|

市場調查報告書

商品編碼

1842628

施肥機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Fertilizer Spreader - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

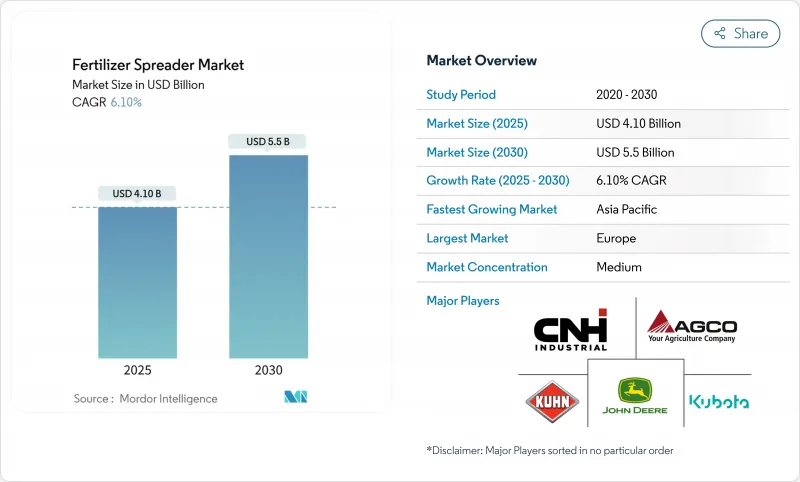

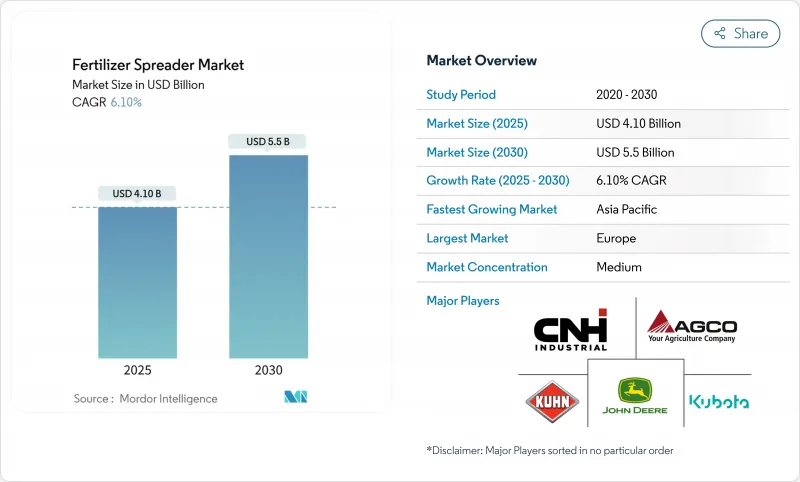

預計 2025 年施肥機市場規模將達到 41 億美元,到 2030 年將增加至 55 億美元,複合年成長率為 6.1%。

精密農業的進步、嚴重的勞動力短缺以及更嚴格的環境法規迫使生產商用支援GPS的變數設備替換或升級傳統機械。雖然旋轉式槳鼻罩因其覆蓋範圍廣而仍然在大面積穀物生產中佔據主導地位,但在均勻性和多種營養成分的精準度決定產量的領域,氣動氣流系統正日益受到青睞。北美和歐洲的補貼計畫正在縮短高規格撒播機的投資回收期,而數銷售管道也為小品牌進入市場開闢了新的途徑。同時,對顆粒狀微量營養素混合物和季節性液體肥料的需求不斷成長,也拓寬了製造商必須支持的產品組合。

全球施肥機市場趨勢與洞察

全球卡路里需求增加和耕地短缺

人口的穩定成長和飲食習慣的不斷變化推動著每英畝產量的預期提升。由於土地擴張潛力有限,採用先進的氣流機械進行均勻施肥對高價值作物而言日益重要。與土壤測繪平台同步的變數噴霧器使種植者能夠微調施肥量,從而在現有土地上實現更高的產量。這些功能支持亞太和非洲地區以出口為導向的種植者在不加劇土壤劣化的情況下提高產量。能夠在田間證明投資報酬率的製造商將能夠充分利用這項持續的需求。

農業勞動力短缺與成本上升推動機械化

北美和西歐的農場經營正面臨兩位數的薪資上漲和操作員短缺。自走式噴霧器減少了對人員的需求,並能在天氣變化前完成多條田間作業路線,將勞動力短缺轉化為招聘機會。 GPS自動駕駛和堵塞感測器使缺乏經驗的駕駛員也能達到與經驗豐富的操作員相當的重疊精度,從而緩解了勞動力瓶頸。面對季節性勞動力遷移趨勢的南美生產商也正在採用更高容量的PTO裝置來維持產量。將遠距離診斷和操作員培訓捆綁在一起的設備供應商預計將獲得額外的服務收入。

與傳統噴塗方法相比,初始成本較高

先進噴霧器的價格從2.5萬美元到20萬美元不等,這對利潤微薄、銷量大的中小型農場來說是一個障礙。新興經濟體的信貸管道不均衡,因此生產者優先考慮短期流動性,而非多年的效率提升。 「設備即服務」模式,以公頃使用量收費,並針對傳統槳鼻罩提供VRT套件改造,正作為過渡解決方案日益普及。原始設備製造商正在收費捆綁硬體、軟體更新和農藝建議的訂閱套餐,以緩解資金高峰並擴大市場覆蓋範圍。

細分分析

旋轉式/槳鼻罩式施肥機市場規模將在2024年達到可觀水平,佔全球銷售額的46%。氣動氣流設計雖然目前產量較低,但以9.6%的複合年成長率擴張。

空氣撒播機也支援控制釋放顆粒和包衣營養素,且不會出現顆粒偏析,使其成為高價飼料項目的首選技術。在多風地區,封閉式吊桿設計可最大限度地減少漂移,並符合日益嚴格的緩衝區法規。隨著飼料供應商擴大其顆粒微量營養素供應,投資於最佳化吊桿長度和更有效率液壓風扇驅動的製造商預計將繼續獲得市場佔有率。活性碳內襯落料斗和耐腐蝕合金的引入,旨在延長機器壽命,鑑於肥料撒播機市場資本成本的上升,這是一個重要的採購考慮因素。

傳統的非 GPS 撒肥機仍佔據肥料撒肥機市場佔有率的 72%,這反映了它們在成本敏感地區的高安裝基數和誘人的低價,但精密/GPS 導引平台的複合年成長率為 11.0%,這受到可量化的投入節省和要求數位記錄保存的環境合規性的推動。

透過行動電話網路傳輸的 VRT 處方允許操作員隨時隨地調整施肥量,確保營養液施用與高解析度土壤層相匹配。領先的原始設備製造商正在整合相容 ISOBUS 的控制器,使混合品牌車隊能夠共用地圖和機器健康數據。透過智慧型手機存取的擴增實境校準工具可以減少設定錯誤,並降低學習曲線,而這正是施肥機市場先前升級的障礙。

區域分析

到2024年,歐洲將以29%的市場佔有率引領施肥機市場,這得益於其成熟的精密農業基礎設施和補貼技術應用的通用農業政策獎勵。嚴格的硝酸鹽指令和流域保護條例使得變數施肥幾乎成為大規模耕作作業的必要條件。該地區強大的經銷商網路和成熟的融資管道為高規格機械的採購提供了順暢的途徑。瞄準該市場的製造商強調軟體與農場管理平台的整合,以及與歐洲衛星校正訊號的兼容性,從而實現亞米級精度。

預計到2030年,亞太地區的複合年成長率將達到7.8%,成為全球成長最快的地區。在中國,政策轉向在保持產量的同時降低施肥強度,這催生了對最佳化施用效率的噴霧器的需求。政府的農業現代化計畫為機械化津貼,特別是針對多農合作社。印度農化產業規模在2024年將達到324億美元,該產業正在擴張,顯示對噴霧設備的投資潛力正在不斷成長。製造商正在針對亞洲的具體情況進行設計,為稻田提供更窄的作業寬度,並為技術培訓較少的操作員提供簡化的控制設備。

儘管近期大宗商品價格波動和設備成本上漲帶來不利影響,北美地區仍維持龐大的施肥機市場。大規模糧食種植強調精準技術和數據管理能力的整合,並與既定的數位化農業實踐保持一致。然而,愛科集團2024年第二季銷售額下降15.1%,反映出其謹慎的資本投資,因為農民更重視設備的使用壽命而非更換。製造商正在推出改裝方案,為現有施肥機增加可變速率功能。巴西大豆種植面積的不斷擴大推動了對高容量機器的需求,這些機器可以在較窄的噴灑窗口內覆蓋大片田地,但由於外匯波動,南美洲的成長並不均衡。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 全球卡路里需求增加和耕地短缺

- 農業勞動力短缺與成本上升推動機械化

- 精準施肥設備補貼制度

- 採用變數施肥技術(VRT)

- 轉向需要精確施用的顆粒狀微量營養素混合物

- 獎勵最佳化營養利用的碳權計畫激增

- 市場限制

- 與傳統噴塗方法相比,初始成本更高

- 小規模農戶意識低下

- 售後服務及校準服務網路分散

- 對化肥價格和農場收入的波動敏感

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 按機器類型

- 撒佈機

- 旋轉式/槳鼻罩撒佈機

- 鐘擺式撒佈機

- 氣流/氣動噴霧器

- 液體肥料撒播機

- 依技術

- 傳統的

- 精確/GPS導

- 自主/機器人相容

- 按驅動系統

- PTO 驅動

- 路線類型

- 自走式

- 手扶式/手動

- 按肥料類型

- 顆粒狀

- 粉末

- 液體

- 按最終用途

- 大田作物種植戶

- 專業/園藝

- 草坪和景觀美化

- 果園和葡萄園

- 按銷售管道

- OEM

- 經銷商/分銷商

- 線上

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東

- 沙烏地阿拉伯

- 土耳其

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- AGCO Corporation

- CNH Industrial NV(Exor NV)

- Deere & Company

- Kubota Corporation

- Kuhn Group(Bucher Industries)

- Mahindra & Mahindra Ltd.

- Amazone Werke

- BOGBALLE A/S(Erhvervsinvest)

- Rauch Landmaschinenfabrik

- Salford Group(Linamar Corporation)

- Jacto

- IRIS Spreaders Co., Ltd.

- Adams Fertilizer Equipment(Reppert Capital Partners)

- Teagle Machinery Limited

第7章 市場機會與未來展望

The fertilizer spreader market size is valued at USD 4.1 billion in 2025 and is forecast to climb to USD 5.5 billion by 2030, translating into a 6.1% CAGR.

Evolving precision-farming practices, acute labor shortages, and tightening environmental regulations are compelling growers to replace or upgrade conventional equipment with GPS-enabled variable-rate machines. Rotary spinner designs still dominate large-acreage grain production because of their wide swath coverage, yet pneumatic airflow systems are gaining traction where uniformity and multi-nutrient accuracy drive yield. Subsidy programs in North America and Europe are shortening payback cycles for high-specification spreaders, and digital sales channels are unlocking new routes to market for smaller brands. Meanwhile, rising demand for granular micronutrient blends and in-season liquid fertilization is widening the product mix that manufacturers must support.

Global Fertilizer Spreader Market Trends and Insights

Rising Global Calorie Demand and Arable-Land Scarcity

Steady population growth and changing diets are escalating yield-per-acre expectations. Because land expansion potential is limited, uniform nutrient placement through advanced airflow machines is becoming critical for high-value crops. Variable-rate spreaders that sync with soil-mapping platforms let growers fine-tune application, squeezing more output from existing hectares. These capabilities support export-oriented producers in Asia-Pacific and Africa, trying to lift productivity without aggravating soil degradation. Manufacturers able to prove field-level return on investment are well-positioned to ride this secular demand wave.

Shortage and Rising Cost of Agricultural Labour Stimulate Mechanization

Farm operations in North America and Western Europe face double-digit wage inflation and persistent operator gaps. Self-propelled spreaders reduce crew requirements and can finish multi-field routes before weather windows close, turning labor scarcity into a catalyst for adoption. GPS autosteer and blockage sensors allow less-experienced drivers to achieve overlap accuracy comparable to skilled operators, mitigating the talent bottleneck. South American growers confronting seasonal labor migration trends are also adopting higher-capacity PTO units to maintain throughput. Equipment suppliers that bundle remote diagnostics and operator training stand to capture additional service revenue.

High Upfront Cost vs. Conventional Broadcast Methods

Price tags on advanced spreaders range from USD 25,000 to USD 200,000, a hurdle for small and medium farms operating on thin margins. Credit access is uneven across emerging economies, so growers prioritize near-term liquidity over multi-year efficiency gains. Equipment-as-a-service models that charge per-hectare usage and retrofit VRT kits targeting legacy spinners are gaining popularity as bridge solutions. OEMs are experimenting with subscription packages bundling hardware, software updates, and agronomic advice to flatten capital spikes and widen market reach.

Other drivers and restraints analyzed in the detailed report include:

- Subsidy Programmes for Precision-Fertilizer Equipment

- Adoption of Variable-Rate Technology (VRT) for Fertilizer

- Low Farmer Awareness in Smallholder Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The fertilizer spreader market size for rotary/spinner units reached a substantial scale in 2024, commanding 46% of global sales as large-acreage grain farms value wide coverage and low operating costs. Pneumatic airflow designs, though currently smaller in volume, are expanding at a 9.6% CAGR because airflow paths deliver even distribution of multi-density blends critical to vegetables, orchards, and seed crops.

Airflow spreaders also support controlled-release pellets and coated nutrients without particle segregation, positioning them as the technology of choice for premium-price input programs. In regions with frequent wind events, their enclosed boom design minimizes drift, aligning with tightening buffer-zone regulations. Manufacturers investing in boom length optimization and hydraulic fan drive efficiency expect continued share gain as input suppliers broaden granular micronutrient offerings. Activated-carbon-lined drop hoppers and corrosion-resistant alloys are being introduced to lengthen machine life, a key buying consideration given rising capital costs within the fertilizer spreader market.

Conventional non-GPS spreaders still occupy 72% of the fertilizer spreader market share, reflecting the sheer installed base and the appeal of lower ticket prices in cost-sensitive geographies. Precision/GPS-guided platforms, however, are registering 11.0% CAGR backed by quantifiable input savings and environmental-compliance mandates that require digital record keeping.

VRT prescriptions transmitted over cellular networks let operators alter rates on the go, ensuring nutrient applications match high-resolution soil layers. Leading OEMs are integrating ISOBUS-compatible controllers so that mixed-brand fleets can share maps and machine health data, a capability prized by custom-applicator service providers managing multi-client routes. Augmented-reality calibration tools accessed via smartphones reduce set-up errors, lowering the learning curve that historically deterred upgrades within the fertilizer spreader market.

The Fertilizer Spreader Market Report is Segmented by Machine Type (Drop Spreaders and More), Technology (Conventional, Precision/GPS-Guided, and More), Drive Mechanism (PTO-Driven Mounted and More), Fertilizer Form (Granular and More), End-Use Application (Row-Crop Farms and More), Sales Channel (OEM and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe leads the fertilizer spreader market with a 29% share in 2024, reflecting mature precision-agriculture infrastructure and Common Agricultural Policy incentives that subsidize technology adoption. Stringent nitrate directives and watershed protection regulations make variable-rate application a near-requirement for large arable operations. The region's strong dealer networks and established financing channels smooth the path to high-specification machines. Manufacturers targeting this market emphasize software integration with farm management platforms and compatibility with European satellite correction signals that enable sub-meter accuracy.

The Asia-Pacific region is advancing at a 7.8% CAGR through 2030, the fastest regional growth rate globally. China's policy shift toward reduced fertilizer intensity while maintaining yields creates demand for spreaders that optimize placement efficiency. The government's agricultural modernization program subsidizes mechanization, particularly for cooperatives serving multiple smallholders. India's expanding agrochemical sector, valued at USD 32.4 billion in 2024, signals growing investment capacity for application equipment. Manufacturers are adapting designs for Asian conditions by offering narrower working widths for paddy fields and simplified controls for operators with limited technical training.

North America maintains a significant fertilizer spreader market size despite recent headwinds from commodity price volatility and rising equipment costs. Large-scale grain operations value precision technology integration and data management capabilities that align with established digital farming practices. However, AGCO's 15.1% sales decline in Q2 2024 reflects cautious capital spending as farmers prioritize equipment longevity over replacement. Manufacturers are responding with retrofit packages that add variable-rate capability to existing spreaders at lower entry points. South American growth is uneven due to currency fluctuations, though Brazil's expanding soybean acreage drives demand for high-capacity machines that can cover vast plantations during narrow application windows.

- AGCO Corporation

- CNH Industrial N.V. (Exor N.V.)

- Deere & Company

- Kubota Corporation

- Kuhn Group (Bucher Industries)

- Mahindra & Mahindra Ltd.

- Amazone Werke

- BOGBALLE A/S (Erhvervsinvest)

- Rauch Landmaschinenfabrik

- Salford Group (Linamar Corporation)

- Jacto

- IRIS Spreaders Co., Ltd.

- Adams Fertilizer Equipment (Reppert Capital Partners)

- Teagle Machinery Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global calorie demand and arable-land scarcity

- 4.2.2 Shortage and the rising cost of agricultural labor stimulate mechanization

- 4.2.3 Subsidy programmes for precision-fertiliser equipment

- 4.2.4 Adoption of variable-rate technology (VRT) for fertilizer

- 4.2.5 Shift to granular micronutrient blends requiring high-accuracy spread

- 4.2.6 The surge of carbon credit schemes rewarding optimized nutrient use

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. conventional broadcast methods

- 4.3.2 Low farmer awareness in smallholder economies

- 4.3.3 Fragmented after-sales and calibration service networks

- 4.3.4 Sensitivity to fertilizer price volatility and farm income swings

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Machinery Type

- 5.1.1 Drop Spreaders

- 5.1.2 Rotary/Spinner Spreaders

- 5.1.3 Pendulum Spreaders

- 5.1.4 Air-Flo/Pneumatic Spreaders

- 5.1.5 Liquid Fertilizer Sprayers

- 5.2 By Technology

- 5.2.1 Conventional

- 5.2.2 Precision/GPS-guided

- 5.2.3 Autonomous/Robotics-enabled

- 5.3 By Drive Mechanism

- 5.3.1 PTO-driven Mounted

- 5.3.2 Trailed

- 5.3.3 Self-propelled

- 5.3.4 Walk-behind/Manual

- 5.4 By Fertilizer Form

- 5.4.1 Granular

- 5.4.2 Powdered

- 5.4.3 Liquid

- 5.5 By End-use Application

- 5.5.1 Row-crop Farms

- 5.5.2 Specialty/Horticulture

- 5.5.3 Turf and Landscaping

- 5.5.4 Orchard and Vineyard

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Dealer/Distributor

- 5.6.3 Online

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Spain

- 5.7.3.5 Russia

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 Turkey

- 5.7.5.3 UAE

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Egypt

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 AGCO Corporation

- 6.4.2 CNH Industrial N.V. (Exor N.V.)

- 6.4.3 Deere & Company

- 6.4.4 Kubota Corporation

- 6.4.5 Kuhn Group (Bucher Industries)

- 6.4.6 Mahindra & Mahindra Ltd.

- 6.4.7 Amazone Werke

- 6.4.8 BOGBALLE A/S (Erhvervsinvest)

- 6.4.9 Rauch Landmaschinenfabrik

- 6.4.10 Salford Group (Linamar Corporation)

- 6.4.11 Jacto

- 6.4.12 IRIS Spreaders Co., Ltd.

- 6.4.13 Adams Fertilizer Equipment (Reppert Capital Partners)

- 6.4.14 Teagle Machinery Limited