|

市場調查報告書

商品編碼

1842694

關節機器人:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Articulated Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

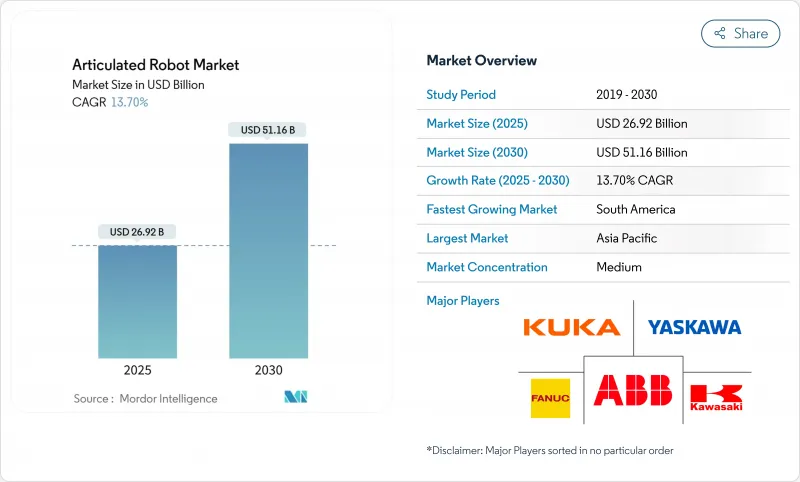

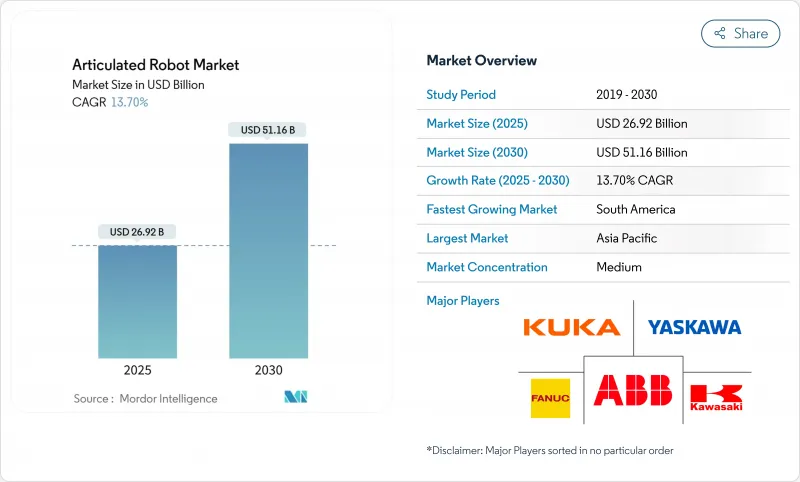

2025年關節機器人市場規模預計為269.2億美元,預計到2030年將達到511.6億美元,預測期內(2025-2030年)的複合年成長率為13.70%。

對智慧製造解決方案、自主生產政策以及人工智慧協作系統的需求激增,是這項擴張的基石。電動車生產資本投入的加強、電商巨頭持續推廣倉庫自動化以及精準食品應用的擴展,進一步推動了這一發展勢頭。同時,零件製造商正在透過垂直整合策略解決半導體和伺服馬達的瓶頸問題,而隨著用戶尋求降低營運成本,節能機器人設計也越來越受到青睞。競爭策略正在分化:像ABB這樣的老牌公司正在尋求結構性分拆以增強專注力,而新興企業則正在利用雲端連接平台來縮短部署時間。

全球關節機器人市場趨勢與洞察

向工業 4.0主導的自動化轉變

製造商正將多關節機器人與人工智慧分析和物聯網感測器結合,打造封閉回路型生產生態系統,以實現品質、運作和能耗的自我最佳化。富士康的無人值守工廠將預測性維護演算法融入其機器人運作單元,在維持產量的同時減少了15萬名員工。小米全天候智慧型手機工廠則展現了這種黑暗工廠模式的擴充性。此類部署將自動化的經濟效益從勞動力替代轉向產品組合敏捷性,從而能夠快速切換,以適應客製化批次和變體的引入。

人事費用上升和技術工人短缺

機器人營業成本目前為每小時1.60-2美元,低於人類工資(在許多地區,人類工資超過5.50美元),投資回報率計算明顯傾向於自動化。通用汽車和約翰迪爾在採用機器人焊接單元後,焊接人事費用降低了50%,廢品率降低了25%。像GXO 物流這樣的倉庫業者正在轉向使用Apollo機器人來填補人員缺口,同時提高安全指標。歐洲和東亞的人口老化將是這一趨勢的長期促進因素。

初始部署和整合成本高

如果將整合、安全設備和培訓等成本考慮在內,關節式機器人單元的總成本可能會翻倍,這阻礙了中小企業的採用。拉丁美洲的中小企業認為,獲得整合商和金融機構的管道有限是採用該技術的主要障礙。 Formic 報告稱,其合約生產小時數為 20 萬小時,運轉率99.8%,凸顯了投資者對使用驅動型自動化的熱情。

細分分析

由於採用電子、製藥和協作機器人的普及,預計16公斤以下機器人的複合年成長率將達到16.1%,而16-60公斤機器人的市佔率將在2024年維持32.6%。用戶更青睞更輕的平台,因為它速度更快、更節能,而且更安全。 Freedom Fresh Australia的澳洲堅果生產線採用輕量級SCARA單元,實現了0.39秒的循環週期,凸顯了食品包裝生產效率的提升。

在汽車車身修理廠和鑄造廠,60-225 公斤及以上重量的機器人需求保持穩定,但由於原始設備製造商希望減少而非擴大其安裝基數,成長正在放緩。大容量機械手臂擴大與形狀記憶合金夾爪整合,將氣動能耗降低 90%。

2025年至2030年間,重型關節機器人的市場規模預計將以個位數成長,主要受提升電動車電池組和處理風力發電機組件等應用的推動。

到2024年,六軸機器人將佔總收益的51.8%,而關節機器人市場已成為焊接、噴漆和精密組裝事實上的主力。就成本而言,可供選擇的型號多種多樣,從5,000美元以下的小型機器到售價超過500,000美元的潔淨室相容機器。

七軸和超靈巧型機器人是成長最快的細分市場,複合年成長率達16.5%。Yamaha的YA系列彎頭機器人可圍繞有限的夾具旋轉,從而縮短密集生產單元的節拍時間。 MDPI正在研究的並聯拓樸機器人有望在拾放循環中實現更高的剛度重量比。隨著汽車內裝日益複雜,家用電器趨於小型化,對在更狹窄範圍內移動的附加軸的需求可能會成長。

關節機器人市場承重能力(最高16公斤、16-60公斤及其他)、軸類型(4軸、5軸及其他)、應用領域(物料輸送、焊接/錫焊、組裝、噴漆/應用及其他)、終端用戶產業(汽車、電氣/電子、金屬/機械、製藥/醫療設備及其他)及地區細分。市場預測以美元計算。

區域分析

受中國市場規模和日本創新生態系統的推動,亞太地區將在2024年繼續保持主導地位,佔全球機器人總收入的42.4%。各地區政府正在資助「燈塔計劃」,鼓勵中小企業採用這些技術,即使國內工資上漲抑制了成本優勢,也能穩定關節機器人市場的擴張。日本的機器人稅額扣抵和韓國的人工智慧代金券計畫將使機器人市場保持強勁成長。

預計到2030年,南美洲的複合年成長率將達到15.3%,是該地區成長最快的地區,這得益於汽車電氣化和農業自動化領域的外國直接投資。巴西的SOLIX田間機器人展示了人工智慧視覺如何將鉸接式設計擴展到露天作物管理。凱斯紐荷蘭公司斥資2000萬美元對索羅卡巴的升級改造,將人工智慧應用於90%的收割機功能,展現了該地區對先進機器人技術的巨大需求。

在聯邦政府回流獎勵和電動車供應鏈計劃的支持下,預計2024年,北美的機器人安裝量將年增12%,達到44,303台。到2027年,安川電機在斯洛維尼亞投資3,150萬歐元的機器人生產中心將實現其歐洲、中東和非洲地區80%的機器人交付在當地生產。中東和非洲地區雖然仍在發展中,但已吸引了建築和石化維護領域的試點項目,為關節型機器人的長期市場應用奠定了基礎。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 向工業 4.0主導的自動化轉變

- 人事費用上升和技術純熟勞工短缺

- 政府對智慧製造的獎勵

- 電動車資本投資蓬勃發展

- 支援人工智慧的自適應關節協作機器人

- 電子商務巨頭將履約中心自動化

- 市場限制

- 前期投資和整合成本高

- 系統整合人員短缺

- 聯網機器人控制器的網路安全風險

- 伺服馬達和半導體供應瓶頸

- 產業價值鏈分析

- 監管狀況

- 技術展望

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章市場規模及成長預測(金額)

- 按有效載荷容量

- 16公斤以下

- 16-60 kg

- 60-225 kg

- 225公斤以上

- 按軸類型

- 第四軸

- 5軸

- 6軸

- 7個或更多軸

- 按用途

- 物料輸送

- 焊接和釬焊

- 組裝

- 油漆和塗料

- 包裝和堆疊

- 檢驗和品質保證

- 其他

- 按最終用戶產業

- 車

- 電氣和電子

- 金屬和機械

- 藥品和醫療設備

- 食品和飲料

- 電子商務與物流

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 新加坡

- 馬來西亞

- 澳洲

- 其他亞太地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corp.

- KUKA AG

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Electric Corp.

- Nachi-Fujikoshi Corp.

- DENSO Corp.

- Seiko Epson Corp.

- Staubli International AG

- Hyundai Robotics Co., Ltd.

- Comau SpA

- Omron Adept Technology Inc.

- Universal Robots A/S

- Durr AG(Paint Robots)

- Estun Automation Co., Ltd.

- SIASUN Robot & Automation Co.

- JAKA Robotics Ltd.

- Techman Robot Inc.

- Precise Automation Inc.

- CMA Robotics SpA

- Gudel Group AG

- IAI Corporation

- Aubo Robotics Inc.

- Robot Industrial Association(RIA)

第7章 市場機會與未來趨勢

The Articulated Robot Market size is estimated at USD 26.92 billion in 2025, and is expected to reach USD 51.16 billion by 2030, at a CAGR of 13.70% during the forecast period (2025-2030).

Surging demand for smart manufacturing solutions, sovereign production policies, and AI-enabled collaborative systems underpin this expansion. Intensifying capital expenditure in electric-vehicle production, sustained warehouse automation roll-outs by e-commerce majors, and growing precision-oriented food applications further reinforce momentum. Meanwhile, component makers are responding to semiconductor and servo-motor bottlenecks with vertical-integration strategies, and energy-efficient robotic designs are gaining traction as users chase lower operating costs. Competitive strategies are bifurcating: incumbents such as ABB pursue structural spin-offs to sharpen focus, while start-ups leverage cloud-connected platforms to shorten deployment times.

Global Articulated Robot Market Trends and Insights

Shift toward Industry 4.0-led automation

Manufacturers are linking articulated robots with AI analytics and IoT sensors to create closed-loop production ecosystems that self-optimise quality, uptime, and energy consumption. Foxconn's lights-off sites cut headcount by 150,000 yet sustained output by embedding predictive-maintenance algorithms in robotic workcells. Xiaomi's 24/7 smartphone facility demonstrates the scalability of such dark-factory models. These deployments shift automation economics from manpower substitution to product-mix agility, enabling rapid re-tooling for customised lots and variant introductions.

Rising labor cost and skilled-worker shortage

Robot operating costs of USD 1.60-2.00 per hour now undercut human wages exceeding USD 5.50 in many regions, tilting ROI calculations decisively toward automation. General Motors and John Deere trimmed welding labor expenses by 50% and defects by 25% after adopting robotic welding cells. Warehouse operators such as GXO Logistics have turned to Apollo humanoids to bridge head-count gaps while improving safety metrics. Ageing demographics in Europe and East Asia anchor this driver for the long term.

High upfront acquisition and integration cost

Total cost of an articulated robot cell can double once integration, safety equipment, and training are included, discouraging smaller enterprises. Latin American SMEs cite limited access to integrators and finance as key barriers to adoption. Robots-as-a-Service models mitigate this restraint by converting cap-ex into opex; Formic reported 200,000 contracted production hours at 99.8% uptime, highlighting investor appetite for pay-per-use automation.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives for smart manufacturing

- Automotive e-mobility cap-ex boom

- Servo-motor and semiconductor supply bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The <= 16 kg class is projected to outpace all others at a 16.1% CAGR on the back of electronics, pharma, and collaborative deployments, whereas the 16-60 kg segment retained 32.6% of articulated robot market share in 2024. Users favour lighter platforms for speed, energy thrift, and human-adjacent safety. Freedom Fresh Australia's macadamia line runs 0.39-second cycles with a lightweight SCARA unit, underscoring productivity gains in food packing. Energy-efficiency pressures are driving material innovations: carbon-fibre arms from Cognibotics cut consumption by 90% while maintaining rigidity.

Demand for 60-225 kg and > 225 kg robots remains stable in automotive body-shop and foundry tasks, yet growth decelerates as OEMs sweat installed assets rather than expand footprint. High-payload arms increasingly integrate shape-memory alloy grippers that slash pneumatic energy use by 90%. Over 2025-2030, the articulated robot market size for heavy-duty classes is forecast to expand at single-digit rates, supported by EV battery pack lifting and wind-turbine component handling.

Six-axis models captured 51.8% of revenue in 2024, anchoring the articulated robot market as the de-facto workhorse for welding, painting and precision assembly. Cost points now span under USD 5,000 for light units to beyond USD 500,000 for clean-room variants. Modular controllers are shrinking installation footprints, a boon for SMEs with space constraints.

Seven-axis and hyper-dexterous formats are the fastest-rising niche, charting a 16.5% CAGR. Yamaha's YA series elbows rotate around confined fixtures, enabling shorter takt times in dense production cells. Parallel-topology robots studied by MDPI promise higher stiffness-to-weight ratios for pick-and-place cycles. As automotive interiors grow more complex and consumer electronics trend toward miniaturisation, demand for extra axes to navigate tight envelopes will intensify.

Articulated Robot Market is Segmented by Payload Capacity (Up To 16 Kg, 16 - 60 Kg, and More), Axis Type (4-Axis, 5-Axis, and More), Application (Material Handling, Welding and Soldering, Assembly, Painting and Dispensing, and More), End-User Industry (Automotive, Electrical and Electronics, Metals and Machinery, Pharmaceutical and Medical Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained its dominance with 42.4% revenue in 2024, propelled by China's scale and Japan's innovation ecosystems. Regional governments fund lighthouse projects that accelerate SME uptake, stabilising articulated robot market size gains even as domestic wage growth tempers cost advantages. Japan's Robot Tax Credit and Korea's AI Voucher Scheme keep pipeline activity robust.

South America is forecast to grow the fastest at 15.3% CAGR through 2030, underwritten by foreign direct investments in automotive electrification and agri-automation. Brazil's SOLIX field robot shows how AI vision extends articulated design into open-field crop management. Case IH's USD 20 million Sorocaba upgrade embeds AI to command 90% harvester functions, demonstrating regional appetite for advanced robotics.

North America posted 12% year-on-year installation growth in 2024-totaling 44,303 units-supported by federal reshoring incentives and EV supply-chain projects. Europe faces energy-price headwinds yet invests in local capacity; Yaskawa's EUR 31.5 million Slovenian hub will localise 80% of EMEA robot deliveries by 2027. The Middle East and Africa remain nascent but attract pilots in construction and petrochemical maintenance, laying the groundwork for long-run articulated robot market adoption.

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corp.

- KUKA AG

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Electric Corp.

- Nachi-Fujikoshi Corp.

- DENSO Corp.

- Seiko Epson Corp.

- Staubli International AG

- Hyundai Robotics Co., Ltd.

- Comau SpA

- Omron Adept Technology Inc.

- Universal Robots A/S

- Durr AG (Paint Robots)

- Estun Automation Co., Ltd.

- SIASUN Robot & Automation Co.

- JAKA Robotics Ltd.

- Techman Robot Inc.

- Precise Automation Inc.

- CMA Robotics SpA

- Gudel Group AG

- IAI Corporation

- Aubo Robotics Inc.

- Robot Industrial Association (RIA)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward Industry 4.0-led automation

- 4.2.2 Rising labor cost and skilled-worker shortage

- 4.2.3 Government incentives for smart manufacturing

- 4.2.4 Automotive e-mobility cap-ex boom

- 4.2.5 AI-enabled adaptive articulated cobots

- 4.2.6 Fulfilment-center automation by e-commerce majors

- 4.3 Market Restraints

- 4.3.1 High upfront acquisition and integration cost

- 4.3.2 Scarcity of system-integration talent

- 4.3.3 Cyber-security risk in connected robot controllers

- 4.3.4 Servo-motor and semiconductor supply bottlenecks

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Payload Capacity

- 5.1.1 Up to 16 kg

- 5.1.2 16 - 60 kg

- 5.1.3 60 - 225 kg

- 5.1.4 Above 225 kg

- 5.2 By Axis Type

- 5.2.1 4-Axis

- 5.2.2 5-Axis

- 5.2.3 6-Axis

- 5.2.4 7-Axis and Above

- 5.3 By Application

- 5.3.1 Material Handling

- 5.3.2 Welding and Soldering

- 5.3.3 Assembly

- 5.3.4 Painting and Dispensing

- 5.3.5 Packaging and Palletizing

- 5.3.6 Inspection and Quality Assurance

- 5.3.7 Others

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Electrical and Electronics

- 5.4.3 Metals and Machinery

- 5.4.4 Pharmaceutical and Medical Devices

- 5.4.5 Food and Beverages

- 5.4.6 E-commerce and Logistics

- 5.4.7 Other End-User Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corporation

- 6.4.3 Yaskawa Electric Corp.

- 6.4.4 KUKA AG

- 6.4.5 Kawasaki Heavy Industries Ltd.

- 6.4.6 Mitsubishi Electric Corp.

- 6.4.7 Nachi-Fujikoshi Corp.

- 6.4.8 DENSO Corp.

- 6.4.9 Seiko Epson Corp.

- 6.4.10 Staubli International AG

- 6.4.11 Hyundai Robotics Co., Ltd.

- 6.4.12 Comau SpA

- 6.4.13 Omron Adept Technology Inc.

- 6.4.14 Universal Robots A/S

- 6.4.15 Durr AG (Paint Robots)

- 6.4.16 Estun Automation Co., Ltd.

- 6.4.17 SIASUN Robot & Automation Co.

- 6.4.18 JAKA Robotics Ltd.

- 6.4.19 Techman Robot Inc.

- 6.4.20 Precise Automation Inc.

- 6.4.21 CMA Robotics SpA

- 6.4.22 Gudel Group AG

- 6.4.23 IAI Corporation

- 6.4.24 Aubo Robotics Inc.

- 6.4.25 Robot Industrial Association (RIA)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment