|

市場調查報告書

商品編碼

1842541

LTE 和 5G 廣播:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)LTE And 5G Broadcast - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

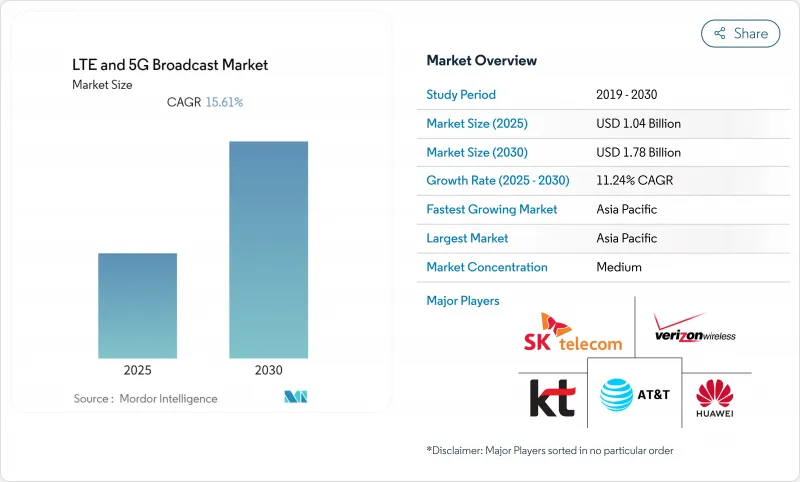

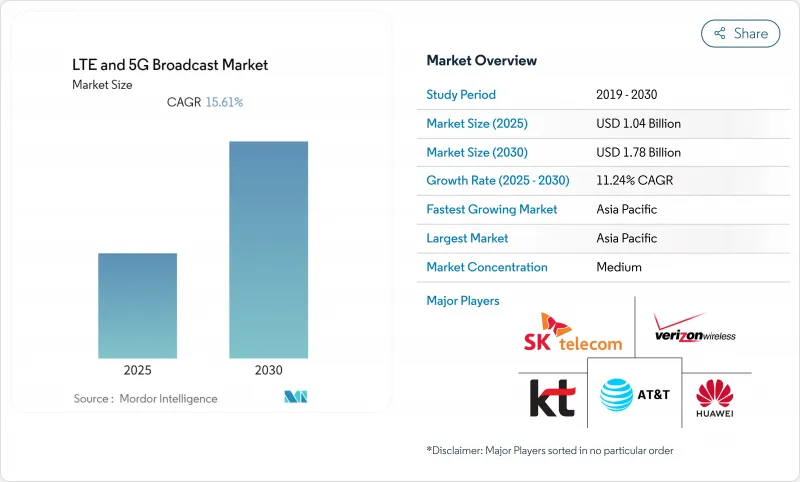

LTE 和 5G 廣播市場預計在 2025 年達到 10.4 億美元,在 2030 年達到 17.8 億美元,複合年成長率為 11.24%。

對高效頻譜視訊分發、現代化緊急警報以及快速設備普及的需求日益成長,推動著商業試驗向全國範圍的部署邁進。通訊業者正在從傳統的 LTE eMBMS 遷移到 5G FeMBMS,以實現多播靈活性和 AI主導的資源分配;廣播公司也在試驗 ATSC 3.0-5G 混合工作流程。融合端到端蜂窩和廣播專業知識的供應商正在贏得早期訂單;Release 18多播增強功能的專利申請暗示著新的授權模式,這可能會進一步重塑競爭格局。

全球 LTE 和 5G 廣播市場趨勢和洞察

行動視訊和直播活動串流需求不斷成長

隨著行動觀眾對 4K、360 度和擴增實境廣播的需求不斷成長,營運商正在轉向多播以緩解單播擁塞。德國電信和愛立信為 2024 年歐洲盃的無線攝影機提供了低於 25 毫秒的延遲和 500Mbps 的上行鏈路,證明了專業製作的可行性。馬來西亞透過網路切片的 5G 連結直播了國慶閱兵式,即使在尖峰負載下也能確保始終如一的品質。廣播公司目前要求每台攝影機保持 50Mbps 的持續上行鏈路速度,但只有當多個觀眾共用同一個多播串流時才能滿足這項要求。 Verizon 正在其私人 5G 廣播套件中添加基於人工智慧的觀眾密度感知功能,以即時微調位元率。

5G 設備數量激增

NTT Docomo 展示了 5G 獨立網路,下載速度達 6.6Gbps,顯示該裝置能夠接收高位元率廣播。 BMW將為其所有 2025 年車型配備 5G 天線,以實現廣播內容的串流傳輸和韌體更新的同步推送。在中國,高階行動電話必須支援 700MHz,這擴大了能夠接收 FeMBMS的裝置量,並加速了服務的使用。雖然目前廣播專用晶片組仍然很少,但汽車資訊娛樂供應商正在率先整合這些晶片組,為更廣泛的消費者應用奠定基礎。

廣播升級資金投入高

與僅提供資料通訊的5G相比,增加多播控制器、重新調整天線以及部署密集的毫米波小型基地台可能會使單站成本增加50%。諾基亞指出,由於營運商為了節省資金而推遲了廣播模組的訂單將出現下降。對於體育場館至關重要的毫米波廣播所需的基地台是Sub-6 GHz頻段的1.5到2倍,這進一步壓縮了預算。一些通訊業者正在採用分階段部署的方案,只允許在承載70%尖峰時段視訊流量的10%的小區上進行廣播,但這種策略延長了全國覆蓋的時間。

細分分析

到2024年,直播賽事串流媒體將維持28%的收益,這主要得益於對品質有嚴格要求的大型體育和文化節目的播出。然而,隨著汽車原始設備製造商同時向數百萬輛汽車推送無線更新,到2030年,連網汽車的複合年成長率將達到12.12%。 BMW全面支援5G的車款系列和特斯拉的工廠內專用網路,彰顯了廣播在生產分析和車載資訊娛樂領域的雙重作用。 LTE和5G廣播市場將支援遠距離診斷、V2X安全訊息以及無需用戶干預的地圖資料更新。

第二條成長通道是公共。 FirstNet 的升級正在添加無人機多播影像和即時隨身攝影機饋送,以提高緊急應變人員的情境察覺。行動電視和視訊點播依靠廣播來減少選舉之夜等突發人群聚集情況下的回程傳輸流量,而廣告網路正在測試基於位置的多播廣告,將本地優惠插入全國視訊串流中。這種用例的多樣化確保了應用層的多樣性,並保持了對任何單一細分市場低迷時期的韌性。

到2024年,LTE eMBMS將佔據LTE和5G廣播市場佔有率的61%,而隨著營運商在其現有5G核心上疊加Release 18軟體,5G FeMBMS的年成長率將達到14.23%。中國移動在100個城市推出FeMBMS證明了其可擴展性,其到2025年將覆蓋範圍擴大兩倍的計劃也表明了其雄心勃勃的時間表。營運商看重FeMBMS在滿足受眾閾值的情況下在單播和多播之間無縫切換的功能,從而最佳化每一兆赫茲。

ATSC 3.0 混合廣播為地面電波媒體公司進入行動傳輸提供了切入點。巴西已製定了在 2026 年世界盃前在全國範圍內推廣 ATSC 3.0 的藍圖,美國通訊委員會 (FCC) 的試驗也正在進行中,展示了行動電話和地面電波融合的潛力。 Release 18 的 AI 調度程式可減少小區邊緣封包遺失並提升移動性。隨著設備生態系統的成熟,LTE eMBMS 遷移場景很可能在未來十年內從共存狀態轉變為日落規劃。

LTE 和 5G 廣播市場報告按應用(公共、聯網汽車、廣告等)、廣播技術(LTE EMBMS、5G FeMBMS 等)、頻段(sub-6 GHz(6 GHz 以下)、 L波段(1-2 GHz)等)、最終用戶(行動網路營運商、汽車 OEM 等)和地區細分。

區域分析

到2024年,亞太地區將佔全球總收入的38%,複合年成長率為14.43%。由中國、日本和韓國政府支援的5G-Advanced部署將從第一天起就納入多播。中國通訊將涵蓋100個城市,到2025年將擴展到300個城市,在同一平台上提供超高清串流媒體、工業IoT和群體警報。日本通訊業者將在2024年將基地台數量增加20%,結合中頻段和毫米波,實現人口稠密的大都會的廣播覆蓋。韓國正在加速製造業和物流業的廣播應用,並透過為工廠提供私人5G補貼來補充消費者5G。

北美位居第二,這得益於FirstNet Authority斥資80億美元打造的十年計劃,其中包括63億美元用於以廣播為中心的5G增強。福特、通用和特斯拉等汽車巨頭正在部署私人5G網路,以同步工廠機器人,並在一夜之間將軟體推送到汽車上。儘管設備生態系統日趨成熟,但資本支出的嚴格限制阻礙了全國廣播的快速升級。

歐洲的監管協調正在推進。歐洲廣播聯盟的5G和衛星混合測試廣播將縮小農村覆蓋差距,同時符合歐盟綠色新政的能源目標。德國在汽車廣播整合方面處於領先地位。 BMW的5G連接計劃涵蓋了組裝和售後更新。中東/非洲和南美等較小的地區也反映了5G的整體時間表。頻譜競標較早完成的地區將在18個月內開始廣播試驗,儘管規模較小。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 行動視訊和實況活動串流媒體的需求不斷成長

- 5G相容設備普及率快速提升

- 利用 5G FeMBMS多播提高頻譜效率

- 緊急警報現代化授權(3GPP Rel-17+)

- 使用廣播頻道進行車載 OTA 更新

- 衛星和移動混合(NTN)融合

- 市場限制

- 廣播級升級的高資本投入

- 頻寬碎片化和監管不確定性

- FeMBMS 支援僅限於某些晶片組/設備

- 邊緣快取和 Wi-Fi 卸載導致投資回報率下降

- 價值鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資和資本趨勢

第5章市場規模及成長預測

- 按用途

- 公共

- 連網汽車

- 實況活動直播

- 行動電視串流媒體

- 廣告投放

- 內容/數據分發

- 視訊點播

- 透過廣播技術

- LTE eMBMS

- 5G FeMBMS

- ATSC 3.0混合廣播

- 按頻寬

- Sub-6 GHz(低於 6 GHz)

- L波段(1-2 GHz)

- 毫米波(24 GHz 以上)

- 按最終用戶

- 行動網路營運商

- 媒體和娛樂公司

- 汽車原廠設備製造商

- 公共機構

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Huawei Technologies Co. Ltd.

- ZTE Corporation

- Ericsson AB

- Nokia Corp.

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- KT Corporation

- Verizon Communications Inc.

- AT&T Inc.

- China Unicom(HK)Ltd.

- SK Telecom Co. Ltd.

- KDDI Corporation

- Telstra Corp. Ltd.

- Reliance Jio Infocomm Ltd.

- Rohde and Schwarz GmbH

- Enensys Technologies SA

- Harmonic Inc.

- Ateme SA

- MediaTek Inc.

- Rohde & Schwarz GmbH & Co KG

第7章 市場機會與未來展望

The LTE and 5G broadcast market size is USD 1.04 billion in 2025 and is forecast to reach USD 1.78 billion by 2030, advancing at an 11.24% CAGR.

Rising demand for spectrum-efficient video delivery, emergency-alert modernization, and rapid device proliferation are expanding commercial trials into nationwide rollouts. Operators are migrating from legacy LTE eMBMS toward 5G FeMBMS to gain multicast flexibility and AI-driven resource allocation, while broadcasters experiment with hybrid ATSC 3.0-5G workflows. Vendors that combine end-to-end cellular and broadcast know-how secure early contracts, and patent filings around Release 18 multicast enhancements hint at new licensing models that could further reshape competition.

Global LTE And 5G Broadcast Market Trends and Insights

Rising demand for mobile video and live event streaming

Operators pivot to multicast to curb unicast congestion as mobile viewers demand 4K, 360-degree, and augmented-reality feeds. Deutsche Telekom and Ericsson delivered sub-25 ms latency and 500 Mbps uplinks for Euro 2024 wireless cameras, proving viability for professional production. Malaysia streamed its National Day parade over a network-sliced 5G link, ensuring stable quality even at peak load. Broadcasters now request 50 Mbps sustained uplink per camera, a requirement met only when several viewers share the same multicast flow. Verizon has added AI-based audience-density recognition inside its private 5G broadcast suite to fine-tune bitrate in real time.

Surge in 5G-enabled device penetration

NTT Docomo demonstrated 6.6 Gbps downlink on 5G Stand-Alone, signaling handset readiness for high-bitrate broadcast reception. BMW equips all 2025 models with 5G antennas to stream broadcast content and push simultaneous firmware updates. China's mandate that premium phones support 700 MHz expanded the installed base capable of FeMBMS reception, accelerating service availability. While broadcast-specific chipsets remain scarce, automotive infotainment suppliers are integrating them first, creating a beachhead for wider consumer adoption.

High CapEx for broadcast-capable upgrades

Adding multicast controllers, re-tuning antennas, and deploying dense mmWave small cells can raise per-site cost by 50% versus data-only 5G. Nokia noted weaker equipment orders in 2024 as operators deferred broadcast modules to preserve cash. mmWave broadcast, essential for stadiums, needs 1.5-2X more base stations than Sub-6 GHz, further stretching budgets. Some carriers adopt phased rollouts, enabling broadcast only on 10% of cells that carry 70% of peak video traffic, yet this tactic elongates nationwide coverage timelines.

Other drivers and restraints analyzed in the detailed report include:

- Spectrum-efficiency gains via 5G FeMBMS multicast

- Emergency-alert modernization mandates

- Limited chipset/device support for FeMBMS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Live Event Streaming retained 28% of 2024 revenue by exploiting marquee sports and cultural broadcasts that demand guaranteed quality levels. Still, Connected Vehicles will post a 12.12% CAGR through 2030 as automotive OEMs push over-the-air updates to millions of cars simultaneously, a task unicast networks struggle to scale. BMW's fully 5G-equipped model line and Tesla's factory private networks show broadcast's dual role in production analytics and in-vehicle infotainment. The LTE and 5G broadcast market underpins remote diagnostics, V2X safety messages, and map data refresh without user intervention.

A second growth lane appears in public safety. FirstNet's upgrade adds multicast drone imagery and real-time body-camera feeds that improve situational awareness for first responders. Mobile TV and video on demand rely on broadcast to reduce backhaul in flash-crowd situations like election nights, while advertising networks test location-based multicast spots that insert local offers into a national video stream. These varied use cases cement application-layer diversity and maintain resilience against single-segment downturns.

LTE eMBMS still commands 61% of the LTE and 5G broadcast market share in 2024 on the strength of earlier deployments, yet 5G FeMBMS grows 14.23% annually as operators overlay Release 18 software onto existing 5G cores. China Mobile's 100-city launch validated FeMBMS scalability, and plans to triple coverage by 2025 illustrate aggressive timelines. Operators appreciate FeMBMS's seamless switch between unicast and multicast when audience thresholds are met, thereby optimizing every megahertz.

ATSC 3.0 hybrid broadcast gives terrestrial media companies an entry point to mobile distribution. Brazil's roadmap to nationwide ATSC 3.0 by the 2026 World Cup and ongoing FCC trials in the United States demonstrate convergent cellular-terrestrial standards. Release 18's AI schedulers cut cell-edge packet loss and boost mobility, benefits that accrue across both LTE and 5G implementations. As device ecosystems mature, the transition narrative will shift from coexistence to sunset planning for LTE eMBMS in the next decade.

The LTE and 5G Broadcast Market Report is Segmented by Application (Public Safety, Connected Vehicles, Advertising, and More), Broadcast Technology (LTE EMBMS, 5G FeMBMS, and More), Frequency Band (Sub-6 GHz (less Than 6 GHz), L-Band (1-2 GHz), and More), End User (Mobile Network Operators, Automotive OEMs, and More), and Geography.

Geography Analysis

Asia Pacific commands 38% of 2024 revenue and grows at 14.43% CAGR. Government-backed 5G-Advanced rollouts in China, Japan, and South Korea embed multicast from day one. China Mobile's coverage of 100 cities, expanding to 300 in 2025, serves UHD streaming, industrial IoT, and mass alerts on the same platform. Japanese operators added 20% more base stations in 2024, pairing mid-band with mmWave for broadcast in dense metros. South Korea complements consumer focus with private 5G grants for factories, accelerating broadcast adoption in manufacturing and logistics.

North America ranks second, propelled by the FirstNet Authority's USD 8 billion ten-year plan, including USD 6.3 billion earmarked for broadcast-centric 5G enhancements. Automotive majors-Ford, GM, Tesla-install private 5G to synchronize plant robots and push software to vehicles overnight. The device ecosystem is mature, yet CapEx discipline tempers rapid nationwide broadcast upgrades.

Europe advances on regulatory harmonization. The European Broadcasting Union's hybrid 5G/satellite pilot reduces rural coverage gaps while complying with EU Green Deal energy targets. Germany leads automotive broadcast integration; BMW's 5G connectivity plan covers both assembly lines and post-sale updates. Smaller regions-Middle East, Africa, South America-mirror overall 5G timelines; where spectrum auctions conclude early, broadcast trials begin within 18 months, albeit at modest scale.

- Huawei Technologies Co. Ltd.

- ZTE Corporation

- Ericsson AB

- Nokia Corp.

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- KT Corporation

- Verizon Communications Inc.

- AT&T Inc.

- China Unicom (HK) Ltd.

- SK Telecom Co. Ltd.

- KDDI Corporation

- Telstra Corp. Ltd.

- Reliance Jio Infocomm Ltd.

- Rohde and Schwarz GmbH

- Enensys Technologies SA

- Harmonic Inc.

- Ateme SA

- MediaTek Inc.

- Rohde & Schwarz GmbH & Co KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for mobile video and live event streaming

- 4.2.2 Surge in 5G-enabled device penetration

- 4.2.3 Spectrum-efficiency gains via 5G FeMBMS multicast

- 4.2.4 Emergency-alert modernization mandates (3GPP Rel-17+)

- 4.2.5 Automotive OTA updates leveraging broadcast channels

- 4.2.6 Hybrid satellite-to-mobile (NTN) convergence

- 4.3 Market Restraints

- 4.3.1 High CapEx for broadcast-capable upgrades

- 4.3.2 Fragmented spectrum and regulatory uncertainty

- 4.3.3 Limited chipset/device support for FeMBMS

- 4.3.4 Edge-caching and Wi-Fi offload diluting ROI

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment and Funding Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Public Safety

- 5.1.2 Connected Vehicles

- 5.1.3 Live Event Streaming

- 5.1.4 Mobile TV Streaming

- 5.1.5 Advertising

- 5.1.6 Content/Data Delivery

- 5.1.7 Video on Demand

- 5.2 By Broadcast Technology

- 5.2.1 LTE eMBMS

- 5.2.2 5G FeMBMS

- 5.2.3 ATSC 3.0 Hybrid Broadcast

- 5.3 By Frequency Band

- 5.3.1 Sub-6 GHz (<6 GHz)

- 5.3.2 L-Band (1-2 GHz)

- 5.3.3 mmWave (>24 GHz)

- 5.4 By End User

- 5.4.1 Mobile Network Operators

- 5.4.2 Media and Entertainment Firms

- 5.4.3 Automotive OEMs

- 5.4.4 Public Safety Agencies

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huawei Technologies Co. Ltd.

- 6.4.2 ZTE Corporation

- 6.4.3 Ericsson AB

- 6.4.4 Nokia Corp.

- 6.4.5 Qualcomm Technologies Inc.

- 6.4.6 Samsung Electronics Co. Ltd.

- 6.4.7 KT Corporation

- 6.4.8 Verizon Communications Inc.

- 6.4.9 AT&T Inc.

- 6.4.10 China Unicom (HK) Ltd.

- 6.4.11 SK Telecom Co. Ltd.

- 6.4.12 KDDI Corporation

- 6.4.13 Telstra Corp. Ltd.

- 6.4.14 Reliance Jio Infocomm Ltd.

- 6.4.15 Rohde and Schwarz GmbH

- 6.4.16 Enensys Technologies SA

- 6.4.17 Harmonic Inc.

- 6.4.18 Ateme SA

- 6.4.19 MediaTek Inc.

- 6.4.20 Rohde & Schwarz GmbH & Co KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment