|

市場調查報告書

商品編碼

1842585

SMS 防火牆:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)SMS Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

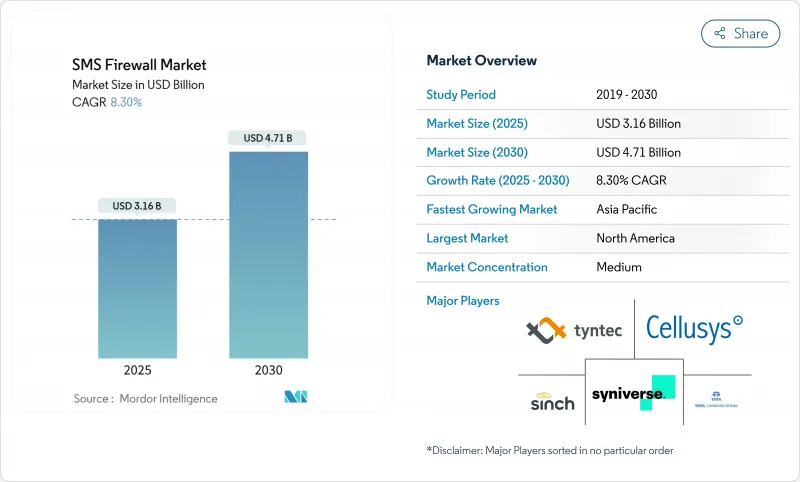

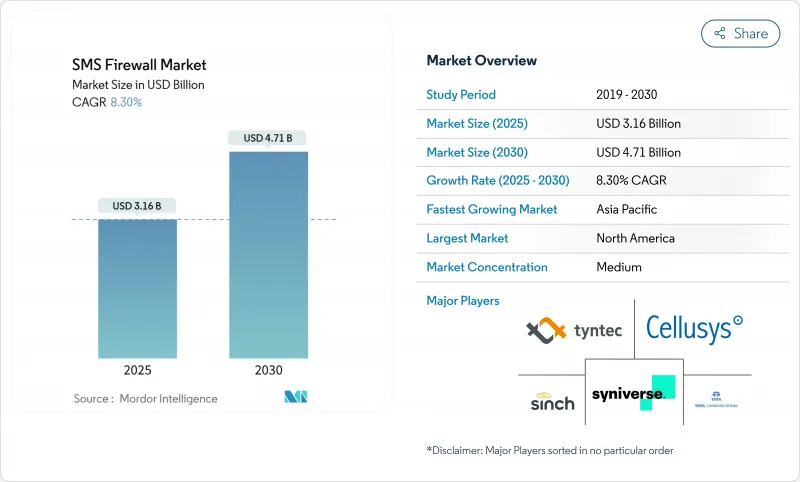

預計 2025 年簡訊防火牆市場規模為 31.6 億美元,到 2030 年將達到 47.1 億美元,預測期內(2025-2030 年)的複合年成長率為 8.30%。

通訊業者正在投資下一代防火牆,以確保A2P收益,履行新的可追溯性義務,並保護5G網路切片免受信令威脅。由於從SS7到Diameter防火牆的過渡、早期採用者國家5G部署的加速以及國家資料主權規則強制要求在岸過濾,資本支出只會持續成長。同時,CPaaS整合正在擠壓供應商的利潤空間,供應商們正透過人工智慧驅動的分析和託管服務產品脫穎而出。適度的供應商碎片化為利基專家留下了發展空間,他們利用雲端原生、基於訂閱的工具,瞄準三、四級行動網路營運商。

全球簡訊防火牆市場趨勢與洞察

A2P流量收益激增

隨著營運商面臨語音收入下滑的困境,經過身份驗證的A2P通訊對於恢復收益至關重要。印度的分散式帳本框架已幫助Airtel客戶減少了40%的洩漏和98%的垃圾郵件。巴西和奈及利亞的類似收益計畫依靠先進的流量分析技術,將合法的企業聲明與灰色管道區分開來。此模式還允許通訊業者轉售內建安全性的優質遞送服務。雖然經濟上可行,但部署需要基於機器學習的偵測工具,而小型通訊業者無法在傳統基礎架構上部署這些工具。

移動詐騙和灰色路由損失不斷增加

SIM 卡盒詐騙每年造成 31.1 億美元的損失,佔所有通訊詐騙的 7.8%。人為誇大的流量和利用語音、簡訊和社交應用程式進行的網路宣傳活動正迫使監管機構採取行動。印度一個基於人工智慧的反詐騙平台在三個月內將詐騙電話減少了 90%。此類成功案例促使其他監管機構要求將簡訊防火牆功能整合到更廣泛的詐騙防制堆疊中,從而擴大簡訊防火牆市場。

Tier 3/4 行動網路業者的技術意識較低

成千上萬的小型企業正在致力於DLT註冊和規則最佳化,同時,印度有2.7萬家企業正在尋求合規援助。機器學習規則的持續調整和即時威脅來源的整合,正在推動這些企業轉向託管服務,但預算限制減緩了其採用速度。

細分分析

到2024年,A2P通訊將佔據簡訊防火牆市場佔有率的65.3%,這得益於金融、醫療保健和公共服務領域強制實施的身份驗證規則。隨著企業為保證送達和垃圾郵件防護付費,A2P領域的簡訊防火牆市場規模預計將以8.3%的複合年成長率成長。企業也投資安全的P2P警報,推動P2P企業類別的複合年成長率達到10.2%。 Jack Henry目前已透過Twilio每月發送1,200萬至1,500萬條安全警報,預計發送量將增加50倍。

A2P 的成長加速了防火牆的升級,以過濾灰色路由;而 P2A 用例(例如入境客戶諮詢)則依賴身分驗證來保護企業免受欺騙攻擊。 RCS 等競爭管道正在減緩 P2A 的發展勢頭,但受監管的行業仍然依賴簡訊服務 (SMS)。動態密碼和服務通知的興起使安全的 A2P 流量成為營運商收益策略的核心,從而增強了簡訊防火牆市場。

由於一級營運商更傾向於本地資料控制,本地部署在2024年的收入佔有率將維持在53.22%。儘管如此,雲端部署的複合年成長率預計將達到13.1%,這反映了小型營運商的強勁需求。隨著允許跨境處理的區域監管機構青睞威脅共用來源,雲端部署的簡訊防火牆市場規模預計將大幅成長。

在實施資料本地化法律的地區,混合架構正日益受到青睞,它允許營運商在陸地上儲存訊息內容,同時在雲端分析元資料。位於通訊業者設施內的邊緣節點可提供近乎即時的分析,而無需將敏感資料遷移異地。這種靈活性正在刺激額外的投資,簡訊防火牆市場在傳統和新興部署模式下均持續成長。

區域分析

由於嚴格的隱私法規、5G 的早期普及以及將防火牆納入企業通訊堆疊的龐大 CPaaS 生態系統,北美在 2024 年將以 37.8% 的收入佔有率領先。 2025 年,由於與加拿大和墨西哥的跨境通訊觸發了新的審核追蹤要求,通訊業者支出將保持強勁。聯邦政府對語音自動電話和簡訊網路釣魚詐騙的關注將進一步推動需求,鞏固北美在簡訊防火牆市場的領導地位。

亞太地區是成長最快的地區,到2030年,複合年成長率將達到12.5%。印度的分散式帳本技術(DLT)框架增強了端到端訊息可追溯性,為該地區樹立了藍圖。而中國積極推動的5G切片部署正在加速下一代防火牆的採用。東南亞的業者也紛紛效法印度,採取垃圾資訊減少措施,擴大了簡訊防火牆市場的整體規模。

在歐洲,GDPR合規性與泛歐盟跨境交通規則(要求精細的同意記錄)之間的平衡正在不斷加強。資料主權條款正推動營運商轉向在岸過濾,而共用威脅來源則推動低風險類別的雲端應用。在中東和非洲,行動優先經濟體正在採用雲端原生防火牆以降低資本成本,但認知差距正在減緩小型行動通訊業者的採用速度。在南美,與印度一樣,訊息的KYC身份驗證正成為強制性要求,這推動了對低成本、符合法規的解決方案的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- A2P流量收益激增

- 移動詐騙和灰色路由損失加劇

- SS7 → Diameter 防火牆升級週期

- 國家資料主權條款強制實施境內過濾

- 優先考慮用戶品質和品牌信任的營運商

- 5G切片開闢了新的攻擊面

- 市場限制

- Tier 3/4 行動網路業者的技術意識較低

- CPaaS整合帶來的定價壓力

- RCS部署延遲導致資本投資時機不確定

- 跨境訊息檢查監理模糊性

- 產業價值鏈分析

- 監管狀況

- 技術展望

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章市場規模及成長預測(金額)

- 按簡訊類型

- A2P

- P2A

- P2P(企業快訊/警報)

- 依部署類型

- 本地部署

- 雲

- 按服務類型

- 專業服務(諮詢、整合)

- 託管服務(全天候監控、SOC)

- 按最終用戶產業

- BFSI

- 政府/公共

- 資訊科技和電訊

- 醫療保健和生命科學

- 零售與電子商務

- 媒體與娛樂

- 教育

- 製造業

- 其他最終用戶產業

- 網路生成

- 2G/3G

- 4G/LTE

- 5G

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 新加坡

- 澳洲

- 其他亞太地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Cellusys Telecommunications

- Tyntec GmbH

- Tata Communications Ltd.

- Syniverse Technologies LLC

- Sinch AB

- Omobio(Pvt)Ltd.

- Route Mobile Ltd.

- AMD Telecom SA

- BICS SA/NV

- SAP SE

- Monty Mobile

- NewNet Communication Technologies

- Mahindra Comviva

- Infobip Ltd.

- Twilio Inc.

- Anam Technologies

- Mobileum Inc.

- Mavenir Systems Inc.

- Proofpoint Inc.

- AdaptiveMobile Security(Enea)

- NetNumber Global Data Services

- Openmind Networks

- HORISEN AG

- Sparkle(Telecom Italia)

- Orange Wholesale International

- VOX Solutions

- Global Message Services AG

第7章 市場機會與未來趨勢

The SMS Firewall Market size is estimated at USD 3.16 billion in 2025, and is expected to reach USD 4.71 billion by 2030, at a CAGR of 8.30% during the forecast period (2025-2030).

Operators are investing in next-generation firewalls to secure A2P revenues, comply with new traceability mandates, and guard 5G network slices from signaling threats. Migration from SS7 to Diameter firewalls, accelerated 5G rollouts in early-adopter countries, and national data-sovereignty rules that force on-shore filtering keep capital spending elevated. At the same time, CPaaS consolidation is compressing vendor margins, prompting suppliers to differentiate with AI-driven analytics and managed services offers. Moderate fragmentation among suppliers leaves space for niche specialists that target tier-3 and tier-4 mobile network operators with cloud-native, subscription-based tools.

Global SMS Firewall Market Trends and Insights

Surge in A2P Traffic Monetisation

Operators face declining voice income, so authenticated A2P messaging has become pivotal for revenue recovery. India's distributed ledger framework showed a 40% cut in leakage and a 98% spam drop for Airtel customers. Similar monetisation programs in Brazil and Nigeria rely on advanced traffic analytics that separate legitimate enterprise messages from grey routes. The model also lets carriers resell premium delivery services with embedded security. Although profitable, rollout demands machine-learning inspection tools that smaller carriers cannot host on legacy infrastructure.

Intensifying Mobile Fraud and Grey-Route Losses

SIM-box fraud causes USD 3.11 billion in yearly losses and represents 7.8% of total telecom fraud. Artificially inflated traffic and phishing campaigns now combine voice, SMS, and social apps, pressuring regulators to act. India's AI-based anti-spoofing platform cut fraudulent calls by 90% in three months. Such successes push other regulators to demand integrated SMS firewall capability within wider fraud-prevention stacks, expanding the SMS firewall market.

Low Technical Awareness Among Tier-3/4 MNOs

Thousands of smaller operators grapple with DLT registration and rule optimization, as seen when 27,000 entities in India sought compliance assistance. Continuous tuning of machine-learning rules and integration of live threat feeds push these operators toward managed services, yet budget limits slow adoption.

Other drivers and restraints analyzed in the detailed report include:

- SS7 to Diameter Firewall Upgrade Cycle

- 5G Slicing Opening New Attack Surfaces

- Pricing Pressure from CPaaS Consolidations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

A2P messaging held 65.3% of the SMS firewall market share in 2024, underpinned by mandatory authentication rules across finance, healthcare, and public services. The SMS firewall market size for A2P segments is set to expand at an 8.3% CAGR as enterprises pay for guaranteed delivery and spam control. Enterprises also invest in secure P2P alerts, pushing the P2P enterprise category to a 10.2% CAGR. Jack Henry already moves 12-15 million secured alerts each month through Twilio and plans a fifty-fold volume growth.

A2P growth accelerates firewall upgrades that filter grey routes, while P2A use cases such as inbound customer queries hinge on authentication that shields enterprises from impersonation attacks. Competing channels like RCS slow P2A momentum, yet regulated sectors still rely on SMS for universal reach. The rising volume of one-time passwords and service notifications keeps security-rich A2P traffic central to operator revenue strategies, fortifying the SMS firewall market.

On-premise deployments retained 53.22% revenue share in 2024 because tier-1 carriers favor local data control. Even so, cloud options are projected to record a 13.1% CAGR, reflecting strong demand from smaller operators. The SMS firewall market size for cloud deployments is forecast to rise sharply as regulators in regions that allow cross-border processing endorse shared-threat feeds.

Hybrid architectures gain traction where data localization laws exist, letting operators analyze metadata in the cloud while storing message content on shore. Edge nodes positioned inside carrier facilities provide near-real-time analytics without moving sensitive data off-site. This flexibility spurs additional investment, ensuring that the SMS firewall market continues to grow in both traditional and emerging deployment models.

The SMS Firewall Market is Segmented by SMS Type (A2P, P2A, and P2P), Deployment Mode (On-Premise and Cloud), Service Type (Professional Services and Managed Services), End-User Industry (BFSI, Government and Public Safety, and More), Network Generation (2G/3G, 4G/LTE, and 5G), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with a 37.8% revenue share in 2024, thanks to stringent privacy rules, early 5G adoption, and large CPaaS ecosystems that embed firewalls into enterprise communication stacks. Carrier spending stays strong in 2025 as cross-border messaging with Canada and Mexico triggers new audit trail mandates. Federal attention on robocalls and smishing scams further boosts demand, anchoring North American leadership within the SMS firewall market.

Asia-Pacific is the fastest-growing region at a 12.5% CAGR to 2030. India's DLT framework enforces end-to-end message traceability and functions as a regional blueprint, while China's aggressive 5G slicing deployment accelerates next-generation firewall uptake. Southeast Asian operators follow with spam-reduction drives that mirror India's performance gains, collectively enlarging the SMS firewall market.

Europe balances GDPR compliance with pan-EU cross-border traffic rules that require granular consent logs. Data-sovereignty clauses push operators toward on-shore filtering, yet shared threat feeds encourage cloud adoption in low-risk categories. In the Middle East and Africa, mobile-first economies adopt cloud-native firewalls to reduce capital expenses, though awareness gaps among smaller MNOs slow penetration. South America mirrors India by mandating KYC verification on messages, fueling demand for low-cost, regulation-ready solutions.

- Cellusys Telecommunications

- Tyntec GmbH

- Tata Communications Ltd.

- Syniverse Technologies LLC

- Sinch AB

- Omobio (Pvt) Ltd.

- Route Mobile Ltd.

- AMD Telecom S.A.

- BICS SA/NV

- SAP SE

- Monty Mobile

- NewNet Communication Technologies

- Mahindra Comviva

- Infobip Ltd.

- Twilio Inc.

- Anam Technologies

- Mobileum Inc.

- Mavenir Systems Inc.

- Proofpoint Inc.

- AdaptiveMobile Security (Enea)

- NetNumber Global Data Services

- Openmind Networks

- HORISEN AG

- Sparkle (Telecom Italia)

- Orange Wholesale International

- VOX Solutions

- Global Message Services AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in A2P traffic monetisation

- 4.2.2 Intensifying mobile fraud and grey-route losses

- 4.2.3 SS7 -> Diameter firewall upgrade cycle

- 4.2.4 National data-sovereignty clauses forcing on-shore filtering

- 4.2.5 Operator focus on subscriber QoE and brand trust

- 4.2.6 5G slicing opening new attack surfaces

- 4.3 Market Restraints

- 4.3.1 Low technical awareness among Tier-3/4 MNOs

- 4.3.2 Pricing pressure from CPaaS consolidations

- 4.3.3 Delayed RCS roll-outs blurring capex timing

- 4.3.4 Regulatory ambiguity on cross-border message inspection

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By SMS Type

- 5.1.1 A2P

- 5.1.2 P2A

- 5.1.3 P2P (Enterprise Flash/Alert)

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Service Type

- 5.3.1 Professional Services (Consulting, Integration)

- 5.3.2 Managed Services (24X7 Monitoring, SOC)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Government and Public Safety

- 5.4.3 IT and Telecom

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Retail and E-Commerce

- 5.4.6 Media and Entertainment

- 5.4.7 Education

- 5.4.8 Manufacturing

- 5.4.9 Other End-user Industries

- 5.5 By Network Generation

- 5.5.1 2G / 3G

- 5.5.2 4G / LTE

- 5.5.3 5G

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cellusys Telecommunications

- 6.4.2 Tyntec GmbH

- 6.4.3 Tata Communications Ltd.

- 6.4.4 Syniverse Technologies LLC

- 6.4.5 Sinch AB

- 6.4.6 Omobio (Pvt) Ltd.

- 6.4.7 Route Mobile Ltd.

- 6.4.8 AMD Telecom S.A.

- 6.4.9 BICS SA/NV

- 6.4.10 SAP SE

- 6.4.11 Monty Mobile

- 6.4.12 NewNet Communication Technologies

- 6.4.13 Mahindra Comviva

- 6.4.14 Infobip Ltd.

- 6.4.15 Twilio Inc.

- 6.4.16 Anam Technologies

- 6.4.17 Mobileum Inc.

- 6.4.18 Mavenir Systems Inc.

- 6.4.19 Proofpoint Inc.

- 6.4.20 AdaptiveMobile Security (Enea)

- 6.4.21 NetNumber Global Data Services

- 6.4.22 Openmind Networks

- 6.4.23 HORISEN AG

- 6.4.24 Sparkle (Telecom Italia)

- 6.4.25 Orange Wholesale International

- 6.4.26 VOX Solutions

- 6.4.27 Global Message Services AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment