|

市場調查報告書

商品編碼

1844484

暖通空調設備:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)HVAC Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

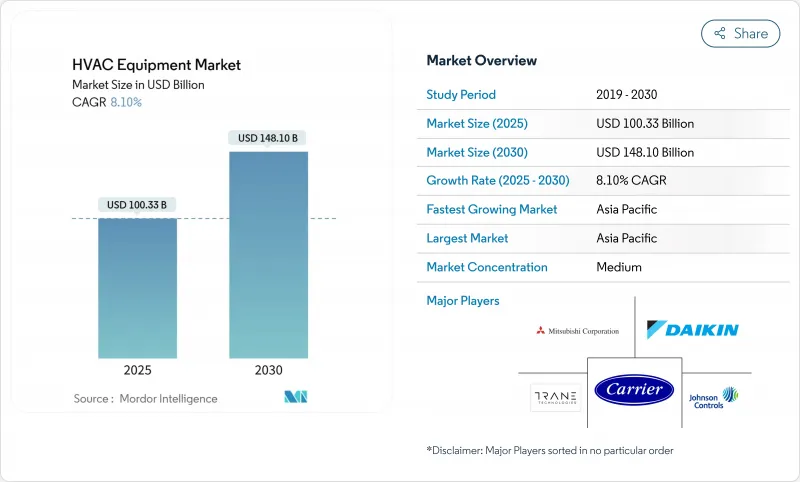

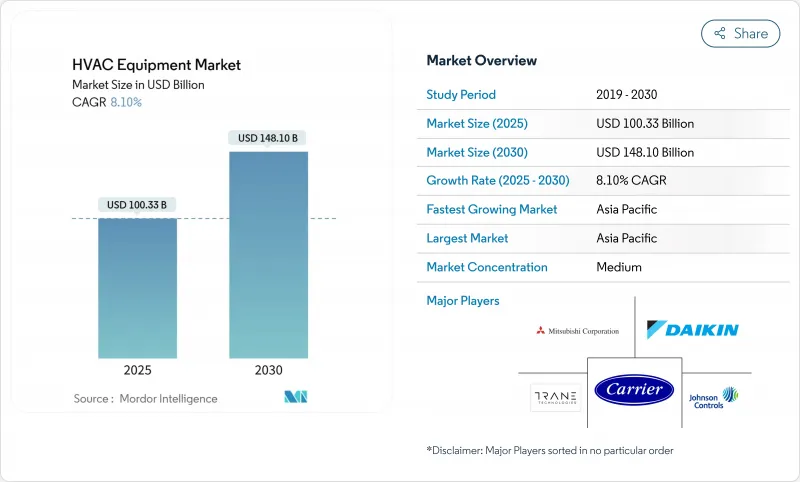

目前,暖通空調設備市場價值為 1,003.3 億美元,預計到 2030 年將成長至 1,481 億美元,複合年成長率為 8.1%。

成長動力源自於日益嚴格的能源效率法規、向低全球暖化潛勢冷媒的轉變,以及數位化控制升級,這些升級不僅提升了營運性能,也提升了最終用戶價值。熱泵獎勵正在重塑歐洲和北美的供暖組合,資料中心的建設給傳統的製冷設計帶來壓力,亞洲的都市化也促進了室內空調數量的成長。隨著原始設備製造商(OEM)爭奪寒冷氣候熱泵的軟體人才和智慧財產權,頂級供應商之間的整合正在加速,而區域專家則向尚未開發的細分市場(例如偏遠地區的太陽能混合系統)擴張。預計到2027年,與2025年1月冷媒截止日期相關的短期供應摩擦將有所緩解,這將為高階電氣化解決方案提供更清晰的道路。

全球暖通空調設備市場趨勢與洞察

更嚴格的歐洲建築能源標準加速了熱泵的普及

在歐洲,隨著近零能耗建築的強制要求,到2024年,熱泵的安裝數量將比2022年增加38%,新建建築中的熱泵普及率將達到所有售出單元的一半。在北歐國家,目前超過60%的新建住宅安裝了熱泵,大容量熱泵也被引入商業房地產的維修中。

北歐和FLAP-D地區資料中心建設激增推動精密冷卻需求

超過30千瓦的機架密度、每年35%的冷凍容量成長以及瑞典和挪威65%的新建專案開工率,正在推動液體冷卻技術的採用。江森自控指出,資料中心計劃目前佔其商用暖通空調收益的18%,高於去年同期的12%。

成熟市場缺乏認證暖通空調技術人員

目前,全產業的重新設計成本已超過 100 億美元,平均系統價格上漲了 8-12%。

細分分析

氣溫升高和都市區中等收入人口的成長將推動強勁的需求,到2024年,空調將佔暖通空調設備市場的46.1%。同年,中國用房間室內空調的普及率達73% [cheaa.org]。在北美,無管道迷你分離式空調的年成長率達到18%,因為屋主們追求無需維修管道即可享受分區舒適度。

VRF 仍然是成長最快的細分市場,到 2030 年的複合年成長率將達到 12.7%。醫院、飯店和混合用途建築重視同時供暖和冷氣的靈活性。三菱電機的數據顯示,2024 年全球 VRF 安裝量激增 32%。

到 2024 年,維修和更換將佔 HVAC 設備市場規模的 63.4%,這主要是由於 2005 年至 2010 年繁榮時期安裝的系統的使用壽命終止。根據哈佛大學的一項研究,由於業主追求降低能源費用,到 2024 年,美國住宅 HVAC 更換量將增加 14%。

新建項目規模雖小,但預計年增率將達9.4%。 2023年美國能源法規將更加嚴格,最低能源效率基準值將提高15%,這將鼓勵建商指定高階方案。基於性能的維修持續成長,江森自控指出,此類合約目前佔其維修訂單的32%。

暖通空調設備市場報告按設備類型(例如鍋爐和熔爐、熱泵)、安裝類型(例如新建、維修/更換)、最終用戶(例如住宅、商業)、建築類型(例如辦公大樓、醫療機構)和地區(例如美國、中國)對產業進行細分。市場規模和預測以美元計算。

區域分析

受城鎮建設和中產階級不斷壯大的推動,到2024年,亞太地區將佔據暖通空調設備市場的34.9%。僅中國就佔了該地區42%的佔有率,但隨著房地產活動的穩定,其年成長率放緩至6.8%。 [daikin.com] 日本和韓國青睞高規格的多聯機(VRF)和空氣清淨機型號,而越南和印尼的商業建設則實現了兩位數的成長。

北美地區佔28.6%,得益於強勁的更換需求和通膨控制稅收優惠,美國熱泵銷量激增32% [carrier.com]。資料中心和醫療保健計劃推動商業收益成長22%。

歐洲佔24.3%,儘管面臨宏觀經濟逆風,但到2024年,熱泵出貨量仍將成長17%。由於歐盟成員國計劃逐步淘汰石化燃料,暖通空調(HVAC)升級佔歐盟維修支出的38%。

中東是成長最快的地區,預計複合年成長率為 10.6%,因為沙烏地阿拉伯的「2030 願景」增加了大規模區域供冷能力,而阿拉伯聯合大公國的開發商迅速採用 VRF。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 嚴格的歐洲建築能源法規促進了熱泵的採用

- 北歐和FLAP-D地區資料中心建設的快速成長將推動精密冷卻的需求

- 亞洲高層住宅快速採用可變冷凍 (VRF) 系統

- 美國《通貨膨脹削減法案》稅額扣抵促進早期爐子更換週期

- 東歐區域供熱擴張推動高容量鍋爐維修

- 太陽能混合暖通空調系統在非洲離網採礦營地廣受歡迎

- 市場限制

- 原始設備製造商過渡到低 GWP 冷媒的初始成本較高

- 成熟市場缺乏認證暖通空調技術人員

- 半導體供應鏈波動導致 VRF 逆變器供應受限

- 嚴格的歐盟含氟氣體配額增加了進口商的合規負擔

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 關鍵績效指標

第5章市場規模及成長預測

- 依設備類型

- 加熱設備

- 鍋爐和熔爐

- 熱泵

- 單元加熱器

- 通風設備

- 空氣調節機

- 加濕器和除濕器

- 空氣過濾器

- 風機盤管機組

- 空調設備

- 單元空調

- 管道式分體

- 無管迷你分離式

- 套餐屋頂

- 變冷劑流量 (VRF) 系統

- 室內空調

- 包終端機空調

- 冷卻器

- 加熱設備

- 按安裝類型

- 新建築

- 改裝/更換

- 按最終用戶

- 住房

- 商業的

- 工業的

- 按建築類型(商業)

- 辦公大樓

- 醫療機構

- 酒店和休閒

- 零售店和商場

- 教育機構

- 資料中心

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 卡達

- 非洲

- 南非

- 奈及利亞

- 埃及

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Daikin Industries Ltd.

- Carrier Global Corp.

- Trane Technologies PLC

- Johnson Controls International PLC

- Mitsubishi Electric Corp.

- Lennox International Inc.

- Rheem Manufacturing Co.

- Midea Group

- Gree Electric Appliances Inc.

- NIBE Group

- Panasonic Corp.

- Samsung Electronics(HVAC Division)

- LG Electronics(Air-Solution)

- Bosch Thermotechnology

- Vaillant Group

- Alfa Laval AB

- Stiebel Eltron GmbH and Co. KG

- Systemair AB

- Greenheck Fan Corporation

- FlaktGroup

- TROX GmbH

- Swegon Group AB

- Hitachi-Johnson Controls Air Conditioning

- Danfoss A/S(Commercial Compressors)

第7章 市場機會與未來展望

The HVAC equipment market is currently valued at USD 100.33 billion, and forecasts show it climbing to USD 148.1 billion by 2030 on an 8.1% CAGR.

Growth momentum rests on tightening energy-efficiency rules, the pivot to low-GWP refrigerants and digital-control upgrades that lift both operating performance and end-user value. Demand is broad-based: heat-pump incentives in Europe and North America are reshaping heating portfolios, data-center build-outs are straining traditional cooling designs and urbanization in Asia keeps room-air-conditioner volumes rising. Consolidation among tier-one vendors is accelerating as OEMs race to lock in software talent and cold-climate heat-pump IP, while regional specialists are moving into unserved niches such as solar-hybrid systems for remote sites. Short-term supply frictions tied to the January 2025 refrigerant deadline are likely to ease by 2027, setting a clearer runway for premium electrification solutions.

Global HVAC Equipment Market Trends and Insights

Stringent Building-Energy Codes in Europe Accelerating Heat-Pump Adoption

Europe's near-zero-energy-building mandate moved heat-pump installations 38% higher in 2024 versus 2022, pushing penetration in new builds to half of all units sold across the bloc. Nordic countries now deploy heat pumps in more than 60% of new homes, and large-capacity variants are entering commercial retrofits, creating a durable pull for cold-climate technology providers

Surge in Data-Center Construction in Nordics and FLAP-D Elevating Precision-Cooling Demand

Rack densities topping 30 kW, a 35% annual leap in cooling capacity and 65% growth in Swedish-Norwegian build-starts are fuelling liquid-cooling adoption. Johnson Controls notes that data-center projects now generate 18% of its commercial HVAC revenue, up from 12% a year earlier.

Talent Shortage of Certified HVAC Technicians in Mature Markets

Industrywide redesign outlays now exceed USD 10 billion and have lifted average system prices 8-12%, a short-lived drag until economies of scale improve after 2026

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of VRF Systems in High-Rise Asian Residential Complexes

- Inflation Reduction Act Tax Credits Catalyzing Early Furnace-Replacement Cycles

- High Up-Front Cost of Low-GWP Refrigerant Transition for OEMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-conditioning units contributed 46.1% to the HVAC equipment market in 2024 as rising temperatures and urban middle-class growth kept demand resilient. Residential room air conditioners in China reached 73% penetration that year [cheaa.org]. Ductless mini-splits advanced 18% annually in North America, where homeowners want zonal comfort without duct retrofits.

VRF remains the fastest-growing sub-segment, expanding at a 12.7% CAGR through 2030. Hospitals, hotels and mixed-use towers prize its simultaneous heating-cooling flexibility. Mitsubishi Electric recorded a 32% jump in global VRF installations in 2024

Retrofit and replacement activity represented 63.4% of the HVAC equipment market size in 2024, largely because systems commissioned during the 2005-2010 boom have reached end of life. Harvard research shows U.S. household HVAC replacements rose 14% in 2024 as owners chased lower utility bills.

New construction, although smaller, is forecast to climb 9.4% annually. Stricter 2023 U.S. energy-code updates lifted minimum efficiency thresholds 15%, prompting builders to specify premium packages. Performance-based retrofits continue to gain ground, with Johnson Controls indicating such contracts account for 32% of its retrofit backlog

HVAC Equipment Market Report Segments the Industry by Equipment Type (Boilers and Furnaces, Heat Pumps and More), Installation Type (New Construction, Retrofit / Replacement and More), End User (Residential, Commercial and More), Building Type (Office Buildings, Healthcare Facilities and More), and Geography (United States, China and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 34.9% of the HVAC equipment market in 2024, driven by urban construction and middle-income expansion. China alone made up 42% of regional value, though its annual growth cooled to 6.8% as real-estate activity stabilized [daikin.com]. Japan and Korea favor high-spec VRF and air-purification models, while Vietnam and Indonesia post double-digit gains on commercial builds.

North America accounted for 28.6%, buoyed by robust replacement demand and a 32% surge in U.S. heat-pump sales following Inflation Reduction Act incentives [carrier.com]. Data-center and healthcare projects lifted commercial revenue 22%.

Europe held 24.3%; heat-pump shipments climbed 17% in 2024 despite macro headwinds. HVAC upgrades made up 38% of EU renovation-wave spending as member states schedule fossil-fuel phaseouts.

The Middle East is the fastest-growing pocket, forecast at a 10.6% CAGR, with Saudi Arabia's Vision 2030 adding large-scale district-cooling capacity and UAE developers adopting VRF at speed.

- Daikin Industries Ltd.

- Carrier Global Corp.

- Trane Technologies PLC

- Johnson Controls International PLC

- Mitsubishi Electric Corp.

- Lennox International Inc.

- Rheem Manufacturing Co.

- Midea Group

- Gree Electric Appliances Inc.

- NIBE Group

- Panasonic Corp.

- Samsung Electronics (HVAC Division)

- LG Electronics (Air-Solution)

- Bosch Thermotechnology

- Vaillant Group

- Alfa Laval AB

- Stiebel Eltron GmbH and Co. KG

- Systemair AB

- Greenheck Fan Corporation

- FlaktGroup

- TROX GmbH

- Swegon Group AB

- Hitachi-Johnson Controls Air Conditioning

- Danfoss A/S (Commercial Compressors)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Building Energy Codes in Europe Accelerating Heat-Pump Adoption

- 4.2.2 Surge in Data-Center Construction in Nordics and FLAP-D Region Elevating Precision Cooling Demand

- 4.2.3 Rapid Uptake of Variable-Refrigerant-Flow (VRF) Systems in High-Rise Asian Residential Complexes

- 4.2.4 Inflation Reduction Act (U.S.) Tax Credits Catalyzing Early Furnace Replacement Cycles

- 4.2.5 District-Heating Expansion in Eastern Europe Spurring Large-capacity Boiler Retrofits

- 4.2.6 Solar-Hybrid HVAC Packages Gaining Traction in Off-Grid African Mining Camps

- 4.3 Market Restraints

- 4.3.1 High Up-front Cost of Low-GWP Refrigerant Transition for OEMs

- 4.3.2 Talent Shortage of Certified HVAC Technicians in Mature Markets

- 4.3.3 Semiconductor Supply-Chain Volatility Constraining VRF Inverter Availability

- 4.3.4 Stringent F-Gas Quotas in EU Increasing Compliance Burden for Importers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Performance Indicators

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Equipment Type

- 5.1.1 Heating Equipment

- 5.1.1.1 Boilers and Furnaces

- 5.1.1.2 Heat Pumps

- 5.1.1.3 Unitary Heaters

- 5.1.2 Ventilation Equipment

- 5.1.2.1 Air Handling Units

- 5.1.2.2 Humidifiers and Dehumidifiers

- 5.1.2.3 Air Filters

- 5.1.2.4 Fan Coil Units

- 5.1.3 Air-Conditioning Equipment

- 5.1.3.1 Unitary Air Conditioners

- 5.1.3.1.1 Ducted Splits

- 5.1.3.1.2 Ductless Mini-Splits

- 5.1.3.1.3 Packaged Rooftops

- 5.1.3.1.4 Variable Refrigerant Flow (VRF) Systems

- 5.1.3.2 Room Air Conditioners

- 5.1.3.3 Packaged Terminal Air Conditioners

- 5.1.3.4 Chillers

- 5.1.1 Heating Equipment

- 5.2 By Installation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit / Replacement

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 By Building Type (Commercial)

- 5.4.1 Office Buildings

- 5.4.2 Healthcare Facilities

- 5.4.3 Hospitality and Leisure

- 5.4.4 Retail Stores and Malls

- 5.4.5 Educational Institutions

- 5.4.6 Data Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Qatar

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Daikin Industries Ltd.

- 6.4.2 Carrier Global Corp.

- 6.4.3 Trane Technologies PLC

- 6.4.4 Johnson Controls International PLC

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Lennox International Inc.

- 6.4.7 Rheem Manufacturing Co.

- 6.4.8 Midea Group

- 6.4.9 Gree Electric Appliances Inc.

- 6.4.10 NIBE Group

- 6.4.11 Panasonic Corp.

- 6.4.12 Samsung Electronics (HVAC Division)

- 6.4.13 LG Electronics (Air-Solution)

- 6.4.14 Bosch Thermotechnology

- 6.4.15 Vaillant Group

- 6.4.16 Alfa Laval AB

- 6.4.17 Stiebel Eltron GmbH and Co. KG

- 6.4.18 Systemair AB

- 6.4.19 Greenheck Fan Corporation

- 6.4.20 FlaktGroup

- 6.4.21 TROX GmbH

- 6.4.22 Swegon Group AB

- 6.4.23 Hitachi-Johnson Controls Air Conditioning

- 6.4.24 Danfoss A/S (Commercial Compressors)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment