|

市場調查報告書

商品編碼

1842505

BPO(業務流程外包):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Business Processing Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

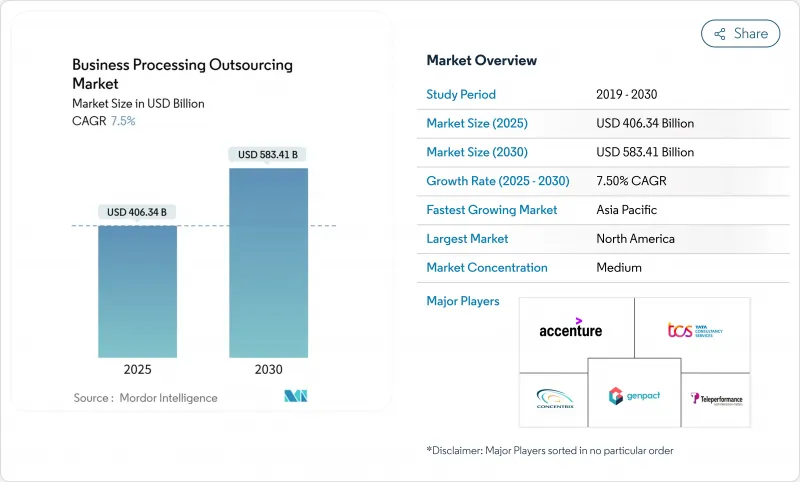

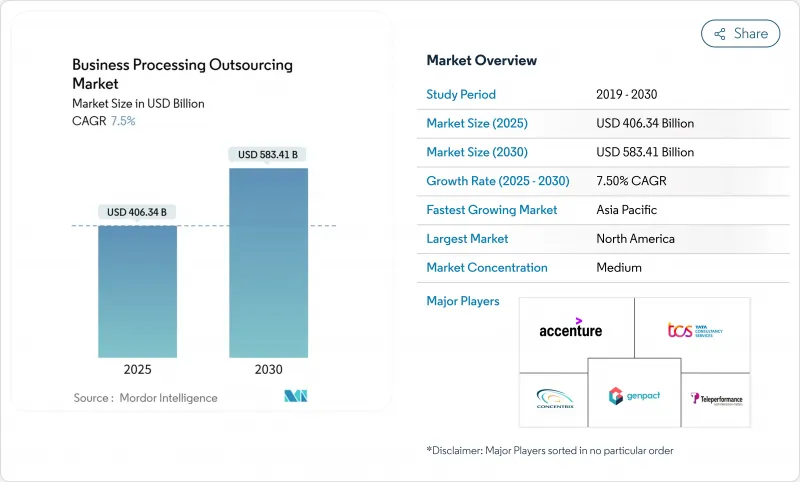

預計 2025 年 BPO(業務流程外包)市場規模將達到 4,063.4 億美元,2030 年將達到 5,834.1 億美元,複合年成長率為 7.5%。

這一成長反映了從勞動力套利模式向人工智慧賦能、結果主導的服務交付的轉變,將提供者定位為轉型中的合作夥伴。 GenAI、雲端優先架構和績效掛鉤合約的採用正在擴大供應商的淨利率,同時降低中端市場客戶的進入門檻。一級供應商之間的整合正透過數十億美元的收購推動成長,這些收購擴大了服務覆蓋的地域範圍並整合了專有的人工智慧平台。同時,雖然大型企業仍然是核心需求促進因素,但中小型企業正在透過提供基於訂閱的服務來擴大採用,這些服務捆綁了流程專業知識、分析和自動化功能,並收取一定費用。雖然資料主權規則的不斷改善、傳統樞紐的薪資上漲以及供應商集中風險正在限制擴張軌跡,但其對BPO(業務流程外包)市場的淨效應依然強勁。

全球 BPO(業務流程外包)市場趨勢與洞察

數位轉型和超自動化的需求

全球企業正在優先考慮智慧自動化,以軟體機器人取代重複的、基於規則的任務,從而提供更快的週期時間和審核就緒的準確性。 Concentrix 推出了 iX Hello,這是一個 GenAI 自助服務層,利用大規模語言模型和內部數據來建立虛擬助手,用於分析、翻譯和安全的知識搜尋。根據一項企業調查,78% 的大公司打算增加對機器人流程自動化的支出。透過將流程挖掘診斷與低程式碼工作流程結合,實施團隊可以幫助提供者將業務案例從勞動力數量轉變為非接觸式交易比率。隨著越來越多的工作流程轉移到雲端平台,外包商正在捆綁分析儀表板,使客戶能夠即時追蹤直通式處理分數,進一步將 BPO 合作夥伴視為轉型專家,而不是成本削減供應商。

在持續的利潤壓力下最佳化成本

ISG 基準顯示,BPO 合約的平均成本節省為 15%,對於使用雲端原生交付的中小型企業,這一比例甚至高達 40%。虛擬優先的供應商將財務、人力資源和支援流程打包成不同的訂閱層級,從而消除了資本支出。定價框架正在從僵化的全職等效模式演變為與消費量掛鉤的層級,可根據訂單量和工單負載靈活擴展。供應商正在透過分析來補充成本節省承諾,這些分析可以突出潛在的缺陷,為財務主管提供超越勞動仲裁的可量化價值證據。降低費用和產生洞察的雙重優勢,已牢固確立了成本最佳化作為 BPO(業務流程外包)市場成長動力的地位。

加強資料隱私和主權監管

印度的《數位個人資料保護法》規定,違規者最高可處以25億印度盧比的罰款,並要求在該國設立申訴負責人。超過75%的國家實施某種形式的資料在地化,這增加了營運成本,並導致全球交付藍圖碎片化。歐洲銀行客戶在《一般資料保護規範》(GDPR)下實施了更嚴格的剩餘條款,限制了跨境處理選項。這些限制延長了銷售週期,並削弱了曾經源自於集中式多租戶架構的淨利率優勢。

其他促進因素和限制因素分析

- 發展中經濟體的人才短缺

- 「即服務」和基於績效的 BPO 合約的興起

- 主要樞紐的地緣政治工資通膨上升

細分分析

客戶服務,透過全通路支援、自助服務機器人和基於分析的品質監控,預計將創造最大的收入,佔2024年BPO(業務流程外包)市場的33.4%。該細分市場受益於GenAI copilot,它可以減少通話時間並實現個人化互動。在用於招聘和社會福利諮詢的人工智慧聊天機器人的推動下,人力資源部門預計將實現最快的10.12%的複合年成長率,這將推動BPO(業務流程外包)市場規模的擴張。薪資核算合規、學習和體驗平台以及端到端人才招募套件正在吸引跨國公司和大型企業。

資訊科技、財務會計以及銷售和行銷等部門正在整合智慧工作流引擎,以提高直通式處理率。 ITIT基礎設施服務台正在整合 AIOps 來預測事件,財務主管正在外包交易處理,以專注於預測和業務合作。採購、供應鏈視覺性和 ESG 資料管理等新興領域為服務供應商提供了在業務流程外包市場中增加現有客戶佔有率的新途徑。

BPO(業務流程外包)市場按應用(人力資源、採購、資訊科技、銷售和行銷、財務和會計、客戶服務和其他應用)、最終用戶(BFSI、製造、醫療保健和其他)、組織規模(大型企業、中小型企業)和地區(北美、歐洲、亞太地區和其他)進行細分。

區域分析

2024年,北美將佔銷售額的45.7%,這得益於合規敏感產業以及美國、墨西哥和加拿大對離岸人才的強勁需求。墨西哥的出口額將增至4,752億美元,外國直接投資將成長20%以上,對美國客戶的雙語支持也將加強。加拿大將支持人工智慧倫理諮詢和法英雙語營運,鞏固該地區在BPO(業務流程外包)市場的領先地位。

亞太地區是一個快速發展的地區,到2030年,複合年成長率將達到9.23%。印度持續創新人機互動營運模式;菲律賓擁有130萬名客服人員,年均收入達300億美元;此外,菲律賓還獲得了《CREATE法案》的激勵措施,該法案旨在佔據全球10%至15%的市場佔有率。日本、中國和澳洲正在增加專業化製造和IT工作量;東南亞國家則正在投資數位基礎設施,以合格複雜的流程。

南美洲正在崛起成為近岸中心,業務範圍從語音服務拓展到金融、人力資源和分析。疫情爆發前,巴西、哥倫比亞和墨西哥的 BPO 收入合計達 23 億美元,並憑藉多語言技能和時區協同優勢迅速擴張。歐洲正在平衡嚴格的《一般資料保護規範》(GDPR)義務與特定產業專業知識的需求,尤其是在金融服務和生命科學領域。預計到 2025 年,中東和非洲地區的 BPO 收入將超過 20 億美元,這得益於政府的智慧化規定和日益壯大的英語水平新畢業生群體。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 數位轉型和超自動化需求

- 在持續的利潤壓力下最佳化成本

- 新興經濟體的人才短缺

- 「即服務」和基於績效的 BPO 合約的興起

- 使用 GenAI 提供超個人化 CX

- 共享服務中心向第三方BPO的銷售浪潮

- 市場限制

- 加強資料隱私和主權監管

- 主要樞紐的地緣政治工資通膨上升

- 關鍵流程中的供應商集中風險

- 近岸外包差距-基於時間的人員配置瓶頸

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 定價分析

第5章市場規模及成長預測

- 按用途

- HR

- 採購

- IT

- 銷售和行銷

- 核算

- 客戶服務

- 其他用途

- 按最終用戶產業

- BFSI

- 製造業

- 衛生保健

- 零售

- 資訊科技/通訊

- 其他最終用戶

- 按組織規模

- 主要企業

- 小型企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(瑞典、挪威、丹麥、芬蘭、冰島)

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 東南亞(新加坡、馬來西亞、泰國、印尼、越南、菲律賓)

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Accenture plc

- Tata Consultancy Services Limited

- Concentrix Corporation

- Teleperformance SE

- Genpact Limited

- Cognizant Technology Solutions

- IBM Corporation

- Wipro Limited

- Capgemini SE

- Infosys BPM Limited

- Automatic Data Processing, Inc

- Alorica Inc.

- Foundever(Sitel Group)

- HCLTech

- EXL Service Holdings

- Tech Mahindra Limited

- Sutherland Global Services

- Atento SA

- Amdocs

- TaskUs, Inc.

第7章 市場機會與未來展望

The business process outsourcing market touched USD 406.34 billion in 2025 and is projected to reach USD 583.41 billion by 2030, registering a 7.5% CAGR.

The growth reflects a pivot from labor-arbitrage models toward AI-enabled, outcome-driven service delivery that positions providers as transformation partners. GenAI deployments, cloud-first architectures, and performance-linked contracts are widening provider margins while lowering entry barriers for mid-market customers. Consolidation among tier-1 vendors is progressing through multi-billion-dollar acquisitions that broaden geographic delivery and embed proprietary AI platforms. At the same time, large enterprises still anchor demand, but SMEs are scaling adoption through subscription-based offerings that bundle process expertise, analytics, and automation in a pay-per-use structure. Rising data-sovereignty rules, wage inflation in legacy hubs, and vendor-concentration risk temper the expansion trajectory, yet the net effect remains strongly positive for the business process outsourcing market.

Global Business Processing Outsourcing Market Trends and Insights

Digital Transformation & Hyper-Automation Demand

Global enterprises are prioritizing intelligent automation to replace repetitive, rule-based work with software bots that deliver faster cycle times and audit-ready accuracy. Concentrix introduced iX Hello, a GenAI self-service layer that taps large-language models and internal data so clients can build virtual assistants for analytics, translation, and secure knowledge retrieval. Corporate surveys show 78% of large companies intend to raise robotic-process-automation spending because compliance mandates, productivity targets, and cost discipline now intersect in one technology roadmap. Implementation teams weave process-mining diagnostics with low-code workflows, allowing providers to shift business cases away from labor counts toward touchless transaction ratios. As more workflows move to cloud platforms, outsourcers bundle analytics dashboards that let clients track straight-through-processing scores in real time, reinforcing a perception that BPO partners are transformation specialists rather than cost-reduction vendors.

Cost-Optimization Amid Persistent Margin Pressures

ISG benchmarks find average 15% cost savings from BPO engagements, a figure that climbs to 40% for SMEs using cloud-native delivery. Virtual-first vendors package finance, HR, and support processes in subscription tiers that remove capital outlays. Pricing frameworks have evolved from rigid full-time-equivalent models to elastic, consumption-linked tiers that flex with order volumes or ticket loads. Providers supplement savings pledges with analytics that spotlight root-cause defects, giving finance chiefs quantifiable evidence of value beyond labor arbitration. The dual benefit of expense relief and insight generation keeps cost optimization firmly positioned as a growth driver for the business-process-outsourcing market.

Data-Privacy & Sovereignty Regulations Tightening

India's Digital Personal Data Protection Act sets fines up to INR 250 crore and mandates in-country grievance officers, prompting providers to localize infrastructure. More than 75% of countries enforce some form of data-localization, increasing overhead and fracturing global delivery blueprints. European banking clients impose even tighter residency clauses under GDPR, limiting cross-border processing options. These restrictions elongate sales cycles and chip away at margin advantages that once stemmed from centralized, multi-tenant architectures.

Other drivers and restraints analyzed in the detailed report include:

- Talent Shortages in Developed Economies

- Rise of "As-a-Service" & Outcome-Based BPO Contracts

- Rising Geopolitical Wage Inflation in Key Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Customer Services generated the largest revenue slice, securing 33.4% of the business process outsourcing market in 2024 through omnichannel support, self-service bots, and analytics-based quality monitoring. The segment benefits from GenAI copilots that trim call durations and personalize interactions. The Human Resources line, buoyed by AI chatbots for recruitment and benefits queries, records the fastest 10.12% CAGR, contributing an expanding share of the business process outsourcing market size. Payroll compliance, learning-experience platform, and end-to-end talent-acquisition suites are attracting both multinationals and scale-ups.

The Information Technology, Finance & Accounting, and Sales & Marketing buckets follow close behind, each integrating intelligent workflow engines to lift straight-through processing rates. IT-infrastructure help desks are embedding AIOps to predict incidents, while finance controllers outsource transaction processing to focus on forecasting and business partnering. Emerging niches such as procurement, supply-chain visibility, and ESG data stewardship provide new avenues for providers to deepen wallet share inside existing accounts of the business process outsourcing market.

The Business Process Outsourcing Market is Segmented by Application (Human Resource, Procurement, Information Technology, Sales and Marketing, Finance and Accounting, Customer Service, and Other Application), End User (BFSI, Manufacturing, Heathcare, and More), Organization Size (Large Enterprises, Small and Medium Enterprises), and Geography (North America, Europe, Asia Pacific, and More).

Geography Analysis

North America captured 45.7% revenue in 2024, anchored by compliance-intensive sectors and a robust appetite for near-shore talent across the US-Mexico-Canada corridor. Mexico's exports climbed to USD 475.2 billion while foreign direct investment rose more than 20%, enhancing bilingual delivery for US clients. Canada supports AI-ethics consulting and bilingual French-English operations, solidifying the region's lead in the business process outsourcing market.

Asia-Pacific is the high-velocity growth theater, posting a 9.23% CAGR to 2030. India continues to innovate with human+AI operating models, and the Philippines employs 1.3 million agents generating USD 30 billion annually, aided by CREATE Law incentives that target a 10-15% global share. Japan, China and Australia add specialized manufacturing and IT workloads, while Southeast-Asian nations invest in digital infrastructure to qualify for complex processes.

South America serves as a rising near-shore hub, diversifying from voice services into finance, HR, and analytics. Brazil, Colombia, and Mexico together cleared USD 2.3 billion in BPO revenue pre-pandemic and are scaling rapidly on the back of multilingual skills and time-zone alignment. Europe balances stringent GDPR obligations with demand for sector-specific expertise, particularly in financial services and life sciences. The Middle East & Africa region, projected to top USD 2 billion by 2025, benefits from smart-government mandates and an English-fluent graduate pool.

- Accenture plc

- Tata Consultancy Services Limited

- Concentrix Corporation

- Teleperformance SE

- Genpact Limited

- Cognizant Technology Solutions

- IBM Corporation

- Wipro Limited

- Capgemini SE

- Infosys BPM Limited

- Automatic Data Processing, Inc

- Alorica Inc.

- Foundever (Sitel Group)

- HCLTech

- EXL Service Holdings

- Tech Mahindra Limited

- Sutherland Global Services

- Atento S.A.

- Amdocs

- TaskUs, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital transformation & hyper-automation demand

- 4.2.2 Cost-optimisation amid persistent margin pressures

- 4.2.3 Talent shortages in developed economies

- 4.2.4 Rise of "as-a-service" & outcome-based BPO contracts

- 4.2.5 GenAI-enabled hyper-personalised CX offerings

- 4.2.6 Wave of captive shared-service-centre divestitures to third-party BPOs

- 4.3 Market Restraints

- 4.3.1 Data-privacy & sovereignty regulations tightening

- 4.3.2 Rising geopolitical wage inflation in key hubs

- 4.3.3 Vendor concentration risk for critical processes

- 4.3.4 Near-shoring gaps - time-zone staffing bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

5 Market Size & Growth Forecasts

- 5.1 By Application

- 5.1.1 Human Resource

- 5.1.2 Procurement

- 5.1.3 Information Technology

- 5.1.4 Sales and Marketing

- 5.1.5 Finance and Accounting

- 5.1.6 Customer Service

- 5.1.7 Other Applications

- 5.2 By End-Use Industry

- 5.2.1 BFSI

- 5.2.2 Manufacturing

- 5.2.3 Healthcare

- 5.2.4 Retail

- 5.2.5 IT and Telecom

- 5.2.6 Other End Users

- 5.3 By Organisation Size

- 5.3.1 Large Enterprises

- 5.3.2 Small & Medium Enterprises

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Colombia

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Benelux (Belgium, Netherlands, Luxembourg)

- 5.4.3.7 Nordics (Sweden, Norway, Denmark, Finland, Iceland)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 Tata Consultancy Services Limited

- 6.4.3 Concentrix Corporation

- 6.4.4 Teleperformance SE

- 6.4.5 Genpact Limited

- 6.4.6 Cognizant Technology Solutions

- 6.4.7 IBM Corporation

- 6.4.8 Wipro Limited

- 6.4.9 Capgemini SE

- 6.4.10 Infosys BPM Limited

- 6.4.11 Automatic Data Processing, Inc

- 6.4.12 Alorica Inc.

- 6.4.13 Foundever (Sitel Group)

- 6.4.14 HCLTech

- 6.4.15 EXL Service Holdings

- 6.4.16 Tech Mahindra Limited

- 6.4.17 Sutherland Global Services

- 6.4.18 Atento S.A.

- 6.4.19 Amdocs

- 6.4.20 TaskUs, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment