|

市場調查報告書

商品編碼

1842631

水肥一體化和化學灌溉:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Fertigation And Chemigation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

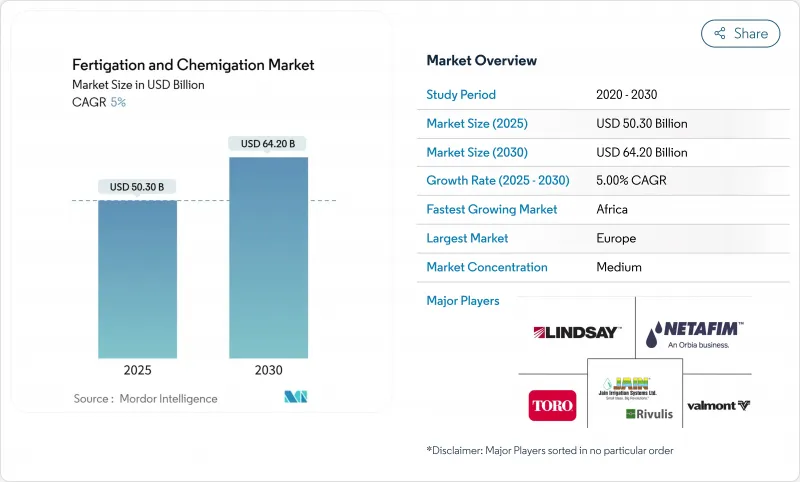

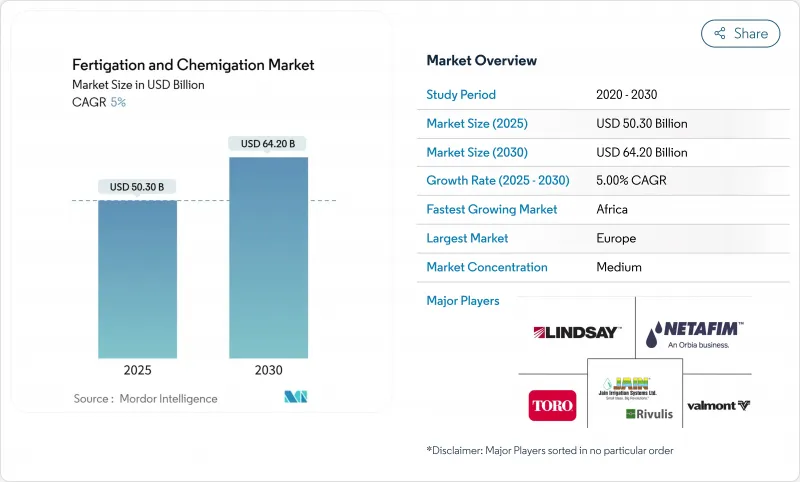

預計到 2025 年,水肥一體化和化學灌溉市場規模將達到 503 億美元,到 2030 年將以 5.0% 的複合年成長率成長至 642 億美元。

推動這一成長的因素包括日益成長的水資源短缺問題、日益攀升的肥料成本(凸顯了對效率的追求)以及物聯網和人工智慧技術在營養輸送系統中的整合。這些因素正在改變農場管理實踐,減少營運浪費,並提高對氣候變遷的適應能力。企業正在投資研發水溶性配方、雲端基礎控制系統以及即時監測水分、鹽分和養分水平的感測器技術。已開發國家和開發中國家的政府都在擴大微灌溉補貼,鼓勵設備升級,並支持國內創新。投入品製造商正在整合軟體解決方案、農藝服務和維護支持,以提高客戶保留率和價值。

全球水肥一體化和化學灌溉市場趨勢和洞察

對糧食安全和產量最大化的需求不斷增加

全球卡路里需求的成長速度快於可耕地供應的成長速度,這要求農民最大限度地提高單位水、養分和勞動力的產量。灌溉施肥技術透過將氮、磷、鉀與植物發育階段同步,將養分直接輸送到植物根部,已被證明可使高價值作物的產量提高15-35%。據報導,商業果園和蔬菜農場的肥料利用率提高了高達30%,在投入品價格波動期間降低了成本,並減少了養分流失。灌溉施肥技術與氣候智慧型農業結合,可以用數據主導的持續施肥方案取代定期的一次性施肥。

政府補貼和微灌溉獎勵

政府政策透過津貼、稅額扣抵和補貼貸款等方式支持農業技術的應用。美國農業部(USDA)25財政年度預算為自然資源保護局(NRCS)撥款105億美元,該局專注於精準水資源管理系統。印度和中國也推出了類似的項目,為低壓滴灌設備提供高達55%的補貼,鼓勵中小型農戶採用該設備。這些舉措正在推動農藝諮詢、感測器製造和基於軟體的灌溉管理等支援服務的發展。

資本和營運維護成本高

先進的滴灌系統需要大量的基礎設施,包括壓力調節主管道、雙重過濾、防回流和可程式控制器。這些要求使得初始成本超出了許多小農戶的承受能力。經濟分析表明,對於經濟作物,變流量灌溉系統的投資回收期超過27年,而固定流量樞軸灌溉系統的投資回收期僅為10年。在農場規模較小、信貸管道有限的低收入地區,財務挑戰尤其嚴峻。此外,持續的維護成本(例如系統清潔、酸處理和感測器校準)也帶來了額外的經濟壓力,阻礙了系統升級和新採購。

細分分析

肥料將主導灌溉施肥和化學灌溉市場,到2024年將佔46.0%的收入佔有率。這種主導地位主要歸功於水溶性NPK配方,這些配方溶解迅速,沉澱極少。領先的製造商正在開發螯合微量營養素混合物,以解決密集園藝實踐中的營養缺乏問題。

生物刺激素和微量營養素正成為關鍵促進因素,預計2025年至2030年的複合年成長率將達到10.2%。這一成長主要源自於農民在變幻莫測的天氣條件下尋求可靠的產量。研究表明,與傳統施肥相比,植物來源和微生物菌群可提高30%的養分利用效率,這促使大型生菜和漿果種植者在其整個種植過程中實施這些解決方案。專為低壓滴灌系統設計的新型液體接種劑可促進土壤與微生物的相互作用,且不會堵塞發送器。

由於灌溉施肥系統能夠在整個濃密的作物座艙罩均勻施藥,殺蟲劑和殺菌劑保持了適度的成長速度,從而減少了化學品的總體使用量,同時保持了有效的病蟲害防治水平。除草劑產業雖然由於使用限制而規模較小,但在控制Glyphosate抗性雜草族群方面表現出適度的成長。

到2024年,水果和蔬菜將保持最大的市場佔有率,達到38.0%,這得益於灌溉系統能夠有效滿足作物對養分定時施用的高需求。滴灌系統已證明可使作物、草莓和葉菜類的產量提高15-35%,尤其是在土地成本高、生產力需求高的郊區。穀物和穀類生產商正在從試點項目轉向商業性化應用,玉米和小麥種植者已在輪作計劃中採用低壓系統。該技術也擴大應用於作物和豆類作物,在這些作物中,分次施氮可以減少因揮發造成的養分損失,尤其是在缺水地區。

茶葉、咖啡、可可、椰子和橡膠等種植作物表現出獨特的施肥模式。儘管目前市場佔有率較小,但預計2025年至2030年期間種植作物的灌溉和化學灌溉市場將以8.0%的複合年成長率成長。這些作物生產週期長,根系多年生,因此低劑量、高頻率的施肥方式對其大有裨益。種植者報告稱,在降雨量大的地區,滴灌技術可以減少養分流失,從而改善葉片發育,並提高豆類品質的一致性。種植作物的壽命延長,有助於在多年內累積收益,並提高整體投資收益,從而支持初始資本投資。

區域分析

到 2024 年,歐洲將佔灌溉施肥和化學灌溉市場收入的 34.0%。橄欖樹、葡萄園和溫室蔬菜種植者正在採用基於感測器的灌溉系統,以滿足歐盟硝酸鹽指令的要求,同時提高產量穩定性和產品品質。通用農業政策提供政府補貼和低利率貸款,以支持採用結合土壤濕度感測器、自動過濾和數位監控平台的先進系統,儘管人事費用增加,但仍縮短了投資回收期。荷蘭、西班牙和義大利的大型溫室設施正在刺激技術應用,因為受控環境可最大限度地提高精確營養施用和 pH 值管理的有效性。市場成長由成熟的服務網路支持,農業投入品供應商與技術公司合作,提供從設計到維護的完整解決方案包,目標客戶是需要遵守法規而又不增加技術人員的中型農業合作社。

北美佔據第二大市場以金額為準,這得益於廣泛的數位技術和成熟的技術支援網路。該地區的收益預計將從2023年的2.6382億美元成長到2030年的4.3374億美元,主要得益於中西部農民對化肥價格波動的積極響應。調查結果顯示,78.6%的玉米和大豆種植者重視化肥效率,導致其變數灌溉系統的應用日益廣泛。聯邦水土保持資金和嚴格的徑流管理也增強了其應用的可行性。

非洲顯示出最高的成長潛力,2025年至2030年的複合年成長率為9.4%。非洲肥料與土壤健康高峰會和區域智慧灌溉舉措強調了灌溉的節水和養分效益。在南非的Vhembe地區,24%的農場採用氣候智慧灌溉,而Capricorn地區的比例為68%。基於簡訊和低頻寬的數位推廣服務正在幫助彌合知識差距。肯亞和坦尚尼亞的精準施肥計畫顯示了該地區對用於養分管理指導的行動應用程式的興趣。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 對糧食安全和產量最大化的需求不斷增加

- 政府補貼和微灌溉獎勵

- 水資源短缺加劇推動營養供應效率

- 水溶性專用肥料快速推廣

- 物聯網變量灌溉系統

- 勞動和成本效率

- 市場限制

- 資本和營運維護成本高

- 農民缺乏技術知識

- 沉積物或生物膜導致發送器堵塞

- 加強對營養物質淋失的監管

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 按輸入類型

- 肥料

- 殺蟲劑

- 消毒劑

- 除草劑

- 生物刺激素和微量營養素

- 其他輸入類型

- 按作物類型

- 糧食

- 油籽和豆類

- 水果和蔬菜

- 種植作物

- 草坪和觀賞作物

- 其他作物

- 按用途

- 露天耕作

- 溫室和水耕

- 苗圃和園林綠化

- 城市垂直農業

- 其他用途

- 按灌溉類型

- 滴灌

- 噴水灌溉

- 其他灌溉類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 土耳其

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 肯亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Netafim Limited(An Orbia Business)

- Jain Irrigation Systems Limited(Rivulis Irrigation Ltd.)

- Lindsay Corporation

- Valmont Industries, Inc.

- The Toro Company

- Rain Bird Corporation

- Automat Industries Private Limited

- Mahindra EPC Irrigation Limited

- Hunter Industries Inc.

- Irritec SpA

第7章 市場機會與未來展望

The fertigation and chemigation market reached USD 50.3 billion in 2025 and is projected to grow at a CAGR of 5.0%, reaching USD 64.2 billion by 2030.

This growth is driven by increasing water scarcity concerns, rising fertilizer costs emphasizing efficiency needs, and the integration of IoT and AI technologies in nutrient delivery systems. These factors are transforming farm management practices, reducing operational waste, and improving adaptability to climate change. Companies are investing in research and development of water-soluble formulations, cloud-based control systems, and sensor technologies that monitor moisture, salinity, and nutrient levels in real-time. Governments across developed and developing nations are expanding micro-irrigation subsidies, facilitating equipment upgrades, and supporting domestic innovation. Input manufacturers are integrating software solutions, agronomic services, and maintenance support to enhance customer retention and value.

Global Fertigation And Chemigation Market Trends and Insights

Rising Demand for Food Security and Yield Maximization

The global demand for calories is increasing faster than the availability of arable land, requiring farmers to maximize output per unit of water, nutrients, and labor. Fertigation, which delivers nutrients directly to plant root zones, increases crop yields by 15-35% in high-value crops by synchronizing nitrogen, phosphorus, and potassium delivery with plant developmental stages. Commercial orchards and vegetable farms report up to 30% improvement in fertilizer use efficiency, reducing costs during periods of volatile input prices while decreasing nutrient run-off. Fertigation, when integrated with climate-smart farming practices, enables farms to implement data-driven, continuous nutrition programs instead of periodic bulk fertilizer applications.

Government Subsidies and Micro-Irrigation Incentives

Government policies support agricultural technology adoption through grants, tax credits, and subsidized loans. The USDA's 2025 budget allocates USD 10.5 billion to the Natural Resources Conservation Service, focusing on precision water management systems.Similar programs in India and China provide reimbursements of up to 55% for low-pressure drip irrigation equipment, encouraging adoption among small and medium-scale farmers. These initiatives have fostered the development of supporting services, including agronomic consulting, sensor production, and software-based irrigation management.

High Capital and O&M Costs

Drip fertigation systems with advanced features require significant infrastructure, including pressure-regulated mainlines, dual filtration, backflow prevention, and programmable controllers. These requirements increase initial costs beyond what many smallholder farmers can afford. Economic analyses indicate that variable-rate fertigation systems have payback periods of over 27 years for commodity crops, while fixed-rate pivot systems achieve payback in 10 years. The financial barriers are particularly challenging in low-income regions with small farm sizes and limited credit access. The ongoing maintenance costs, including system flushing, acid treatment, and sensor calibration, create additional financial pressure, which reduces system upgrades and new purchases.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Water-Soluble Specialty Fertilizers

- Growing Water Scarcity Heightens Efficient Nutrient Delivery

- Less Technical Knowledge Among Farmers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The fertigation and chemigation market is dominated by fertilizers, which accounted for 46.0% of revenue share in 2024. This dominance is primarily due to water-soluble NPK formulations that offer rapid dissolution and minimal line precipitation. Major manufacturers are developing chelated micronutrient blends to address nutrient deficiencies in intensive horticultural operations.

Biostimulants and micronutrients are emerging as significant growth drivers, with projections indicating a 10.2% CAGR from 2025-2030. This growth is driven by farmers seeking consistent yields during unpredictable weather conditions. Research indicates that plant-based extracts and microbial consortia improve nutrient-use efficiency by 30% compared to conventional fertilizer applications, leading major lettuce and berry producers to implement these solutions across their operations. New liquid inoculants designed for low-pressure drip systems enhance soil-microbe interactions without emitter blockage.

Insecticides and fungicides maintain moderate growth rates, as fertigation systems enable uniform distribution throughout dense crop canopies, reducing overall chemical usage while maintaining effective pest control levels. The herbicide segment, though smaller due to application limitations, shows gradual growth in managing glyphosate-resistant weed populations.

Fruits and vegetables maintain the largest market share at 38.0% in 2024, driven by their high nutrient timing requirements that fertigation effectively addresses. Drip line fertigation systems demonstrate yield increases of 15-35% in vine crops, strawberries, and leafy greens, particularly in peri-urban areas where high land costs necessitate increased productivity. Cereal and grain producers are transitioning from pilot programs to commercial implementation, with maize and wheat farmers adopting low-pressure systems within crop rotation schedules. The technology also shows increasing adoption in oil crops and pulses, especially in water-scarce regions where split nitrogen applications reduce nutrient loss through volatilization.

Plantation crops, including tea, coffee, cocoa, coconut, and rubber, exhibit unique fertigation adoption patterns. While currently holding a smaller market share, the fertigation and chemigation market for plantation crops is projected to grow at an 8.0% CAGR from 2025-2030. These crops benefit significantly from low-volume, high-frequency nutrient delivery due to their long production cycles and perennial root systems, particularly during extended dry periods. Growers report improved leaf development and bean quality uniformity after implementing drip fertigation, which reduces nutrient leaching in high-rainfall areas. The extended lifespan of plantation crops supports the initial capital investment, as the revenue benefits accumulate over multiple years, improving the overall return on investment.

The Fertigation and Chemigation Market is Segmented by Input Type (Fertilizers, Insecticides, and More), by Crop Type (Grains and Cereals, and More), by Application (Open-Field Agriculture, and More), by Irrigation Type (Drip Irrigation, and More), and by Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe holds a 34.0% share of the fertigation and chemigation market revenue in 2024. Growers of olives, vineyards, and greenhouse vegetables have implemented sensor-based fertigation systems to meet EU nitrate-directive requirements while improving yield consistency and product quality. The Common Agricultural Policy provides government grants and low-interest loans that support the adoption of advanced systems incorporating soil-moisture sensors, automated filtration, and digital monitoring platforms, reducing return-on-investment periods despite increasing labor costs. The extensive greenhouse facilities in the Netherlands, Spain, and Italy drive technology adoption, as controlled environments maximize the effectiveness of precise nutrient application and pH management. The market growth is supported by an established service network, where agricultural input suppliers collaborate with technology companies to deliver complete solution packages, from design through maintenance, targeting medium-sized farming cooperatives that require regulatory compliance without expanding their technical staff.

North America holds the second-largest market share by value, supported by widespread digital technology adoption and established technical support networks. Regional revenue is anticipated to grow from USD 263.82 million in 2023 to USD 433.74 million by 2030, driven by Midwestern farmers responding to fertilizer price fluctuations. Research indicates 78.6% of corn and soybean farmers prioritize fertilizer efficiency, increasing the implementation of variable-rate pivot fertigation. Federal conservation funding and strict runoff regulations strengthen the implementation rationale.

Africa demonstrates the highest growth potential with a 9.4% CAGR from 2025-2030. The Africa Fertilizer and Soil Health Summit and regional smart-irrigation initiatives highlight fertigation's water conservation and nutritional advantages. Implementation varies significantly-24% of farms in South Africa's Vhembe district utilize climate-smart irrigation, compared to 68% in Capricorn. SMS-based and low-bandwidth digital extension services help address knowledge gaps. Precision-fertilization programs in Kenya and Tanzania demonstrate regional interest in mobile applications for nutrient management guidance.

- Netafim Limited (An Orbia Business)

- Jain Irrigation Systems Limited (Rivulis Irrigation Ltd.)

- Lindsay Corporation

- Valmont Industries, Inc.

- The Toro Company

- Rain Bird Corporation

- Automat Industries Private Limited

- Mahindra EPC Irrigation Limited

- Hunter Industries Inc.

- Irritec S.p.A

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Food Security and Yield Maximization

- 4.2.2 Government Subsidies and Micro-Irrigation Incentives

- 4.2.3 Growing Water Scarcity Heightens Efficient Nutrient Delivery

- 4.2.4 Rapid Adoption of Water-Soluble Specialty Fertilizers

- 4.2.5 IoT-enabled variable-rate fertigation systems

- 4.2.6 Labor and Cost Efficiency

- 4.3 Market Restraints

- 4.3.1 High Capital and O&M Costs

- 4.3.2 Less Technical Knowledge Among Farmers

- 4.3.3 Emitter Clogging from Precipitates and Biofilms

- 4.3.4 Increasing Regulatory Scrutiny on Nutrient Leaching

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Input Type

- 5.1.1 Fertilizers

- 5.1.2 Insecticides

- 5.1.3 Fungicides

- 5.1.4 Herbicides

- 5.1.5 Biostimulants and Micronutrients

- 5.1.6 Other Input Types

- 5.2 By Crop Type

- 5.2.1 Cereals and Grains

- 5.2.2 Oilseeds and Pulses

- 5.2.3 Fruits and Vegetables

- 5.2.4 Plantation Crops

- 5.2.5 Turf and Ornamentals

- 5.2.6 Other Crop Types

- 5.3 By Application

- 5.3.1 Open-Field Agriculture

- 5.3.2 Greenhouse and Hydroponics

- 5.3.3 Nursery and Landscaping

- 5.3.4 Urban Vertical Farming

- 5.3.5 Other Applications

- 5.4 By Irrigation Type

- 5.4.1 Drip Irrigation

- 5.4.2 Sprinkler Irrigation

- 5.4.3 Other Irrigation Types

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Kenya

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Netafim Limited (An Orbia Business)

- 6.4.2 Jain Irrigation Systems Limited (Rivulis Irrigation Ltd.)

- 6.4.3 Lindsay Corporation

- 6.4.4 Valmont Industries, Inc.

- 6.4.5 The Toro Company

- 6.4.6 Rain Bird Corporation

- 6.4.7 Automat Industries Private Limited

- 6.4.8 Mahindra EPC Irrigation Limited

- 6.4.9 Hunter Industries Inc.

- 6.4.10 Irritec S.p.A