|

市場調查報告書

商品編碼

1844446

功能印刷:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Functional Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

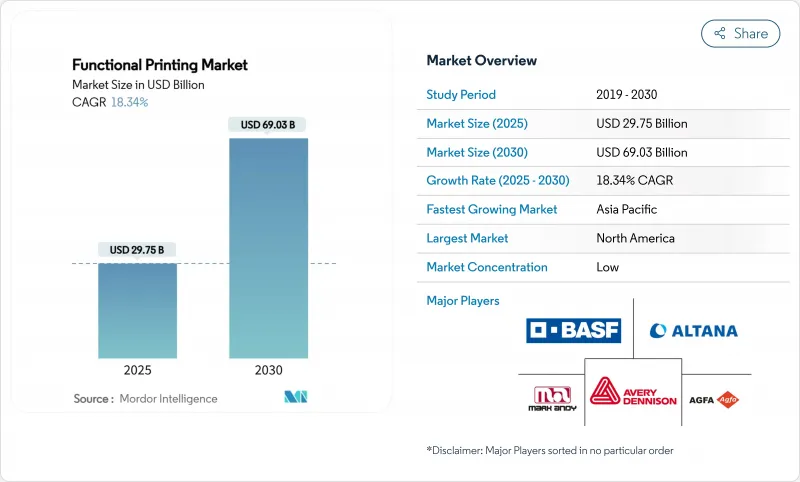

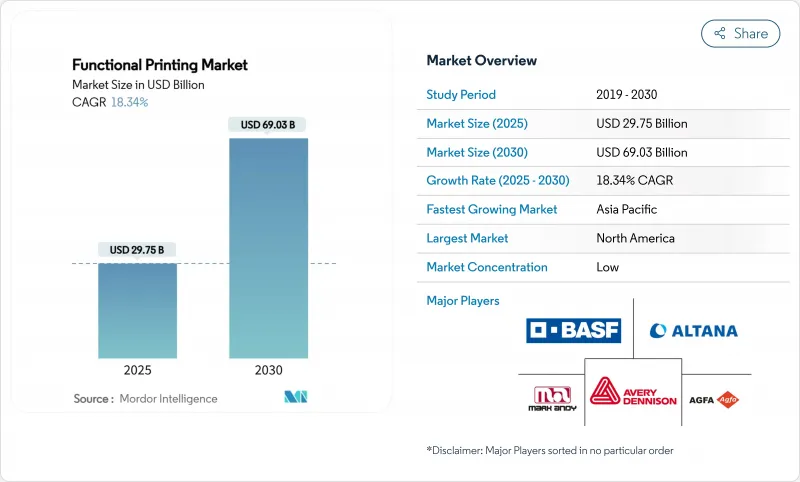

預計2025年功能印刷市場規模將達297.5億美元,2030年將達690.3億美元。

導電油墨化學技術的進步已將可實現的線寬推至 10µm 以下,而材料成本使大規模生產觸手可及。靈活的外形規格、輕量化組裝和低溫處理提供了優於傳統矽技術的成本優勢,加速了汽車、包裝和醫療設備等領域的需求。對於診斷貼片和智慧標籤等新興產品,製造商擴大轉向支援大批量、在地化生產的捲對卷設備,從而降低了資本強度並縮短了供應鏈。隨著對奈米銀線生產和噴墨製程最佳化的投資增加,規模經濟正穩步轉向有利於感測器、天線、電源管理薄膜和其他應用的印刷解決方案。市場風險仍然存在,包括貴金屬原料的波動和不斷變化的廢棄物管理規則,這些可能會使首選的基材轉向可回收紙和陶瓷。

全球功能印刷市場趨勢與洞察

對低成本、高速電子產品生產的需求

消費品和汽車行業的成本壓力正促使原始設備製造商 (OEM) 以不需要無塵室基礎設施的捲繞式功能電路取代微影術。汽車電池管理系統現已整合印刷溫度和電流感測器,可將電子成本降低高達 60%,同時滿足非關鍵精度閾值。擁有捲對卷生產線的區域晶圓廠可以在六個月內實現本地化生產,從而實現比傳統矽晶圓代工廠更快的設計迭代。這種靈活性使亞洲契約製造製造商能夠透過將設計支援與利潤率較低的量產捆綁在一起,贏得智慧包裝插頁和藍牙天線的新計畫。隨著卓越的油墨燒結技術提高了性能上限,功能印刷市場正在獲得中階電子產品的市場佔有率,而此前這些市場僅限於剛性 PCB。

軟性和穿戴式電子產品的迅速普及

數位化醫療保健正在擁抱能夠隨著身體運動自然彎曲的貼膚設備,而剛性矽基基板在這方面處於劣勢。西北大學的皮膚健康貼片可以捕捉水分和pH值數據,且不會給使用者帶來不適。歐洲心臟病診所正在試用印刷式心電圖貼片,可連續佩戴96小時且不會產生刺激,從而提高了患者的依從性。可拉伸電路的高產量比率印刷消除了昂貴的組裝步驟,並可實現大規模部署,因為每個單元在印刷機出廠時都能完全正常工作。亞洲製造商正在利用規模經濟效應,每年出貨數千萬個血糖監測貼片,為全球客戶提供裝置量,從而推動對雲端基礎的輔助分析的持續需求。

與矽電子元件的性能差異

印刷IGZO電晶體的遷移率仍落後於矽基基準,限制了其在運算和高速通訊設備的應用。碳化矽的熔點為2700 度C,超過了印刷電子產品低於200 度C的熱上限,這使得印刷電路無法應用於極端溫度的汽車領域。由於聚合物油墨長期漂移有失效風險,關鍵任務航太設備和醫療植入必須使用成熟的矽基材料。這限制了功能性印刷市場的發展,其應用領域將靈活性和價格置於最終性能之上。

細分分析

預計到2030年,玻璃和陶瓷基板的複合年成長率將達到22.56%,超過更廣泛的功能性印刷市場。其熱穩定性和光學透明度使其非常適合用於汽車HUD顯示器和高溫壓力感測器。到2024年,塑膠薄膜的功能性印刷市場佔有率將維持在54.56%,支援超高速、低成本的捲對卷生產線,為智慧標籤和消費性穿戴設備提供原料。雖然玻璃的處理成本較高,但其在微米間距下尺寸穩定性的提升使其能夠實現多層OLED背板,而塑膠無法以足夠的產量比率滿足這一需求。

PET 可在幾秒鐘內將銀光燒結,而陶瓷工藝則可透過熱燒結實現高導電性,且基板不會翹曲。紙張和奈米纖維素基板正逐漸成為符合循環經濟法規的一次性生物設備貼片的主流選擇。金屬箔在電磁干擾屏蔽和大電流總線領域仍佔有一席之地,其導電性可抵消增加的重量。基板的多樣化為原始設備製造商提供了多種選擇,使其能夠兼顧性能和永續性目標,從而推動功能性印刷市場各個細分領域的均衡成長。

導電油墨仍是大多數印刷電路的基礎,到2024年將佔其總收入的65.45%。然而,基於奈米粒子的功能性油墨預計將以22.89%的複合年成長率成長,這突顯了其在不提高固化溫度的情況下降低線路電阻的卓越能力。銀奈米粒子漿料在光燒結後可達到10^5 S/m的電導率,這一數字先前僅限於塊狀金屬。雖然銅油墨可以降低材料成本,但它們需要惰性氣體固化站來防止氧化,因此需要採用在過程中切換氣體的混合印刷生產線。

介電油墨與導體油墨一同持續發展,低損耗有機矽酸鹽配方可在薄PET上實現GHz頻段天線,並在低功耗物聯網節點中取代蝕刻FR-4。光伏和熱電油墨系統使製造商能夠在幾分鐘內完成大型太陽能電池和能量收集層的塗覆,從而拓展了功能性印刷市場的潛在應用場景。隨著化學創新的加速,油墨供應商正在透過薄片形態、黏合劑生物學和燒結相容性來實現差異化,深化與印表機原始設備製造商的研發合作。

功能印刷市場按基材(紙張/紙板、塑膠薄膜等)、油墨(導電油墨、介電油墨、絕緣油墨等)、印刷技術(噴墨印刷、絲網印刷、凹版印刷、柔版印刷等)、應用(感測器、顯示器、OLED照明面板等)和地區細分。市場規模和預測以美元計算。

區域分析

到2024年,北美將以32.45%的市佔率保持領先地位,這主要得益於國防航空電子設備和使用尖端印刷薄膜的先進汽車內裝。由於軟性PCB生產線的設備更換週期較長,北美功能性印刷市場規模預計將強勁成長。同時,受中國和日本為卷對卷生產提供資本支出補償的激勵措施的推動,亞太地區預計將以21.78%的複合年成長率快速成長。 Elephantech的2,010萬美元E輪融資顯示了國內市場對永續印刷電路基板的需求。

歐洲供應商正專注於醫療穿戴式裝置和汽車LiDAR外殼等高階領域,並利用嚴格的監管障礙作為競爭壁壘。 「改革計劃」等舉措旨在確保關鍵油墨和基板的本地供應鏈,並降低地緣政治風險。中東和非洲的公司正在投資用於非電力照明的印刷太陽能箔,而南美洲的農業企業則正在推出低成本的土壤濕度標籤,以最佳化灌溉。這些不同的重點表明,區域專業化而非一刀切的解決方案將推動功能性印刷的市場滲透。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 對低成本、高速電子產品生產的需求

- 軟性和穿戴式電子產品的迅速普及

- 導電和介電油墨化學進展

- 物聯網主導的智慧包裝量

- 電動車中的捲對卷 3D 結構電子裝置

- 遠端醫療皮膚診斷貼片

- 市場限制

- 與矽電子裝置的性能差距

- 缺乏全球製造標準

- 銀奈米粒子供應不穩定

- 電子廢棄物法規針對不可回收基板

- 供應鏈分析

- 監管狀況

- 技術展望

- 投資金籌措格局

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章市場規模及成長預測

- 按基材

- 紙和紙板

- 塑膠薄膜

- 玻璃和陶瓷

- 金屬箔和軟性金屬

- 透過墨水

- 導電油墨

- 介電/絕緣油墨

- 半導體和光伏油墨

- 基於奈米粒子的功能墨水

- 透過印刷技術

- 噴墨列印

- 按需噴墨

- 普通噴墨

- 網版印刷

- 凹版印刷

- 柔版印刷

- 氣溶膠噴射列印

- 其他印刷技術

- 噴墨列印

- 按用途

- 感應器

- 溫濕度感測器

- 壓力/力道感測器

- 生物感測器和穿戴式設備

- 展示

- 電子紙顯示器

- 有機發光二極體顯示器

- 有機發光二極體照明面板

- 軟性薄膜電池

- 太陽能電池

- 有機光伏

- 鈣鈦礦太陽能電池

- RFID 和 NFC 標籤

- 其他用途

- 感應器

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- ASEAN

- 澳洲

- 其他亞太地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Avery Dennison Corp.

- BASF SE

- Blue Spark Technologies

- E Ink Holdings Inc.

- Eastman Kodak Co.

- Enfucell Oy

- GSI Technologies LLC

- Isorg SA

- Mark Andy Inc.

- ALTANA AG

- Agfa-Gevaert NV

- Ceradrop-MGI Group

- DuPont de Nemours Inc.

- Samsung Electronics(Printed Solutions)

- LG Display Co.

- Molex LLC

- Thinfilm Electronics ASA

- Toppan Forms Co.

- Toyo Ink SC Holdings

- Optomec Inc.

- Xaar PLC

- Xennia Technology Ltd.

- Kateeva Inc.

- NovaCentrix

- Cambrios Advanced Materials

- Nano Dimension Ltd.

第7章 市場機會與未來展望

The functional printing market size reached a value of USD 29.75 billion in 2025 and is forecast to climb to USD 69.03 billion by 2030, translating into an 18.34% CAGR.

At this trajectory the functional printing market size is positioned to more than double within five years, largely because advances in conductive ink chemistry have pushed achievable line widths below 10 µm while keeping material costs within reach for mass production. Demand accelerates across automotive, packaging, and medical devices where flexible form factors, lightweight assemblies, and low-temperature processing give printed electronics a cost advantage over traditional silicon technology. Manufacturers are increasingly shifting to roll-to-roll equipment that supports high-volume regional production, which reduces capital intensity and shortens supply chains for emerging products such as diagnostic patches and smart labels. Heightened investment flows into silver nanowire production and inkjet process optimization indicate that scale economics are moving steadily in favor of printed solutions for sensors, antennas, and power management films. Market risks remain around precious-metal feedstock volatility and evolving waste-management rules that could shift preferred substrate choices toward recyclable papers or ceramics.

Global Functional Printing Market Trends and Insights

Demand for Low-Cost, High-Speed Electronic Production

Cost pressure across the consumer and automotive sectors prompts OEMs to replace photolithography with roll-processed functional circuits that require no cleanroom infrastructure infinitypv.com. Automotive battery-management systems now integrate printed temperature and current sensors that cut electronics cost by up to 60% while meeting non-critical accuracy thresholds. Regional fabs equipped with roll-to-roll lines can localize production in under six months, allowing quicker response to design iterations than traditional silicon foundries. This flexibility helps Asian contract manufacturers win new projects for smart packaging inserts and Bluetooth antennas by bundling design support with low-margin, high-volume output. As performance ceilings rise through better ink sintering, the functional printing market gains share in mid-range electronics previously reserved for rigid PCBs.

Rapid Adoption of Flexible and Wearable Electronics

Digitized healthcare embraces on-skin devices that flex naturally with body movement, an area where rigid silicon substrates underperform. Northwestern University's skin health patch captures hydration and pH data without user discomfort. European cardiology clinics are piloting printed ECG stickers that achieve 96-hour wear without irritation, improving patient compliance. High-yield printing of stretchable circuits enables mass adoption because each unit ships fully functional from the press, reducing costly assembly steps. Asian manufacturers capitalize on scale economics to ship tens of millions of glucose-monitoring patches annually, feeding a global installed base that drives recurring demand for ancillary cloud-based analytics.

Performance Gap vs. Silicon Electronics

Printed IGZO transistors still lag silicon mobility benchmarks, limiting uptake in computing and high-speed telecom devices. Silicon carbide's 2700 °C melting point dwarfs printed electronics' thermal ceiling below 200 °C, excluding printed circuits from harsh-temperature automotive zones. Mission-critical aerospace and medical implants remain tethered to proven silicon because long-term drift in polymer inks risks field failures. This ceiling confines the functional printing market to segments where flexibility or price trumps ultimate performance.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Conductive and Dielectric Ink Chemistry

- IoT-Driven Smart Packaging Volumes

- Lack of Global Manufacturing Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glass and ceramic substrates are projected to grow at 22.56% CAGR, outpacing the wider functional printing market through 2030. Their thermal stability and optical clarity suit automotive HUD displays and high-temperature pressure sensors. Plastic films retained 54.56% functional printing market share in 2024 by supporting ultrafast, low-cost roll-to-roll lines that supply smart labels and consumer wearables. Despite higher handling costs, glass improves dimensional stability at micron pitches, enabling multilayer OLED backplanes that plastic cannot achieve with sufficient yield.

Manufacturers optimize each substrate choice around curing profiles; PET allows photo-sintered silver within seconds, while ceramic routes use thermal sintering to achieve high conductivity without substrate warping. Paper and nanocellulose boards gain traction for disposable biodevice patches, aligning with circular-economy regulations. Metal foils remain niche for EMI shielding and high-current bus lines where their conductivity offsets added weight. Substrate diversification gives OEMs a palette to match performance with sustainability targets driving balanced growth across segments of the functional printing market.

Conductive inks captured 65.45% of revenue in 2024 and remain the bedrock of most printed circuits. Yet nanoparticle-based functional inks are forecast to escalate at 22.89% CAGR, underscoring their prowess in reducing line resistance without elevating curing temperature. Silver nanoparticle pastes now reach 10^5 S/m conductivity after photonic sintering, a figure once reserved for bulk metal. Copper inks pare material spend but demand inert-atmosphere curing stations to prevent oxidation, prompting hybrid printing lines that switch atmospheres mid-run.

Dielectric inks evolve alongside conductors; low-loss organosilicate formulations permit GHz-range antennas on thin PET, replacing etched FR-4 in low-power IoT nodes. Photovoltaic and thermoelectric ink systems widen functional printing market addressable use-cases by letting manufacturers coat large solar or energy-harvest layers in minutes. As chemistry innovation accelerates, ink suppliers differentiate on flake geometry, binder biology, and sintering compatibility, deepening collaborative R&D with printer-OEMs.

Functional Printing Market is Segmented by Substrates (Paper and Paperboard, Plastic Films, and More), Ink (Conductive Inks, Dielectric and Insulating Inks, and More), Printing Technology (Inkjet Printing, Screen Printing, Gravure Printing, Flexography Printing, and More), Application (Sensors, Displays, OLED Lighting Panels, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained leadership with 32.45% share in 2024 on the back of defense avionics and advanced automotive interiors that specify cutting-edge printed films. The functional printing market size for North America is slated to grow steadily on high equipment replacement cycles in flexible PCB lines. Asia-Pacific, meanwhile, is forecast for the quickest 21.78% CAGR, buoyed by Chinese and Japanese incentives that reimburse capital outlays for roll-to-roll production. Elephantech's USD 20.1 million Series E demonstrates domestic appetite for sustainable printed PCBs.

European suppliers focus on premium segments such as medical wearables and automotive lidar housings, leveraging stringent regulatory hurdles as a competitive moat. Initiatives like the Reform Project aim to secure a local supply chain for critical inks and substrates, mitigating geopolitical risk . The Middle East and Africa invest in printed solar foils for off-grid lighting, while South American agribusiness deploys low-cost soil-moisture labels to optimize irrigation. These divergent priorities underline why regional specialization rather than one-size-fits-all solutions will drive functional printing market adoption.

- Avery Dennison Corp.

- BASF SE

- Blue Spark Technologies

- E Ink Holdings Inc.

- Eastman Kodak Co.

- Enfucell Oy

- GSI Technologies LLC

- Isorg SA

- Mark Andy Inc.

- ALTANA AG

- Agfa-Gevaert NV

- Ceradrop - MGI Group

- DuPont de Nemours Inc.

- Samsung Electronics (Printed Solutions)

- LG Display Co.

- Molex LLC

- Thinfilm Electronics ASA

- Toppan Forms Co.

- Toyo Ink SC Holdings

- Optomec Inc.

- Xaar PLC

- Xennia Technology Ltd.

- Kateeva Inc.

- NovaCentrix

- Cambrios Advanced Materials

- Nano Dimension Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for low-cost, high-speed electronic production

- 4.2.2 Rapid adoption of flexible and wearable electronics

- 4.2.3 Advances in conductive and dielectric ink chemistry

- 4.2.4 IoT-driven smart packaging volumes

- 4.2.5 Roll-to-roll 3D structural electronics in e-mobility

- 4.2.6 On-skin diagnostic patches for tele-health

- 4.3 Market Restraints

- 4.3.1 Performance gap vs. silicon electronics

- 4.3.2 Lack of global manufacturing standards

- 4.3.3 Silver nanoparticle supply volatility

- 4.3.4 E-waste rules targeting non-recyclable substrates

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Investment and Funding Landscape

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Substrates

- 5.1.1 Paper and Paperboard

- 5.1.2 Plastic Films

- 5.1.3 Glass and Ceramics

- 5.1.4 Metal Foils and Flex-metals

- 5.2 By Inks

- 5.2.1 Conductive Inks

- 5.2.2 Dielectric and Insulating Inks

- 5.2.3 Semiconductive and PV Inks

- 5.2.4 Nanoparticle-based Functional Inks

- 5.3 By Printing Technology

- 5.3.1 Inkjet Printing

- 5.3.1.1 Drop-on-Demand Inkjet

- 5.3.1.2 Continuous Inkjet

- 5.3.2 Screen Printing

- 5.3.3 Gravure Printing

- 5.3.4 Flexography Printing

- 5.3.5 Aerosol Jet Printing

- 5.3.6 Other Printing Technology

- 5.3.1 Inkjet Printing

- 5.4 By Application

- 5.4.1 Sensors

- 5.4.1.1 Temperature and Humidity Sensors

- 5.4.1.2 Pressure and Force Sensors

- 5.4.1.3 Biosensors and Wearables

- 5.4.2 Displays

- 5.4.2.1 E-paper Displays

- 5.4.2.2 OLED Displays

- 5.4.3 OLED Lighting Panels

- 5.4.4 Flexible Thin-film Batteries

- 5.4.5 Photovoltaic

- 5.4.5.1 Organic PV

- 5.4.5.2 Perovskite PV

- 5.4.6 RFID and NFC Tags

- 5.4.7 Other Application

- 5.4.1 Sensors

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 ASEAN

- 5.5.3.6 Australia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 GCC

- 5.5.4.1.2 Turkey

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Avery Dennison Corp.

- 6.4.2 BASF SE

- 6.4.3 Blue Spark Technologies

- 6.4.4 E Ink Holdings Inc.

- 6.4.5 Eastman Kodak Co.

- 6.4.6 Enfucell Oy

- 6.4.7 GSI Technologies LLC

- 6.4.8 Isorg SA

- 6.4.9 Mark Andy Inc.

- 6.4.10 ALTANA AG

- 6.4.11 Agfa-Gevaert NV

- 6.4.12 Ceradrop - MGI Group

- 6.4.13 DuPont de Nemours Inc.

- 6.4.14 Samsung Electronics (Printed Solutions)

- 6.4.15 LG Display Co.

- 6.4.16 Molex LLC

- 6.4.17 Thinfilm Electronics ASA

- 6.4.18 Toppan Forms Co.

- 6.4.19 Toyo Ink SC Holdings

- 6.4.20 Optomec Inc.

- 6.4.21 Xaar PLC

- 6.4.22 Xennia Technology Ltd.

- 6.4.23 Kateeva Inc.

- 6.4.24 NovaCentrix

- 6.4.25 Cambrios Advanced Materials

- 6.4.26 Nano Dimension Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment