|

市場調查報告書

商品編碼

1844486

丙酮:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Acetone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

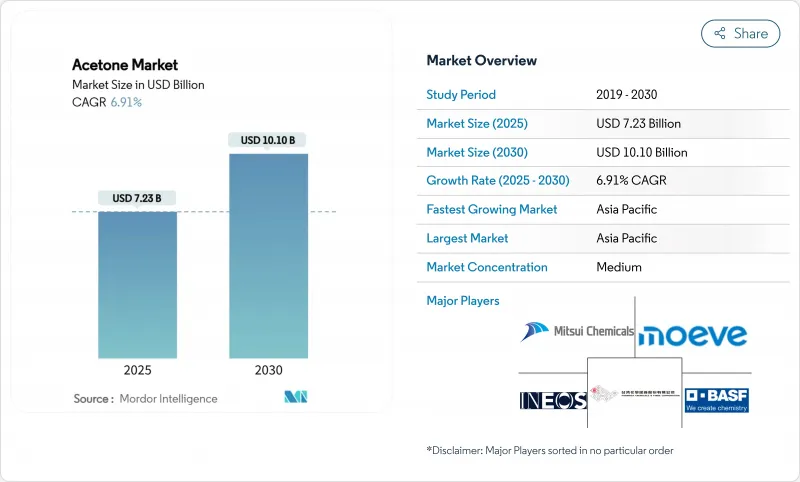

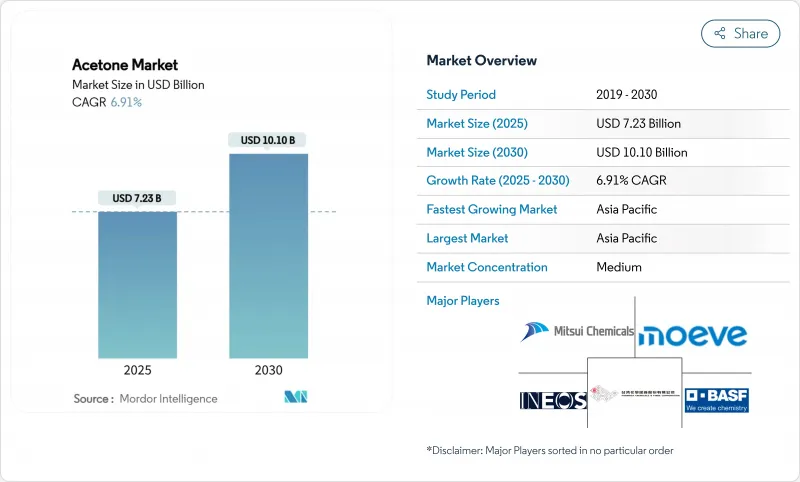

預計 2025 年丙酮市場規模為 72.3 億美元,到 2030 年將達到 101 億美元,預測期內(2025-2030 年)的複合年成長率為 6.91%。

這一市場規模成長軌跡得益於丙酮作為揮發性有機化合物(VOC)豁免溶劑、甲基丙烯酸甲酯 (MMA) 和雙酚A (BPA) 聯產原料以及製藥行業高純度介質日益重要的作用。輕量化電動車、新興市場的個人護理需求以及後疫情時代的製藥產能擴張正在推動銷售量的成長。同時,由於對雙酚A的監管壓力和煉油廠合理化措施導致傳統原料供應緊張,生物丙酮技術正在削弱基於異丙苯的供應鏈優勢。隨著新興企業展現可能重塑產業成本曲線的碳負性丙酮路線,同時垂直整合的大型企業確保了原料和下游銷售通路的穩定,競爭態勢仍將保持穩定。

全球丙酮市場趨勢和見解

電動車輕量化對MMA基丙烯酸板材的需求快速成長

電動車製造商正在用基於甲基丙烯酸甲酯 (MMA) 的丙烯酸板材取代玻璃和金屬,以減輕汽車重量。由於生產一磅 MMA 需要消耗約 0.5 磅丙酮,因此丙酮的需求量正在翻倍。到 2023 年,北美平均每輛汽車將含有價值 4,371 美元的化學物質。日益嚴格的 CAFE 燃油經濟性法規正在提升丙烯酸嵌裝玻璃在較重基材上的吸引力。三菱化學集團擁有先進的微波輔助 PMMA 回收技術,創造了封閉式溢價,進一步推動了下游丙酮市場的發展。

東南亞個人護理溶劑需求不斷成長

東南亞地區收入的成長和都市化正在重塑人們的美容習慣,丙酮成為洗去光水和化妝品配方的首選溶劑。丙酮揮發速度快,對皮膚刺激性小,因此非常適合高階化妝品。當地生產商利用丙酮的揮發性有機化合物(VOC)豁免特性,規避了替代溶劑所面臨的嚴格排放費,使其在泰國、越南和印尼市場具有成本競爭力。

歐盟和歐洲化學品管理局加強 BPA 法規

歐盟於2025年1月對食品接觸用品實施了廣泛的雙酚A(BPA)限制,減少了苯酚和丙酮的聯產,並消除了歐洲丙酮的一個主要出口管道。生產商必須轉向甲基丙烯酸甲酯(MMA)、溶劑和生物基路線,以彌補需求缺口。北美和亞洲部分地區正在就監管限制進行同步討論,這可能會進一步增加異丙苯基企業的壓力。

細分分析

受丙酮快速揮發和VOC法規豁免(尤其是在塗料和黏合劑領域)的推動,預計溶劑類產品將在2024年佔據市場收入的43.22%。受電動車和建築領域丙烯酸玻璃取代玻璃的推動,MMA預計將以7.45%的複合年成長率成長最快。雙酚A產業面臨監管限制,但一些雙酚A(BPA)仍透過聚碳酸酯在家用電器中的使用。甲基異丁基酮和特種中間體將利用丙酮的多樣化反應性來實現細分市場成長。

供應方面的變化同樣引人注目。汽車輕量化推動了對MMA的需求,而三菱化學集團的微波PMMA回收技術則創造了一個循環的需求環,擴大了丙酮市場的發展機會。溶劑混合商重視丙酮的交叉極性相溶性,這使得低VOC塗料能夠滿足更嚴格的排放法規,而無需昂貴的再製造成本。總體而言,即使BPA法規不斷發展,應用組合的多樣化也使丙酮市場免受任何單一細分市場的影響。

由於油漆、被覆劑和黏合劑在各行各業的廣泛應用,到2024年,它們將消耗37.88%的丙酮。而到2030年,化妝品和個人護理品的複合年成長率將達到最高,達到7.23%。東南亞日益壯大的中產階級將推動指甲油和護膚的使用,而丙酮的溫和特性在這些領域備受推崇。電子產品透過聚碳酸酯樹脂供應丙酮,確保了穩定的需求。汽車應用將透過基於甲基丙烯酸甲酯(MMA)的壓克力面板實現成長,而製藥業也將隨著亞洲新建的原料藥工廠而擴張。

穩定的需求多樣性正在推動產品韌性。個人護理配方師正在利用丙酮的雙重混溶性,將水和油性活性成分融合在一個產品中,從而提高配方靈活性。在北美和歐洲,專業沙龍連鎖店正在採用富含丙酮的卸妝液,以縮短使用時間,並增加重複購買週期。工業終端使用者正在使用需要快速乾燥的建築被覆劑來維持基準用量。

區域分析

受中國龐大的苯酚、丙酮和雙酚A(BPA)產能以及東南亞不斷擴張的利基化工產業叢集的推動,亞太地區將在2024年佔據42.45%的銷售量。預計該地區的需求成長將超過經合組織國家,到2030年,複合年成長率將達到7.66%。中國政府的化工產業藍圖強調自給自足和高附加價值產品,引導資本流向能夠在利潤率波動的情況下在燃料和石化產品之間切換的綜合煉油廠。中國2023年的原油產量將達到1,480萬桶/日,為下游丙酮生產裝置提供了可行的原料。

由於煉油廠關閉,北美異丙苯丙烯供應量正在下降,但汽車和航太輕量化領域表現良好。歐洲正面臨對雙酚A(BPA)的監管審查日益嚴格,但對永續生產的投資正在抵消部分產量損失。英力士的馬爾工廠就是一個結合原料管理和減碳策略,以確保未來丙酮供應的典範。

南美,尤其是巴西,由於國內產能有限,工業化進程加快,正在推動新的進口。國家鼓勵圍繞乙醇原料建設化工園區,預計在預測期內可能會刺激發酵計劃的發展。在中東和非洲,低成本的石腦油和液化石油氣正在支持待開發區石化綜合體,包括苯酚-丙酮一體化項目,提供出口導向供應,但國內需求有限。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 隨著電動車減重工作的持續推進,MMA 基丙烯酸板材的需求激增

- 家電中聚碳酸酯的消費量不斷增加

- 東南亞個人護理溶劑需求不斷成長

- 新冠疫情後,對藥物原料藥成分溶劑的需求增加

- 廢甘油發酵生產生質丙酮的成本平準化

- 市場限制

- 歐盟和歐洲化學品管理局加強 BPA 法規

- 煉油廠關閉導致異丙苯原料供應受限

- 溶劑使用的新VOC法規

- 價值鏈分析

- 監管狀況

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 生產能力分析

- 貿易分析

第5章市場規模及成長預測

- 按用途

- 甲基丙烯酸甲酯(MMA)

- 雙酚A(BPA)

- 溶劑

- 甲基異丁基酮(MIBK)

- 其他用途(化學中間體)

- 按最終用途行業

- 化妝品和個人護理

- 電子產品

- 車

- 製藥

- 油漆、被覆劑、黏合劑

- 紡織品

- 其他終端用戶產業(塑膠)

- 按製造程序

- 異丙苯工藝

- 異丙醇氧化

- 丙烯直接氧化

- 生物基發酵

- 按年級

- 技術等級

- 醫藥級

- 試劑/分析級

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太地區其他國家

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Altivia

- BASF SE

- Borealis GmbH

- Deepak

- Formosa Chemicals & Fibre Corp.

- Honeywell International Inc.

- INEOS

- Kumho P&B Chemicals

- LG Chem

- Mitsui Chemicals Inc.

- Moeve

- PTT Phenol Co. Ltd.

- SABIC

- Shell plc

- Ufaorgsintez(Bashneft)

第7章 市場機會與未來展望

The Acetone Market size is estimated at USD 7.23 billion in 2025, and is expected to reach USD 10.10 billion by 2030, at a CAGR of 6.91% during the forecast period (2025-2030).

This market size trajectory is supported by acetone's expanding role as a VOC-exempt solvent, a feedstock for methyl methacrylate (MMA) and bisphenol A (BPA) co-production, and a high-purity medium for pharmaceutical manufacturing. Electric vehicle lightweighting, personal care demand in emerging economies, and post-COVID pharmaceutical capacity additions are accelerating volume growth. At the same time, bio-acetone technologies are eroding the dominance of cumene-based supply chains, while regulatory pressures on BPA and refinery rationalizations tighten traditional feedstock availability. Competitive dynamics remain moderate as vertically integrated majors secure raw materials and downstream outlets, even as biotechnology start-ups demonstrate carbon-negative acetone routes that could re-set industry cost curves.

Global Acetone Market Trends and Insights

Surging Demand for MMA-Based Acrylic Sheets in EV Lightweighting

Electric vehicle makers are replacing glass and metal with MMA-based acrylic sheets to cut curb weight, which multiplies acetone demand because MMA consumes roughly 0.5 pounds of acetone per pound produced. The average North American auto contained USD 4,371 worth of chemistry in 2023, underscoring the material intensity of modern vehicles. Stricter CAFE fuel-economy rules heighten the appeal of acrylic glazing over heavier substrates. Mitsubishi Chemical Group has advanced microwave-assisted PMMA recycling, creating a closed-loop premium that further strengthens downstream pull on the acetone market.

Expansion of Personal-Care Solvent Demand in Southeast Asia

Rising incomes and urbanization in Southeast Asia are reshaping beauty routines, making acetone a preferred solvent for nail polish removers and cosmetic blends. The chemical's rapid evaporation and low dermal irritation suit premium formulations. Local producers capitalize on acetone's VOC-exempt status, avoiding the stricter emission fees faced by alternative solvents and enhancing cost competitiveness across Thailand, Vietnam, and Indonesia.

Tightening BPA Regulations by EU & ECHA

The EU enforced broad BPA restrictions in January 2025 for food-contact articles, reducing phenol-acetone co-production volumes and removing a notable outlet for acetone in Europe. Producers must pivot to MMA, solvents, or bio-routes to cushion the demand gap. Parallel debates in North America and parts of Asia may duplicate regulatory limits, compounding pressure on cumene-based operations.

Other drivers and restraints analyzed in the detailed report include:

- Growing Pharmaceutical API Solvent Requirements Post-COVID

- Bio-Acetone Cost Parity via Waste-Glycerol Fermentation

- Emerging VOC Limits on Solvent Use

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solvents held 43.22% of 2024 revenues, supported by acetone's rapid evaporation and exemption from most VOC caps, especially in paints and adhesives. MMA is the fastest riser at 7.45% CAGR as acrylic glazing replaces glass in electric vehicles and construction. The bisphenol A segment faces regulatory drag, yet consumer electronics sustain some BPA volume through polycarbonate use. Methyl isobutyl ketone and specialty intermediates provide niche growth by leveraging acetone's versatile reactivity.

Supply-side changes are equally stark. Automotive lightweighting magnifies MMA pull, whereas microwave PMMA recycling from Mitsubishi Chemical Group creates circular demand loops that lengthen acetone market opportunity windows. Solvent blenders prize acetone for miscibility across polarities, permitting lower VOC coatings that meet tougher emission caps without costly reformulation. Overall, application mix diversification shields the acetone market from single-segment shocks even as BPA curbs unfold.

Paints, coatings, and adhesives consumed 37.88% of acetone in 2024 due to broad industrial adoption, yet cosmetics and personal care post the highest 7.23% CAGR to 2030. Southeast Asia's rising middle class fuels nail polish and skincare volumes, where acetone's low irritation profile is prized. Electronic devices channel acetone through polycarbonate resins, locking in stable demand. Automotive applications grow through MMA-based acrylic panels, while pharmaceuticals expand alongside new API plants in Asia.

Stable demand diversity bolsters resilience. Personal care formulators exploit acetone's dual miscibility to pair water and oil actives in a single product, raising formulation flexibility. In North America and Europe, professional salon chains adopt acetone-rich removers that cut service times, boosting repeat purchase cycles. Industrial end users maintain baseline volume through architectural coatings that need fast dry times.

The Acetone Market Report is Segmented by Application (Methyl Methacrylate, Bisphenol A, Solvents, and More), End-Use Industry (Cosmetics and Personal Care, Electronics, and More), Production Process (Cumene Process, Isopropanol Oxidation, and More), Grade (Technical Grade, Pharmaceutical Grade, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific captured 42.45% of 2024 volume owing to China's vast phenol-acetone and BPA base and Southeast Asia's expanding niche chemicals clusters. The region is projected to post a 7.66% CAGR to 2030 as local demand outstrips OECD growth. Government chemical industry roadmaps emphasize self-sufficiency and higher value products, steering capital into integrated refineries that can toggle between fuels and petrochemicals amid margin swings. China processed 14.8 million b/d of crude in 2023, underscoring feedstock availability for downstream acetone units.

North America enjoys a strong automotive and aerospace lightweighting pull, although refinery closures narrow the propylene supply for cumene. Europe faces the sharpest regulatory scrutiny on BPA but offsets some volume loss through sustainable production investments. INEOS's Marl facility exemplifies strategy that pairs feedstock control with carbon-cuts to future-proof acetone supply.

South America's industrialization, especially in Brazil, invites new imports as local capacity remains limited. State incentives to build chemical parks around ethanol feedstocks could spur fermentation projects over the forecast period. In the Middle East and Africa, low-cost naphtha and LPG underpin greenfield petrochemical complexes that include phenol-acetone integration, providing export-oriented supply but limited domestic pull.

- Altivia

- BASF SE

- Borealis GmbH

- Deepak

- Formosa Chemicals & Fibre Corp.

- Honeywell International Inc.

- INEOS

- Kumho P&B Chemicals

- LG Chem

- Mitsui Chemicals Inc.

- Moeve

- PTT Phenol Co. Ltd.

- SABIC

- Shell plc

- Ufaorgsintez (Bashneft)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for MMA-based acrylic sheets in EV light-weighting

- 4.2.2 Rising polycarbonate consumption in consumer electronics

- 4.2.3 Expansion of personal-care solvent demand in Southeast Asia

- 4.2.4 Growing pharmaceutical API solvent requirements post-COVID

- 4.2.5 Bio-acetone cost parity via waste-glycerol fermentation

- 4.3 Market Restraints

- 4.3.1 Tightening BPA regulations by EU and ECHA

- 4.3.2 Refinery closures curbing cumene feedstock supply

- 4.3.3 Emerging VOC limits on solvent use

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Rivalry

- 4.7 Production Capacity Analysis

- 4.8 Trade Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Methyl Methacrylate (MMA)

- 5.1.2 Bisphenol A (BPA)

- 5.1.3 Solvents

- 5.1.4 Methyl Isobutyl Ketone (MIBK)

- 5.1.5 Other Applications (Chemical Intermediates)

- 5.2 By End-Use Industry

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Electronics

- 5.2.3 Automotive

- 5.2.4 Pharmaceutical

- 5.2.5 Paints, Coatings and Adhesives

- 5.2.6 Textile

- 5.2.7 Other End-user Industry (Plastics)

- 5.3 By Production Process

- 5.3.1 Cumene Process

- 5.3.2 Isopropanol Oxidation

- 5.3.3 Direct Propylene Oxidation

- 5.3.4 Bio-based Fermentation

- 5.4 By Grade

- 5.4.1 Technical Grade

- 5.4.2 Pharmaceutical Grade

- 5.4.3 Reagent/Analytical Grade

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of APAC

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Altivia

- 6.4.2 BASF SE

- 6.4.3 Borealis GmbH

- 6.4.4 Deepak

- 6.4.5 Formosa Chemicals & Fibre Corp.

- 6.4.6 Honeywell International Inc.

- 6.4.7 INEOS

- 6.4.8 Kumho P&B Chemicals

- 6.4.9 LG Chem

- 6.4.10 Mitsui Chemicals Inc.

- 6.4.11 Moeve

- 6.4.12 PTT Phenol Co. Ltd.

- 6.4.13 SABIC

- 6.4.14 Shell plc

- 6.4.15 Ufaorgsintez (Bashneft)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment