|

市場調查報告書

商品編碼

1842592

擠壓聚丙烯(XPP)泡沫:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Extruded Polypropylene (XPP) Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

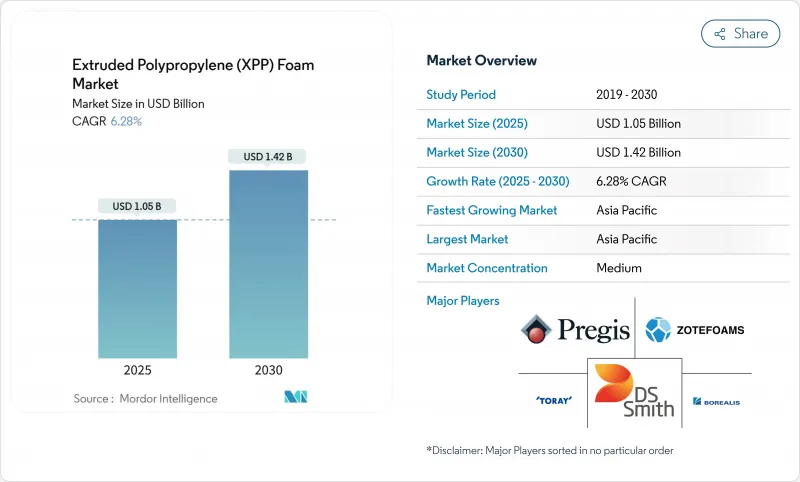

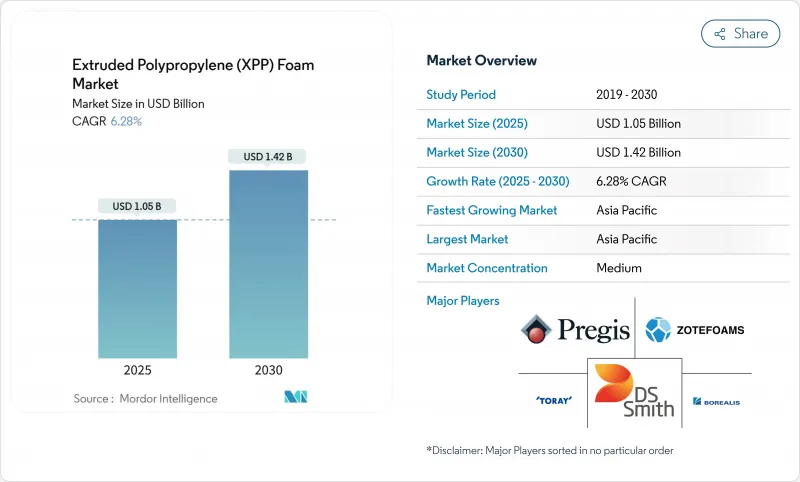

擠壓聚丙烯 (XPP) 泡棉市場預計在 2025 年價值為 10.5 億美元,到 2030 年將達到 14.2 億美元,複合年成長率為 6.28%。

這一上升趨勢反映了汽車、包裝和建築領域材料替代性的不斷成長,低密度、高抗衝擊強度和耐熱性提供了可衡量的性能和永續性優勢。汽車輕量化要求、包裝可回收內容目標以及更嚴格的建築能源法規繼續擴大基本客群。對生物循環聚丙烯的投資增強了供應勢頭,這種聚丙烯可以減少碳足跡並符合回收法規,而超臨界發泡的最新突破正在提高設計靈活性。同時,波動的丙烯成本和緊張的擠出產能限制了短期擴大規模,並為老牌製造商提供了定價權。總體而言,擠出聚丙烯 (XPP) 泡沫市場預計將在未來十年內持續成長。

全球擠壓聚丙烯(XPP)泡沫市場趨勢與洞察

優異的性能和高可回收性

XPP泡棉的封閉式基質使其能夠吸收能量、降低噪音,並提供比許多現有聚合物更好的隔熱性能。它能夠在高達130°C的高溫下保持尺寸穩定,使其成為暴露在高溫下的汽車引擎蓋和座艙部件的必備材料。其熱塑性特性使其能夠被壓碎、重新製粒和重新擠壓,且不會發生交聯劣化,符合循環經濟採購政策。其耐濕氣、耐溶劑和耐紫外線的特性可延長產品壽命並降低整體成本。全球再生聚丙烯的使用量持續成長,為加工商提供了不斷成長的原料池,從而提升了擠出聚丙烯 (XPP) 泡沫市場的價值提案。

汽車輕量化法規

美國企業平均燃油經濟性法規、歐盟二氧化碳排放目標以及中國的雙重積分計畫正迫使汽車製造商降低車輛整體重量。在保險桿芯、車門面板和電池外殼中,用XPP泡沫取代厚重的塑膠或金屬嵌件,可以減輕約25%的零件重量,同時保持良好的碰撞能量吸收性能。化學發泡可以生產出具有精細泡孔形態的薄壁部件,以滿足嚴格的尺寸公差要求。汽車製造商擴大指定使用含有再生成分的XPP牌號,例如內部供應商安通林集團就透過使用發泡泡沫實現了20%的減重。

擠出聚丙烯價格高,丙烯原料成本不穩定。

由於煉油廠停產導致供應緊張,2025年初丙烯現貨價格上漲至825-835美元/噸(韓國離岸價)。北美聚丙烯合約價格也隨之上漲,由於生產商宣布不可抗力,2025年第一季上漲了9%。這些價格波動給加工商利潤帶來壓力,並推遲了資本支出,尤其是對於那些無法透過長期合約對沖原料風險的小型企業而言。樹脂成本上漲將波及擠出擠出發泡聚丙烯市場,推高最終產品價格,並鼓勵短期客戶在性能要求允許的情況下轉向低成本發泡體替代產品。

細分分析

高密度等級是擠壓聚丙烯 (XPP) 泡棉市場中成長最快的,到 2030 年的複合年成長率為 7.98%。到 2024 年,低密度泡沫將保持領先地位,佔據擠壓聚丙烯 (XPP) 泡沫市場佔有率的 48.19%。

透過在整個熔體曲線中調節成核劑,製程工程師現在能夠客製化單片板材的密度,從而實現兼具緩衝和剛度的多區域部件。超臨界二氧化碳發泡可縮小泡孔尺寸分佈,提高機械完整性,並為承受集中負荷的板材帶來突破性進展。奈米填料(包括添加石墨烯薄片)的研究表明,在填料添加量低於1 wt%時,模量可提高高達30%,這擴展了XPP在建築隔熱組件中的適用性。建築規範的日益嚴格促使建築師指定使用密度高於礦棉的XPP。

低密度泡棉仍然是在線可回收包裝、折疊墊材和暖通空調管道領域的有力競爭者。新型透明母粒可將熱變形溫度提高 8°C,從而延長引擎室下方氣流部件的使用壽命,這些部件可連續承受 110°C 的高溫。市場領導者正在工業廢棄物樹脂和原生樹脂結合,用於生產低密度板材,在保持物理性能的同時,降低樹脂成本和溫室氣體強度。

材料工程師預測,擠壓聚丙烯泡棉市場將轉向混合密度解決方案,充分利用各個等級的優勢。將高密度芯材與低密度表皮結合在單層共擠層壓板中,將可實現輕盈而堅固的貨櫃壁。這種新配置可能會搶佔聚丙烯實心板和鋁蜂窩的市場佔有率,尤其是在需要減輕重量和降低成本的最後一哩物流貨櫃領域。

擠塑聚丙烯 (XPP) 泡棉市場按類型(低密度 XPP 泡棉、高密度 XPP 泡棉)、終端用戶產業(汽車、建築、包裝、其他)和地區(亞太地區、北美、南美、歐洲、中東和非洲)細分。市場預測以美元計算。

區域分析

受中國汽車出口、印度快餐外賣激增以及日本率先採用循環包裝的推動,亞太地區佔據了擠出聚丙烯 (XPP) 泡沫市場的 54.61%。隨著原始設備製造商 (OEM) 實現電動汽車零件本地化生產,以及電子商務滲透率不斷擴大至一線城市以外,預計到 2030 年,該地區的消費量將以 7.45% 的複合年成長率成長。政府針對輕型車輛的補貼計畫以及一次性塑膠的限制,正在增強對可回收發泡體的需求。生產商享有與區域丙烯裂解廠短距離的供應鏈,這使得他們能夠享受具有競爭力的價格,成本通膨低於全球平均水平。

北美佔據第二大市場佔有率,這主要得益於需要大型吸能部件的皮卡和SUV平台。美國能源局輕量材料聯盟持續資助發泡聚烯電池防護罩的研究,使該地區處於應用工程領域的前沿。德克薩斯州已安裝一套生物丙烷丙烯生產裝置,增強了原料安全性,並開發了低碳發泡等級。然而,該地區仍受丙烯價格波動的影響,一旦供應中斷,下游投資可能會受到阻礙。

在歐洲,一個與嚴格的可回收性和碳足跡目標相關的高價值利基市場正在蓬勃發展。德國和法國的汽車製造商正在採用XPP材料作為防撞墊片結構,這些結構必須通過行人安全測試,同時完全可回收。如果PPWR合規性能夠加速零售食品托盤中發泡聚苯乙烯的轉型,到2030年,該地區擠塑聚丙烯(XPP)泡沫的市佔率可能會上升3個百分點。歐洲的加工商受益於統一的廢棄物收集方案,該方案確保了閉合迴路項目獲得清潔的消費後廢物流,但與亞洲相比,不斷上漲的能源價格持續對其營業利潤率構成壓力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 優異的性能和高可回收性

- 汽車輕量化

- 包裝產業的需求不斷成長

- 對可回收和永續發泡體的需求不斷增加

- 無人機和無人駕駛飛機保護包裝熱潮

- 市場限制

- 擠壓聚丙烯價格高

- 丙烯原料成本不穩定

- 部分地區大規模擠壓產能受限

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 類型

- 低密度XPP泡沫

- 高密度XPP泡沫

- 按最終用戶產業

- 車

- 建築/施工

- 包裝

- 其他終端用戶產業(消費品、玩具等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- BOREALIS GMBH

- Braskem

- DS Smith

- Furukawa Electric Co., Ltd.

- NMC International SA

- Pregis LLC

- Sekisui Voltek

- SPUR

- Sumitomo Chemical Co., Ltd.

- TORAY INDUSTRIES, INC.

- Zotefoams plc

第7章 市場機會與未來展望

The extruded polypropylene foam market is valued at USD 1.05 billion in 2025 and is forecast to reach USD 1.42 billion by 2030, advancing at a 6.28% CAGR.

The steady climb mirrors rising material substitution in automotive, packaging, and construction, where low density, high impact strength, and heat resistance deliver measurable performance and sustainability benefits. Lightweighting mandates in vehicles, recyclable-content targets in packaging, and stricter building-energy codes continue to expand the customer base. Supply-side momentum is reinforced by bio-circular polypropylene investments that lower carbon footprints and align with recycling rules, while recent breakthroughs in supercritical foaming add design flexibility. At the same time, volatile propylene costs and tight extrusion capacity constrain immediate scaling, giving established producers pricing power. Overall, the extruded polypropylene foam market is positioned for durable growth through the end of the decade.

Global Extruded Polypropylene (XPP) Foam Market Trends and Insights

Superior Properties & High Recyclability

XPP foam delivers a closed-cell matrix that absorbs energy, dampens noise, and insulates heat better than many incumbent polymers. It maintains dimensional integrity up to 130 °C, vital for vehicle under-hood and cabin components that experience temperature spikes. Because it is thermoplastic, the material can be shredded, re-pelletized, and extruded again without cross-linking degradation, satisfying circular-economy procurement policies. Its resistance to moisture, solvents, and ultraviolet radiation lengthens product life and lowers total cost. Global recycled-polypropylene usage continues to rise, giving converters a growing pool of feedstock that reinforces the extruded polypropylene foam market value proposition.

Automotive Lightweighting Mandates

Corporate Average Fuel Economy rules in the United States, the European Union's CO2 fleet targets, and China's dual-credit system collectively pressure automakers to shed vehicle mass. Replacing heavy plastics or metal inserts with XPP foam in bumper cores, door panels, and battery enclosures cuts part weight by about 25% while keeping crash energy absorption intact. Chemical foaming enables thin-wall sections with fine cell morphology that meet strict dimensional tolerances. Automakers are now specifying recycled-content XPP grades, as demonstrated by interior-trim supplier Grupo Antolin's 20% weight-reduction program using foamed recyclate.

High Price of Extruded Polypropylene & Volatile Propylene Feedstock Costs

Spot propylene climbed to USD 825-835/mt FOB Korea in early 2025 after refinery outages tightened supply. North American polypropylene contracts followed, jumping 9% in Q1 2025 as producers declared force majeure. These price swings compress converter margins and delay capacity investments, especially for smaller firms that cannot hedge raw-material risk through long-term contracts. High resin costs ripple through the extruded polypropylene foam market, raising finished-product prices and prompting short-term customer substitution toward lower-priced foams when performance demands allow.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand from Packaging Industry

- Increasing Demand for Recyclable and Sustainable Foams

- Limited Large-Scale Extrusion Capacity in Several Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

High-density grades represent the fastest-advancing slice of the extruded polypropylene foam market, posting a 7.98% CAGR through 2030 as designers pursue higher compressive strength and dimensional rigidity. In 2024, Low-density foam remained the leader, holding 48.19% of the extruded polypropylene foam market share, thanks to packaging and interior auto uses where weight savings trump structural loads.

Process engineers now tailor density within a single sheet by modulating nucleating agents across the melt profile, achieving multi-zone parts that blend cushioning and stiffness. Supercritical CO2 foaming narrows cell-size distribution and lifts mechanical integrity, a breakthrough for panels subject to concentrated loads. Nanofiller research, including graphene platelet additions, demonstrates up to 30% modulus uplift at filler loadings below 1 wt%, broadening the suitability of XPP in construction thermal-break assemblies. Architects specify high-density XPP over mineral wool as building-envelope codes tighten due to comparable R-values at half the mass.

Low-density foam still powers in-line returnable packaging, foldable dunnage, and HVAC ducts. New clarifier masterbatches raise heat-distortion temperatures by 8 °C, extending service life in under-hood airflow components where continuous temperatures reach 110 °C. Market leaders are combining post-industrial scrap with virgin resin for low-density sheets, keeping physical properties unchanged while lowering resin costs and greenhouse-gas intensity.

Materials technologists expect the extruded polypropylene foam market to shift toward hybrid density solutions that exploit the best attributes of each grade. High-density cores paired with low-density skins inside one co-extruded laminate enable lightweight yet robust transport container walls. The new configurations are likely to capture share from solid polypropylene boards and aluminum honeycomb, especially in last-mile logistics enclosures seeking weight and cost reductions.

The Extruded Polypropylene (XPP) Foam Market Segments the Industry by Type (Low-Density XPP Foam and High-Density XPP Foam), End-User Industry (Automotive, Building and Construction, Packaging, and More), and Geography (Asia-Pacific, North America, South America, Europe, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific anchors the extruded polypropylene foam market with 54.61% of 2024 revenues, driven by China's automotive exports, India's surge in quick-service food delivery, and Japan's early adoption of circular packaging. Regional consumption is projected to climb 7.45% CAGR through 2030 as OEMs localize electric-vehicle component production and e-commerce penetration spreads beyond tier-one cities. Government rebate programs for lightweight vehicles and restrictions on single-use plastics reinforce demand for recyclable foams. Producers enjoy shorter supply chains to regional propylene crackers, keeping cost inflation below global averages and supporting competitive pricing.

North America holds the second-largest slice, propelled by pickup and SUV platforms that require large energy-absorbing components. The United States Department of Energy's Lightweight Materials Consortium continues to fund research into foamed polyolefin battery shields, keeping the region at the forefront of application engineering. Installations of bio-propane-to-propylene units in Texas bolster feedstock security and unlock low-carbon foam grades. However, the region still contends with propylene price volatility, which can slow downstream investment during supply disruptions.

Europe fosters high-value niches tied to stringent recyclability and carbon-footprint targets. Automakers in Germany and France deploy XPP in crash-pad structures that must pass pedestrian-safety tests while remaining fully recyclable. The region's extruded polypropylene foam market share could rise three percentage points by 2030 if PPWR compliance accelerates conversion away from expanded polystyrene in retail food trays. European converters benefit from harmonized waste-collection schemes that secure clean post-consumer streams for closed-loop programs, but higher energy prices continue to pressure operating margins relative to Asia.

- BOREALIS GMBH

- Braskem

- DS Smith

- Furukawa Electric Co., Ltd.

- NMC International SA

- Pregis LLC

- Sekisui Voltek

- SPUR

- Sumitomo Chemical Co., Ltd.

- TORAY INDUSTRIES, INC.

- Zotefoams plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Superior properties & high recyclability

- 4.2.2 Automotive lightweighting mandates

- 4.2.3 Growing demand from packaging industry

- 4.2.4 Increasing demand for recyclable and sustainable foams

- 4.2.5 Drone & UAV protective packaging boom

- 4.3 Market Restraints

- 4.3.1 High price of extruded polypropylene

- 4.3.2 Volatile propylene feedstock costs

- 4.3.3 Limited large-scale extrusion capacity in several regions

- 4.4 Value-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 Type

- 5.1.1 Low-Density XPP Foam

- 5.1.2 High-Density XPP Foam

- 5.2 By End-User Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Packaging

- 5.2.4 Other End-User Industries (Consumer Goods and Toys, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview...Recent Developments)

- 6.4.1 BOREALIS GMBH

- 6.4.2 Braskem

- 6.4.3 DS Smith

- 6.4.4 Furukawa Electric Co., Ltd.

- 6.4.5 NMC International SA

- 6.4.6 Pregis LLC

- 6.4.7 Sekisui Voltek

- 6.4.8 SPUR

- 6.4.9 Sumitomo Chemical Co., Ltd.

- 6.4.10 TORAY INDUSTRIES, INC.

- 6.4.11 Zotefoams plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment