|

市場調查報告書

商品編碼

1842540

功率放大器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Power Amplifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

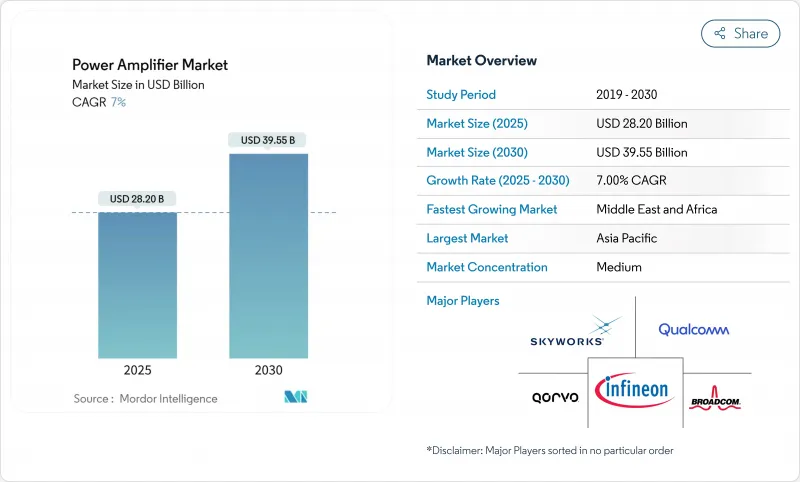

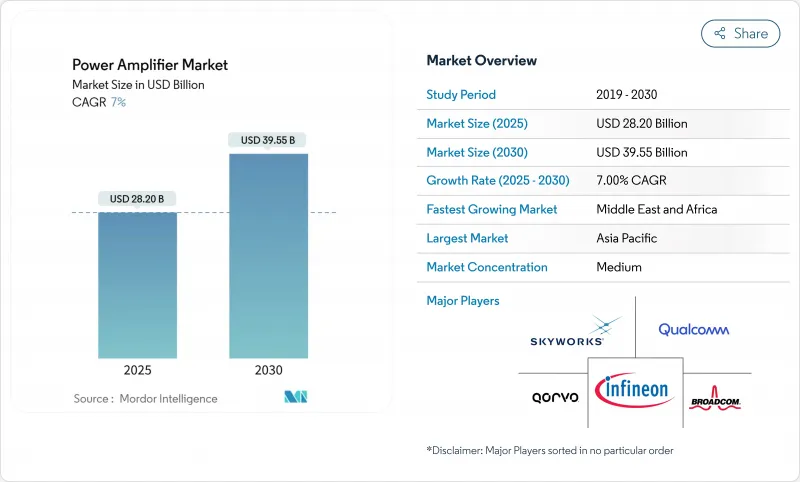

預計功率放大器市場規模到 2025 年將達到 282 億美元,到 2030 年將達到 395.5 億美元,複合年成長率為 7.0%。

5G 的快速部署、Wi-Fi 6/7 更新週期的延長以及汽車行業對高效 D 類音訊平台日益成長的需求,共同支撐了過去一年的收益成長。 GaN 裝置在大型基地台無線電領域持續取代傳統的 GaAs,為營運商提供更高的功率密度和更低的能耗。同時,亞太地區在行動電話功率放大器後端組件方面保持了成本領先地位,使區域供應商能夠加快多頻段射頻前端的上市時間。雖然中頻寬(1-6 GHz)仍然是基礎設施和家用電子電器產品性能和價格的最佳選擇,但隨著衛星寬頻和固定無線接入在 2024 年和 2025 年初的擴展,20 GHz 以上的毫米波放大器的出貨量成長最快。

全球功率放大器市場趨勢和洞察

5G Massive-MIMO 中的 GaN PA

降低每處理比特的能耗。典型的大型基地台無線電單元工作在 1.35 GHz 至 7.6 GHz 的頻率範圍內,在 2024 年的現場部署中,其漏極效率高達 38%,從而降低了通訊業者的營運成本。 GaN晶粒的更小尺寸使其能夠實現更密集的天線面板和簡化的熱佈局,從而實現 64-T/64-R 陣列的大規模出貨,用於都市區密集化計劃。日本和韓國的本地通訊業者利用效率提升來遵守碳減排藍圖,在 2025 年的競標週期中加大了對 GaN 前端模組的採購力度。隨著每瓦成本的持續下降,到 2028 年,GaN 在功率放大器市場的滲透率應能與 GaAs 在大型基地台的滲透率持平。

Wi-Fi 6/7路由器更新

家庭和企業網路基地台供應商正在加速在2024年推出第二代Wi-Fi 6和早期Wi-Fi 7,這需要能夠維持5 GHz和6 GHz多鏈路運作的中功率線性功率放大器。 AsiaRF的AP7988-002平台等解決方案整合了高功率前端模組,可將吞吐量擴展到19 Gbps,從而提高了射頻前端的單價。 2025年第一季,HPE Aruba Networking發布了一款三頻Wi-Fi 7網路基地台,總容量提升了30%,這推動了對具有增強EVM和相鄰頻道洩漏規格的高階晶片的需求。這項更新週期將使功率放大器市場至少在2027年保持強勁的出貨量成長軌跡。

GaAs晶圓供應限制推高BOM成本

出口限制限制了中國冶煉廠的產量,導致2024年下半年鎵供應緊張,導致砷化鎵外延片價格上漲高達18%。因此,多層射頻前端模組面臨材料成本上升的局面,擠壓了行動電話OEM廠商的利潤空間,並加速其向矽基氮化鎵製程的轉型。 Finwave半導體公司已與GlobalFoundries簽署晶圓代工廠協議,將用於6GHz以下行動電話的增強型矽基氮化鎵商業化,旨在抵消砷化鎵的成本波動。雖然長期多元化將限制通膨風險,但短期採購限制正在使功率放大器市場的複合年成長率降低近一個百分點。

細分分析

由於GaAs裝置在1-6 GHz行動電話插座中佔據主導地位,到2024年,其收入將保持41.0%的佔有率,而GaN裝置的出貨量將因大型基地台部署和Ku波段閘道器而激增。預計到2030年,GaN的複合年成長率將達到17.5%,到預測期結束時,將佔據無線接入基礎設施功率放大器市場的近一半。 Qorvo在將其3.5 GHz Doherty級遷移到GaN-on-SiC後,在相同輸出功率下,結溫降低了15°C,這表明營運商的擁有成本更低。

矽鍺對於相位陣列成形核心至關重要,而體矽CMOS則適用於低功耗藍牙和Wi-Fi物聯網節點。 IMEC對GaN MISHEMT偏壓穩定性的研究消除了先前限制30 GHz以上漏極效率的閘極滯後障礙,為GaN在行動裝置毫米波模組中的廣泛應用鋪平了道路。新開發的鑽石基GaN基板有望提供額外的熱餘量,這是後續6G和X波段雷達設計的關鍵推動因素。

在5G宏站、小型基地台和通訊地球站的推動下,射頻和微波類別佔2024年總收入的57.3%。 Filtronic交付了Ku波段GaN MMIC,其PAE性能比領先的GaAs產品線高出40%,並實現了更緊湊的陣列孔徑。音頻功率放大器是一個規模雖小但成長迅速的細分市場。由於智慧音箱和多驅動器車載娛樂系統的普及,其出貨量正在成長,而GaN FET消除了死區時間限制,而死區時間限制曾限制了高功率D類電路板中矽MOSFET的保真度。

用於等離子體和加熱的工業和科學射頻發生器也推動了對碳化矽 (SiC) 和氮化鎵 (GaN) 電晶體的需求。德克薩斯(TI) 透過擴展其寬頻 LDMOS 預驅動器產品目錄,以滿足工業雷射和 MRI 磁鐵中的功率級需求,增強了其射頻產品類型作為功率放大器市場收益驅動力的作用。

功率放大器市場按技術(矽、砷化鎵等)、產品類型(音訊放大器、射頻/微波功率放大器)、頻寬(低於 1 GHz、1-6 GHz 等)、類別(A 類、B 類、AB 類等)、垂直(消費性電器、工業、其他)和地區(北美、南美、歐洲、亞洲、中東和非洲)。

區域分析

2024年,亞太地區將佔全球銷售額的48.7%,這主要得益於中國行動電話組裝廠的推動,這些工廠消耗了該地區一半以上的低頻寬砷化鎵(GaAs )晶片。韓國晶圓廠利用垂直整合提升5G射頻前端產量,而日本材料製造商則擴大了碳化矽(SiC)晶圓產量,以彌補氮化鎵(GaN)基板的缺口。在印度,與智慧型手機EMS廠商生產連結獎勵計畫刺激了國內需求,催生了一個新興但充滿活力的射頻測試和封裝公司叢集。短期內,亞洲優先發展自身化合物半導體供應鏈的政策將鞏固其在功率放大器市場的區域主導地位。

北美地區按以金額為準排名第二。 Qorvo、Broadcom 和 Wolfspeed 等領導企業利用其在 GaN 功率密度和熱感封裝方面的專利組合,贏得了新的國防和 5G O-RAN 獎項。美國國防部的雷達現代化計畫採用了X波段GaN 模組,其元件平均售價顯著超過商用級。通訊業者繼續成為主要買家,在密集的城市叢集中將中頻載波升級到 64T/64R 陣列。

歐洲市場佔有率主要由德國和法國佔據,汽車製造商和航太製造商紛紛將高線性功率放大器應用於車載音響、ADAS和多頻段衛星通訊。歐盟生態設計閒置功率法規推動了D類功率放大器的快速遷移,導致傳統庫存與新規格之間出現暫時性不匹配。英國工廠透過公私合作探索鑽石氮化鎵外延技術,以維持與亞洲同行的競爭力。

中東和非洲地區雖然規模較小,但成長最快,複合年成長率達11.4%,這得益於Ka波段電信港的擴建和政府低軌連接計畫的推動。沙烏地阿拉伯和奈及利亞的國營營運商投資了整合40W Ku波段功率放大器(SSPA)的閘道器,擴大了其在功率放大器市場的潛在佔有率。受巴西5G中頻段競標和政府對農村寬頻的支持推動,南美洲持續保持溫和成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 5G Massive-MIMO 中的 GaN PA 整合

- 升級 Wi-Fi 6/7 路由器以增強中功率PA

- D類音頻PA在電動車資訊娛樂系統與ADAS系統的應用

- LEO衛星星系驅動 Ku/ Ka波段SSPA

- 工業4.0推動智慧工廠射頻加熱需求

- O-RAN碎片化為多供應商PA創造了機會

- 市場限制

- GaAs晶圓供應限制推高BOM成本

- 歐盟生態設計音頻功率放大器的閒置功率限制

- 中國無晶圓廠的進入侵蝕了低階CMOS PA的價格

- 手機中 28GHz 以上矽功率放大器的溫度控管限制

- 價值鏈分析

- 監理展望

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

- 關鍵績效指標

- 宏觀經濟因素的影響

第5章市場規模及成長預測

- 依技術

- 矽(Si)

- 砷化鎵(GaAs)

- 氮化鎵(GaN)

- 矽鍺(SiGe)

- 互補型MOS(CMOS)

- 其他技術

- 按產品

- 音頻功率放大器

- 射頻/微波功率放大器

- 按頻寬

- 低於1 GHz

- 1-6 GHz

- 6-20 GHz

- 超過 20 GHz

- 按類別

- A類

- B類

- AB類

- D類

- E/F類等

- 按行業

- 消費性電子產品

- 產業

- 通訊業

- 車

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 瑞典

- 丹麥

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- UAE

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Broadcom Inc.

- Qorvo Inc.

- Skyworks Solutions Inc.

- Qualcomm Technologies Inc.

- Infineon Technologies AG

- Texas Instruments Inc.

- Analog Devices Inc.

- NXP Semiconductors NV

- STMicroelectronics NV

- Renesas Electronics Corp.

- Wolfspeed Inc.

- MACOM Technology Solutions Inc.

- ON Semiconductor Corp.

- Microchip Technology Inc.

- Rohm Semiconductor

- Panasonic Corp.

- Murata Manufacturing Co. Ltd.

- Mini-Circuits

- CAES(Cobham Advanced Electronics)

- Sumitomo Electric Device Innovations

- Empower RF Systems

- Falcomm Inc.

- Finwave Semiconductor Inc.

第7章 市場機會與未來展望

The power amplifier market size was valued at USD 28.20 billion in 2025 and is forecast to reach USD 39.55 billion by 2030, reflecting a compound annual growth rate (CAGR) of 7.0%.

Rapid 5G roll-outs, expanding Wi-Fi 6/7 refresh cycles, and growing automotive demand for high-efficiency Class-D audio platforms have underpinned revenue expansion over the past year. GaN devices continued to displace legacy GaAs in macro-cell radios, offering higher power density and reduced energy consumption for operators. Meanwhile, Asia-Pacific kept its cost-leadership advantage in handset power-amplifier back-end assembly, enabling regional vendors to accelerate time-to-market for multi-band RF front ends. Mid-band spectrum (1-6 GHz) remained the performance-price sweet spot for both infrastructure and consumer electronics, yet mmWave amplifiers above 20 GHz recorded the fastest unit growth as satellite broadband and fixed-wireless access scaled in 2024 and early 2025.

Global Power Amplifier Market Trends and Insights

GaN PAs in 5G Massive-MIMO

reduce energy use per bit handled. Typical macro-cell radio units operating from 1.35 GHz to 7.6 GHz reported up to 38% drain efficiency in field deployments during 2024, cutting operating expenditure for carriers. The smaller footprint of GaN die enabled denser antenna panels and simplified thermal layouts, allowing 64-T/64-R arrays to ship in volume for urban densification projects. Regional operators in Japan and South Korea capitalized on the efficiency gains to comply with carbon-reduction roadmaps, reinforcing procurement of GaN front-end modules across 2025 bid cycles. As costs per watt continue to fall, GaN penetration in the power amplifier market should approach parity with GaAs in macro-cells before 2028.

Wi-Fi 6/7 Router Refresh

Home and enterprise access-point vendors accelerated second-generation Wi-Fi 6 and early Wi-Fi 7 launches in 2024, requiring mid-power linear PAs capable of sustaining multi-link operation across 5 GHz and 6 GHz. Solutions such as AsiaRF's AP7988-002 platform integrated a high-power front-end module that extended throughput to 19 Gbps, thereby lifting unit ASPs for RF front ends. In Q1 2025, HPE Aruba Networking released tri-band Wi-Fi 7 access points that improved aggregate capacity by 30%, intensifying demand for premium silicon with tighter EVM and adjacent-channel leakage specifications. This refresh cycle is set to keep the power amplifier market on a robust shipment trajectory through at least 2027.

GaAs Wafer Supply Constraints Elevating BOM Costs

Gallium availability tightened in late 2024 after export-control measures constrained Chinese refinery output, inflating GaAs epi-wafer pricing by up to 18%. Multilayer RF front-end modules, therefore, faced higher bill-of-materials outlays, pressuring handset OEM margins and encouraging an accelerated pivot toward GaN-on-silicon processes. Finwave Semiconductor signed a foundry pact with GlobalFoundries to commercialize enhancement-mode GaN-on-Si for sub-6 GHz phones, aiming to neutralize GaAs cost volatility. While long-term diversification will damp inflationary risk, short-run sourcing difficulties are trimming the headline CAGR of the power amplifier market by nearly one percentage point.

Other drivers and restraints analyzed in the detailed report include:

- EV Infotainment and ADAS Adoption of Class-D Audio PAs

- LEO Satellite Constellations Driving Ku/Ka-band SSPAs

- EU Eco-Design Idle-Power Caps on Audio PAs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

GaAs devices retained a 41.0% revenue position in 2024 on the strength of entrenched 1-6 GHz handset sockets, yet GaN shipments surged on macro-cell roll-outs and Ku-band gateways. GaN's 17.5% CAGR through 2030 is projected to lift its portion of the power amplifier market size for radio-access infrastructure to almost half by the end of the forecast window. Qorvo documented a 15 °C reduction in junction temperature at identical output power after migrating a 3.5 GHz Doherty stage to GaN-on-SiC, validating cost-of-ownership savings for operators.

Silicon-germanium remained integral to phased-array beamforming cores, whereas bulk CMOS stayed relevant in low-power Bluetooth and Wi-Fi IoT nodes. Research at IMEC on GaN MISHEMT bias stability removed gate-lag barriers that previously capped drain efficiency above 30 GHz, clearing a pathway for GaN proliferation in handset mmWave modules. Emerging GaN-on-diamond substrates promise further thermal headroom, a key enabler for subsequent 6G and X-band radar design-ins.

RF and microwave categories generated 57.3% of 2024 revenue, anchored by 5G macros, small cells, and satcom earth stations. Filtronic shipped Ku-band GaN MMICs rated at 80 W that outperformed preceding GaAs line-ups by 40% PAE, unlocking more compact array apertures. Audio power amplifiers contributed a smaller but fast-growing slice: proliferation of smart-speakers and multi-driver in-vehicle entertainment lifted shipments, and GaN FETs removed dead-time limitations that constrained silicon MOSFET fidelity in high-power class-D boards.

Industrial and scientific RF generators for plasma and heating also elevated SiC and GaN transistor demand. Texas Instruments expanded its wideband LDMOS pre-driver catalog to service industrial laser and MRI magnet power stages, reinforcing the RF product category's role as the revenue mainstay of the power amplifier market.

Power Amplifier Market is Segmented by Technology (Silicon, Gallium Arsenide, and More), by Product (Audio Power Amplifiers and RF/Microwave Power Amplifiers), by Frequency Band (< 1 GHz, 1 - 6 GHz, and More), by Class (Class A, Class B, Class AB, and More), by Industry Vertical (Consumer Electronics, Industrial, and More), and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 48.7% of global revenue in 2024, anchored by China's handset assembly corridors, which consumed more than half of the region's low-band GaAs die. Korean fabs leveraged vertical integration to ramp 5G RF front ends, while Japanese material suppliers expanded SiC wafer output to mitigate GaN substrate gaps. India's production-linked incentives for smartphone EMS houses widened domestic demand, creating a nascent yet vibrant cluster of RF test and packaging firms. Over the near term, Asia's policy emphasis on indigenous compound-semiconductor supply chains is positioned to strengthen regional control over the power amplifier market.

North America ranked second by value. Dominant players such as Qorvo, Broadcom, and Wolfspeed exploited patent portfolios in GaN power density and thermal packaging to capture new defense and 5G O-RAN awards. The Pentagon's radar-modernization programs adopted X-band GaN tiles, pushing device ASPs significantly above commercial grades. Telecom operators remained central buyers, upgrading mid-band carriers to 64T/64R arrays in dense urban clusters.

Europe's share centered on Germany and France, where automotive and aerospace manufacturers absorbed high-linearity PAs for in-cabin audio, ADAS, and multi-band sat-comms. The EU Eco-Design idle-power regulation prompted a swift transition toward Class-D, creating a temporary mismatch between legacy inventory and new-build specs. United Kingdom fabs explored GaN-on-diamond epitaxy through public-private consortia to retain competitiveness against Asian peers.

The Middle East and Africa region, though smaller, exhibited the fastest growth at an 11.4% CAGR, fueled by Ka-band teleport expansion and sovereign LEO connectivity programs. National operators in Saudi Arabia and Nigeria earmarked capex for gateways that integrate 40 W Ku-band SSPAs, broadening the addressable slice of the power amplifier market. South America followed with moderate uptake, led by Brazil's 5G mid-band auctions and state-backed rural broadband.

- Broadcom Inc.

- Qorvo Inc.

- Skyworks Solutions Inc.

- Qualcomm Technologies Inc.

- Infineon Technologies AG

- Texas Instruments Inc.

- Analog Devices Inc.

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Renesas Electronics Corp.

- Wolfspeed Inc.

- MACOM Technology Solutions Inc.

- ON Semiconductor Corp.

- Microchip Technology Inc.

- Rohm Semiconductor

- Panasonic Corp.

- Murata Manufacturing Co. Ltd.

- Mini-Circuits

- CAES (Cobham Advanced Electronics)

- Sumitomo Electric Device Innovations

- Empower RF Systems

- Falcomm Inc.

- Finwave Semiconductor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of GaN PAs in 5G Massive-MIMO

- 4.2.2 Wi-Fi 6/7 Router Refresh Boosting Mid-Power PAs

- 4.2.3 EV Infotainment and ADAS Adoption of Class-D Audio PAs

- 4.2.4 LEO Satellite Constellations Driving Ku/Ka-band SSPAs

- 4.2.5 Smart-Factory RF-Heating Demand via Industry 4.0

- 4.2.6 O-RAN Disaggregation Creating Multi-Vendor PA Opportunities

- 4.3 Market Restraints

- 4.3.1 GaAs Wafer Supply Constraints Elevating BOM Costs

- 4.3.2 EU Eco-Design Idle-Power Caps on Audio PAs

- 4.3.3 Low-End CMOS PA Price Erosion from Chinese Fabless Entrants

- 4.3.4 Thermal-Management Limits on >28 GHz Silicon PAs in Handsets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Key Performance Indicators

- 4.10 Impact of Macroeconomic factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Silicon (Si)

- 5.1.2 Gallium Arsenide (GaAs)

- 5.1.3 Gallium Nitride (GaN)

- 5.1.4 Silicon Germanium (SiGe)

- 5.1.5 Complementary MOS (CMOS)

- 5.1.6 Other Technologies

- 5.2 By Product

- 5.2.1 Audio Power Amplifiers

- 5.2.2 RF / Microwave Power Amplifiers

- 5.3 By Frequency Band

- 5.3.1 < 1 GHz

- 5.3.2 1 - 6 GHz

- 5.3.3 6 - 20 GHz

- 5.3.4 > 20 GHz

- 5.4 By Class

- 5.4.1 Class A

- 5.4.2 Class B

- 5.4.3 Class AB

- 5.4.4 Class D

- 5.4.5 Class E/F and Others

- 5.5 By Industry Vertical

- 5.5.1 Consumer Electronics

- 5.5.2 Industrial

- 5.5.3 Telecommunications

- 5.5.4 Automotive

- 5.5.5 Other Industry Verticals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Sweden

- 5.6.3.6 Denmark

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global and Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Broadcom Inc.

- 6.4.2 Qorvo Inc.

- 6.4.3 Skyworks Solutions Inc.

- 6.4.4 Qualcomm Technologies Inc.

- 6.4.5 Infineon Technologies AG

- 6.4.6 Texas Instruments Inc.

- 6.4.7 Analog Devices Inc.

- 6.4.8 NXP Semiconductors N.V.

- 6.4.9 STMicroelectronics N.V.

- 6.4.10 Renesas Electronics Corp.

- 6.4.11 Wolfspeed Inc.

- 6.4.12 MACOM Technology Solutions Inc.

- 6.4.13 ON Semiconductor Corp.

- 6.4.14 Microchip Technology Inc.

- 6.4.15 Rohm Semiconductor

- 6.4.16 Panasonic Corp.

- 6.4.17 Murata Manufacturing Co. Ltd.

- 6.4.18 Mini-Circuits

- 6.4.19 CAES (Cobham Advanced Electronics)

- 6.4.20 Sumitomo Electric Device Innovations

- 6.4.21 Empower RF Systems

- 6.4.22 Falcomm Inc.

- 6.4.23 Finwave Semiconductor Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment