|

市場調查報告書

商品編碼

1842515

鑽孔機:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Drilling Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

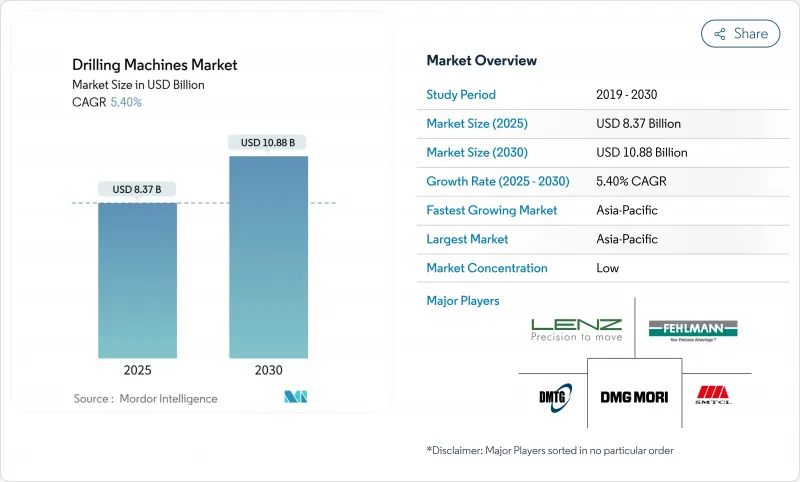

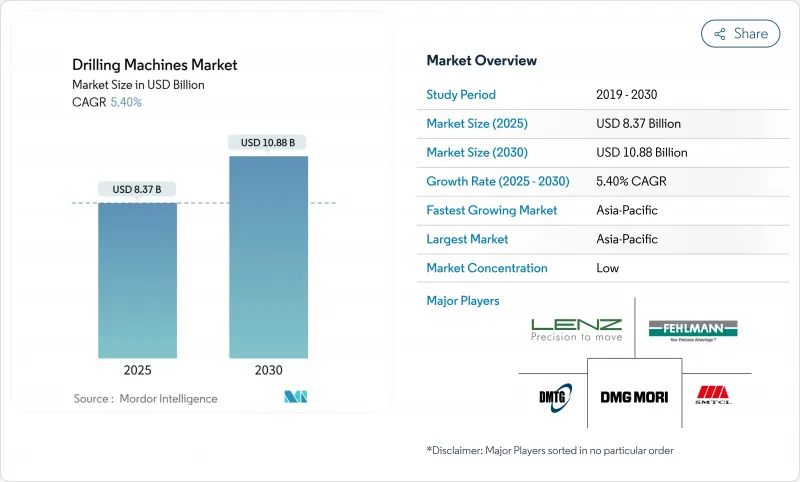

預計 2025 年鑽孔機市場價值將達到 83.7 億美元,到 2030 年將達到 108.8 億美元,複合年成長率為 5.40%。

成長與電動車電池生產線對高精度、多主軸的需求、商用航太生產的復甦以及風力發電機零件產能的擴大息息相關。在大宗商品持續波動的背景下,持續的自動化、輕質材料使用的增加以及對深孔、大直徑加工的需求正在推動資本投資。儘管石油和天然氣應用領域存在短期採購猶豫,但電池製造商、變速箱供應商和造船廠的增加投資仍維持著設備積壓。領先的供應商正在擴展改裝服務和數位化套件,以填補熟練操作員的短缺,並在技術要求高的競標中脫穎而出。

全球鑽孔機市場趨勢與洞察

電動車和可再生能源製造業的快速成長需要高精度多軸鑽孔

由於電池組組裝對孔公差的要求達到亞微米級別,電池供應商正在指定能夠在高產量下保持剛性的多主軸系統。各大電池集團正在整合閉合迴路扭力工具和3D定位系統,以控制扣夾力變化並保護電極對準,同時提高年度生產線產能。類似的精度門檻也正在轉向太陽能追蹤器支架和機艙輪轂,在這些應用中,必須在不影響疲勞性能的情況下對輕質鋁型材進行鑽孔。設備供應商正在透過在主軸頭上安裝硬體安裝振動感測器,並搭配可在毫秒內調整進給速度的邊緣運算模組來應對此需求。亞太地區的需求最為強勁,但歐洲超級工廠和北美公用事業規模的太陽能發電場也需要類似的能力。

商業航太生產的加速推動了對大型徑向機器的需求

Airframe Prime 正在將其單通道飛機計劃恢復到每月 60 架,並更新了競標,該鑽機可在一次設置過程中切割鈦框架構件。五軸自動化和托盤共享允許以更少的工位移動機身部分,同時保持 25 微米的位置重複精度。數位孿生現在將即時扭力和推力數據輸入製造執行系統,在鉚釘錯位之前標記工具磨損異常。這種方法對於永續性認證至關重要,因為減少材料廢料可以直接減少範圍 3排放。雖然北美 Tear-On 仍然處於領先地位,但歐盟航空結構供應商也正在效仿擴大產能,以實現訂單的恢復目標。

大宗商品投資週期削弱資本設備訂單

平均而言,油田服務公司會在原油價格超過損益平衡點時增加工具機採購,但當價格下跌時,他們會迅速延後採購。因此,鑽井承包商在產能過剩和維護延期之間搖擺不定,導致設備製造商的報價週期難以預測。中游加工廠也反映了這種節奏,將採購承諾推遲到最終投資決策做出時。外匯波動為以美元採購設備的拉丁美洲礦業公司帶來了額外的不確定性。這導致銷售管道變長,供應商需要增加營運資金(例如備件和演示設備),以確保快速週轉的訂單。

細分分析

徑向銑床因其在汽車底盤、通用機械和中型鑄件等應用領域的多功能性,在2024年創造了最大的收益。立式銑床和車削中心佔據32.45%的市場佔有率,支援生產單元以均衡的觸覺流程完成矩形零件。由於汽車原始設備製造商繼續供應量產車型,而鋼製和鐵製轉向節屬於徑向生產能力範圍,因此需求仍然強勁。然而,深孔/BTA子集的成長速度最快,複合年成長率達到6.8%,這得益於大直徑能源零件、壓力容器管板和航太機翼樑的廣泛應用。買家表示,他們轉換該子集的原因是每個孔的循環時間更短、冷卻液輸送更佳以及自動排屑排放。

複雜的推拉式工具和嚴格的同心度要求,使得這個細分市場擁有更高的利潤空間。跨國國防造船廠和海上齒輪箱聯合體正在選擇龍門式配置,以便在進程內恢復熱變形。可攜式磁力鑽和微型鑽機叢集為電子設備和現場服務管道提供了緊湊且可快速重新部署的單元。雖然這些設備在鑽機市場中只佔很小的佔有率,但它們在感測器融合和電池模組方面具有開創性,並隨後進入了更重型的領域,從而形成了技術的良性循環。

由於入門成本低且易於維護,手動鑽機仍佔已安裝基數的45.65%。加工車間處理混合批次的維修工作,夾具周轉率率高於週期效率,因此手動主軸和機械限位器仍然具有吸引力。儘管如此,隨著大型按圖生產工廠進行現代化改造以滿足可追溯性要求並彌補勞動力缺口,數控/自動化系統的複合年成長率最高,達到7.3%。機器製造商正在將程式碼模擬、刀具壽命儀錶板和車間MES連結捆綁為標準配置,而不是付費附加元件。

半自動格式構成中階,將液壓進給與操作員監控結合。半自動格式構成中階層,將液壓進給與操作員監控相結合,在客製化重型設備生產線中表現出色,這些生產線的幾何形狀會隨批次變化,且切削深度保持較高。物聯網主軸探頭安裝在復古立柱上,並將振動和推力數據發送到雲分析,從而從沉沒資產中獲取額外運轉率。此類改造透過在已經折舊免稅額的硬體上增加訂閱軟體收益來擴大鑽機市場。

區域分析

預計到2024年,亞太地區將佔銷售額的46.76%,到2030年將維持7.1%的複合年成長率。受政府鼓勵國產數控系統(CNC)的政策推動,中國工具機園區持續擴張。日本製造商正在東協地區實現零件加工本地化,以規避外匯風險。印度製造群也在與生產掛鉤的激勵措施下進行現代化升級。單元工廠、離岸風力發電和地鐵車輛鑄造廠的興起將保持較高的主軸運轉率,並增加維修和改裝機會。

北美的設備基礎技術先進,但在大宗商品價格下跌的周期中卻未被充分利用。回流獎勵和清潔能源稅額扣抵正在提振高階製造商的訂單,為航空航太桁條和電池模組托架的新型複合材料電池提供了保障。加拿大石化工廠和美國航太墨西哥灣沿岸的造船廠正在升級為液壓深孔鑽機,以支持液化天然氣(LNG)的擴張,從而穩定了大型鑽機的市場規模,使其不受週期性鑽機數量的影響。

歐洲正走向成熟,但正轉向零排放強制標準,加速淘汰傳統的三軸鑽孔機,轉而採用配備線上功率分析儀的伺服電動龍門架。一家德國整合商正在測試一種預測性潤滑演算法,可將風電塔法蘭生產線的非計劃性停機時間減少12%。一家南歐造船廠正在競標一台6公尺行程的大直徑立柱機,該機器能夠一次生產鍍鋅艙壁貫穿件,用於船舶翻新。

在中東和非洲,預計鑽機需求將成長31%,這得益於阿拉伯聯合大公國自升式鑽井平台的維修以及沙烏地阿拉伯製造業村為配合「2030願景」鋼鐵計畫而進行的場地升級。撒哈拉以南非洲地區鐵路基礎設施的現代化建設,推動了對能夠在現場條件下加工軌道接頭的移動式磁力鑽的需求。在南美洲,巴西的鹽層下開發和阿根廷的頁岩油田開發處於領先地位,需要配備高扭矩液壓鑽床的管道修整車間。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 電動車和可再生能源製造業的快速成長需要高精度多軸鑽孔

- 商業航太生產的加速推動了對大型徑向機器的需求

- 全球風力發電機齒輪箱產能擴張刺激深孔鑽探投資

- 現場模組化施工的興起促進了可攜式磁力鑽的採用

- 全球國防造船計劃強制要求本地化

- 上游油田修井維修增加對大型工具的需求

- 市場限制

- 大宗商品投資週期抑制資本設備訂單

- 全球數控操作員和機械師技能短缺

- 複雜形狀的積層製造替代方案

- 五軸鑽孔中心對於中小型企業來說初始成本較高

- 價值/供應鏈分析

- 監理展望

- 科技趨勢

- 製造業展望

- 產業吸引力—五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按類型

- 旋臂鑽床

- 立式/立柱式/支柱式鑽床

- 敏感/桌上型鑽床

- 排鑽孔機

- 深孔/BTA 和槍鑽機

- 可攜式鑽孔機

- 轉塔鑽床

- 其他(磁力鑽、微型鑽、專用鑽孔機)

- 按操作

- 手動型

- 半自動

- 數控/自動

- 按技術/動力來源

- 機械/電動式

- 油壓

- 氣壓

- 按最終用戶產業

- 車

- 航太/國防

- 加工和工業機械

- 建造

- 石油、天然氣和能源

- 電子和電氣

- 造船/海洋

- 其他最終用戶(重型機械、醫療設備等)

- 按工作材質

- 金屬

- 複合材料、聚合物和塑膠

- 木頭

- 其他(陶瓷、玻璃、混凝土等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 秘魯

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- Nordix(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東協(印尼、泰國、菲律賓、馬來西亞、越南)

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 土耳其

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- DMG MORI Co. Ltd.

- Mazak Corporation

- Okuma Corporation

- Haas Automation Inc.

- Doosan Machine Tools Co. Ltd.

- Makino Milling Machine Co. Ltd.

- Dalian Machine Tool Group Co. Ltd.

- SMTCL(Shenyang Machine Tool)

- Tongtai Machine & Tool Co. Ltd.

- Hurco Companies Inc.

- ERNST LENZ Maschinenbau GmbH

- Fehlmann AG

- Gate Machinery International Ltd.

- Kaufman Manufacturing Company

- DATRON AG

- Scantool Group

- Taiwan Winnerstech Machinery Co. Ltd.

- Roku-Roku Co. Ltd.

- Hsin Geeli Hardware Enterprise Co. Ltd.

- Minitool Inc.

- LTF SpA*

第7章 市場機會與未來展望

The Drilling Machines Market was valued at USD 8.37 billion in 2025 and is forecast to reach USD 10.88 billion by 2030, advancing at a 5.40% CAGR.

Growth is tied to high-precision, multi-spindle requirements in electric-vehicle battery lines, recovering commercial aerospace output, and expanding wind-turbine component capacity. Continued automation, wider use of lightweight materials, and demand for deep-hole, large-radial formats keep capital expenditures on track even as commodity volatility persists. Rising investments by battery producers, gearbox suppliers, and shipyards sustain equipment backlogs despite short-term procurement hesitancy in oil and gas applications. Major suppliers are broadening retrofit services and digital suites to offset skilled-operator scarcity and differentiate in technically demanding bids.

Global Drilling Machines Market Trends and Insights

Surge in EV & Renewable-Energy Manufacturing Requiring High-Precision Multi-Spindle Drilling

Battery pack assembly now demands sub-micron hole tolerances, pushing cell suppliers to specify multi-spindle systems that can maintain rigidity at elevated throughput. Leading battery groups have integrated closed-loop torque tools and 3-D positioning to control clamp-force variation, lifting annual line capacity while safeguarding electrode alignment. Similar precision thresholds are migrating into solar-tracker mounts and nacelle hubs, where lightweight aluminum sections must be drilled without compromising fatigue performance. Equipment vendors have reacted by hard-mounting vibration sensors in spindle heads and pairing them with edge-computing modules that adjust feed rates in milliseconds. Demand is strongest in the Asia-Pacific corridor, but European gigafactories and North American utility-scale solar yards also seek identical capabilities.

Accelerating Commercial Aerospace Production Boosting Demand for Large Radial Machines

Airframe primes are ramping single-aisle programs back to 60 aircraft per month, renewing tenders for long-reach radial drills that cut titanium frame members in one-setup passes. Five-axis automation and pallet pools allow fuselage sections to move through fewer stations while sustaining 25 µm positional repeatability. Digital twins now feed real-time torque and thrust data to manufacturing execution systems, flagging tool-wear anomalies before rivet misalignment can occur. The approach is critical for sustainability credentials, as material scrap reductions directly lower Scope 3 emissions. North American tier-ones remain the pacesetters, yet EU aerostructure suppliers are mirroring capacity additions to meet backlog recovery targets.

Commodity-Investment Cyclicality Dampening Capital Equipment Orders

Oil-field service firms expand machine-tool fleets when crude averages above breakeven, yet they swiftly defer procurement under price dips. Drilling contractors, therefore, swing between over-capacity and deferred maintenance, creating unpredictable quoting cycles for machine builders. Mid-stream fabrication yards mirror this rhythm, delaying purchase commitments until final investment decisions close. Currency swings add further uncertainty for Latin American miners sourcing dollar-denominated equipment. The result is elongated sales funnels requiring vendors to carry higher working capital in spares and demo fleets to capture short-window orders.

Other drivers and restraints analyzed in the detailed report include:

- Global Expansion of Wind-Turbine Gearbox Capacity Spurring Deep-Hole Drill Investments

- Rise of On-Site Modular Construction Fueling Portable Magnetic Drill Adoption

- Global CNC-Operator and Machinist Skill Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radial machines generated the largest revenue in 2024 on the strength of their versatility across automotive chassis, general machinery, and medium-sized casting work. At a 32.45% share, they anchor production cells that pair vertical mills and turning centers to complete prismatic components in balanced takt flows. Demand remains buoyant as vehicle OEMs still deliver volume models whose steel and iron knuckles fall within radial capacity envelopes. Yet the deep-hole/BTA subset is rising fastest, logging a 6.8% CAGR amid broader adoption in large-bore energy parts, pressure-vessel tube sheets, and aerospace wing spars. Buyers cite lower per-hole cycle times, improved coolant delivery, and automated chip evacuation as reasons for switching.

The niche commands incremental premium margins, given its complex push-pull tooling and tight concentricity specifications. Multinational defense yards and offshore gearbox consortiums opt for gantry configurations able to reclaim heat distortion in-process. Portable magnetic and micro-drill clusters round out the category, feeding electronics and field-service channels with compact units amenable to fast redeployment. These variants, though a smaller slice of the drilling machines market, pioneer sensor fusion and battery modules that later migrate to heavier classes, creating a virtuous technology loop.

Manual rigs still occupy 45.65% of the installed base thanks to low entry costs and simple maintenance. Job-shops handle mixed-lot repair work where fixture turnover outweighs cycle efficiency, preserving the appeal of hand-feed quills and mechanical depth stops. Nevertheless, CNC/automatic systems chart the steepest 7.3% CAGR as large build-to-print houses modernize to meet traceability mandates and mitigate labor gaps. Machine builders bundle code simulation, tool-life dashboards, and shop-floor MES links as standard rather than chargeable add-ons.

Semi-automatic formats form an intermediate tier, marrying hydraulic feeds to operator supervision. They thrive in custom heavy-equipment lines where geometry changes every batch, yet cut depths stay high. Digital retrofits further blur lines; IoT spindle probes mounted on vintage columns broadcast vibration and thrust data to cloud analytics, squeezing extra utilization from sunk assets. Such retrofits enlarge the drilling machines market by inserting subscription software revenue atop hardware already depreciated.

The Drilling Machines Market is Segmented by Type (Radial Drilling Machines, and Others), by Operation (Manual, and Others), by Technology / Power Source (Mechanical, and Others), by End-User Industry (Automotive, and Others), by Work-Piece Material (Metals, and Others), and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 46.76% of 2024 revenue and is projected to maintain a robust 7.1% CAGR through 2030. China's machine-tool park continues to swell, propelled by state incentives for domestic CNC controllers that challenge entrenched foreign incumbents. Japanese builders localize component machining across ASEAN to blunt currency risks, while Indian fabrication clusters modernize under Production-Linked Incentive schemes. Rising cell factories, offshore wind yards, and metro-car foundries keep spindle utilization high, lifting service and retrofit opportunities.

North America's installed base remains technologically advanced yet underutilized in commodity down-cycles. Reshoring incentives and clean-energy tax credits now underwrite new composite-capable cells for aerospace stringers and battery-module carriers, brightening order books for high-end builders. Canada's petrochemical plants and U.S. Gulf Coast yards upgrade to hydraulic deep-hole rigs to support LNG expansion, stabilizing the drilling machines market size for heavy-duty formats against cyclic rig counts.

Europe, though mature, pivots toward zero-emission mandates, accelerating the retirement of legacy 3-axis drills in favor of servo-electric gantries with in-line power analyzers. German integrators test predictive greasing algorithms that cut unplanned downtime by 12% on wind-tower flange lines. Southern European shipyards, galvanized by naval-fleet renewal, tender for large-diameter column machines with 6-m stroke capacity to produce bulkhead penetrations in a single pass.

The Middle East and Africa anticipate a 31% uplift in drilling rig demand, translating into yard upgrades in UAE jack-up refurbishments and Saudi fabrication villages aligned with Vision 2030 steel programs. Sub-Saharan rail infrastructure modernizations call for mobile magnetic drills able to process track joints under field conditions. South American prospects center on Brazilian pre-salt developments and Argentine shale growth, which both require tubular dressing shops equipped with high-torque hydraulic drill presses.

- DMG MORI Co. Ltd.

- Mazak Corporation

- Okuma Corporation

- Haas Automation Inc.

- Doosan Machine Tools Co. Ltd.

- Makino Milling Machine Co. Ltd.

- Dalian Machine Tool Group Co. Ltd.

- SMTCL (Shenyang Machine Tool)

- Tongtai Machine & Tool Co. Ltd.

- Hurco Companies Inc.

- ERNST LENZ Maschinenbau GmbH

- Fehlmann AG

- Gate Machinery International Ltd.

- Kaufman Manufacturing Company

- DATRON AG

- Scantool Group

- Taiwan Winnerstech Machinery Co. Ltd.

- Roku-Roku Co. Ltd.

- Hsin Geeli Hardware Enterprise Co. Ltd.

- Minitool Inc.

- LTF SpA*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in EV & Renewable-Energy Manufacturing Requiring High-Precision Multi-Spindle Drilling

- 4.2.2 Accelerating Commercial Aerospace Production Boosting Demand for Large Radial Machines

- 4.2.3 Global Expansion of Wind-Turbine Gearbox Capacity Spurring Deep-Hole Drill Investments

- 4.2.4 Rise of On-Site Modular Construction Fueling Portable Magnetic Drill Adoption

- 4.2.5 Localization Mandates in Defense Shipbuilding Programs Worldwide

- 4.2.6 Upstream Oilfield Revamps Increasing Demand for Heavy-Duty Tooling

- 4.3 Market Restraints

- 4.3.1 Commodity-Investment Cyclicality Dampening Capital Equipment Orders

- 4.3.2 Global CNC-Operator and Machinist Skill Shortage

- 4.3.3 Substitution by Additive Manufacturing for Complex Geometries

- 4.3.4 High Up-Front Cost of 5-Axis Drilling Centers for Small & Medium Enterprises

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Trends

- 4.7 Manufacturing-Sector Outlook

- 4.8 Industry Attractiveness - Porter's Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Type

- 5.1.1 Radial Drilling Machines

- 5.1.2 Upright/Column/ Pillar Drilling Machines

- 5.1.3 Sensitive/Bench Drilling Machines

- 5.1.4 Gang Drilling Machines

- 5.1.5 Deep-Hole/BTA & Gun Drilling Machines

- 5.1.6 Portable Drilling Machines

- 5.1.7 Turret Drilling Machines

- 5.1.8 Others (Magnetic, Micro/Mini Drilling, Special-Purpose Drilling Machines)

- 5.2 By Operation

- 5.2.1 Manual

- 5.2.2 Semi-Automatic

- 5.2.3 CNC/Automatic

- 5.3 By Technology / Power Source

- 5.3.1 Mechanical/Electric

- 5.3.2 Hydraulic

- 5.3.3 Pneumatic

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace & Defense

- 5.4.3 Fabrication & Industrial Machinery

- 5.4.4 Construction

- 5.4.5 Oil & Gas and Energy

- 5.4.6 Electronics & Electricals

- 5.4.7 Shipbuilding & Marine

- 5.4.8 Other End-users (Heavy Equipment, Medical Devices, etc.)

- 5.5 By Work-piece Material

- 5.5.1 Metals

- 5.5.2 Composites, Polymers & Plastics

- 5.5.3 Wood

- 5.5.4 Others (Ceramics, Glass, Concrete, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Peru

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Qatar

- 5.6.5.4 Kuwait

- 5.6.5.5 Turkey

- 5.6.5.6 Egypt

- 5.6.5.7 South Africa

- 5.6.5.8 Nigeria

- 5.6.5.9 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 DMG MORI Co. Ltd.

- 6.4.2 Mazak Corporation

- 6.4.3 Okuma Corporation

- 6.4.4 Haas Automation Inc.

- 6.4.5 Doosan Machine Tools Co. Ltd.

- 6.4.6 Makino Milling Machine Co. Ltd.

- 6.4.7 Dalian Machine Tool Group Co. Ltd.

- 6.4.8 SMTCL (Shenyang Machine Tool)

- 6.4.9 Tongtai Machine & Tool Co. Ltd.

- 6.4.10 Hurco Companies Inc.

- 6.4.11 ERNST LENZ Maschinenbau GmbH

- 6.4.12 Fehlmann AG

- 6.4.13 Gate Machinery International Ltd.

- 6.4.14 Kaufman Manufacturing Company

- 6.4.15 DATRON AG

- 6.4.16 Scantool Group

- 6.4.17 Taiwan Winnerstech Machinery Co. Ltd.

- 6.4.18 Roku-Roku Co. Ltd.

- 6.4.19 Hsin Geeli Hardware Enterprise Co. Ltd.

- 6.4.20 Minitool Inc.

- 6.4.21 LTF SpA*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment