多用途車輛

- 商用車

- 輕型商用車

- 中大型商用車

- 搭乘用車

- 按機制

- 電子動力方向盤(EPS)

- 液壓動力方向盤(HPS)

- 電動液壓動力方向盤(EHPS)

- 線控轉向

- 按銷售管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 土耳其

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- JTEKT Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Nexteer Automotive Corporation

- NSK Ltd

- Mando Corporation

- Showa Corporation

- Hitachi Astemo

- Hyundai Mobis

- ThyssenKrupp Presta

- Schaeffler Group

- Denso Corporation

- Knorr-Bremse AG

- China Automotive Systems Inc

第7章 市場機會與未來展望

The Automotive Steering System market is valued at USD 34.98 billion in 2025 and is forecast to reach USD 48.31 billion by 2030, reflecting a 5.72% CAGR.

Growth is anchored in the rapid migration from hydraulic assistance to electronic power steering and the first commercial deployments of steer-by-wire. Tightening global emission limits and the rising share of battery-electric vehicles strengthen the business case for energy-efficient steering technologies, while cybersecurity rules under UNECE R155 accelerate demand for software-defined electronic control units. Asia-Pacific retains a 48.67% revenue share, helped by China's scale advantages and Japan's specialization in high-precision components. Tier-1 suppliers are consolidating core technologies to secure intellectual property and to fund the high up-front investment needed for redundant, "fail-operational" architectures. Opportunities emerge for motor and sensor specialists that can remove rare-earth content, cut weight, and improve functional safety without inflating the bill-of-materials.

Global Automotive Steering Market Trends and Insights

Rapid EPS Penetration in ICE & xEV Platforms

Electronic power steering is highly prevalent in China's passenger-car industry and is approaching ubiquity in Europe and Japan. OEMs gain fuel-saving benefits while unlocking regenerative braking compatibility for electric drivetrains. The technology now scales from compact cars to Class 8 trucks, as ZF's commercial-vehicle EPS delivers up to 8,000 Nm without hydraulic fluid. Column-assist units dominate the value B-segment, whereas rack-assist designs earn a share in premium cars that need higher precision and road feel. The accelerating shift keeps the automotive steering system market steadily growing.

Steer-by-wire Deployment in Premium EVs From 2025

Mercedes-Benz will introduce the first European production steer-by-wire system in 2026, following ZF's 2025 launch on NIO's ET9. Removing the mechanical shaft enables variable steering ratios that ease parking and enhance highway stability. Toyota's "One Motion Grip" wheel shows how 200-degree input strokes can replace the traditional 540-degree turn, improving ergonomics and cabin packaging. Redundant motors, power supplies, and haptic feedback maintain driver confidence, although consumer acceptance studies indicate a learning curve that may extend roll-out timelines beyond luxury nameplates.

Rare-earth Magnet Price Volatility Inflates EPS BOM

China controls roughly 70% of global rare-earth processing and has limited neodymium exports. Magnet costs already account for up to 25% of an EPS motor bill of materials. Ford's temporary halt of Explorer production exposed the risk to OEM schedules. Suppliers respond by advancing rare-earth-free innovations such as ZF's I2SM motor and Magna's investment in Niron Magnetics' iron-nitrogen Clean Earth Magnets.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight Steering Columns to Meet Euro 7/CAFE Norms

- OEM Demand for ADAS-ready "Fail-operational" Architectures

- Automotive MCU Shortage Through 2026

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, steering columns and racks dominate the automotive steering system market, commanding a 39.26% revenue share. Integrated collapse mechanisms, multi-function switches, and driver-airbag modules keep the sub-segment essential across all platforms. In parallel, electric motors deliver the fastest expansion at an 8.91% CAGR through 2030 as brushless DC designs replace hydraulic pumps and belt-driven units. Cyber-secure electronic control units form the third-largest bucket, their content per vehicle climbing with every new over-the-air feature that UNECE R155 obliges manufacturers to secure.

Torque, angle, and position sensors advance in lockstep with steer-by-wire and ADAS features that depend on millisecond-accurate feedback. TDK's four-mode HAL 39xy chip illustrates how single-package solutions cut wiring weight while resisting magnetic noise from high-voltage powertrains. Suppliers able to merge motor, sensor, and ECU functions inside compact, shielded housings improve system reliability and lower warranty exposure, reinforcing their standing in the automotive steering system market.

In 2024, passenger cars dominated the global automotive steering system market, capturing 63.28% of the revenue. Meanwhile, light commercial vehicles emerged as the fastest-growing segment, boasting a robust 7.56% CAGR. E-commerce fleets value the precise low-speed maneuvering and lower maintenance that EPS provides, while autonomous delivery concepts lean on software-controlled steering for curb-side accuracy. Heavy commercial vehicles shift away from hydraulics as the latest rack-drive EPS units hit industrial torque outputs. Across classes, the automotive steering system market benefits from fleet owners' focus on fuel savings.

Within the passenger-car arena, battery electric models remove the engine vacuum source used by traditional hydraulics, making EPS mandatory. Sport utility vehicles secure a rising share as buyers favor higher ride positions, and their larger footprint translates into higher steering-system content. Multi-purpose vehicles and minivans leverage EPS packaging gains to offer flat-floor cabins. These combined shifts keep the automotive steering system industry on a stable path of unit and value growth.

The Automotive Steering System Market is Segmented by Component (Hydraulic Pump, Electric Motor, and More), Vehicle Type (Passenger Cars, Commercial Vehicles), Mechanism (Electronic Power Steering (EPS), Hydraulic Power Steering (HPS), Electrically Assisted Hydraulic Power Steering, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

In 2024, Asia-Pacific commands a 48.67% share of the automotive steering system market and is set to achieve a robust 6.81% CAGR through 2030. China's extensive electric-vehicle production base drives near-universal EPS fitment, while local challengers such as HIVE Steering undercut incumbent imports by bundling domestic silicon and magnet supply. Japan contributes specialized know-how, including JTEKT's steer-by-wire tests and NSK's low-friction bearing routes, even as NSK considers divesting its steering arm. Regional governments offer clear road maps for autonomous-driving certification, further enhancing demand for by-wire systems in the automotive steering system market.

Europe follows with high per-vehicle value as Euro 7 and UNECE cyber-rules reward advanced ECUs, lightweight columns, and redundant actuation. ZF and Bosch use local technical centers to tune steering feel for premium brands and are already shipping by-wire pilot volumes. OEMs, however, confront raw-material risks, which are highlighted when neodymium shortages force production pauses. That vulnerability fast-tracks research into rare-earth-free motor technology, allowing suppliers to raise content per vehicle without waiting for new model cycles.

North America sees steady take-up of EPS in pick-ups and sport utilities, the region's largest segments by volume. Fleet operators closely monitor the total cost of ownership, and the 3-5% fuel-saving edge of EPS helps underpin adoption. The United States is also a development hub for alignment-free installation and secure over-the-air software to update steering logic during ownership. Meanwhile, South America, the Middle East and Africa adopt electronified steering as factories upgrade platforms. These markets often leapfrog directly to EPS on new models, creating incremental upside for the automotive steering system market over the long run.

- JTEKT Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Nexteer Automotive Corporation

- NSK Ltd

- Mando Corporation

- Showa Corporation

- Hitachi Astemo

- Hyundai Mobis

- ThyssenKrupp Presta

- Schaeffler Group

- Denso Corporation

- Knorr-Bremse AG

- China Automotive Systems Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid EPS Penetration In ICE & Xev Platforms

- 4.2.2 Steer-By-Wire Deployment In Premium Evs From 2025

- 4.2.3 Lightweight Steering Columns To Meet Euro 7/CAFE Norms

- 4.2.4 OEM Demand For ADAS-Ready "Fail-Operational" Architectures

- 4.2.5 Cyber-Secure ECU Mandates In UNECE R155 Markets

- 4.2.6 OTA-Upgradable Torque-Overlay Software Revenues

- 4.3 Market Restraints

- 4.3.1 Rare-Earth Magnet Price Volatility Inflates EPS BOM

- 4.3.2 Automotive MCU Shortage Through 2026

- 4.3.3 Steering-Feel Concerns Slowing Steer-By-Wire Rollout

- 4.3.4 Tier-1 Consolidation Limits OEM Bargaining Leverage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Hydraulic Pump

- 5.1.2 Electric Motor

- 5.1.3 Steering Column / Rack

- 5.1.4 Sensors (Torque, Angle, Position)

- 5.1.5 Electronic Control Unit (ECU)

- 5.1.6 Other Components

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.1.1 Hatchback

- 5.2.1.2 Sedan

- 5.2.1.3 Sport Utility Vehicle

- 5.2.1.4 Multi-Purpose Vehicle

- 5.2.2 Commercial Vehicles

- 5.2.2.1 Light Commercial Vehicles

- 5.2.2.2 Medium and Heavy Commercial Vehicle

- 5.2.1 Passenger Cars

- 5.3 By Mechanism

- 5.3.1 Electronic Power Steering (EPS)

- 5.3.2 Hydraulic Power Steering (HPS)

- 5.3.3 Electro-hydraulic Power Steering (EHPS)

- 5.3.4 Steer-by-Wire

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 JTEKT Corporation

- 6.4.2 Robert Bosch GmbH

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Nexteer Automotive Corporation

- 6.4.5 NSK Ltd

- 6.4.6 Mando Corporation

- 6.4.7 Showa Corporation

- 6.4.8 Hitachi Astemo

- 6.4.9 Hyundai Mobis

- 6.4.10 ThyssenKrupp Presta

- 6.4.11 Schaeffler Group

- 6.4.12 Denso Corporation

- 6.4.13 Knorr-Bremse AG

- 6.4.14 China Automotive Systems Inc