|

市場調查報告書

商品編碼

1844513

汽車隔熱板:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Heat Shield - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

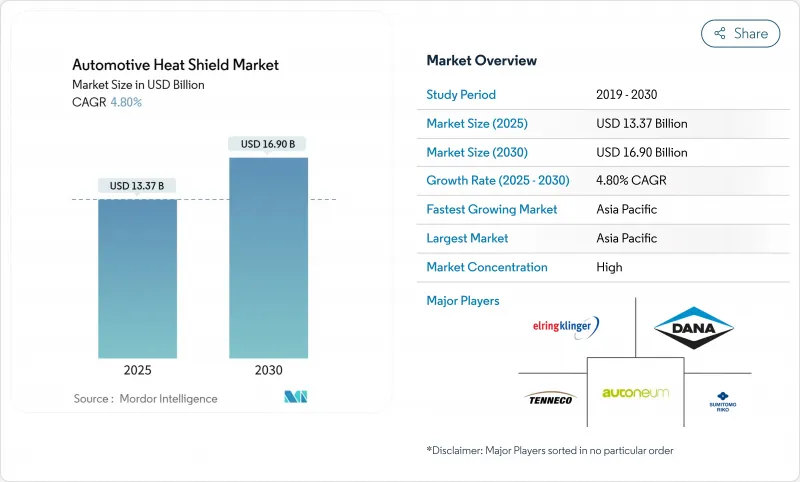

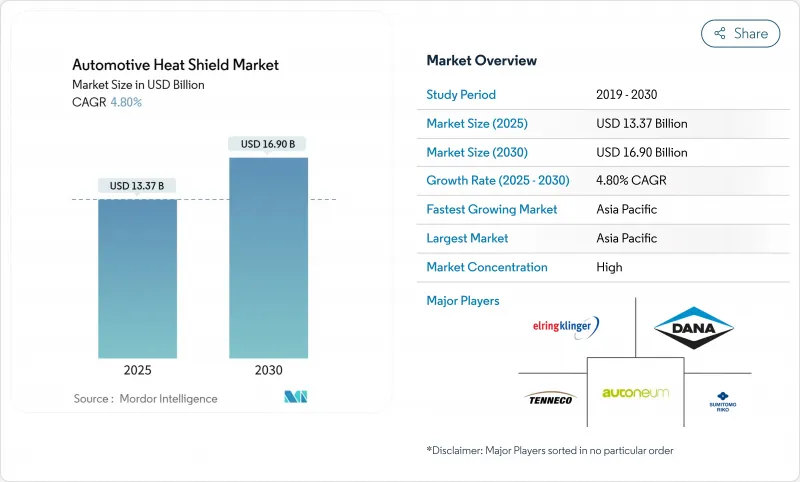

預計 2025 年汽車隔熱板市場規模為 133.7 億美元,到 2030 年將達到 169 億美元,預測期內(2025-2030 年)的複合年成長率為 4.80%。

日益嚴格的排放氣體法規和向電動動力傳動系統的快速轉型正在塑造產業的發展軌跡。受電池安全要求、輕量化目標和創新材料的驅動,所有車型的汽車製造商都將熱防護放在首位。他們正在採用複合材料和智慧感測器來減輕重量、保持觸媒轉換器效率,並在快速充電過程中保護鋰離子電池。同時,大型一級觸媒轉換器正在利用規模經濟優勢,實現材料組合多元化,並採用對沖策略。

全球汽車隔熱板市場趨勢與洞察

更嚴格的排放氣體和燃油經濟法規

根據美國環保署 (EPA) 現行規定,到 2032 年,新乘用車的二氧化碳排放限值將提高至每英里 85 克,這將迫使汽車製造商提高引擎運行溫度,以保持觸媒轉換器處於最佳關閉溫度。能夠吸收輻射廢氣熱量的多層金屬屏蔽層對於滿足排放氣體和企業平均燃油經濟性目標至關重要。高利潤的高階屏蔽層在加州、西歐和日本的普及速度最快,而成本敏感型產品則在法規較弱且截止日期臨近的新興市場佔據主導地位。

混合動力汽車電池溫度控管需求快速成長

鋰離子電池組在20至40°C之間運作最為安全,其密封結構必須能承受超過1000°C的高溫。電池機殼內部的新型陶瓷纖維和阻燃層可抑制熱失控的蔓延,而內建的冷卻通道和相變插件則可應對快速充電峰值。將熱感罩視為安全關鍵硬體的汽車製造商正在推動電動車市場實現兩位數成長,尤其是在中國和德國,這兩個國家的電動車車型投放速度空前。

原物料價格波動(鋁、不鏽鋼)

2025年初,受澳洲礬土供應中斷和昆明地區停電的影響,鋁價飆升15%,擠壓了鋁壓片供應商的淨利率,因為鋁壓片的金屬含量可能超過70%。一級鋁生產商在期貨交易所進行對沖,而許多三級鋁生產商缺乏信貸額度,因此正在加速研發成本曲線更穩定的聚合物和陶瓷替代方案。

細分分析

到2024年,引擎室隔熱板將佔據汽車隔熱板市場的79.56%,這反映了長期以來保護線路、塑膠儲液器和乘客腳部空間免受引擎缸體和排氣歧管輻射的需求。隨著渦輪增壓器的發展和缸頭尺寸的縮小,產生的溫度也隨之升高,玻璃纖維霧面鋁多層設計仍將佔據主導地位。電池和電力電子屏蔽雖然收入佔有率較小,但隨著能量密度每增加一千瓦時,對密封的需求也隨之增加,其複合年成長率高達12.04%。軟性陶瓷紙和阻燃泡沫覆蓋電池框架,而銅網擴散器則在直流快速充電階段將熱點引導至遠離電池單元的位置。

排氣系統防護罩是第二大細分市場,佔15%,主要受歐7和EPA後處理溫度窗口的推動。這些組件通常採用雙殼結構和凹坑圖案,以保留邊界層空氣,並將表面溫度降低40°C。由於渦輪增壓汽油引擎在全球的普及,渦輪增壓器和進氣歧管防護罩的複合年成長率達到9.6%。車身底部和底盤防護罩結合了導熱和吸音層,可將傳動系統噪音降低高達3dB,並可有效抵禦越野SUV的石擊。

金屬解決方案,主要包括3xxx鋁板和409不銹鋼,將在2024年佔據87.01%的市場佔有率,但由於其眾所周知的成型、連接和回收工藝,仍將佔據汽車隔熱板市場的大部分出貨量。可變厚度液壓成形和雷射穿孔技術可減輕重量,同時排放滯留的餘熱。

非金屬和複合材料替代品正逐漸贏得市場佔有率,其重量減輕了40-60%,隔熱性能降低了35%。氣凝膠填充毯可將熱傳導率降至0.015 W/mK,使2毫米厚的夾層結構與6毫米厚的鋁殼結構相當。 Aspen Aerogels的PyroThin®面板環繞電動車電池組,將失控現象限制在單一模組內,並為電池組設計師提供寶貴的冷卻餘量。

單殼壓機佔2024年56.10%的市場佔有率,由於其一體式設計降低了模具成本,在飛濺區和中等溫度支架領域仍然廣受歡迎。然而,引擎室峰值溫度的上升正使其溫度上限達到200°C。雙殼模具可以透過插入空氣間隙來阻擋高達40%的輻射通量,從而在不改變防火牆幾何形狀的情況下滿足更嚴格的座艙保溫目標。

成長最快的類別是夾層複合材料,它將鋁製外殼與微孔陶瓷芯結合在一起。摩根先進材料公司目前供應一種多層墊,可在爬坡工作循環中將排氣管道溫度保持在450°C以下,同時與先前的鋼製墊相比,重量減輕了70%。

區域分析

到2024年,亞太地區將維持46.92%的汽車隔熱板市場佔有率,複合年成長率為9.69%。中國廣東和江蘇的電動車組裝中心指定使用陶瓷纖維電池隔離器,而日本原始設備製造商則推出多層隔音隔熱密度電池組冷卻屏蔽。

歐洲緊隨其後,佔27.22%。歐7排放法規和原始設備製造商嚴格的減重配額刺激了對複合材料和再生鋁設計的需求。德國豪華品牌正在為保護渦輪增壓器外殼的超薄鈦鋁加熱毯支付溢價。法國的一個中型汽車計畫正在試驗消費後鋁原料,該原料可將二氧化碳排放量減少高達95%。英國一家小批量高性能汽車製造商已選擇3D列印的Inconel合金防護罩來製造複雜的渦輪渦流,這表明該地區對積層製造技術的需求。

北美佔2024年銷售額的18.13%。雖然美國皮卡和SUV車型消耗了大量傳統的沖壓鋁製屏蔽罩,但特斯拉、通用和福特的電動車平台正在推動電池艙保護的快速成長。加拿大的凍融氣候提高了耐久性測試閾值,促使複合材料供應商轉向金屬陶瓷混合結構。一個日趨成熟的墨西哥供應商群體正在透過成型氣凝膠填充的軟性包裹層來多元化其區域採購版圖,這些組裝廠。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 更嚴格的廢氣和燃油經濟法規

- 混合動力汽車電池溫度控管需求快速成長

- 輕質鋁及複合材料

- 亞太地區汽車產量不斷成長

- 主動/智慧型隔熱罩的出現

- 升級改造 ELV 鋁材,打造低碳隔熱板

- 市場限制

- 原物料價格波動(Al、SS)

- 非金屬屏蔽的耐久性挑戰

- 全球汽車零件卡特爾調查的合規成本

- 歐洲逐步淘汰柴油車

- 價值/供應鏈分析

- 技術展望

- 監管狀況

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模與成長預測(價值,2024-2030)

- 依零件類型

- 機艙防護罩

- 排氣系統防護罩

- 渦輪增壓器和進氣歧管護罩

- 車身底部和地板護板

- 電池和電力電子屏蔽

- 其他組件屏蔽

- 按材質

- 金屬隔熱罩

- 非金屬/複合材料隔熱罩

- 保溫毯/多層

- 按產品結構

- 單殼

- 雙殼

- 夾層複合材料

- 按形狀

- 難的

- 靈活的

- 按車輛推進功率

- 內燃機汽車

- 油電混合車

- 純電動車

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 大型商用車

- 非公路車輛及農業車輛

- 按銷售管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲國家

- APAC

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太地區其他國家

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Autoneum Holding AG

- Dana Incorporated

- Tenneco Inc.

- ElringKlinger AG

- Sumitomo Riko Co. Ltd.

- DuPont de Nemours, Inc.

- Lydall Inc./Unifrax Thermal Tech

- Denso Corporation

- Nichias Corporation

- Morgan Advanced Materials

- Talbros Automotive Components Ltd.

- Trelleborg AB

- 3M Company

- Toyobo Co., Ltd.

- Zhuzhou Times New Material Technology Co., Ltd.

- Thermo-Tec Automotive Products Inc.

- Happich GmbH(Alutec)

- Robert Bosch GmbH

- Sanko Gosei Ltd.

- HKO Group

第7章 市場機會與未來展望

The Automotive Heat Shield Market size is estimated at USD 13.37 billion in 2025, and is expected to reach USD 16.90 billion by 2030, at a CAGR of 4.80% during the forecast period (2025-2030).

Stricter emissions regulations and a swift pivot to electric powertrains are shaping the industry's trajectory. Across all vehicle classes, automakers prioritize thermal protection, driven by battery safety mandates, lightweighting goals, and innovative materials. They're adopting composite materials and smart sensors to reduce weight, maintain catalytic converter efficiency, and protect lithium-ion batteries during quick charges. Concurrently, larger tier-one suppliers leverage scale benefits, diversify their material portfolios, and employ hedging strategies.

Global Automotive Heat Shield Market Trends and Insights

Stricter Emission & Fuel-Economy Regulations

Current EPA rules push CO2 limits for new passenger models toward 85 g / mile by 2032, compelling automakers to operate engines hotter and keep catalytic converters at optimal light-off temperatures. Multi-layer metallic shields that capture radiant exhaust heat are pivotal to meeting emissions and corporate average fuel-economy targets. Higher-margin premium shields are seeing the fastest uptake in California, Western Europe, and Japan, whereas cost-driven variants dominate emerging markets with looser rules but converging deadlines.

Surge in Hybrid & EV Battery-Thermal-Management Demand

Lithium-ion packs run safest between 20-40 °C, and containment structures must withstand events exceeding 1,000 °C. New ceramic-fiber and intumescent layers inside battery enclosures limit propagation during thermal runaway, while embedded cooling channels and phase-change inserts handle rapid-charge spikes. Automakers treating thermal shields as safety-critical hardware drive double-digit growth, especially in China and Germany, where electric models launch at the unprecedented cadence.

Raw-Material Price Volatility (Al, SS)

Aluminum prices spiked 15% in early 2025 following bauxite disruptions in Australia and power outages in Yunnan, squeezing margins for stamped-sheet suppliers whose bill-of-materials can exceed 70% metal content. Tier-ones hedge on futures exchanges, but many tier-threes lack credit lines, prompting accelerated R&D into polymer or ceramic alternatives with steadier cost curves.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight Aluminum & Composite Material Adoption

- Rising Vehicle Production in APAC

- Durability Challenges of Non-Metallic Shields

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine Compartment Shields controlled 79.56% of the automotive heat shield market in 2024, reflecting the longstanding need to protect wiring, plastic reservoirs, and passenger footwells from engine block and exhaust manifold radiation. Evolving turbo and downsized cylinder heads run hotter, so multilayer aluminum-with-glass-mat designs stay central. Battery & Power-Electronics Shields, though smaller in revenue, are advancing at 12.04% CAGR as every additional kilowatt-hour of energy density raises containment stakes. Flexible ceramic papers and intumescent foams line battery frames, while copper-mesh spreaders move hotspots away from cells during DC-fast-charge phases.

Exhaust System Shields remain the second-largest sub-segment at 15%, driven by Euro 7 and EPA after-treatment temperature windows. These assemblies often carry double-shell construction and dimpled patterns to hold boundary-layer air and slash surface temps by 40 °C. Turbocharger & Intake-Manifold Shields follow, registering 9.6% CAGR thanks to global turbo-gasoline adoption. Underbody & Floor-pan Shields couple thermal and acoustic layers to cut drivetrain hum by up to 3 dB and resist stone impacts in off-road SUVs.

Metallic solutions, hold 87.01% of the market share in 2024-chiefly three xxx aluminum sheet and 409 stainless-still comprise the bulk of automotive heat shield market shipments because of well-known forming, joining, and recycling streams. Variable-thickness hydroforming and laser-perforation now shave weight while venting trapped exhaust heat.

Non-metallic and composite alternatives are seizing share, leveraging 40-60% mass savings and 35% insulation drops. Aerogel-filled blankets push conductivity down to 0.015 W/mK, allowing 2 mm sandwiches that rival 6 mm aluminum shells. Aspen Aerogels' PyroThin(R) panels surround EV cell groups, confining runaway events to single modules and giving pack designers valuable cooling headroom.

Single-shell stampings hold 56.10% of the market share in 2024, remaining popular for splash zones and moderate-heat brackets because their one-piece geometry limits tooling outlay. Yet rising under-bonnet peak temperatures expose their 200 °C ceiling. Double-shell forms insert an air gap that blocks up to 40% radiative flux, meeting stricter cabin soak targets without redesigning firewall geometry.

The fastest growth lies in sandwich composites that pair an aluminum skin with a microporous ceramic center. Morgan Advanced Materials now supplies multi-layer mats that trim 70% of the weight compared with earlier steel pans while holding exhaust-gas ducts at or below 450 °C during hill-climb duty cycles.

The Automotive Heat Shield Market Report is Segmented by Component Type (Engine Compartment Shields and More), Material (Metallic Heat Shields and More), Product Structure (Single Shell and More), Form (Rigid and More), Vehicle Propulsion (ICE Vehicles and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEMs and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific retained a 46.92% share of the automotive heat shield market in 2024 and is expanding at a 9.69% CAGR. Chinese EV assembly hubs in Guangdong and Jiangsu specify ceramic-fiber battery isolators, while Japanese OEMs ship multi-layer acoustic-thermal hybrids that lower drivetrain noise and cabin soak simultaneously. India's localized suppliers produce cost-optimized punched-aluminum forms, meeting small-car price targets while ensuring 500,000-km durability in monsoon climates. South Korean firms specialize in high-density battery pack cooling shields for export SUVs, leveraging domestic cell technology leadership.

Europe followed at 27.22% share, where Euro 7 exhaust rules and stringent OEM lightweighting quotas spur demand for composite and recycled-aluminum designs. German luxury brands pay premiums for ultra-thin titanium-aluminide heat blankets that safeguard turbo housings. French mid-segment programs experiment with end-of-life aluminum feedstock that cuts embedded CO2 by up to 95%. British low-volume performance builders choose 3D-printed Inconel shields for complex turbine scrolls, illustrating the region's appetite for additive manufacturing.

North America contributed 18.13% of 2024 revenue. United States pickup and SUV lines consume traditional stamped aluminum shields in large lots, yet Tesla, GM, and Ford EV platforms drive rapid growth in battery-compartment protection. Canada's freeze-thaw climate elevates durability testing thresholds, pushing composite suppliers toward hybrid metal-ceramic architectures. Mexico's maturing supplier base now molds aerogel-filled flexible wraps for export to Michigan and Ontario assembly plants, diversifying the regional sourcing map.

- Autoneum Holding AG

- Dana Incorporated

- Tenneco Inc.

- ElringKlinger AG

- Sumitomo Riko Co. Ltd.

- DuPont de Nemours, Inc.

- Lydall Inc./Unifrax Thermal Tech

- Denso Corporation

- Nichias Corporation

- Morgan Advanced Materials

- Talbros Automotive Components Ltd.

- Trelleborg AB

- 3M Company

- Toyobo Co., Ltd.

- Zhuzhou Times New Material Technology Co., Ltd.

- Thermo-Tec Automotive Products Inc.

- Happich GmbH (Alutec)

- Robert Bosch GmbH

- Sanko Gosei Ltd.

- HKO Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter Emission & Fuel-Economy Regulations

- 4.2.2 Surge in Hybrid & EV Battery-Thermal-Management Demand

- 4.2.3 Lightweight Aluminum & Composite Material Adoption

- 4.2.4 Rising Vehicle Production in APAC

- 4.2.5 Emergence of Active / Smart Heat Shields

- 4.2.6 Up-Cycling of ELV Aluminum for Low-Carbon Heat Shields

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility (Al, SS)

- 4.3.2 Durability Challenges of Non-Metallic Shields

- 4.3.3 Compliance Costs From Global Auto-Parts-Cartel Probes

- 4.3.4 Diesel-Vehicle Phase-Down in Europe

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Component Type

- 5.1.1 Engine Compartment Shields

- 5.1.2 Exhaust System Shields

- 5.1.3 Turbocharger & Intake-Manifold Shields

- 5.1.4 Underbody & Floor-pan Shields

- 5.1.5 Battery & Power-Electronics Shields

- 5.1.6 Other Component Shields

- 5.2 By Material

- 5.2.1 Metallic Heat Shields

- 5.2.2 Non-metallic / Composite Heat Shields

- 5.2.3 Insulation Blankets / Multi-layer

- 5.3 By Product Structure

- 5.3.1 Single Shell

- 5.3.2 Double Shell

- 5.3.3 Sandwich Composite

- 5.4 By Form

- 5.4.1 Rigid

- 5.4.2 Flexible

- 5.5 By Vehicle Propulsion

- 5.5.1 ICE Vehicles

- 5.5.2 Hybrid Electric Vehicles

- 5.5.3 Battery Electric Vehicles

- 5.6 By Vehicle Type

- 5.6.1 Passenger Cars

- 5.6.2 Light Commercial Vehicles

- 5.6.3 Heavy Commercial Vehicles

- 5.6.4 Off-Highway & Agricultural Vehicles

- 5.7 By Sales Channel

- 5.7.1 OEMs

- 5.7.2 Aftermarket

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Spain

- 5.8.3.5 Italy

- 5.8.3.6 Russia

- 5.8.3.7 Rest of Europe

- 5.8.4 APAC

- 5.8.4.1 China

- 5.8.4.2 India

- 5.8.4.3 Japan

- 5.8.4.4 South Korea

- 5.8.4.5 ASEAN

- 5.8.4.6 Rest of APAC

- 5.8.5 Middle East and Africa

- 5.8.5.1 Saudi Arabia

- 5.8.5.2 United Arab Emirates

- 5.8.5.3 South Africa

- 5.8.5.4 Rest of Middle East and Africa

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Autoneum Holding AG

- 6.4.2 Dana Incorporated

- 6.4.3 Tenneco Inc.

- 6.4.4 ElringKlinger AG

- 6.4.5 Sumitomo Riko Co. Ltd.

- 6.4.6 DuPont de Nemours, Inc.

- 6.4.7 Lydall Inc./Unifrax Thermal Tech

- 6.4.8 Denso Corporation

- 6.4.9 Nichias Corporation

- 6.4.10 Morgan Advanced Materials

- 6.4.11 Talbros Automotive Components Ltd.

- 6.4.12 Trelleborg AB

- 6.4.13 3M Company

- 6.4.14 Toyobo Co., Ltd.

- 6.4.15 Zhuzhou Times New Material Technology Co., Ltd.

- 6.4.16 Thermo-Tec Automotive Products Inc.

- 6.4.17 Happich GmbH (Alutec)

- 6.4.18 Robert Bosch GmbH

- 6.4.19 Sanko Gosei Ltd.

- 6.4.20 HKO Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment