|

市場調查報告書

商品編碼

1842653

汽車智慧天線:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Smart Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

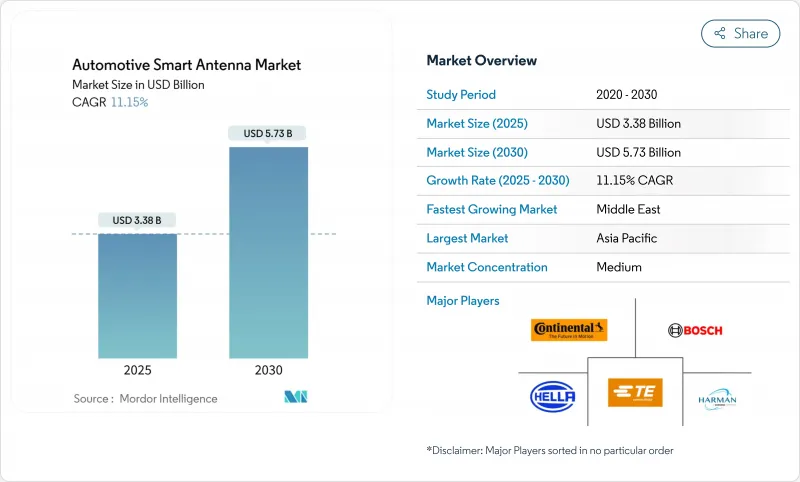

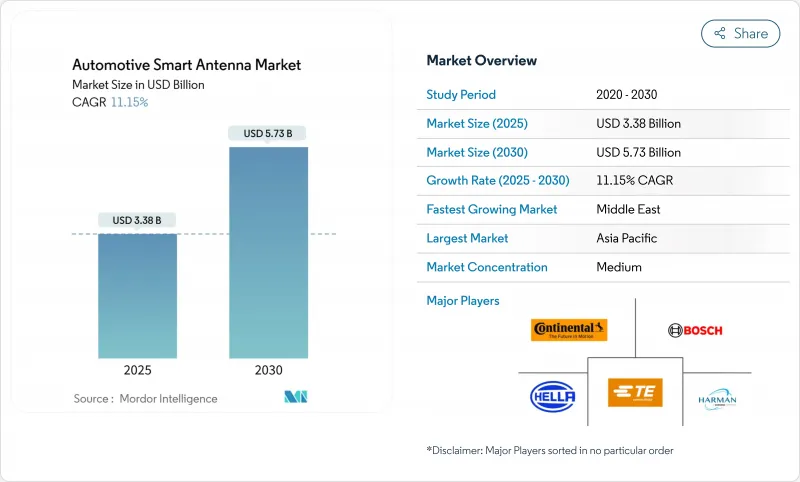

預計2025年汽車智慧天線市場規模為33.8億美元,2030年將達57.3億美元,預測期間(2025-2030年)的複合年成長率為11.15%。

隨著汽車製造商向軟體定義汽車轉型,汽車智慧天線市場正在加速發展。軟體定義汽車需要可靠的高頻寬連結來支援資訊娛樂、無線更新和進階駕駛輔助。這種轉變,加上5G NR的快速部署和歐洲2026年V2X(車聯網)的強制要求,正推動原始設備製造商(OEM)採用整合式多頻段天線模組,以取代笨重的射頻電纜、減輕車輛重量並改善空氣動力學性能,尤其是在電磁干擾一直是設計難題的純電動平台上。由於智慧天線材料成本高昂,入門級車型仍傾向於低成本的天線桿設計,但隨著一級供應商和細分射頻專家競相將波束成形陣列、EMI濾波器和衛星通道嵌入纖薄的車頂或玻璃安裝單元,競爭也日益激烈。

全球汽車智慧天線市場趨勢與洞察

5G NR 的快速部署加速了天線更換週期

5G 能夠實現更高的資料速率,但隨著流量擴展頻寬6 GHz 以下和毫米波頻寬,傳統的單頻段天線將需要更換。汽車製造商目前正在圍繞整合波束成形陣列的智慧共形模組設計 2026 年車型,以減少封裝體積並提高吞吐量。這種轉變意味著更短的天線更新周期;許多車隊可能每三到五年更換一次硬體,而不是十年。值得注意的是,如果沒有相應的硬體升級,單靠軟體定義無線電無法彌補這一差距。

越來越多原始的設備製造商採用車頂整合式 TCU,以減輕線路重量

將遠端資訊處理控制單元安裝在車頂上,可以使收音機更靠近天線,從而省去了曾經沿著A柱鋪設的笨重射頻電纜。北美地區的純電動車型報告稱,其重量減輕了高達2.4公斤,從而顯著提升了續航里程。由於續航里程焦慮是消費者購買車輛時的關鍵因素,即使減輕幾克重量也會影響消費者的感受。這意味著,智慧天線可以在不改變電池化學性質的情況下延長純電續航里程,從而間接地支援了碳減排目標。

與入門級傳統天線桿相比,智慧天線的組件成本較高

入門級車輛仍依賴低成本的桅杆天線,所產生的價格差距阻礙了智慧天線在成本敏感型市場的普及。供應商正在透過模組化設計來解決這個問題,以便在同一機殼內從基本的AM/FM單元擴展到完整的5G堆疊。分層選項使汽車製造商能夠在不改變鈑金設計的情況下提升銷售連接套件。顯而易見的是,靈活的架構(而非一次性客製化單元)將擴大新興國家汽車智慧天線產業的產量。

細分分析

2024年,鯊魚鰭天線佔據了汽車智慧天線市場的58.50%,而嵌入式模組預計在2025年至2030年間的複合年成長率為12.60%,這凸顯了設計重點的轉變。嵌入式安裝的轉變改善了空氣動力學性能並降低了風噪,使得嵌入式單元對高階和大眾市場車型更具吸引力。其次,更少的外部零件簡化了噴漆流程,減少了與進水相關的保固索賠。此外,能夠與車頂板沖壓件共同設計的供應商可能會從結構支架中獲得更高的收入。

由於車頂內襯下方空間緊湊,嵌入式模組的成長促進了天線專家與車身工程團隊之間的夥伴關係。將天線整合到全景玻璃或複合材料車頂的公司,不僅開闢了新的造型可能性,還節省了金屬模具成本。另一個見解是,經過幾個使用週期後,隱藏天線的車輛的轉售價值可能會有所提升,因為買家擴大將流暢的車頂線條與先進的互聯功能聯繫起來。

雖然甚高頻頻頻寬成長最快,複合年成長率為 13.40%,但到 2024 年,甚高頻頻段(含傳統無線電)將佔汽車智慧天線市場規模的 46.20%。透過毫米波鏈路共用數據的駕駛輔助感測器的激增,推動了對天線相位陣列技術的需求。由於兩者使用類似的基板和波束成形晶片,因此存在與雷達工程的交叉學習。此外,如果原始設備製造商 (OEM) 從同一家矽晶圓供應商購買雷達和通訊陣列,則可以推斷這將節省成本。

雖然毫米波有望提供更大的頻寬,但農村地區的覆蓋缺口仍然存在,迫使人們採取多頻段策略,以4G LTE作為備用服務。天線製造商現在將雙連接性能作為關鍵指標,以減少車輛在城市和州際之間行駛時出現的鏈路斷線。供應商正在尋求透過面向未來的6G研究頻率設計來延長產品生命週期,而技術藍圖表明,長期規劃比短期成本節約更重要。

區域分析

亞太地區將引領汽車智慧天線市場,到2024年將佔據約41.55%的市場。中國積極的5G部署和高產量將確保對多頻段模組的需求。台灣和韓國的半導體產業叢集縮短了射頻基板的前置作業時間,使該地區的原始設備製造商能夠應對全球供不應求。日本對C-V2X的投資和嚴格的認證流程也正在提振該地區的需求。由此可見,如果出口到其他大洲的車型繼續使用在地採購的天線,亞洲的主導地位可能會進一步鞏固。

歐洲是第二大市場,這得益於德國和英國推動的車聯網安全法規。 2026 年 V2X 強制規定正在推動合規天線訂單,並幫助供應商鎖定多年期批量合約。汽車製造商也嘗試了整合式車頂模組,以在不影響造型的情況下滿足嚴格的行人碰撞法規。一項新的研究表明,循環經濟指令正在鼓勵歐洲汽車製造商設計可回收天線,這可能成為一項競爭優勢。

北美仍然是技術培養箱,尤其注重基於衛星的越野車緊急訊息。美國注重卡車電氣化,強調減重減阻,這促使原始設備製造商轉向車頂整合式牽引力控制單元 (TCU)。同時,在阿拉伯聯合大公國和沙烏地阿拉伯智慧城市計畫的推動下,中東地區的複合年成長率最高,達12.25%。雖然南美洲和非洲目前的市場佔有率落後,但隨著通訊業者投資5G走廊,人們對5G的興趣日益濃厚,這表明一旦基礎設施壁壘降低,需求可能會快速成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場促進因素

- 5G NR 的快速推出加速了天線更換週期(亞洲和歐洲)

- 越來越多的 OEM 採用車頂整合 TCU 來減輕線路重量(北美)

- V2X(C-V2X 和 DSRC)天線整合對於 OEM 來說是強制性的(歐盟乘用車,從 2026 年起)

- 需要多頻段天線的汽車平臺

- 衛星連線的需求不斷增加

- 需要高精度天線定位的自動駕駛感應器

- 市場限制

- 智慧天線的 BOM 成本高於入門級傳統天線桿

- 金屬漆和車頂導軌會降低射頻性能

- 複雜的全球認證

- 射頻基板和相控陣晶片組短缺

- 價值鏈分析

- 監管和技術展望

- 五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 依天線類型

- 鯊魚鰭天線

- 固定桅杆天線

- 玻璃/整合天線

- 嵌入式天線模組

- 其他(支柱、要素)

- 按頻段

- 高頻(HF)

- 甚高頻(VHF)

- 超高頻(UHF)

- 超高頻(SHF/毫米波)

- 依連接技術

- 3G/4G/LTE

- 5G NR

- V2X-DSRC/C-V2X

- GNSS/GPS

- Wi-Fi/Bluetooth

- 按車輛類型

- 搭乘用車

- 掀背車

- 轎車

- SUV/MUV

- 輕型商用車

- 中大型商用車

- 非公路用車

- 搭乘用車

- 透過車輛推進

- 內燃機(ICE)

- 純電動車(BEV)

- 混合動力和插電式混合動力(HEV/PHEV)

- 按安裝位置

- 車頂安裝

- 擋風玻璃/玻璃支架

- TCU/保險桿嵌入

- 按地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 策略性舉措(併購、合資、資金籌措)

- 市佔率分析

- 公司簡介

- Continental AG

- TE Connectivity Ltd.

- Harman International(Samsung)

- Hella GmbH & Co. KGaA

- Robert Bosch GmbH

- Ficosa International SA

- Abracon LLC

- Ficosa Internacional SA

- INPAQ Technology Co., Ltd.

- Harxon Corporation

- Huf Hulsbeck & Furst GmbH & Co. KG

- Molex LLC

- Taoglas Group

- Amphenol RF(Pulse Electronics)

- Hirschmann Car Communication

- Ace Tech(Shenzhen)Co., Ltd.

第7章 市場機會與未來展望

The Automotive Smart Antenna Market size is estimated at USD 3.38 billion in 2025, and is expected to reach USD 5.73 billion by 2030, at a CAGR of 11.15% during the forecast period (2025-2030).

The Automotive Smart Antenna market is accelerating as automakers transition to software-defined vehicles that require dependable, high-bandwidth links for infotainment, over-the-air updates and advanced driver assistance; this shift, coupled with rapid 5 G NR deployment and Europe's 2026 V2X mandate, is pushing OEMs to adopt integrated multi-band antenna modules that replace bulky RF cabling, trim vehicle weight and improve aerodynamics, particularly in battery-electric platforms where electromagnetic interference is a persistent design hurdle. Competitive intensity is rising as Tier-1 suppliers and niche RF specialists race to embed beam-forming arrays, EMI filters and satellite channels into slim roof- or glass-mounted units, even as entry-level models still lean on low-cost mast designs because of the smart antenna's higher bill of materials.

Global Automotive Smart Antenna Market Trends and Insights

Rapid 5 G NR Roll-outs Accelerating Antenna Replacement Cycles

5 G enables higher data rates, but it spreads traffic across sub-6 GHz and mmWave bands, forcing replacements of legacy single-band antennas. Vehicle makers are now designing 2026 models around smart conformal modules that integrate beam-forming arrays, shrinking packaging volume while boosting throughput. This migration suggests a shorter antenna refresh cycle: many fleets may swap hardware every three to five years rather than a decade. A notable takeaway is that software-defined radios alone cannot bridge the gap without corresponding hardware upgrades.

Increasing OEM Adoption of Roof-Integrated TCUs to Cut Wiring Weight

Roof mounting of the telematics control unit puts radios close to antennas, eliminating heavy RF cables that once ran down A-pillars. North American battery-electric models report weight savings of up to 2.4 kg, which translates into a measurable uptick in driving range. Because range anxiety is a decisive purchase factor, even small gram reductions influence consumer perception. This logic implies that smart antennas indirectly support carbon-reduction targets by extending electric range without changing cell chemistry.

High Smart-Antenna BOM Cost vs. Legacy Mast in Entry-Level Models

Entry-level vehicles still rely on low-cost mast antennas, creating a price gap that slows smart-antenna adoption in cost-sensitive markets. Suppliers tackle this by modularizing designs so that the same housing can scale from a basic AM/FM unit to a full 5 G stack. Tiered options let automakers upsell connectivity packages without redesigning sheet-metal. A clear inference is that flexible architectures, not one-off bespoke units, will unlock volume for the Automotive Smart Antenna industry in emerging economies.

Other drivers and restraints analyzed in the detailed report include:

- OEM Mandates for V2X Antenna Integration from 2026 in EU Passenger Cars

- Electrified Vehicle Platforms Needing Multi-band Antennas to Reduce EMI

- RF Performance Degradation Caused by Metallic Paint & Roof Rails

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shark-fin antennas held a 58.50% share of the Automotive Smart Antenna market in 2024, yet embedded modules post a 12.60% CAGR forecast for 2025-2030, underscoring shifting design priorities. The move toward flush mounting improves aerodynamics and reduces wind noise, making embedded units attractive to premium and mass-market nameplates. Second-order effects include fewer exterior parts, which streamline paint processes and lower warranty claims related to water ingress. A further inference is that suppliers able to co-design with roof panel stampings may capture incremental revenue from structural brackets.

Growth in embedded modules fosters partnerships between antenna specialists and body engineering teams, because package space under headliners is tight. Companies incorporating antennas into panoramic glass or composite roofs open new styling possibilities while saving metal tooling costs. Another insight is that the resale value of vehicles with hidden antennas may rise, as buyers increasingly equate a clean roofline with advanced connectivity after several ownership cycles.

Super High-Frequency bands account for the fastest growth at a 13.40% CAGR, while VHF still covers 46.20% of the 2024 Automotive Smart Antenna market size for legacy radio. The expansion of driver-assist sensors that share data over mmWave links pushes demand for phased-array technology in antennas. This creates cross-learning with radar engineering because both use similar substrates and beam-forming chips. A subtle inference is that cost savings may result when OEMs source radar and communications arrays from the same silicon vendor.

Although mmWave promises higher bandwidth, coverage gaps remain in rural corridors, forcing a multi-band strategy where 4 G LTE delivers fallback service. Antenna makers now list dual-connectivity performance as a critical metric, reducing dropped links when vehicles transition between cities and interstates. By future-proofing designs for 6 G research frequencies, suppliers aim to extend product life cycles, suggesting that long-term planning outweighs short-term cost savings in technology roadmaps.

The Automotive Smart Antenna Market Report is Segmented by Antenna Type (Shark-Fin Antenna and More), Frequency Band (High Frequency, and More), Connectivity Technology (3G / 4G / LTE, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles and More), Vehicle Propulsion (Internal Combustion Engine (ICE) and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific leads the Automotive Smart Antenna market and accounts for roughly 41.55% of the Automotive Smart Antenna market share in 2024. China's aggressive 5G roll-out and high vehicle output ensure ready demand for multi-band modules. Local semiconductor clusters in Taiwan and South Korea shorten lead times for RF substrates, giving regional OEMs resilience against global shortages. Japan's investments in C-V2X and disciplined homologation processes also lift regional demand. An insight here is that Asia's dominance could deepen if export models shipped to other continents keep locally sourced antennas.

Europe has the second-largest market, buoyed by Germany's and the United Kingdom's push toward connected safety regulations. The 2026 V2X mandate drives orders for compliant antennas, helping suppliers lock in multi-year volume contracts. Carmakers also experimented with integrated roof modules to meet stringent pedestrian-impact rules without compromising styling. A fresh observation is that circular-economy directives are prompting European tiers to design antennas for recyclability, which may become a competitive advantage.

North America remains a technology incubator, especially for satellite-backed emergency messaging in off-road vehicles. The United States' focus on truck electrification accentuates the need for weight and drag reduction, pushing OEMs toward roof-integrated TCUs. Meanwhile, Middle East smart-city initiatives in the UAE and Saudi Arabia create the fastest regional CAGR at 12.25%, because premium buyers demand uninterrupted connectivity across desert highways. South America and Africa lag in current share but show rising interest as telecom operators invest in 5G corridors, suggesting that demand could pick up quickly once infrastructure barriers fall.

- Continental AG

- TE Connectivity Ltd.

- Harman International (Samsung)

- Hella GmbH & Co. KGaA

- Robert Bosch GmbH

- Ficosa International SA

- Abracon LLC

- Ficosa Internacional SA

- INPAQ Technology Co., Ltd.

- Harxon Corporation

- Huf Hulsbeck & Furst GmbH & Co. KG

- Molex LLC

- Taoglas Group

- Amphenol RF (Pulse Electronics)

- Hirschmann Car Communication

- Ace Tech (Shenzhen) Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Rapid 5G NR Roll-outs Accelerating Antenna Replacement Cycles (Asia & Europe)

- 4.1.2 Increasing OEM Adoption of Roof-Integrated TCUs to Cut Wiring Weight (North America)

- 4.1.3 OEM Mandates for V2X (C-V2X & DSRC) Antenna Integration from 2026 in EU Passenger Cars

- 4.1.4 Electrified Vehicle Platforms Needing Multi-band Antennas

- 4.1.5 Emerging Demand for Satellite-Based Connectivity

- 4.1.6 Autonomous Driving Sensors Requiring Precision Antenna Positioning

- 4.2 Market Restraints

- 4.2.1 High Smart-Antenna BOM Cost vs. Legacy Mast in Entry-Level Models

- 4.2.2 RF Performance Degradation Caused by Metallic Paint & Roof Rails

- 4.2.3 Complex Global Homologation

- 4.2.4 Shortage of RF Substrates & Phase-Array Chipsets

- 4.3 Value Chain Analysis

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Antenna Type

- 5.1.1 Shark-fin Antenna

- 5.1.2 Fixed Mast Antenna

- 5.1.3 Glass / Integrated Antenna

- 5.1.4 Embedded Antenna Module

- 5.1.5 Others (Pillar, Element)

- 5.2 By Frequency Band

- 5.2.1 High Frequency (HF)

- 5.2.2 Very High Frequency (VHF)

- 5.2.3 Ultra-High Frequency (UHF)

- 5.2.4 Super High Frequency (SHF / mmWave)

- 5.3 By Connectivity Technology

- 5.3.1 3G / 4G / LTE

- 5.3.2 5G NR

- 5.3.3 V2X - DSRC / C-V2X

- 5.3.4 GNSS / GPS

- 5.3.5 Wi-Fi / Bluetooth

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.1.1 Hatchback

- 5.4.1.2 Sedan

- 5.4.1.3 SUVs/MUVs

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Medium and Heavy Commercial Vehicles

- 5.4.4 Off-Highway Vehicles

- 5.4.1 Passenger Cars

- 5.5 By Vehicle Propulsion

- 5.5.1 Internal Combustion Engine (ICE)

- 5.5.2 Battery Electric Vehicle (BEV)

- 5.5.3 Hybrid and Plug-in Hybrid (HEV/PHEV)

- 5.6 By Installation Location

- 5.6.1 Roof-Mounted

- 5.6.2 Windshield / Glass-Mounted

- 5.6.3 Embedded in TCU / Bumper

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Turkey

- 5.7.5.4 South Africa

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves (M&A, JV, Funding)

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Continental AG

- 6.3.2 TE Connectivity Ltd.

- 6.3.3 Harman International (Samsung)

- 6.3.4 Hella GmbH & Co. KGaA

- 6.3.5 Robert Bosch GmbH

- 6.3.6 Ficosa International SA

- 6.3.7 Abracon LLC

- 6.3.8 Ficosa Internacional SA

- 6.3.9 INPAQ Technology Co., Ltd.

- 6.3.10 Harxon Corporation

- 6.3.11 Huf Hulsbeck & Furst GmbH & Co. KG

- 6.3.12 Molex LLC

- 6.3.13 Taoglas Group

- 6.3.14 Amphenol RF (Pulse Electronics)

- 6.3.15 Hirschmann Car Communication

- 6.3.16 Ace Tech (Shenzhen) Co., Ltd.