|

市場調查報告書

商品編碼

1844442

微電網:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Microgrid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

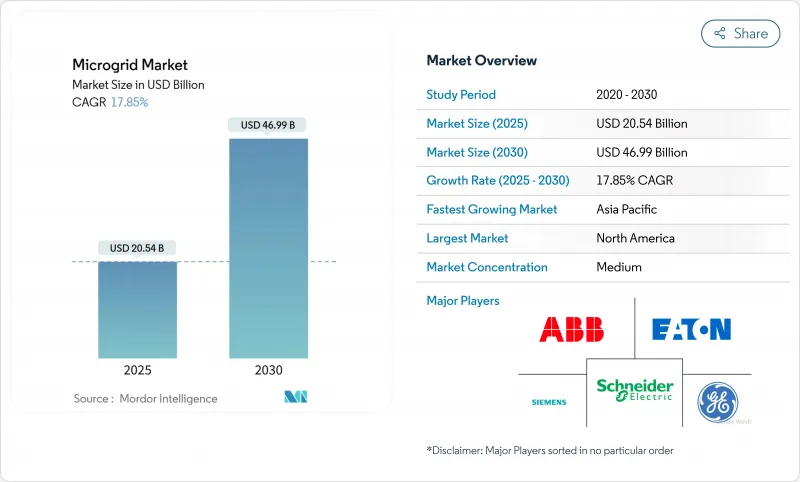

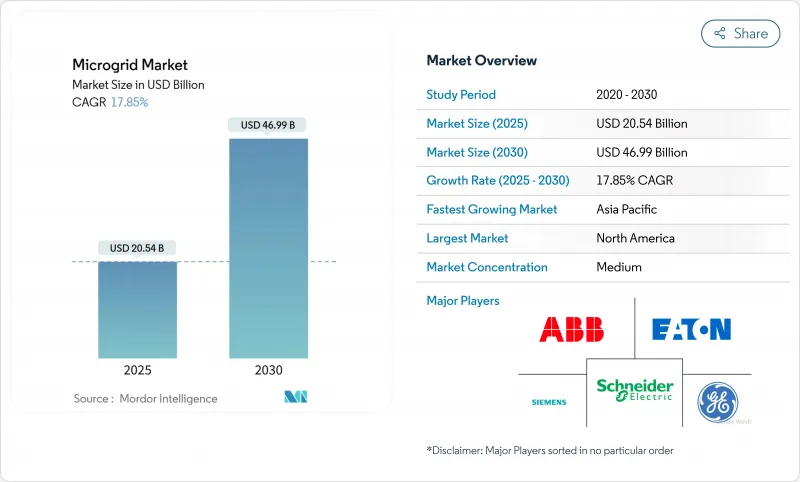

微電網市場規模預計在 2025 年為 205.4 億美元,預計到 2030 年將達到 469.9 億美元,預測期內(2025-2030 年)的複合年成長率為 17.85%。

成長將由IT/OT融合驅動,這種融合將邊緣分析、數位雙胞胎和網路安全層嵌入到先進的控制器中,從而實現跨硬體叢集的即時最佳化。由世界銀行「300計畫」主導的大規模農村電氣化計畫旨在2030年覆蓋3億非洲人口,這正在推動離網需求。在商業和工業領域,對不間斷電源的需求以及國防資助的淨零排放項目正在加速混合微電網的配置。同時,太陽能和電池成本的下降正在創造新的價值流,但鋰離子電池價格的波動和互聯線路的碎片化正在短期內縮短計劃進度。

全球微電網市場趨勢與洞察

加速非洲和南亞農村電氣化

優惠資金籌措、硬體價格下降以及簡化的採購流程將推動農村微電網普及率在 2024 年達到歷史新高。剛果民主共和國於 2024 年 10 月核准了非洲最大的太陽能微電網計畫。該計劃耗資 5,030 萬美元,由多邊投資擔保機構支持,將服務 28,000 戶家庭和中小企業。根據《2024 年全球微電網市場狀況》報告,撒哈拉以南非洲地區目前有 5,000 多個微電網運作,是 2020 年的三倍,其中太陽能光電佔已裝機發電量的 59%。在孟加拉國,2024 年為一個偏遠村莊設計的太陽能-風能-電池微電網案例研究顯示,其平準化成本為 0.0688 美元/千瓦時,低於區域電網擴展基準,證明了純可再生能源設計的經濟可行性。一些政府已經採用了基於績效的融資窗口,在客戶接入後提供補貼,從而降低了私人開發商的前期損失風險,並加速了預計將於 2025 年實現的部署流程。這些發展正在擴大近期需求池,並支持微電網市場預期的複合年成長率不斷提高。

IT/OT融合推動北美先進微電網控制器的發展

先進的控制器如今整合了SCADA數據、雲端分析和AI主導的網路安全,使資產能夠在不斷變化的市場訊號下進行自我最佳化。西門子和微軟於2025年3月擴大了合作夥伴關係,將PLC數據與基於Azure的模型融合,以減少微電網營運商的計畫外停機時間。數位雙胞胎能夠即時模擬運作狀況,加速故障偵測和發電/輸電決策。白宮能源現代化網路安全計畫預測,分散式能源資源將從2024年的90吉瓦成長到2025年的380吉瓦,這將推動對安全OT通訊協定的需求。 AI異常偵測框架的準確率達到了96.5%,顯著縮短了對網路威脅的回應時間。這些能力將增強公用事業和軍事用戶的信任,並增強微電網市場的成長前景。

互聯互通代碼分散阻礙市場成長

美國獨立系統營運商的計劃排隊時間超過五年。舊金山的瓦倫西亞花園電池儲能計劃因意外的互聯成本而被放棄,凸顯了監管風險。美國能源部正在敦促公共產業開發自下而上的負載模型,以緩解瓶頸問題。歐洲開發商也指出,各成員國的標準有差異,增加了工程成本。缺乏協調會打擊投資者的積極性,減緩公用事業採購週期,並在中期內限制微電網市場的擴張。

細分分析

到2024年,併網計劃將佔微電網市場佔有率的62%,全球微電網市場規模將達到107億美元。微電網因其電價套利機會和停電期間的孤島效應而極具吸引力。預計到2030年,微電網的複合年成長率將達到19%。雙模架構現已整契約步器數據,使系統能夠在200毫秒內切換,即使在野火和暴風雨期間也能保持電能品質標準。離網微電網雖然規模較小,但正在支持非洲和南亞的農村電氣化。世界銀行支持的計畫已證明,混合太陽能儲能系統能夠以具有競爭力的電價滿足全天候需求,從而擴大了離網EPC合約的可用性,並增強了微電網市場的深度。

離網部署吸引了來自氣候變遷基金的優惠融資,從而允許更長的投資回報期和補貼費率方案。開發商可以利用標準化的貨櫃設計來最大限度地減少現場施工天數並提高融資可行性。社區所有模式還能提高收益並促進當地經濟發展。隨著通訊塔和採礦作業尋求綠能,自給自足的微電網將拓寬微電網產業的應用範圍,使其超越純電氣化。在預測期內,連接選擇將取決於收費系統、停電統計數據和政策獎勵,但預計混合投資組合將主導投資者的投資方向。

到2024年,硬體市場將達到109億美元,佔微電網市場規模的63%。控制器、逆變器和電池架構成了硬體的實體核心。即使在北歐試點計畫中可再生能源滲透率超過90%的情況下,電網整形逆變器也能維持系統穩定。隨著供應商測試混合電池組並整合超級電容以加快啟動速度,儲存創新正在加速。雖然軟體傳統上僅佔預算的15%,但在數位雙胞胎和市場進入演算法的推動下,其複合年成長率高達22%。這些平台可以延長資產壽命、減少調度錯誤、釋放配套服務收益,並增加微電網市場總收益。

服務提供者涵蓋場地評估、授權、EPC 和營運。複雜性的增加,尤其是在多供應商環境中,推動了對專業整合商的需求,以確保系統級網路安全和服務級協定。諮詢服務正在擴展到效能保證,利用機器學習模型來預測劣化率。隨著客戶優先考慮基於結果的契約,微電網即服務將硬體、軟體和營運捆綁到單一訂閱費用中,降低了小型商業客戶的進入門檻。

微電網市場報告按連接性(併網和離網)、產品(硬體、軟體、服務)、電源(太陽能光伏、熱電聯產、燃料電池、其他)、類型(交流微電網、直流微電網、其他)、額定功率(小於 1 MW、1-5 MW、其他)、最終用戶(公共產業、商業/工業、住宅細分)和其他地區(北美地區進行細分)。

區域分析

北美佔2024年銷售額的38%,得益於美國能源部電網彈性和創新夥伴關係計畫提供的105億美元資金支持。美國國防部撥款5.48億美元用於增強基礎能源供給能力,重點在於採購混合微電網。網路安全仍然是該地區的重點,其基於人工智慧的多層框架在威脅偵測中實現了96.5%的準確率,增強了在關鍵設施部署微電網的信心。這些項目共同鞏固了北美在微電網市場的領導地位。

預計到2030年,亞太地區的複合年成長率將達到24%,這得益於農村電氣化和城市交通堵塞緩解。印度的PM-KUSUM計畫為與社區微電網相連的農業太陽能水泵提供補貼,但補貼取消構成了短期風險。孟加拉的一個試點計畫結合了太陽能光電、風能和電池,結果顯示能源成本低於0.07美元/千瓦時,即使不擴建電網也具有經濟可行性。中國正在擴大整合氫能儲存的工業微電網規模,日本正在升級社區規模系統以提高抗震能力。這些多元化的舉措正推動該地區微電網市場以比其他任何地區都更快的速度擴張。

歐洲正專注於可再生能源滲透和電網整形技術。由芬蘭Fluence公司提供的35兆瓦電池系統正在一個島嶼試驗中支援100%可再生能源運作。歐洲審核院估計,到2050年,淨零電力需要1.9兆至2.3兆歐元的電網投資,其中一部分將用於資助微電網建設,以緩解擁塞並平衡供電。南美、中東和非洲地區的微電網活動目前正在增加,儘管規模較小,其中最大的微電網部署在剛果,服務於28,000個連接。這些計劃凸顯了全球範圍內在以前依賴柴油發電的地區採用微電網的趨勢,並豐富了整體微電網市場前景。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 加速非洲和南亞農村電氣化

- 北美IT/OT融合推動微電網控制器發展

- 用於加勒比海島嶼災難復原的模組化「盒式」微電網

- 美國和澳洲公用事業主導的社區復原力計劃

- 併網逆變器使北歐市場可再生能源利用率達到90%以上

- 美國國防部淨零基地(北約和印度太平洋司令部)推廣混合微電網

- 市場限制

- 程式碼碎片化導致美國各州互聯互通核准延遲

- 印度PM-KUSUM計畫的補貼追回風險

- 鋰離子價格波動擾亂2024-25年資本支出計劃

- 多供應商計劃中的網路安全標準有限

- 供應鏈分析

- 監理前景(目標、政策)

- 技術展望

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 連結性別

- 並聯型微電網

- 離網/島嶼微電網

- 按產品

- 硬體(發電機、儲存系統、電源轉換器和逆變器、控制器)

- 軟體(能源管理平台、微電網控制器)

- 服務(工程、採購和施工(EPC)、營運和維護(O&M)、諮詢和顧問)

- 按電力源

- 光伏(PV)

- 熱電聯產(天然氣)

- 柴油發電機

- 風力

- 燃料電池

- 其他(生質能、水力發電)

- 按類型

- 交流微電網

- 直流微電網

- 交直流混合微電網

- 按額定功率

- 小於1MW

- 1~5 MW

- 5~10 MW

- 超過10MW

- 按最終用戶

- 公共產業

- 商業和工業

- 住房

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Hitachi Energy Ltd

- Eaton Corporation PLC

- Honeywell International Inc.

- Toshiba Corporation

- S&C Electric Company

- ENGIE EPS SA

- Standard Microgrid Inc.

- PowerSecure Inc.

- Bloom Energy Corporation

- Caterpillar Inc.

- Wartsila Corporation

- Rolls-Royce Power Systems AG(MTU)

- Ameresco Inc.

- Tesla Inc.

- Enphase Energy Inc.

- Heila Technologies

- Spirae LLC

- Xendee Corporation

- HOMER Energy LLC

- AutoGrid Systems

第7章 市場機會與未來展望

The Microgrid Market size is estimated at USD 20.54 billion in 2025, and is expected to reach USD 46.99 billion by 2030, at a CAGR of 17.85% during the forecast period (2025-2030).

Growth is catalyzed by IT/OT convergence that embeds edge analytics, digital twins, and cybersecurity layers into advanced controllers, enabling real-time optimization across hardware fleets. Large-scale rural electrification, notably the World Bank's Mission 300 targeting 300 million Africans by 2030, is expanding off-grid demand. The commercial and industrial segment's need for uninterrupted power and defense-funded net-zero base programs accelerates hybrid microgrid configurations. Meanwhile, declining solar PV and battery costs open new value streams, although lithium-ion price volatility and fragmented interconnection codes temper near-term project timelines.

Global Microgrid Market Trends and Insights

Accelerated Rural Electrification in Africa & South Asia

Rural microgrid rollouts hit a new high in 2024 as concessional finance, falling hardware prices, and streamlined procurement converged. The Democratic Republic of Congo approved Africa's largest solar mini-grid in October 2024: a USD 50.3 million project backed by the Multilateral Investment Guarantee Agency to serve 28,000 households and small businesses. The "State of the Global Mini-Grids Market 2024" report shows that sub-Saharan Africa now hosts more than 5,000 operational mini-grids, triple the fleet counted in 2020, with solar providing 59% of installed generation capacity. In Bangladesh, a 2024 case study on a solar-wind-battery microgrid designed for an isolated village demonstrated a levelized cost of USD 0.0688/kWh-less than regional grid extension benchmarks-illustrating the economic viability of renewables-only designs. Multiple governments have adopted results-based financing windows that disburse subsidies upon verified customer connections, cutting first-loss risk for private developers and accelerating deployment pipelines scheduled for 2025. These developments collectively enlarge the near-term demand pool and underpin the forecast CAGR uplift for the microgrid market.

IT/OT Convergence Spurs Advanced Microgrid Controllers in North America

Advanced controllers now integrate SCADA data, cloud analytics, and AI-driven cybersecurity, allowing assets to self-optimize under changing market signals. Siemens and Microsoft extended their partnership in March 2025, blending PLC data with Azure-based models to shrink unplanned downtime for microgrid operators. Digital twins enable real-time simulation of operating states, accelerating fault detection and dispatch decisions. The White House Energy Modernization Cybersecurity plan anticipates distributed energy resources climbing from 90 GW in 2024 to 380 GW by 2025, heightening the need for secure OT protocols. An AI anomaly-detection framework has reached 96.5% accuracy, sharply reducing response time to cyber threats. These capabilities elevate confidence among utilities and military users, reinforcing the microgrid market growth outlook.

Fragmented Interconnection Codes Impede Market Growth

Project queues in several U.S. Independent System Operators have exceeded five years. The Valencia Gardens storage project in San Francisco was abandoned after unforeseen interconnection costs, illustrating regulatory risk. The Department of Energy urges distribution utilities to build bottom-up load models to ease bottlenecks. European developers also cite divergent standards between member states, increasing engineering overheads. Lack of harmonization discourages investors and slows utility procurement cycles, constraining the microgrid market expansion over the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Modular "Box" Microgrids for Disaster-Recovery in Caribbean Islands

- Utility-Led Programs Redefine Community Energy Resilience

- Lithium-Ion Volatility Forces Storage Diversification Strategies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Grid-connected projects held 62% of the microgrid market share in 2024, equating to USD 10.7 billion of the global microgrid market size. Their appeal stems from tariff arbitrage opportunities and the ability to island during outages. Utility resilience mandates and community programs support a projected 19% CAGR through 2030. Dual-mode architectures now integrate synchrophasor data so systems switch in sub-200 ms, maintaining power-quality standards during wildfires or storms. Though smaller in aggregate value, off-grid microgrids underpin the rural electrification push across Africa and South Asia. World Bank-backed schemes prove that solar-storage hybrids can meet 24/7 demand at competitive rates, expanding the funnel for off-grid EPC contracts and adding depth to the microgrid market.

Off-grid deployments attract concessionary finance from climate funds, allowing longer paybacks and subsidized tariffs. Developers leverage standardized container designs to minimize on-site construction days and improve bankability. Community ownership models also enhance revenue recovery and boost local economic development. As telecom towers and mining operations seek cleaner power, self-sufficient microgrids broaden the microgrid industry footprint beyond pure electrification plays. Over the forecast horizon, connectivity choice will depend on tariff structures, outage statistics, and policy incentives, but mixed portfolios are expected to dominate investor pipelines.

In 2024, hardware generated USD 10.9 billion, representing 63% of the microgrid market size. Controllers, inverters, and battery racks form the physical core. Grid-forming inverters keep systems stable even when renewable penetration exceeds 90% in Nordic pilots. Storage innovation is accelerating as vendors test hybrid battery packs and integrate supercapacitors for fast ramping. Software, although accounting for just 15% of traditional budgets, is growing at 22% CAGR, driven by digital twins and market-participation algorithms. These platforms extend asset life, cut dispatch errors, and unlock ancillary-service revenues, amplifying total microgrid market returns.

Service providers cover site assessment, permitting, EPC, and operations. Growing complexity, particularly in multi-vendor environments, raises demand for specialized integrators who guarantee system-level cybersecurity and service-level agreements. Consultancy practices are expanding into performance assurance, leveraging machine-learning models that predict degradation rates. As customers prioritize outcome-based contracts, microgrid-as-a-service offerings bundle hardware, software, and operations into a single subscription fee, lowering the entry barriers for small commercial clients.

The Microgrid Market Report is Segmented by Connectivity (Grid-Connected and Off-Grid), Offering (Hardware, Software, and Services), Power Sources (Solar Photovoltaic, Combined Heat and Power, Fuel Cell, and More), Type (AC Microgrids, DC Microgrids, and Others), Power Rating (Below 1 MW, 1 To 5 MW, and Others), End-User (Utilities, Commercial and Industrial, and Residential) and Geography (North America, Asia-Pacific, and Others).

Geography Analysis

North America generated 38% of 2024 revenue, supported by USD 10.5 billion in Department of Energy Grid Resilience and Innovation Partnerships funding that targets extreme-weather mitigation.The Department of Defense allocated USD 548 million for energy-resilience upgrades at bases, channeling procurement toward hybrid microgrids. Cybersecurity remains a regional focus; a layered AI-based framework recorded 96.5% threat-detection accuracy, reinforcing trust in critical-facility deployments. Collectively, these programs solidify North America's leadership in the microgrid market.

Asia-Pacific is forecast to expand at a 24% CAGR to 2030, propelled by rural electrification and urban congestion relief. India's PM-KUSUM scheme underwrites agricultural solar pumps that interface with community microgrids, although subsidy claw-backs pose short-term risk. A Bangladeshi pilot combining PV, wind, and batteries achieved an energy cost below USD 0.07/kWh, demonstrating economic viability even without grid extension. China is scaling industrial park microgrids that integrate hydrogen storage, while Japan refines neighborhood-scale systems for seismic resilience. These diverse initiatives enlarge the regional microgrid market faster than any other geography.

Europe concentrates on high-renewables penetration and grid-forming technology. A Finnish 35 MW battery system supplied by Fluence supports 100% renewable operation during islanding trials. The European Court of Auditors states that reaching net-zero will demand EUR 1.9-2.3 trillion in grid investments by 2050, part of which will fund microgrids to relieve congestion and balance supply. South America and the Middle East & Africa are smaller today but show escalating activity, highlighted by the Congo's largest mini-grid rollout that will serve 28,000 connections. These projects underscore the global diffusion of microgrids into regions previously reliant on diesel generation, enriching the overall microgrid market landscape.

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Hitachi Energy Ltd

- Eaton Corporation PLC

- Honeywell International Inc.

- Toshiba Corporation

- S&C Electric Company

- ENGIE EPS SA

- Standard Microgrid Inc.

- PowerSecure Inc.

- Bloom Energy Corporation

- Caterpillar Inc.

- Wartsila Corporation

- Rolls-Royce Power Systems AG (MTU)

- Ameresco Inc.

- Tesla Inc.

- Enphase Energy Inc.

- Heila Technologies

- Spirae LLC

- Xendee Corporation

- HOMER Energy LLC

- AutoGrid Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Rural Electrification in Africa & South Asia

- 4.2.2 IT/OT Convergence Spurs Advanced Microgrid Controllers in North America

- 4.2.3 Modular "Box" Microgrids for Disaster-Recovery in Caribbean Islands

- 4.2.4 Utility-led Community Resilience Programs in U.S. & Australia

- 4.2.5 Grid-Forming Inverters Enabling 90%+ Renewables in Nordic Markets

- 4.2.6 Defense-Funded Net-Zero Bases Driving Hybrid Microgrids (NATO & INDOPACOM)

- 4.3 Market Restraints

- 4.3.1 Fragmented Codes Stalling Inter-connection Approvals in U.S. States

- 4.3.2 Subsidy Claw-Back Risk in India's PM-KUSUM Programme

- 4.3.3 Lithium-ion Price Volatility Disrupting CAPEX Planning 2024-25

- 4.3.4 Limited Cyber-security Standards for Multi-Vendor Projects

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook (Targets, Policies)

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Connectivity

- 5.1.1 Grid-Connected Microgrids

- 5.1.2 Off-Grid/Islanded Microgrids

- 5.2 By Offering

- 5.2.1 Hardware (Power Generators, Energy-Storage Systems, Power Converters & Inverters, and Controllers)

- 5.2.2 Software (Energy Management Platforms, and Microgrid Controllers)

- 5.2.3 Services (Engineering, Procurement & Construction (EPC), Operations & Maintenance (O&M), and Consulting & Advisory)

- 5.3 By Power Source

- 5.3.1 Solar Photovoltaic (PV)

- 5.3.2 Combined Heat and Power (Natural Gas)

- 5.3.3 Diesel Generators

- 5.3.4 Wind

- 5.3.5 Fuel Cells

- 5.3.6 Others (Biomass, Hydro)

- 5.4 By Type

- 5.4.1 AC Microgrids

- 5.4.2 DC Microgrids

- 5.4.3 Hybrid AC/DC Microgrids

- 5.5 By Power Rating

- 5.5.1 Below 1 MW

- 5.5.2 1 to 5 MW

- 5.5.3 5 to 10 MW

- 5.5.4 Above 10 MW

- 5.6 By End-User

- 5.6.1 Utilities

- 5.6.2 Commercial and Industrial

- 5.6.3 Residential

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Nordic Countries

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 ASEAN Countries

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Colombia

- 5.7.4.4 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 South Africa

- 5.7.5.4 Egypt

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 General Electric Company

- 6.4.5 Hitachi Energy Ltd

- 6.4.6 Eaton Corporation PLC

- 6.4.7 Honeywell International Inc.

- 6.4.8 Toshiba Corporation

- 6.4.9 S&C Electric Company

- 6.4.10 ENGIE EPS SA

- 6.4.11 Standard Microgrid Inc.

- 6.4.12 PowerSecure Inc.

- 6.4.13 Bloom Energy Corporation

- 6.4.14 Caterpillar Inc.

- 6.4.15 Wartsila Corporation

- 6.4.16 Rolls-Royce Power Systems AG (MTU)

- 6.4.17 Ameresco Inc.

- 6.4.18 Tesla Inc.

- 6.4.19 Enphase Energy Inc.

- 6.4.20 Heila Technologies

- 6.4.21 Spirae LLC

- 6.4.22 Xendee Corporation

- 6.4.23 HOMER Energy LLC

- 6.4.24 AutoGrid Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment