|

市場調查報告書

商品編碼

1842656

電動割草機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Electric Lawn Mowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

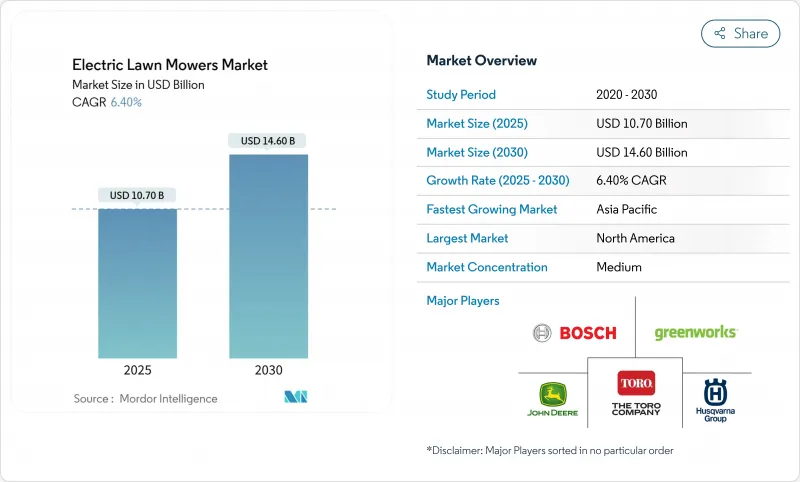

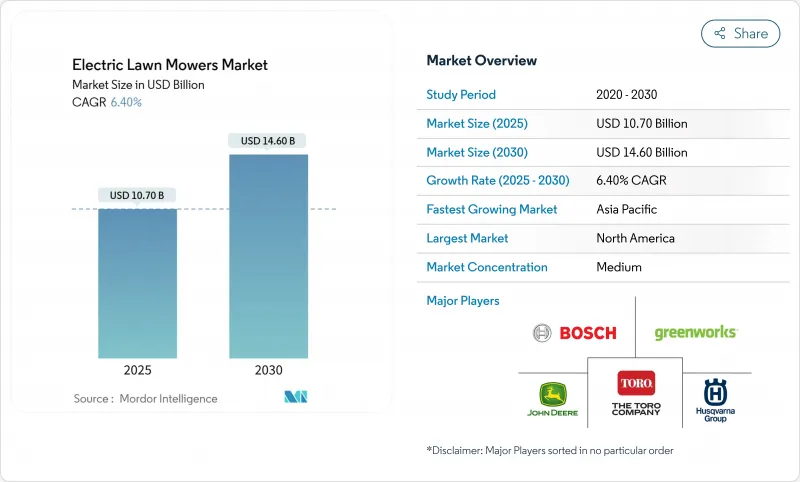

電動割草機市場規模預計在 2025 年達到 107 億美元,預計到 2030 年將達到 146 億美元,預測期內複合年成長率為 6.4%。

更嚴格的排放法規、快速的電池創新以及消費者對更安靜、更低維護設備日益成長的興趣推動了電動車的普及。手推式無線電器將引領潮流,佔2024年銷售額的41.3%,而機器人和自動駕駛系統預計到木工將以15.1%的複合年成長率成長。到2024年,住宅DIY用戶將產生68.1%的需求,隨著公共機構以零排放汽車取代汽油動力汽車,市政採購將以14.2%的複合年成長率加速。到2024年,北美將以35.2%的佔有率保持其最大的區域基礎,而受都市化和國家乾淨科技項目的推動,亞太地區將以11.1%的複合年成長率成為成長引擎。 37-60V中型電池對尋求在運行時間和機動性之間取得平衡的專業工作者俱有吸引力,即使電子商務的普及率不斷提高,專業經銷商仍將繼續主導專業級分銷。

全球電動割草機市場趨勢與洞察

鋰離子電池成本快速下降,能量密度上升

電池成本下降使得無線割草機更加經濟實惠,而能量密度的提升則提升了運作時間和能源效率,使電動車型與傳統燃氣動力車型不相上下。在美國稅收優惠政策和汽車電池量產的推動下,鋰離子電池組價格預計將從2023年的每千瓦時140美元降至2035年的每千瓦時86美元。高鎳陰極可將電池密度提高15-20%,使手扶式無線割草機單次充電即可運作45-60分鐘,且不會增加重量。先進的溫度控管可將電池組壽命延長至5-7年,且無需日常維護,可將總營業成本降至低於汽油水準。

全球加強小型燃氣引擎的排氣和噪音法規

世界各國政府正在加強污染物排放監管,市政當局也推出了噪音限制措施,這使得傳統的汽油動力割草機不再適合住宅和商業用途。加州的小型非道路引擎 (SORE) 法規將從 2024 年開始禁止銷售新的汽油動力割草機,這促使美國其他州也紛紛效仿。美國環保署 (EPA) 第三階段標準和加拿大的協調法規也施加了類似的限制,這增加了火星點火式割草機製造商的合規成本。由於電池供電的割草機運作噪音低於 70 分貝,並且可以繞過時段限制,人口密集城市的噪音法規進一步加速了人們向電動割草機的轉變。

與同類汽油割草機相比,初始價格更高

與汽油動力割草機相比,電動割草機的前期成本較高,這仍然是市場限制因素,減緩了價格敏感型消費者的接受度。市售電池供電的零轉彎割草機售價在 1.5 萬至 2.5 萬美元之間,而汽油動力割草機售價在 8,000 至 1.2 萬美元之間,即使電池成本下降,仍會造成較高的資金門檻。美國對中國產電池組的關稅將在 2024 年上調至 25%,到 2025 年將達到 58%。加州和南海岸空氣品質管理區 (AQMD) 將為專業級設備提供最高 1.5 萬美元的退稅,以緩解影響並將投資回收期縮短至三個季度以內。

細分分析

無線手扶式割草機是電動割草機市場的最大細分市場,佔 2024 年銷售額的 41.3%。隨著感測器、地圖軟體和無邊界導航減少對住宅和市政草坪的勞動力依賴,機器人和自動駕駛割草機預計將實現 15.1% 的複合年成長率。有線手扶式割草機在小塊土地上佔據利基市場,而搭乘用式零轉彎割草機則針對優先考慮大面積生產力的專業割草機用戶。 Positec 的自動駕駛系列和 Husqvarna 的衛星導引裝置等產品的推出凸顯了原始設備製造商對節省勞動力的價值提案的關注。雖然站立式設計仍然是一種專業產品,但其緊湊的佔地面積非常適合樹木繁茂的商業場所,在這些場所中,緊密的樞軸比甲板寬度更重要。

住宅DIY用戶將佔據電動割草機市場的最大佔有率,到2024年將貢獻68.1%的銷售量。郊區居民出於便利性考量將選擇電池平台,較小的用地面積也更適合45分鐘的駕駛時間限制。市政和政府車輛到2024年將僅佔出貨量的8.3%,但隨著零排放採購規則逐步淘汰汽油庫存,其複合年成長率將達到14.2%。預計到2030年,專業服務電動割草機市佔率將達到18%。

區域分析

受各州激勵措施和加州2024年SORE禁令的支撐,北美將在2024年引領電動割草機市場,銷售額佔35.2%。 100美元至1.5萬美元不等的補貼將縮短屋主和市政當局的投資回報期。加拿大的後視鏡排氣管法規允許供應商將兩個國家視為一個監管區域,從而簡化認證流程。

預計亞太地區將以11.1%的複合年成長率實現最高成長,到2030年將佔到21%至27%的收入佔有率。中國2024年的「煥新」獎勵策略、電池的成本優勢以及蓬勃發展的中產階級將推動電動車的普及。日本精通科技的消費者是整合智慧家庭生態系統的機器人割草機的早期使用者,而印度的城市擴張和政府的電動車政策正在逐漸釋放龐大的屋主群體。

在嚴格的噪音法規和消費者的永續性導向的推動下,歐洲繼續保持穩定成長勢頭。由於 Husqvarna 的經銷商網路和產品知名度,機器人在該地區割草機銷量中的滲透率已超過 20%,遠高於全球平均水平。隨著人均 GDP 的成長以及歐盟生態標籤獎勵的推廣,東歐已成為一個空白區域。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 鋰離子電池成本快速下降,能量密度不斷提高

- 全球對小型燃氣引擎廢氣和噪音的監管更加嚴格

- 消費者越來越偏好低維護的無線設備

- 大型零售商擴大自有品牌無線刷式修剪器生產線

- 透過電動自行車/Scooter電池的二手供應鏈降低零件成本

- 「割草即服務」訂閱經營模式的出現

- 市場限制

- 與同類汽油割草機相比,初始價格更高

- 當在大面積使用時,運作時間和充電速度受到限制。

- 貿易關稅和關鍵礦物限制增加了電池成本

- 更嚴格的防火法規,限制大容量包裝的儲存和運輸

- 監管狀況

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 依產品類型

- 有線步行類型

- 手推式無線

- 搭乘用草坪曳引機

- 搭乘用零轉彎

- 站立式

- 機器人/自主

- 按最終用戶

- 房屋DIY

- 專業庭園綠化服務

- 高爾夫球場和體育設施

- 市政當局/政府

- 按電池電壓

- 36V 或更低(輕型)

- 37 至 60 V(中負荷)

- 60V或更高(商業級)

- 按銷售管道

- 商店零售(家居裝飾店)

- 專業經銷商/專業經銷商

- 網路商城

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 紐西蘭

- 其他亞太地區

- 中東

- 沙烏地阿拉伯

- UAE

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Deere & Company

- Husqvarna Group

- The Toro Company

- Robert Bosch GmbH

- Stanley Black & Decker, Inc.

- STIGA SpA

- Honda Motor Co.

- Greenworks North America LLC

- Chervon(EGO Power+)

- Techtronic Industries Co. Ltd.(Ryobi)

- Positec(WORX)

- STIHL

- Segway Navimow

- Mammotion

- Makita

第7章 市場機會與未來展望

The Electric Lawn Mowers Market size is estimated at USD 10.7 billion in 2025 and is projected to reach USD 14.6 billion by 2030, at a CAGR of 6.4% during the forecast period.

Expanding adoption stems from stronger emission rules, rapid battery innovation, and a growing consumer focus on quieter, low-maintenance equipment. Walk-behind cordless units led with 41.3% of 2024 revenue, while robotic and autonomous systems recorded a brisk 15.1% CAGR outlook to 2030. Residential do-it-yourself (DIY) owners generated 68.1% of demand in 2024, yet municipal procurement is accelerating at 14.2% CAGR as public agencies replace gasoline fleets with zero-emission alternatives. North America retained the largest regional base with a 35.2% share in 2024, whereas Asia-Pacific emerged as the growth engine at 11.1% CAGR, supported by urbanization and national clean-technology programs. Mid-duty 37-60 V batteries appeal to professional crews that seek a balance between runtime and maneuverability, and specialty dealers continue to dominate pro-level distribution even as e-commerce penetration rises.

Global Electric Lawn Mowers Market Trends and Insights

Rapid Decline in Lithium-Ion Battery Cost and Rising Energy Density

Lower battery costs are making cordless mowers more affordable, while improved energy density enhances runtime and power efficiency, allowing electric models to rival traditional gas-powered mowers. Lithium-ion pack prices dropped from USD 140 per kWh in 2023 to a projected USD 86 per kWh for 2035, helped by tax incentives in the United States and large-scale automotive cell output. Higher-nickel cathodes deliver 15-20% density gains, allowing walk-behind cordless mowers to run 45-60 minutes on a single charge without weight penalties. Pack life now extends to 5-7 years under advanced thermal management, pushing total operating cost below gasoline equivalents once routine maintenance is removed.

Stricter Worldwide Emission and Noise Standards on Small Gas Engines

Governments worldwide are enforcing tighter restrictions on pollutants, while municipalities impose noise limitations, making traditional gas-powered mowers less viable for residential and commercial use. California's Small Off-Road Engine (SORE) rule banned new gasoline lawn equipment sales from 2024, framing policy adoption for other U.S. states. Similar limits under U.S. EPA Phase 3 standards and Canada's aligned regulations raise compliance costs for spark-ignition manufacturers. Noise ordinances in dense metros further accelerate electric substitutions because battery mowers operate below 70 dBA and avoid time-of-day restrictions.

Higher Upfront Price Compared with Equivalent Gas-Powered Mowers

The higher upfront cost of electric lawnmowers compared to their gas-powered counterparts remains a key market restraint, slowing adoption among price-sensitive consumers. Commercial battery zero-turn models list at USD 15,000-25,000 versus USD 8,000-12,000 for gasoline units, widening the capital hurdle even after declining cell costs. U.S. duties on Chinese battery packs rose to 25% in 2024 and will reach 58% in 2025, inflating street prices while suppliers diversify sourcing. California and South Coast AQMD rebates of up to USD 15,000 for pro-grade equipment soften the impact and shorten payback to under three seasons.

Other drivers and restraints analyzed in the detailed report include:

- Growing Consumer Preference for Low-Maintenance Cordless Equipment

- Expansion of Private-Label Cordless Mower Lines by Large Retailers

- Limited Runtime and Recharge Speed for Large-Area Professional Usage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Walk-behind cordless mowers captured 41.3% of 2024 revenue, highlighting the largest segment within the electric lawn mowers market. Robotic and autonomous units post a 15.1% CAGR outlook as sensors, mapping software, and boundary-free navigation reduce labor dependency for residential and municipal turf. Corded walk-behinds retain a small-lot niche, while ride-on zero-turn formats cater to professional grounds crews prioritizing productivity on wide acreage. Product launches such as Positec's autonomous range and Husqvarna's satellite-guided units underscore OEM's focus on labor-saving value propositions. Stand-on designs remain a specialized play, yet their compact footprint suits tree-rich commercial sites where tight pivots matter more than outright deck width.

Residential DIY owners generated 68.1% of revenue in 2024, anchoring the largest stake in the electric lawn mowers market. Suburban homeowners choose battery platforms for convenience, while smaller lot sizes align well with 45-minute runtime limits. Municipal agencies and government fleets, though just 8.3% of 2024 shipments, will add a 14.2% CAGR as zero-emission procurement rules phase out gasoline stock. The electric lawn mowers market share for professional services is forecast to reach 18% by 2030.

The Electric Lawn Mowers Market Report is Segmented by Product Type (Walk-Behind Corded, Walk-Behind Cordless, and More), by End User (Residential DIY, and More), by Battery Voltage (Less Than or Equal To 36V, and More), by Distribution Channel (In-Store Retail, and More), and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the electric lawn mowers market in 2024 with 35.2% revenue, underpinned by state incentive schemes and California's 2024 SORE ban. Rebate programs ranging from USD 100 to USD 15,000 shorten payback horizons for homeowners and municipalities alike. Canada's mirrored exhaust rules allow vendors to treat both nations as one regulatory bloc, streamlining certification.

Asia-Pacific delivered the highest regional growth at 11.1% CAGR, moving from 21% to an anticipated 27% revenue share by 2030. China's 2024 "equipment renewal" stimulus, battery-cell cost advantages, and a burgeoning middle-class lift adoption. Japan's tech-savvy consumers are early adopters of robotic mowers integrated with smart-home ecosystems, while India's urban sprawl and government EV policies gradually unlock a sizeable homeowner base.

Europe maintains steady momentum on the back of strict noise rules and a consumer sustainability ethos. Robotic penetration exceeds 20% of regional mower sales, far above global norms, aided by Husqvarna's entrenched dealer web and product familiarity. Eastern Europe offers white space as GDP per capita rises, and EU eco-label incentives ripple eastward.

- Deere & Company

- Husqvarna Group

- The Toro Company

- Robert Bosch GmbH

- Stanley Black & Decker, Inc.

- STIGA S.p.A

- Honda Motor Co.

- Greenworks North America LLC

- Chervon (EGO Power+)

- Techtronic Industries Co. Ltd. (Ryobi)

- Positec (WORX)

- STIHL

- Segway Navimow

- Mammotion

- Makita

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid decline in lithium-ion battery cost and rising energy density

- 4.2.2 Stricter worldwide emission and noise standards on small gas engines

- 4.2.3 Growing consumer preference for low-maintenance cordless equipment

- 4.2.4 Expansion of private-label cordless mower lines by large retailers

- 4.2.5 Second-life e-bike/scooter battery supply chains cutting BOM costs

- 4.2.6 Emergence of 'mowing-as-a-service' subscription business models

- 4.3 Market Restraints

- 4.3.1 Higher upfront price compared with equivalent gas-powered mowers

- 4.3.2 Limited runtime and recharge speed for large-area professional usage

- 4.3.3 Trade tariffs and critical-minerals rules inflating battery expenses

- 4.3.4 Stricter fire-safety codes on storage/transport of high-capacity packs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Walk-behind Corded

- 5.1.2 Walk-behind Cordless

- 5.1.3 Ride-on Lawn Tractor

- 5.1.4 Ride-on Zero-Turn

- 5.1.5 Stand-on

- 5.1.6 Robotic/Autonomous

- 5.2 By End User

- 5.2.1 Residential DIY

- 5.2.2 Professional Landscaping Services

- 5.2.3 Golf Courses and Sports Facilities

- 5.2.4 Municipal and Government

- 5.3 By Battery Voltage

- 5.3.1 Less than or equal to 36 V (Light-Duty)

- 5.3.2 37-60 V (Mid-Duty)

- 5.3.3 More than 60 V (Commercial-Grade)

- 5.4 By Distribution Channel

- 5.4.1 In-store Retail (Home Centers)

- 5.4.2 Specialty Dealer/Pro Dealer

- 5.4.3 Online Marketplaces

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 UAE

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 Husqvarna Group

- 6.4.3 The Toro Company

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Stanley Black & Decker, Inc.

- 6.4.6 STIGA S.p.A

- 6.4.7 Honda Motor Co.

- 6.4.8 Greenworks North America LLC

- 6.4.9 Chervon (EGO Power+)

- 6.4.10 Techtronic Industries Co. Ltd. (Ryobi)

- 6.4.11 Positec (WORX)

- 6.4.12 STIHL

- 6.4.13 Segway Navimow

- 6.4.14 Mammotion

- 6.4.15 Makita