|

市場調查報告書

商品編碼

1842701

光學鏡片磨邊機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Optical Lens Edger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

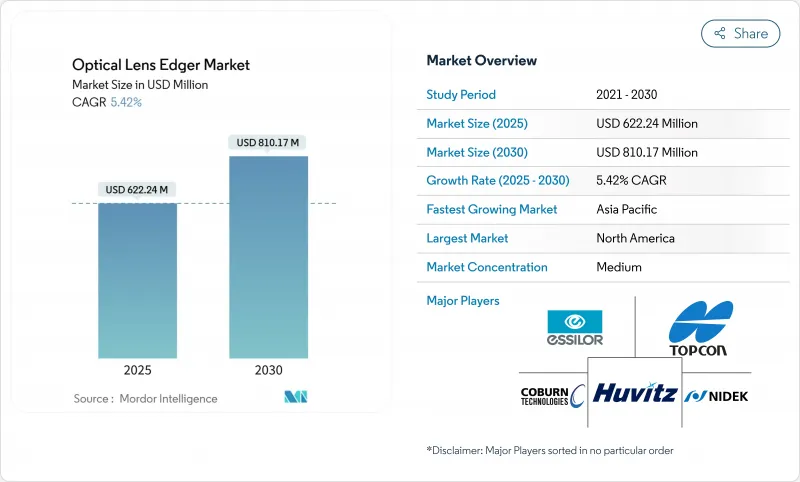

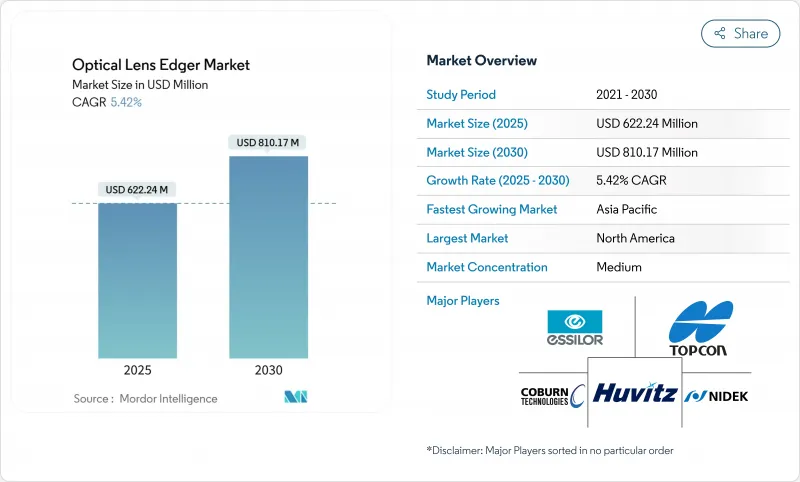

預計光學鏡片磨邊機市場規模到 2025 年將達到 6.2224 億美元,到 2030 年將達到 8.1017 億美元,複合年成長率為 5.42%。

目前的成長模式反映了近視盛行率上升、老花眼患者人數增加以及精密光學元件在消費性和工業設備中應用不斷擴大等一系列因素的共同作用。自動化、無模數值控制(CNC) 設備如今已成為技術標準,因為它可以減少加工誤差,並能適應複雜、自由曲面的鏡片形狀。區域性零售連鎖店正在建立店內加工實驗室,智慧型手機製造商對超薄相機光學元件的需求不斷成長,醫院也正在集中提供光學服務,所有這些都在影響需求曲線。優質鑽石砂輪的供應鏈限制以及更嚴格的空氣粉塵處理法規構成了成本阻力,但大多數主要供應商都在尋求垂直整合以降低風險。

全球光學鏡片磨邊機趨勢與洞察

近視率激增和螢幕過度暴露

2020年,全球近30%的人口患有近視,預計2050年這一數字將達到50%,其中包括10億依賴複雜處方鏡片的重度近視人群。自由曲面磨邊技術將為光學鏡片磨邊市場帶來利好,因為高屈光基板可保持纖薄外形,同時滿足功耗需求。遠距辦公文化增加了人們使用螢幕的時間,減少了戶外活動,從而加速了近視的發展。從經濟角度來看,亞洲成年人每年在近視矯正上的支出已達3,280億美元,顯示其對先進精加工工具的持續購買力。新型磨邊機整合了演算法,以促進藍光濾光鏡片的製造,使實驗室能夠獲得優質訂單。

視力保健零售連鎖店在新興市場的快速擴張

區域連鎖店正在加速門市擴張,引入緊湊型磨邊實驗室,並承諾當日送達。巴黎美琪 (Paris Miki) 在美國國內擁有 635 家門市,在海外擁有 74 家門市,每家門市均在店內進行鏡片精加工,從而節省了外部實驗室的成本,同時提高了服務速度。店內系統可降低每例成本 5 至 15 美元,一旦日產量超過 50 副,即可快速獲得投資回報。設備製造商將其中檔自動化系統定位在 2 萬至 5 萬美元之間,為新進業者彌補了價格與精度之間的差距。

人們對隱形眼鏡和LASIK 的偏好日益成長

到2023年,英國日拋型隱形眼鏡佔軟式鏡片配戴者的比重將成長至78.8%。像EVO ICL這樣的屈光矯正手術選項可以延長年輕用戶的脫眼鏡時間。雖然這些轉變正在緩解成熟零售通路對量產鏡片磨邊的需求,但工業和診斷光學市場仍然動盪不安。

細分分析

自動機型創造了最大的收益池,佔了 2024 年光學鏡片磨邊機市場 54.81% 的佔有率。閉合迴路伺服馬達和無模式追蹤縮短了完成時間、降低了廢品率並實現了多焦點鏡片的當日交貨。隨著中端零售商逐漸放棄手動工作台,預計到 2030 年,與自動化平台相關的光學鏡片磨邊機市場規模將以 5.8% 的複合年成長率擴大。手動機器在資本預算緊張的地區仍然強勁,但隨著整修的自動化機器進入次市場,其佔有率面臨下降。半自動化系統彌補了產能和成本之間的差距,但由於市佔率僅為 6.47%,其長期吸引力有限。整合式阻擋器-磨邊機設計預計將實現最高的單位成長率,因為它們可以減少占地面積並簡化工作流程。

整合將使供應商將軟體、封邊和塗層功能捆綁到一個機殼中。弗勞恩霍夫IPT的48小時光學單元展示了一個工廠就緒的模組,該模組在單軌道上完成成型、雷射消熔和邊緣精加工,可以成為推動下一代產品線發展的模板。供應商正在整合人工智慧驅動的參數庫,以便從CR-39切換到聚碳酸酯,而無需手動重新校準。這些功能清楚地表明了為什麼即使在硬體利潤縮水的情況下,系統仍會變得更有價值。

區域分析

2024年,北美將佔據最大的收益佔有率,達到42.72%。強大的眼科檢查保險覆蓋率、消費者對優質鍍膜的接受度以及密集的獨立驗光師網路正在刺激設備更新換代。許多從業者正在轉向在診所內進行一小時服務,這增加了自動磨邊機的採用率。該地區還擁有在當地設有服務點的大型製造商,從而降低了停機損失並鼓勵技術更新。有關光照的安全準則正在加強除塵標準,並推動驗光師採用現代密封系統。

預計亞太地區成長最快,2025年至2030年的複合年成長率將達到7.15%。在新加坡等市場,都市區青少年的近視率超過80%,這推動了處方藥數量的持續成長。依視路陸遜梯卡(EssilorLuxottica)在該地區的收入成長了8.2%,這反映了其連鎖店擴張,並融入了店內磨邊業務。中國正在透過有利於高價鏡片的採購規則來緩解價格壓力,並引導實驗室進行多焦點鏡片加工以保持利潤率。日本的Miki連鎖店注重精準度,刺激了對人工智慧鏡片的需求。隨著可支配收入的提高,印度和東南亞正在開闢新的管道,以升級高階鏡片。

歐洲市場需求將保持穩定,主要受技術更新周期和專業應用的驅動。精加工業務轉移至羅敦司得捷克工廠將專注於成本最佳化,但品質標準仍將保持高水準。歐洲隱形眼鏡的普及率將成長5.2%,銷售成長仍將保持低迷,但對於需要緊密同心度的多焦點硬式隱形眼鏡而言,這將帶來利基市場機會。拉丁美洲和中東市場初期安裝基數較小,但隨著官民合作關係資助視力檢查計劃,市場將實現兩位數的銷售成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 近視和螢幕暴露時間的激增

- 新興市場視力保健零售連鎖店的快速擴張

- 老花眼患者人數不斷增加

- 相機和光學成像設備製造商的需求不斷成長

- 獨立公司採用辦公室內精加工實驗室

- 轉向無圖案 CNC 磨邊機來加工複雜鏡片

- 市場限制

- 人們對隱形眼鏡和LASIK 的偏好日益成長

- 硬體創新週期停滯

- 優質鑽石砂輪供不應求

- 眼鏡研討會粉塵排放標準趨嚴

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按類型

- 手動型

- 半自動

- 自動的

- 無模數控

- 阻斷器/邊緣器整合系統

- 按用途

- 眼鏡鏡片

- 顯微鏡/科學鏡頭

- 相機/成像鏡頭

- 智慧型手機/AR-VR鏡頭

- 按最終用戶

- 獨立眼鏡店

- 眼科醫院和診所

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 市佔率分析

- 公司簡介

- EssilorLuxottica

- Topcon Corp.

- NIDEK Co., Ltd.

- Coburn Technologies

- Huvitz Corp.

- MEI Srl

- Santinelli International

- Satisloh(Buhler)

- Schneider Optical Machines

- OptoTech

- Briot-Weco(Luneau Tech)

- Supore Instruments

- National Optronics

- Visslo

- INNOVA Medical Ophthalmics

- Nanjing Laite Optical

- Veer Optronics

- DTC(Delco)

- Marmore Inc.

- Beijing HongDi

第7章 市場機會與未來展望

The optical lens edger market generated USD 622.24 million in 2025 and is forecast to reach USD 810.17 million by 2030, advancing at a 5.42% CAGR.

The current growth pattern reflects the powerful mix of rising myopia prevalence, a larger presbyopic population, and the widening use of precision optics across consumer and industrial devices. Automatic, pattern-less computer-numerical-control (CNC) units now set the technology benchmark because they reduce finishing errors and accommodate complex freeform lens geometries. Regional retail chains that build in-store finishing labs, smartphone makers that demand ultra-thin camera optics, and hospitals that centralize optical services all feed the demand curve. Supply chain restraints for premium diamond wheels and stricter rules on airborne dust disposal introduce cost headwinds, yet most leading vendors pursue vertical integration to limit risk.

Global Optical Lens Edger Market Trends and Insights

Soaring prevalence of myopia & hyper-screen exposure

Nearly 30% of the world's population lived with myopia in 2020; projections point to 50% by 2050, including 1 billion high myopes who rely on complex prescription lenses . The optical lens edger market benefits because freeform edging allows high-index substrates to retain thin profiles while meeting power requirements. Remote work culture amplifies screen time and shortens outdoor exposure, both linked to faster myopia progression. Economically, Asian adults already spend USD 328 billion yearly on myopia correction, signaling sustained purchasing power for advanced finishing tools. New edgers integrate algorithms to ease blue-light filter lens production, enabling labs to capture premium order value.

Rapid expansion of vision-care retail chains in emerging markets

Regional chains accelerate store rollouts and embed compact edging labs to promise same-day delivery. Paris Miki operates 635 outlets in Japan and 74 abroad, each equipped to finish lenses in-house, cutting external lab fees while improving service speed. In-office systems trim USD 5-15 per job, yielding quick payback when volumes exceed 50 pairs a day. Equipment makers position mid-tier automatic units at the USD 20,000-50,000 range, bridging affordability and precision for new entrants.

Growing preference for contact lenses & LASIK

Daily disposable lenses grew to 78.8% of UK soft-lens fits in 2023, reflecting consumer tilt toward lower maintenance eyewear . Refractive surgery options such as EVO ICL extend spectacle-free intervals for younger users. These shifts temper high-volume lens edging demand in mature retail channels, though industrial and diagnostic optics remain insulated.

Other drivers and restraints analyzed in the detailed report include:

- Uptick in geriatric population with presbyopia

- Rising demand from camera & imaging optics makers

- Plateauing incremental hardware innovation cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automatic models generated the largest revenue pool and captured 54.81% optical lens edger market share in 2024. Their closed-loop servo motors and patternless tracing shorten finishing time, reduce reject rates, and enable same-day delivery for multifocal lenses. The optical lens edger market size tied to automatic platforms is forecast to expand at 5.8% CAGR through 2030 as mid-tier retailers move away from manual benches. Manual machines persist where capital budgets are tight, yet their share faces erosion as refurbished automatic units enter the secondary market. Semi-automatic systems bridge capability and cost, but only 6.47% share confirms limited long-run appeal. Integrated blocker-edger designs post the highest unit growth because they cut floor space and streamline workflows, a key metric for urban clinics with limited real estate.

Consolidation drives suppliers to bundle software, edging, and coating in one enclosure. Fraunhofer IPT's 48-hour optics cell indicates how factory-ready blocks encompass forming, laser ablation, and edge finishing in a single track, a template that could spur next-generation product lines. Vendors embed AI-driven parameter libraries to switch from CR-39 to polycarbonate with no manual recalibration. Such features underscore why system value rises even as hardware margins compress.

Optical Lens Edger Market is Segmented by Type (Manual, Automatic, and More), Application (Eyeglass Lens, Microscope Lens, and More), by End User (Independent Optical Stores, Ophthalmology Hospitals & Clinics, and Others), and Geography. The Market Provides the Value (in USD Million) for the Above-Mentioned Segments.

Geography Analysis

North America generated the largest revenue slice at 42.72% in 2024. Strong insurance coverage for eye exams, consumer acceptance of premium coatings, and a dense network of independent optometrists fuel equipment turnover. Many practitioners shifted to in-office labs for one-hour service, extending automatic edger penetration. The region also hosts major manufacturers that offer local service hubs; therefore, downtime penalties remain low and encourage technology updates. Safety guidelines on optical-radiation exposure tighten dust-extraction standards, pushing labs to modern enclosed systems.

Asia-Pacific is the fastest riser at 7.15% CAGR from 2025-2030. Myopia incidences above 80% among urban teens in markets such as Singapore feed sustained prescription volumes. EssilorLuxottica logged 8.2% revenue lift in the region, mirroring chain expansion that embeds in-store edging. China moderates price pressure through procurement rules that favor value lenses, steering labs toward multifocal finishing to preserve margins. Japan's Paris Miki chain prioritizes precision, spurring demand for AI-enabled blockers. India and Southeast Asia open fresh lanes as disposable incomes permit premium lens upgrades.

Europe exhibits stable demand driven by technology refresh cycles and specialized applications. Rodenstock's migration of finishing to Czech plants underscores cost-optimization, yet quality bars remain high. Contact-lens adoption-up 5.2% across Europe-tempers unit volumes yet stimulates niche opportunities in multifocal hard lenses that need tight concentricity. Latin America and the Middle East start from small installed bases but post double-digit unit growth where public-private partnerships fund vision-screening initiatives.

- EssilorLuxottica

- Topcon Corp.

- Nidek

- Coburn Technologies

- Huvitz Corp.

- MEI Srl

- Santinelli International

- Satisloh (Buhler)

- Schneider Optical Machines

- OptoTech

- Briot-Weco (Luneau Tech)

- Supore Instruments

- National Optronics

- Visslo

- INNOVA Medical Ophthalmics

- Nanjing Laite Optical

- Veer Optronics

- DTC (Delco)

- Marmore Inc.

- Beijing HongDi

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soaring prevalence of myopia & hyper-screen exposure

- 4.2.2 Rapid expansion of vision-care retail chains in EMs

- 4.2.3 Uptick in geriatric population with presbyopia

- 4.2.4 Rising demand from camera & imaging optics makers

- 4.2.5 Adoption of in-office finishing labs by independents

- 4.2.6 Shift to patternless CNC edgers for complex lenses

- 4.3 Market Restraints

- 4.3.1 Growing preference for contact lenses & LASIK

- 4.3.2 Plateauing incremental hardware innovation cycles

- 4.3.3 Tight supply of premium diamond-abrasive wheels

- 4.3.4 Stricter dust-emission norms for optical workshops

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Type

- 5.1.1 Manual

- 5.1.2 Semi-Automatic

- 5.1.3 Automatic

- 5.1.4 Patternless CNC

- 5.1.5 Integrated Blocker-Edger Systems

- 5.2 By Application

- 5.2.1 Eyeglass Lens

- 5.2.2 Microscope/Scientific Lens

- 5.2.3 Camera & Imaging Lens

- 5.2.4 Smartphone/AR-VR Lens

- 5.3 By End User

- 5.3.1 Independent Optical Stores

- 5.3.2 Ophthalmology Hospitals & Clinics

- 5.3.3 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 EssilorLuxottica

- 6.3.2 Topcon Corp.

- 6.3.3 NIDEK Co., Ltd.

- 6.3.4 Coburn Technologies

- 6.3.5 Huvitz Corp.

- 6.3.6 MEI Srl

- 6.3.7 Santinelli International

- 6.3.8 Satisloh (Buhler)

- 6.3.9 Schneider Optical Machines

- 6.3.10 OptoTech

- 6.3.11 Briot-Weco (Luneau Tech)

- 6.3.12 Supore Instruments

- 6.3.13 National Optronics

- 6.3.14 Visslo

- 6.3.15 INNOVA Medical Ophthalmics

- 6.3.16 Nanjing Laite Optical

- 6.3.17 Veer Optronics

- 6.3.18 DTC (Delco)

- 6.3.19 Marmore Inc.

- 6.3.20 Beijing HongDi

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment