|

市場調查報告書

商品編碼

1844514

地工磚:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Geofoams - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

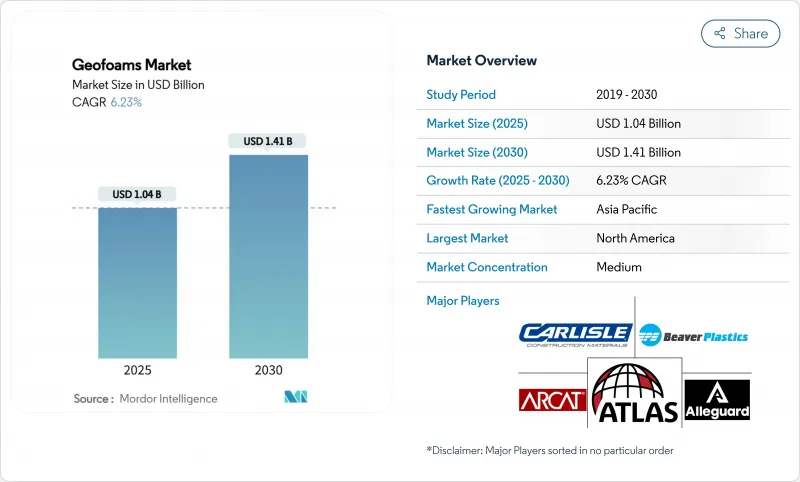

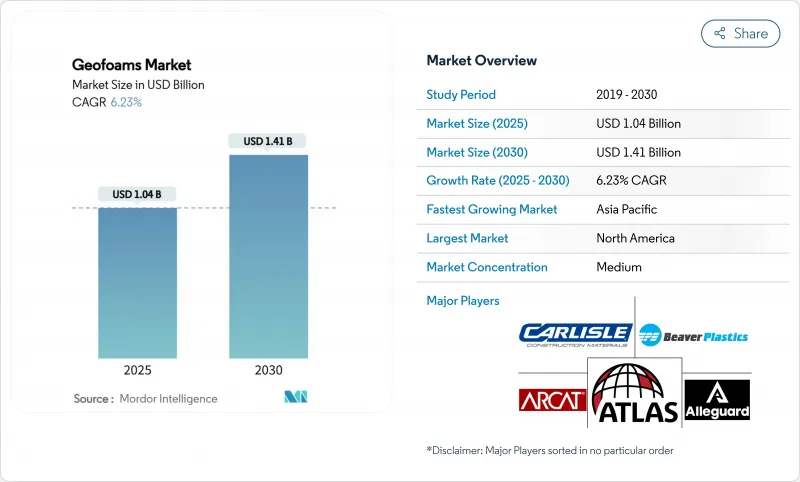

地工磚市場規模預計在 2025 年為 10.4 億美元,預計到 2030 年將達到 14.1 億美元,預測期內(2025-2030 年)的複合年成長率為 6.23%。

基礎設施更新、輕量化建築趨勢和日益成長的永續性要求支撐了整體需求,而發泡和押出成型聚苯乙烯技術正在重新定義傳統的填土方法。亞太地區和北美地區對高速公路、橋樑和城市交通系統的資本投資不斷增加,直接推動了對地工磚塊的競標增加,特別是在軟土地基和地震風險限制傳統回填的地區。設計建造商越來越欣賞地工磚的工廠控制一致性和快速應用時間,這減少了高流量走廊的車道封閉。同時,監管機構也越來越關注碳排放揭露,這加強了地工磚相對於顆粒填充材的生命週期成本優勢。競爭差異化依賴聚苯乙烯供應、再生材料開發和阻燃化學的垂直整合。

全球地工磚市場趨勢與洞察

道路和橋樑路堤需求增加

交通運輸機構正在採用地工磚泡沫塊來減輕不均勻沉降、縮短施工進度並避免昂貴的地面改良項目。在科羅拉多的一項緊急公路修復項目中,地工磚取代了傳統的擋土結構,將進度縮短了 30%。挪威的一項公路計劃展示了地工磚在凍融循環下的彈性,350 個安裝案例顯示其耐用性可達 100 年。橋樑引橋坡道尤其有益,因為即使在沒有深基礎的軟土地基中它們也能保持形狀。由於其密度為土壤的 1%,因此安裝後幾天而不是幾週就可以恢復交通。長期監測證實,地震和熱事件期間的載重分佈與設計模型一致。

傳統輕型路堤的經濟高效替代方案

地工磚的吸引力遠不止於單價。預製塊料可減少高達40%的邊坡修復工時,避免現場攪拌及保養。當骨材供應地距離數百公里時,運輸成本的節省將非常顯著。這些塊料可手工搬運,所需工人更少,設備更輕,從而降低燃料和租賃成本。其密度和抗壓強度在工廠控制,省去了與現場混合方案相關的品質保證成本。這些綜合特性可以釋放計劃預算,用於資助排水系統改進等輔助領域。

極易受到石油基溶劑和碳氫化合物的影響

聚苯乙烯對碳氫化合物溶劑的親和性限制了其在燃料處理區域附近的使用。美國國家海洋暨大氣總署化學物質資料庫指出,EPS 與汽油接觸時體積會迅速縮小,因此需要使用高密度聚乙烯 (HDPE)地工止水膜屏障,這會使安裝成本增加 5-10%。高溢油風險的道路必須設置監測井和緊急襯墊,使其設計更加複雜。工業蓄水池也面臨類似的風險,因此設計師需要考慮替代填充材和複合封裝系統。雖然塗層技術正在進步,但長期現場檢驗仍然有限,這促使設計師在關鍵設施的設計上謹慎行事。

細分分析

預計到2024年,發泡聚苯乙烯 (EPS) 將佔據地工磚市場65.12%的佔有率,而押出成型聚苯乙烯年成長率預計將達到6.58%,直至2030年。發泡聚苯乙烯 (EPS) 在成本敏感的堤防領域蓬勃發展,這些領域以數量為主導籌資策略,從而支撐了整個地工磚市場。然而,XPS 吸水率低且抗壓強度高,使其非常適合用於橋樑、隧道和寒冷氣候下的地基,這些地方需要較長的使用壽命。杜邦測試表明,XPS 的厚度可以減少30-40%,以實現相同的熱阻值,這對於尋求無需過度開挖即可實現基層保溫的設計師來說極具吸引力。

蒸汽膨脹所需能量和苯乙烯投入較少,單位成本比XPS低15-20%。相反,XPS的連續擠壓可產生均勻的泡孔尺寸,從而抗蠕變,支援設計壽命超過75年的高階應用。 EPS回收基礎設施青睞EPS,因為塊狀邊角料可以輕鬆製成顆粒並蒸煮成新的珠粒,而XPS的再擠壓則需要更嚴格的熔體過濾。展望未來,隨著市政當局採用綠色建築計劃,並因其耐濕性而減少維護預算,XPS的市場佔有率可能會進一步上升。然而,EPS的價格優勢很可能在大規模散裝填料應用中繼續保持其地位。

區域分析

受大型公路維修和橋樑引橋嚴格的沉降控制標準推動,北美地區到2024年將佔全球銷售額的35.19%。科羅拉多、明尼蘇達州和安大略省的計劃證明了控制差異沉降可以實現生命週期成本的節省。加拿大北極走廊正在利用地工磚的隔熱性能來穩定永久凍土,防止融水在跑道和管道下方下沉。

預計到2030年,亞太地區將以6.92%的複合年成長率位居全球首位,這得益於每年1.7兆美元的基礎設施需求。中國和印度的大型鐵路走廊正在採用地工磚來處理軟弱的沖積土,而無需進行深基坑開挖。日本的地震標準認可使用輕質堤防來減輕慣性荷載,而EPS砌塊則是韓國高速公路匝道拓寬計劃的標準配備。

在歐洲,循環經濟政策和沿海氣候挑戰正在推動泡沫塑膠的穩定應用。德國和法國正在將再生地工磚納入防洪工程,以符合歐盟的廢棄物減量目標。英國的智慧高速公路升級工程正在使用地工磚來最大限度地縮短封閉時間,並支持與降低用戶延誤成本相關的承包商獎勵。北歐國家正在利用30年來檢驗地工磚在零下溫度下韌性的現場數據,以核准公眾信任並獲得監管機構的批准,從而擴大地工磚的使用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 道路、橋樑和堤防的需求不斷增加

- 傳統輕型路堤的經濟高效替代方案

- 亞太地區基礎建設投資快速成長

- 利用 EPS地工磚地工布加速模組化橋樑項目

- 透過重複使用回收的 EPS地工磚來促進循環經濟

- 市場限制

- 極易受到石油溶劑和碳氫化合物的影響

- 新興國家的設計知識有限

- 防火標準更加嚴格導致成本上升

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按類型

- 發泡聚苯乙烯(EPS)

- 擠塑聚苯乙烯(XPS)

- 按最終用戶產業

- 路

- 大樓

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Airfoam

- Alleguard

- ARCAT, Inc.

- Atlas Roofing Corporation

- BASF SE

- Beaver Plastics Ltd.

- Benchmark Foam Inc.

- Carlisle Construction Materials LLC

- FMI-EPS LLC

- Harbor Foam Inc.

- NOVA Chemicals Corporate

- Plasti-Fab Ltd

- Poly Molding LLC

- Styro Insulations Mat. Ind. LLC.

- ThermaFoam, LLC

- Universal Foam Products

第7章 市場機會與未來展望

The Geofoams Market size is estimated at USD 1.04 billion in 2025, and is expected to reach USD 1.41 billion by 2030, at a CAGR of 6.23% during the forecast period (2025-2030).

Infrastructure renewal, lightweight construction trends and growing sustainability mandates collectively underpin demand, while expanded and extruded polystyrene technologies redefine conventional earth-fill approaches. Accelerated capital expenditure on highways, bridges and urban transit systems in Asia-Pacific and North America is translating directly into larger bid volumes for geofoam blocks, especially where weak soils or seismic risk constrain traditional backfills. Design-build contractors increasingly value geofoam's factory-controlled consistency and fast installation times, reducing lane-closure periods on heavily trafficked corridors. Meanwhile, heightened regulatory interest in embodied-carbon disclosure is elevating the material's lifecycle cost advantages relative to granular fills. Competitive differentiation now hinges on vertical integration into polystyrene supply, recycled-content development and fire-retardant chemistry.

Global Geofoams Market Trends and Insights

Rising Demand from Roadway & Bridge Embankments

Transportation agencies are turning to geofoam blocks to mitigate differential settlement, shorten construction schedules and avoid costly ground-improvement programs. Colorado's emergency highway repair demonstrated 30% schedule compression when geofoam replaced traditional earthwork. Norwegian highway projects show 100-year durability across 350 installations, proving the material's resilience under freeze-thaw cycles. Bridge approach ramps gain particular benefit, maintaining geometry over weak soils without deep foundations. The 1% density versus soil allows traffic to reopen days, not weeks, after placement. Long-term monitoring confirms load distribution that matches design models during seismic and thermal events.

Cost-Effective Alternative to Traditional Lightweight Fills

Geofoam's attraction extends beyond unit price. Prefabricated blocks bypass on-site mixing and curing, trimming labor hours by up to 40% in slope repair works. Transport savings are pronounced where aggregate sources lie hundreds of kilometers away. Because blocks can be manually maneuvered, smaller crews and lighter equipment reduce fuel and rental costs. Factory-controlled density and compressive strength slash quality-assurance outlays tied to field-mixed solutions. Together, these attributes reposition project budgets, freeing capital for ancillary scope such as drainage upgrades.

High Vulnerability to Petroleum Solvents & Hydrocarbons

Polystyrene's affinity for hydrocarbon solvents constrains deployment near fuel handling zones. NOAA's chemical database cites rapid volumetric loss when EPS contacts gasoline, necessitating HDPE geomembrane barriers that add 5-10% to installed cost. Roadways with high spill risk must incorporate monitoring wells and contingency liners, complicating designs. Industrial storage yards face similar exposure, pushing specifiers toward alternative fills or composite encapsulation systems. Although coating technologies are advancing, long-term field validation remains limited, keeping designers cautious in critical facilities.

Other drivers and restraints analyzed in the detailed report include:

- Surging Infrastructure CAPEX in Asia-Pacific

- Accelerated Modular Bridge Programs Using EPS Geofoam Blocks

- Stricter Fire-Resistance Standards Driving Cost Up

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Expanded polystyrene retained 65.12% of geofoams market share in 2024, while extruded polystyrene is forecast to grow at a 6.58% CAGR to 2030. EPS thrives in cost-sensitive roadway embankments where volume rules procurement strategies, sustaining the overall geofoams market. Yet XPS's lower water absorption and superior compressive strength satisfy bridge, tunnel and cold-climate foundations demanding long service life. DuPont tests reveal XPS can deliver the same thermal R-value with 30-40% thinner sections, appealing to designers seeking subgrade insulation without over-excavation.

Production economics illustrate why EPS dominates volume: steam expansion uses less energy and input styrene, keeping unit costs 15-20% below XPS. Conversely, XPS's continuous extrusion yields uniform cell size that resists creep, supporting premium applications where design life exceeds 75 years. Recycling infrastructure favors EPS because block off-cuts can be readily granulated and steamed into new beads, whereas XPS re-extrusion demands stricter melt-filtering. Looking forward, municipalities with aggressive green-building codes may tilt share further toward XPS as moisture durability lessens maintenance budgets, but EPS will stay entrenched in large-scale bulk fills owing to its price advantage.

The Geofoams Market Report is Segmented by Type (Expanded Polystyrene (EPS), Extruded Polystyrene (XPS)), End-User Industry (Roadways, Buildings), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 35.19% of global revenue in 2024, underpinned by extensive highway rehabilitation and stringent settlement-control criteria in bridge approaches. Projects in Colorado, Minnesota and Ontario testify to lifecycle cost savings once differential settlement is curtailed. Canadian Arctic corridors leverage geofoam's insulating value to stabilize permafrost, preventing thaw settlement beneath runways and pipelines.

Asia-Pacific is projected to expand at a 6.92% CAGR to 2030, the fastest globally, on the back of USD 1.7 trillion yearly infrastructure needs. Mega-rail corridors in China and India favor geofoam to manage weak alluvial soils without deep excavation. Japanese seismic codes reward lightweight fills that reduce inertial loads, while South Korean expressways have standardized EPS blocks for ramp widening projects.

Europe demonstrates steady adoption driven by circular-economy mandates and coastal climate challenges. Germany and France integrate recycled-content geofoam into flood-defense works, aligning with EU waste-reduction targets. The United Kingdom's smart-motorway upgrades specify geofoam to minimize closure times, supporting contractor incentives tied to user delay cost savings. Nordic countries capitalize on three decades of field data validating geofoam resilience in sub-zero conditions, reinforcing public trust and regulatory approval for expanded use.

- Airfoam

- Alleguard

- ARCAT, Inc.

- Atlas Roofing Corporation

- BASF SE

- Beaver Plastics Ltd.

- Benchmark Foam Inc.

- Carlisle Construction Materials LLC

- FMI-EPS LLC

- Harbor Foam Inc.

- NOVA Chemicals Corporate

- Plasti-Fab Ltd

- Poly Molding LLC

- Styro Insulations Mat. Ind. LLC.

- ThermaFoam, LLC

- Universal Foam Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from roadway and bridge embankments

- 4.2.2 Cost-effective alternative to traditional lightweight fills

- 4.2.3 Surging infrastructure CAPEX in Asia-Pacific

- 4.2.4 Accelerated modular bridge programs using EPS geofoam blocks

- 4.2.5 Circular-economy push for recycled-EPS geofoam reuse

- 4.3 Market Restraints

- 4.3.1 High vulnerability to petroleum solvents and hydrocarbons

- 4.3.2 Limited design know-how in emerging economies

- 4.3.3 Stricter fire-resistance standards driving cost up

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Expanded Polystyrene (EPS)

- 5.1.2 Extruded Polystyrene (XPS)

- 5.2 By End-user Industry

- 5.2.1 Roadways

- 5.2.2 Buildings

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Airfoam

- 6.4.2 Alleguard

- 6.4.3 ARCAT, Inc.

- 6.4.4 Atlas Roofing Corporation

- 6.4.5 BASF SE

- 6.4.6 Beaver Plastics Ltd.

- 6.4.7 Benchmark Foam Inc.

- 6.4.8 Carlisle Construction Materials LLC

- 6.4.9 FMI-EPS LLC

- 6.4.10 Harbor Foam Inc.

- 6.4.11 NOVA Chemicals Corporate

- 6.4.12 Plasti-Fab Ltd

- 6.4.13 Poly Molding LLC

- 6.4.14 Styro Insulations Mat. Ind. LLC.

- 6.4.15 ThermaFoam, LLC

- 6.4.16 Universal Foam Products

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment