|

市場調查報告書

商品編碼

1842660

造紙染料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Paper Dyes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

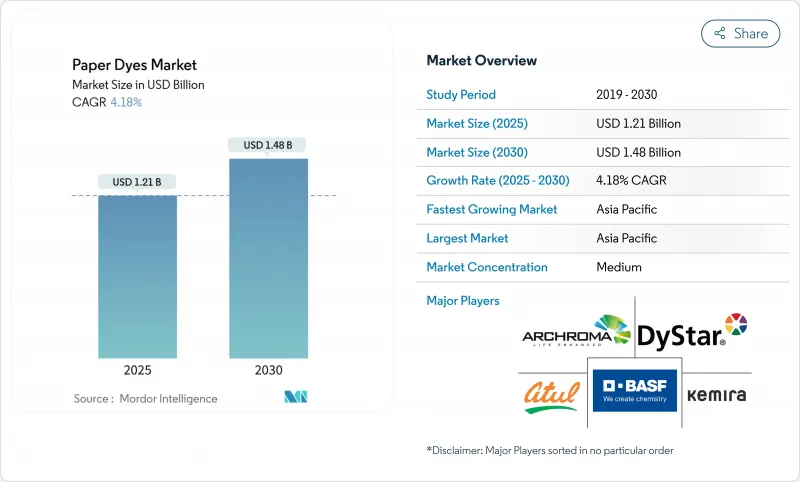

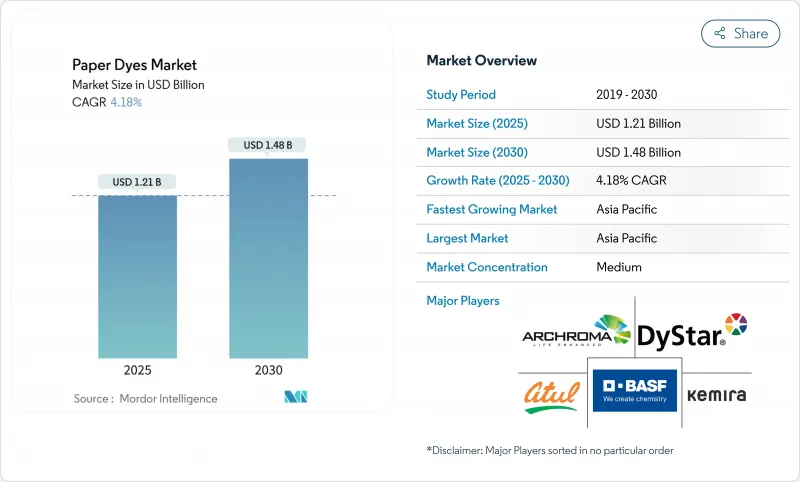

預計全球造紙染料市場規模到 2025 年將達到 12.1 億美元,到 2030 年將達到 14.8 億美元,複合年成長率為 4.18%。

這一穩定的成長軌跡反映了市場在數位文件替代方面的韌性,這得益於包裝從塑膠向紙質的結構性轉變,以及電子商務貨運對色彩鮮豔、品牌一致性圖形日益成長的需求。與現代噴墨生產線無縫整合的墨水有助於加工商減少停機時間,而主要染料製造商的產能擴張則平衡了原料供應。限制一次性塑膠的法規以及品牌所有者對可再生基材的偏好,即使在圖形紙產量萎縮的情況下,也支撐著成長前景。對木質素相容和奈米封裝化學品的投資,正在幫助供應商實現差異化,並贏得食品接觸和高速數位應用領域的優質訂單。

全球造紙染料市場趨勢與洞察

從塑膠包裝到紙質包裝的轉變

為了回應一次性塑膠禁令並滿足消費者對紙張的偏好,零售品牌持續以可回收的纖維基材料取代石油基材。雀巢、聯合利華和其他跨國公司目前正在從某些SKU中淘汰高達97%的塑膠,從而加速了對高性能染料的訂單,這些染料可透過多個回收循環保持一致的性能。歐盟《一次性塑膠指令》帶來的監管確定性,支持了對需要食品級、抗遷移色素的加工商的資本投資。消費者願意為永續包裝支付溢價,這使得染料製造商能夠確保新的、可靠的配方價格,這些配方能夠承受回收纖維系統中的鹼性脫墨和氧化漂白。

電子商務推動紙板和郵件需求激增

超過80%的線上訂單採用紙箱運輸,小包裹量持續成長,尤其是在亞太地區和北美地區。履約中心需要高速旋轉噴墨生產線,並運作專為低維護印字頭設計的液體染料,以實現當日大規模個人化服務。到2024年,包裝廠租金將比20年平均值高出45%,這清楚地表明結構性產能擴張,並將在整個預測期內支撐紙染料市場。

無紙化辦公室和數位文件的興起

隨著企業和教育用戶加速數位化工作流程,圖形紙的需求急劇萎縮。歐洲造紙工業聯合會記錄到,2023年紙張和紙板產量下降了13%,其中僅圖形紙產量就下降了28%。遠距辦公通訊協定仍然有效,導致印刷量減少50%至70%,電子簽章平台也減少了對紙本的需求。雖然包裝染料彌補了部分損失,但圖形紙產量的萎縮將限制整體產量的成長,尤其是在成熟地區。

細分分析

預計到2024年,流體將佔銷售額的51.92%,複合年成長率為6.40%,這將鞏固其在支援電商包裝升級的高速噴墨生產線中的關鍵作用。粉末級流體更易於散裝運輸,但必須滿足粉塵暴露法規和緩慢的分散時間要求。奈米封裝流體系統現在可實現超過1,000小時的列印頭工作週期,從而最大限度地減少維護停機時間並提高加工商的OEE。穩定的溫度黏度支援自動計量,並滿足準時制生產目標。

乳化和微流體封裝技術的不斷進步正在延長保存期限,使其在25°C下能夠保持顏色強度超過12個月,而標準配方則只能保持6個月。因此,加工商能夠減少因庫存過期而造成的減損損失。粉末供應商正在透過壓實和防塵技術來應對這項挑戰,但數位化化工廠仍落後於液體粉末競爭對手。

直接染料因其經濟高效的輸送工藝而備受青睞,將在高產量箱板紙廠保持主導地位,到2024年將佔其總收入的28.45%。然而,活性染料市場正以5.90%的複合年成長率成長,這得益於其卓越的耐洗牢度,而這一特性受到高階折疊紙盒用戶的青睞,因為他們需要圖案能夠經受住回收利用。纖維測試表明,棉纖維含量高的特種紙品使用活性染料的上染率為41.45%,而其他化學染料的上染率為35.68%。

供應商正在將典型的反應槽溫度從 90°C 降低至 60°C,同時不犧牲附著力,降低能耗,並擴大受脫碳目標限制的工廠的採用率。直接染料因其在中性 pH 下易於沉積而仍然是主要染料,但其市場佔有率正逐漸被符合循環經濟要求的高價值化學品所取代。

區域分析

到2024年,亞太地區將以44.79%的收益保持領先地位,預計到2030年複合年成長率將達到5.70%,這反映了其作為全球製造業核心和快速擴張的消費市場的地位。中國化工產業的領導企業恆力、萬華等企業正在利用政府對精細化工計劃的獎勵,提高該地區的自給自足能力。越南擁有7,500家紡織企業,僱用了430萬名工人,這將增加紙板和特種紙的消費,從而導致該地區染料使用量增加。

北美以以金額為準計算位居第二,這得益於履約的成長以及食品飲料跨國公司積極減少塑膠使用的承諾。昂高位於南卡羅來納州的工廠和索理思位於維吉尼亞的工廠正在實現供應本地化,而PFAS法規的明確性正推動加工商採用合規的水性系統。雖然圖紙的收縮抑制了產量,但青睞環保染料的高階訂單支撐了價格實現,使其漲幅超過通膨。

歐洲面臨嚴格的《歐盟化學品註冊、評估、許可和限制》(REACH) 修正案和波動的紙漿價格(北方漂白針葉木牛皮紙漿價格在 2024 年 4 月達到 1,380 歐元/噸),這給營業利潤率帶來了壓力。然而,歐盟在循環經濟法規方面的領導地位以及對木質素衍生著色劑研發的資金投入,使本地供應商在高價值、環保產品方面處於領先地位。水處理公司正在投資閉合迴路水處理以滿足排放許可要求,這推動了對低鹽、高排放染料的需求,符合零液體排放的目標。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 從塑膠包裝到紙質包裝的轉變

- 電子商務推動瓦楞紙箱和郵件的需求

- 提高大型染料製造商的產能

- 生物基木質素相容染料的突破

- 奈米膠囊染料可在紙上進行數位噴墨列印

- 市場限制

- 無紙化辦公室和數位文件的興起

- 有毒胺和 REACH 合規成本上升

- 木漿供應和價格的波動

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按形狀

- 粉末

- 液體

- 按類型

- 酸性

- 基本的

- 直接地

- 依產地分類

- 有機的

- 合成

- 按用途

- 列印/書寫

- 包裝

- 專業

- 其他(紙巾、衛生材料)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Archroma

- Ashok Alco-chem

- Atul Ltd.

- BASF

- Celanese Corporation

- ChromaScape

- DyStar Singapore Pte Ltd

- Kemira Oyj

- Kiri Industries Limited

- Lonza

- Merck KGaA

- Milliken

- Nitin Dye Chem Pvt. Ltd

- Setas Kimya

- Standard Colors, Inc.

- Steiner-Axyntis

- Sudarshan Chemical Industries Limited.

- Synthesia, as

- Thermax Limited

- Vipul Organics Ltd.

- Zhejiang Longsheng

第7章 市場機會與未來展望

The global paper dyes market stood at USD 1.21 billion in 2025 and is forecast to reach USD 1.48 billion by 2030, advancing at a 4.18% CAGR.

This steady trajectory reflects the market's resilience in digital-document substitution, supported by the structural migration from plastic to paper-based packaging and rising demand for vivid, brand-consistent graphics in e-commerce shipments. Liquid formulations that integrate seamlessly with modern inkjet lines are helping converters reduce downtime, while capacity additions by major dye makers keep raw material supply balanced. Regulatory tailwinds that restrict single-use plastics and brand owners' preference for renewable substrates underpin an expansionary outlook even as graphic-paper volumes contract. Investments in lignin-compatible and nano-encapsulated chemistries further differentiate suppliers, positioning them to capture premium orders in food-contact and high-speed digital applications.

Global Paper Dyes Market Trends and Insights

Shift from Plastic to Paper-Based Packaging

Retail brands continue to replace petroleum-based substrates with recyclable, fiber-based formats to comply with single-use plastic bans and to meet consumer preference for paper. Nestle, Unilever, and other multinationals now eliminate up to 97% of plastic from certain SKUs, accelerating orders for high-performance dyes that remain stable through multiple recycling loops. Regulatory certainty created by the European Union's Single-Use Plastics Directive supports capital investment in converters that require food-contact-compliant, migration-safe colorants. Consumer willingness to pay premiums for sustainable packaging has held steady, allowing dye producers to defend pricing for novel, colorfast formulations that tolerate alkaline de-inking and oxidative bleaching in recovered-fiber systems.

E-commerce-Fueled Boom in Corrugated & Mailer Demand

Over 80% of online orders ship in corrugated formats, and parcel volumes continue to rise-particularly in Asia-Pacific and North America-creating concentrated demand for vivid graphics that elevate the unboxing experience. Fulfillment centers require rapid-turn inkjet lines that run on liquid dyes engineered for low-maintenance printheads, enabling same-day personalization at scale. Building leases for packaging plants rose 45% above the 20-year average in 2024, a clear signal of structural capacity expansion that will sustain the paper dyes market over the forecast horizon.

Paperless Office & Digital Documents Adoption

Graphic-paper demand contracted sharply after corporate and educational users accelerated digital workflows. The Confederation of European Paper Industries recorded a 13% fall in paper and board production in 2023, with graphic grades alone down 28%. Remote-work protocols that cut printing volumes by 50-70% remain in force, while e-signature platforms reduce the need for hard copies. Although packaging dyes offset some losses, graphic-paper contraction limits overall tonnage growth, particularly in mature regions.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Expansions by Major Dye Manufacturers

- Breakthroughs in Bio-Based Lignin-Compatible Dyes

- Toxic Amines & Rising REACH Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid offerings held 51.92% of 2024 revenue and are projected to expand at a 6.40% CAGR, reinforcing their pivotal role in high-speed inkjet lines that power versioned e-commerce packaging. Powder grades, although easier to transport in bulk, must contend with dust-exposure rules and slower dispersion times. Nano-encapsulated liquid systems now enable print-head duty cycles exceeding 1,000 hours, minimizing maintenance shutdowns and improving OEE for converters. Stable viscosity across temperature swings supports automated dosing, aligning with just-in-time production targets.

Ongoing advances in mini-emulsion and microfluidic encapsulation increase shelf life, preserving hue intensity for over 12 months when stored at 25 °C, compared with six months for standard formulations. As a result, converters see reduced write-offs from expired stocks. Powder suppliers respond with compaction and dust-suppressant technologies but still trail liquid rivals in digitally enabled plants.

Direct dyes, favored for cost-efficient exhaust processes, commanded 28.45% of 2024 sales, maintaining dominance in high-volume linerboard mills. Yet the reactive segment is advancing at a 5.90% CAGR on the strength of superior wash-fastness, an attribute prized by premium folding-carton users who require graphics to survive recycling. According to fiber-specific trials, cotton-fiber-rich specialty grades register dye uptake of 41.45% with reactivatives versus 35.68% for other chemistries.

Suppliers reduce typical reactive-bath temperatures from 90 °C to 60 °C without sacrificing fixation, lowering energy loads, and broadening adoption in mills constrained by decarbonization targets. Direct dyes remain a staple because they attach readily under neutral pH, but their market share is gradually ceded to higher-value chemistries that align with circular-economy mandates.

The Paper Dyes Market Report Segments the Industry by Form (Powder and Liquid), Type (Acidic, Basic, and More), Origin (Organic and Synthetic), Application (Printing and Writing, Packaging, Specialty, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained leadership with 44.79% of 2024 revenue and is forecast to rise at a 5.70% CAGR to 2030, reflecting its status as a global manufacturing nucleus and fast-expanding consumer market. China's chemical champions-Hengli, Wanhua, and peers-channel government incentives into fine-chemical projects that lift regional self-sufficiency. Vietnam, hosting 7,500 textile enterprises employing 4.3 million workers, boosts regional consumption of corrugated and specialty papers, translating into higher local dye usage.

North America ranks second by value, propelled by e-commerce fulfillment growth and aggressive plastic-reduction pledges from food and beverage multinationals. Archroma's South Carolina site and Solenis's Virginia complex provide localized supply, while regulatory clarity on PFAS pushes converters to adopt compliant, water-based systems. Although graphic-paper contraction tempers total tonnage, premium-grade orders that favor environmentally optimized dyes support above-inflation price realization.

Europe grapples with stringent REACH amendments and pulp-price volatility-Northern Bleached Softwood Kraft touched EUR 1,380 / t in April 2024-pressuring operating margins. Yet the bloc's leadership in circular-economy regulation and R&D funding for lignin-derived colorants positions local suppliers at the forefront of high-value, eco-optimized offerings. Converters invest in closed-loop water treatment to meet discharge permits, raising demand for low-salt, high-exhaustion dyes that align with zero-liquid-discharge ambitions.

- Archroma

- Ashok Alco-chem

- Atul Ltd.

- BASF

- Celanese Corporation

- ChromaScape

- DyStar Singapore Pte Ltd

- Kemira Oyj

- Kiri Industries Limited

- Lonza

- Merck KGaA

- Milliken

- Nitin Dye Chem Pvt. Ltd

- Setas Kimya

- Standard Colors, Inc.

- Steiner-Axyntis

- Sudarshan Chemical Industries Limited.

- Synthesia, a.s.

- Thermax Limited

- Vipul Organics Ltd.

- Zhejiang Longsheng

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift from plastic to paper-based packaging

- 4.2.2 E-commerce-fuelled boom in corrugated & mailer demand

- 4.2.3 Capacity expansions by major dye manufacturers

- 4.2.4 Breakthroughs in bio-based lignin-compatible dyes

- 4.2.5 Nano-encapsulated dyes enabling digital inkjet printing on paper

- 4.3 Market Restraints

- 4.3.1 Paperless office & digital documents adoption

- 4.3.2 Toxic amines & rising REACH compliance costs

- 4.3.3 Volatility in wood-pulp availability & pricing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Form

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.2 By Type

- 5.2.1 Acidic

- 5.2.2 Basic

- 5.2.3 Direct

- 5.3 By Origin

- 5.3.1 Organic

- 5.3.2 Synthetic

- 5.4 By Application

- 5.4.1 Printing and Writing

- 5.4.2 Packaging

- 5.4.3 Specialty

- 5.4.4 Others (Tissue and Hygiene)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Archroma

- 6.4.2 Ashok Alco-chem

- 6.4.3 Atul Ltd.

- 6.4.4 BASF

- 6.4.5 Celanese Corporation

- 6.4.6 ChromaScape

- 6.4.7 DyStar Singapore Pte Ltd

- 6.4.8 Kemira Oyj

- 6.4.9 Kiri Industries Limited

- 6.4.10 Lonza

- 6.4.11 Merck KGaA

- 6.4.12 Milliken

- 6.4.13 Nitin Dye Chem Pvt. Ltd

- 6.4.14 Setas Kimya

- 6.4.15 Standard Colors, Inc.

- 6.4.16 Steiner-Axyntis

- 6.4.17 Sudarshan Chemical Industries Limited.

- 6.4.18 Synthesia, a.s.

- 6.4.19 Thermax Limited

- 6.4.20 Vipul Organics Ltd.

- 6.4.21 Zhejiang Longsheng

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment