|

市場調查報告書

商品編碼

1842570

壓電元件:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Piezoelectric Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

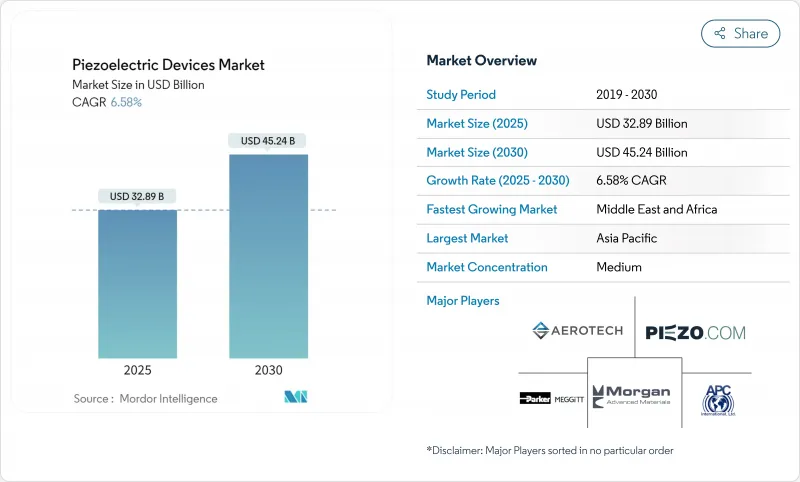

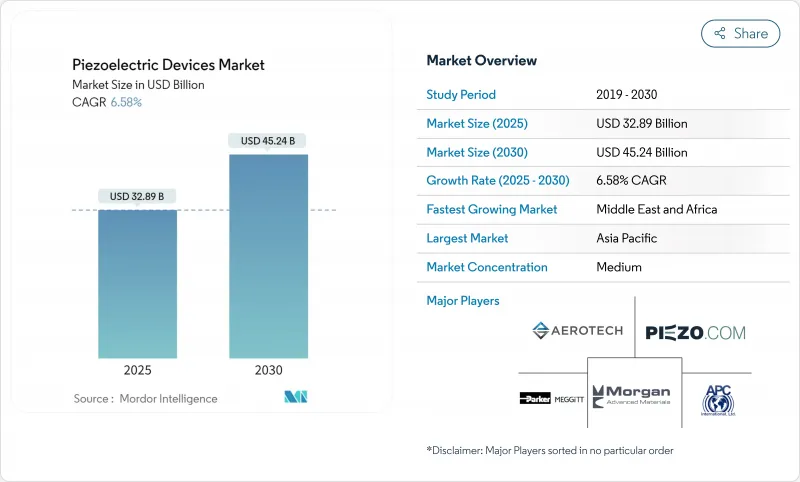

壓電元件市場規模預計在 2025 年達到 329 億美元,到 2030 年將增加至 452.4 億美元,複合年成長率為 6.58%。

推動這一擴張的因素包括 5G RF 濾波器的小型化、汽車電氣化的日益發展以及依賴堅固、節能的壓電元件的工業 4.0維修。體聲波濾波器中氮化鋁鈧的採用使智慧型手機頻率能夠達到 6 GHz 以上,而歐盟的無鉛政策正在加速向鈮酸鉀鈉和鈦酸鉍鈉的轉變,儘管它們的製造成本較高。亞太地區憑藉大規模消費性電子產品生產引領需求,而中東和非洲則因石油和天然氣能源採集計劃而經歷快速成長。雖然 TDK、村田製作所和京瓷等垂直整合供應商確保上游材料和下游生產能力,緩和了競爭,但鈮和鋰的供應風險給國防和航太用戶帶來了不確定性。

全球壓電市場趨勢與洞察

5G智慧型手機壓電MEMS射頻濾波器的小型化(亞洲)

基於氮化鋁鈧的體聲波濾波器現在可以實現 6 GHz 以上的頻率,耦合因子比標準氮化鋁高 40%,同時保持高達 400 度C 的熱穩定性。這些進步將晶粒尺寸縮小至 0.83 x 0.75 mm2,並將插入損耗降低至 1.5 dB 以下,從而延長智慧型手機電池壽命。3D機械共振器進一步將多頻段功能整合到單一晶片上,為超寬頻連接創建可擴展的解決方案。亞洲的晶圓級密封矽共振器平台實現了超過 439 的品質因數,從而減少了製造流程和成本。加速的 6G 和毫米波計畫將推動對超緊湊鈮酸鋰基濾波器晶片的需求,從而加強我們在亞太地區的技術領先地位。

用於歐洲高檔汽車燃油噴射和 ADAS 的電動壓電致動器

採用銅電極的愛普科斯( EPCOS) 多層致動器在 170 度C下可承受超過 10 億次操作,性能比銀鈀執行器提高 20%。 Denso 的 i-ART 系統將微處理器與壓電噴射器整合在一起,可即時調節燃油輸送,從而在更嚴格的排放法規下提高引擎效率。半主動懸吊模組中的壓電感測器支援磁流變減震器,可提高電動平台的乘坐舒適性和穩定性。框架式致動器傳遞的力道是慣性模型的 300 倍,可為高級駕駛輔助系統 (ADAS) 提供快速的機械響應。使用 PowerHap 堆疊的觸覺回饋模組現在可以透過精確的觸覺提示移動 2 公斤的車載顯示螢幕,增強人機互動。

歐盟無鉛指令推高PZT替代品成本

《限制有害物質指令》正在推動從PZT(壓電陶瓷)到無鉛陶瓷的轉變,但這也導致製造成本增加了15%至20%,並使全球供應策略複雜化。基於KNN的織構陶瓷的壓電係數最近已達到550 pC/N,在25°C至150°C之間的變化小於1.2%,使其在性能關鍵型應用中具有競爭力。透過逆向複合製程再生氧化物的回收方法可將能源需求降低至原始生產的1%,同時維持感測品質。製造商必須維持兩條供應鏈來供應依賴PZT的地區,同時為歐盟買家擴展原始生產線,這增加了間接成本。儘管監管截止日期已在不到兩年內臨近,但成本差異已推遲了價格敏感型消費性電子應用中的替代。

細分分析

到2024年,感測器將佔據壓電裝置市場佔有率的32.1%,這反映了其在智慧型手機、汽車和工業監控等領域的跨產業普及。能量收集器是成長最快的細分市場,複合年成長率為9.1%,這與青睞免維護節點的自供電物聯網設備的部署趨勢一致。致動器和馬達將佔據第二大收入佔有率,受益於電動車的普及和精密製造。隨著5G部署對網路同步要求的提高,共振器正獲得新的發展動力。此細分市場的加速發展反映了壓電奈米發電機與矽橡膠複合材料結合的突破,其在常規彎曲下的功率密度可達1.56 pW/cm²。如今,混合設備將感測、驅動和能量收集功能整合在一個堆疊中,為自主機器人提供了緊湊的解決方案。嵌入地磚中的發電機在人流作用下可產生 249.6 mW 的電力,每塊地磚的成本約為 10.2 美元,展示了智慧建築的低入口能量收集。

日益成長的需求給高溫無鉛材料和低成本聚合物共混物帶來了上行壓力。壓電變壓器在50 kHz時擁有88%的轉換效率,能夠為遠端感測器節點實現射頻能源採集。隨著製造商整合邊緣AI,雜訊濾波測量和雙向回饋迴路變得至關重要,從而保持了感測設備在壓電市場中的中心地位。

得益於PZT成熟的供應鏈和高度的電子機械耦合,陶瓷材料將在2024年佔據67.4%的收益。由於採用軟性穿戴裝置和生物醫學植入的興起,聚合物(尤其是PVDF)正以8.7%的複合年成長率快速成長。單晶材料為航太和國防領域提供了卓越的性能,而複合材料結構則融合了不同的優勢。濕紡PVDF纖維目前在50N壓縮下輸出電壓為0.88V,線性度為R²=0.996,使其在軟性機器人領域的效用前景廣闊。

能隙為 5.9 eV 的 MgSiN2 薄膜表現出 2.3 pC/V 的逆係數,拓展了壓電材料在納機電系統中的整合度。無鉛 Ba0.85Ca0.15Ti0.9Zr0.1O3 陶瓷的逆係數超過 650 pC/N,同時維持 96.5°C 的居里溫度,在不產生重大影響的情況下符合歐盟標準。 Y 摻雜的 ZnO 透過控制載流子濃度實現了 8.5 倍的輸出躍遷,推動氧化物半導體應用於濾波器和感測器領域。這些並行的進展表明,壓電市場將繼續以陶瓷為中心,但市場將日益多元化。

區域分析

受行動電話組裝、汽車電氣化和高速5G部署的規模經濟推動,亞太地區將在2024年佔據全球銷售額的38.8%。中國和韓國正在推動智慧超音波儀表和微型射頻濾波器的發展,而日本的村田製作所、TDK和京瓷則將其深厚的陶瓷專業知識應用於高利潤的多層元件。印度和東南亞吸引了對成本敏感的大宗商品的感測器組裝,澳洲的礦業公司則部署了能源採集用於資產監控。人事費用的上升刺激了自動化投資,從而增強了對高階壓電元件的需求。

北美在價值方面排名第二,這得益於國防和航太專案對高超音速陶瓷的需求。美國國防部將SBIR 24.1計畫撥款用於積層製造紋理壓電元件,刺激了國內研發。加拿大資源礦場指定使用重型採集器用於偏遠油井,美國晶片工廠也擴大了精密平台的採用。 Physik Instrumente在麻薩諸塞州開設了一家佔地12萬平方英尺的工廠,以滿足美國每年30%至50%的需求成長。由於供應鏈距離較近,墨西哥汽車廠將壓電噴油嘴與ADAS觸覺模組整合在一起。

在歐洲,嚴格的環保法規和豪華汽車的生產正在推動無鉛陶瓷和下一代致動器的採用。德國原始設備製造商正在採用壓電懸吊和噴射器,北歐電力公司正在採用電網感測器,法國航太業則對高溫單晶的需求日益成長。隨著海灣地區的管道、智慧城市和太陽能園區部署管道振動收集器和基礎設施流量計,中東和非洲地區的複合年成長率將在2030年達到最高水平,達到8.5%。非洲的供應多元化措施可能導致上游材料在預測期內佔據主導地位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 5G智慧型手機壓電MEMS射頻濾波器的小型化(亞洲)

- 歐洲高階汽車 ADAS 的燃油噴射和壓電致致動器電氣化

- 美國離散製造業對壓電感測器的工業4.0改裝需求

- 韓國和中國公共部署智慧超音波水錶

- 遠程石油和天然氣管道的微振動能源採集(中東)

- 美國國防部高超音速壓電陶瓷獲得聯邦政府資助

- 市場限制

- 歐盟無鉛指令增加PZT替代品的成本

- 鈮和鋰供應單一導致價格波動

- 資本密集型多階段生產限制中小企業進入(日本/德國)

- 航空引擎壓電壓電薄膜的溫度極限

- 產業供應鏈分析

- 監管和技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 依產品類型

- 致動器和電機

- 感應器

- 感應器

- 發電機

- 能量收集器

- 共振器

- 按材質

- 陶瓷製品

- 單晶

- 聚合物(PVDF等)

- 複合材料/其他

- 按運轉方式

- 縱向位移/d33模式

- 並行/d15模式

- 橫向位移/d31模式

- 厚度模式超音波

- 按最終用戶產業

- 資訊科技/通訊

- 家電

- 製造和工業自動化

- 汽車和運輸設備

- 醫療保健和醫療設備

- 航太/國防

- 能源與公共產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 其他南美

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 其他亞太地區

- 中東和非洲

- 中東

- 波灣合作理事會成員國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略性舉措(併購、合資、資金籌措、許可)

- 市佔率分析

- 公司簡介

- APC International, Ltd.

- Physik Instrumente(PI)GmbH and Co. KG

- Morgan Advanced Materials plc

- CTS Corporation(incl. Noliac)

- CeramTec GmbH

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Kyocera Corporation

- Piezotech SAS(Arkema Group)

- Piezomechanik Dr. Lutz Pickelmann GmbH

- Piezosystem Jena GmbH

- Mad City Labs, Inc.

- Aerotech, Inc.

- Johnson Matthey Piezo Products GmbH

- Kistler Group

- Piezo.com(Meggitt PLC)

- Parker Hannifin-Meggitt Sensing

- Mide Technology(QinetiQ North America)

- TRS Technologies, Inc.

- Triumph Group-Transducer Systems

第7章 市場機會與未來展望

The piezoelectric devices market size reached USD 32.9 billion in 2025 and is forecast to climb to USD 45.24 billion by 2030, reflecting a 6.58% CAGR.

Expansion stems from the miniaturization of 5G RF filters, rising automotive electrification, and Industry 4.0 retrofits that rely on robust, energy-efficient piezo components. The adoption of aluminum scandium nitride for bulk acoustic wave filters enables smartphone frequencies above 6 GHz, while the European Union's lead-free agenda accelerates the shift to potassium sodium niobate and bismuth sodium titanate despite their higher manufacturing costs. Asia-Pacific leads demand through large-scale consumer electronics output, and Middle East and Africa shows the fastest growth on oil-and-gas energy harvesting projects. Competitive intensity is moderate because vertically integrated suppliers such as TDK, Murata, and Kyocera secure upstream materials and downstream capacity, yet supply risks around niobium and lithium introduce volatility for defense and aerospace users.

Global Piezoelectric Devices Market Trends and Insights

Miniaturization of Piezo-MEMS RF Filters for 5G Smartphones (Asia)

Bulk acoustic wave filters built on aluminum scandium nitride now achieve frequencies above 6 GHz with coupling coefficients 40% higher than standard aluminum nitride, while maintaining thermal stability to 400 °C. These advances shrink die footprints to 0.83 X 0.75 mm2 and keep insertion losses below 1.5 dB, preserving smartphone battery life. Three-dimensional nanomechanical resonators further consolidate multiband functions onto single chips, creating scalable solutions for ultrawide-band connectivity. Asian wafer-level sealed silicon cavity platforms have achieved quality factors above 439, reducing production steps and cost. As 6G and millimeter-wave initiatives gather pace, demand rises for lithium niobate-based ultra-small filter chips, reinforcing Asia-Pacific's technology leadership.

Electrified Fuel-Injection and ADAS Piezo Actuators in European Premium Cars

Copper-electroded EPCOS multilayer actuators withstand more than 1 billion cycles at 170 °C, offering 20% performance gains over silver-palladium units while trimming material expenses. DENSO's i-ART system integrates microprocessors with piezo injectors to tailor fuel delivery in real time, enhancing engine efficiency under stricter emission norms.] Piezo sensors in semi-active suspension modules support magnetorheological dampers that raise ride comfort and stability for electrified platforms. Frame-type actuators transmit forces over 300 times higher than inertial models, giving advanced driver-assistance systems quicker mechanical response. Haptic feedback modules using PowerHap stacks now move 2 kg automotive displays with precise tactile cues that bolster human-machine interaction.

EU Lead-Free Directive Increasing Cost of PZT Substitutes

The Restriction of Hazardous Substances mandate propels the migration from PZT to lead-free ceramics that carry 15-20% higher production costs and complicate global supply strategies. KNN-based textured ceramics recently reached 550 pC/N piezo coefficients with less than 1.2% variability between 25 °C and 150 °C, making them competitive for performance-critical uses. Recycling methods that reclaim oxides via upside-down composite processing slash energy demand to 1% of virgin production and keep sensing quality intact. Manufacturers must maintain twin supply chains to serve PZT-dependent regions while scaling pristine lines for EU buyers, raising overheads. Cost differentials slow substitution in price-sensitive consumer electronics even as regulatory deadlines loom within two years.

Other drivers and restraints analyzed in the detailed report include:

- Industry 4.0 Retrofit Demand for Piezo Sensors in United States Discrete Manufacturing

- Smart Ultrasonic Meter Roll-outs in South-Korea and China Utilities

- Price Volatility from Single-Source Niobium and Lithium Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sensors captured 32.1% of piezoelectric devices market share in 2024, reflecting their cross-industry ubiquity in smartphones, vehicles, and industrial monitoring. Energy harvesters form the fastest-growing cohort at a 9.1% CAGR, aligned with self-powered IoT rollouts that favor maintenance-free nodes. Actuators and motors hold the second-largest slice by revenue, benefiting from EV adoption and precision manufacturing. Resonators see renewed traction as 5G deployment raises network synchronization requirements. The segment's acceleration mirrors break-throughs in piezoelectric nanogenerators that pair silicone rubber composites with power densities of 1.56 pW/cm2 under daily flexing. Hybrid devices now combine sensing, actuation, and harvesting within a single stack, offering compact solutions for autonomous robots. Generators embedded in floor tiles yield 249.6 mW under foot traffic at roughly USD 10.2 per tile, illustrating low-entry energy harvesting for smart buildings.

Demand convergence places upward pressure on high-temperature lead-free materials and low-cost polymer blends. Piezoelectric transformers boasting 88% conversion efficiency at 50 kHz enable RF-energy harvesting for distant sensor nodes As manufacturers integrate edge AI, noise-filtered measurements and two-way feedback loops become essential, preserving the centrality of sensing devices within the piezoelectric devices market.

Ceramics accounted for 67.4% of 2024 revenue, maintained by PZT's mature supply chain and high electromechanical coupling. Polymers, especially PVDF, are growing fastest at an 8.7% CAGR thanks to flexible wearables and biomedical implants. Single-crystal options deliver premium performance for aerospace and defense, while composite architectures merge disparate advantages. Wet-spun PVDF fibers now register 0.88 V outputs under 50 N compression with R2 = 0.996 linearity, extending utility into soft robotics.

MgSiN2 thin films with a 5.9 eV bandgap show converse coefficients of 2.3 pm/V, broadening piezo integration in nanoelectromechanical systems. Lead-free Ba0.85Ca0.15Ti0.9Zr0.1O3 ceramics top 650 pC/N while keeping Curie temperatures of 96.5 °C, addressing EU compliance without severe trade-offs. Y-doped ZnO exhibits an 8.5-fold output jump through carrier-concentration control, pushing oxide semiconductors toward filter and sensor roles. These parallel advances suggest the piezoelectric devices market will remain ceramic-centric yet increasingly diversified.

The Piezoelectric Devices Market Report is Segmented by Product Type (Actuators and Motors, Sensors, Transducers, and More), Material (Ceramics, Single-Crystal, Polymers, and More), Operating Mode (Compression/D33 Mode, Shear/D15 Mode, and More), End-User Industry (IT and Telecommunication, Consumer Electronics, Healthcare and Medical Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 38.8% of global revenue in 2024, driven by scale advantages in handset assembly, automotive electrification, and fast 5G rollouts. China and South Korea advance smart ultrasonic meters and miniaturized RF filters, while Japan's Murata, TDK, and Kyocera channel deep ceramics expertise into higher-margin multilayer components. India and Southeast Asia attract sensor assembly for cost-sensitive goods, whereas Australia's mining firms deploy energy harvesting for asset monitoring. Rising labor costs spur automation investments, reinforcing premium piezo demand.

North America ranks second in value, underpinned by defense and aerospace programs that require hypersonic-grade ceramics. The Department of Defense earmarked SBIR 24.1 funds for additively manufactured textured piezo components, sparking domestic R&D. Canadian resource sites specify rugged harvesters for remote wells, and US chip fabs expand precision-stage adoption. Physik Instrumente opened a 120,000 sq ft Massachusetts plant to meet 30-50% annual US demand growth. Mexico's vehicle plants integrate piezo injectors and ADAS haptic modules, given supply chain proximity.

Europe leverages stringent environmental rules and luxury-car production to drive lead-free ceramics and next-gen actuators. German OEMs embed piezo suspensions and injectors; Nordic utilities incorporate grid sensors; France's aerospace sector demands high-temperature single crystals. The Middle East and Africa region posts the highest CAGR at 8.5% to 2030 as Gulf pipelines, smart cities, and solar parks deploy pipeline vibration harvesters and infrastructure flow meters. Supply diversification efforts in Africa could evolve into upstream material advantages over the forecast horizon.

- APC International, Ltd.

- Physik Instrumente (PI) GmbH and Co. KG

- Morgan Advanced Materials plc

- CTS Corporation (incl. Noliac)

- CeramTec GmbH

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Kyocera Corporation

- Piezotech S.A.S. (Arkema Group)

- Piezomechanik Dr. Lutz Pickelmann GmbH

- Piezosystem Jena GmbH

- Mad City Labs, Inc.

- Aerotech, Inc.

- Johnson Matthey Piezo Products GmbH

- Kistler Group

- Piezo.com (Meggitt PLC)

- Parker Hannifin - Meggitt Sensing

- Mide Technology (QinetiQ North America)

- TRS Technologies, Inc.

- Triumph Group - Transducer Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Miniaturization of Piezo-MEMS RF Filters for 5G Smartphones (Asia)

- 4.2.2 Electrified Fuel-Injection and ADAS Piezo Actuators in European Premium Cars

- 4.2.3 Industry 4.0 Retrofit Demand for Piezo Sensors in United States Discrete Manufacturing

- 4.2.4 Smart Ultrasonic Meter Roll-outs in South-Korea and China Utilities

- 4.2.5 Micro-Vibration Energy Harvesting for Remote Oil and Gas Pipelines (Middle East)

- 4.2.6 Federal Funding for Hypersonic-Grade Piezo Ceramics in United States Defense

- 4.3 Market Restraints

- 4.3.1 EU Lead-Free Directive Increasing Cost of PZT Substitutes

- 4.3.2 Price Volatility from Single-Source Niobium and Lithium Supply

- 4.3.3 Capital-Intensive Multi-Axis Stage Production Limiting SME Entry (JP/DE)

- 4.3.4 Temperature Limits of Polymer Piezo Films in Aero-engines

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 Actuators and Motors

- 5.1.2 Sensors

- 5.1.3 Transducers

- 5.1.4 Generators

- 5.1.5 Energy Harvesters

- 5.1.6 Resonators

- 5.2 By Material

- 5.2.1 Ceramics

- 5.2.2 Single-Crystal

- 5.2.3 Polymers (e.g., PVDF)

- 5.2.4 Composites/Others

- 5.3 By Operating Mode

- 5.3.1 Compression/d33 Mode

- 5.3.2 Shear/d15 Mode

- 5.3.3 Bending/d31 Mode

- 5.3.4 Thickness-Mode Ultrasonic

- 5.4 By End-user Industry

- 5.4.1 IT and Telecommunication

- 5.4.2 Consumer Electronics

- 5.4.3 Manufacturing and Industrial Automation

- 5.4.4 Automotive and Transportation

- 5.4.5 Healthcare and Medical Devices

- 5.4.6 Aerospace and Defense

- 5.4.7 Energy and Utilities

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, Tech-Licensing)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 APC International, Ltd.

- 6.4.2 Physik Instrumente (PI) GmbH and Co. KG

- 6.4.3 Morgan Advanced Materials plc

- 6.4.4 CTS Corporation (incl. Noliac)

- 6.4.5 CeramTec GmbH

- 6.4.6 TDK Corporation

- 6.4.7 Murata Manufacturing Co., Ltd.

- 6.4.8 Kyocera Corporation

- 6.4.9 Piezotech S.A.S. (Arkema Group)

- 6.4.10 Piezomechanik Dr. Lutz Pickelmann GmbH

- 6.4.11 Piezosystem Jena GmbH

- 6.4.12 Mad City Labs, Inc.

- 6.4.13 Aerotech, Inc.

- 6.4.14 Johnson Matthey Piezo Products GmbH

- 6.4.15 Kistler Group

- 6.4.16 Piezo.com (Meggitt PLC)

- 6.4.17 Parker Hannifin - Meggitt Sensing

- 6.4.18 Mide Technology (QinetiQ North America)

- 6.4.19 TRS Technologies, Inc.

- 6.4.20 Triumph Group - Transducer Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment