|

市場調查報告書

商品編碼

1842578

自動駕駛計程車:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Robo Taxi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

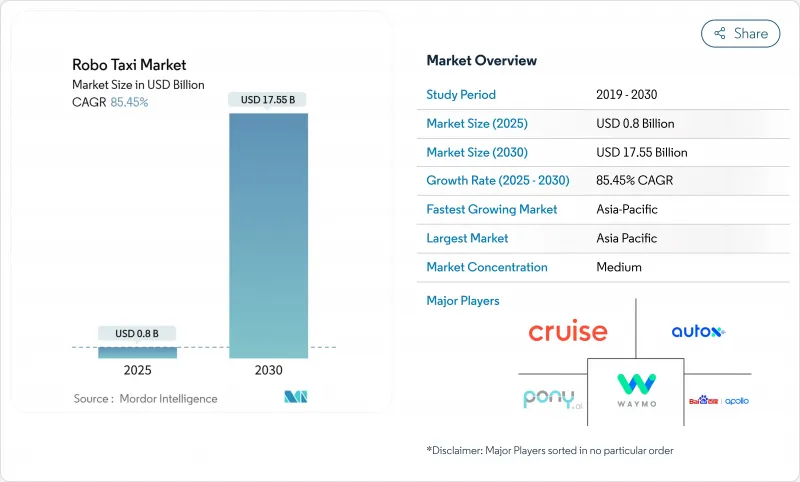

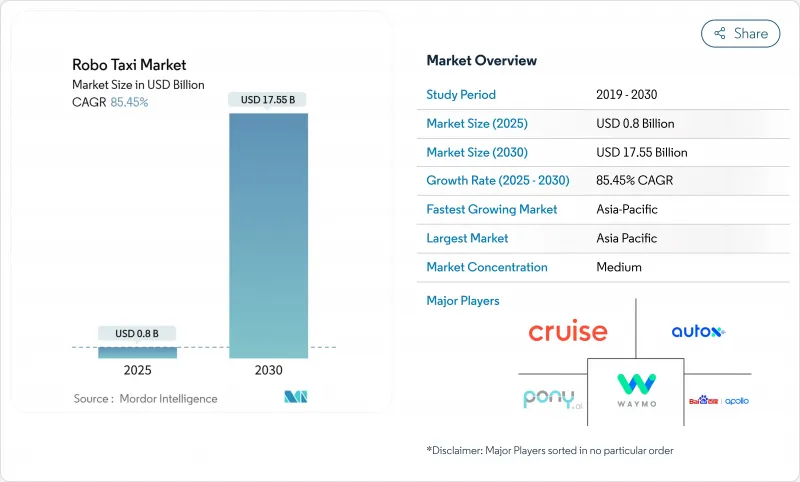

預計 2025 年自動駕駛計程車市場規模為 8 億美元,到 2030 年將達到 175.5 億美元,預測期內(2025-2030 年)的複合年成長率為 85.45%。

來自策略和金融投資者的資本流入持續重塑競爭動態,而硬體(尤其以雷射雷達和高性能電腦為代表)的快速萎縮則消除了關鍵的經濟障礙。更清晰的法律規範,例如杜拜的自動駕駛汽車專項法律和德國的KIRA計劃,將把試點計畫轉變為可擴展的商業營運。

全球自動駕駛計程車市場趨勢與洞察

AD感測器和運算成本的下降

LiDAR和車載計算單元成本的壓縮正在重新定義車隊級經濟效益。 NVIDIA 的 DRIVE Hyperion 平台即將實現車規級量產,而中國供應商預測雷射雷達模組的價格將低於 1,000 美元,低於十年前的 75,000 美元。在兩個車型週期內,每輛 4 級自動駕駛汽車的硬體支出已從 25 萬美元降至 15 萬美元。由於零件成本接近傳統汽車水平,高運轉率車隊的投資回收期不到三年。這項成本軌跡擴大了自動駕駛計程車市場在高階和大眾市場領域的可拓展機會。

政府自動駕駛汽車試點和監管沙盒

各司法管轄區目前發放的是商業牌照,而非實驗許可證。德國的KIRA車隊在主要路線載客付費,法國正在加速無人駕駛法規,杜拜2023年第9號法律則明確授權付費自動駕駛服務。每項舉措都透過明確責任、保險和資料登錄要求,縮短了部署前置作業時間。可預測的合規要求可以釋放長期資本,並鼓勵在多個城市推出,從而擴大了自動駕駛計程車營運商的可及市場。

社會信任與安全意識差距巨大

儘管Waymo報告其保險索賠比人類駕駛員少90%,但JD Power的信任指數顯示,全自動駕駛汽車在100個評分中僅排在第39位。美國和德國消費者對軟體可靠性和責任保險範圍表示不確定性,71%的消費者拒絕支付單程保險。地區差異也顯現出來:上海的一項調查發現,早期引進意願很高,這表明未來採用情況將不均衡。縮小這一差距需要透明的事故報告、分階段的推廣以及清晰可見的安全免責聲明,而所有這些都會延長自動駕駛計程車市場的行銷預算和部署時間。

細分分析

2024年,4級自動駕駛汽車將佔大部分付費出行佔有率,佔自動駕駛計程車市場佔有率的61.73%。這些車輛將在地理圍欄覆蓋的大都會圈運行,在這些區域,高清地圖和遠端援助將彌補剩餘的邊緣情況。隨著5級原型車在非結構化環境中證明其可靠性,這一細分市場將穩步成長,但其相對比重將下降。 5級自動駕駛汽車的複合年成長率高達87.41%,將打破自動駕駛計程車產業的長期天花板。在預測期內,早期採用者將逐步轉型其車隊,通常同時營運4級和5級自動駕駛汽車,在攤銷沉沒投資的同時,為全天候和地形條件下的無人駕駛營運做好準備。

營運商的經濟效益也將同步發展:目前,5 級自動駕駛硬體比 4 級自動駕駛硬體貴 15%,但一旦每天使用時間超過 8 小時,遠端控制和遠端監控的取消就能抵消這一成本差異。 Waymo 最新的設計成本週期已經降低了溢價,這標誌著 5 級曲折點即將成為車隊擴張的預設採購選擇。

到2024年,純電力傳動系統將佔據71.32%的市場佔有率,複合年成長率為79.52%。電動動力傳動系統非常適合自動駕駛汽車的工作週期。再生煞車、較短的維護間隔和集中充電站充電非常適合24小時運作和高里程行駛。因此,在評估整體擁有成本時,與內燃機和混合動力汽車相比,自動駕駛計程車市場更青睞電動車。鳳凰城和武漢路邊充電站安裝的感應式充電墊片進一步縮短了車輛停留時間,並幫助車隊維持90%以上的佔用率目標。

燃料電池和混合動力替代方案在遠距航線和極端溫差航線上仍然適用,因為這些航線的電池性能會下降。然而,磷酸鐵鋰等新型化學電池比鎳鈷錳電池組每千瓦時成本降低了30%,這使得電動車在區域班車領域更具競爭力。汽車製造商正在為自動駕駛旅遊客戶提供單獨的電池生產線,以減少電池組的波動性和現場停機時間。

受傳統叫車客戶預期的推動,到2024年,轎車車將佔總收入的67.34%。然而,隨著營運商轉向更高乘客或貨物密度的出行方式,廂型車和班車型車輛的成長速度最快,複合年成長率將達到75.23%。專用型車輛正獲得監管部門的支持,因為它們可以減少車頭擠壓區,在駕駛員不在車上時提供更大的內部空間,同時又不影響被動安全性。

數位雙胞胎軟體可在硬體凍結前模擬數百萬公里的路程,從而強化產品開發的回饋循環。以製造為導向的設計可將零件數量減少近 18%,從而降低與小批量生產相關的零件成本風險。因此,自動駕駛計程車市場正在從傳統的後裝式感測器艙從傳統轎車中伸出的方式,轉變為隱藏感知陣列的整合外觀。

自動駕駛計程車市場按自動駕駛等級(4 級、5 級)、動力(純電動、其他)、車輛類型(乘用車、其他)、應用領域(客運、其他)、服務類型(租賃、其他)、商業模式(B2C、其他)、車隊規模、營運環境和地區進行細分。市場預測以價值(美元)和數量(單位)表示。

區域分析

亞太地區將引領全球市場,到2024年將佔據45.13%的市場。中國已在16個城市發放了自動駕駛計程車牌照,其政策目標是到2028年在武漢部署1,000輛全自動駕駛汽車。政府採購獎勵措施、自由貿易區試點以及5G的廣泛應用正在為基礎設施建設創造良性循環。因此,亞太地區自動駕駛計程車市場的複合年成長率高達85.23%。跨國車隊正利用這項監管利好,開發多語言語音使用者體驗和整合車載支付等功能原型,並向出口市場轉型。

北美仍然是營運基準,Waymo 每週在鳳凰城、舊金山和洛杉磯三個城市營運 20 萬輛自動駕駛汽車。雖然各州的自動駕駛法律各不相同,但已有 27 個州和華盛頓特區批准了 4 級或 5 級自動駕駛汽車,打造了北美大陸最多樣化的路線組合。資本持續流入北美,光是 Waymo 就在 2024 年的資金籌措中獲得了 56 億美元的融資。特斯拉正在奧斯汀準備一項試點項目,在混合速高速公路上對無人駕駛車輛進行壓力測試,這表明儘管 Cruise 近期有所回落,但競爭仍然激烈。

在歐洲,德國的KIRA計劃和法國的全國無人駕駛藍圖正在推動這項進程。儘管密集的、過時的街道網路和GDPR合規義務使營運變得複雜,但漢堡、巴黎和巴塞隆納等城市仍在尋求零排放走廊,明確支持自動駕駛接駁車。像倫敦的Wayve-Uber這樣的戰略聯盟正在將英國的人工智慧堆疊與叫車業務整合在一起,為歐盟協調法規生效後在整個歐洲大陸的擴展提供模板。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- AD感測器和運算成本下降

- 政府自動駕駛汽車試點和監管沙盒

- 解決都市區擁塞將共用共享自主

- 透過 MaaS 平台整合提高車輛利用率

- 專為最後一哩物流打造的自動駕駛汽車架構

- 自動駕駛企業資本流入創紀錄

- 市場限制

- 社會信任和安全意識之間的差距依然很大

- 前期投資高,投資報酬率不確定

- 世界各地的法律責任和安全認證系統存在差異

- V2X網路安全漏洞

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 按自治級別

- 4級

- 5級

- 透過促銷

- 純電動車

- 油電混合車

- 燃料電池電動車

- 按車輛類型

- 車

- 麵包車/接駁車

- 按用途

- 客運

- 貨運/小包裹運輸

- 按服務類型

- 租賃基礎(自由浮動)

- 基於站點(樞紐到樞紐)

- 按經營模式

- B2C(直接面向乘客)

- B2B(企業/物流合約)

- 公共運輸整合

- 按車輛保有量

- OEM 擁有

- 營運商所有(跨國公司和新興企業)

- 公有

- 按運轉環境

- 市中心

- 郊區/校園

- 高速公路/城際公路

- 混合用途區

- 按地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 土耳其

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Waymo LLC

- GM Cruise LLC

- Baidu Apollo

- AutoX Inc.

- Pony.ai

- Zoox Inc.

- Tesla Inc.

- DiDi Autonomous Driving

- Yandex Self-Driving Group

- EasyMile SAS

- Navya SA

- Nuro Inc.

- ZF Friedrichshafen AG

- AB Volvo-Volvo Autonomous Solutions

- Mobileye(Intel)

第7章 市場機會與未來展望

The Robo Taxi Market size is estimated at USD 0.8 billion in 2025, and is expected to reach USD 17.55 billion by 2030, at a CAGR of 85.45% during the forecast period (2025-2030).

Capital inflows from strategic and financial investors continue to reset competitive dynamics, while rapid hardware deflation-most visibly in LiDAR and high-performance compute-erases a chief economic barrier. Clearer regulatory frameworks, such as Dubai's dedicated autonomous-vehicle law and Germany's KIRA project, convert pilot schemes into scalable commercial operations.

Global Robo Taxi Market Trends and Insights

Declining AD-sensor & computing costs

Unit-price compression in LiDAR and on-board compute redefines fleet-level economics. Chinese suppliers forecast LiDAR modules below USD 1,000, against USD 75,000 less than a decade ago, while NVIDIA's DRIVE Hyperion platform reaches automotive-grade volume production. Hardware outlay per Level 4 vehicle fell from USD 250,000 to USD 150,000 in two model cycles. As bills of material move closer to parity with traditional vehicles, payback periods fall under three years for high-utilisation fleets. This cost trajectory improves the addressable opportunity for the robo taxi market across premium and mass-market urban zones.

Government AV pilots & regulatory sandboxes

Jurisdictions now issue commercial licences rather than test permits. Germany's KIRA fleet carries fare-paying passengers on arterial routes, France fast-tracks driverless statutes, and Dubai's Law No. 9 of 2023 explicitly authorises paid autonomous services. Each initiative compresses deployment lead times by clarifying liability, insurance, and data logging mandates. Predictable compliance requirements unlock long-dated capital and trigger multi-city ramp-ups, thereby expanding the immediately serviceable available market for robo taxi operators.

Persistent public-trust & safety-perception gap

J.D. Power's confidence index scores just 39/100 for fully automated vehicles despite Waymo recording 90% fewer insurance claims than human drivers. Consumers in the United States and Germany cite uncertainty over software reliability and liability coverage, with 71% rejecting per-ride insurance premiums. Regional asymmetry also appears: surveys in Shanghai show higher early-adopter intent, suggesting uptake will not be uniform. Closing this gap calls for transparent incident reporting, incremental rollouts, and visible safety disclaimers, all stretching marketing budgets and deployment timelines for the robo taxi market.

Other drivers and restraints analyzed in the detailed report include:

- Urban congestion pricing nudging shared autonomy

- MaaS platform integration unlocking fleet utilisation.

- V2X cybersecurity vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Level 4 vehicles produced the bulk of paid rides in 2024, holding 61.73% of the Robo taxi market share. They run inside geofenced metropolitan zones where high-definition maps and remote assistance offset residual edge cases. The segment grows steadily yet cedes relative weight as Level 5 prototypes prove reliability in unstructured environments. At an 87.41% CAGR, Level 5 lifts the long-run ceiling of the Robo taxi industry. Over the forecast horizon, early adopters transition fleets incrementally, often operating Level 4 and Level 5 vehicles side-by-side to amortise sunk investments while preparing for driver-out operations in all weather and terrain.

Operator economics evolve in parallel. Level 5 hardware currently carries a 15% cost premium over Level 4 equivalents, yet eliminating tele-operations and remote supervisors offsets that delta once daily utilisation exceeds eight hours. Waymo's latest design-to-cost cycle already narrows the premium, signalling an inflection at which Level 5 becomes the default procurement choice for fleet expansions.

Battery-electric drivetrains held a 71.32% market share in 2024 and exhibit a 79.52% CAGR. Electric powertrains harmonise with autonomous-vehicle duty cycles: regenerative braking, low service intervals, and central depot charging align with high-mileage, round-the-clock operations. The Robo taxi market, therefore, favours electric fleets when evaluating total cost of ownership against internal combustion or hybrid alternatives. Inductive charging pads at curbside stands in Phoenix and Wuhan further truncate dwell time, helping fleets maintain ride availability targets above 90%.

Fuel-cell and hybrid alternatives retain relevance in long-range or temperature-extreme routes where battery performance degrades. However, new chemistries such as lithium-iron-phosphate reduce cost per kilowatt-hour by 30% relative to nickel cobalt manganese packs, extending electric competitiveness into regional shuttles. Automakers dedicate separate battery lines for autonomous-mobility clients, lowering variance and frontline downtime.

Car-based designs captured 67.34% of 2024 revenue due to legacy ride-hailing user expectations. Yet van and shuttle formats compound fastest at a 75.23% CAGR as operators pivot to multi-passenger or cargo-dense missions. Purpose-built shapes gain regulatory favour because their reduced front crumple zones free interior volume without compromising passive safety when no human driver is on board.

Product-development feedback loops tighten as digital twins simulate millions of kilometres before hardware freeze. Design for manufacturability disciplines drive part-count reductions near 18%, lowering bill-of-materials risk for low-volume skews. Consequently, the Robo taxi market moves from retrofit approaches, where sensor pods protrude from traditional sedans, to integrated exteriors that conceal perception arrays.

The Robo Taxi Market is Segmented by Level of Autonomy (Level 4, and Level 5), Propulsion (Battery-Electric Vehicles, and More), Vehicle Type (Car, and More), by Application (Passenger Transportation, and More), by Service Type (Rental-Based, and More), Business Modal (B2C, and More), Fleet Ownership, Operating Environment and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific anchors global upside, with a 45.13% share in 2024. China already licenses robotaxis in 16 cities, and policy goals envision 1,000 fully driverless vehicles in Wuhan by 2028. Government procurement incentives, free-trade-zone test beds, and 5G coverage create a virtuous infrastructure loop. As a result, the Robo taxi market in Asia-Pacific is compounding at an 85.23% CAGR. Multinational fleets leverage this regulatory tailwind to prototype features such as multilingual voice UX and integrated in-vehicle payments, which then migrate to export markets.

North America remains the operational benchmark owing to Waymo's 200,000 weekly rides across Phoenix, San Francisco, and Los Angeles. State-level autonomy statutes differ, but 27 states and Washington D.C. already authorise Level 4 or Level 5 rides, yielding the continent's most diverse route portfolios. In North America as capital inflows continue-Waymo alone secured USD 5.6 billion in 2024 funding rounds. Tesla prepares an Austin pilot to stress-test driverless rides on mixed-speed arterials, signaling that competitive intensity remains robust despite Cruise's recent retrenchment.

Europe is propelled by Germany's KIRA project and France's nationwide driverless roadmap. Dense medieval street grids and GDPR compliance obligations add operational complexity, yet cities such as Hamburg, Paris, and Barcelona pursue zero-emission corridors that explicitly accommodate autonomous shuttles. Strategic alliances like Wayve-Uber in London integrate British AI stacks with ride-hailing volume, providing a template for continent-wide scaling once harmonised EU regulation takes effect.

- Waymo LLC

- GM Cruise LLC

- Baidu Apollo

- AutoX Inc.

- Pony.ai

- Zoox Inc.

- Tesla Inc.

- DiDi Autonomous Driving

- Yandex Self-Driving Group

- EasyMile SAS

- Navya SA

- Nuro Inc.

- ZF Friedrichshafen AG

- AB Volvo - Volvo Autonomous Solutions

- Mobileye (Intel)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining AD-sensor & computing costs

- 4.2.2 Government AV pilots & regulatory sandboxes

- 4.2.3 Urban congestion pricing nudging shared autonomy

- 4.2.4 MaaS platform integration unlocking fleet utilisation

- 4.2.5 Purpose-built autonomous van architectures for last-mile logistics

- 4.2.6 Record capital inflows into autonomous-mobility ventures

- 4.3 Market Restraints

- 4.3.1 Persistent public-trust & safety-perception gap

- 4.3.2 High upfront CAPEX & uncertain pay-back

- 4.3.3 Patchy global liability & safety certification regimes

- 4.3.4 V2X cyber-security vulnerabilities

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Level of Autonomy

- 5.1.1 Level 4

- 5.1.2 Level 5

- 5.2 By Propulsion

- 5.2.1 Battery-Electric Vehicles

- 5.2.2 Hybrid-Electric Vehicles

- 5.2.3 Fuel-Cell Electric Vehicles

- 5.3 By Vehicle Type

- 5.3.1 Car

- 5.3.2 Van / Shuttle

- 5.4 By Application

- 5.4.1 Passenger Transportation

- 5.4.2 Goods / Parcel Transportation

- 5.5 By Service Type

- 5.5.1 Rental-Based (free-floating)

- 5.5.2 Station-Based (hub-to-hub)

- 5.6 By Business Model

- 5.6.1 B2C (direct to riders)

- 5.6.2 B2B (corporate / logistics contracts)

- 5.6.3 Public-Transit Integration

- 5.7 By Fleet Ownership

- 5.7.1 OEM-Owned

- 5.7.2 Operator-Owned (TNCs & start-ups)

- 5.7.3 Public-Agency-Owned

- 5.8 By Operating Environment

- 5.8.1 Urban Core

- 5.8.2 Sub-Urban / Campus

- 5.8.3 Highway / Inter-city

- 5.8.4 Mixed-Use Zones

- 5.9 By Geography

- 5.9.1 North America

- 5.9.1.1 United States

- 5.9.1.2 Canada

- 5.9.1.3 Rest of North America

- 5.9.2 South America

- 5.9.2.1 Brazil

- 5.9.2.2 Argentina

- 5.9.2.3 Rest of South America

- 5.9.3 Europe

- 5.9.3.1 Germany

- 5.9.3.2 United Kingdom

- 5.9.3.3 France

- 5.9.3.4 Italy

- 5.9.3.5 Spain

- 5.9.3.6 Russia

- 5.9.3.7 Rest of Europe

- 5.9.4 Asia-Pacific

- 5.9.4.1 China

- 5.9.4.2 Japan

- 5.9.4.3 India

- 5.9.4.4 South Korea

- 5.9.4.5 Rest of Asia-Pacific

- 5.9.5 Middle East and Africa

- 5.9.5.1 Turkey

- 5.9.5.2 Saudi Arabia

- 5.9.5.3 United Arab Emirates

- 5.9.5.4 South Africa

- 5.9.5.5 Nigeria

- 5.9.5.6 Rest of Middle East and Africa

- 5.9.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Waymo LLC

- 6.4.2 GM Cruise LLC

- 6.4.3 Baidu Apollo

- 6.4.4 AutoX Inc.

- 6.4.5 Pony.ai

- 6.4.6 Zoox Inc.

- 6.4.7 Tesla Inc.

- 6.4.8 DiDi Autonomous Driving

- 6.4.9 Yandex Self-Driving Group

- 6.4.10 EasyMile SAS

- 6.4.11 Navya SA

- 6.4.12 Nuro Inc.

- 6.4.13 ZF Friedrichshafen AG

- 6.4.14 AB Volvo - Volvo Autonomous Solutions

- 6.4.15 Mobileye (Intel)

7 Market Opportunities & Future Outlook

- 7.1 Autonomous ride-hailing integration into city MaaS platforms

- 7.2 Dedicated robo-van networks for last-mile parcel delivery

- 7.3 Subscription-based robo-taxi services for senior mobility

- 7.4 Cross-border robo-taxi corridors (e.g., EU Schengen pilot)

- 7.5 Carbon-credit monetisation for zero-emission robo-taxi fleets